Why CRWV Stock Matters for Today’s Investors

Header image details:

- Alt text: Abstract design representing AI and financial growth – CRWV stock

- Filename: c0896f2b7a6b599ce7d564b5added99ebb390ba3.jpg

- Metadata: title=CRWV stock header image; description=Abstract design representing AI and financial growth for CoreWeave investors; keywords=CRWV stock, CoreWeave, AI infrastructure, GPU cloud

CRWV stock represents CoreWeave Inc., a cloud infrastructure company that went public in 2025 and has quickly become a hot topic in AI investing. Here’s what you need to know:

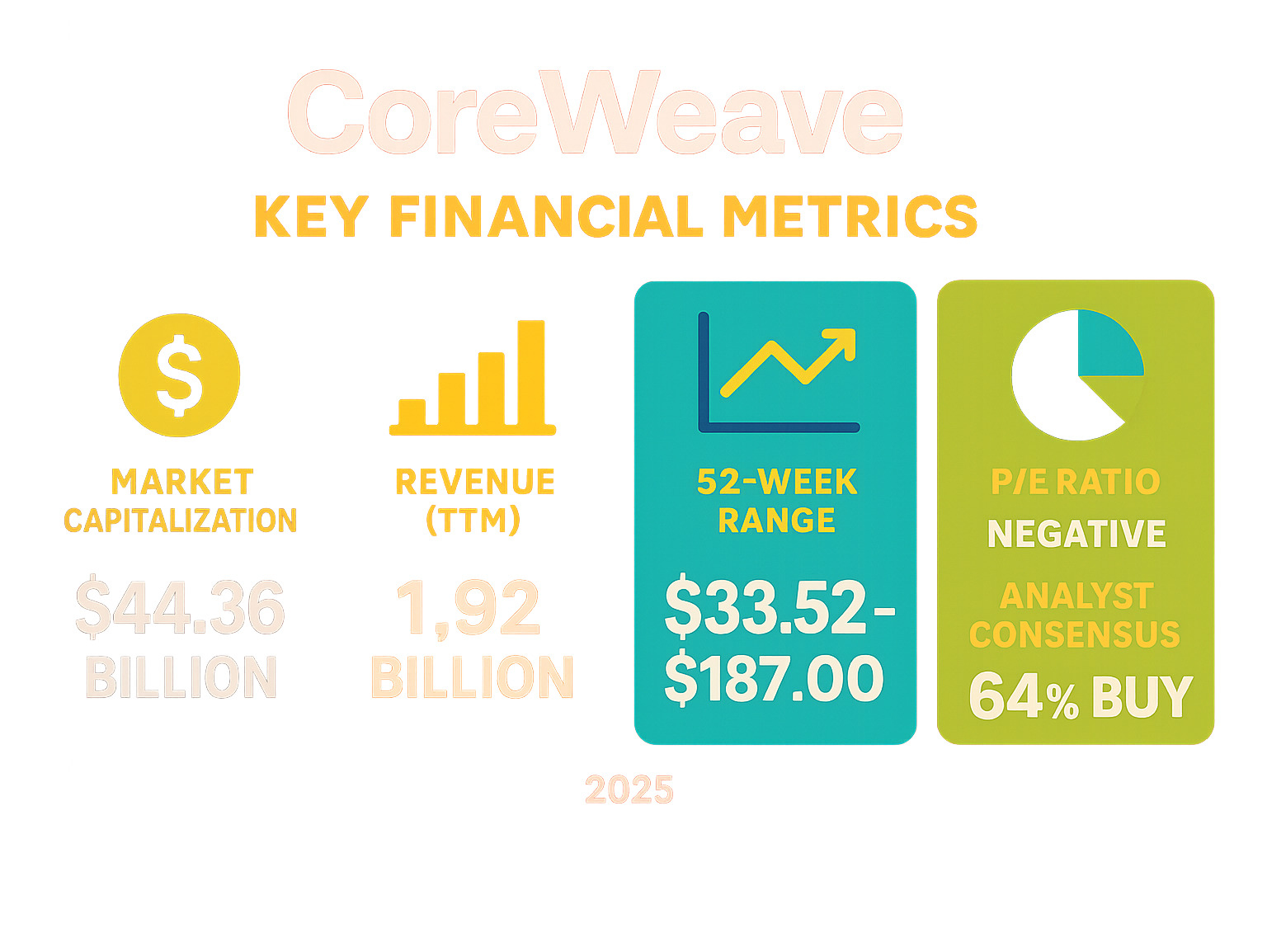

Key CRWV Stock Facts:

- Current Price: $93.99 (as of latest trading)

- Market Cap: $44.36 billion

- 52-Week Range: $33.52 – $187.00

- Year-to-Date Performance: +141.00%

- Analyst Rating: 64% Buy, 24% Hold, 12% Sell

Founded in 2017 by Michael Intrator, Brian Venturo, and Brannin McBee, CoreWeave provides high-performance computing resources for artificial intelligence, machine learning, and visual effects, positioning it as a key player in the AI infrastructure boom.

Since its IPO, the stock has shown significant volatility, reflecting both the excitement and uncertainty surrounding AI. While recent insider trading shows heavy selling by executives, Wall Street analysts remain generally positive.

For investors, CRWV represents the potential rewards and risks of the AI revolution. Its strong revenue growth and key partnerships contrast with its current lack of profitability and high debt levels.

CoreWeave resources:

- https://www.coreweave.com/products

- https://www.coreweave.com/solutions

- https://www.coreweave.com/pricing

CoreWeave at a Glance: Company Profile and Industry Standing

Unlike cloud companies that try to be everything to everyone, CoreWeave focuses on one thing: powering artificial intelligence with high-speed computing.

CRWV stock represents a company with a laser focus on AI cloud infrastructure and high-performance computing. Their business model is to provide the specialized GPU-accelerated computing that AI and machine learning applications require to run smoothly. This heavy-duty infrastructure powers everything from movie visual effects to cutting-edge AI research.

Founded in 2017 by Michael Intrator, Brian Venturo, and Brannin McBee, the company anticipated the growing need for specialized AI computing power. Today, Michael Intrator leads as CEO and President. CoreWeave garners praise due to AI growth and their Nvidia partnership, positioning them as a critical player in the AI revolution.

CoreWeave’s timing and partnerships are key. Their relationship with Nvidia gives them access to the most advanced GPU technology for their customers.

The numbers tell an impressive story. With a market cap of $44.36 billion and revenue of $1.92 billion, CoreWeave has achieved remarkable scale. Their gross margin of 74.24% shows a profitable core business model, even as they invest heavily in growth.

Like many high-growth tech companies, CoreWeave is not yet profitable. Its negative P/E ratio of -50.99, net margin of -45.08%, and a debt-to-equity ratio of 290.91% reflect a strategy that prioritizes expansion and leverage over immediate profits.

For readers evaluating CoreWeave services, see the company pages for more detail:

- https://www.coreweave.com/solutions

- https://www.coreweave.com/products

CRWV Stock’s Current Market Performance

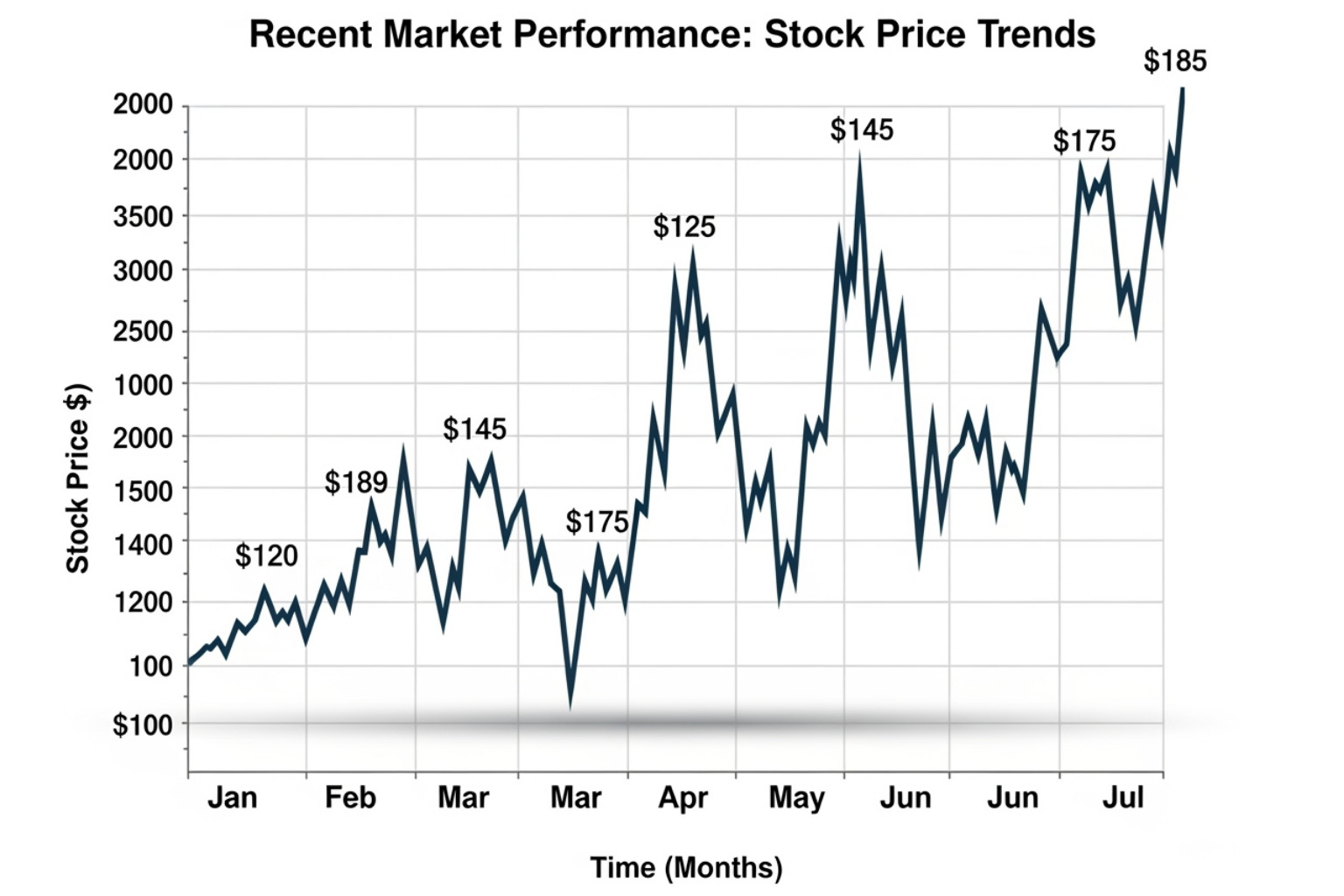

CRWV stock is at the center of the AI revolution, with its price reflecting the sector’s excitement. The current price is $93.99, up 3.52% from the previous close. Daily trading for CRWV stock is active, with a recent range between $85.26 and $92.64 and an average volume of 29.80 million shares, indicating strong investor interest.

CoreWeave’s market capitalization stands at $44.36 billion, though this figure has seen dramatic shifts, dropping 34.92% in the past week alone. This volatility is typical for companies in the fast-moving AI space.

Financially, the company’s P/E ratio is negative at -50.99, meaning it isn’t profitable on a trailing twelve-month basis. This is common for high-growth tech companies reinvesting heavily in expansion. Their earnings per share is also negative at -2.02. However, revenue is booming, with $1.92 billion for the fiscal year and $1.21 billion last quarter, exceeding analyst expectations. This top-line growth excites investors about the future.

One metric to watch is the debt-to-equity ratio of 290.91%, indicating significant borrowing to fuel growth. While common in capital-intensive businesses, it’s a risk factor. On the plus side, a gross margin of 74.24% shows their core services are profitable before accounting for expansion costs.

Historical Performance of crwv stock

The journey of CRWV stock has been a rollercoaster since its public debut. Recent performance shows a 3.52% gain in the past day, but a -1.99% decline over the past week and a -28.80% drop in the last month. This kind of pullback often follows a significant run-up.

Despite recent dips, CRWV stock is still up an incredible 141.00% year-to-date, which also represents its all-time performance. This massive gain is what attracts growth investors.

The 52-week range highlights the volatility, with a high of $187.00 (June 20, 2025) and a low of $33.52 (April 21, 2025). That’s a nearly 5x difference between the high and low points.

CoreWeave’s IPO debut in 2025 was challenging due to tough market conditions, with the stock initially struggling. While some analysts found the IPO pricing expensive, it was justified by the company’s growth potential. This post-IPO volatility is normal for companies in emerging, high-growth sectors like AI infrastructure as the market determines their long-term value.

Wall Street’s Take: Analyst Ratings and Price Targets for crwv stock

Wall Street analysts are largely positive on CRWV stock. Out of 25 analyst ratings, 64% recommend buying, 24% suggest holding, and only 12% advise selling. This indicates that nearly two-thirds of professionals studying the stock believe it has room to grow.

The buy camp is enthusiastic. JPMorgan issued an “Overweight” rating, praising the “extremely rapid revenue growth.” Cantor Fitzgerald, HC Wainwright and Co., Argus Research, Citigroup, and Northland Capital Markets have also issued strong “Buy” or equivalent ratings.

However, there are dissenting voices. HSBC took a more conservative stance with a “Reduce” rating, and DA Davidson issued an “Underperform” rating. The stock’s performance has been described as “wild, lumpy, and volatile,” which sums up the experience for many investors, yet the consensus often leans toward a buy.

Analyst price targets for crwv stock show a wide range of opinions. Over the past six months, the median target price sits at $115.0, suggesting decent upside potential. However, predictions span from a conservative $32.00 to an ambitious $200.00. This wide range reflects differing views on CoreWeave’s future.

High targets include Kevin Dede (HC Wainwright) at $180.0 and Jim Kelleher (Argus Research) at $200.0. More cautious targets include Nick Del Deo (MoffettNathanson) at $65.0. Other notable targets are Thomas Blakey (Cantor Fitzgerald) at $116.0 and Brad Sills (B of A Securities) at $168.0.

Insider Trading Activity and Key Events

Insider activity at CoreWeave has been a point of discussion. Over the past six months, transactions were heavily skewed towards selling, with 131 sales versus only 3 purchases.

Notable sales include those by CEO Michael Intrator, a large sale of over 4.2 million shares by Jack Cogen for approximately $382 million, and significant sales by Magnetar Financial LLC and Co-founder Brannin McBee. While these sales can be for personal financial planning, the sheer volume is worth noting.

On the buying side, Glenn Hutchins purchased nearly $10 million worth of shares, and Karen Boone bought about $500,000 worth. However, these purchases are overshadowed by the selling activity. This heavy insider selling suggests that those closest to the business may feel the stock is fairly valued at current levels or are simply diversifying their wealth.

Key dates for investors include the next earnings report, scheduled for November 12, 2025. The last report was a mixed bag, with an earnings miss but a significant revenue beat. Another key event was the lock-up expiration on August 14, 2025, which can create downward pressure on stock prices by increasing the supply of available shares.

For those wanting to stay on top of all the latest developments, you can find more recent company news and updates as they unfold.

Technicals and Future Outlook: Risks, Rewards, and Predictions

From a technical perspective, the charts for CRWV stock tell an interesting story. The Relative Strength Index (RSI) is around 36-38, indicating neutral to bearish momentum but not extreme oversold conditions. The Moving Average Convergence Divergence (MACD) is below its signal line, which is generally a bearish signal suggesting potential short-term downward pressure.

The 50-day moving average for CRWV stock is $116.3. With the current price trading below this average, it indicates recent weakness. As a recent IPO, a meaningful 200-day average is not yet available.

CRWV stock shows about 11.31% volatility with a beta of 0.40. This low beta suggests the stock’s movements are more tied to AI sector news and company-specific developments than the broader market.

Key support and resistance levels to watch are around $35.42 for support and $171.93 for resistance. Breaking through resistance would be needed for strong upward momentum.

Understanding the Risk-Reward Balance

Investing in CRWV stock involves significant potential but also considerable uncertainty.

On the risk side, market volatility is a major factor. The stock’s “wild, lumpy, and volatile” nature, as some have described it, is a reality for investors. Competition in the AI cloud space is also heating up. The company’s high debt (290.91% debt-to-equity) and current lack of profitability are substantial financial risks. Finally, the heavy insider selling has raised some concerns among investors.

On the reward side, the potential is substantial. CoreWeave is perfectly positioned to benefit from the AI growth explosion. Its Nvidia partnership provides a distinct competitive advantage with access to cutting-edge GPU technology. The company’s “extremely rapid revenue growth” and recent revenue beats show strong market traction. Furthermore, CoreWeave is expanding capacity aggressively, indicating confidence in future demand. The fact that most Wall Street analysts maintain positive ratings suggests professional confidence in the long-term story.

Looking Ahead: What the Future Might Hold

Predicting stock movements is difficult, especially in the AI sector. Short-term technical analysis suggests mixed signals. However, the long-term predictions are much brighter.

AI-driven forecasts suggest a price target of $141.57 for 2026 and an ambitious $227.33 for 2030, based on financials, market sentiment, and other factors. Wall Street analysts show similar long-term optimism, with a median target of $115.0 and some targets as high as $200.0. This suggests significant upside potential if CoreWeave executes its growth strategy successfully.

For teams evaluating CoreWeave’s offerings, explore:

- https://www.coreweave.com/solutions

- https://www.coreweave.com/products

Frequently Asked Questions about CRWV Stock

Here are answers to the most common questions we receive about CRWV stock.

Is CoreWeave (CRWV) a good stock to buy?

Whether CRWV stock is a good buy depends on your risk tolerance. A strong majority (64%) of Wall Street analysts rate it a “Buy,” and alternative data scores are positive, citing revenue growth and expansion.

However, the stock is highly volatile, the company is not yet profitable, it carries high debt (290.91% debt-to-equity), and has seen significant insider selling. It is best viewed as a speculative investment for long-term believers in the future of artificial intelligence who have a high tolerance for risk. Always do your own research and consider consulting a financial advisor.

What does CoreWeave do?

CoreWeave provides specialized cloud infrastructure focused on high-performance computing. They supply the powerful GPU resources that are essential for artificial intelligence, machine learning, visual effects rendering, and other intensive computing tasks. Their target customers range from big tech companies to innovative startups, all of whom need serious computing power to handle the most sophisticated AI challenges.

Why is CRWV stock so volatile?

The high volatility of CRWV stock stems from several factors:

- Recent IPO: The company only went public in 2025. New stocks, especially in hyped sectors, often experience wild price swings as the market determines their value.

- AI Sector Hype: The AI industry is prone to dramatic shifts based on news and sentiment, which directly impacts CoreWeave’s stock.

- Financials: The company’s current unprofitability and high debt levels make the stock more sensitive to market sentiment and doubts about its path to profitability.

- Lock-up Expiration: A lock-up expiration on August 14, 2025, increased the supply of tradable shares, which can create downward pressure on the price.

- Insider Selling: Heavy selling by company executives and early investors can make other investors nervous, contributing to price swings.

In short, CRWV stock embodies all the excitement and uncertainty of the AI revolution, making it a ride not suited for the faint of heart.

Conclusion

After diving deep into CRWV stock, we’ve uncovered a compelling investment story that captures the excitement and uncertainty of today’s AI revolution. CoreWeave Inc. has positioned itself as a vital player in the artificial intelligence ecosystem, offering the specialized cloud infrastructure that powers tomorrow’s most innovative technologies.

The company’s impressive revenue growth and strategic partnership with Nvidia demonstrate real market traction. A 64% buy rating from Wall Street analysts, despite the stock’s volatility, speaks to CoreWeave’s perceived long-term potential.

However, CRWV stock is not a typical blue-chip investment. The wild price swings since its 2025 IPO, heavy insider selling, and current lack of profitability are complexities every investor must consider. CoreWeave’s journey mirrors the broader challenges of investing in transformative technologies. The exciting AI-driven price targets of $141.57 for 2026 and $227.33 for 2030 remind us that this is a bet on a future that’s still being written.

Ready to learn more about CoreWeave’s services and capabilities? Explore:

- https://www.coreweave.com/products

- https://www.coreweave.com/solutions