Understanding Vertiv (VRT) and Its Role in the Digital Age

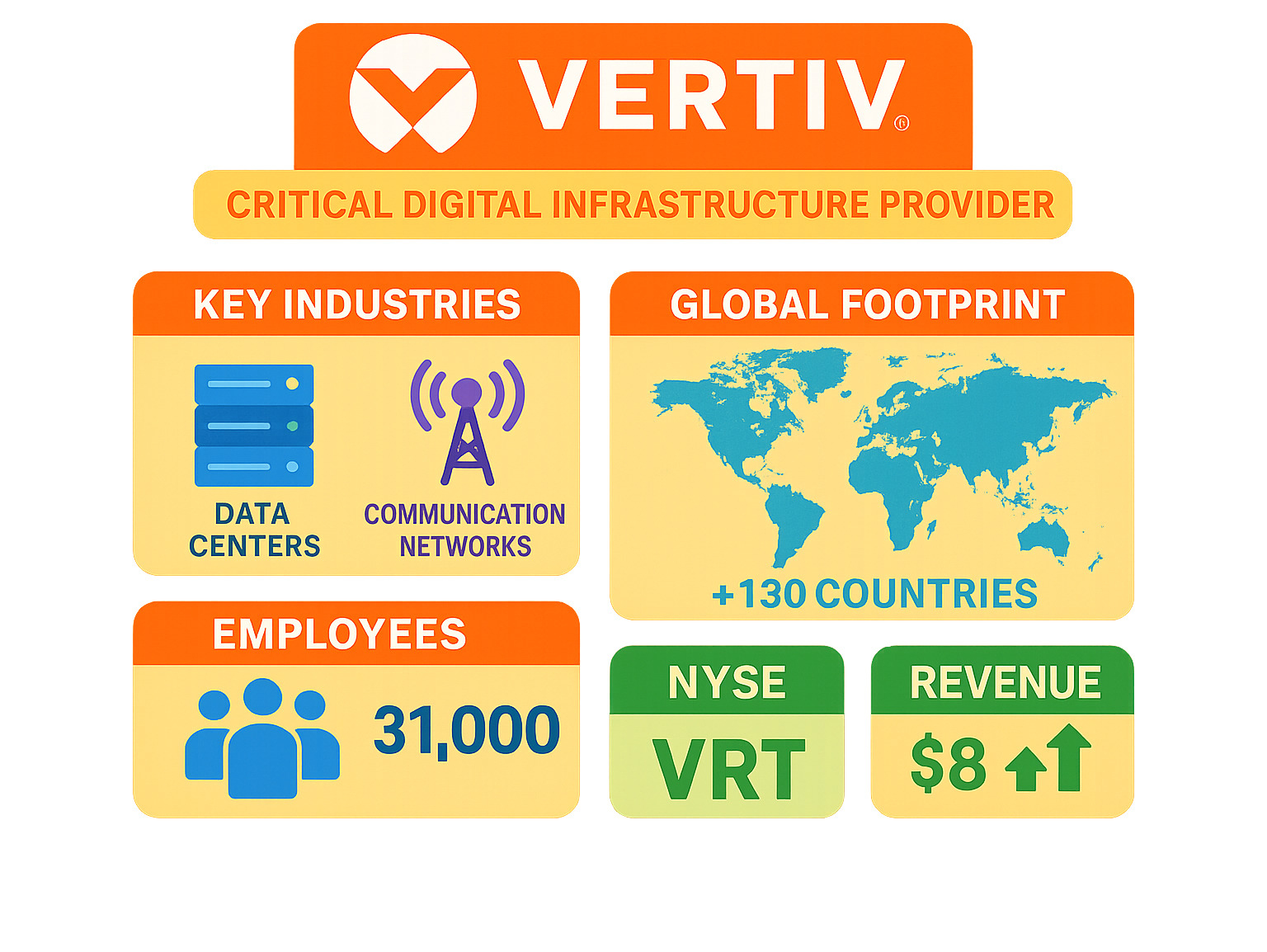

At Beyond Beauty Lab, we believe that true wellness extends beyond skincare and self-care routines to encompass financial health and empowerment. Understanding the forces that shape our modern world is a key part of this holistic approach. That’s why we’re taking a closer look at vrt stock, which represents Vertiv Holdings Co., a company that forms the invisible backbone of our digital lives. Trading on the NYSE under the ticker VRT, this $40+ billion company designs and manufactures the essential technology that powers data centers, communication networks, and industrial facilities in over 130 countries.

Key VRT Stock Facts:

- Current Price: Around $107-$136 (varies by source)

- Market Cap: $40-47 billion

- Industry: Electrical Equipment & Parts (Industrials sector)

- Revenue: $8.0 billion (2024)

- Employees: 31,000

- Dividend Yield: 0.11-0.14%

Vertiv operates at the intersection of two major trends: the explosive growth in artificial intelligence and the massive infrastructure needed to support it. The company provides power management, cooling systems, and IT infrastructure that keep data centers running 24/7.

What makes VRT interesting right now? The AI boom is driving unprecedented demand for data center infrastructure. As companies like Microsoft, Google, and Amazon expand their cloud services, they need Vertiv’s cooling and power solutions to handle the heat and energy requirements of AI processing.

The stock has shown remarkable growth over the long term – up over 750% in five years – though it’s experienced recent volatility as investors weigh AI opportunities against potential tariff impacts.

Whether you’re building a path to financial independence or are simply curious about the companies that enable your digital lifestyle, understanding Vertiv’s business model is a fascinating step into the mechanics of our tech-driven landscape.

Must-know vrt stock terms:

What is Vertiv and What Industry Does It Serve?

Vertiv Holdings Co. (VRT) is a global leader in designing and servicing the critical digital infrastructure that our world runs on. Think of them as the unsung heroes working behind the scenes. Every time you shop for beauty products online, stream a wellness podcast, or use a meditation app, Vertiv’s solutions are likely involved, ensuring everything runs smoothly.

The company primarily operates within the Electrical Equipment & Parts industry, part of the broader Industrials sector. This means they create specialized equipment to manage power, cooling, and IT infrastructure for environments where failure is not an option. Their global operations are extensive, serving customers in over 130 countries. Headquartered in Columbus, Ohio, Vertiv employs approximately 31,000 people, a number that has grown in recent years, reflecting the increasing demand for their services.

To truly appreciate their role, consider that Vertiv combines hardware, software, and analytics to ensure their customers’ vital applications run continuously and perform optimally. They are quite literally powering the foundation of our modern digital society. For more insights into how companies like Vertiv impact the broader financial landscape, you can explore the US Markets.

Vertiv’s Core Solutions and Market Focus

Vertiv solves some of the most pressing challenges facing today’s data centers and communication networks. Their comprehensive portfolio is designed to address the intricate demands of these critical environments. Let’s break down their key focus areas:

- Power Management Solutions: Imagine a data center without reliable power – chaos! Vertiv provides robust Alternate Current (AC) and Direct Current (DC) power management products, along with switchgear and busbar products. These are crucial for ensuring a stable and uninterrupted power supply, which is the lifeblood of any digital operation.

- Thermal Management Innovations: With the increasing density of computing power, especially driven by AI, heat generation is a massive challenge. Vertiv specializes in advanced thermal management products designed to keep IT infrastructure cool and prevent overheating. This includes everything from precision cooling units to liquid cooling solutions, which are becoming increasingly vital for high-density AI servers.

- IT Infrastructure Support: Beyond power and cooling, Vertiv offers integrated rack systems and modular solutions. These are pre-engineered and pre-assembled systems that can be rapidly deployed, significantly reducing the complexity and time required to set up new data center capacity or expand existing ones.

- Management Systems for Digital Environments: It’s not just about providing the hardware; it’s about intelligent management. Vertiv offers sophisticated management systems for monitoring and controlling digital infrastructure. These systems provide real-time insights, predictive analytics, and automation capabilities, allowing operators to optimize performance, prevent downtime, and manage their infrastructure more efficiently. They also provide comprehensive lifecycle services, ensuring that these critical systems are maintained and updated throughout their operational life.

Vertiv’s solutions extend from the vast cloud computing environments down to the “edge” of the network, where data processing happens closer to the source, enabling faster responses for applications like autonomous vehicles or smart cities. This broad reach and integrated approach make them a unique and indispensable player in the digital infrastructure landscape.

Analyzing VRT Stock Performance and Financial Health

Just as you’d research the ingredients in a new skincare product, diving into a company’s financial health is a crucial step in caring for your financial future. For vrt stock, this means understanding its performance history, examining its current financial state, and learning what makes it tick.

Think of this analysis as Vertiv’s financial wellness check-up. We’ll look at various indicators to get a complete picture of the company’s strength and potential, helping you make more informed and empowered decisions.

A Look at VRT’s Recent Stock Performance

VRT stock has been on an impressive journey, especially for long-term investors. While daily market movements can feel like a rollercoaster, the bigger picture tells a compelling story about a company that has found its sweet spot in our digital world.

Let’s break down how vrt stock has performed across different time periods:

| Timeframe | Performance (Approx.) |

|---|---|

| 1-Day | +9.78% |

| 5-Day | +7.86% |

| 1-Month | -11.05% |

| 6-Month | +58.79% |

| YTD | +19.86% |

| 1-Year | +83.13% |

| 5-Year | +710.46% |

| All-Time | +1,320% |

These numbers can shift daily, so think of them as a snapshot rather than set-in-stone figures.

What’s really striking here is the contrast between short-term volatility and long-term growth. Yes, the stock dipped about 11% over the past month-that’s the kind of bump that can make investors nervous. But when you zoom out, you see that vrt stock has delivered an incredible 710% return over five years. That’s the kind of performance that can transform portfolios.

The stock has traded between a 52-week low of $53.60 and a high of $155.84, showing just how much investor sentiment can swing. With average daily trading volumes often exceeding 8-10 million shares, there’s clearly no shortage of interest in this company. This high liquidity is good news, as it means you can buy or sell shares without dramatically affecting the price.

Key Financial Statistics for the vrt stock

Now let’s look at the core numbers of Vertiv’s financial profile. These statistics tell us not just how big the company is, but how the market values it and how efficiently it operates.

Market Capitalization sits at an impressive $47.95 billion, placing Vertiv firmly in the large-cap category. This isn’t a small startup; it’s a major player with substantial market presence.

The Price-to-Earnings (P/E) Ratio of 58.20 might seem high, but it reflects strong investor belief in Vertiv’s growth potential. When people are willing to pay a premium for earnings, it usually means they expect those earnings to grow significantly in the future.

Revenue tells us about the company’s sales muscle. At $8.01 billion over the trailing twelve months, Vertiv is clearly meeting substantial market demand. This isn’t just theoretical potential-it’s real money from customers who need what Vertiv provides.

Earnings Per Share (EPS) of $2.14 shows that all that revenue is translating into actual profits for shareholders. It’s one thing to generate sales; it’s another to convert them into earnings that benefit investors.

The Enterprise Value of $44.22 billion gives us a more complete picture by factoring in debt and cash. This metric helps us understand the true cost of acquiring the entire company, making it useful for comparing companies with different financial structures.

For those wanting to dive deeper into understanding these financial concepts, we recommend you learn more about business financials to build your investment knowledge.

Understanding VRT’s Key Financial Ratios

Financial ratios are like vital signs for a company-they quickly tell us about its health, efficiency, and potential red flags. For vrt stock, these ratios paint a picture of a company that’s not just growing, but growing intelligently.

The Profit Margin of 6.19% shows that Vertiv is successfully converting revenue into actual profit. While this might not sound huge, it’s solid for an industrial company, especially one that’s scaling rapidly. Every dollar of sales generates about six cents of profit after all expenses.

Return on Equity (ROE) is where things get really interesting. At 32.96%, this metric shows that Vertiv is exceptionally good at generating profits from shareholder investments. A high ROE suggests efficient management and a competitive business model.

The Debt-to-Equity Ratio of 120.29% indicates that Vertiv uses leverage to fuel its growth. For every dollar of equity, the company has about $1.20 in debt. While this might sound concerning, it’s common for industrial companies that need significant capital for operations and expansion.

Looking forward, the Forward P/E of 30.02 is notably lower than the trailing P/E, suggesting that analysts expect earnings to grow substantially in the coming year. This makes vrt stock appear more reasonably valued when you consider its future earnings potential.

Finally, the PEG Ratio of 1.00 suggests that the stock’s price growth is in line with its expected earnings growth over the next five years. A PEG ratio around 1.00 is often considered to represent fair value.

These ratios collectively tell us about a profitable company that’s effectively using shareholder capital, managing its debt responsibly, and positioned for continued growth in the expanding digital infrastructure market.

The Future Outlook: AI Tailwinds and Analyst Ratings

At Beyond Beauty Lab, we’re always looking ahead-whether it’s the future of clean beauty or the trends shaping our financial landscape. The story of vrt stock is a fascinating look into our digital future, where Vertiv finds itself at the perfect intersection of massive technological change and essential infrastructure needs.

The artificial intelligence boom isn’t just creating opportunities for software companies; it’s creating an entirely new category of infrastructure demand that companies like Vertiv are uniquely positioned to fulfill. Think of it as building the foundation for the next generation of the internet.

What makes this particularly exciting for vrt stock investors is that this isn’t a short-term trend. The AI revolution is just getting started, and every new AI application requires more computing power, which means more heat and energy consumption. This creates a powerful cycle of demand that plays directly into Vertiv’s strengths in cooling and power solutions.

How the AI Boom is Fueling Vertiv’s Growth

When you ask an AI chatbot a question or get a personalized product recommendation online, massive data centers are working behind the scenes. These aren’t your typical office computers-they’re incredibly powerful machines that generate enormous amounts of heat. That’s where Vertiv’s expertise becomes absolutely critical.

The data center buildout happening right now is unprecedented. Major cloud providers like Microsoft, Google, and Amazon are pouring billions into expanding their infrastructure. Vertiv reported a 15% rise in Q2 orders, largely driven by these hyperscalers who simply can’t build fast enough to meet AI demand. Every new data center needs Vertiv’s power management and cooling solutions.

Here’s where it gets really interesting: traditional cooling methods are no longer enough. Liquid cooling technology has moved from a niche solution to an essential one. Vertiv’s liquid cooling systems directly remove heat from high-powered processors, allowing for much more powerful and compact server deployments.

This positions Vertiv perfectly in what’s known as the “picks and shovels” of AI. During the California Gold Rush, the people who consistently made money weren’t always the gold miners-they were the ones selling picks and shovels. While other companies produce the AI “gold,” Vertiv provides the essential tools needed to make it all work.

Vertiv’s CEO has been optimistic about the company’s position, highlighting that they’re gaining market share as the AI buildout continues. For more insights into how AI is changing infrastructure needs, you can read about AI growth and digital infrastructure.

What Do Analysts Say About the vrt stock?

Just as you might seek a second opinion from a dermatologist for a new skincare regimen, it’s wise to see what professional analysts think about a stock. The investment community has taken notice of Vertiv’s strategic position, and the consensus is notably positive.

Most analysts maintain bullish sentiment toward vrt stock, with many issuing “Buy” or “Strong Buy” ratings. Mizuho Securities recently reaffirmed its “Buy” rating, reflecting confidence in Vertiv’s growth trajectory. This broad consensus suggests the investment community sees real value here.

Of course, price targets do get adjusted. TD Cowen recently moved their target to $139 from $141, while Barclays adjusted theirs to $131 from $142. These price target adjustments might seem like downgrades, but they still represent significant upside potential from current trading levels. Think of it as fine-tuning rather than a fundamental change in outlook.

The financial media has been enthusiastic, with headlines like “Time To Buy The Recovery” and “The Worst Is Behind Us, Double-Digit Upside Potential Ahead.” Vertiv’s Q1 2025 earnings were described as “exceptional,” leading to renewed “Buy” recommendations. Some analysts even suggest that recent market sell-offs have been “overdone,” potentially creating attractive entry points for investors.

One concern that has occasionally surfaced is the potential impact of trade tariffs. However, Vertiv’s management has been proactive in addressing this. The CEO has stated that any potential tariff impact mitigation will be achieved by 2026, providing a clear timeline for managing this risk.

The overall message from analysts is clear: despite some short-term market volatility, the long-term growth story for vrt stock remains compelling. To explore more perspectives on industrial sector investments, you can see what analysts are saying.

Frequently Asked Questions about Vertiv (VRT)

When you’re exploring a new opportunity, whether it’s a wellness practice or an investment like vrt stock, it’s natural to have questions. We’ve gathered the most common questions investors ask about Vertiv to help you build your knowledge and make informed decisions.

Does VRT stock pay a dividend?

Yes, vrt stock does pay a dividend, but it’s a modest one. Think of it less as a primary source of income and more like a small, consistent reward-a little bonus while the company focuses on reinvesting for growth.

Current dividend details show a yield of around 0.11% to 0.14%. To put that in perspective, an investment of $10,000 would yield about $11 to $14 annually. The company pays approximately $0.0375 to $0.04 per share each quarter.

Timing matters for dividends. The most recent ex-dividend date was December 3, 2024. To receive the next payment, you must own the stock before the next ex-dividend date is announced. Visit Vertiv’s Investor Relations page for official dates to stay updated.

Why such a low dividend? Vertiv’s dividend payout ratio for 2024 was around 8.77%, meaning it reinvests over 90% of its earnings back into the business. This strategy makes sense given the massive growth opportunities in AI and data centers. The company is essentially betting that it can grow your money faster by building more infrastructure than by returning it as cash dividends.

What are some key trends in the digital infrastructure market?

The digital infrastructure landscape is undergoing a change that’s creating incredible opportunities for companies like Vertiv. Understanding these trends helps explain why vrt stock has performed so well and why it’s relevant to our daily lives.

The data explosion is the most fundamental driver. Every time you browse for clean beauty tips, watch a wellness tutorial, or order your favorite skincare products, you’re creating and consuming data that needs to be stored and processed.

Cloud computing continues its relentless growth. Businesses are moving their operations to the cloud, which means providers like Amazon Web Services and Microsoft Azure need massive data centers filled with the power and cooling solutions that Vertiv specializes in.

Artificial intelligence is the current superstar trend. AI workloads generate enormous heat and consume vast amounts of power. Traditional air cooling often can’t keep up, which is why Vertiv’s liquid cooling technology has become so valuable.

Edge computing brings data processing closer to where it’s needed, enabling faster applications. This trend creates new opportunities for Vertiv’s modular and integrated solutions in smaller, localized facilities.

Sustainability concerns are driving demand for more energy-efficient infrastructure. Companies want to reduce their carbon footprint and electricity bills, creating a market for innovative power and cooling technologies.

5G networks require significant infrastructure upgrades, including new base stations and edge data centers that need reliable power and thermal solutions.

These trends work together to create a “perfect storm” of demand for digital infrastructure-and Vertiv sits right in the middle of it all.

When is Vertiv’s next earnings report?

Mark your calendar: Vertiv’s next earnings report is expected on October 22, 2025. These quarterly reports are like report cards for public companies and can significantly impact stock prices.

Why earnings matter so much becomes clear when you look at Vertiv’s recent performance. In its last reported quarter, the company earned $0.95 per share, beating analyst expectations of $0.83-a 14.16% positive surprise. Revenue also exceeded expectations.

Guidance updates are often just as important as the results. After its Q1 2025 earnings beat, Vertiv raised its full-year outlook, projecting strong earnings and sales growth for 2025, driven largely by AI-related demand.

Forward-looking statements from these reports help investors understand where the company is heading. Management has been optimistic about AI data center momentum and has addressed concerns about potential tariffs, stating that any negative effects should be mitigated by 2026.

These consistent beats and positive outlooks help explain why analysts remain bullish on vrt stock. For the most accurate and up-to-date earnings information, always check Vertiv’s Investor Relations page for official dates.

Conclusion: Is VRT a Stock to Watch?

At Beyond Beauty Lab, our mission is to empower you with knowledge for a more beautiful and well-rounded life. While we often focus on skincare ingredients and wellness routines, we believe that understanding finance is another powerful form of self-care. Exploring a company like Vertiv and its vrt stock is a step toward building that financial wellness.

Vertiv is much more than just an industrial company; it’s the essential infrastructure that keeps our digital world running. Every time you stream a wellness podcast, shop online, or use an AI-powered app, Vertiv’s technology is likely working behind the scenes.

The financial picture shows a company with strong fundamentals, including impressive revenue and a high return on equity. While the stock has seen recent volatility, its incredible long-term growth of over 750% in five years highlights its powerful market position.

What’s most exciting is Vertiv’s role in the AI revolution. It’s a classic “picks and shovels” story: as companies race to build AI, Vertiv provides the essential cooling and power systems needed to make it all possible. This isn’t a speculative trend but a fundamental need, and analysts largely agree, maintaining bullish ratings on the stock.

Of course, no investment is without risk. The stock’s volatility means it’s best suited for those with a long-term perspective. Investing, like any wellness journey, requires patience, research, and an understanding of your own goals.

For our community, which seeks growth and empowerment in all areas of life, learning about a company like Vertiv is a way to connect with the foundational technologies that shape our world. We believe that financial literacy is a cornerstone of overall well-being, and vrt stock offers a fascinating case study in the digital infrastructure space. It certainly deserves a spot on your watchlist as you continue your journey toward a secure and radiant future.

Investing always requires careful consideration of your personal financial situation and goals. We’re here to help you understand the opportunities, but the decisions are ultimately yours to make. For more insights into navigating today’s financial landscape, explore more financial guides and insights.