Why High-Risk Businesses Need Specialized Payment Processing

A high risk merchant account at highriskpay.com can be the difference between accepting credit card payments and losing customers to competitors. Getting approved for payment processing shouldn’t feel like winning the lottery, yet thousands of businesses in challenging industries face this reality every day.

Quick Answer for High-Risk Merchant Accounts at HighRiskPay.com:

- Approval Rate: Claims 99% approval with 24-hour turnaround

- Starting Rates: 1.79% + $0.25 for low-risk, 2.95% + $0.25 for high-risk businesses

- Monthly Fees: Starting at $9.95 with no setup fees

- Key Features: Next-day funding, chargeback management, A+ BBB rating

- Reality Check: Actual processing timeline typically 7-14 business days

If your business operates in industries like supplements, CBD, nutraceuticals, or subscription services, you’ve likely experienced the frustration of mainstream processors like PayPal, Square, and Stripe either rejecting your application or suddenly freezing your account.

HighRiskPay.com positions itself as a solution for these “hard-to-place” merchants. They claim a 99% approval rate and promise 24-hour processing – but what’s the reality behind these bold claims?

This guide examines everything you need to know about HighRiskPay.com’s services, from their actual approval process and hidden costs to real customer experiences. We’ll help you understand whether their high-risk merchant accounts are the right fit for your business needs.

For businesses in the wellness and beauty space, understanding these payment processing options is crucial for sustainable growth and customer satisfaction.

Simple high risk merchant account at highriskpay.com glossary:

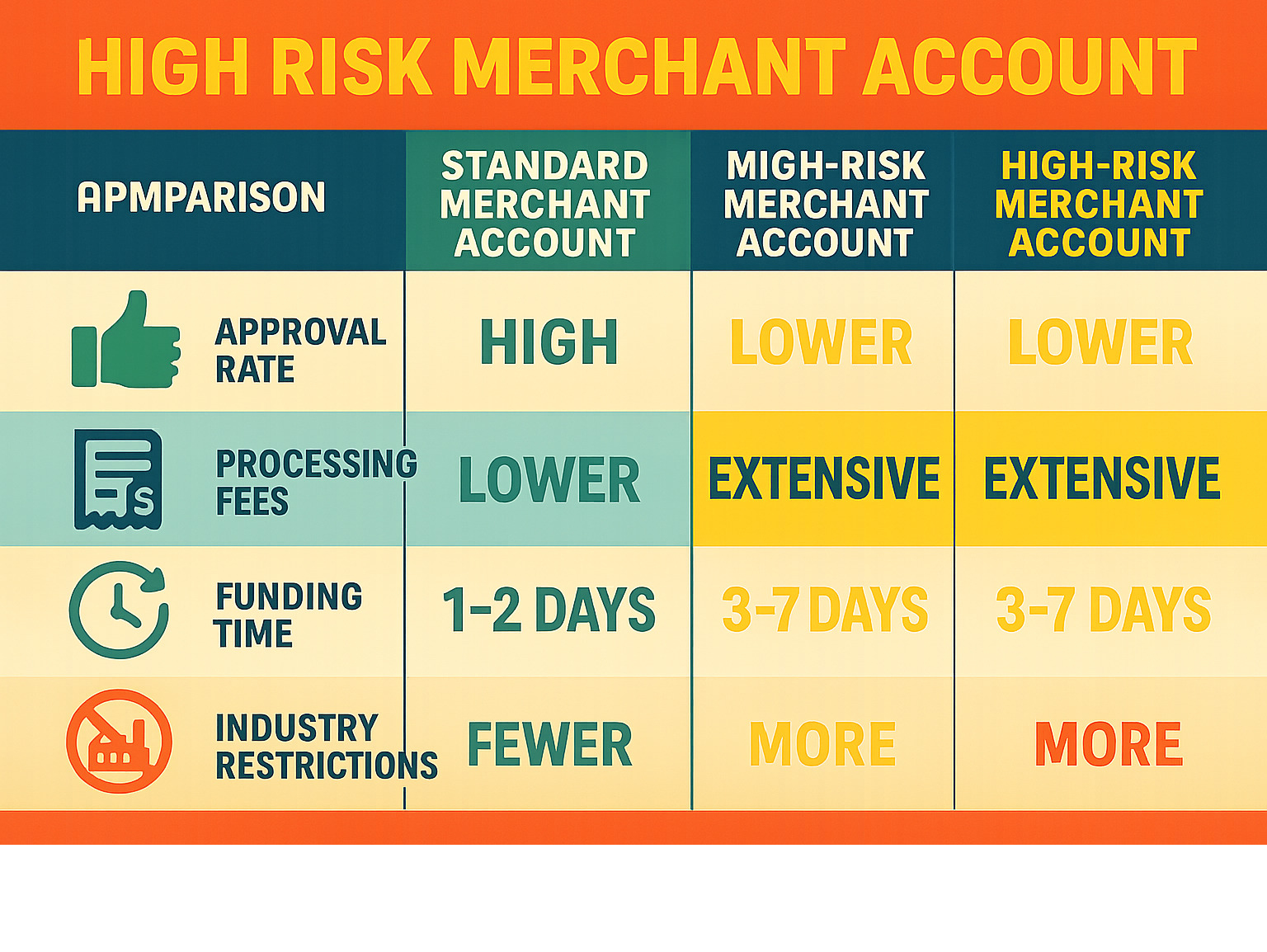

What is a High-Risk Merchant Account and Why Do You Need One?

If you’ve ever had your payment processor suddenly freeze your account or reject your application outright, you’re not alone. A high risk merchant account at highriskpay.com might be exactly what your business needs to keep those credit card payments flowing.

What exactly is a high-risk merchant account? Think of it as specialized payment processing for businesses that traditional processors consider too risky to handle. It’s like having a friend who’s willing to lend you money when the bank says no – except this friend charges higher fees for taking on that extra risk.

Payment processors are essentially in the business of managing risk. Every time they process a transaction, they’re betting that the customer won’t dispute the charge later. When customers file chargebacks (disputes), the processor often gets stuck covering the cost if your business can’t pay up. This makes them understandably picky about who they work with.

Several factors can land your business in the high-risk category, and honestly, some of them might surprise you. Industry type is the biggest factor – certain sectors just see more disputes and fraud than others. If you’re selling health supplements, running subscription services, or operating in the broader wellness space, you’re automatically flagged as higher risk.

The worldwide marketplaces for health supplement industry, for example, faces unique challenges with customer expectations and regulatory scrutiny. Even businesses offering natural skincare solutions can find themselves needing specialized payment processing.

High chargeback history is another red flag. If more than 1% of your transactions get disputed, you’re in trouble with most processors. That might sound like a lot, but it’s surprisingly easy to hit that threshold, especially in industries where customers have high expectations or complex return policies.

Recurring billing models also raise eyebrows. While subscription boxes and monthly supplement deliveries are great for customer retention, they’re also prime targets for forgotten purchases and unauthorized card use. Processors know that “I didn’t sign up for this” is one of the most common chargeback reasons.

Your personal financial history matters too. Bad credit, previous bankruptcies, or being a brand-new business without processing history can all push you into the high-risk category. It’s not fair, but processors use your financial track record to predict future risk.

Here are the most common high-risk industries that need specialized processing:

- E-commerce (especially digital goods and high-value items)

- CBD and nutraceuticals

- Supplements and wellness products

- Subscription boxes and recurring services

- Travel and tourism

- Tech support services

- Multi-level marketing

Why do standard processors decline these businesses? Simple – their business models aren’t built to handle the extra risk. They prefer predictable, low-maintenance merchants who rarely generate disputes. When your chargeback ratio starts climbing or you’re in a “problematic” industry, they’d rather just say no than deal with the headaches.

This is where specialized providers step in. They understand that a wellness business selling monthly vitamin subscriptions isn’t necessarily riskier than a restaurant – it just operates differently. They’ve built their systems and pricing to accommodate these realities, allowing legitimate businesses to process payments without constantly worrying about account shutdowns.

The bottom line? If you’ve been rejected by mainstream processors or your current provider is making threats, a high-risk merchant account isn’t a mark of shame – it’s simply a business tool designed for your specific needs.

Evaluating a high risk merchant account at highriskpay.com

When you’re exploring a high risk merchant account at highriskpay.com, you want to understand exactly what you’re getting into. After all, choosing the right payment processor can make or break your business – especially if you’re in the wellness or beauty space where traditional processors often say “thanks, but no thanks.”

HighRiskPay.com positions itself as your payment processing lifeline, offering a full suite of services designed specifically for businesses that mainstream processors won’t touch. Their credit card processing covers all major cards, which is essential whether you’re selling skincare products online or running a subscription service. They also handle ACH and eCheck processing, giving your customers more ways to pay – something particularly valuable for higher-ticket wellness programs or beauty treatments.

What really caught our attention is their payment gateway integration. This technology is the invisible backbone that securely processes your customers’ card information. Without it, you simply can’t accept online payments. They’ve also built in chargeback management tools, which is smart considering chargebacks are the number one reason high-risk accounts get shut down.

Their fraud prevention measures add another layer of protection, though we’ll be honest – no system is foolproof. But having these safeguards in place shows they understand the unique challenges high-risk businesses face.

Now, here’s where things get interesting. HighRiskPay.com offers some genuinely appealing features that set them apart. Their next-day funding is a game-changer for cash flow – imagine having access to your money within 24 hours instead of waiting a week or more. For businesses in the beauty and wellness space, where inventory turnover and seasonal fluctuations matter, this can be crucial.

They also claim no application fees, which removes that initial financial hurdle. When you’re already dealing with higher processing costs, every saved dollar counts.

Their reputation tells a compelling story. They’ve maintained an A+ BBB rating since 2014 – that’s nearly a decade of consistent customer satisfaction. On Trustpilot, they’re sitting pretty with a 4.8 out of 5 stars from 55 reviews. What’s particularly noteworthy is how often customers mention specific representatives by name, especially someone called “Julie” who seems to be their customer service superstar.

This personal touch matters more than you might think. When you’re dealing with complex payment processing issues – and trust us, they will come up – having a real person who knows your account can be invaluable. You can visit their website to see more reviews and get a feel for their approach.

For businesses focusing on clean beauty routines or other wellness services, this kind of specialized support becomes even more important when navigating industry-specific compliance requirements.

The 99% Approval Rate and 24-Hour Turnaround: A Reality Check

Let’s talk about the elephant in the room – those bold claims about 99% approval rates and 24-hour turnarounds. They sound almost too good to be true, and well… they kind of are.

Here’s what’s really happening behind that 99% approval claim. HighRiskPay.com likely uses pre-qualification filters to weed out applications that have no chance of approval before they even hit the underwriting desk. They’re also probably counting conditional approvals – where they say “yes, but…” with conditions like higher fees or rolling reserves.

This doesn’t mean they’re being deceptive. They genuinely do approve more applications than traditional processors. But that 99% figure represents their carefully curated pool of viable candidates, not every single person who fills out their online form.

The 24-hour approval promise is where expectations really need adjustment. What they’re typically offering is initial feedback or pre-approval within 24 hours, not a fully functional account. The reality is more like this: you’ll hear back quickly, but actually processing payments takes longer.

From application to going live typically takes 7-14 business days. Here’s why: document collection can take 3-7 days depending on how organized you are, underwriting and bank matching takes another 2-5 business days, and account setup plus testing adds 1-3 more days.

Several factors influence your approval speed. Complete documentation from day one speeds things up dramatically. Industry complexity matters too – some sectors require more regulatory review than others. And if you have prior processing history, especially clean history, you’ll likely move through faster.

For the most current information, you can check directly with High Risk Pay, but remember to set realistic expectations about timing.

Advantages and Potential Drawbacks of Using HighRiskPay.com

Every payment processor comes with trade-offs, and a high risk merchant account at highriskpay.com is no exception. Understanding both sides helps you make a decision that fits your business reality.

The advantages are genuinely compelling. That high acceptance rate isn’t just marketing fluff – it’s their core value proposition. When traditional processors have shown you the door, HighRiskPay.com often opens it. Their specialized expertise in high-risk industries means they understand your challenges in ways that mainstream processors simply don’t.

The next-day funding deserves special mention. Cash flow is the lifeblood of any business, but it’s especially critical for seasonal businesses or those with fluctuating revenues. Getting your money fast can mean the difference between seizing an opportunity and watching it slip away.

Their customer service consistently earns praise, and that matters more than you might think. When payment issues arise – and they will – having responsive support can save your business from serious problems. The no application fees policy also removes a common barrier, making their services accessible to smaller businesses or startups.

However, there are some important trade-offs to consider. Higher fees are inevitable with high-risk processing. You’re paying for the privilege of acceptance, and that premium adds up over time.

Rolling reserves represent a more complex challenge. Many high-risk processors, including HighRiskPay.com, hold back a percentage of your daily sales – sometimes 5-10%, occasionally up to 25% – for 90 days to several months. This protects them against future chargebacks, but it ties up your working capital. While these funds are typically refundable, the timing can create cash flow challenges.

There’s also the reality gap between marketing promises and practical experience. Those impressive approval rates and turnaround times come with asterisks in real life. Finally, even after approval, high-risk accounts face stricter monitoring. Chargeback spikes or unusual transaction patterns can trigger fund holds or account reviews.

The key is understanding these realities upfront so you can plan accordingly. For many businesses, especially those in challenging industries like wellness and beauty, these trade-offs are simply the cost of doing business in the digital payment world.

The Application Process: From Submission to Going Live

Getting your high risk merchant account at highriskpay.com up and running is more straightforward than you might expect, though it does require some patience and preparation. Think of it like preparing for a job interview – the better organized you are upfront, the smoother everything goes.

The journey typically starts with completing their online application form. This isn’t just a quick signup – you’ll want to be thorough and accurate here. Every detail you provide should match exactly with the documents you’ll submit later. It’s like introducing yourself to a new friend; you want to make a good first impression.

Once you’ve submitted your initial application, the real work begins with document submission. This is where many businesses stumble, not because it’s complicated, but because they’re not prepared. The more complete and organized your submission, the faster you’ll move through the process. You’ll likely sign everything electronically through DocuSign, which keeps things modern and efficient.

Behind the scenes, HighRiskPay.com’s team conducts their underwriting and review process. They’re essentially getting to know your business – understanding your industry, checking your financial stability, and assessing how well you’ve handled payment processing in the past. This is often where that famous “24-hour feedback” happens, though remember, feedback isn’t the same as being fully approved and ready to process payments.

The bank matching phase is particularly important because HighRiskPay.com works as an ISO (Independent Sales Organization). They’re essentially playing matchmaker between your business and an acquiring bank that’s comfortable with your specific industry risks.

After approval comes the exciting part – getting everything set up. Your account gets configured, you’ll integrate your payment gateway with your website or point-of-sale system, and you’ll run some test transactions to make sure everything works smoothly. Most businesses start seeing payouts within 1-2 business days of their first successful transaction.

Required Documentation

Here’s where being prepared really pays off. High-risk businesses face more paperwork than standard merchants, but there’s a good reason – processors need to understand your business thoroughly to manage the increased risk effectively.

You’ll need your government-issued ID (driver’s license or passport work fine) and your business license or registration to prove you’re legally authorized to operate. Your recent bank statements from the last 3-6 months help them understand your financial stability and cash flow patterns.

If you’ve processed payments before, your prior processing history becomes incredibly valuable. Those last 3-6 months of processing statements show your transaction volume and, crucially, your chargeback rates. This historical data can actually work in your favor if you’ve maintained good practices.

For online businesses, your website needs to be fully functional with crystal-clear policies. Your Terms of Service, Privacy Policy, and Refund Policy should be easy to find and professionally written. Don’t forget your contact information – a physical address, phone number, and email address build trust with both processors and customers.

Going above and beyond with a detailed business plan (especially for newer businesses) or comprehensive marketing materials that clearly explain your products and services can set you apart from other applicants. It shows you’re serious about your business and understand your market.

For those of us in the wellness and beauty space, having clear, compliant policies is particularly important. If you’re looking to strengthen your overall business foundation, The Ultimate Guide to Wellness and Well-being offers valuable insights that can help you present a more professional, well-rounded business to potential processors.

Common Reasons for Denial and How to Mitigate Them

Even with HighRiskPay.com’s high approval rates, denials do happen. The good news? Most denial reasons are completely preventable with proper preparation.

Incomplete or inaccurate documentation tops the list of denial reasons, and it’s probably the most frustrating because it’s so avoidable. When your online application doesn’t match your submitted documents, or when crucial information is missing, it raises immediate red flags with underwriters.

Sometimes businesses get denied because they fall into an unsupported business vertical. While HighRiskPay.com works with many high-risk industries, they might have reached capacity in certain niches or simply don’t support extremely specialized areas.

Unclear business models create uncertainty for underwriters. If they can’t understand what your business does, how it operates, or how you handle customer service and refunds, they can’t properly assess the risk. Your website policies play a huge role here.

High personal credit risk can sink applications, especially for newer or smaller businesses where the owner’s personal credit history carries significant weight. While HighRiskPay.com works with various credit histories, extremely poor credit can still be problematic.

The key to avoiding these issues is preparation and transparency. Double-check every piece of information for consistency. Be completely honest about your business model and any potential risk factors – trying to hide aspects of your business that might be considered high-risk usually backfires.

Improve your website compliance before applying. Make sure your policies are professionally written, legally sound, and easy to find. If personal credit is a concern, take steps to improve it before submitting your application.

If you do get denied, don’t panic. You can usually reapply after addressing whatever caused the issue. The key is getting specific feedback about why you were denied, then systematically addressing those concerns. Many merchants get approved on their second attempt once they’ve corrected the identified problems.

The goal isn’t just to get approved – it’s to build a long-term relationship with a processor who understands your business and can grow with you.

Understanding the Costs: A Full Breakdown of HighRiskPay.com Fees

When considering a high risk merchant account at highriskpay.com, look beyond those attractive starting rates and understand what you’ll actually pay. High-risk processing is inherently more expensive, and the hidden costs can really add up if you’re not prepared.

The Advertised Pricing Structure

HighRiskPay.com presents their pricing in a straightforward way. Their starting rates begin at 1.79% + $0.25 per transaction for retail businesses with good credit. For businesses in high-risk categories, rates are estimated to start at 2.95% + $0.25 per transaction – which is actually competitive in the high-risk space where anything below 4% is considered pretty good.

Their monthly fees start at just $9.95, and they don’t charge application or setup fees. This no-upfront-cost approach is genuinely helpful for businesses already struggling to find payment processing.

The Reality of Total Costs

Here’s where things get more complex. The advertised rates are just the beginning. A complete picture of your costs includes several additional components that can significantly impact your bottom line.

| Cost Category | HighRiskPay.com Advertised | Potential Actual Range | Impact on Your Business |

|---|---|---|---|

| Processing Rate | 1.79%-2.95% + $0.25 | 2.95%-6.5% + fees | Your biggest ongoing expense |

| Monthly Fees | Starting at $9.95 | $9.95-$99+ | Predictable monthly cost |

| Gateway Fees | Not specified | $15-$25/month typical | Necessary for online processing |

| PCI Compliance | Not specified | $5-$15/month | Required security fee |

| Chargeback Fees | Not specified | $15-$50 per chargeback | Can add up quickly |

| Rolling Reserve | Not advertised | 5%-25% held for 90-180 days | Significant cash flow impact |

Monthly and Incidental Fees

Beyond processing rates, you’ll encounter various monthly charges. Account maintenance fees cover the basic cost of keeping your account active. Gateway fees are necessary if you process online payments – think of this as the technology that connects your website to the payment network. PCI compliance fees ensure your business meets security standards, which isn’t optional.

Chargeback fees deserve special attention. Every time a customer disputes a charge, you’ll pay a fee regardless of whether you win or lose the dispute. For high-risk businesses, this can become a significant expense.

The Less Obvious Costs

The biggest surprise for many merchants is the rolling reserve. This is where the processor holds back a percentage of your daily sales – sometimes 5%, but it can be as high as 25% for very high-risk businesses. They keep this money for a period (typically 90-180 days, sometimes longer) as protection against future chargebacks or other liabilities.

This rolling reserve can have a serious impact on cash flow. If you’re processing $10,000 monthly and they hold 10% for 180 days, that’s $1,000 of your money tied up for six months. While these funds are eventually released (assuming no issues), it affects your working capital significantly.

Early termination fees are another consideration. While HighRiskPay.com advertises “no contracts,” there may still be penalties if you close your account within a certain timeframe or switch processors quickly.

For businesses in the beauty and wellness space, understanding these costs is crucial – especially if you’re selling supplements or running subscription services that might face higher reserves. Check out our Fintechzoom Money Guide for more insights on managing business finances.

How to get the best rates for a high risk merchant account at highriskpay.com

Getting the best possible rates isn’t just about luck – it’s about positioning your business as attractively as possible to the processor. Your negotiating power increases significantly if you’re an established business with a clean processing history rather than a startup with no track record.

Factors that determine your final rate go beyond just your industry. Yes, some industries are inherently riskier, but your processing volume matters too. Higher volume merchants often get better rates because they represent more revenue for the processor. Your chargeback ratio is probably the most critical factor – keep it below 1% and you’ll have much more negotiating room.

When comparing quotes, always ask for a detailed fee schedule. Don’t just focus on the processing rate – look at the complete picture including monthly fees, chargeback costs, and any rolling reserve requirements. A slightly higher processing rate with lower monthly fees and no rolling reserve might actually save you money in the long run.

The key is being transparent about your business model and demonstrating that you’re actively working to minimize risk. Show them your chargeback prevention strategies, your customer service approach, and your compliance efforts. Processors want to work with merchants who understand the risks and are proactively managing them.

Getting approved is just the first step. Maintaining good standing with reasonable fees requires ongoing attention to your chargeback rates and overall account health. The businesses that succeed with high-risk processing are those that treat it as a partnership rather than just a service.