Why Hims Stock Has Captured Investor Attention

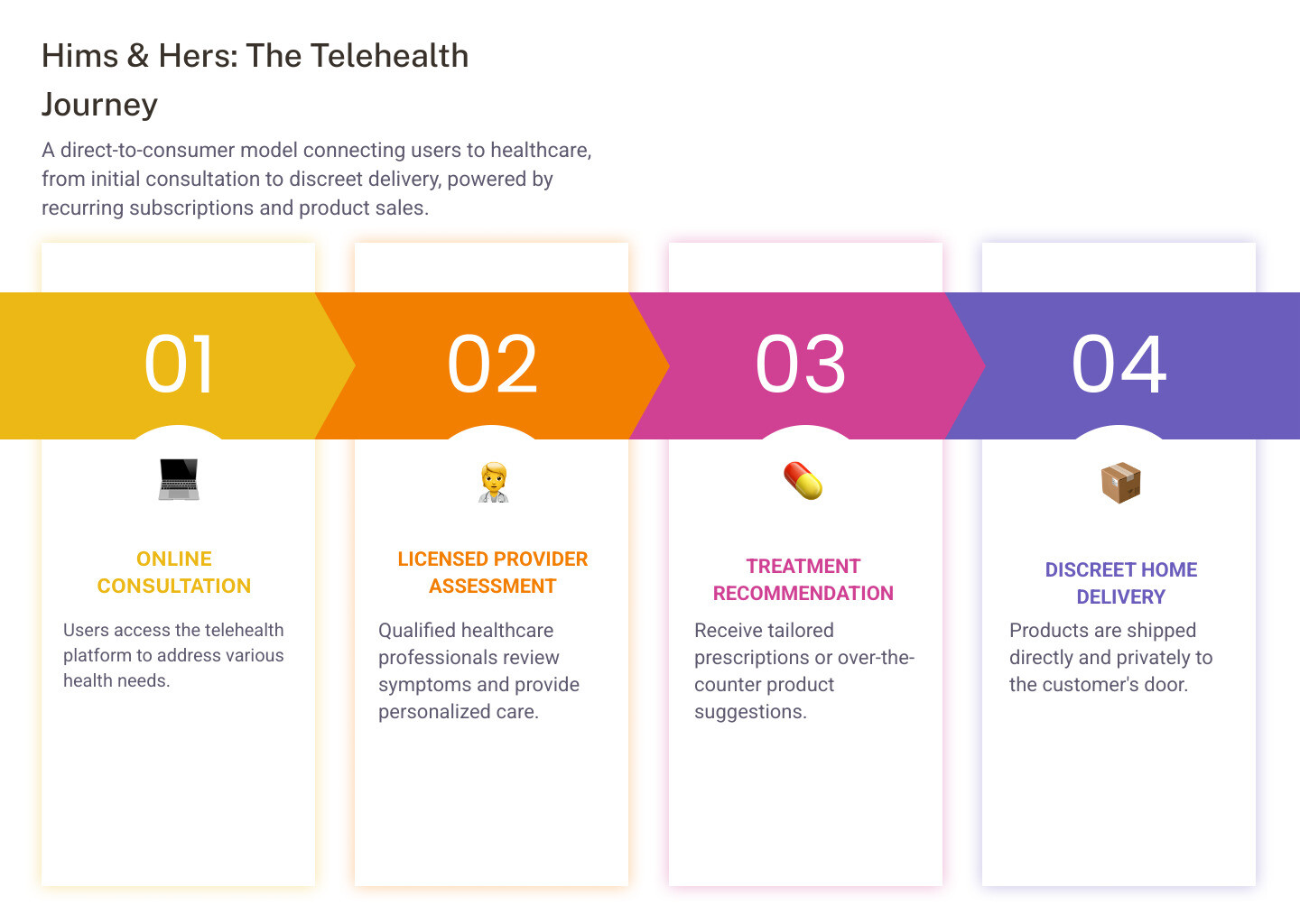

Hims stock has become one of the most talked-about investments in the telehealth sector, with dramatic price swings and explosive growth that’s caught Wall Street’s eye. The company behind this volatile ticker – Hims & Hers Health, Inc. (NYSE: HIMS) – operates a direct-to-consumer telehealth platform that’s disrupted traditional healthcare delivery.

Key Facts About Hims Stock:

- Current Status: Trading at $59.18 with a market cap of $12.99 billion

- Performance: Stock jumped 172% last year and doubled again in 2025

- Valuation: High P/E ratio of 70.48 reflecting growth expectations

- Revenue Growth: From $272 million in 2021 to $1.8 billion over trailing 12 months

- Profitability: Generated $164 million in earnings over past four quarters

But this growth story comes with serious complications. The company faces a class-action lawsuit for alleged securities fraud, controversy over its use of compounded medications, and the recent termination of a high-profile partnership with Novo Nordisk that sent shares tumbling 34% in three days.

For investors considering Hims stock, the question isn’t just about the company’s impressive revenue growth or its million-plus subscribers. It’s about whether the risks – from legal challenges to regulatory scrutiny – outweigh the potential rewards in this fast-growing telehealth market.

Hims stock terms you need:

What is Hims & Hers Health? A Look at the Business Model

When you think about getting healthcare, you probably picture waiting rooms, insurance cards, and awkward conversations with doctors. Hims stock represents something completely different – a company that’s turned healthcare into something as simple as ordering your favorite coffee online.

Founded in 2017 in San Francisco, Hims & Hers Health has become a powerhouse in the telehealth world by making sensitive healthcare conversations feel normal and accessible. The company connects people with licensed healthcare professionals across all 50 states, covering everything from mental health and sexual health to dermatology and primary care.

Here’s what makes their approach so refreshing: no insurance hassles, no embarrassing pharmacy visits, and no scheduling nightmares. You simply fill out an online form about your symptoms and medical history, then a licensed provider reviews everything and creates a treatment plan just for you.

The magic happens through their subscription model, which has attracted over 1 million subscribers and generates an impressive 6 million online visits. Depending on your state, you might have a quick video chat with a provider, or you could get your treatment recommendations sent directly to your secure inbox.

What really sets them apart is the discreet delivery – your treatments arrive in plain packaging, right to your door. No pharmacy small talk required. This approach has resonated with people who want quality healthcare without the traditional barriers. For more insights on wellness services and how companies like this are changing the game, check out more info about wellness services.

How Hims & Hers Makes Money

The beauty of Hims & Hers’ business model lies in its simplicity and transparency. They’ve ditched the confusing insurance maze in favor of straightforward consultation fees and product sales wrapped up in recurring subscriptions.

When you sign up, you pay a clear, upfront price that covers your medical consultation, ongoing medication shipments, and unlimited messaging with your provider. No surprise bills, no insurance denials, just transparent pricing that lets you know exactly what you’re paying for.

Their revenue streams include both prescription medications and over-the-counter products, creating multiple touchpoints with customers. This subscription approach builds loyalty while providing the company with predictable income – something investors love to see when evaluating hims stock.

The “no insurance required” model removes a huge barrier for many people. Instead of wondering if your insurance covers a particular treatment, you simply pay the listed price and get the care you need.

Key Service Categories

Hims & Hers has smartly organized their services into two main brands that speak directly to their audiences. Men’s Health (Hims) tackles issues like erectile dysfunction, hair loss, and other concerns that men often struggle to discuss openly. Women’s Health (Hers) addresses similar sensitive topics from a female perspective.

The company has expanded well beyond its original focus. Their weight loss treatments have become increasingly popular, offering prescription medications that many people couldn’t easily access before. Hair care goes beyond basic shampoos to include specialized treatments for thinning hair and hair loss solutions.

Skincare services provide personalized routines and prescription-strength treatments for various skin concerns. Perhaps most importantly, their mental health offerings recognize that emotional wellness deserves the same attention as physical health, providing online consultations for anxiety, stress, and other mental health conditions.

Some of their most popular products showcase this innovative approach: Hard Mints for erectile dysfunction, Topical Finasteride spray for hair loss, and Generic for Lexapro for mental health support. These products represent the company’s commitment to making traditionally difficult-to-access treatments both convenient and discreet.

This comprehensive approach to wellness – covering everything from physical health to mental wellness – helps explain why hims stock has captured so much investor attention in the growing telehealth market.

Analyzing the Financial Health and Performance of Hims Stock

When we dive into the numbers behind Hims stock, the story that emerges is both impressive and eye-opening. The company’s financial change has been remarkable, and frankly, it’s the kind of growth that makes investors do a double-take.

Let’s start with the headline numbers that really tell the story. Hims & Hers has experienced explosive revenue growth, jumping from $272 million in 2021 to a staggering $1.8 billion over the trailing 12 months. That’s nearly a 600% increase in just a few years – the kind of growth that doesn’t happen by accident.

What makes this even more exciting is that the company isn’t just growing for growth’s sake. They’ve managed to turn that revenue into real profits, generating $164 million in earnings over the past four quarters. This shift to profitability is crucial because it shows their business model actually works at scale.

The market has definitely taken notice. Hims stock now commands a market capitalization of approximately $12.99 billion, reflecting just how much investors believe in the company’s future. However, this success comes with a reality check – the stock trades at a P/E ratio of 70.48, which means investors are paying a premium price for those future growth expectations.

The Price Journey of Hims Stock (HIMS)

The price journey of Hims stock reads like a financial thriller – complete with dramatic plot twists, soaring highs, and nerve-wracking lows. Last year alone, the stock jumped an incredible 172%, and by June 27th of this year, it had already more than doubled again. These aren’t typical stock movements; they’re the kind of gains that create both millionaires and cautionary tales.

The stock’s all-time high of $72.98 came on February 19, 2025, representing the peak of investor enthusiasm for the telehealth revolution. But here’s where the story gets interesting – this same stock once traded at an all-time low of $2.72 back on May 12, 2022. That dramatic range tells you everything you need to know about the volatility investors should expect.

The 52-week range paints a similar picture of recent volatility, with the stock trading between $9.22 and $59.55 as of February 13, 2025. This wide swing isn’t necessarily bad news – it reflects a company in rapid transition, with the market still figuring out exactly what Hims & Hers is worth.

For anyone following Hims stock closely, staying current with real-time data is essential: HIMS Stock Price | Hims & Hers Health Inc. Stock Quote (U.S.: NYSE) | MarketWatch.

Quarterly Performance and Future Guidance

The company’s recent quarterly results show why investors are getting excited about Hims stock. In Q3 2024, Hims & Hers delivered $400 million in sales, representing a robust 77% year-over-year growth. But what really caught our attention at Beyond Beauty Lab was their ability to convert that growth into meaningful profits, with adjusted EBITDA exceeding $50 million for the quarter.

This combination of top-line growth and bottom-line improvement suggests the company has found its sweet spot – they’re not just throwing money at growth anymore, they’re growing efficiently.

Looking ahead, management is projecting Q4 2024 revenue between $465 million and $470 million. If they hit these targets, it would represent an impressive 89% to 91% increase year-over-year. These aren’t modest projections – they’re the kind of ambitious forecasts that either validate investor confidence or set the company up for disappointment.

For those interested in understanding how these financial trends fit into the broader market landscape, we recommend exploring more about financial markets and investment strategies: Learn more about financial markets.

Major Risks and Controversies Facing Investors

While Hims stock has delivered impressive returns, we’d be doing you a disservice if we didn’t talk about the elephant in the room – the significant risks that come with this investment. Think of it like buying a sports car: sure, it’s exciting and fast, but you need to know about the potential for expensive repairs down the road.

The reality is that Hims stock faces some serious headwinds that could dramatically impact its future performance. We saw this play out in real-time when the stock plummeted over 34% in just three days – from $64.22 on June 20, 2025, to $41.98 on June 23, 2025. This wasn’t just a market hiccup; it was a direct response to the termination of their partnership with Novo Nordisk and the legal troubles that followed.

What makes this particularly concerning for investors is how quickly things can change in the telehealth space. Regulatory scrutiny is intense, partnerships can dissolve overnight, and legal challenges can emerge seemingly out of nowhere. These aren’t just minor bumps in the road – they’re fundamental risks that could reshape the company’s entire business model.

The Class-Action Lawsuit Explained

Here’s where things get really serious for Hims stock investors. The company is currently facing a class-action lawsuit that alleges securities fraud – essentially claiming that Hims & Hers misled investors about some pretty important business matters.

The lawsuit centers around what happened with their Novo Nordisk partnership and how the company presented its ability to sell weight-loss medications. According to the legal filing, Hims & Hers allegedly made misleading statements about their partnership and their compliance with FDA regulations regarding compounded medications.

The timeline is particularly damaging. In April 2025, Hims & Hers announced this exciting partnership with Novo Nordisk, the maker of popular weight-loss drugs like Wegovy. Investors were thrilled – it seemed like a game-changing opportunity. But less than two months later, Novo Nordisk pulled the plug, citing “deceptive promotion and selling of illegitimate, knockoff versions of Wegovy.”

That’s a pretty harsh accusation from a major pharmaceutical company, and it sent Hims stock tumbling. The lawsuit covers the period from April 29 to June 23, 2025, and investors who bought shares during this time have until August 25, 2025, to seek lead plaintiff status. You can find more details about the ongoing legal proceedings here: Lawsuit filed against Hims & Hers Health, Inc..

For those considering their investment options, it might be worth exploring other opportunities: Explore top-rated stocks.

Regulatory and Legal Considerations

The controversy around compounded medications is where things get really complicated, and frankly, a bit concerning for Hims stock investors. Let’s break this down in simple terms.

Compounded medications are essentially custom-made versions of FDA-approved drugs. Think of them as the “generic” or “modified” versions that pharmacies can create when there’s a shortage or when a patient needs a specific formulation. The problem? These compounded drugs haven’t gone through the same rigorous FDA approval process as the original medications.

During drug shortages, the FDA allows compounding of certain medications – including popular weight-loss drugs like those containing semaglutide (the active ingredient in Ozempic and Wegovy). But here’s the catch: Hims & Hers continued selling these compounded versions even when the shortages ended, justifying it by calling them “personalized” treatments rather than mass-produced alternatives.

Novo Nordisk clearly disagreed with this interpretation, calling Hims & Hers’ practices “deceptive” and arguing that the company was essentially mass-selling unapproved knockoffs of their FDA-approved medications. This isn’t just a business dispute – it strikes at the heart of how Hims & Hers operates and generates revenue.

The regulatory landscape here is murky, which creates significant uncertainty for investors. If the FDA decides to crack down on these practices, or if courts rule against Hims & Hers’ interpretation of compounding regulations, it could force major changes to their business model. Given that these medications represent a significant portion of their growth story, any regulatory action could have serious implications for Hims stock performance.

This regulatory uncertainty is particularly challenging because it’s not just about one product or one partnership – it’s about whether a core part of their business model can continue operating as it has been.

Growth Drivers and Future Prospects

Despite the legal and regulatory challenges swirling around Hims stock, the company’s growth potential remains genuinely exciting. At Beyond Beauty Lab, we believe in looking beyond the headlines to understand what truly drives a company’s future success, and Hims & Hers has several compelling factors working in its favor.

The company’s expansion into new specialties represents one of its strongest growth engines. What started as a focused approach to men’s and women’s health has blossomed into something much bigger. They’re now tackling mental health services with genuine commitment – even partnering with actress Kristen Bell as their Mental Health Ambassador to help destigmatize these important conversations.

Their move into weight management couldn’t have come at a better time. With obesity affecting millions of Americans and traditional healthcare often falling short in providing accessible solutions, Hims & Hers is positioned to capture a massive underserved market. This diversification strategy is smart because it reduces their dependence on any single product category while opening doors to entirely new revenue streams.

Strategic partnerships continue to fuel growth, even after the high-profile Novo Nordisk setback. Their collaboration with Eli Lilly to expand access to obesity medications shows they’re not backing down from this lucrative space. Perhaps even more interesting is their partnership with ChristianaCare, which brings in-person healthcare access to patients in Delaware, Maryland, New Jersey, and Pennsylvania. This hybrid approach – combining digital convenience with traditional care when needed – could be a game-changer.

The company’s focus on technological advancements and operational efficiency keeps them ahead of the curve. Their platform’s seamless user experience, from initial consultation to discreet delivery, sets the standard for what modern healthcare should feel like. Continued investment in technology promises to make treatments more personalized and outcomes better, while operational improvements help boost profitability.

Future Outlook for Hims Stock in the Telehealth Market

The telehealth landscape has been transformed over the past few years, and Hims stock sits at the center of this revolution. While many telehealth companies struggle to find their footing, Hims & Hers has cracked the code with their consumer-first platform approach.

Their first-mover advantage in addressing sensitive health issues with privacy and convenience has created something special – a loyal customer base that actually wants to engage with healthcare. Think about it: when was the last time you looked forward to a doctor’s appointment? Hims & Hers has managed to make healthcare feel less intimidating and more accessible.

The digital health industry growth shows no signs of slowing down. Modern consumers, especially younger generations, expect healthcare to fit into their busy lives rather than the other way around. This trend toward convenience and personalization plays directly into Hims & Hers’ strengths, positioning Hims stock favorably for sustained growth.

What really impresses us is how they’ve built market leadership not through flashy marketing, but by genuinely solving problems people face every day. Their subscription model creates that all-important recurring revenue while fostering real customer relationships.

New Product Lines and Innovation

Innovation at Hims & Hers goes far beyond just adding new pills to their catalog. Their expansion into weight loss treatments demonstrates how they identify massive market opportunities and move quickly to capitalize on them. These aren’t just generic solutions either – they’re developing personalized solutions that recognize every person’s health journey is unique.

The company’s venture into beauty and personal care products shows they understand wellness holistically. Their new volumizing shampoos and conditioners featuring advanced ingredients like Biovolume 128™ represent the kind of innovation that attracts customers who care about both health and beauty. This aligns perfectly with our philosophy at Beyond Beauty Lab – true wellness encompasses how you look and feel.

Their broad consumer attraction strategy is working. By expanding from sensitive health issues into everyday wellness products, they’re changing from a specialized telehealth company into a comprehensive wellness platform. This evolution creates more touchpoints with customers and more opportunities for growth.

The mental health services expansion, backed by celebrity partnerships and genuine advocacy, shows they’re not afraid to tackle complex, important issues. This kind of innovation – combining medical expertise with cultural awareness and smart partnerships – is what separates leaders from followers in the wellness space.

For investors interested in exploring different growth opportunities beyond healthcare, you might find value in examining real estate investment trends as another avenue for portfolio diversification.

Frequently Asked Questions about Hims Stock

Investing in Hims stock can feel overwhelming with all the moving parts – from explosive growth to legal challenges. We’ve gathered the most common questions investors ask about HIMS to help you make sense of this complex but fascinating investment opportunity.

Is Hims & Hers a profitable company?

Yes, Hims & Hers has successfully turned the corner on profitability – a major achievement for any high-growth telehealth company. The numbers tell an impressive story: they generated $164 million in earnings over the past four quarters, showing that their business model isn’t just about rapid expansion anymore.

What’s particularly encouraging is the consistent upward trend in their quarterly results. Last quarter alone, they reported $49.48 million in net income, which represents a significant jump from the previous quarter’s $26.02 million. This kind of quarter-over-quarter improvement suggests their operations are becoming more efficient as they scale.

For investors, this profitability milestone matters because it shows Hims stock isn’t just riding a growth wave – they’re building a sustainable business that can generate real returns.

What are the biggest risks for HIMS investors?

When it comes to Hims stock, the risks are as significant as the opportunities. The most pressing concern is the ongoing class-action lawsuit that alleges securities fraud and misrepresentation. This legal cloud creates uncertainty that could result in substantial financial penalties or operational changes.

Regulatory scrutiny presents another major headwind. The company’s use of compounded medications has drawn criticism, particularly after the FDA raised concerns about unapproved compounded versions of popular drugs like Wegovy. If regulators crack down harder on this practice, it could severely impact a key revenue stream.

The stock’s high valuation is another risk factor worth considering. With a P/E ratio over 70, a lot of future growth is already baked into the current price. This means Hims stock could face significant corrections if growth slows or unexpected challenges arise.

Finally, the competitive telehealth landscape means the company must continuously innovate to maintain its market position. While they’ve been successful so far, staying ahead in this rapidly evolving space requires constant investment and adaptation.

What is the analyst consensus on Hims stock?

The analyst community is genuinely divided on Hims stock, which actually makes sense given the company’s unique risk-reward profile. Some analysts are bullish, maintaining ‘Buy’ ratings based on the company’s impressive revenue growth, expanding subscriber base, and successful diversification into new health categories. These optimistic analysts often set high price targets, believing the innovative direct-to-consumer model will continue disrupting traditional healthcare.

On the flip side, more cautious analysts focus on the legal uncertainties, regulatory challenges, and high valuation concerns. They tend to issue ‘Hold’ or even ‘Sell’ ratings, advising investors to wait for more clarity on the legal and regulatory fronts.

Interestingly, technical analysis has been more consistently positive. Recent technical indicators have shown ‘strong buy’ signals for daily trading and ‘buy’ ratings for weekly performance, with ‘strong buy’ signals for monthly trends. However, when you average out all the professional ratings, Hims stock typically receives a ‘Neutral’ consensus – reflecting the balanced view that while opportunities exist, significant risks remain.

This mixed analyst sentiment actually reflects the complexity of evaluating Hims stock in today’s market environment.

Conclusion: Is Hims Stock a Good Investment?

After diving deep into the numbers, challenges, and opportunities, Hims stock emerges as one of those investment stories that keeps you on the edge of your seat. It’s the kind of company that makes you believe in the power of innovation to transform healthcare, while simultaneously reminding you that rapid growth often comes with equally dramatic risks.

Let’s be honest about what we’re looking at here. Hims & Hers has built something remarkable – a telehealth platform that’s genuinely changed how people access healthcare for sensitive conditions. With over 1 million subscribers and revenue that’s skyrocketed from $272 million to $1.8 billion in just a few years, this isn’t just growth – it’s a healthcare revolution in action. The company has proven it can turn a profit too, generating $164 million in earnings over the past four quarters.

But here’s where things get complicated. Hims stock isn’t just riding high on success stories. The ongoing class-action lawsuit alleging securities fraud casts a serious shadow over future prospects. When you add the regulatory scrutiny around compounded medications and that dramatic partnership breakup with Novo Nordisk that sent shares tumbling 34% in three days, you start to see why this investment requires nerves of steel.

The numbers tell their own story about volatility. With a P/E ratio over 70, investors are essentially betting big on future growth that may or may not materialize. The stock’s journey from an all-time low of $2.72 to highs of $72.98 shows just how wild this ride can be.

At Beyond Beauty Lab, we believe in making informed decisions about both wellness and investments. That’s why we think Hims stock could be compelling for investors who truly understand what they’re getting into. The long-term outlook for telehealth remains bright, and Hims & Hers has positioned itself as a leader in this space through innovation and customer-focused solutions.

However, this isn’t an investment for everyone. The legal challenges, regulatory uncertainties, and high valuation mean you need to be prepared for significant ups and downs. If you’re considering this investment, thorough due diligence isn’t just recommended – it’s essential. Understanding your overall financial picture is crucial too, and you can always Check your credit score to ensure you’re in a solid position for investment decisions.

Our take? Hims stock represents the kind of high-risk, high-reward opportunity that could pay off handsomely for patient investors willing to weather the storms ahead. The company’s pioneering approach to accessible healthcare aligns with broader trends toward digital wellness solutions that we’re passionate about at Beyond Beauty Lab.

Whether Hims stock belongs in your portfolio ultimately depends on your risk tolerance and investment timeline. For those who believe in the future of telehealth and can handle the volatility, it might just be worth the ride. For more insights on wellness and making informed decisions, we invite you to Explore more wellness insights on our homepage.