Understanding the Complex World of Crypto30x.com Gemini

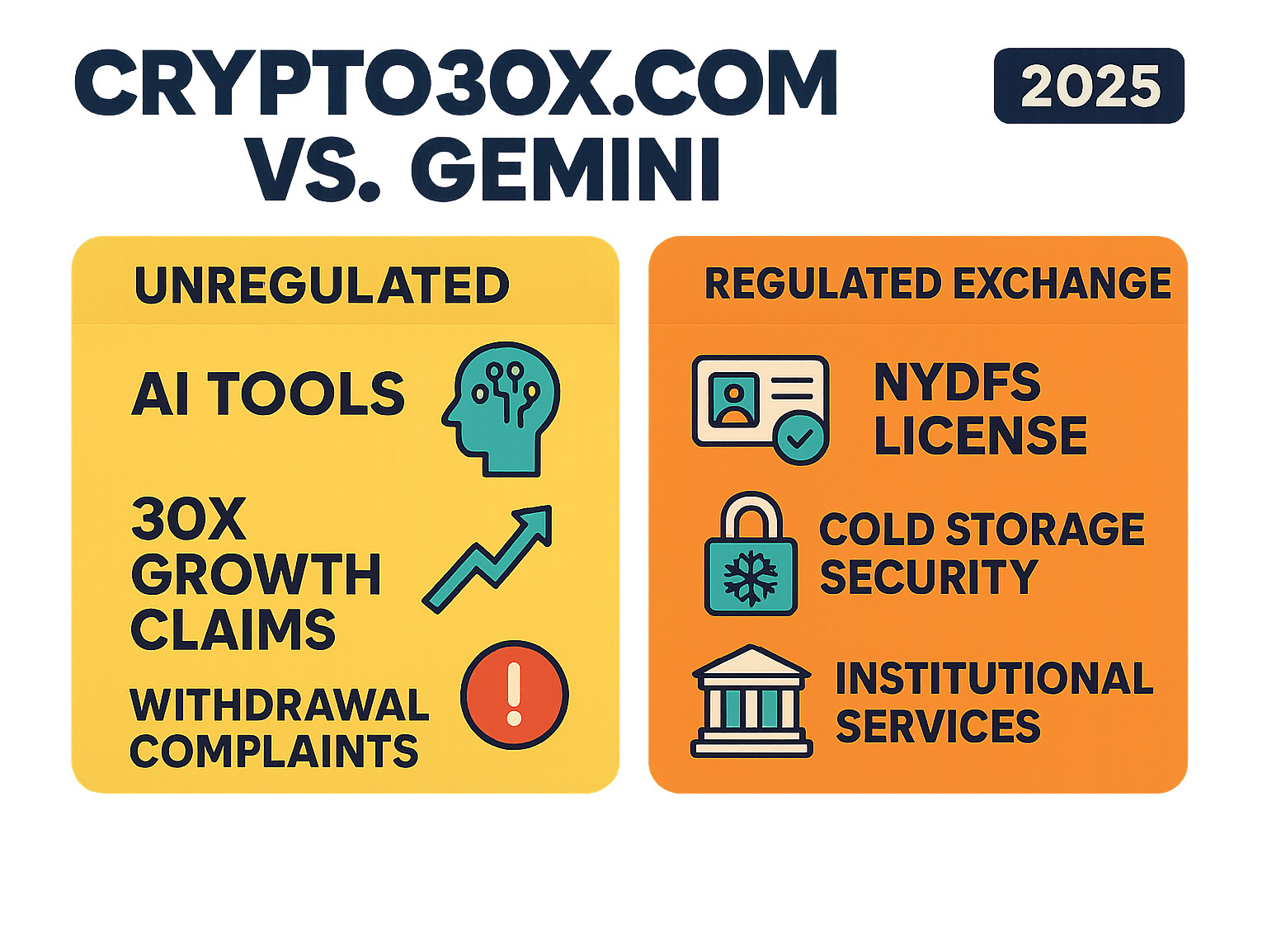

Crypto30x.com gemini represents a pairing that has caught the attention of cryptocurrency investors seeking both analytical insights and secure trading platforms. This combination brings together two very different entities: Crypto30x.com, an unregulated analytics platform claiming to identify “30x growth potential” in digital assets, and Gemini, a highly regulated cryptocurrency exchange founded by the Winklevoss twins.

Quick Answer: What You Need to Know About Crypto30x.com Gemini

- Crypto30x.com: Unregulated analytics platform offering AI-powered trading insights and high-leverage analysis

- Gemini: Regulated U.S. cryptocurrency exchange with SOC 2 certification and NYDFS licensing

- Key Risk: Crypto30x.com lacks SEC/FCA registration and has user complaints about withdrawals

- Key Benefit: Gemini provides secure, compliant trading with cold storage and hack-free history

- Best For: Investors who want speculative insights but prioritize secure execution

The financial wellness journey often involves navigating complex investment landscapes, much like choosing the right skincare routine requires understanding different product formulations. Just as transparency matters in clean beauty, it’s equally crucial in cryptocurrency platforms.

Cameron and Tyler Winklevoss created Gemini because they “struggled to find a secure platform for their growing cryptocurrency portfolio.” This security-first approach contrasts sharply with Crypto30x.com’s high-risk, high-reward positioning in the market.

While Gemini boasts over $200 billion in trading volume and operates as a New York Trust Company, Crypto30x.com operates without major regulatory oversight. This creates a dynamic where investors might use Crypto30x.com’s analytical tools while executing trades on Gemini’s regulated platform.

Relevant articles related to crypto30x.com gemini:

Deconstructing the Platforms: What Are Crypto30x.com and Gemini?

When we explore crypto30x.com gemini, we’re looking at two completely different approaches to cryptocurrency investing. It’s like comparing a trusted dermatologist’s advice with an experimental skincare trend you found on social media – both might promise results, but they come with very different levels of reliability and risk.

Gemini: The Pillar of Security and Regulation

Picture this: Cameron and Tyler Winklevoss had a problem back in 2014. These twins, famous for their legal battles with Facebook, owned significant cryptocurrency holdings but couldn’t find a platform they truly trusted to manage them safely. So they did what any determined entrepreneurs would do – they built their own.

Gemini Trust Company emerged from this personal need, and it shows in every aspect of their security-first approach. The Winklevoss twins operate with a philosophy of “asking permission, not forgiveness,” which might sound boring compared to the flashy promises elsewhere in crypto, but it’s exactly why your digital assets stay safe.

What makes Gemini special? They’re not just another crypto exchange – they’re a regulated Trust Company licensed by the New York State Department of Financial Services. This means they follow the same strict rules as traditional banks, including maintaining capital reserves and meeting rigorous cybersecurity standards.

Gemini earned their SOC 2 Certification as the first crypto exchange ever to achieve both SOC 1 Type 2 and SOC 2 Type 2 certifications. Think of this as the gold standard for internal security controls – it’s like having your skincare products tested by independent labs rather than just trusting the manufacturer’s claims.

This commitment to excellence is why Forbes Advisor Best of 2024 recognized Gemini among the top crypto exchanges. With over 70 supported cryptocurrencies and more than $200 billion in trading volume across 70+ countries, they’ve proven that security and growth can go hand in hand.

Here’s what really matters for your peace of mind: Gemini has maintained a hack-free record throughout its entire history. They store the majority of user funds in cold storage (completely offline), use hardware security keys, and offer institutional services for larger investors who need even more sophisticated protections.

You can dive deeper into Gemini’s comprehensive background on the Gemini (cryptocurrency exchange) Wikipedia page to see just how established this platform really is.

Crypto30x.com: The High-Risk, High-Reward Analyst

Now let’s talk about the other side of this pairing. Crypto30x.com operates in a completely different universe from Gemini’s regulated environment. This platform makes bold claims about helping users identify cryptocurrencies with 30x growth potential – the kind of promise that makes your heart race and your wallet nervous at the same time.

The platform offers AI-based trading tools and analytical services that claim to spot the next big crypto opportunities before they explode. Their “Zeus signals” supposedly analyze technical, fundamental, and on-chain data to guide trading decisions. It sounds impressive, and artificial intelligence is definitely changing how people approach trading.

But here’s where things get concerning. Crypto30x.com’s unregulated status means it doesn’t have to follow the same strict rules that protect Gemini users. There’s no registration with major regulators like the SEC or FCA, which is like buying skincare products from a company that’s never been inspected by health authorities.

User complaints about withdrawal difficulties and poor customer support have surfaced regularly. Some people have even raised “catfish” marketing concerns, suggesting that the platform’s promotional tactics might be misleading. When promises seem too good to be true in the crypto world, they usually are.

For those curious about the specifics, our Crypto30x.com Zeus: Complete Guide breaks down their analytical tools in detail. You can also explore their main platform through our comprehensive Crypto30x.com overview.

The contrast couldn’t be clearer: while Gemini builds trust through transparency and regulation, Crypto30x.com operates in the high-risk, high-reward space where potential gains come with significant dangers. Understanding both sides helps you make informed decisions about your financial wellness journey.

A Tale of Two Securities: Comparing Crypto30x.com Gemini Protections

When you’re choosing platforms to handle your precious digital assets, security should be your top priority. It’s like selecting skincare products – you want to know exactly what you’re putting your trust in. The crypto30x.com gemini comparison reveals a fascinating tale of two very different approaches to protecting your investments.

Regulatory and Compliance Showdown

Think of Gemini as that friend who always follows the rules and somehow makes it look effortless. Gemini holds a coveted NYDFS license, operating as a New York Trust Company under the strict oversight of the New York State Department of Financial Services. This isn’t just paperwork – it means Gemini follows the same rigorous financial laws as traditional banks.

What does this mean for you? Mandatory KYC and AML processes ensure every user is verified, creating a transparent environment. Gemini operates as a full-reserve exchange, holding customer assets 1:1, so your funds are always there when you need them. They maintain capital reserves and meet cybersecurity standards that would make any traditional bank proud.

The investor protection that comes with regulation is invaluable. When disputes arise, there are legal frameworks and regulatory bodies to turn to. Even when Gemini faced challenges with their Earn program, the regulatory framework provided accountability and resolution paths.

On the flip side, Crypto30x.com’s lack of SEC and FCA registration creates a regulatory void. Without oversight from major financial authorities, users miss out on the safety nets that regulated platforms provide. There’s no mandatory verification process, no regulatory body to appeal to if things go wrong, and no guarantee of financial safeguards.

It’s like the difference between a clinically tested skincare ingredient and one that promises miracle results but has never been properly studied. We always recommend transparency and accountability in both beauty and finance.

Technical Security Measures

Here’s where the rubber meets the road – or where your digital assets meet their storage solutions. Gemini’s cold storage approach keeps the majority of user funds offline, away from internet-based threats. They’ve pioneered the use of hardware security keys across mobile devices, giving users military-grade account protection.

Perhaps most impressively, Gemini maintains a hack-free record – something incredibly rare in the cryptocurrency world. Their multi-factor authentication isn’t just a checkbox; it’s a comprehensive system that includes features like Address Book with Withdrawal Protection and a 7-day hold for new addresses.

Gemini’s ISO/IEC 27001:2013 certification and PCI DSS compliance aren’t just fancy acronyms – they represent internationally recognized standards for information security and payment card data protection.

Crypto30x.com’s claimed security measures sound impressive on paper. They mention AES-256 encryption, mandatory 2FA, and cold storage for user assets. However, without independent verification or regulatory backing, these remain unproven claims. It’s the difference between a beauty brand that submits to third-party testing versus one that simply lists impressive-sounding ingredients without verification.

The absence of a proven track record or verifiable security audits makes it difficult to assess the actual protection level. In the crypto world, where “trust but verify” is the golden rule, unverified claims raise red flags.

For those curious about the technical details behind Crypto30x.com’s blockchain claims, our Crypto30x.com Blockchain: Complete Guide explores these aspects further.

Ready to experience proven security? You can Start trading today on Gemini’s regulated platform, where your peace of mind comes standard with every transaction.

The User Experience: Features, Fees, and Support

When it comes to your daily trading experience, the tools you use and the support you receive can make or break your financial journey. Think of it like choosing between a high-end beauty routine with premium ingredients and customer service versus an experimental product with questionable support – the difference matters.

Trading Tools and Market Insights for crypto30x.com gemini

Gemini understands that every trader is different. If you’re just starting out, their clean, intuitive interface makes buying your first Bitcoin feel less intimidating. You’ll see clear fees upfront, detailed transaction history, and straightforward buy-and-sell options that won’t overwhelm you.

But here’s where Gemini really shines for experienced traders: ActiveTrader™. This isn’t just another trading interface – it’s a professional-grade platform that puts serious tools at your fingertips. You get multiple chart types, customizable watchlists, real-time price alerts, and sophisticated order types that let you execute your strategy with precision. Whether you’re setting stop-losses or planning complex trades, ActiveTrader gives you the control you need. We encourage you to Try ActiveTrader® and experience the difference yourself.

On the flip side, Crypto30x.com takes a completely different approach. Rather than providing a trading platform, they focus on market intelligence and analysis. Their main attraction is the AI-powered “Zeus signals” system, which claims to crunch technical data, fundamental analysis, and on-chain metrics to spot opportunities. They’re essentially positioning themselves as your crypto research assistant, promising to identify coins with massive growth potential.

The platform also offers insights into high-leverage trading – up to 30x – which can amplify both gains and losses dramatically. For traders seeking aggressive strategies, this kind of analysis might seem appealing. You can stay updated with their latest market insights through our Crypto30x.com News Guide.

Here’s where the crypto30x.com gemini pairing makes sense: you could potentially use Crypto30x.com’s analytical tools to research opportunities, then execute your actual trades on Gemini’s secure, regulated platform. It’s like getting experimental beauty advice from an influencer but buying your products from a trusted, certified retailer.

Navigating Fees, Withdrawals, and Customer Service

Let’s talk about the practical stuff – because fees and customer service are where the rubber meets the road in any financial relationship.

Gemini operates with transparent, volume-based fee structures. Yes, their fees might be higher than some less-regulated exchanges, but you’re paying for something valuable: security, compliance, and reliability. Think of it as the difference between a premium skincare brand and a knockoff – sometimes the extra cost is worth the peace of mind.

The ActiveTrader platform offers even better fee structures for higher-volume traders, making it more economical as your trading activity grows. What we love about Gemini is that there are no hidden surprises – you know exactly what you’re paying before you trade.

Now, here’s where things get concerning with Crypto30x.com. Our research has uncovered numerous user complaints about withdrawal difficulties and unresponsive customer service. Imagine trying to return a defective beauty product only to find the company won’t respond to your emails – that’s the kind of frustration many Crypto30x.com users report experiencing.

These withdrawal issues are particularly troubling because they affect your ability to access your own money. No matter how promising their analytical tools might seem, difficulty withdrawing funds is a major red flag that should give any investor pause.

Gemini takes a completely different approach to customer support. They offer 24/7 email support and maintain comprehensive help resources. When you have an urgent issue – like being locked out of your account during a market move – their support team typically responds quickly and effectively. Having reliable customer service isn’t just nice to have; it’s essential when you’re dealing with your financial assets.

For those interested in managing crypto assets across different platforms, our Crypto30x.com Trust Wallet guide provides helpful insights into wallet management and security practices.

Who Should Consider This Pairing? Identifying the Target Investor

Just like finding the perfect skincare routine requires understanding your skin type and goals, determining whether crypto30x.com gemini fits your investment style starts with honest self-reflection about your risk tolerance and financial objectives.

Think of this pairing as having two very different tools in your financial toolkit. Gemini is like your trusted daily moisturizer—reliable, well-tested, and something you can count on every day. Crypto30x.com, on the other hand, is more like that experimental serum you’ve been curious about—potentially transformative, but definitely requiring careful consideration before use.

Beginners seeking security will find Gemini’s regulated environment particularly appealing. If you’re just starting your crypto journey, Gemini’s user-friendly interface and strong regulatory backing provide a safe space to learn. The platform’s educational resources and clear fee structure make it easy to understand what you’re getting into. For newcomers, we’d suggest focusing primarily on Gemini’s offerings rather than diving into Crypto30x.com’s high-risk analytics right away.

Long-term holders who prioritize asset safety represent another ideal group for this combination. If your goal is to securely store established cryptocurrencies like Bitcoin and Ethereum for years to come, Gemini’s cold storage solutions and hack-free history offer peace of mind. These investors might occasionally peek at Crypto30x.com’s insights for educational purposes, but their core strategy remains focused on secure, long-term holding.

The most natural fit for the crypto30x.com gemini pairing is experienced traders with calculated risk appetites. These investors understand that successful trading often involves gathering insights from multiple sources while executing trades on the most secure platforms available. They might use Crypto30x.com’s AI-powered analytics to identify potential opportunities, then execute those trades on Gemini’s regulated exchange.

Institutional investors and family offices typically gravitate toward Gemini’s institutional services, appreciating the regulatory compliance and professional-grade custody solutions. However, these sophisticated investors rarely rely on unregulated analytics platforms like Crypto30x.com for their decision-making processes.

Speculative traders looking for high-growth opportunities find themselves in an interesting position with this pairing. While Crypto30x.com’s claims of “30x growth potential” might spark curiosity, wise traders understand the importance of executing any resulting trades on a platform they can trust. This creates a natural workflow: research on Crypto30x.com, execution on Gemini.

The key insight here is that successful investors often separate their research phase from their execution phase. You might explore various analytical tools and insights, but when it comes time to actually put your money at risk, choosing a regulated, secure platform becomes crucial.

Investing in cryptocurrency should always represent money you can afford to lose. Whether you’re drawn to the security of Gemini alone or curious about combining it with Crypto30x.com’s analytics, your investment decisions should align with your overall financial wellness goals—just like choosing beauty products that support your skin’s long-term health rather than chasing every trending ingredient.

Frequently Asked Questions about crypto30x.com Gemini

We understand that exploring crypto30x.com gemini can feel overwhelming – much like trying to decode a complex ingredient list on a skincare product. That’s why we’ve gathered the most common questions our readers ask about this pairing. Think of this as your friendly guide to making sense of it all.

Is it safe to use Crypto30x.com with Gemini?

This question deserves a thoughtful answer because safety in crypto is just as important as choosing safe ingredients for your skin. Using Gemini itself is remarkably safe – it’s like choosing a dermatologist-recommended product with years of proven results. Gemini has never suffered a major hack, stores most assets in cold storage, and operates under strict New York State regulations.

The complexity comes when you add Crypto30x.com to the mix. While your actual funds would remain secure on Gemini’s platform, using Crypto30x.com’s insights introduces significant risks. It’s an unregulated platform with user complaints about withdrawals and transparency issues. Think of it this way: you might read beauty advice from an unverified blogger, but you’d still buy your products from a trusted retailer.

The bottom line? Your money stays safe on Gemini, but the advice you’re getting from Crypto30x.com could lead you astray. We always recommend approaching unregulated platforms with the same caution you’d use when trying a new product with questionable ingredients.

What are the main risks of using an unregulated tool like Crypto30x.com?

Using an unregulated platform like Crypto30x.com is a bit like using a skincare product with no ingredient list or safety testing. The risks are real and worth understanding fully.

Lack of investor protection is perhaps the biggest concern. Without regulatory oversight from bodies like the SEC or FCA, you have virtually no legal recourse if something goes wrong. If the platform disappears or engages in fraudulent activities, your money could simply vanish.

Transparency issues create another layer of risk. Our research shows there’s little information about who runs Crypto30x.com, where they’re based, or whether they hold any legal licenses. This opacity should raise immediate red flags for any thoughtful investor.

Withdrawal problems have been repeatedly reported by users. Multiple complaints about difficulties accessing funds mean you might find yourself unable to retrieve your own money. That’s not just inconvenient – it’s potentially devastating.

The platform’s promises of “30x returns” should also trigger your skepticism radar. These claims, combined with what some have called “catfish” marketing tactics, suggest the platform may be using misleading information to attract users.

Without mandatory KYC and AML processes, Crypto30x.com doesn’t follow global standards designed to prevent financial crime. This absence of basic compliance measures puts both individual users and the broader financial system at risk.

Can I use insights from Crypto30x.com to trade on Gemini?

Technically, yes – you can use insights from Crypto30x.com to inform your trading decisions on Gemini. These are separate services: Crypto30x.com provides analytics while Gemini serves as your secure trading platform. You’d gather information from one and execute trades on the other.

However, this approach requires extreme caution. Just as you wouldn’t base your entire skincare routine on advice from an unverified source, you shouldn’t base your financial decisions on insights from an unregulated platform with questionable credibility.

The key consideration is the reliability of Crypto30x.com’s insights. While Gemini provides a secure environment for your assets, it can’t vouch for the quality of third-party advice. The platform’s lack of regulation, user complaints, and transparency issues make it a risky source for financial guidance.

If you do choose to use this approach, treat any insights from Crypto30x.com with healthy skepticism. Always conduct your own research, never invest more than you can afford to lose, and remember that promises of extraordinary returns often come with extraordinary risks.

Your financial wellness, much like your skin health, depends on making informed decisions based on trustworthy sources. While the crypto30x.com gemini combination might seem appealing, the risks associated with unregulated platforms should give any prudent investor pause.

Conclusion: Balancing Innovation with Security for Financial Wellness

Navigating crypto30x.com gemini feels a lot like choosing between an experimental skincare ingredient and a tried-and-true formula. Both have their place, but understanding the difference could make or break your results.

After exploring these two platforms, one thing becomes crystal clear: informed decision-making is your superpower. Just as we wouldn’t recommend mixing unknown beauty ingredients without understanding their effects, we encourage the same thoughtful approach to your financial wellness journey.

Gemini serves as your secure foundation – think of it as the gentle, dermatologist-approved cleanser in your routine. It’s reliable, regulated, and has never let users down with a major security breach. The Winklevoss twins built something special when they prioritized “asking permission, not forgiveness.” This philosophy has created a platform where your digital assets can rest safely, protected by cold storage, regulatory oversight, and institutional-grade security measures.

Crypto30x.com, however, represents the speculative side – more like that trendy ingredient everyone’s talking about but hasn’t been fully tested yet. Its promises of “30x growth potential” and AI-powered insights sound exciting, but the lack of regulation, transparency issues, and user withdrawal complaints make it a risky proposition. If you choose to explore its insights at all, treat it like you would any experimental product: use the smallest amount possible and be prepared for unexpected results.

The beauty of understanding both platforms lies in recognizing how they might work together, if at all. Some investors use Crypto30x.com’s analytical tools while executing their actual trades on Gemini’s secure platform. It’s like getting inspiration from social media beauty trends but buying your products from trusted, verified retailers.

Financial wellness, much like skincare wellness, thrives on consistency, safety, and informed choices. Your investment journey should align with your personal goals and risk tolerance. Whether you’re a beginner seeking security or an experienced trader willing to explore higher-risk insights, the key is never investing more than you can afford to lose.

At Beyond Beauty Lab, we believe wellness encompasses every aspect of your life – from the products you put on your skin to the platforms you trust with your financial future. Both require research, understanding, and a commitment to your long-term well-being.

Our comprehensive Crypto30x.com Gemini: Complete Guide offers even more insights to help you make the best decision for your unique situation. In both beauty and investing, knowledge truly is your most powerful tool.