Why Understanding Natural Gas Markets Matters for Your Financial Wellness

fintechzoom.com natural gas represents more than just market data – it’s a gateway to understanding how energy costs affect your daily life and financial future.

Quick Answer for fintechzoom.com natural gas:

- Real-time pricing data from major exchanges like NYMEX and Henry Hub

- Expert analysis and commentary on market trends and geopolitical factors

- Technical tools including RSI, MACD, and custom indicators

- ESG tracking for sustainable investment decisions

- Free access to professional-grade natural gas market insights

- Mobile-friendly dashboards for monitoring on-the-go

Natural gas powers our homes, influences electricity prices, and affects the cost of everyday goods. When you understand these market forces, you gain control over your financial planning.

The global energy landscape is shifting rapidly in 2025. Natural gas serves as a “bridge fuel” during the transition to renewables, making it crucial for both environmental and economic reasons. Whether you’re budgeting for winter heating bills or exploring sustainable investment options, having access to reliable natural gas data empowers better decisions.

FintechZoom.com has democratized access to institutional-quality market information. What once required expensive Bloomberg terminals is now available free to anyone with an internet connection. This represents a significant shift toward financial transparency and empowerment.

For eco-conscious professionals like you, understanding energy markets isn’t just about money – it’s about making informed choices that align with your values while protecting your financial well-being.

Explore more about fintechzoom.com natural gas:

What is FintechZoom.com and Its Natural Gas Hub?

Think of FintechZoom.com as your friendly neighborhood guide to the complex world of finance. This financial technology platform has made it their mission to take all that intimidating market data and make it actually understandable for real people like us.

You know how financial information used to be locked away behind expensive paywalls and complicated jargon? FintechZoom.com changed all that. They’ve created a bridge between Wall Street’s insider knowledge and your kitchen table financial planning.

The fintechzoom.com natural gas section is where things get really interesting. This isn’t just another boring data feed – it’s like having a personal energy market analyst right at your fingertips.

The platform pulls real-time prices from all the major trading hubs. We’re talking about NYMEX (the New York Mercantile Exchange), Henry Hub in Louisiana (which basically sets the price standard for North American natural gas), and global LNG markets. It’s the same data that professional traders pay thousands for, but you get it free.

But here’s what makes it special – the platform doesn’t just throw numbers at you. It weaves together historical data going back decades, so you can spot those seasonal patterns. Ever wonder why your heating bill spikes in winter? The historical trends show exactly how weather cycles affect prices year after year.

The expert analysis is where FintechZoom.com really shines. Instead of leaving you to guess what a price jump means, they provide context. When geopolitical tensions affect supply routes, when new pipeline infrastructure comes online, or when environmental regulations shift the market – you’ll understand the why behind the price movements.

The news aggregation feature pulls together relevant stories from trusted sources, so you’re not hunting across multiple websites to understand what’s happening. And with growing focus on sustainability, the platform includes ESG data to help you track environmental impacts alongside financial ones.

What’s remarkable is how they’ve made professional-grade tools accessible to everyone. The interface feels intuitive rather than overwhelming, which is exactly what we need when dealing with something as complex as energy markets.

Core Features and Tools for Market Analysis

The fintechzoom.com natural gas platform comes packed with tools that would make any market analyst smile. But don’t worry – they’ve designed everything to be user-friendly, not intimidating.

Real-Time Price Feeds form the foundation of everything. You get live updates from Henry Hub, NYMEX, and major LNG trading points around the world. No more wondering if you’re looking at yesterday’s news – these prices move as the market moves.

The Advanced Charting Tools let you visualize trends in ways that actually make sense. You can zoom in on hourly movements or pull back to see multi-year patterns. The customizable views mean you can set up your dashboard exactly how you like it.

Here’s a game-changer: Customizable Alerts. Set up notifications for price thresholds that matter to you, and you’ll get email or mobile alerts when they hit. No more staring at screens all day wondering if you missed something important.

Integrated News & Expert Commentary brings context right into your dashboard. When prices jump, you’ll immediately see the related news stories and expert opinions explaining what’s driving the movement. It’s like having a financial news team curated just for natural gas markets.

The ESG Data Overlays are particularly valuable for conscious investors. Track methane emissions, carbon intensity, and regulatory impacts alongside price data. This helps align your financial decisions with your environmental values.

The technical indicators are where things get sophisticated. RSI helps spot when markets might be due for a reversal. MACD reveals momentum shifts that could signal new trends. The platform also includes proprietary indicators developed specifically for energy markets.

Global coverage ensures you’re seeing the complete picture. Natural gas is a worldwide commodity, and price movements in Europe or Asia can ripple through to affect North American markets.

The beauty of all these features? They’re presented in a clean, intuitive interface that doesn’t require a finance degree to steer. Professional-quality analysis made accessible – that’s the FintechZoom.com difference.

Why Tracking Natural Gas is a Form of Financial Self-Care in 2025

In 2025, staying informed about natural gas prices isn’t just for Wall Street traders anymore—it’s become a genuine form of financial self-care. Think about it: this single commodity touches nearly every aspect of our daily lives, from the warmth in our homes to the cost of groceries on our shelves.

Natural gas has earned its reputation as a natural gas as a “bridge fuel” during our global energy transition. While we’re all working toward a greener future with renewables, natural gas serves as that crucial stepping stone—cleaner than coal and oil, yet reliable enough to keep our lights on while solar and wind technology continues advancing.

The reality is simple: when natural gas prices move, your wallet feels it immediately. Your heating bills during those chilly winter months? Directly tied to natural gas markets. That spike in electricity costs last summer? Often connected to natural gas-powered generation plants responding to demand.

But here’s where it gets really interesting for your everyday budget. Natural gas doesn’t just heat homes—it’s a key ingredient in manufacturing everything from the fertilizers that grow our food to the plastics in our beauty product packaging. When fintechzoom.com natural gas data shows price volatility, we can actually anticipate ripple effects through grocery stores and retail shelves weeks before they hit.

This is where platforms like fintechzoom.com natural gas transform from nice-to-have into essential financial wellness tools. Instead of feeling blindsided by utility bill increases or sudden cost-of-living jumps, we gain the power of informed anticipation. We can spot seasonal patterns, understand weather-related price swings, and even factor geopolitical events into our household budgeting.

The job market feels these impacts too. Entire regions depend on natural gas extraction, pipeline operations, and related industries. Understanding these market forces helps us make smarter career and investment decisions, whether we’re directly involved in energy sectors or simply want to understand economic trends affecting our communities.

Market volatility doesn’t have to mean financial anxiety when we’re equipped with the right information. By tracking natural gas trends through reliable sources, we shift from reactive spending to proactive planning. It’s the same mindset we bring to skincare routines or wellness practices—consistent attention and informed choices lead to better outcomes.

For broader economic context and how these energy trends connect to larger financial patterns, you might find valuable insights at More info about the economy. After all, understanding the forces shaping our financial landscape is just as important as any other aspect of our wellness journey.

A Practical Guide to Using fintechzoom.com Natural Gas Data

Getting started with fintechzoom.com natural gas doesn’t require a finance degree or years of trading experience. The platform was designed with everyday users in mind, making sophisticated market analysis accessible to anyone curious about energy markets.

Your journey begins at the natural gas hub, which serves as your personal command center. When you first visit this section, you’ll see current prices, recent news headlines, and key market indicators all laid out clearly. Think of it as your one-stop dashboard for understanding what’s happening in the natural gas world right now.

The beauty of fintechzoom.com natural gas lies in its customization options. You can arrange widgets and data displays to match your specific interests. If you’re mainly concerned about your winter heating bills, you might focus on seasonal price trends and weather-related news. For those exploring investment opportunities, real-time price feeds and technical indicators become more important.

Historical data analysis is where things get really interesting. Natural gas follows predictable seasonal patterns – demand typically spikes during harsh winters when everyone’s cranking up their heat, and again during scorching summers when air conditioners work overtime. By studying these patterns on FintechZoom’s charts, you can anticipate when prices might rise or fall.

The platform’s technical indicators help decode market psychology. The RSI (Relative Strength Index) tells you if prices have moved too far, too fast in either direction. When natural gas appears “overbought,” it might be due for a price drop. When it’s “oversold,” a rebound could be coming. The MACD indicator helps spot momentum changes before they become obvious to everyone else.

But numbers only tell part of the story. Fundamental analysis on fintechzoom.com natural gas includes expert commentary that explains why prices are moving. Maybe a pipeline shutdown is restricting supply, or an unusually cold winter forecast is boosting demand. These insights help you understand the bigger picture behind the price movements.

Setting up custom alerts means you don’t need to watch screens all day. You can receive notifications when prices hit certain levels or when major news breaks. This feature transforms passive price watching into active market awareness without the stress of constant monitoring.

Let’s look at how this worked in practice during summer 2024. FintechZoom’s alert system flagged rising prices driven by two key factors: unusual monsoon patterns in Asia increased LNG demand, while U.S. export bottlenecks limited supply to global markets. Users who paid attention to these fundamental insights, combined with bullish technical signals like a MACD crossover, were able to spot an opportunity that delivered impressive returns.

Investment Strategies for the Empowered User

Armed with fintechzoom.com natural gas data, you can explore several investment approaches that match your comfort level and goals.

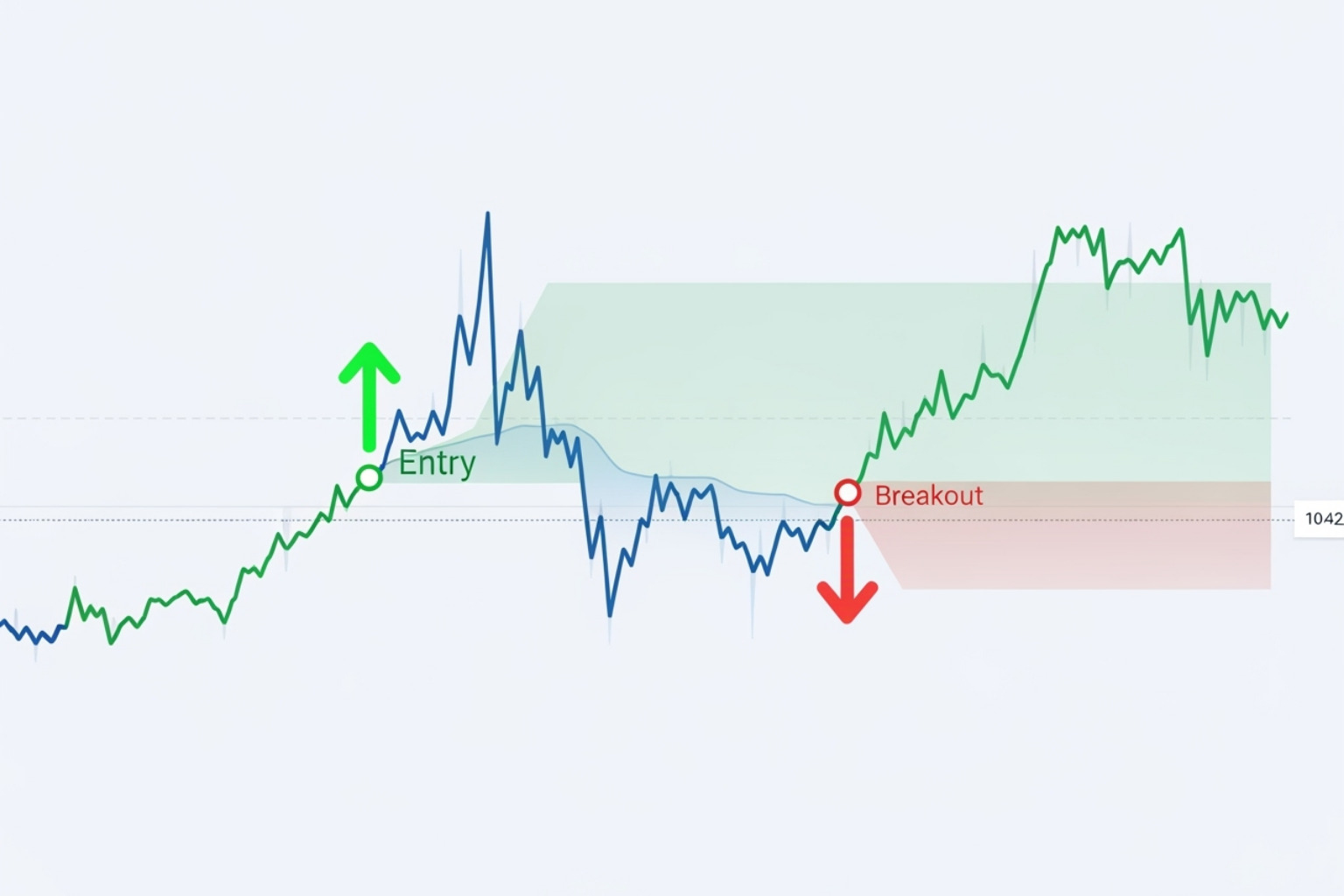

Trend following works well for beginners. When natural gas prices are consistently moving in one direction, you can look for opportunities to ride that wave. FintechZoom’s moving averages and trend indicators make it easy to spot these patterns and time your entries.

Mean reversion strategies assume that extreme price movements eventually correct back toward normal levels. If natural gas prices spike way above their historical average, they might be due for a pullback. The platform’s RSI and Bollinger Bands help identify these situations.

Breakout trading involves watching for moments when prices burst through important support or resistance levels. These breakouts often signal the start of new trends. FintechZoom’s customizable alerts can notify you the moment these critical levels are breached.

Risk management remains crucial regardless of your strategy. The platform helps you identify logical stop-loss levels using technical analysis, protecting you from devastating losses. Understanding how natural gas correlates with other commodities is equally important. You might explore Fintechzoom.com Gold Price or Fintechzoom.com Nickel to see how different commodities move together, informing your diversification decisions.

Portfolio diversification beyond direct natural gas exposure might include energy ETFs, stocks of pipeline companies, or mutual funds focused on the energy sector. Fintechzoom.com natural gas provides the foundational data to research these options intelligently.

Understanding the Pros and Cons of fintechzoom.com natural gas

Every tool has strengths and limitations, and fintechzoom.com natural gas is no exception. Understanding both sides helps you use the platform most effectively.

The major advantages include completely free access to professional-grade data that would typically cost hundreds of dollars monthly elsewhere. The user-friendly interface means you don’t need extensive financial training to steer and understand the information. Real-time data feeds keep you current with market movements, while the ESG focus helps align your financial decisions with environmental values.

The limitations are worth noting too. While the data is highly accurate, there can be occasional delays compared to premium institutional feeds. The analysis depth, while substantial for retail users, may not satisfy professional traders who need Bloomberg-level detail. Since FintechZoom aggregates data from multiple sources, you’re getting excellent breadth but potentially less granular detail than single-source feeds.

For most users interested in understanding energy markets, tracking utility costs, or exploring investment opportunities, these limitations are minor compared to the substantial benefits. The platform successfully democratizes access to information that was once exclusive to Wall Street professionals, making it an invaluable resource for financial self-care in 2025.