Understanding Financeville CraigScottCapital: What You Need to Know

Financeville craigscottcapital represents a complex financial entity that has garnered attention for both its investment services and regulatory challenges. This comprehensive guide breaks down everything you need to understand about this financial firm.

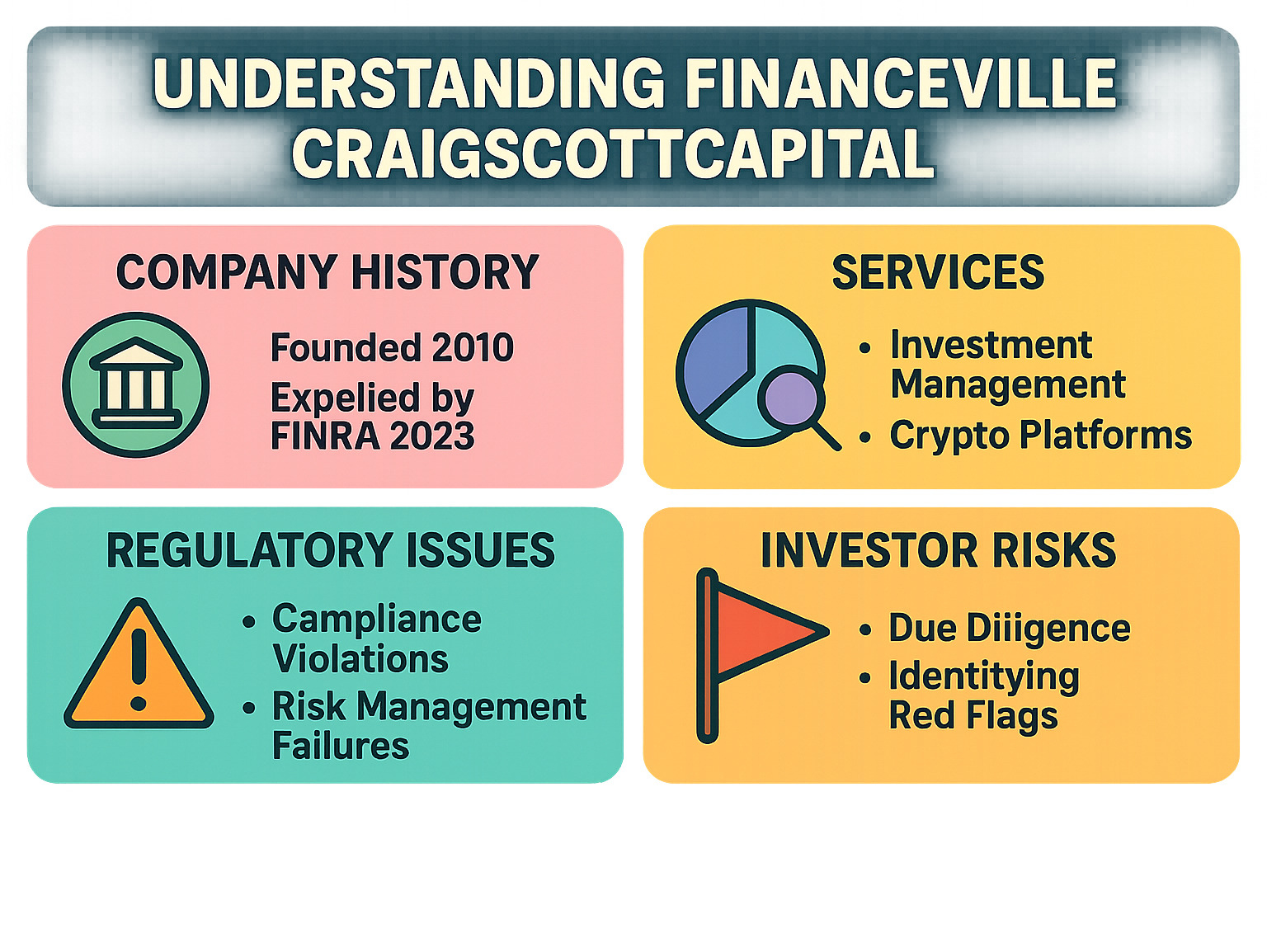

Quick Facts About Financeville CraigScottCapital:

- Founded: 2010 as an asset management and financial advisory firm

- Peak Assets: Managed approximately $500 million at its height

- Current Status: Expelled from FINRA in early 2023 due to regulatory violations

- Services: Investment management, wealth planning, and cryptocurrency offerings

- Key Concern: History of misrepresenting investment products and poor risk management

The term “financeville craigscottcapital” combines two concepts. Financeville represents a philosophy of financial literacy and community-driven money management. CraigScottCapital is the actual investment firm that expanded from traditional asset management into alternative investments and digital currencies.

However, this story isn’t just about growth and innovation. The firm’s trajectory took a dramatic turn when regulators finded “multiple breaches of financial regulations,” leading to its expulsion from the Financial Industry Regulatory Authority (FINRA).

For potential investors, understanding both the services offered and the regulatory red flags is crucial. This firm’s history serves as an important case study in the importance of due diligence when selecting financial advisors.

Whether you’re researching this firm for potential investment or simply trying to understand the financial landscape, this guide will help you steer the complex reality behind the financeville craigscottcapital story.

Common financeville craigscottcapital vocab:

Unpacking the Concept: What is Financeville CraigScottCapital?

When you first hear “financeville craigscottcapital,” it might sound like a busy financial district where money never sleeps. But the reality is both simpler and more complex than that.

Financeville CraigScottCapital combines two distinct concepts that came together in the investment world. Think of it as a marriage between an idealistic vision of financial education and a real-world investment firm that promised to make that vision come true.

At its heart, this story begins with understanding what finance actually means. Finance is concerned with the management of money – from simple transactions to complex investment strategies. It’s the backbone of how we manage our personal wealth and how businesses grow.

CraigScottCapital positioned itself as more than just another investment firm. They wanted to be your financial guide, helping you steer everything from asset management to wealth management. Their goal was making sophisticated financial strategies accessible to everyday investors.

For those interested in understanding broader market trends, you might find our comprehensive market guides helpful in building your financial knowledge foundation.

The “Financeville” Philosophy

Picture a community where financial knowledge flows as freely as conversation at your favorite coffee shop. That’s the essence of “Financeville” – not a real place, but a beautiful concept about making finance approachable for everyone.

This philosophy centers on empowering people to make smart money choices. Whether you’re learning the basics of budgeting, finding the magic of saving, or taking your first steps into investing, Financeville represents that supportive environment we all need.

The idea is refreshingly simple: financial literacy shouldn’t be reserved for Wall Street experts. Everyone deserves to understand how money works, from teenagers saving for their first car to parents planning for their children’s education.

Financeville promotes practical wisdom like saving at least 10% of your income, understanding before you invest, and setting clear financial goals. It’s about creating a world where financial empowerment is the norm, not the exception.

The “CraigScottCapital” Entity

Enter CraigScottCapital, the financial advisory firm that emerged in 2010 with big dreams and ambitious plans. This wasn’t just another investment company – they wanted to be the bridge between complex financial concepts and real people’s money goals.

The firm built its reputation on providing comprehensive investment solutions custom to individual needs. They managed client portfolios with a focus on diversification and growth, while emphasizing the importance of solid risk management practices.

CraigScottCapital’s approach was refreshingly human. They understood that most people find financial jargon intimidating, so they worked to make investing feel less like rocket science and more like a conversation with a knowledgeable friend.

Their services expanded beyond basic investment management to include retirement planning, estate planning, and even ventures into alternative investments. The firm positioned itself as a one-stop shop for anyone looking to build and protect their wealth.

However, as we’ll explore in the following sections, this promising story took some unexpected turns that every potential investor should understand before making any financial decisions.

The History and Tumultuous Trajectory of CraigScottCapital

The journey of financeville craigscottcapital reads like a financial thriller – complete with rapid success, ambitious dreams, and a dramatic fall from grace. When CraigScottCapital first opened its doors in 2010, the founders had big aspirations for their asset management and financial advisory firm.

Those early years were marked by impressive growth and expansion. The company didn’t just stick to basic investment advice – they boldly moved into wealth management, acceptd portfolio diversification strategies, and ventured into the exciting (and sometimes risky) world of alternative investments. It was like watching a small-town business transform into a financial powerhouse, and for a while, everything seemed to be going according to plan.

By their peak, financeville craigscottcapital was managing an impressive $500 million in assets. They weren’t just growing their money – they were growing their reputation too. The firm improved their operational efficiency by 25% in 2017 after adopting cutting-edge financial software (because who doesn’t love a good tech upgrade?). By 2020, they had successfully doubled their client base to over 500 investors who trusted them with their financial futures.

The numbers looked fantastic on paper. Their portfolio value exceeded $100 million by 2023, outperforming many industry averages. For anyone interested in understanding the broader economic landscape that shaped these developments, you can learn about the economy through our comprehensive resources.

The Controversial History of financeville craigscottcapital

But here’s where our story takes a sharp turn – and not the good kind. Despite all those impressive growth statistics, financeville craigscottcapital was harboring some serious problems behind the scenes. In early 2023, the firm faced the ultimate regulatory nightmare: expulsion from FINRA.

This wasn’t just a slap on the wrist or a minor fine. FINRA – the Financial Industry Regulatory Authority – found “multiple breaches of financial regulations” that were serious enough to kick the firm out entirely. Think of it like being permanently banned from the financial industry’s most important club.

The regulatory breaches were particularly concerning. FINRA finded that the firm had been misrepresenting investment products to their clients – essentially not telling the whole truth about what people were investing in. Imagine buying what you think is a safe, reliable investment, only to find later that it was much riskier than advertised.

Even more troubling were the risk management failures. In finance, proper risk management is like having a good security system for your home – you hope you never need it, but you’re in serious trouble without it. Financeville craigscottcapital failed to maintain adequate systems to protect their clients’ money, leaving investors vulnerable to unnecessary risks.

The investor implications of these violations were severe. When a firm gets expelled from FINRA, it’s essentially a giant red flag telling the investment community that something went seriously wrong. For the clients who had trusted financeville craigscottcapital with their money, this regulatory action raised serious questions about the safety of their investments and the integrity of the advice they had received.

This dramatic fall from grace serves as a powerful reminder that impressive growth numbers and slick marketing don’t always tell the whole story. Sometimes, the most important information is hidden in the regulatory fine print.

A Deep Dive into Services and Investment Philosophy

Before its regulatory troubles, financeville craigscottcapital positioned itself as a comprehensive financial services provider with an impressive menu of offerings. The firm aimed to be a one-stop shop for investors, whether you were just starting your financial journey or managing substantial wealth.

At the heart of their operations was investment management, where they crafted custom portfolio strategies for each client. Think of it as financial tailoring – they claimed to measure your risk tolerance, financial goals, and timeline to create a perfectly fitted investment approach. Beyond just managing money, they offered financial planning services that covered the full spectrum of personal finance, from basic budgeting advice to complex cash flow management for businesses.

Their retirement solutions promised to help clients build a secure future, while estate planning services aimed to ensure your hard-earned assets would transfer smoothly to the next generation. The firm also emphasized tax optimization – because who doesn’t want to keep more of their investment returns instead of handing them over to Uncle Sam?

What made financeville craigscottcapital particularly appealing to some investors was their focus on education and transparency. They supposedly took time to explain the “why” behind each recommendation, ensuring clients understood their financial decisions rather than blindly following advice. For those interested in exploring income-generating investments, understanding different approaches can be valuable. Guide to income stocks

Key Investment Strategies

The firm’s investment philosophy centered around several core strategies that reflected modern financial thinking. Asset allocation and portfolio diversification formed the backbone of their approach – essentially the age-old wisdom of not putting all your eggs in one basket, but with sophisticated mathematical models to optimize the basket distribution.

ESG investing became a significant part of their strategy, aligning with the growing trend of socially responsible investing. This meant they considered how companies treated the environment, their employees, and their stakeholders when making investment decisions. It’s the financial equivalent of shopping with your values – seeking profits while supporting companies that do good in the world.

The firm also pursued high-yield investment opportunities, though this always came with the reminder that higher returns typically mean higher risks. It’s like choosing between a gentle bike ride and mountain climbing – both can be rewarding, but one requires more preparation and carries more risk.

Perhaps most notably, financeville craigscottcapital acceptd technology in their investment process. They reportedly used AI-powered tools for predictive analytics and automated trading, employing algorithms to spot market trends and identify potentially undervalued assets. This tech-forward approach was designed to give clients an edge in increasingly complex markets. The intersection of artificial intelligence and investing continues to evolve rapidly. AI in investing

The Crypto Angle: financeville craigscottcapital and Digital Assets

In what seemed like a forward-thinking move, financeville craigscottcapital ventured into cryptocurrencies and digital assets. They established something called the ‘Cryptopia’ platform, which sounds like a digital paradise for crypto enthusiasts but came with all the real-world complexities of this emerging asset class.

The firm offered investment opportunities in major cryptocurrencies like Bitcoin and Ethereum, positioning themselves at the cutting edge of financial innovation. However, crypto investing is notoriously volatile – imagine a roller coaster designed by someone who’s had way too much coffee, and you’ll get the idea of crypto price swings.

This digital asset focus also brought additional regulatory concerns, especially given that cryptocurrency regulations are still evolving worldwide. Different countries have different rules, and those rules change frequently. For anyone interested in understanding crypto markets better, key events like the Bitcoin halving can significantly impact prices and market dynamics. Bitcoin halving explained

While the firm’s willingness to accept digital currencies showed innovation, it also added another layer of complexity to their operations. In hindsight, given their later regulatory troubles, this expansion into less regulated territories raises questions about whether they had the proper oversight and risk management systems in place to handle such sophisticated and volatile investments responsibly.

For the Investor: Risks, Red Flags, and Due Diligence

The story of financeville craigscottcapital serves as a powerful reminder that even firms with impressive growth stories can harbor serious risks beneath the surface. When a company gets expelled from FINRA for misrepresenting investment products and failing to maintain proper risk management, it’s like finding out your trusted mechanic has been using duct tape instead of proper parts – alarming doesn’t begin to cover it.

As investors, we need to become financial detectives. The most dangerous red flags often hide behind polished marketing materials and smooth-talking sales teams. Unrealistic promises should make your alarm bells ring louder than a fire station – legitimate investments don’t guarantee sky-high returns with zero risk. High-pressure sales tactics are another major warning sign. Any advisor who pushes you to “invest today or miss out forever” is probably more interested in their commission than your financial wellbeing.

Lack of transparency is equally concerning. If a firm won’t clearly explain their fees, investment strategies, or how they make money, that’s like agreeing to surgery without knowing what the doctor plans to do. With financeville craigscottcapital, their regulatory history represents the biggest red flag of all – FINRA expulsion is the financial equivalent of having your medical license revoked.

Other warning signs include unclear investment strategies that sound impressive but make no sense when you dig deeper, and complicated exit strategies that make withdrawing your money feel like escaping from a maze. Your money should be accessible when you need it, not trapped behind confusing procedures.

The question of trust becomes particularly complex when dealing with firms that have regulatory issues. While financeville craigscottcapital may attempt to rebuild credibility, extreme caution is warranted. Trust in finance should be built on proven integrity, transparent practices, and a clean regulatory record – not promises of redemption. For guidance on making sound investment choices, exploring top stock picks guide can provide valuable insights.

Conducting Your Own Research

Think of due diligence as your financial health checkup – it’s not optional, it’s essential. FINRA BrokerCheck should be your first stop when researching any financial firm. This free tool reveals everything from licensing information to disciplinary actions, and it would have immediately flagged financeville craigscottcapital’s expulsion.

Independent reviews provide crucial perspective beyond a company’s own marketing materials. Look for testimonials on third-party websites, but even reviews can be manipulated – trust patterns over individual glowing comments.

Consulting with a trusted financial advisor who has no connection to the firm you’re researching can provide invaluable outside perspective. They can spot red flags you might miss and help you understand whether an investment opportunity makes sense for your situation.

Verifying credentials might seem boring, but it’s like checking that your pilot actually has a license before takeoff. Make sure any financial professional you work with has proper licensing and certifications from recognized authorities.

Understanding fees requires patience, but it’s worth the effort. Get everything in writing and don’t accept vague explanations about “standard industry fees.” If they can’t explain their fee structure clearly, that’s a problem in itself.

Staying informed about financial trends helps you spot inconsistencies in what firms tell you. The more you understand about markets and investing basics, the harder it becomes for questionable firms to mislead you. For deeper market insights, consider reading our Guide to US Markets to build your knowledge foundation.

At Beyond Beauty Lab, we believe that informed decisions lead to better outcomes – whether you’re choosing skincare products or investment advisors. Taking time for proper research protects both your financial future and your peace of mind.

Frequently Asked Questions about Financeville Craigscottcapital

When researching financeville craigscottcapital, many investors have similar questions about this controversial financial firm. Let’s address the most common concerns with straightforward answers based on our research.

What were the specific reasons for CraigScottCapital’s expulsion from FINRA?

The expulsion wasn’t a minor slap on the wrist – it was the regulatory equivalent of being permanently banned from the playground. FINRA cited multiple serious violations that put investor money at real risk.

The primary issues centered on misrepresenting investment products to clients. Think of it like a salesperson telling you a sports car gets excellent gas mileage when it actually guzzles fuel. Clients weren’t getting accurate information about what they were buying, which is a fundamental breach of trust in the financial world.

Even more concerning was the failure to maintain adequate risk management systems. This means the firm didn’t have proper safeguards in place to protect investor assets. It’s like driving without seatbelts – everything might seem fine until something goes wrong.

These regulatory failures had real consequences. The firm’s assets under management dropped significantly, falling from a peak of $500 million to approximately $300 million by late 2023 following these issues. When regulators find this level of misconduct, it’s a clear signal that something was seriously wrong behind the scenes.

What is the relationship between “Financeville” and “CraigScottCapital”?

This is where things get a bit confusing, and honestly, it seems intentionally so. “Financeville” appears to be more of a marketing concept than an actual place or separate company. Think of it as an idealized community where everyone makes smart money decisions – a financial utopia, if you will.

In this conceptual “Financeville,” people learn about saving, investing, and spending money wisely. It’s meant to represent a place where financial literacy thrives and everyone has access to good money advice. Pretty appealing, right?

“CraigScottCapital,” on the other hand, was the actual financial advisory firm that offered real services like asset management and investment advice. They were the ones managing actual money and providing concrete financial services.

The combined term “financeville craigscottcapital” appears to be largely an online marketing keyword. It’s likely the firm used this combination to attract people searching for both financial education (the “Financeville” part) and practical investment services (the “CraigScottCapital” part). It’s a clever marketing strategy that blends the appeal of a knowledge community with a real investment provider.

Can investors still trust a firm with a history of regulatory issues?

Here’s where we need to be brutally honest: extreme caution is absolutely necessary. A regulatory expulsion from FINRA isn’t like getting a parking ticket – it’s more like losing your driver’s license for reckless driving.

A history of regulatory expulsion is a major red flag that indicates serious operational or ethical failures. When a respected regulatory body like FINRA takes such drastic action, it means they found problems significant enough to warrant the financial equivalent of a lifetime ban.

While it’s theoretically possible for a firm to reform and continue operations in some capacity, the reality is harsh. Investors should prioritize firms with clean regulatory records rather than gambling on whether a problematic firm has truly changed its ways.

The smart approach? Conduct extensive due diligence before considering any engagement with such a firm. Use tools like FINRA’s BrokerCheck to validate trustworthiness, and honestly, there are plenty of established firms with spotless records who would be happy to earn your business.

Think of it this way: would you hire a babysitter who had been fired from their last job for not watching the kids properly? Probably not. The same logic applies to choosing who handles your hard-earned money.

Conclusion

Our journey through financeville craigscottcapital reveals a story that’s both fascinating and cautionary. What began as an ambitious vision – combining the community-focused ideals of financial literacy with real-world investment services – ultimately became a stark reminder of why regulatory oversight exists in the first place.

The tale of Financeville CraigScottCapital teaches us that even the most promising financial firms can stumble when they lose sight of their fundamental responsibilities to clients. The firm’s 2023 FINRA expulsion wasn’t just a regulatory hiccup – it was a clear signal that something had gone seriously wrong behind the scenes.

What we’ve learned matters deeply. The concept of “Financeville” – that beautiful idea of a community where everyone has access to financial knowledge – remains as relevant as ever. We all deserve to understand how money works, whether we’re budgeting for groceries or planning our retirement. But the CraigScottCapital side of this story shows us that good intentions aren’t enough when misrepresentation and poor risk management enter the picture.

For anyone considering their financial future, this story offers invaluable lessons. Due diligence isn’t optional – it’s your financial lifeline. Before trusting any firm with your hard-earned money, dig deep into their regulatory history, seek independent reviews, and never let high-pressure sales tactics rush you into decisions. Your future self will thank you for taking the time to research properly.

At Beyond Beauty Lab, we believe that informed decisions are the foundation of personal growth, whether you’re choosing the right skincare routine or selecting a financial advisor. Knowledge empowers us to make choices that truly serve our best interests, and that principle applies just as much to your investment portfolio as it does to your wellness journey.

The financeville craigscottcapital story ultimately reminds us that in finance, as in beauty and wellness, authenticity and transparency should never be compromised. Trust is earned through consistent ethical behavior, not flashy marketing or unrealistic promises.