What is FintechZoom’s Role in Forex Trading?

The fintechzoom.com forex market has become a go-to resource for traders seeking comprehensive financial intelligence and real-time market data. FintechZoom serves as more than just another financial news site – it’s a complete trading platform that combines institutional-grade data with user-friendly tools.

Quick Overview: FintechZoom Forex Market Features

- Real-time data: Sub-millisecond latency for major currency pairs

- Global coverage: 47 international markets with local currency conversion

- Advanced tools: Carry trade calculators and institutional positioning data

- AI-powered alerts: Market-moving insights 4-6 hours ahead of mainstream media

- Educational resources: FintechZoom Academy with tutorials and webinars

- Pricing: Free tier available, Essential Plan ($99/month), Premium Plan ($199/month)

FintechZoom processes over 2.8 million data points per second during market hours, giving forex traders access to the same quality of information that was once exclusive to Wall Street institutions. The platform covers everything from major pairs like EUR/USD to exotic currencies, all while providing context through economic calendars and central bank announcements.

What sets FintechZoom apart is its focus on turning raw market data into actionable insights. Instead of just showing price movements, the platform explains why currencies are moving based on economic indicators, institutional flows, and global market sentiment.

Whether you’re a beginner learning about currency pairs or an experienced trader looking for advanced analytics, FintechZoom offers tools designed to help you make informed decisions in the volatile forex market.

Easy fintechzoom.com forex market word list:

Key Features of the FintechZoom.com Forex Market Platform

When you first land on FintechZoom.com, you’ll notice something refreshing – it doesn’t feel overwhelming like many financial platforms do. The fintechzoom.com forex market section is designed with real traders in mind, not just data scientists with three monitors.

What makes this platform special is how it brings together everything you need in one place. Instead of jumping between five different websites to check real-time quotes, scan central bank calendars, and track institutional data feeds, you can do it all from a single dashboard. It’s like having a financial command center that actually makes sense.

The platform covers 47 global markets, which means you’re not limited to just the big currency pairs everyone talks about. Whether you’re interested in the EUR/USD or want to explore something more exotic, FintechZoom has you covered. And here’s the thing – they process over 2.8 million data points per second, so you’re getting information that’s as fresh as it gets.

Now, let’s talk about pricing because we know that matters. FintechZoom offers three tiers, and honestly, they’ve structured it pretty fairly:

| Feature / Plan | Free Tier | Essential Plan ($99/month) | Premium Plan ($199/month) |

|---|---|---|---|

| Forex Data | Real-time quotes (major pairs) | Real-time quotes (all pairs), basic charts | Sub-millisecond latency, Level II data, institutional flow, advanced charting, back-testing |

| Analysis | Basic economic calendar, news headlines | AI-generated forecasts, sentiment analysis | AI alerts, Squawk Box, behavioral analytics, detailed economic surprise indices |

| Tools | Watchlists, basic screeners | Carry trade calculators, currency panels | Real-time positioning data, volatility shields, advanced risk management tools |

| Education | Basic articles | Educational guides, tutorials | FintechZoom Academy, webinars, whitepapers, sample pro strategies |

| Market Coverage | Major stock indexes, basic crypto/forex | Wider stock/crypto/commodity/forex coverage | 47 global markets, deep dive into all asset classes |

The free tier is actually useful (unlike some platforms that give you basically nothing), but if you’re serious about forex trading, the Essential or Premium plans open up tools that can genuinely impact your results.

Real-Time Data and Comprehensive Coverage

Speed matters in forex – like, really matters. While you’re still processing yesterday’s news, the market has already moved on to tomorrow’s possibilities. FintechZoom gets this, which is why their premium subscribers get sub-millisecond latency through proprietary fiber-optic connections.

But it’s not just about speed – it’s about coverage. The fintechzoom.com forex market section covers all the currency pair types you need to know about. Major pairs like EUR/USD are your bread and butter – highly liquid, tight spreads, and plenty of trading opportunities. Minor pairs (think EUR/GBP or GBP/JPY) give you more options without involving the US Dollar. Then there are exotic pairs like USD/THB, which can be exciting but come with wider spreads and higher risk.

What’s really impressive is how FintechZoom handles economic indicators. They don’t just throw numbers at you – they help you understand what GDP growth, inflation rates, and interest rate decisions actually mean for currency movements. For a deeper dive into all the markets they cover, check out Fintechzoom.com Markets.

Advanced Forex-Specific Tools

Here’s where FintechZoom really shines – they’ve built tools specifically for forex traders, not just adapted stock market tools and hoped for the best.

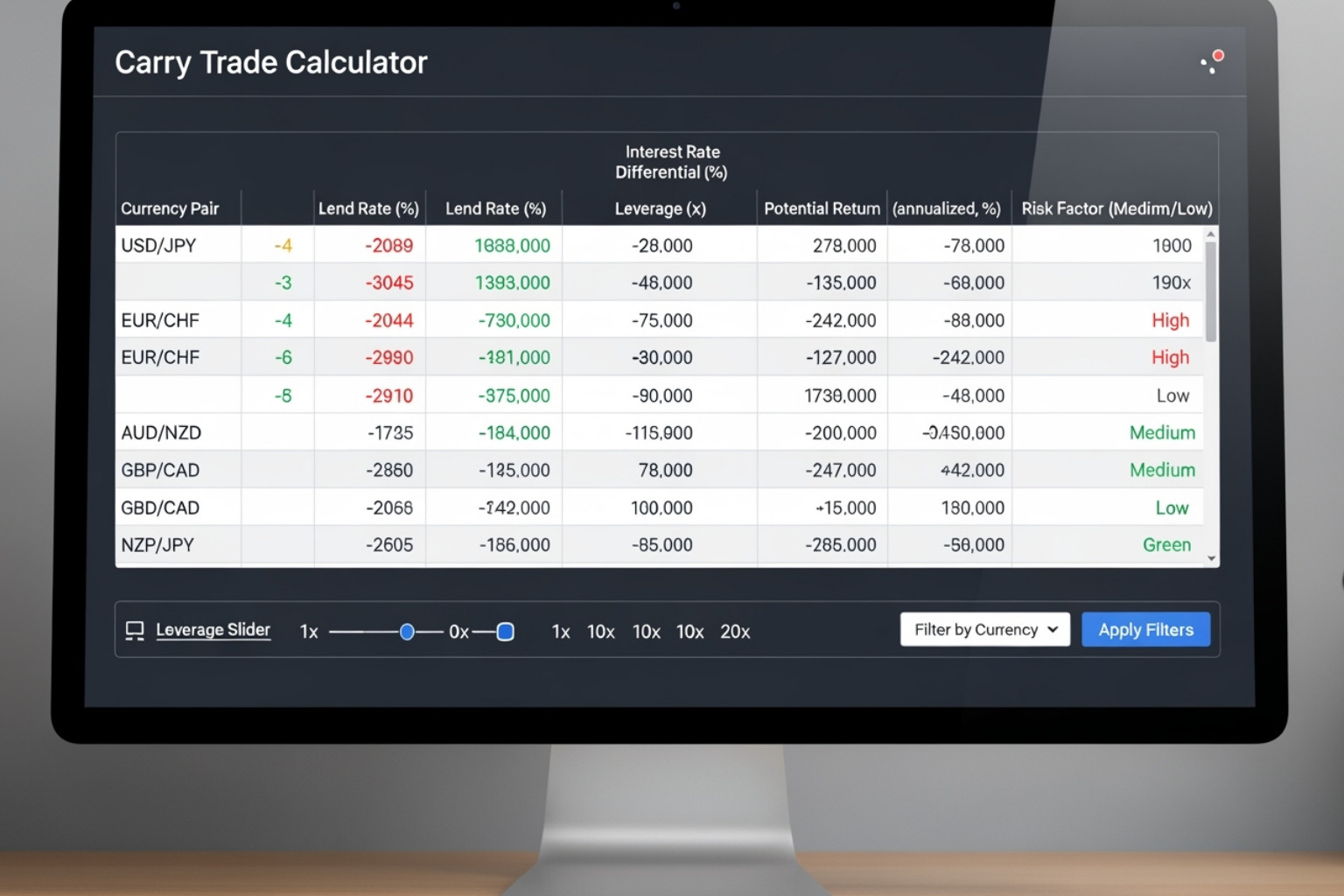

The carry trade calculator is a perfect example. If you’ve ever wondered about profiting from interest rate differences between countries, this tool makes it simple. Instead of doing complex math in your head, you can see potential returns at a glance. It’s like having a financial calculator that actually understands forex.

But perhaps the most valuable feature is the real-time positioning data from major banks. This is like getting a peek at the institutional playbook. When you can see where the big players are positioned, you can spot “crowded trades” before they potentially unwind. It’s the kind of insight that was once exclusive to Wall Street.

The platform also provides volatility analysis tools that help you understand expected price swings for different pairs. This isn’t just academic – it’s crucial for setting realistic stop-losses and profit targets. Combined with their economic surprise indices, you can gauge whether economic data is beating or missing expectations, which often drives the biggest currency moves.

These aren’t just fancy features for the sake of it – they’re practical tools that can genuinely improve your trading decisions in the dynamic fintechzoom.com forex market.

Identifying Trading Opportunities with FintechZoom’s Advanced Tools

The real magic of the fintechzoom.com forex market platform happens when raw data transforms into those “aha!” moments that lead to profitable trades. FintechZoom doesn’t just throw numbers at you – it uses cutting-edge artificial intelligence and machine learning to help you spot opportunities before they become obvious to everyone else.

Think of it like having a really smart friend who never sleeps, constantly watching the markets and tapping you on the shoulder when something interesting is about to happen. The platform’s advanced analytics combine AI-driven forecasts with solid technical analysis tools, comprehensive charting, and powerful back-testing features. This means you’re not just reacting to what already happened – you’re getting ahead of the curve.

The fintech revolution has made these institutional-grade tools available to everyday traders like us. What used to require a team of analysts and millions of dollars in infrastructure now fits right in your browser.

Leveraging AI for Market-Moving Insights

Here’s where things get exciting. FintechZoom’s AI processes an incredible 2.8 million data points per second from exchanges, news sources, and even social media chatter. The result? You often get market-moving alerts 4-6 hours before mainstream news picks up the story.

Imagine getting a heads-up about a central bank policy shift while financial journalists are still having their morning coffee. That’s the kind of edge we’re talking about.

The AI-generated alerts work by monitoring multiple data streams and triggering notifications when certain thresholds are crossed. Maybe a regulatory tweet gains unusual traction, or institutional money starts flowing in an unexpected direction. The system catches these signals early and sends you a notification.

One feature that sounds quirky but proves surprisingly useful is the Squawk Box. These are short, 30-second audio clips from professional trading desks that help you catch intraday market shifts. During volatile periods, these rapid insights can be the difference between catching a profitable move and missing it entirely.

The AI also excels at sentiment analysis, reading the mood from social media and news headlines. In forex, market sentiment often moves currencies before the fundamentals catch up. Pattern identification is another strength – the AI spots complex trading patterns that might take human eyes hours to notice.

Using Technical Indicators and Charting for the fintechzoom.com forex market

For chart enthusiasts, FintechZoom’s interactive charting tools are like having a Swiss Army knife for technical analysis. You can drag and drop indicators, customize your workspace, and dive deep into price action for the fintechzoom.com forex market.

Beyond your standard moving averages and RSI, the platform supports some sophisticated concepts that can give you an edge. Fibonacci Time Zones are particularly interesting – these vertical lines help you predict when significant price moves might happen, not just where. By combining time-based analysis with traditional price levels, you get a more complete picture. For a deeper dive into this concept, check out Understanding Fibonacci Time Zones in Forex Trading.

Kill Zones represent those golden hours when major trading sessions overlap and volatility spikes. The Asian session winds down just as London wakes up, or London hands off to New York – these transitions often create the best trading opportunities. FintechZoom’s real-time data helps you capitalize on these high-probability windows.

The confluence strategy is where everything comes together. Instead of relying on a single indicator, you look for multiple signals pointing in the same direction. Maybe a Fibonacci Time Zone aligns with a Kill Zone, an AI alert pops up, and institutional data shows heavy buying – now you’ve got a compelling trade setup.

These tools work best when they complement each other. The AI might alert you to unusual activity, the technical analysis helps you time your entry, and the institutional data confirms that smart money agrees with your thesis. It’s this layered approach that turns the fintechzoom.com forex market platform from a simple data provider into a comprehensive trading intelligence system.

Mastering Risk Management and Strategy with FintechZoom

Trading forex can feel like riding a roller coaster – exciting, but you definitely want to be strapped in properly. That’s where FintechZoom really shows its value, offering solid risk management tools and educational resources that help us trade smarter, not just harder.

Just like we care for our overall wellness at Beyond Beauty Lab, managing our financial health is part of taking care of ourselves. Financial stress can affect everything from our sleep to our skin, so learning to trade responsibly isn’t just about money – it’s about our well-being too.

What we love about FintechZoom’s approach is that risk management isn’t an afterthought. It’s built right into how we use the platform, helping us make decisions we can sleep peacefully with at night.

Proactive Risk Control and Portfolio Management

FintechZoom gives us the same kind of risk management tools that big banks use, but in a way that actually makes sense for regular people like us. The portfolio analytics feature is particularly helpful – it’s like having a financial advisor watching over our shoulder.

One of our favorite features is the max draw-down limits. We can set a maximum percentage we’re willing to lose, and if our portfolio gets close to that line, FintechZoom sends us an alert. Think of it as a gentle tap on the shoulder saying “Hey, maybe it’s time to step back and reassess.” This volatility shield has saved many traders from making emotional decisions during stressful market moments.

The behavioral analytics feature is fascinating – it actually learns our trading patterns and points out our blind spots. Maybe we hold onto losing trades too long on Fridays, or we get overly excited about certain currency pairs. Users report that fixing these habits can improve their win rate by 16 percentage points and reduce average losses by 31%.

Historical data analysis lets us test our strategies against past market conditions before risking real money. It’s like having a time machine that shows us how our ideas would have performed during different market situations. This back-testing helps us refine our approach and build confidence in our strategy.

For those interested in hedging strategies, FintechZoom shows us simple ways to protect our portfolios – like using gold positions or keeping some cash on hand to reduce overall volatility. Survey data suggests these hedges can cut portfolio risk by about 15%.

The platform’s connection to broader economic trends, covered in detail in Fintechzoom.com Economy, helps us understand how global events might affect our fintechzoom.com forex market positions. This bigger picture view is crucial for managing systemic risks.

Trading always involves risk, and losses can happen. FintechZoom’s tools are incredibly helpful, but they don’t eliminate risk entirely. We always recommend talking to a financial professional before investing real money.

Enhancing Your Strategy in the fintechzoom.com forex market

Beyond just managing risk, FintechZoom offers amazing resources to continuously improve our trading skills and results. The FintechZoom Academy feels like having access to a top-tier financial education without the hefty price tag.

The Academy includes tutorials that break down complex trading concepts into bite-sized pieces, webinars with market experts who share real-world insights, and detailed whitepapers that dive deep into advanced topics. What we particularly appreciate is how everything is explained in plain English – no confusing jargon that makes our heads spin.

For beginners, there’s a five-lesson onboarding path that covers the basics – order types, bid-ask spreads, and chart reading – all presented with clear, easy-to-understand explanations. It’s perfect for anyone just starting their forex journey.

More experienced traders can explore advanced strategies like news arbitrage – acting on FintechZoom’s early AI insights before the information hits mainstream media. Some traders have found success with sector rotation strategies, using the platform’s heatmaps to track where big money is moving. While this primarily applies to stocks, these economic shifts often ripple through currency markets too.

One particularly interesting approach is the anti-consensus play – finding opportunities where retail traders and big institutions are positioned differently. FintechZoom’s institutional flow data makes it easier to spot these divergences, especially during volatile market periods.

By combining real-time data, AI-powered insights, solid risk management tools, and extensive educational resources, FintechZoom helps us become more disciplined, informed traders in the dynamic fintechzoom.com forex market. It’s about building skills that last, not just chasing quick profits.

Frequently Asked Questions about FintechZoom Forex Services

We get it – choosing the right platform for forex trading can feel overwhelming. You want to know the real details before diving in. Let’s tackle the most common questions we hear about using FintechZoom for the fintechzoom.com forex market, so you can make an informed decision.

How much does FintechZoom.com cost for forex traders?

The beauty of FintechZoom is its flexibility. Whether you’re just starting out or managing serious capital, there’s likely a plan that fits your needs and budget.

Starting with the free tier is honestly a smart move. You’ll get access to real-time market updates, basic charts, and news headlines – perfect for getting your feet wet. This gives beginners a chance to learn chart reading and understand market correlations without any financial commitment.

When you’re ready to level up, the Essential Plan at $99 per month opens doors to the more powerful features. We’re talking AI-generated forecasts, sentiment analysis, and those handy carry trade calculators. For active retail traders, this investment often pays for itself through better-informed trading decisions.

The Premium Plan at $199 monthly is where things get really exciting. This is institutional-grade territory – sub-millisecond data speeds, Level II market information, and that game-changing Squawk Box feature. Plus, you get real-time positioning data from major banks and advanced risk management tools. One user told us a single trade based on a Squawk Box insight covered their Premium subscription for six months!

The value really depends on how seriously you trade and how much capital you’re working with. If you’re managing significant amounts or day trading regularly, the premium features can quickly justify their cost.

How accurate is the forex data on FintechZoom?

This is probably the most important question, and rightfully so. In forex, timing and accuracy can make or break your trades.

FintechZoom takes data quality seriously. They source information directly from reputable exchanges and purchase Level II market data – no shortcuts here. The platform runs on low-latency servers that update forex rates in real-time with minimal delay. For premium users, we’re talking sub-millisecond latency, which is incredibly fast.

Here’s what really impressed us: FintechZoom processes approximately 2.8 million data points per second during market hours. This massive data processing power allows their AI systems to surface market-moving information often hours before traditional news outlets catch on.

Now, let’s be realistic. No platform can predict the future with 100% accuracy – that’s just not how markets work. FintechZoom’s own data shows their longer-term forecasts (beyond 30 days) have accuracy rates around 43%. But here’s the thing: the real value lies in the speed and quality of real-time data and early alerts, not crystal ball predictions.

Is FintechZoom suitable for beginner forex traders?

Absolutely, and this is where FintechZoom really shines. The platform strikes a beautiful balance between being beginner-friendly and offering advanced tools for growth.

The interface is genuinely intuitive. When you first log in, you won’t feel overwhelmed by charts and numbers. The default view shows essential information like price, volume, and – here’s what we love – plain-English trend verdicts. Instead of confusing jargon, you might see “mildly bullish” or “showing weakness,” which makes so much more sense when you’re starting out.

FintechZoom also provides a structured five-lesson onboarding path that covers the fundamentals. You’ll learn about order types, basic risk management, and chart reading – all the building blocks you need before placing your first trade.

The educational resources are extensive too. Articles, tutorials, and webinars break down complex forex concepts into digestible pieces. Everything is written in simple language, so you won’t need a finance degree to understand what’s happening in the fintechzoom.com forex market.

Three standout features for beginners include the comprehensive educational content that grows with you, those plain-English trend explanations that remove the guesswork, and the ability to create custom watchlists. You can monitor your preferred currency pairs and learn their behavior patterns without the pressure to trade immediately.

Our advice? Start with the free tier for a few weeks. Get comfortable with basic chart reading and watch how different currency pairs move. Once you feel confident, consider upgrading to access the more advanced features. This gradual approach helps build both knowledge and confidence – exactly what you need for successful forex trading.

Conclusion: Elevating Your Forex Trading with FintechZoom

Trading forex can feel overwhelming at times, but having the right tools makes all the difference. Throughout our deep dive into the fintechzoom.com forex market platform, we’ve finded something truly special – a comprehensive hub that transforms complex market data into actionable insights that actually help us make better trading decisions.

What sets FintechZoom apart isn’t just the impressive technical specs like sub-millisecond latency or processing 2.8 million data points per second. It’s how these powerful features work together to give us a real competitive edge. The AI-driven alerts that warn us about market-moving events hours before mainstream media catches on, the institutional positioning data that shows us where the “smart money” is flowing, and the behavioral analytics that help us recognize and fix our own trading patterns – these tools genuinely change how we approach the forex market.

The educational component deserves special mention too. FintechZoom Academy’s tutorials, webinars, and plain-English explanations mean we’re not just getting data – we’re learning how to use it effectively. Whether you’re just starting out with the five-lesson onboarding path or diving deep into advanced concepts like Fibonacci Time Zones and Kill Zones, the platform grows with you.

Here at Beyond Beauty Lab, we believe that true wellness extends beyond skincare and nutrition to include financial wellness. Just as we carefully research the best ingredients for our skin, we should approach our financial decisions with the same thoughtfulness and preparation. Financial stress can impact our overall well-being in profound ways, affecting our sleep, our relationships, and yes, even our skin health.

FintechZoom’s emphasis on proactive risk management and education aligns perfectly with our philosophy of making informed choices. The platform’s volatility shields and max draw-down limits aren’t just technical features – they’re tools for peace of mind. When we trade with proper risk management and solid education backing our decisions, we’re protecting not just our capital but our overall stress levels too.

The beauty of the fintechzoom.com forex market platform lies in its ability to turn what can be a chaotic, emotion-driven activity into a more systematic, informed process. By leveraging real-time institutional data, AI-powered insights, and comprehensive educational resources, we can approach forex trading with greater confidence and clarity.

Successful trading isn’t about making perfect predictions – it’s about making informed decisions, managing risk intelligently, and continuously learning from both wins and losses. FintechZoom provides the foundation for all three.