Why the FintechZoom.com Lifestyle is Changing Modern Living

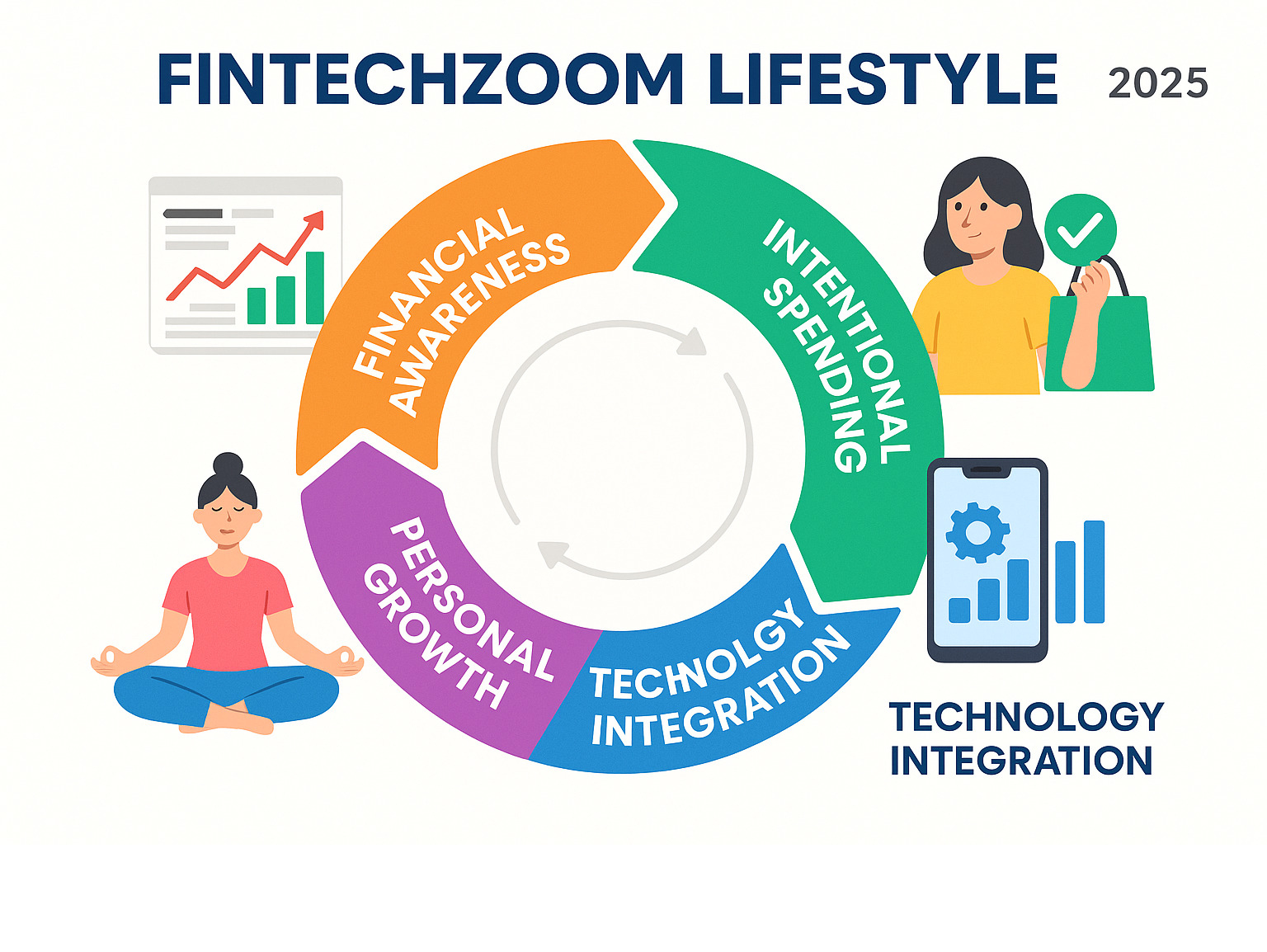

The fintechzoom.com lifestyle represents a modern approach to living where financial awareness seamlessly integrates with daily decisions to create a more fulfilling, stress-free life. Here’s what defines this lifestyle:

Key Elements:

- Financial Clarity – Using real-time market data and insights to make informed decisions

- Intentional Spending – Aligning purchases with personal values and long-term goals

- Technology Integration – Leveraging fintech tools for smarter money management

- Stress Reduction – Changing financial anxiety into empowerment through knowledge

In today’s digital world, money touches nearly every aspect of our lives. The fintechzoom.com lifestyle isn’t about restrictive budgeting or obsessing over numbers. Instead, it’s about creating a holistic approach that blends financial intelligence with wellness, personal growth, and authentic living.

This mindset transforms how you approach everything from your morning coffee purchase to planning a wellness retreat. By staying informed through platforms like FintechZoom.com, you gain the confidence to make choices that support both your financial health and overall well-being.

For eco-conscious individuals seeking sustainable beauty solutions, this lifestyle approach is particularly powerful. It provides the framework to invest mindfully in clean beauty products, sustainable practices, and wellness experiences without the guilt or stress that often accompanies financial decisions.

Fintechzoom.com lifestyle basics:

What is the FintechZoom.com Lifestyle? More Than Just Money

Think of the fintechzoom.com lifestyle as your financial GPS for modern living. It’s not about becoming a finance expert overnight or obsessing over every penny. Instead, it’s about weaving financial awareness naturally into the decisions you’re already making every day.

Picture this: You’re scrolling through your favorite wellness brand’s new skincare line. Instead of that familiar flutter of financial anxiety, you feel confident because you understand exactly where this purchase fits in your bigger picture. That’s the power of this lifestyle approach.

The beauty lies in how it transforms daily choices from sources of stress into moments of empowerment. Whether you’re choosing between that expensive organic face oil or planning a weekend wellness retreat, you’re making decisions that align with both your values and your financial reality.

Blending Finance with Daily Life

The magic happens when financial awareness stops feeling like homework and starts feeling like self-care. You’re not just checking market updates for the sake of it-you’re understanding how broader economic trends might affect your personal goals.

Maybe you notice that sustainable beauty products are becoming more affordable due to market shifts. Or perhaps you realize that investing in that high-quality skincare routine now actually saves money long-term. These insights help with stress reduction because you’re making informed choices rather than emotional ones.

This approach recognizes that we live in a digital economy where every swipe and tap has financial implications. The Fintechzoom.com Economy connects global financial trends with personal decision-making, while financial technology continues to make these insights more accessible than ever.

Why Financial Awareness is a Form of Self-Care

Here’s something that might surprise you: taking control of your finances is one of the most powerful acts of personal empowerment you can practice. In our modern society, where we’re constantly bombarded with spending opportunities and financial decisions, clarity becomes a form of mental wellness.

When you understand your financial landscape, you’re not just protecting your bank account-you’re protecting your peace of mind. That constant background worry about money? It starts to fade when you have systems and knowledge in place.

This holistic well-being approach means you can enjoy that luxurious face mask or sign up for that yoga retreat without the guilt spiral afterward. You’re making choices from a place of awareness rather than impulse, which feels completely different emotionally.

The digital economy we live in offers incredible opportunities for both spending and earning, but it requires a new level of financial literacy to steer successfully. For those interested in exploring this further, there’s more info about the Digital Economy.

The Core Benefits: How Financial Clarity Creates a Beautiful Life

When you accept the fintechzoom.com lifestyle, something magical happens. The constant worry about money that used to keep you up at night? It starts to fade. That guilt you felt when treating yourself to a quality skincare product or planning a weekend getaway? It transforms into confidence.

This isn’t just about having more money in your bank account. It’s about gaining the confidence to make bold decisions that align with your values. Maybe that means finally investing in the organic beauty products you’ve been eyeing, or perhaps it’s booking that wellness retreat you’ve dreamed about. When you understand your finances, these choices become empowering rather than anxiety-inducing.

The ripple effects touch every corner of your life. Improved mental health comes naturally when you’re not constantly stressed about money. You become more present in conversations, more creative in your pursuits, and more generous with your time and energy. Financial security becomes the solid foundation that supports a truly beautiful and intentional life.

Real-World Examples of the Fintechzoom.com Lifestyle in Action

Let’s look at how this plays out in everyday situations. Take smart travel planning, for instance. Instead of booking the first vacation package you see, you might use insights from financial platforms to track exchange rates and find the perfect timing for your dream trip. The rise of digital nomads has been another big trend in modern travel, where financial awareness makes it possible to explore places like Thailand for as little as $25-35 per day.

Conscious fashion becomes second nature too. Rather than impulse-buying trendy pieces that’ll sit unworn in your closet, you invest in quality items that truly improve your style. That well-custom blazer or luxurious cashmere sweater becomes a strategic choice that lifts your entire wardrobe for years to come.

When it comes to wellness investments, the fintechzoom.com lifestyle helps you make smart choices about your health. Maybe you decide that expensive gym membership isn’t worth it and invest in quality home equipment instead. Or perhaps you realize that those premium supplements align perfectly with your wellness goals and budget. Understanding market trends through resources like more info about Gold Prices can even help you steer the luxury wellness market more intelligently.

Even your daily coffee run becomes a conscious choice. You’re not depriving yourself of life’s small pleasures, but you’re making decisions that feel good both in the moment and long-term.

Navigating the Challenges of a Financially-Aware Life

Let’s be honest – diving into financial awareness can feel overwhelming at first. The sheer amount of information overload from market updates, investment strategies, and economic news can make your head spin. It’s like trying to drink from a fire hose when all you wanted was a sip of water.

The initial overwhelm is real, and many people get discouraged right at the start. You might find yourself checking financial apps obsessively or second-guessing every purchase decision. This is where avoiding obsession becomes crucial – the fintechzoom.com lifestyle is about balance, not becoming a financial robot.

Maintaining balance means remembering that life is meant to be enjoyed. Financial awareness should improve your life, not control it. The goal isn’t perfection; it’s progress. Some days you’ll make decisions purely based on joy, and that’s perfectly okay. The key is having the knowledge and tools to make informed choices when they matter most.

For those moments when you need guidance on the bigger picture, exploring more info about Business can provide valuable context for your personal financial journey. This lifestyle is about creating space for both financial wisdom and spontaneous happiness.

Your Practical Guide to Adopting the FintechZoom.com Lifestyle

Starting your fintechzoom.com lifestyle journey doesn’t require a complete life overhaul. Think of it like starting a new skincare routine – you wouldn’t use every product at once, right? The same gentle approach works here.

Begin with just one area of your finances. Maybe it’s those sneaky subscription services you forgot about, or perhaps your weekly grocery budget. Pick something manageable and use insights from platforms like FintechZoom.com to guide your decisions.

Technology becomes your best friend in this process. Just as you might use apps to track your water intake or meditation practice, financial management apps can make money decisions feel less overwhelming. From simple budgeting tools to smart investment platforms, these digital helpers transform complex financial concepts into bite-sized, actionable steps.

The beauty of this approach is that it grows with you. Start small, build confidence, and gradually expand your financial awareness. Before you know it, checking market trends will feel as natural as checking the weather.

Step 1: Educate Yourself with Key Financial Insights

Building your financial knowledge is like learning any new skill – it takes time, but the payoff is worth it. FintechZoom.com serves as your personal financial tutor, breaking down complex market movements into understandable insights.

Start by following major market indicators like the S&P 500 and Dow Jones. These aren’t just numbers on a screen – they reflect the economic environment that affects everything from your job security to the cost of your favorite products. For those ready to dive deeper into American markets, there’s more info about US Markets.

The crypto landscape might seem intimidating, but it’s becoming increasingly relevant to everyday financial planning. FintechZoom.com helps decode blockchain trends and cryptocurrency developments, making this complex world more accessible. Whether you’re curious about Bitcoin’s latest movements or want to understand digital assets better, you can find more info about Bitcoin.

You don’t need to become a financial expert overnight. Focus on understanding economic trends that directly impact your lifestyle choices. When you grasp how inflation affects your grocery budget or how interest rates influence your savings, you’re already living the fintechzoom.com lifestyle.

Step 2: Leverage Technology for Smarter Decisions

Technology transforms financial management from a chore into an empowering daily practice. Think of it as having a personal financial assistant that never sleeps and always has your best interests at heart.

Mobile banking has evolved far beyond simple account checking. Today’s apps offer spending insights, savings goals, and even predictive analytics to help you make better choices. Meanwhile, robo-advisors use sophisticated algorithms to create investment strategies custom to your specific situation and goals.

The real game-changer is AI-driven insights. These systems learn your spending patterns, understand your financial goals, and offer personalized recommendations. It’s like having a financial advisor who knows you intimately and can suggest whether that weekend spa trip fits your budget and priorities. For those interested in advanced AI applications in investing, there’s more info about 5StarsStocks AI.

Blockchain technology is revolutionizing how we think about money and transactions. While it might sound technical, platforms like FintechZoom.com excel at decoding blockchain trends in simple, practical terms. This technology promises greater transparency and security in financial dealings, making it easier to trust and track your financial decisions.

The goal isn’t to become dependent on technology, but to use it as a tool that supports your financial wellness journey. Just as you might use a fitness tracker to monitor your health goals, these financial tools help you stay aligned with your money objectives while living the life you love.

The Future is Integrated: Where Finance and Lifestyle are Headed

Picture this: you wake up tomorrow morning, and your phone gently suggests a calming meditation app because it noticed some financial stress in your spending patterns last week. After your mindfulness session, it shows you that your wellness budget can comfortably cover that organic skincare routine you’ve been eyeing. This isn’t science fiction-it’s where the fintechzoom.com lifestyle is heading.

The trend of merging finance with lifestyle is only beginning. We’re moving toward a world where money management feels as natural as checking the weather. Technology is evolving to understand not just our bank accounts, but our whole lives. Your financial apps will soon know when you’re stressed, when you’re planning a big purchase, and even when you need a gentle nudge toward self-care.

Imagine an app that tracks your spending and suggests a yoga class when it detects high-stress levels-but only after confirming you have the budget for it. Or picture a system that notices you’ve been working late and reminds you to invest in that quality sleep mask you bookmarked, knowing it aligns with both your wellness goals and financial plan.

This seamless integration means our financial decisions will naturally support our pursuit of beauty, wellness, and personal growth. Instead of money being a separate worry, it becomes woven into the fabric of living well.

The Role of AI and Personalization

The future of the fintechzoom.com lifestyle rests on AI becoming our most trusted financial wellness coach. We’re stepping into an era where smart recommendations aren’t just about maximizing returns-they’re about maximizing life satisfaction.

Tomorrow’s AI won’t just analyze your spending habits; it’ll understand your wellness journey, your beauty goals, and your personal growth aspirations. It might suggest investing in companies that align with your values, or recommend setting aside funds for that meditation retreat you mentioned to a friend.

This tech evolution will make financial decisions feel effortless and supportive rather than stressful. Your AI assistant might notice you’ve been researching clean beauty products and suggest reallocating some entertainment budget toward that high-quality skincare investment. Or it could recommend a sustainable fashion purchase that fits both your style goals and your ethical investing strategy.

For those exploring the broader digital landscape, there’s more info about Digital Money and platforms like more info about 5StarsStocks that are pioneering this personalized approach.

This seamless integration ensures that our finances become a supportive foundation for the beautiful, intentional life we want to create. Instead of managing money feeling like a chore, it becomes another form of self-care-one that nurtures both our bank accounts and our well-being.

Frequently Asked Questions about the FintechZoom.com Lifestyle

Is the FintechZoom.com lifestyle only for financial experts?

Not at all! The fintechzoom.com lifestyle is designed for anyone who wants to make more informed and empowered decisions about their life. You don’t need a finance degree or years of investment experience to start living this way.

Platforms like FintechZoom.com break down complex topics into accessible insights, making financial awareness achievable for beginners and experts alike. Think of it like learning about skincare-you don’t need to be a dermatologist to understand that certain ingredients work better for your skin type.

The goal is progress, not perfection. Whether you’re just starting to track your spending or you’re already comfortable with investment basics, this lifestyle meets you where you are and helps you grow from there.

Does this lifestyle mean sacrificing fun for saving money?

Absolutely not! This is one of the biggest misconceptions about the fintechzoom.com lifestyle. The core principle is balance, not deprivation.

It’s about intentional spending rather than restrictive budgeting. When you understand your finances, you can allocate funds guilt-free to the things that bring you joy-whether that’s travel, dining out, or investing in your hobbies-while still securing your future.

Think of it like choosing quality skincare products. You might spend more on a serum that truly works for your skin rather than buying multiple cheaper products that don’t deliver results. The fintechzoom.com lifestyle applies this same thoughtful approach to all your spending decisions.

You’re not giving up your morning coffee or weekend adventures. Instead, you’re making sure these choices align with your values and long-term goals, which actually makes them more enjoyable because there’s no financial stress attached.

What is the main long-term benefit?

The ultimate benefit is confidence and peace of mind. By taking control of your finances, you eliminate a major source of stress, which positively impacts your mental and physical health.

This leads to greater clarity in all your life decisions and the freedom to pursue a life you find truly beautiful and fulfilling. When you’re not constantly worried about money, you have more mental energy to focus on your wellness, relationships, and personal growth.

Financial security provides the foundation for everything else-your ability to invest in quality self-care products, take that wellness retreat, or simply sleep better at night knowing you’re prepared for whatever comes your way. It’s holistic wellness that starts with financial wellness, creating a ripple effect that touches every aspect of your life.

Conclusion

The fintechzoom.com lifestyle is more than a trend; it’s an evolution in how we approach modern living. It reframes financial management as an act of self-care and empowerment, changing what many see as a chore into a pathway toward inner peace and confidence.

By using resources like FintechZoom.com to stay informed, we can make choices that truly align with our values and build a life of both prosperity and well-being. This platform serves as our bridge to understanding the fast-changing world of markets and technology, offering the timely insights we need to make decisions with confidence rather than anxiety.

What makes this lifestyle so powerful is how it ripples through every aspect of our lives. When we’re no longer stressed about money, we have more mental energy for the things that matter most-our health, our relationships, and our personal growth. We can invest in that quality skincare routine without guilt, plan that wellness retreat with excitement rather than worry, or pursue our passions knowing we have a solid financial foundation.

At Beyond Beauty Lab, we believe that true beauty radiates from a place of inner peace and confidence. Financial wellness is a vital, often overlooked, component of that equation. When we master our money, we create space to invest in ourselves authentically. We can choose clean beauty products that align with our values, prioritize wellness practices that nourish us, and cultivate habits that make us feel beautiful from the inside out.

The fintechzoom.com lifestyle isn’t about perfection-it’s about progress. It’s about making small, intentional choices every day that add up to a life that feels both secure and joyful. When financial stress affects so many of us, this approach offers a refreshing alternative that honors both our practical needs and our desire for a beautiful, fulfilling life.