Why Closing Your Chase Checking Account Is Easier Than You Think

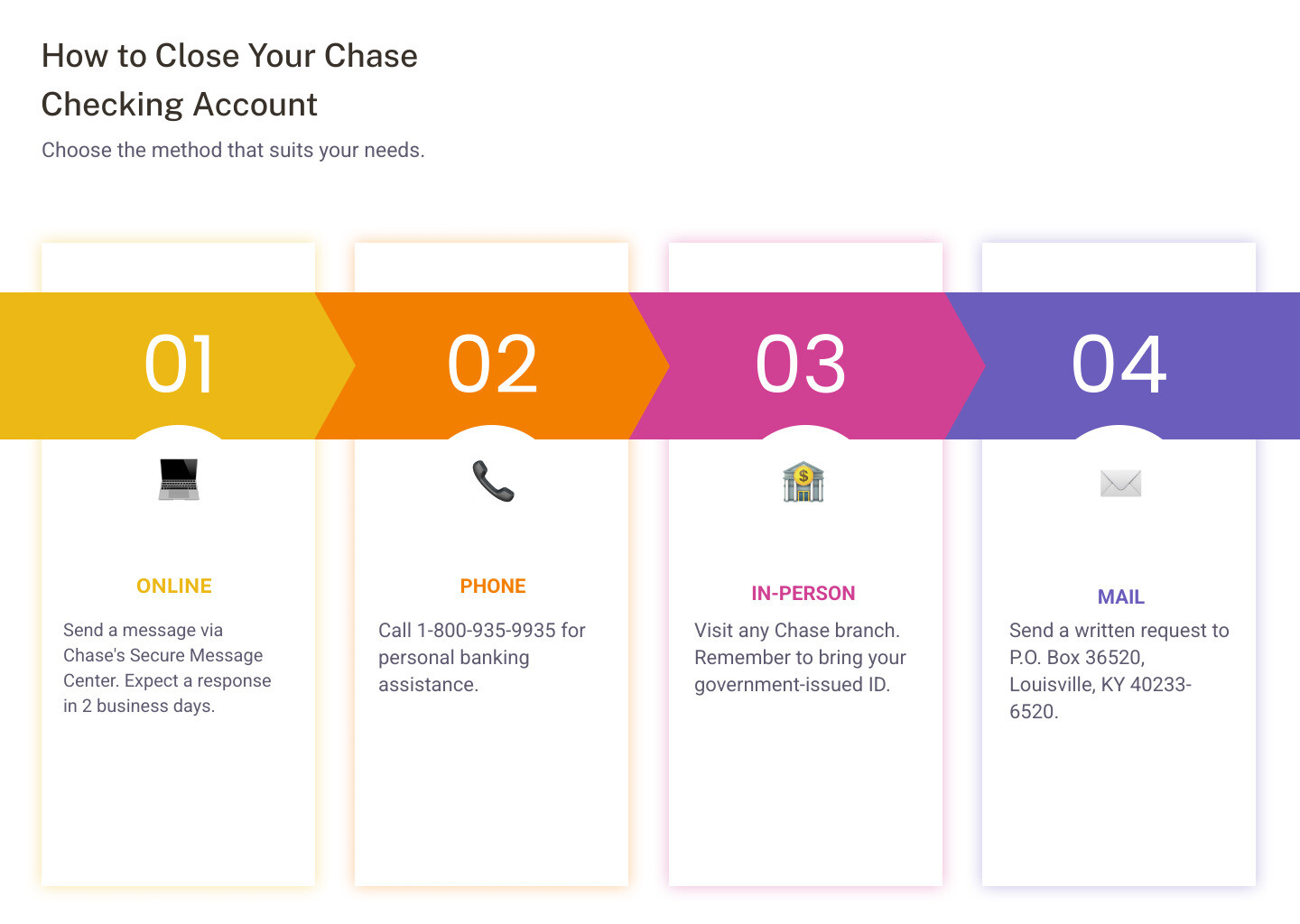

Learning how to close chase checking account can feel overwhelming, but the process is actually straightforward once you know the steps. Whether you’re switching to a bank with better rates, consolidating your finances, or simply no longer need the account, Chase offers four main methods to close your checking account.

Quick Answer: How to Close Your Chase Checking Account

- Online – Send a message through Chase’s Secure Message Center (2 business days response)

- Phone – Call 1-800-935-9935 for personal banking

- In-Person – Visit any Chase branch with your ID

- Mail – Send written request to P.O. Box 36520, Louisville, KY 40233-6520

Before closing your account, you’ll need to zero out your balance, update automatic payments, and transfer any remaining funds. The good news? Closing a checking account won’t affect your credit score as long as you don’t have unpaid fees or a negative balance.

Chase typically processes account closures within 1-2 business days once initiated. They’ll send you confirmation and mail a check for any remaining funds over $1. The key is proper preparation – having all your financial ducks in a row before you start the process.

Just like simplifying your skincare routine can lead to clearer, healthier skin, streamlining your banking can reduce financial stress and give you better control over your money. The process might seem complex at first, but breaking it down into manageable steps makes it much more achievable.

Learn more about how to close chase checking account:

- fintechzoom.com lifestyle

- profitable intraday trading advice 66unblockedgames.com

- wellness lifestyle tips

Before You Close: A 3-Step Preparation Checklist

Think of preparing to how to close chase checking account like getting your skin ready for a new skincare routine. You wouldn’t just jump into new products without preparing your complexion first, right? The same principle applies to closing your bank account – a little preparation goes a long way toward avoiding future headaches.

Getting your financial house in order before closing your Chase account isn’t just smart; it’s essential. Skip these steps, and you might find yourself dealing with bounced payments, unexpected fees, or lost records down the road. Let’s walk through the three crucial preparation steps that’ll make your account closure smooth as silk.

Step 1: Settle Your Account Balance

Here’s the golden rule: Chase won’t let you close an account unless it has a zero balance. No exceptions. If you’ve got money sitting in there, you’ll need to move it out. If you’re in the red with a negative balance, you’ll need to settle up first.

Moving your money out is easier than you might think. An ACH transfer through Chase’s online banking is usually your best bet – it’s free and lets you move up to $25,000 daily. For smaller amounts, a simple cash withdrawal from a Chase ATM works perfectly fine. Just watch out for those pesky out-of-network ATM fees if you use someone else’s machine.

If you need to move a large sum quickly, a wire transfer will do the trick, though Chase charges around $35 for the service. For those who prefer the old-school approach, you can always request a check for your remaining balance – just factor in a few extra days for processing and delivery.

Think of this step like cleansing your face before starting a Skincare Routine for Oily Skin with Large Pores – you need a clean slate to move forward successfully.

Step 2: Reroute Your Automatic Payments and Direct Deposits

This step is where many people trip up, and honestly, it’s understandable. We set up so many automatic payments and direct deposits that it’s easy to forget about them all. Your paycheck, Netflix subscriptions, utility bill pay, insurance premiums – they all need new marching orders.

Start by reviewing statements from the past six months to spot every recurring transaction. Your employer’s HR department will need your new account details for direct deposit changes. Meanwhile, most subscription services let you update payment information through their websites or apps.

The good news? You can update your payments through the Chase online banking portal to see exactly what’s set up for automatic processing. Give yourself at least two weeks for this step – some companies are slower than others when updating their systems.

Missing this step is like forgetting to remove makeup before bed. You might get away with it once, but eventually, it’s going to cause problems you’d rather avoid.

Step 3: Download Your Statements and Records

Once Chase closes your account, accessing your bank statements and account history through their online portal becomes much harder. You don’t want to be scrambling for tax records next April, only to realize you’re losing access to important financial information.

Download at least two years’ worth of statements and save them somewhere secure. These digital records are crucial for tax preparation, budgeting, and general financial organization. Most people store them in a dedicated folder on their computer or a cloud service – just make sure wherever you choose is backed up and secure.

This step takes maybe fifteen minutes but saves you hours of potential frustration later. It’s like taking progress photos of your skincare journey – you might not need them right away, but you’ll be grateful to have them when you do. Just as understanding How to Tighten Pores on Cheeks requires tracking your skin’s changes over time, good financial health means keeping detailed records of your banking history.

Taking care of these three preparation steps might seem like extra work, but they’re what separate a smooth account closure from a stressful ordeal. Once you’ve got everything squared away, you’ll be ready to tackle the actual closure process with confidence.

How to Close Your Chase Checking Account: 4 Methods

With your account prepped and ready, it’s time to choose your adventure! Chase offers four primary methods to close your checking account, each with its own quirks and convenience levels. Let’s explore them.

Method 1: How to Close a Chase Checking Account Online

While you can’t simply click a “close account” button on the Chase website (wouldn’t that be easy!), you can initiate the process online through their Secure Message Center. This method is generally preferred by 72% of users, according to some data, due to its convenience.

Here’s how we do it:

- Log In: First, log into your Chase account via their online banking portal or use the Chase mobile app.

- Steer to Secure Message Center: Look for a “Secure Message Center,” “Contact Us,” or similar option within your account. You might find it under “Customer Service” or by searching within the help section.

- Send a Closure Request: Compose a message clearly stating your intention to close your checking account. Include your account number and any other identifying information they might need (full name, address, phone number). You can also state a desired closure date if applicable, though typically it’s best to request immediate closure once all funds are out.

- Await Response: Chase typically replies to online closure requests within 2 business days. They will likely send you a message back with further instructions or to schedule a phone call for verification purposes. As of July 2021, you often couldn’t close it fully online yourself, but rather initiate a call-back. This process takes about 10-15 minutes to initiate, but finalization can take a few days.

This method offers the convenience of not having to speak to someone immediately, allowing you to compose your thoughts clearly.

Method 2: Closing Your Account Over the Phone

For those who prefer direct communication, closing your Chase account over the phone is a popular choice (17% of users prefer this method). Chase has customer service representatives available all hours, every day of the week, which makes this a flexible option.

Here’s the drill:

- Gather Information: Before you call, have your account number, Social Security Number, mailing address, current balance (which should be zero!), and debit card number handy.

- Make the Call:

- For personal banking within the US, call Chase customer service at 1 (800) 935-9935.

- For international customers, the number is 1 (713) 262-3300.

- State Your Intent: Once connected, clearly state that you wish to close your checking account. The representative will then guide you through the verification process.

- Verification and Confirmation: Be prepared to answer security questions to verify your identity. Once confirmed, they will process your closure request.

You can even schedule a phone call with a representative through Chase’s website, which can help avoid hold times. Be aware that the representative might try to offer incentives or ask why you’re leaving, but you are not obligated to accept or explain.

Method 3: Visiting a Chase Branch in Person

If you prefer a face-to-face interaction or have complex questions, visiting a Chase branch in person is a solid option (6% of users prefer this method). This allows for immediate assistance and ensures all paperwork is handled on the spot.

What to bring with us:

- Identification: A valid government-issued ID (like a driver’s license or passport).

- Account Details: Your checking account number, and preferably a copy of a recent statement.

- Debit Card & Checkbook: Bring the debit card associated with the account and any unused checks, as they will likely be collected or shredded.

You can find your nearest branch with the locater tool on the company’s website. While you can just walk in, it’s often a good idea to schedule an appointment beforehand, especially if you anticipate needing more time or if the branch is typically busy. This ensures a dedicated banker is available to assist you.

Method 4: Sending a Closure Request by Mail

While it’s the slowest method (preferred by only 5% of users), closing your Chase account by mail is an option, especially if you’re unable to use the other methods. This requires a formal written request.

Here’s what your letter should include:

- Your full name

- Your current mailing address

- Your Chase checking account number

- Your phone number and email address

- A clear statement requesting to close the account

- Your signature

Where to send it:

- Standard Mail: National Bank By Mail, P.O. Box 36520, Louisville, KY 40233-6520.

- For Rush Delivery (Certified/Overnight): National Bank By Mail, Mail Code KY1-0900, 416 West Jefferson, Floor L1, Louisville, KY, 40202-3202.

We highly recommend sending this via certified mail with a return receipt requested. This provides proof that Chase received your request. After mailing, follow up with a phone call to Chase customer service after about a week or two to confirm they received your letter and are processing the closure. Just like understanding the nuances of Oily Skin Pores requires patience and consistent effort, so does navigating the mail-in closure process.

A note on joint accounts: If you have a joint checking account, typically both account holders may need to authorize the closure, depending on Chase’s specific terms. It’s best to confirm this with Chase directly, especially if only one account holder is initiating the closure.

What to Expect After Closing Your Account

Congratulations! You’ve successfully steerd how to close chase checking account. Now you might be wondering what happens next. Don’t worry – the post-closure process is actually quite straightforward, and knowing what to expect will help you feel confident about your decision.

Confirmation and Final Steps

Once you’ve initiated your account closure, Chase moves pretty quickly to wrap things up. The bank typically processes closures within 1-2 business days after receiving your request, regardless of which method you used.

You’ll receive an email confirmation once your account is officially closed. This email is your digital receipt, so save it somewhere safe! It’s proof that everything went smoothly and your account is truly closed. Think of it as your financial fresh start certificate.

If you had any remaining funds in your account – even just a dollar or two that you might have missed – Chase will mail you a check for that amount. Make sure your address is current with Chase before closing, or you might be playing hide-and-seek with your own money! The check usually arrives within a week of closure.

Will Closing My Chase Checking Account Affect My Credit Score?

Here’s some great news that’ll put your mind at ease: closing your checking account will not hurt your credit score. Not even a little bit.

Your FICO score is built on credit-related activities like credit cards, loans, and payment history. Checking accounts live in a completely different world from your credit report. The major credit bureaus don’t track your everyday banking activities like deposits, withdrawals, or account balances.

However, there’s one important exception to remember. If you close an account with a negative balance or leave unpaid fees behind, that’s a different story. Chase could eventually send that debt to a collections agency, and that would definitely show up on your credit report and damage your score.

This is exactly why we emphasized getting your balance to zero in our preparation steps. As long as your account is in good standing when you close it, your credit score stays completely unaffected. You can learn more about how closing a bank account can affect credit if you want to dive deeper into this topic.

Are There Any Hidden Fees for Closing an Account?

The good news is that Chase doesn’t charge a specific account closure fee for checking accounts that are in good standing. You won’t see a surprise “goodbye” charge on your final statement.

But here’s where you need to stay alert. A few other fees could sneak up on you if you’re not careful. Monthly service fees might hit your account if you don’t meet the waiver requirements before closing. Chase charges $12 monthly for Total Checking accounts unless you maintain certain balances or direct deposits.

Overdraft fees are another potential gotcha. If your account goes negative due to pending transactions after you think it’s empty, you could face fees that complicate the closure process.

If you used a wire transfer to move your final balance, that $35 fee we mentioned earlier will apply. And withdrawing cash from out-of-network ATMs can cost you $3 to $5, depending on your location.

The secret to avoiding these fees is simple: double-check that your balance is truly zero, all pending transactions have cleared, and you’ve met any monthly requirements before starting the closure process. It’s like doing a final mirror check before leaving the house – a small step that prevents bigger problems later.

Frequently Asked Questions about Closing a Chase Account

You’ve probably got a few more questions rattling around in your head about how to close chase checking account. Don’t worry – we’ve all been there! Here are the questions that come up most often, along with the answers that’ll put your mind at ease.

Can I close a Chase savings account at the same time?

Absolutely! If you’re looking to simplify your financial life and have both a Chase checking and savings account, you can close them together in one fell swoop. It’s like decluttering your entire skincare routine at once rather than doing it piece by piece.

The process works exactly the same for both account types. You’ll need to zero out both balances, transfer any remaining funds, and have both account numbers ready when you make your closure request. Whether you choose to go online, call customer service, visit a branch, or send a mail request, you can handle both accounts during the same interaction.

This approach saves you time and keeps your financial transition organized. Just remember to update any automatic payments or direct deposits that might be connected to either account!

What if I have a negative balance?

Here’s the deal – Chase simply won’t let you close an account that’s in the red. Think of it like trying to leave a restaurant without paying your bill – it’s just not happening!

If your account shows a negative balance due to overdrafts or fees, you’ll need to deposit enough money to bring it back to zero before you can proceed with closure. This might sting a little, but it’s absolutely necessary.

Here’s what gets really important: if you ignore a negative balance and just walk away, Chase will eventually close the account themselves and send that debt to a collections agency. That’s when your credit score takes a hit – and trust us, that’s a headache you don’t want to deal with later.

Our advice? If you find a negative balance, tackle it head-on immediately. Deposit the needed funds, wait for everything to clear, then proceed with your closure. It’s like treating a skincare issue right when you notice it rather than hoping it’ll disappear on its own.

Can I reopen a closed Chase account?

Unfortunately, this is where we have to deliver some not-so-great news. Once your Chase checking account is officially closed, it’s permanently closed. There’s no “oops, changed my mind” option here.

If you decide down the road that you want to bank with Chase again, you’ll need to start completely fresh – just like any new customer walking through their doors for the first time. You’ll go through the entire new account application process, meet current requirements, and essentially hit the reset button on your relationship with Chase.

This is exactly why we encourage you to be absolutely certain about your decision before moving forward. Take some time to think it through, maybe even sleep on it. Just like committing to a major change in your wellness routine, closing a bank account is a decision that deserves your full consideration.

The good news? If you do change your mind later, starting fresh isn’t necessarily a bad thing – you might even qualify for new customer promotions or find that their services have improved since you left.

Conclusion

Taking the step to learn how to close chase checking account is really about taking control of your financial well-being. What might have seemed overwhelming at first becomes much more manageable when you break it down into simple, actionable steps.

The beauty of this process lies in its straightforward nature. Whether you choose to send a secure message online, make a quick phone call, visit a branch in person, or send a letter by mail, each method gets you to the same destination. The most important part isn’t which method you choose – it’s making sure you’re properly prepared with a zero balance, updated automatic payments, and your financial records safely downloaded.

Just like a thoughtful skincare routine that starts with understanding your skin’s needs, closing your bank account successfully starts with understanding what needs to be done beforehand. The preparation might take a bit of time, but it prevents headaches later on.

This isn’t just about closing an account – it’s about simplifying your financial life. Maybe you’re consolidating accounts to reduce monthly fees, switching to a bank that better fits your needs, or just decluttering your finances. Whatever your reason, you’re making a conscious choice to streamline your money management.

The peace of mind that comes from having fewer accounts to track, fewer statements to review, and a clearer picture of your finances is invaluable. It’s similar to the calm you feel when you’ve organized your space or simplified your daily routines – everything just flows more smoothly.

Your credit score will remain unaffected as long as you follow the steps we’ve outlined, and Chase won’t charge you hidden fees for closing an account in good standing. Within a few business days, you’ll receive confirmation that the process is complete, and you can move forward with confidence.