Understanding CRCL Stock: The Digital Finance Revolution

CRCL stock represents Circle Internet Group, a pioneering financial technology company that’s reshaping how we think about digital payments and blockchain infrastructure. Here’s what you need to know:

Key CRCL Stock Facts:

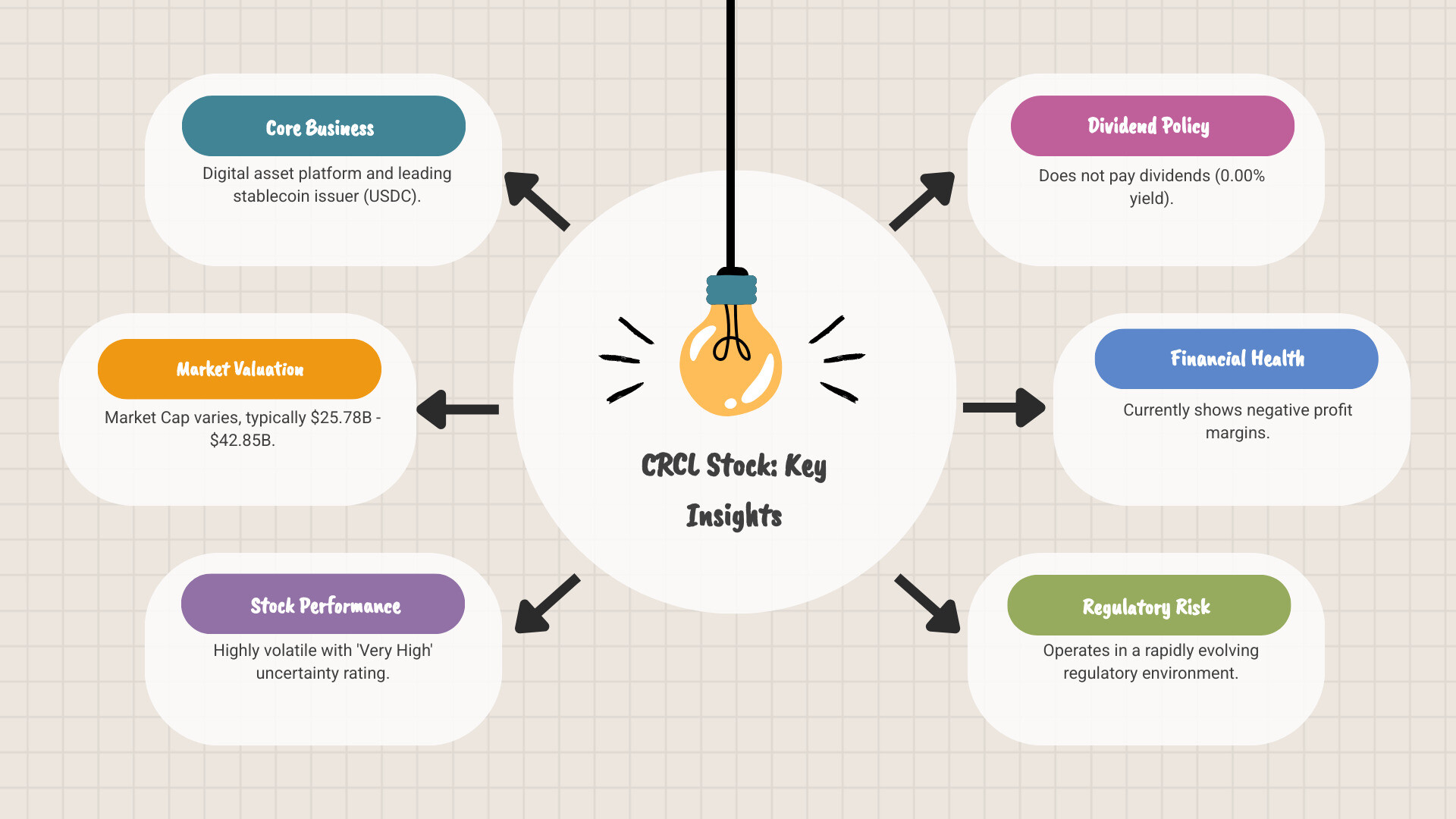

- Company: Circle Internet Group Inc. (NYSE: CRCL)

- Market Cap: $25.78B – $42.85B (varies by source)

- Business: Digital asset platform and stablecoin issuer

- Primary Product: USD Coin (USDC) stablecoin

- Stock Performance: Highly volatile with “Very High” uncertainty rating

- Dividend: Does not pay dividends (0.00% yield)

Circle Internet Group isn’t your typical investment. This company operates at the intersection of traditional finance and cutting-edge blockchain technology. They’re the force behind USD Coin (USDC), one of the world’s largest stablecoins – digital currencies designed to maintain a stable value.

The company provides network utility systems that help businesses harness digital currencies for payments, commerce, and financial applications. Think of them as the infrastructure builders of tomorrow’s financial system.

Important Note: Don’t confuse CRCL with CRC stock. CRCL is Circle Internet Group (fintech), while CRC is California Resources Corporation (energy company). This guide focuses exclusively on CRCL.

Recent headlines show Circle’s ambitious growth strategy, including acquisitions like Malachite to power their upcoming Arc Blockchain. As one analyst noted, “Circle Stock Went Gangbusters. Crypto IPOs Are the Next Big Thing.”

But investing in CRCL comes with significant risks. The stock shows extreme volatility, negative profit margins, and operates in a rapidly evolving regulatory environment.

Handy crcl stock terms:

What is Circle Internet Group (CRCL)?

Understanding CRCL stock means getting to know the innovative company behind it. Circle Internet Group isn’t your typical financial services company – they’re building the digital highways that tomorrow’s money will travel on.

Circle Internet Group operates as a financial technology solutions provider that bridges traditional banking with the digital asset world. Think of them as the architects creating the infrastructure that makes digital money work smoothly for businesses and individuals alike.

The company’s main focus revolves around digital asset platforms and public blockchains. They’ve positioned themselves as the go-to provider for organizations wanting to tap into the power of digital currencies for payments and commerce applications. You can explore their full range of services on Circle’s official website.

What really sets Circle apart is their role as a stablecoin issuer. They’re the creators and guardians of USD Coin (USDC), one of the most trusted digital dollars in existence. USDC maintains a 1:1 relationship with the U.S. dollar, offering the stability that businesses need when dealing with digital payments.

The Core Business: Stablecoins and Blockchain Infrastructure

Circle’s bread and butter is the USDC stablecoin and the technology that makes it work seamlessly. Their network utility systems create a comprehensive ecosystem where digital money flows as easily as sending an email.

The company has built what they call an application platform that includes tokenized funds – essentially digital versions of traditional assets that can move instantly across borders. Their developer services provide the tools that allow other companies to build innovative financial applications on top of Circle’s foundation.

One of Circle’s most exciting moves was acquiring Malachite, which will power their upcoming Arc Blockchain. This strategic purchase shows they’re not just maintaining their current position – they’re actively building the next generation of financial infrastructure.

Circle’s Role in the Future of Finance

Circle is essentially creating the plumbing for digital currencies to become mainstream. Their work enables global payments to happen faster, cheaper, and more inclusively than traditional banking systems allow.

The company’s financial applications and market infrastructure are already processing billions of dollars in transactions. They’re making it possible for businesses to accept digital payments, send money internationally, and build new types of financial services.

The market is taking notice too. As highlighted in a recent Barron’s article, Crypto IPOs Are the Next Big Thing, showing that mainstream finance is recognizing the potential of companies like Circle to reshape how money works in the digital age.

CRCL stock represents an investment in this financial change. While the technology might seem complex, Circle’s mission is simple: make digital money as easy and reliable to use as the cash in your wallet.

CRCL Stock Performance and Key Financials

When it comes to understanding CRCL stock, the numbers tell a fascinating story of a company riding the waves of digital finance innovation. Let’s explore what the financial data reveals about Circle Internet Group’s market position.

The first thing you’ll notice about CRCL stock is its impressive scale. Circle’s market capitalization ranges from approximately $25.78 billion to $42.85 billion, depending on when you check the data. This variation isn’t unusual for a company operating in the fast-moving digital asset space – valuations can shift dramatically based on market sentiment and crypto trends.

What really catches our attention is the stock’s 52-week range, which tells a story of remarkable volatility. The stock has traded anywhere from lows of $31.00 to $64.00 all the way up to highs of $138.57 to $298.99. That’s the kind of price swing that can make your heart race – and it perfectly illustrates why investing in CRCL stock isn’t for the faint of heart.

Trading activity around Circle has been robust, with daily volumes ranging from 1.15 million to 36.54 million shares. This high volume indicates strong investor interest, whether people are buying into the digital finance revolution or taking profits after significant gains.

The company’s Price-to-Earnings ratio presents an interesting puzzle. Different sources report wildly different P/E ratios – from 0.79 to 233.32 – reflecting the challenges of valuing a rapidly evolving fintech company. These variations often stem from how “normalized” earnings are calculated and the timing of data collection.

Current Performance of crcl stock

The recent performance of CRCL stock has been nothing short of a rollercoaster ride. We’ve seen dramatic swings that would make even seasoned investors hold their breath.

Short-term movements have been particularly striking. In some five-day periods, the stock has surged by 28.01%, while other monthly periods have seen declines of -36.73%. These aren’t typos – they’re the reality of investing in a company at the forefront of digital finance innovation.

Despite these wild swings, the year-to-date performance tells a compelling growth story. CRCL stock has delivered returns of approximately 105.19%, dramatically outperforming the S&P 500’s more modest gains. This outperformance highlights both the tremendous opportunity and significant risk that comes with CRCL stock.

After-hours trading adds another layer of excitement (or anxiety, depending on your perspective). We’ve seen instances where the stock dropped -9.10% after regular market hours, reminding investors that Circle’s story doesn’t pause when the closing bell rings.

Valuation and Key Metrics for crcl stock

Digging deeper into Circle’s valuation reveals some fascinating insights about how the market views this digital finance pioneer.

The company has approximately 200 to 230 million shares outstanding, depending on the source, which impacts how we calculate per-share metrics. With an Enterprise Value-to-Revenue ratio of 14.91, investors are clearly betting on Circle’s future growth potential rather than current profitability.

One particularly intriguing metric is Circle’s Beta of -0.98. This negative beta suggests that CRCL stock often moves in the opposite direction of the broader market. Rather than following traditional market trends, Circle appears to dance to the rhythm of the crypto and blockchain world.

The Price-to-Book ratio of 13.70 indicates that investors value Circle far above its tangible book value. This premium reflects the market’s belief in the company’s intangible assets – its technology, market position, and future potential in the digital finance space.

Like many growth-focused technology companies, Circle doesn’t pay dividends (0.00% yield). Instead, the company reinvests its resources into expanding its blockchain infrastructure and growing its stablecoin ecosystem.

Looking ahead, investors should mark November 11, 2025 on their calendars for Circle’s next earnings announcement. These quarterly reports provide crucial updates on the company’s financial health and strategic direction.

The variations in financial metrics across different sources underscore an important point about CRCL stock: this is a company operating in a rapidly evolving space where traditional valuation methods sometimes struggle to keep pace. As always, we recommend consulting multiple reliable sources and understanding your risk tolerance before making any investment decisions.

Analyst Sentiment and Top Stories

At Beyond Beauty Lab, we know that staying informed about market sentiment is just as important as understanding the numbers. When it comes to CRCL stock, the story that emerges from analyst opinions and recent headlines is both exciting and complex.

The analyst community seems cautiously optimistic about Circle’s future. Based on 15 professional ratings, 40% recommend buying the stock, while 33.3% suggest holding and 26.7% advise selling. This split tells us something important – analysts recognize Circle’s potential but also understand the risks.

Think of it like trying a new skincare routine. Some experts might be all-in on the latest ingredients, others prefer to wait and see, and a few stick with what’s proven. The same dynamic plays out with CRCL stock in this rapidly evolving digital finance space.

What’s particularly fascinating is the broader excitement around crypto IPOs. Barron’s captured this perfectly when they noted that “Circle Stock Went Gangbusters. Crypto IPOs Are the Next Big Thing.” This enthusiasm isn’t happening in isolation – we’re seeing similar energy with companies like Chime, whose IPO success reinforces the market’s appetite for innovative financial technology. The Chime IPO and market trends show how investors are gravitating toward companies that reimagine traditional finance.

Even Jim Cramer has weighed in on Circle, though with his characteristic flair. He once remarked that Circle Internet Group “Does Not Like My Analysis” – which, depending on how you feel about Cramer’s track record, might actually be a good sign!

The institutional backing is perhaps most telling. When Ethereum’s biggest supporters start pouring billions into Wall Street ventures, it signals a fundamental shift. These aren’t speculative bets – they’re strategic moves by players who understand where finance is heading.

Recent News Driving the Conversation

Several key developments are shaping the narrative around CRCL stock right now. Circle’s acquisition of Malachite stands out as a strategic masterstroke. This isn’t just about buying a company – it’s about powering their upcoming Arc Blockchain and building the infrastructure for tomorrow’s financial system.

The regulatory landscape continues to evolve, and as a major stablecoin issuer, Circle sits right in the middle of these changes. Every new policy announcement or regulatory clarification can significantly impact how the company operates and grows.

Stablecoin market growth remains the engine driving Circle’s potential. As more businesses find the benefits of using USDC for payments and financial applications, Circle’s network becomes more valuable. It’s like watching a new technology go mainstream – first the early adopters, then businesses, then everyone.

The phenomenon of “superfan” IPO scrambles has created interesting dynamics in the market. When retail investors get excited about high-profile tech and crypto IPOs, we see dramatic price movements. This enthusiasm can drive rapid gains, but it also means more volatility.

Partnership announcements and strategic moves continue to generate buzz. Every time Circle makes a significant business decision, competitors and investors take notice. The question “Does Circle’s Latest Move Threaten XRP?” shows just how closely the industry watches Circle’s every move.

What emerges from all this news is a picture of a company that’s not just participating in the digital finance revolution – they’re actively shaping it. Whether that translates to investment success depends on your risk tolerance and belief in the future of digital currencies.

Understanding the Risks and Company Health

When considering CRCL stock, we need to take an honest look at Circle’s financial health and the unique risks that come with investing in cutting-edge financial technology. Think of it like evaluating a new wellness routine – we want to understand both the potential benefits and any side effects.

Circle’s current financial picture tells an interesting story. The company is in what we might call a “growth investment phase,” much like when you’re building healthy habits that require upfront commitment before you see results.

Financial Health Indicators

Let’s start with the numbers that matter most. Circle’s Profit Margin sits at -16.21%, which means the company is currently spending more than it’s bringing in. Before you worry too much, this is actually quite common for fast-growing tech companies that are investing heavily in their future.

The company’s Net Income shows a loss of $397.88 million over the trailing twelve months. While that might sound alarming, Circle has a strong financial cushion with $1.12 billion in cash reserves. That’s like having a substantial emergency fund while you’re building your dream business.

What’s particularly encouraging is Circle’s Debt to Equity ratio of just 9.35%. This low ratio means the company isn’t heavily borrowing to fund its operations – they’re primarily using their own equity and cash reserves. It’s a sign of financial discipline and stability, even while they’re not yet profitable.

The Return on Assets (ROA) and other profitability ratios reflect this growth-investment phase. While these numbers aren’t positive yet, they’re part of Circle’s strategy to capture market share in the rapidly expanding stablecoin and blockchain infrastructure space.

Risks and Considerations for Investors

Now for the important part – understanding what you’re getting into with CRCL stock. Morningstar assigns this stock a “Very High” uncertainty rating, and there are several reasons why.

Market volatility is perhaps the biggest consideration. The digital asset world moves fast and can be unpredictable. CRCL stock has shown dramatic swings, with a 52-week range that spans from lows around $31-$64 to highs reaching $138-$299. That’s like a roller coaster that goes way up and way down.

The stock’s negative Beta of -0.98 adds another layer of complexity. This means CRCL stock tends to move in the opposite direction of the broader market. When the S&P 500 goes up, Circle might go down, and vice versa. It’s unusual and makes the stock less predictable for traditional investors.

Regulatory uncertainty looms large in the stablecoin space. Government policies around digital currencies are still evolving, and new regulations could significantly impact Circle’s business model. It’s like navigating a wellness trend before all the research is complete – there’s potential, but also unknowns.

The competitive landscape in stablecoins is heating up. While Circle’s USDC is currently one of the leading stablecoins, new competitors and potential central bank digital currencies could challenge their market position.

CRCL stock is available for trading on Robinhood with 24/5 trading hours, which offers convenience but also means prices can move dramatically outside normal market hours. One recent example showed a -9.10% drop in after-hours trading.

Perhaps most importantly, Morningstar noted that at certain points, CRCL stock has traded at a “significant premium of 663%” to its fair value. This suggests that a lot of future growth expectations are already baked into the current price.

Circle doesn’t pay dividends (0.00% dividend yield), which is typical for growth companies that reinvest everything back into expansion. Investors are betting on future appreciation rather than current income.

For us, the key takeaway is that CRCL stock represents a high-risk, high-potential-reward investment. It’s not for everyone, and it certainly shouldn’t be your entire portfolio. But for investors who understand and can handle the volatility, Circle’s position in the growing digital finance ecosystem makes it an intriguing option to consider.

Frequently Asked Questions about CRCL Stock

We know that diving into digital finance can feel overwhelming, especially when you’re trying to understand a new company like Circle Internet Group. At Beyond Beauty Lab, we believe in making complex topics accessible and clear. Here are the most common questions we hear about CRCL stock, answered in a way that actually makes sense.

Is CRCL the same as CRC stock?

This confusion happens more often than you’d think, and we totally get why! The answer is a definitive no – CRCL and CRC are completely different companies with very different business models.

CRCL is the ticker symbol for Circle Internet Group, the fintech company we’ve been discussing throughout this guide. They’re the ones behind USDC stablecoin and blockchain infrastructure that’s shaping the future of digital payments.

CRC, on the other hand, represents California Resources Corporation, which operates in the energy sector focusing on oil and gas exploration and production. It’s like comparing a tech startup to an oil company – they couldn’t be more different!

This mix-up is understandable since both tickers start with “CRC,” but making this mistake could lead to some very unintended investment consequences. Always double-check that you’re looking at Circle Internet Group when researching CRCL stock.

Does CRCL stock pay a dividend?

No, CRCL stock currently doesn’t pay any dividends to shareholders. The dividend yield sits at 0.00% for both trailing and forward projections.

This might seem disappointing if you’re looking for regular income from your investments, but it’s actually quite typical for growth-focused technology companies, especially those in emerging sectors like blockchain and digital currencies.

Instead of handing out cash to shareholders, Circle is doing what most smart growth companies do – they’re reinvesting every dollar back into the business. This means funding research and development, expanding their operations, making strategic acquisitions like the Malachite deal we mentioned earlier, and capturing more market share in the rapidly growing stablecoin space.

For investors in CRCL stock, the focus is typically on long-term capital appreciation rather than quarterly dividend checks. The thinking is that if Circle can successfully execute their vision for the future of digital finance, the stock price growth could potentially provide much better returns than traditional dividend-paying stocks.

What is USDC and how does it relate to Circle?

USDC, which stands for USD Coin, is absolutely central to understanding why CRCL stock exists and what makes Circle Internet Group valuable. Think of USDC as digital cash that behaves exactly like a US dollar.

Here’s what makes USDC special: it’s a stablecoin that maintains a 1:1 peg with the US dollar. This means that for every USDC token in circulation, Circle holds one actual US dollar in reserve. It’s designed to give you all the benefits of cryptocurrency – like fast, borderless transactions – without the wild price swings that make Bitcoin and other cryptocurrencies unsuitable for everyday payments.

Circle didn’t just create USDC and walk away. They actively manage everything about it – the issuance of new coins, the redemption process when people want to convert back to regular dollars, and most importantly, the massive reserves that back every token. It’s similar to how a traditional bank operates, but in the digital world.

USDC has become incredibly popular for several practical uses. People use it for digital payments that can cross borders in minutes instead of days. Online businesses accept it for commerce because they get the stability of dollars with the efficiency of blockchain technology. It’s also become a cornerstone of financial applications in the decentralized finance world, where people use it for lending, borrowing, and trading.

The success and adoption of USDC directly impacts Circle’s business and, by extension, the performance of CRCL stock. The more people and businesses use USDC, the more valuable Circle’s platform becomes. It’s this relationship that makes Circle such an interesting investment opportunity in the evolving world of digital finance.

Conclusion

As we wrap up our journey through CRCL stock, it’s clear that Circle Internet Group represents something truly fascinating – a company that’s literally building the financial infrastructure of tomorrow. From issuing one of the world’s most trusted stablecoins to developing cutting-edge blockchain technology, Circle isn’t just riding the digital finance wave; they’re creating it.

We’ve finded that CRCL stock tells a story of incredible potential wrapped in significant complexity. The impressive year-to-date gains and bullish analyst sentiment paint an exciting picture of growth possibilities. Yet we’ve also been honest about the challenges – the current losses, the wild price swings, and that “Very High” uncertainty rating that reminds us this isn’t your grandmother’s dividend stock.

At Beyond Beauty Lab, we believe in the same thorough approach to financial wellness that we bring to personal wellness. Just as we wouldn’t recommend a skincare routine without understanding your skin type and concerns, we’d never suggest diving into CRCL stock without truly grasping what you’re getting into. This investment requires not just faith in technological innovation, but also a clear-eyed assessment of your own risk tolerance.

The beautiful thing about living in this era is witnessing how technology transforms every aspect of our lives – from the clean beauty products we choose to the digital currencies reshaping global finance. Understanding companies like Circle helps us stay informed about the forces shaping our financial future, which ultimately contributes to our overall sense of empowerment and security.

Financial wellness and personal wellness are more connected than many people realize. When we feel confident about our financial decisions – whether that’s investing in promising technologies or simply understanding the changing landscape around us – it reduces stress and improves our overall quality of life.

We hope this guide has given you the clarity and confidence to make your own informed decisions about CRCL stock. The best investment strategy is always one built on knowledge, patience, and honest self-reflection about your goals and comfort level with risk.

Ready to continue your wellness journey beyond the financial markets? Learn more about enhancing your wellness journey and find how taking care of your whole self – mind, body, and financial future – creates the foundation for a truly fulfilling life.