Why Understanding Tariff News is Critical for Your Business Right Now

Tariff news is making headlines as a U.S. federal appeals court ruled that most of President Trump’s sweeping tariffs are illegal, creating massive uncertainty for businesses worldwide. This landmark 7-4 decision challenges presidential authority and could reshape global trade.

Latest Tariff News Updates:

- Court Ruling: U.S. Court of Appeals found tariffs exceeded presidential authority

- Legal Basis: International Emergency Economic Powers Act (IEEPA) doesn’t authorize tariffs

- Financial Impact: $159 billion in tariff revenue at risk of refund

- Timeline: Tariffs remain until mid-October pending Supreme Court appeal

- Global Effect: Trade deals with UK, Japan, and other countries now uncertain

The ruling stems from the court’s finding that the 1977 International Emergency Economic Powers Act doesn’t give presidents unlimited power to impose taxes on imports. As one legal expert noted, “The President cannot lawfully impose tariffs on his own, and IEEPA does not give him unlimited unilateral tariff authority.”

This decision affects every business that imports goods or relies on global supply chains. From beauty brands sourcing natural ingredients to manufacturers importing equipment, the uncertainty creates planning challenges and potential cost fluctuations.

The stakes are enormous. The U.S. Justice Department warned that revoking tariffs could mean “financial ruin” for the United States, while businesses face the possibility of sudden supply chain cost changes.

Tariff news definitions:

1. The Latest Tariff News: U.S. Appeals Court Rules Most Trump Tariffs Illegal

The U.S. Court of Appeals for the Federal Circuit ruled in a 7-4 split decision that the sweeping tariffs imposed by President Trump are illegal. The court found that the president exceeded his authority by using emergency powers to implement these taxes on imports from partners like Canada, Mexico, and China. This landmark decision, which upholds a ruling from a specialized federal trade court, creates significant uncertainty for U.S. trade policy.

This ruling is a significant setback for the previous administration’s trade policies, which have often been characterized by aggressive use of tariffs. The court’s decision centers on a broad array of tariffs, including those slapped in April on almost all U.S. trading partners, as well as earlier levies imposed on China, Mexico, and Canada. These were often referred to as “reciprocal tariffs” or “Liberation Day” tariffs by the former President, who claimed virtually unlimited power to bypass Congress and impose sweeping taxes on foreign products.

The impact of this tariff news is profound. It means that the legal foundation for a substantial portion of the tariffs currently in place has been seriously questioned by a high court. While the tariffs remain active for now, this ruling has effectively thrown a wrench into the administration’s trade machinery, signaling that the executive branch’s power to unilaterally impose such economic measures may not be as expansive as once claimed.

Legal Grounds for the Ruling and What It Means for Tariff News

The court’s majority opinion stated that the law used to justify the tariffs, the International Economic Emergency Powers Act (IEEPA), does not grant the president the power to impose taxes. This ruling directly challenges the administration’s claim of having virtually unlimited power to bypass Congress on trade matters. The tariff news here is that the judiciary is asserting its role in checking presidential authority, particularly when it comes to an area traditionally reserved for the legislative branch: taxation.

The U.S. Court of Appeals for the Federal Circuit specifically rejected the argument that the tariffs were permitted under the president’s emergency economic powers, calling the levies “invalid as contrary to law.” This decision underscores a fundamental principle of U.S. governance: the U.S. Constitution grants Congress the power over taxes and tariffs. Therefore, any attempt by the executive branch to impose such taxes without explicit congressional authorization, or under a statute that doesn’t clearly grant such power, is subject to legal challenge.

President Trump, in response, immediately rejected the judgment, taking to Truth Social to call the appeals court “highly partisan” and made an “incorrect decision.” However, the court’s 7-4 split decision, while not unanimous, indicates a strong legal consensus that the executive branch overstepped its bounds. The ruling suggests it’s unlikely Congress intended to grant the president unlimited authority to impose tariffs, especially considering the lack of clear procedural safeguards within the statutes used. This legal scrutiny aims to ensure that presidential actions do not infringe upon Congress’s constitutional role in controlling the nation’s purse strings.

2. Understanding the Legal Battle: IEEPA and Presidential Powers

The heart of this tariff news story lies in a decades-old law that most people have never heard of. The International Economic Emergency Powers Act (IEEPA) became the legal battleground where presidential authority met constitutional limits – and the results are reshaping how we think about trade policy.

This 1977 law was designed to give presidents swift tools to respond to genuine national security threats from abroad. Think of it as an economic emergency kit, allowing a president to freeze assets, block transactions, or impose sanctions when foreign threats emerge. But here’s where things get interesting: the court found that this emergency toolkit doesn’t include the power to create new taxes on imported goods.

The ruling could set a major precedent that extends far beyond this specific case. Future presidents may find their ability to use emergency declarations for trade policy significantly limited. For businesses trying to plan their supply chains and pricing strategies, this tariff news means the rules of the game are changing in real time.

The International Economic Emergency Powers Act (IEEPA) Explained

The 1977 law states that a president can use various economic levers to deal with any unusual and extraordinary threat that comes from outside the United States and threatens national security, foreign policy, or the economy. Sounds pretty broad, right? That’s exactly what made this legal challenge so complex.

The law has been used many times before, but typically for things like sanctions rather than tariffs. When presidents wanted to freeze Russian assets or block financial transactions with hostile nations, IEEPA provided the legal foundation. These actions directly control money flows and transactions – which is quite different from imposing taxes on imported cherry equipment or Swiss gold bars.

But here’s where the Congressional authority piece becomes crucial. The Constitution specifically gives Congress – not the president – the power to impose taxes and regulate trade. The appeals court argued that while IEEPA allows presidents to control economic transactions during emergencies, it doesn’t hand over Congress’s constitutional role in taxation.

The dissenting judges saw things differently. They argued that the tariffs served as a “bargaining chip” for cooperation on serious issues like fentanyl trafficking, which they believed fell within IEEPA’s scope. They also contended that the 1977 law represented a constitutional delegation of authority from Congress to the executive branch.

This disagreement reflects a fundamental tension in American governance. When does presidential power during a national emergency declaration cross the line into territory that belongs to Congress? The answer to that question will influence how future administrations approach trade policy and emergency powers – making this tariff news relevant for years to come.

3. Economic Fallout: Global Trade and Your Bottom Line

The court’s ruling creates a financial headache of epic proportions. The U.S. Justice Department isn’t being dramatic when they warn that revoking the tariffs could mean “financial ruin” for the United States. We’re talking about refunding a record-breaking $159 billion in collected tariffs – that’s more than double what was collected the year before.

For business owners, this tariff news translates into sleepless nights and difficult planning decisions. Do you continue budgeting with current tariff costs in mind? Or do you start preparing for a world where these taxes disappear overnight? It’s like trying to plan a outdoor wedding when the weather forecast keeps changing every hour.

The numbers tell a stark story. By July, tariff revenue had reached that staggering $159 billion figure, highlighting just how much money is at stake. President Trump himself called the potential removal of tariffs a “total disaster for the Country” and warned about another “Great Depression.” While the language might be strong, the underlying concern about what happens to the U.S. Treasury is very real.

This uncertainty ripples through financial markets, which historically get nervous when trade policies become unpredictable. For businesses already juggling supply chain challenges, this adds another layer of complexity that can freeze investment and growth decisions.

Impact on International Trade Deals

Here’s where things get really messy. Countries around the world negotiated specific agreements with the U.S. to avoid these tariffs, often making significant concessions in the process. Now that the legal foundation for those tariffs is shaky, these nations might want to revisit those deals.

Think about it from their perspective. The UK, Japan, and South Korea all rushed to make trade deals before deadline dates, sometimes agreeing to terms they might not have accepted under normal circumstances. If the threat of tariffs disappears, will these countries demand better terms? The answer is probably yes.

The situation gets even more complex when you look at specific examples. The U.S. slapped a 50% tariff on imports from India as punishment for buying Russian oil. Canada faced 35% tariffs starting August 1st, supposedly because of fentanyl flow – despite U.S. data showing that fentanyl seized at the Canada-U.S. border accounts for less than one percent of all fentanyl found at U.S. borders.

Not all tariffs are affected equally, which creates an uneven playing field. Tariffs on steel, aluminum, and copper remain intact because they were imposed under different legal authority (the Trade Expansion Act of 1962). But the broad “reciprocal tariffs” affecting nearly everything else from most countries are hanging in legal limbo.

This selective impact means businesses must steer an increasingly complex global trade landscape. The potential for the U.S. to refund billions in collected taxes could also weaken future negotiating positions and embolden other governments to resist future trade demands.

4. Sector-Specific Impacts: From Agriculture to Beauty and Wellness

The ripple effects of these tariffs have touched virtually every corner of the economy, creating real challenges for businesses across different sectors. Take Michigan’s cherry farmers, for instance – they’ve been dealing with a perfect storm of rising costs and declining profits.

Michigan produces about 75% of America’s tart cherries, which amounts to roughly 180 million pounds worth $36.5 million in 2022. But these farmers have watched their input costs climb as tariffs made equipment and fertilizer more expensive. When you add a 10% rise in labor costs for specialty crops, the math gets pretty scary – an MSU report suggests this could lead to over 1,600 job losses in the state.

The numbers tell a sobering story. Cherry values have dropped 40% since 2015, and trade policy uncertainty has made it nearly impossible for farmers to plan ahead. How do you decide what to plant when you don’t know what your costs will be next season?

Global markets have felt the shake-up too. The gold trade got turned upside down when U.S. Customs reclassified gold bars, suddenly making Swiss kilobars subject to a potential 39% tariff. Major Swiss refineries had to slam the brakes on U.S. shipments, creating shortages and disrupting what had been a smooth-running global market. One analyst compared it to “pouring sand into an otherwise well-functioning engine.”

But it’s not all doom and gloom. Southeast Asian countries actually caught a break when final tariff rates came in lower than expected. Vietnam ended up with a 20% levy instead of the threatened 36% or 49%. For Cambodia’s crucial garments sector, this was huge news – it meant keeping jobs and staying competitive in the global market.

How Tariffs Affect the Beauty and Wellness Industry

For those of us in the beauty and wellness world, this tariff news hits particularly close to home. Our industry thrives on sourcing the best ingredients from around the globe – and that makes us vulnerable to trade disruptions.

Think about what goes into your favorite clean beauty products. That exotic essential oil from Madagascar, the rare French clay that makes your face mask so special, or those potent plant extracts from the Amazon. When tariffs kick in on these countries, those costs don’t just disappear – they get passed down the supply chain until they eventually reach your customers.

Here’s how it works in practice. Let’s say a botanical extract from Vietnam suddenly faces a 20% tariff. That cost increase flows through every step – from the supplier to the manufacturer to the brand to the final product price. Beauty companies then face a tough choice: absorb the extra costs and watch profit margins shrink, or pass them on to customers and risk pricing people out.

The supply chain disruption goes deeper than just money, though. Many clean beauty brands have spent years building relationships with specific suppliers who meet their ethical sourcing standards. When tariffs make those partnerships too expensive, brands might be forced to find alternatives that don’t align with their values or quality standards.

The unpredictability is the real killer. How do you plan a product launch when you don’t know if your key ingredient will cost 10% or 30% more next month? This uncertainty affects everything from new formulation research to long-term sustainability commitments. For an industry built on trust and transparency, that kind of instability creates real headaches for brands trying to stay true to their mission while keeping products accessible.

At Beyond Beauty Lab, we’ve seen how these trade tensions ripple through the entire wellness ecosystem, affecting everything from ingredient availability to product innovation timelines.

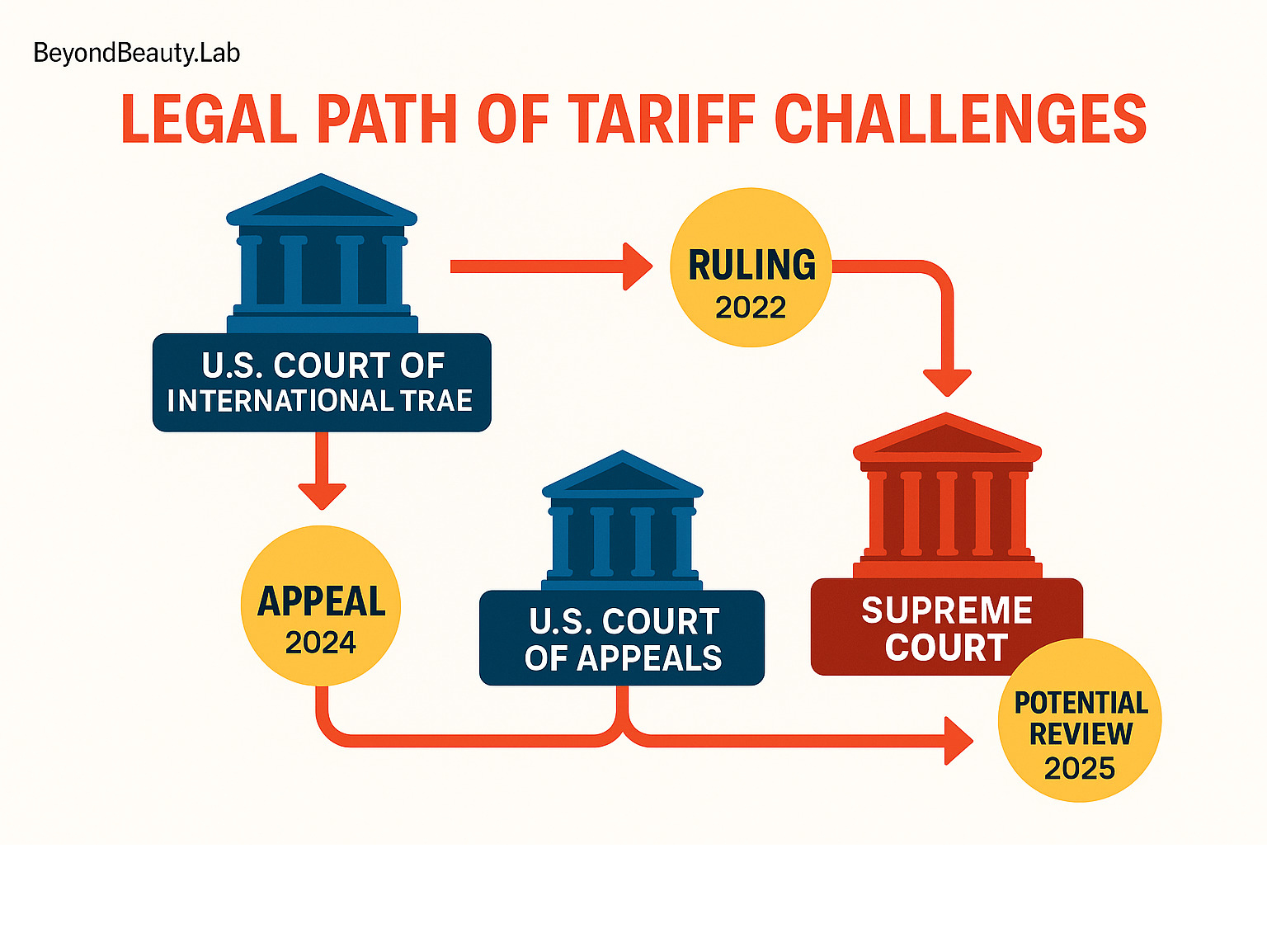

5. What’s Next? The Path to the Supreme Court and How to Prepare

Despite the ruling, the tariffs will remain in place until at least mid-October to allow the administration to appeal to the U.S. Supreme Court, a step President Trump has vowed to take. This creates a waiting period where the future of U.S. trade policy hangs in the balance.

This delay is crucial for businesses everywhere. You can’t just assume the tariffs are suddenly gone – they’re still very much in effect while the legal wheels keep turning. The Supreme Court’s conservative majority, with six of the nine justices appointed by Republican presidents (and three by Donald Trump during his first term), might seem like it would favor the former president’s position.

But here’s the thing – the court has also shown it’s willing to rein in presidential overreach when needed. They’ve applied something called the “major questions doctrine” to strike down administrative actions on big issues like greenhouse gas emissions and student loan debt forgiveness. So honestly, the outcome could go either way.

The Future of Global Trade and Ongoing Tariff News

The Supreme Court appeal is the next major hurdle, and it’s a big one. If the Supreme Court agrees with the appeals court decision, we’re looking at potential financial market chaos, serious questions about repaying that massive $159 billion in collected import taxes, and complete uncertainty around existing trade deals. What happens next after court rules them illegal? The implications are enormous for everyone involved.

For businesses – especially those in beauty and wellness who depend on global ingredients – preparing for both scenarios is absolutely essential. You need to review your supply chain dependencies and identify alternative sourcing options right now. Know exactly where your critical ingredients, components, and packaging come from, and understand what tariff risks you’re facing. Having a backup plan for sourcing isn’t just smart – it’s necessary.

It’s also time to consult with financial and legal advisors to understand what these potential changes could mean for your bottom line. This includes figuring out what refunds might look like if tariffs get struck down, or what continued tariff costs mean for your pricing strategy and profit margins.

Stay informed on the Supreme Court’s decision to intervene by monitoring reliable tariff news sources and legal analyses. The more you know, the faster you can react when decisions are made. And definitely model different pricing scenarios based on whether tariffs stick around or disappear. This helps you understand how flexible your pricing structure really is and how changes might affect your ability to compete.

The uncertainty is challenging, sure, but it also creates opportunities for nimble businesses to adapt and potentially gain an edge. Those who plan proactively now will be in the best position to steer whatever comes next in this evolving global trade landscape.

Conclusion

This federal appeals court ruling represents a turning point in how we think about presidential power and global trade. The tariff news coming out of this decision doesn’t just affect government policy—it ripples through every industry, touching everything from the essential oils in your favorite serum to the packaging that protects your wellness products.

For those of us in the beauty and wellness world, these changes hit particularly close to home. When tariffs affect the cost of natural ingredients we rely on, or disrupt the supply chains that bring us ethically-sourced botanicals, it challenges our ability to create the clean, effective products our customers deserve. The uncertainty makes it harder to plan, harder to price fairly, and harder to maintain the quality standards that matter most.

But here’s what we’ve learned: knowledge really is power. The businesses that stay informed, that understand these complex trade dynamics, are the ones that can adapt quickly and continue serving their customers well. Whether the Supreme Court upholds these tariffs or strikes them down, being prepared for either outcome gives you a real competitive advantage.

At Beyond Beauty Lab, we’ve always believed that understanding the bigger picture—whether it’s the science behind skincare or the economics behind our industry—helps you make better decisions. This tariff news is just another piece of that puzzle. The beauty and wellness industry has weathered many storms, and we’ll steer this one too.

The key is staying curious, staying informed, and remembering that every challenge also brings opportunity. Explore our resources to stay ahead and keep building the knowledge that will serve you well, no matter what changes come next.