Why Traceloans.com Personal Loans Are Changing How We Access Funding

Traceloans.com personal loans offer a modern alternative to traditional bank lending, connecting borrowers with multiple lenders through a single application process. Here’s what you need to know:

Key Features:

- Loan amounts: $1,000 to $50,000+

- Interest rates: 6-36% APR

- Funding speed: 1-2 business days

- Credit requirements: All credit types accepted

- Application: 100% online, soft credit check for pre-qualification

Best for:

- Debt consolidation

- Emergency expenses

- Wellness and self-care investments

- Home improvements

- Medical bills

In today’s world, financial stress can significantly impact our overall well-being. Whether you’re looking to consolidate high-interest debt, fund a wellness retreat, or cover unexpected expenses, the traditional bank loan process often feels slow and restrictive.

Digital lending platforms like Traceloans.com have captured nearly 38% of the personal loan market since 2023, offering a streamlined alternative to conventional banking. Unlike traditional lenders that may take weeks for approval, Traceloans.com uses AI-driven underwriting to provide decisions within hours.

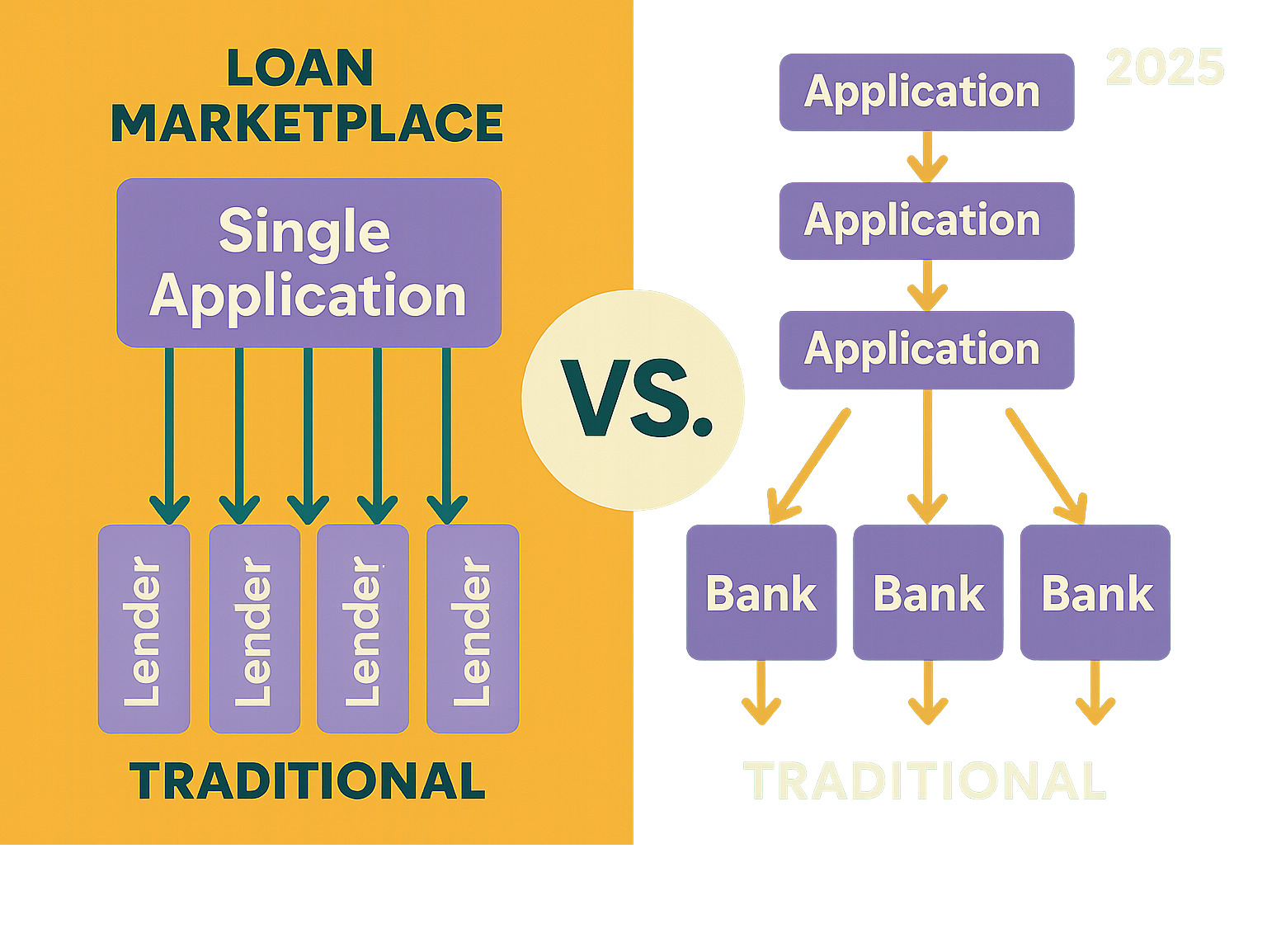

The platform works as a loan marketplace, matching you with lenders from their network based on your financial profile. This means you can compare multiple offers without impacting your credit score through their soft inquiry process.

For eco-conscious individuals seeking financial wellness, personal loans can be a tool for investing in sustainable living improvements, organic wellness programs, or consolidating debt to reduce financial stress – all contributing to a more balanced, mindful lifestyle.

Easy traceloans.com personal loans glossary:

Understanding Traceloans.com: How It Works and Who It’s For

At Beyond Beauty Lab, we believe that true wellness includes feeling confident about your finances. That’s why we’re exploring traceloans.com personal loans – a modern solution that’s making borrowing simpler and less stressful for everyday people.

Think of Traceloans.com as your personal matchmaker, but for loans instead of romance. Rather than spending hours filling out separate applications at different banks (and facing potential rejection after rejection), you complete just one application that gets shared with multiple lenders in their network.

Here’s how the magic happens: You submit your information once, and Traceloans.com’s technology works behind the scenes to find lenders who might want to work with you. Within hours, you could have several loan offers sitting in your inbox, each with different terms and rates. It’s like having a personal shopping assistant for your financial needs.

This loan marketplace model is a game-changer compared to traditional banking. Instead of being stuck with whatever your local bank offers (or doesn’t offer), you get to compare options and choose what works best for your situation.

The platform shines for people who need quick access to funds without the usual banking headaches. Whether you’re dealing with debt consolidation from multiple credit cards, facing emergency expenses like unexpected medical bills, or wanting to invest in wellness goals like a transformative retreat or personal development course, Traceloans.com can connect you with the right funding.

Beyond personal loans, the platform also offers connections for other financial needs, including business loans, auto loans, and even mortgage options. If you’re dreaming of a peaceful home sanctuary, you might explore Traceloans.com Mortgage Loans as well.

The Traceloans.com Advantage Over Traditional Lenders

Let’s be honest – traditional bank lending can feel like trying to meditate in a construction zone. It’s stressful, slow, and often leaves you feeling frustrated. Traceloans.com personal loans offer a refreshingly different experience.

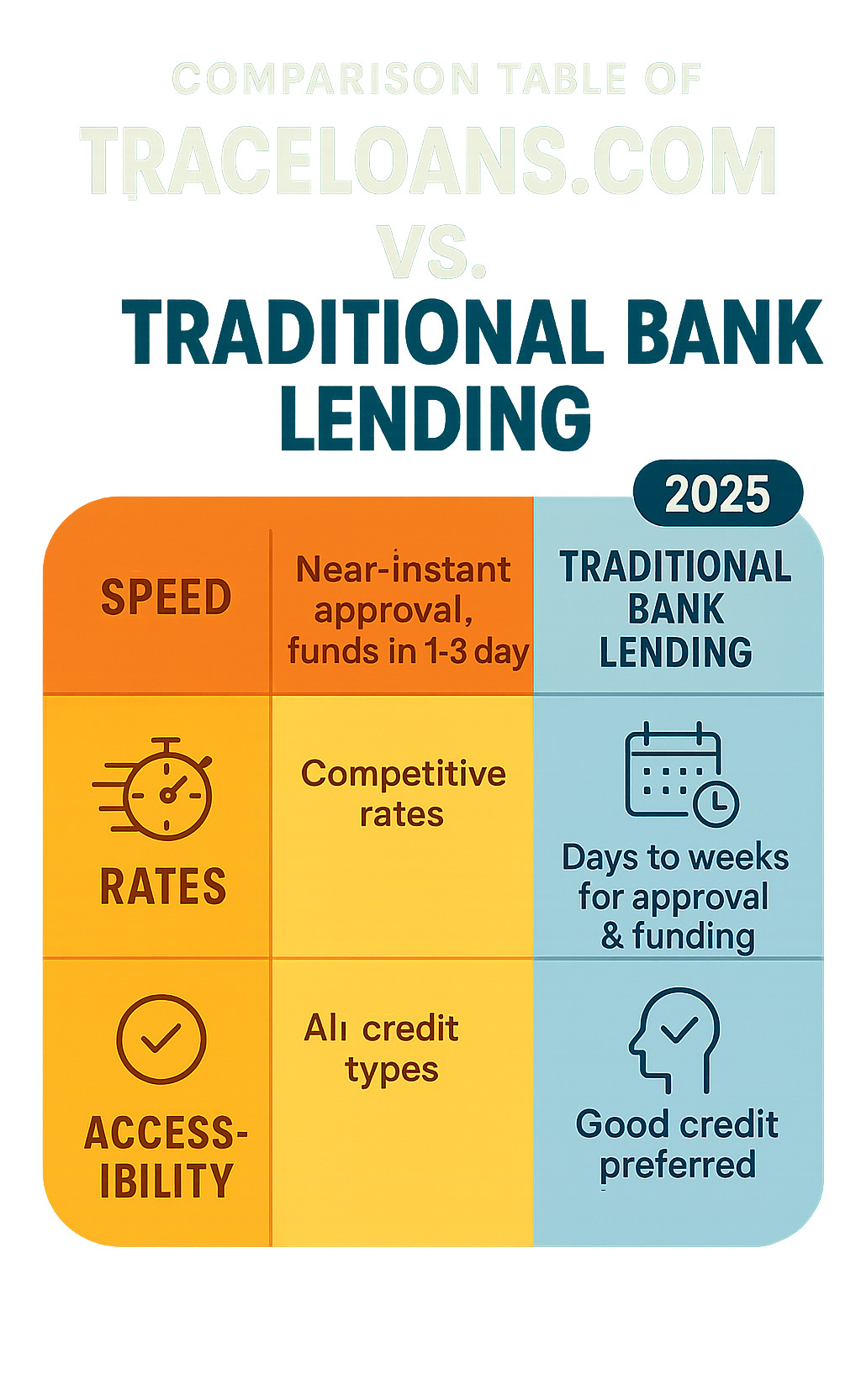

Speed and efficiency are where digital platforms really shine. While your neighborhood bank might take weeks to process your application (and require multiple visits), Traceloans.com uses AI-driven technology to provide decisions within hours. You could literally apply during your lunch break and have an answer before dinner.

The accessibility factor is huge too. Traditional banks often turn away anyone with less-than-perfect credit, leaving many people feeling hopeless. Traceloans.com works with lenders who consider all credit types, including those with bad credit histories. This opens doors for people who might otherwise feel stuck with high-interest credit cards or predatory payday loans.

The digital-first experience means no more awkward bank meetings or stacks of paperwork. You can apply from your cozy home office in your favorite pajamas if you want. The platform is available 24/7, so whether you’re an early bird or a night owl, you can handle your financial needs on your schedule.

Perhaps most importantly, you get broader lender choice. Instead of accepting whatever terms one bank offers, you can compare multiple offers side by side. This transparency puts you in the driver’s seat of your financial decisions.

Common Uses for a Personal Loan

Personal loans are incredibly versatile tools that can support both your financial health and overall well-being. Many people use them for consolidating high-interest credit cards – imagine turning four different credit card payments into one manageable monthly payment, often at a lower interest rate. It’s like decluttering your finances.

Others invest in their well-being by funding cosmetic procedures or wellness programs. Whether it’s a confidence-boosting treatment or a life-changing wellness retreat, sometimes the best investment is in yourself.

Unexpected medical bills can derail even the best financial plans. A personal loan provides breathing room when health emergencies strike, letting you focus on healing instead of worrying about money.

Creating a serene living space through home improvements is another popular use. That spa-like bathroom renovation or peaceful meditation corner could be more affordable than you think.

Finally, many people use personal loans for financing personal development courses or certifications. Investing in your skills and growth often pays dividends far beyond the loan amount.

The beauty of traceloans.com personal loans is that they make all these goals more accessible, regardless of your current financial situation or credit history.

The Application Process for traceloans.com personal loans

We know that applying for a loan can feel overwhelming, especially when you’re already dealing with financial stress. The good news? Traceloans.com has designed their process to be as gentle and straightforward as possible, so you can focus on what really matters – your well-being and financial peace of mind.

The beauty of traceloans.com personal loans lies in their streamlined, step-by-step online process. You start by visiting their website and filling out a simple pre-qualification form with basic personal and financial information. This initial step uses what’s called a soft credit pull – think of it as a gentle peek at your credit history that won’t leave any marks or affect your credit score.

Within minutes, their system works its magic, matching you with potential lenders from their network. You’ll receive pre-qualified offers showing exactly what you could qualify for – including interest rates, monthly payments, and total costs. This transparency means no surprises later, which we absolutely love.

Once you choose the offer that feels right for your situation, you’ll complete the official application with your selected lender. This step involves a hard credit inquiry, but by this point, you already know you’re likely to be approved. After final approval, funds typically arrive in your bank account within 1-2 business days.

Most lenders offer convenient repayment options like automatic direct debit from your bank account, making it easier to stay on track with your payments. This automated approach can actually help build better credit habits over time.

Eligibility for traceloans.com personal loans

The eligibility requirements for traceloans.com personal loans are refreshingly straightforward. You need to be at least 18 years old (or 19 if you live in Alabama or Nebraska), and either a U.S. citizen or permanent resident.

Lenders want to see that you have verifiable income – but don’t worry if you don’t have a traditional 9-to-5 job. Many lenders in the Traceloans.com network consider alternative income sources like freelance work, social security benefits, or even disability payments. You’ll also need an active bank account for receiving funds and making payments.

Here’s where things get interesting: while your credit score does impact the rates and terms you’ll receive, Traceloans.com welcomes all credit types. Excellent credit will get you the lowest rates, but even if your credit has seen better days, you’ll still find lenders willing to work with you. Some even consider alternative data like your utility payment history or rent payments when making decisions.

From Application to Funding: How Quickly You Get Your Money

Speed is where traceloans.com personal loans truly shine. Thanks to their AI-driven underwriting technology, you can receive near-instant decisions – often within hours, sometimes even minutes after submitting your application.

This rapid approval process is a game-changer when you’re dealing with urgent expenses or simply want to move forward with your financial plans quickly. Compare this to traditional banks, where you might wait days or even weeks for an answer, and the difference is remarkable.

Once approved, the funding process is equally impressive. Most borrowers receive their funds within 1-2 business days. If you apply early in the day and complete all necessary verifications promptly, there’s even a possibility of same-day funding. This speed makes Traceloans.com an excellent choice when life throws you a curveball or when you want to seize an opportunity for personal growth.

The platform maintains clear communication throughout the process, so you’ll always know where your application stands. This transparency helps reduce the anxiety that often comes with financial decisions, allowing you to focus on your wellness journey instead of worrying about paperwork and approvals.

Key Benefits and Potential Risks of Using Traceloans.com

When you’re considering any financial decision, especially one that affects your overall wellness and peace of mind, it’s important to look at both sides of the coin. Traceloans.com personal loans offer some genuinely compelling advantages, but like any financial tool, they come with considerations worth understanding.

| Feature | Traceloans.com (Marketplace) | Traditional Bank Lending |

|---|---|---|

| Speed | Near-instant approval, funds in 1-3 days | Days to weeks for approval & funding |

| Rates | Competitive, 6-36% APR, varies by lender | Varies, often higher for lower credit |

| Accessibility | All credit types, including bad credit | Primarily good to excellent credit |

| Application | 100% online, soft credit check | Often in-person or lengthy online forms |

| Lender Choice | Multiple offers from network of lenders | Single offer from one institution |

| Transparency | Full disclosure of terms upfront | May require more digging for details |

The most exciting benefit of using Traceloans.com is access to multiple lenders through one simple application. Instead of spending your precious time visiting different banks or filling out countless forms, you get to compare offers side by side. This is like having a personal shopping assistant for loans – someone who does the legwork while you focus on choosing what works best for your lifestyle.

Competitive APRs are another major advantage. With rates typically ranging from 6-36% APR, you’re often looking at much better terms than what you’d find on credit cards. The platform shows you exactly what rate you qualify for before you commit, which takes the guesswork out of the equation.

The flexibility in repayment is something we particularly appreciate at Beyond Beauty Lab. With terms up to 84 months, you can choose monthly payments that don’t strain your budget. This means you can invest in your wellness goals without sacrificing your daily peace of mind.

What really sets Traceloans.com apart is their commitment to transparency. No hidden surprises, no fine print that requires a magnifying glass. You see the interest rate, monthly payment, and total cost upfront. It’s refreshing in a world where financial products often feel like they’re designed to confuse rather than clarify.

The platform also prioritizes data security with modern cloud infrastructure and encryption protocols. Your sensitive information is protected with the same level of security you’d expect from major financial institutions.

Of course, no financial product is perfect. Some lenders in the network may charge origination fees, typically ranging from 1-5% of your loan amount. While these fees are clearly disclosed upfront, they do add to the total cost of borrowing.

Since you’re working with different lenders through the platform, the specific terms and customer service experience can vary. This means it’s crucial to read each loan agreement carefully before signing. Think of it like reading reviews before trying a new skincare product – a little research goes a long way.

There’s always the risk of over-borrowing with any loan. It’s tempting to take more than you need when funds are easily accessible, but we always encourage borrowing only what’s necessary for your specific goals.

While the initial credit check won’t affect your score, accepting a loan offer will result in a hard inquiry on your credit report. The good news? Making consistent, on-time payments will actually help improve your credit score over time.

For deeper insights into personal loans, we recommend checking out Understanding personal loans from the Consumer Financial Protection Bureau and staying informed about Warnings on high-cost credit from the Federal Trade Commission.

Understanding the Costs: APR, Interest, and Fees

Let’s break down the true cost of borrowing because understanding these numbers is key to making smart financial decisions that support your overall wellness.

The interest rate is straightforward – it’s the percentage charged on your loan amount. But the APR (Annual Percentage Rate) tells the whole story. APR includes the interest rate plus any additional fees, giving you the most accurate picture of what you’ll actually pay over the life of your loan.

Origination fees are upfront charges that some lenders add for processing your loan. These typically range from 1-5% of your total loan amount. Here’s how it works: if you borrow $10,000 with a 3% origination fee, you’d receive $9,700 in your account. Traceloans.com makes sure these fees are crystal clear before you accept any offer.

One feature we love is that many lenders on the platform don’t charge prepayment penalties. This means if you get a bonus at work or decide to pay off your loan early, you won’t face extra fees. It’s like having the freedom to pay off your wellness investment ahead of schedule without being punished for it.

Understanding late payment policies is equally important. While life happens and sometimes payments get missed, knowing the consequences helps you plan better. Most lenders charge late fees and report missed payments to credit bureaus, which can impact your credit score.

How Traceloans.com Protects Your Data

In our digital world, sharing financial information can feel vulnerable. Traceloans.com understands this concern and has built their platform with security as a top priority.

The platform uses modern cloud infrastructure with robust security measures, including data encryption that scrambles your information so it can’t be read by unauthorized parties. It’s like having a digital safe that only you and your chosen lender can access.

Traceloans.com follows strict privacy policies and uses advanced security protocols like real-time monitoring for unusual activity and multi-factor authentication. This means they’re constantly watching for anything suspicious and require multiple forms of verification to access your account.

Their commitment to user data security provides the peace of mind you need when sharing sensitive financial information. After all, your financial wellness journey should feel secure and supported, not stressful and uncertain.

How Traceloans.com Can Support Your Financial Wellness, Even with Bad Credit

At Beyond Beauty Lab, we know that true wellness starts from within – and that includes having peace of mind about your finances. When money worries keep you up at night or prevent you from investing in your self-care, it affects everything from your skin’s glow to your overall energy. This is where traceloans.com personal loans can become a powerful tool for change, especially if you’ve been turned away by traditional banks because of your credit history.

Let’s be honest – life happens. Maybe you went through a divorce, faced unexpected medical bills, or had a period of unemployment. These experiences can damage your credit score, but they don’t define your worth or your ability to manage money responsibly moving forward. Unlike traditional banks that often require pristine credit scores of 650 or higher, Traceloans.com connects you with lenders who specialize in working with all credit types, including those with bad credit or limited credit history.

What makes this particularly exciting for your wellness journey is how reducing financial stress can dramatically improve your overall well-being. When you’re no longer juggling multiple high-interest credit card payments or worrying about covering an emergency expense, you free up mental and emotional energy for the things that truly nourish you. Suddenly, that wellness retreat you’ve been dreaming about becomes possible, or you can finally invest in that personal development course that’s been calling your name.

The beauty of using a personal loan responsibly is that it can actually help rebuild your credit over time. Each on-time payment gets reported to the major credit bureaus, slowly but surely improving your credit profile. It’s like a gentle skincare routine for your financial health – consistent care leads to visible results.

For those dealing with overwhelming debt, platforms like Traceloans.com offer pathways to consolidation that can simplify your financial life. We’ve seen how effective solutions like Traceloans.com Debt Consolidation can be for our community members who want to regain control and focus on their wellness goals.

A Path to Financial Freedom with a Bad Credit Score

Here’s something that might surprise you – having bad credit doesn’t have to be a permanent roadblock to financial freedom. Traceloans.com personal loans can actually become your stepping stone to a brighter financial future, and here’s how that magic happens.

The platform uses sophisticated lender matching technology that goes beyond just looking at your credit score. Think of it like a matchmaker for your finances – it connects you with lenders who understand that your three-digit credit score doesn’t tell your whole story. Some of these lenders look at alternative data points like your history of paying rent, utilities, or even subscription services on time. This more complete picture of your financial responsibility can open doors that seemed permanently closed.

Take Sarah, for example. After a difficult divorce left her with damaged credit and $12,000 in credit card debt, traditional banks wouldn’t even consider her application. Through Traceloans.com, she found a lender who saw her consistent freelance income and responsible payment of monthly bills. The personal loan she secured allowed her to reduce her monthly payments by $400 and create a clear 48-month path to being debt-free. More importantly, it gave her the emotional space to focus on rebuilding her life and investing in her wellness.

The real beauty of this approach is how it creates an upward spiral. As you make consistent, on-time payments, your credit score gradually improves. This better credit opens up more financial opportunities in the future, like lower interest rates on future loans or better credit card offers. Meanwhile, the reduced financial stress allows you to sleep better, make healthier choices, and invest in the self-care practices that help you thrive.

What we love most about this journey is that it’s not just about the money – it’s about gaining financial control and the confidence that comes with it. When you know you have options and a plan, you can approach life’s challenges with more grace and resilience. That inner peace? It shows up in everything from clearer skin to more energy for the activities and relationships that matter most to you.

Frequently Asked Questions about Traceloans.com Personal Loans

When it comes to traceloans.com personal loans, we know you want straight answers to your most pressing questions. At Beyond Beauty Lab, we believe in transparency and helping you make informed decisions that support your overall well-being. Let’s address the questions we hear most often from our community.

Will checking for offers on Traceloans.com affect my credit score?

Here’s some wonderful news that puts many minds at ease: checking for offers on Traceloans.com will not hurt your credit score. When you explore your options through their platform, they use what’s called a “soft credit inquiry” to assess your eligibility.

Think of a soft inquiry as a gentle peek at your credit report. It’s like window shopping – you get to see what’s available without any commitment or consequences. This soft check doesn’t appear on your credit report when other lenders look at it, and most importantly, it has zero impact on your credit score.

The beauty of this approach is that you can explore multiple loan offers and compare terms without any risk. It’s only when you decide to accept a specific offer and move forward with the full application that a “hard inquiry” occurs. This risk-free comparison shopping gives you the power to make the best choice for your financial wellness journey.

How much can I borrow and what are the typical interest rates?

Traceloans.com personal loans offer impressive flexibility when it comes to loan amounts. You can typically borrow anywhere from $1,000 to $50,000 or more, depending on your financial profile and needs. Whether you’re looking to cover a smaller wellness investment or fund a major life transition, there’s likely an option that fits.

Interest rates for personal loans through Traceloans.com generally fall within the 6-36% APR range. Where you land within this spectrum depends on several key factors that lenders consider when evaluating your application.

Your credit score plays the biggest role in determining your rate. Those with excellent credit typically qualify for the lowest rates, while borrowers with fair or poor credit may see higher rates – but they still have access to funding options that traditional banks might deny.

Your income level and stability also matter significantly. Lenders want to see that you have the means to comfortably repay the loan. Additionally, your debt-to-income ratio – which compares your monthly debt payments to your gross monthly income – helps lenders assess your overall financial health.

The loan term you choose can also influence your rate. Longer repayment periods might carry slightly higher interest rates but offer the benefit of lower monthly payments, which can be helpful for managing your budget.

Are there hidden fees with traceloans.com personal loans?

We completely understand why this question comes up so often – nobody wants unpleasant financial surprises! The good news is that Traceloans.com prioritizes transparency throughout their lending process.

Before you commit to any loan offer, you’ll see a clear, detailed breakdown of all costs. This includes your interest rate, monthly payment amount, total loan cost, and any applicable fees. The platform is designed to show you exactly what you’re signing up for, with no fine print surprises.

Some lenders in their network may charge origination fees, which are typically disclosed upfront and range from 1-5% of your loan amount. These fees are deducted from your loan proceeds, so you’ll know about them before accepting any offer.

One particularly appealing feature is that most traceloans.com personal loans come with no prepayment penalties. This means if you come into extra money or simply want to pay off your loan early, you won’t face additional charges. In fact, paying early can save you significant money on interest – a win for both your wallet and your peace of mind.

The platform’s commitment to clear, upfront pricing aligns perfectly with our philosophy at Beyond Beauty Lab: authentic, honest information that empowers you to make the best decisions for your holistic well-being.

Conclusion

As we wrap up our exploration of traceloans.com personal loans, it’s clear that this platform represents more than just another lending option—it’s a bridge to financial peace and personal empowerment. At Beyond Beauty Lab, we’ve always believed that true beauty comes from feeling confident and secure in all aspects of your life, and financial wellness is absolutely part of that equation.

The beauty of Traceloans.com lies in its ability to simplify what has traditionally been a complex, stressful process. The incredible speed of their AI-driven approvals means you’re not left waiting weeks in uncertainty. The remarkable accessibility for all credit types ensures that past financial challenges don’t define your future opportunities. Most importantly, their unwavering transparency means no nasty surprises—just clear, honest information that helps you make the best decision for your unique situation.

Think about it: when you’re not lying awake at night worrying about high-interest credit card debt, you have more energy for your morning meditation. When you’re not stressed about how to pay for that wellness retreat you desperately need, you can actually focus on healing and growth. When unexpected expenses don’t send you into panic mode, you maintain that inner calm we all strive for.

Traceloans.com personal loans can be your tool for creating this kind of financial serenity. Whether you’re consolidating debt to breathe easier, covering an emergency without depleting your peace of mind, or investing in personal development that enriches your soul, this platform offers a path forward that feels manageable and hopeful.

Financial stress has a way of seeping into every corner of our lives, affecting our sleep, our relationships, and even our skin (yes, stress really does show on our faces!). By taking control of your financial situation through smart borrowing decisions, you’re not just managing money—you’re investing in your overall well-being and creating space for the beautiful, balanced life you deserve.

We encourage you to explore what’s possible when financial stress no longer holds you back. Your journey toward holistic wellness deserves every tool available, and sometimes that includes making smart financial moves that support your bigger picture of health and happiness.

Explore more resources to improve your financial and personal wellness