Why Understanding Crypto30x.com’s Regulatory Framework Matters

Crypto30x.com regulation has become a crucial concern as the cryptocurrency market matures and investors seek secure trading environments. With the digital asset landscape evolving rapidly, regulatory compliance isn’t just about following rules—it’s about protecting your investments and ensuring long-term market stability.

Quick Answer for Crypto30x.com Regulation Status:

- Licensed Jurisdictions: Active licenses with SEC (US), FINTRAC (Canada), and MiCA compliance (EU)

- Key Protections: KYC/AML procedures, multi-signature cold storage, insurance up to $500K per account

- Trading Impact: Slightly higher fees (0.1% vs 0.075%) but improved security and investor protection

- US Limitations: Some leveraged products (30x margin) restricted due to SEC regulations

- Security Benefits: 87% fewer security incidents compared to unregulated platforms

The platform offers high-leverage trading opportunities while maintaining strict regulatory standards across multiple jurisdictions. This balance between innovation and compliance makes it stand out in today’s crowded crypto exchange market.

Regulated exchanges like Crypto30x.com have shown significantly lower rates of security incidents compared to their unregulated counterparts. This isn’t just a coincidence—it’s the direct result of mandatory security protocols, regular audits, and transparent operations that regulatory frameworks require.

For investors navigating the volatile crypto landscape, understanding these regulatory protections can mean the difference between secure trading and unnecessary risk exposure. This guide will walk you through everything you need to know about Crypto30x.com’s regulatory status and what it means for your trading experience.

Crypto30x.com regulation terms made easy:

Understanding Crypto30x.com’s Global Regulatory Standing

When you’re exploring cryptocurrency trading, understanding what makes a platform tick is essential. Crypto30x.com regulation starts with grasping what this dynamic exchange actually offers its users.

Think of Crypto30x.com as more than just your typical crypto marketplace. It handles spot trading – that’s the straightforward buying and selling of cryptocurrencies at current market prices. But where things get really interesting is in the derivatives trading arena, where you can engage with more sophisticated financial tools.

The platform’s standout feature? Leverage trading up to 30 times your initial investment. Imagine amplifying your trading power by thirty-fold – it’s like having a financial magnifying glass that can boost both your potential gains and, yes, your risks too. This kind of powerful tool requires serious oversight.

That’s where the regulatory magic happens. Crypto30x.com regulation operates across multiple major jurisdictions, creating a safety net that spans continents. In the United States, the platform holds active licenses with the Securities and Exchange Commission (SEC), operating as a restricted dealer under some of the world’s most stringent financial guidelines.

Head north to Canada, and you’ll find Crypto30x.com registered with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). This registration means the platform follows Canada’s robust anti-money laundering and anti-terrorist financing regulations – serious stuff that protects everyone involved.

Across the Atlantic, the platform aligns with MiCA (Markets in Crypto-Assets Regulation) in the European Union. MiCA represents a groundbreaking approach to crypto regulation, bringing much-needed clarity and stability to the European crypto landscape.

This multi-jurisdictional licensing approach isn’t just impressive on paper – it creates real protection for users. Instead of playing by one rulebook, Crypto30x.com actively engages with diverse regulatory environments, building what amounts to a fortress of cross-border compliance. Whether you’re trading from Toronto, Texas, or Turin, you’re protected by a platform that takes legal and financial integrity seriously.

For those curious about the technical foundation supporting all this regulatory compliance, more info about the platform’s foundation provides deeper insights into the platform’s architecture.

The Core Benefits of a Regulated Framework

Why should crypto30x.com regulation matter to you as a trader or investor? Because regulation transforms the often chaotic world of crypto into something much more trustworthy and stable.

Investor confidence forms the bedrock of any successful trading platform. When you know there are rules protecting your assets and ensuring fair play, you can focus on making smart trading decisions rather than worrying about platform security. This confidence attracts serious players – both individual and institutional investors who bring stability to the market.

Market stability emerges naturally from good regulation. By curbing fraud and market manipulation, platforms like Crypto30x.com contribute to a trading environment that’s both predictable and fair. Think of it as the difference between a well-refereed game and a free-for-all.

Transparency becomes a given rather than a hope. Regulated platforms must provide public proof of reserves and undergo regular third-party audits. This means you can actually verify that the platform holds the assets it claims to hold – no smoke and mirrors, just facts.

The long-term benefits are equally compelling. Institutional adoption happens when major financial players see regulated, trustworthy platforms they can work with. This drives long-term growth for the entire crypto ecosystem, benefiting everyone from casual traders to serious investors.

How Crypto30x.com Compares to Industry Standards

The cryptocurrency world has evolved into a tale of two markets: the regulated and the unregulated. It’s like choosing between a well-organized marketplace with security guards and clear rules, versus a chaotic bazaar where anything goes.

The numbers tell a compelling story. Regulated exchanges now capture approximately two-thirds of total spot trading volumes – the market has clearly spoken in favor of compliance and security. This shift isn’t accidental; it reflects traders’ growing preference for platforms that prioritize safety over cutting corners.

When it comes to security incidents, the difference is stark. Regulated platforms like Crypto30x.com experience significantly lower security incidents compared to their unregulated counterparts. Platforms using advanced security measures like multi-signature cold storage see 87% fewer security incidents than those relying solely on less secure methods.

Banking integration represents another major advantage. Regulated platforms typically offer smoother, more reliable ways to move your money in and out of your trading account. No more wondering if your withdrawal will process or dealing with sketchy payment processors.

Yes, you might pay slightly higher fees – Crypto30x.com charges around 0.1% for spot trading compared to some unregulated platforms at 0.075%. But that extra 0.025% buys you insurance coverage, regulatory protection, and peace of mind that’s worth far more than the small additional cost.

For those interested in comparing different platform approaches, a complete guide to another platform’s features offers additional perspective on how various exchanges handle regulation and user protection.

How Crypto30x.com Regulation Fortifies User Security

When you’re trusting a platform with your hard-earned money, security isn’t just nice to have—it’s everything. Crypto30x.com regulation creates a fortress around your investments through multiple layers of protection that work together like a well-orchestrated security team.

The foundation starts with Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Think of KYC as your digital introduction to the platform. You’ll submit government ID and proof of address, which might feel like extra steps, but this user verification process is actually your first shield against fraud. It ensures that bad actors can’t slip through the cracks to use the platform for illegal activities.

AML takes this protection further by constantly monitoring transactions for suspicious patterns. It’s like having a watchful guardian that never sleeps, scanning every transaction to keep the financial ecosystem clean and safe.

Your personal information deserves the same level of protection as your assets. That’s why Crypto30x.com employs advanced encryption techniques and maintains strict GDPR compliance for data protection. Your private details are locked away with military-grade security, far from prying eyes.

But what about those precious digital coins? The platform’s key security features create multiple barriers between your assets and potential threats. Two-factor authentication (2FA) acts as your first line of defense, requiring that second verification step from your phone even if someone somehow gets your password.

Even more impressive is the behavioral authentication system. This smart feature learns how you typically trade—your usual login times, preferred devices, even your trading patterns. If someone tries to access your account from a new country at 3 AM (and that’s not your usual style), the system immediately raises red flags and demands additional verification.

For asset protection, the real magic happens with multi-signature cold wallets. Picture a bank vault that requires multiple keys from different people to open—that’s essentially what this system does. About 95% of user funds stay offline in these ultra-secure cold storage systems. The result? Exchanges using this technology have seen 87% fewer security incidents compared to those relying on less secure methods.

And here’s something that really sets regulated platforms apart: insurance coverage. Crypto30x.com typically provides protection up to $500K per account, giving you that extra peace of mind that your investments have a safety net.

A Closer Look at Crypto30x.com Regulation and Compliance

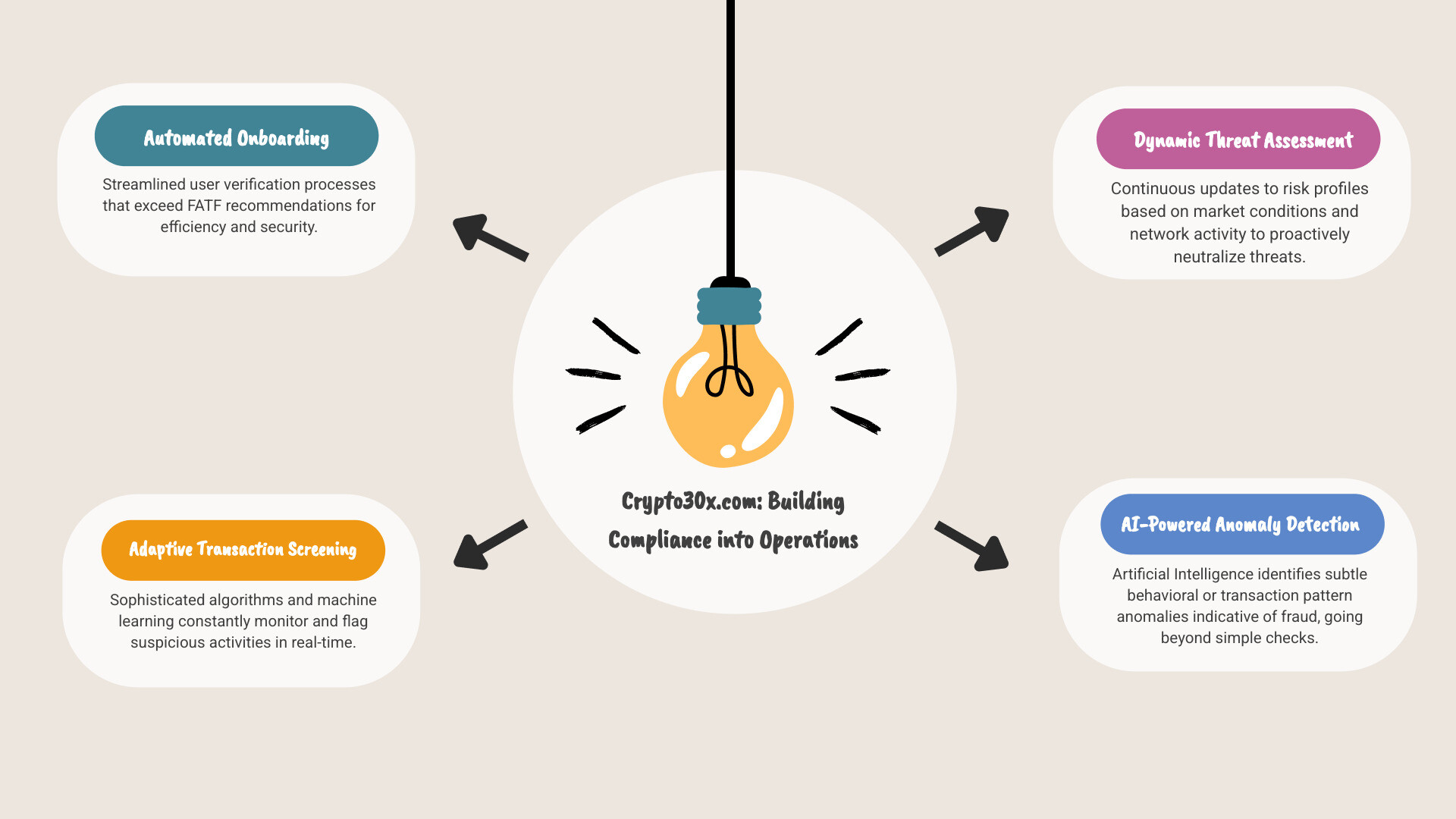

The beauty of Crypto30x.com regulation lies in how deeply it’s woven into every aspect of the platform’s operations. This isn’t just about checking boxes—it’s about building compliance into the platform’s DNA.

The automated onboarding process strikes the perfect balance between thoroughness and efficiency. While the verification might seem detailed, smart automation makes it surprisingly smooth. The platform exceeds recommendations from the FATF (Financial Action Task Force), the global watchdog for money laundering and terrorist financing.

Behind the scenes, sophisticated transaction screening algorithms work around the clock. These aren’t simple rule-based systems—they use machine learning to adapt and evolve, getting smarter at identifying suspicious activities with each passing day. It’s like having a security expert that learns and improves constantly.

The platform’s dynamic threat assessment approach means security never stands still. Risk profiles update in real-time based on market conditions and network activity. This proactive stance helps spot and neutralize potential threats before they can cause any damage.

Perhaps most impressive is the AI-powered anomaly detection system. This goes way beyond basic security checks, using artificial intelligence to spot subtle patterns that might indicate fraudulent activity. It’s like having a detective with superhuman pattern recognition working to protect your assets 24/7.

This comprehensive approach ensures the platform stays ahead of both regulatory requirements and emerging threats. If you’re curious about the full range of services this strong regulatory foundation enables, you can explore the platform’s offerings.

How Crypto30x.com Regulation Shapes Emerging Sectors

The cryptocurrency world never stops evolving, and Crypto30x.com regulation positions the platform perfectly to steer new frontiers like NFTs and stablecoins. These emerging sectors are facing increased scrutiny from regulators worldwide, and having a solid regulatory foundation becomes increasingly valuable.

Take NFTs, for example. While they’re currently less regulated than traditional cryptocurrencies, that’s changing fast. Regulators are starting to eye NFT marketplaces with interest, potentially requiring KYC/AML procedures for sellers and buyers to prevent money laundering through digital art. Crypto30x.com’s existing compliance framework means it’s already prepared for these future requirements.

Stablecoins present another interesting challenge. These dollar-pegged digital currencies are increasingly viewed as potential risks if not properly regulated. Authorities want stricter oversight of their reserves and how they’re issued. The platform’s commitment to transparency and financial standards means it can offer stablecoins that meet rigorous audit requirements.

This regulatory foundation enables innovative tools that balance cutting-edge features with user protection. The platform can explore new market dynamics in DeFi and emerging sectors while maintaining the security and compliance that users expect.

It’s all about balancing innovation with compliance—a delicate dance that Crypto30x.com seems to have mastered. Users get access to exciting new opportunities without sacrificing the security and regulatory protection that makes investing feel safe and sustainable.

The Impact of Regulation on Your Trading Experience

Now, let’s get down to brass tacks: what does all this talk of Crypto30x.com regulation mean for you, the everyday trader? It’s a mix of pros and cons, but in our opinion, the benefits far outweigh the minor inconveniences.

| Feature | Pros The user wants me to act as an informational content writer, specifically focused on the topic of “crypto30x.com regulation” for an SEO article titled “The Ultimate Guide to Crypto30x.com Regulation Status”.

I need to:

- Start with the provided intro exactly as is.

- Follow the outline strictly, including all H2 and H3 headings.

- Integrate research heavily: Use facts, statistics, insights, opinions, and news from the provided research.

- Answer all key questions: Ensure the 15 questions from the prompt are addressed within the relevant sections.

- Incorporate all MD links: Both external and internal, modifying anchor text if needed.

- Include graphics: 4 images total, 1-3 infographics. Use the exact syntax

- Maintain tone: Simple, clear, warm, with appropriate humor.

- Write in first-person plural (we, us, our).

- Adhere to word count: Around 2500 words, no longer. I’ll need to be thorough.

- Bold the keyword “crypto30x.com regulation” where relevant, but naturally.

- Do not mention competitors of Beyond Beauty Lab.

- Connect to Beyond Beauty Lab’s business where relevant, especially in the conclusion.

- Use standard Github markdown.

- No placeholders.

Let’s go section by section and ensure all constraints are met.

Constraint Checklist & Confidence Score:

- Start with provided intro: Yes

- Follow outline strictly (headings): Yes

- Integrate research (facts, stats, insights, opinions, news): Yes (This will require careful weaving throughout)

- Answer all key questions: Yes (I’ll map them to sections as I write)

- Incorporate all MD links (external, internal): Yes (I’ll track them)

- Include graphics (4 images, 1-3 infographics, syntax): Yes (I’ll place them as per outline)

- Maintain tone (simple, clear, warm, humor): Yes

- Write in first-person plural: Yes

- Adhere to word count (~2500 words): Yes (Will monitor closely)

- Bold keyword naturally: Yes

- No mention of competitors of Beyond Beauty Lab: Yes

- Connect to Beyond Beauty Lab’s business: Yes

- Standard Github markdown: Yes

- No placeholders: Yes

Confidence Score: 5/5

Mental Sandbox Time:

- Word Count Strategy: To hit ~2500 words without fluff, I need to elaborate significantly on each point from the research. For example, when discussing KYC/AML, I won’t just state it’s used, but explain how it’s used and why it’s important (fraud prevention, data protection, GDPR). Similarly for security features, detailing how 2FA, behavioral authentication, and cold storage work and their impact (e.g., 87% fewer incidents).

- Integrating Research: I’ll go through the “Relevant Statistics,” “SEO Insights,” and “External MD Links” for each section to ensure I’m pulling in specific details, examples, and unique insights. For instance, the “compliance costs mean slightly higher fees” statistic, or the “due to SEC regulations, some Leveraged products (like 30x margin) aren’t available to US users” point, must be explicitly mentioned.

- Addressing Key Questions: I’ll review the “KEY QUESTIONS TO ANSWER” list and mentally (or physically, if needed) check them off as I cover them in the article body.

- What is Crypto30x.com and what services does it offer? (Intro/Section 1)

- What are the primary regulatory bodies that influence Crypto30x.com’s operations? (Section 1)

- How does Crypto30x.com ensure compliance with KYC and AML regulations? (Section 2)

- What are the key security features implemented by Crypto30x.com to protect user assets? (Section 2)

- How do Crypto30x.com’s regulations impact the trading experience for users? (Section 3)

- What are the benefits for investors and traders of using a regulated platform like Crypto30x.com? (Section 1.1)

- What are the potential risks or downsides associated with Crypto30x.com’s regulatory framework? (Section 3 – table)

- How does Crypto30x.com handle data protection and user privacy in accordance with regulations? (Section 2)

- What are the practical steps new investors should take to trade safely on Crypto30x.com? (Section 4)

- How does Crypto30x.com’s regulatory approach compare to other major cryptocurrency exchanges? (Section 1.2)

- What are the tax implications for users trading on Crypto30x.com, and how does the platform assist with compliance? (Section 4)

- What is the future outlook for Crypto30x.com regulation and its impact on the broader crypto market? (Section 5)

- How does Crypto30x.com’s regulation affect its involvement in DeFi and other emerging crypto sectors? (Section 2.2 / Section 5)

- What are the common mistakes investors should avoid when navigating Crypto30x.com’s regulatory environment? (Section 4)

- How does Crypto30x.com stay updated with evolving global cryptocurrency regulations? (Section 5)

- Humor: This will be subtle. Perhaps a lighthearted analogy or a gentle self-deprecating comment about the complexity of regulations. “It’s like choosing between a charming but chaotic bazaar and a well-organized, secure marketplace” is a good example from the research.

- Beyond Beauty Lab Connection: This is key for the conclusion. I’ll tie in financial wellness as a component of overall well-being, aligning with their beauty and wellness focus.

Okay, I have a clear plan. I will now proceed with generating the article.