Understanding the Current Exchange Rate

The usd to inr exchange rate indicates how many Indian Rupees one US Dollar can buy. This rate is dynamic, fluctuating constantly throughout the day due to global market activity. For instance, recent trends have shown the rate moving within a certain range, but this can change quickly.

Key takeaways on the usd to inr rate:

- Recent Performance: The US Dollar has generally strengthened against the Indian Rupee over the last year.

- Volatility: The rate can see significant swings. For example, in a recent 30-day period, highs reached 87.69 while lows were at 85.68.

- Best Sources: For the most accurate data, consult sources like Reuters, the Reserve Bank of India, and reputable online currency converters.

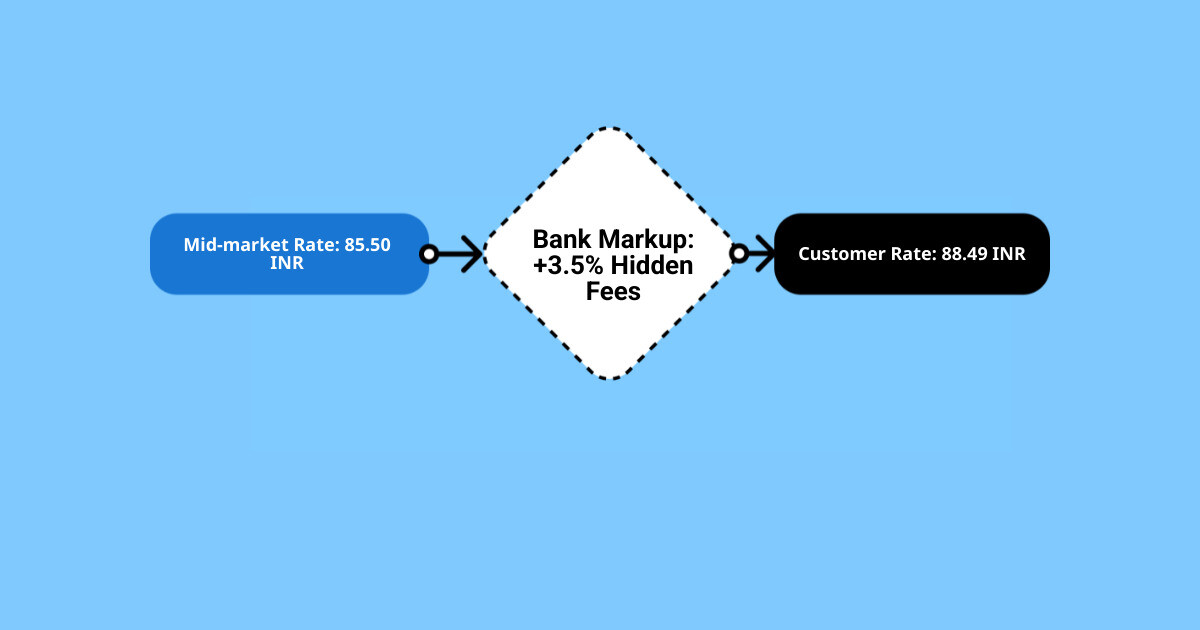

Understanding this rate is crucial. Whether you’re sending money to family, paying for services, or planning travel, even small rate differences impact the final amount. The main challenge is that the “real” exchange rate, or mid-market rate, isn’t what consumers typically get. Banks and exchanges often add markups of 2-4%.

Usd to inr terms you need:

When we talk about the current exchange rate, we’re really looking for the most accurate representation of a currency’s value against another. This is often called the mid-market rate, and it’s the true rate at which currencies are traded on the global market, without any added fees or markups. Think of it as the midpoint between the buying and selling prices on the interbank market. It’s the rate that major financial institutions use when trading with each other.

However, the rate you see online or get from a bank might not be this pure mid-market rate. There’s often a “transfer rate markup” applied, which is how many financial service providers make their profit. This can vary significantly, from a small fraction of a percent to several percentage points. For travelers, there’s also the “tourist rate,” which is typically less favorable than the rates offered for larger, institutional transfers. Understanding these distinctions is crucial for making informed decisions about your usd to inr conversions.

To find reliable data, we often turn to financial news sites and dedicated currency data platforms. These sources strive to provide real-time or near real-time updates on exchange rates, reflecting the dynamic nature of global markets. Knowing where to look for this information empowers us to get closer to the real exchange rate and avoid unnecessary costs.

More info about the economy

What is the difference between mid-market and actual transfer rates for usd to inr?

The mid-market rate is the “real” exchange rate you see on Google or financial news sites. It’s the rate at which banks trade currencies with each other, without any consumer-facing profit margin.

When you transfer money, however, you get a different rate. Providers apply a “markup” or “spread” to the mid-market rate to make a profit. For example, if the mid-market rate is 85.50 INR per USD, a service might offer you 84.50 INR. That 1 Rupee difference is their margin. These markups are often “hidden fees” because they are embedded in the rate, not listed separately. A service might claim “zero fees” but still profit from an unfavorable exchange rate.

To make the best choice, always compare the total amount the recipient will receive. This accounts for both fees and the exchange rate, giving you a clear picture of the true cost of your usd to inr conversion.

Where can I find reliable real-time usd to inr exchange rate data?

Finding reliable, real-time usd to inr data is essential. Here are the best sources:

- Financial Data Providers: Platforms like Reuters and Bloomberg offer live mid-market rates, historical charts, and market analysis. Many have free, user-friendly versions for the public.

- Central Bank Websites: The Reserve Bank of India (RBI) and the US Federal Reserve provide official rates and economic insights that drive currency values. This helps in understanding long-term trends.

- Currency Converter Tools: Online tools and mobile apps provide quick conversions and historical data charts. Many also offer rate alerts, notifying you when the usd to inr rate hits a target you’ve set. While they show the mid-market rate, they are invaluable for tracking trends.

For example, a financial data site might show the usd to inr rate has gained a certain percentage over the last 12 months, giving you insight into long-term trends.

USCINR USD Coin Indian Rupee

Key Factors That Influence the USD to INR Rate

Think of the usd to inr exchange rate like a delicate balance scale – there are always multiple forces pushing and pulling from different sides. Just like how your skin reacts to various factors in your environment, currency rates respond to a complex mix of economic and political influences.

- Interest Rates: This is a primary driver. When the US Federal Reserve raises rates, it can make the US Dollar more attractive to investors, strengthening it against the Rupee. Conversely, rate hikes by the Reserve Bank of India can strengthen the Rupee.

- Inflation Rates: High inflation in one country compared to another can weaken its currency. If India’s inflation is significantly higher than in the US, the Rupee’s purchasing power decreases, and it typically weakens.

- Economic Performance: Strong economic indicators like GDP growth and low unemployment signal a healthy economy, attracting foreign investment and strengthening the currency. A robust US economy generally leads to a stronger Dollar, while a thriving Indian economy supports the Rupee.

- Political Stability and Geopolitical Events: Investors prefer stability. Events like elections, trade disputes, or international conflicts can cause uncertainty, leading investors to move funds to “safe-haven” currencies, which can cause sudden swings in the usd to inr rate.

- Trade Balance: The flow of goods and services between the US and India affects currency demand. If India imports more from the US than it exports, there is a higher demand for US Dollars to pay for those goods, pushing the value of the Dollar up against the Rupee.

These factors are interconnected and can pull the exchange rate in different directions, which is why the usd to inr rate is often volatile.

A Look at Historical Performance and Trends

Understanding how the usd to inr exchange rate has moved over time is like looking at your skincare routine results over months – the patterns tell a story that helps us make better decisions going forward.

For example, in a recent year, the US Dollar gained notable strength against the Indian Rupee. The rate saw significant swings during that period. The highest point reached was 85.787 Indian Rupees per USD, while the lowest was 82.695 Rupees per Dollar. This spread of over 3 Rupees highlights how much the rate can fluctuate within a single year, impacting the value of large conversions.

Recent movements often show high volatility as well. It’s not uncommon to see the usd to inr rate fluctuate within a wide range over 30-day or 90-day periods. For instance, a recent 30-day window saw highs of 87.6910 and lows of 85.6800, while a 90-day range stretched from 84.9535 to 87.6910.

Different timeframes can tell different stories. A long-term, 1-year return might show a solid gain for the Dollar, while shorter-term returns (e.g., 1-month or 5-day) could show a temporary dip. This illustrates the constant flux of the market. Data from related instruments like the USCINR (USD Coin Indian Rupee) often confirms these trends, showing similar gains over various periods.

This historical data underscores that currency markets are always moving. While the long-term trend may favor one currency, short-term volatility is a constant. This means timing your conversion can make a real difference.

Read our ultimate guide on market indices

Best Methods for Converting USD to INR

When you need to convert usd to inr, you have several options, and honestly, some are much better than others. Think of it like choosing the right skincare routine – you want something that’s effective, affordable, and fits your lifestyle.

The good news is that we live in an age where sending money to India has become much easier and more affordable than it used to be. Gone are the days when your only option was expensive bank wire transfers that took forever to process.

Here’s how the main conversion methods stack up:

| Method Category | Cost (Exchange Rate & Fees) | Speed | Convenience |

|---|---|---|---|

| Online Transfer Platforms | Generally Low | Fast (often same-day or instant) | High (24/7 access, app-based) |

| Traditional Banks | Moderate to High | Moderate (1-5 business days) | Moderate (branch visits, online banking) |

| Currency Bureaus | High | Instant (cash-to-cash) | Low (limited locations, cash only) |

The reality is that online transfer platforms have completely changed the game. They’re usually your best bet for getting more rupees for your dollars, and they’re incredibly convenient too.

Comparing Money Transfer Services

- Online Transfer Platforms: These digital services have lower overhead than banks, allowing them to offer more competitive exchange rates and transparent fees. Many provide same-day or even instant transfers to India, and you can initiate them anytime from a computer or phone.

- Traditional Banks: While a familiar option, banks are usually more expensive. Their exchange rates often include a larger markup, and transfers can take several business days to process.

- Currency Bureaus & Airport Exchanges: These are convenient for immediate cash needs but are the most expensive option. The exchange rates, especially at airports, can be 5-8% worse than what you’d find online.

When comparing, always focus on the final amount of rupees the recipient will get. A “no fee” offer can be misleading if the exchange rate is poor.

Understanding the Fees and Charges

Converting usd to inr involves several potential costs. Here’s what to watch for:

- Transfer Fee: An upfront charge for the service, which can be a flat rate or a percentage of the transfer amount.

- Exchange Rate Margin: This is often the biggest cost, hidden within the exchange rate. It’s the difference between the mid-market rate and the rate you’re offered.

- Credit Card Fees: Using a credit card to fund a transfer may trigger cash advance fees (3-5%) and high interest from your card issuer. It’s better to use a debit card or a direct bank transfer.

- Hidden Costs: Some recipient banks in India may charge a fee for incoming international transfers, though many modern services account for this.

Always use a debit card or bank transfer to fund your conversion and compare the total cost, not just the advertised fees.

How to Track and Time Your Currency Conversion

Just like tracking your skincare routine for the best results, timing your usd to inr conversion can make a real difference in your wallet. The good news? You don’t need to become a financial expert or stare at charts all day to get this right.

- Set Rate Alerts: This is one of the most effective strategies. Most currency platforms and apps allow you to set an alert for your desired usd to inr rate. You’ll receive a notification when the market hits your target, allowing you to convert at an opportune moment.

- Use Currency Tracking Apps: Mobile apps provide live rates, historical charts, and trend analysis at your fingertips. You can quickly see performance over the last week, month, or year to understand the current market context.

- Establish a Target Rate: By looking at recent performance, you can set a realistic target. For example, if the 30-day range has been between 85.50 and 87.50, you can decide whether to convert now or wait for a more favorable rate within that range.

- Analyze Charts for Trends: A quick look at a 30-day or 1-year chart can reveal the broader trend. If the rate has been steadily climbing, you might decide to convert sooner rather than later.

- Follow Market Summaries: Many platforms offer daily or weekly email summaries that highlight major market movements. These provide valuable context without requiring you to track changes minute-by-minute.

The goal isn’t to perfectly time the market but to make an informed decision within your timeframe. Using these tools helps take the stress out of currency conversion while maximizing your return.

Frequently Asked Questions about USD to INR

When it comes to converting your dollars to rupees, we know you probably have quite a few questions swirling around in your mind. Just like when you’re trying a new skincare routine, it’s natural to want all the details before diving in. Let’s tackle the most common questions we hear about usd to inr exchanges.

What kind of volatility has the USD to INR rate seen recently?

The usd to inr rate can be quite volatile. To understand this, it’s helpful to look at historical data. For example, in one recent year, the rate experienced significant fluctuations.

The highest point in that year was 85.787 Indian Rupees per US Dollar, while the lowest point was 82.695. This represents a swing of over 3 rupees per dollar. On a $1,000 transfer, that difference is more than 3,000 rupees.

Even in the short term, volatility is common. It’s not unusual to see the rate move significantly within a 30-day period. For instance, a recent month saw highs of 87.6910 and lows of 85.6800. These fluctuations highlight why timing your usd to inr conversion can be so important.

How can I get the best possible exchange rate?

Getting the best usd to inr rate requires a bit of research.

- Compare Providers: Don’t default to your bank. Use online comparison tools to see which service offers the best final amount for your recipient.

- Check the Mid-Market Rate: Use Google or a financial site to find the real exchange rate. This is your benchmark for judging the markups charged by providers.

- Avoid Airport Exchanges: These offer the worst rates and should be avoided unless absolutely necessary.

- Consider Transfer Size: Some services offer better rates for larger transfers. It may be beneficial to send one larger amount instead of several smaller ones.

- Seek Transparency: Choose services that are clear about their fees and the exchange rate they’re using.

How quickly can I send money from the USA to India?

The speed of your usd to inr transfer depends on the method you choose.

- Online Transfer Platforms: These are typically the fastest, with many offering instant or same-day delivery to bank accounts in India.

- Traditional Bank Transfers: These are slower, usually taking 1-5 business days to complete.

The speed can also be affected by bank holidays, weekends, and the accuracy of the recipient’s information. Always double-check the recipient’s bank account number, IFSC code, and name to avoid delays. For urgent needs, online platforms are the most reliable option.

Conclusion

Understanding the usd to inr exchange rate is like mastering any wellness routine – it takes a little knowledge, the right tools, and consistent attention to get the best results. The good news? Once you know what to look for, converting your US Dollars to Indian Rupees becomes much more straightforward and cost-effective.

The most important thing we’ve learned is that the rate you see on Google isn’t the rate you’ll actually get. Those hidden markups can quietly eat away at your money, sometimes costing you hundreds of dollars on larger transfers. By understanding the difference between the mid-market rate and what transfer services actually offer, you’re already ahead of most people.

We’ve also seen how economic factors like interest rates, inflation, and political stability constantly push the usd to inr rate up and down. While we can’t predict exactly where it’s heading, knowing these influences helps us make sense of the daily fluctuations. The historical data shows us that patience can pay off – the rate has moved significantly in recent years.

When it comes to actually sending your money, online transfer platforms consistently beat traditional banks and currency bureaus on both cost and speed. Skip those expensive airport exchanges entirely – they’re convenience traps that can cost you dearly. Instead, take a few minutes to compare providers and look at the total amount your recipient will receive in Indian Rupees.

Timing your transfers doesn’t have to mean staring at charts all day. Set up rate alerts, track the general trends, and be ready to act when the rate moves in your favor. Even waiting for a slightly better rate can make a meaningful difference.

At Beyond Beauty Lab, we believe in empowering you with knowledge that makes a real difference in your life. Just as we help you steer clean beauty and wellness, understanding usd to inr conversions helps you take control of your financial wellness. Every dollar you save on transfer fees and poor exchange rates is money that stays in your pocket – or reaches your loved ones in India.

The key is staying informed, comparing your options, and choosing services that are transparent about their costs. With these tools in hand, you can confidently convert your dollars to rupees, knowing you’re getting the best value possible.