Why Understanding Digital Finance Platforms Matters

Coyyn.com banking has generated significant interest among users seeking modern financial solutions, but understanding what this platform actually offers is crucial before making any financial decisions.

Quick Answer: What is Coyyn.com Banking?

- Information Platform: Coyyn.com appears to be a financial education hub focused on digital banking, AI, and blockchain topics

- Not a Licensed Bank: No evidence suggests Coyyn.com is a chartered banking institution

- Related Service: Coyni.com (different platform) offers USD-backed stablecoin payment services

- Content Focus: Articles about digital finance, cryptocurrency, and fintech trends

- User Responsibility: Always verify regulatory status before using any financial service

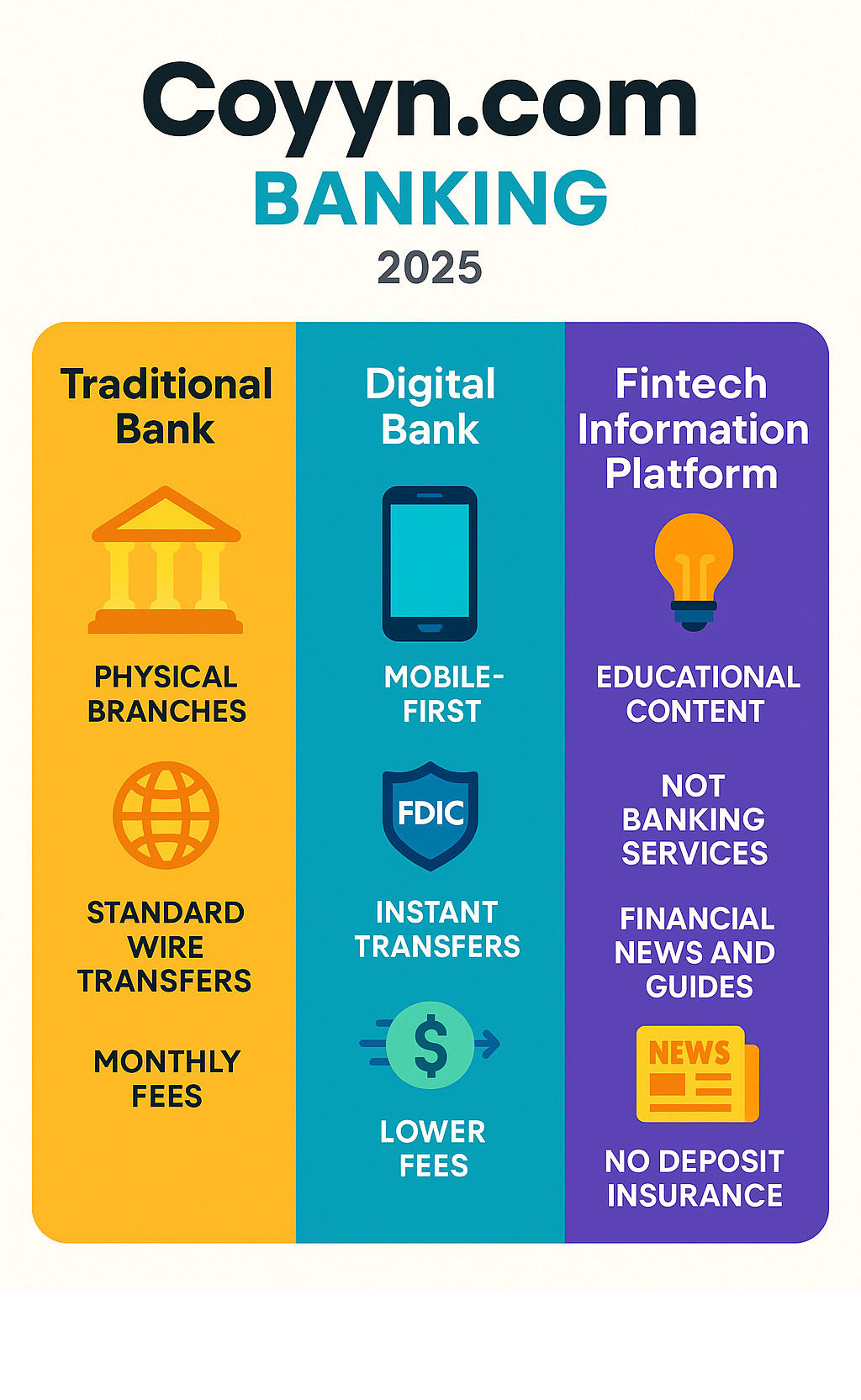

The financial world is rapidly changing. Traditional banking is evolving alongside new fintech platforms, cryptocurrency solutions, and digital payment systems. Many people are searching for alternatives to conventional banking that offer faster transactions, lower fees, and modern features.

However, the line between financial information platforms and actual banking services can be confusing. Some websites provide educational content about digital finance, while others offer direct financial services. Understanding this distinction is essential for your financial safety.

At Beyond Beauty Lab, we believe that financial wellness is part of your overall well-being journey. Just as you research ingredients in beauty products, researching financial platforms helps you make informed decisions that support your holistic lifestyle.

Coyyn.com banking word roundup:

What is Coyyn.com? Deconstructing the Digital Platform

The world of finance is changing faster than ever before. New platforms pop up daily, promising solutions to age-old money problems. In this exciting but sometimes confusing landscape, Coyyn.com banking has emerged as a topic of interest for many people exploring digital finance options.

But here’s where things get interesting: Coyyn.com isn’t actually a bank at all. Instead, it operates as an informational hub that explores the fascinating intersection of traditional finance, cutting-edge technology, artificial intelligence, and blockchain. Think of it as your friendly guide through the sometimes overwhelming world of digital finance.

The platform serves as a valuable resource for anyone trying to understand how digital currencies, blockchain technology, and artificial intelligence are reshaping our financial future. Whether you’re curious about cryptocurrency or wondering how AI might change banking, Coyyn.com aims to make these complex topics more accessible.

Understanding the Core Mission

Coyyn.com has set itself an ambitious goal: to bridge the gap between traditional finance and the digital currency revolution. Their mission centers on making financial management simpler and more accessible for everyone, regardless of their technical background.

The platform focuses heavily on financial education and user empowerment. Rather than offering banking services directly, they provide the knowledge you need to make informed decisions about your financial life. This educational approach aligns beautifully with our philosophy at Beyond Beauty Lab – we believe that understanding leads to better choices, whether you’re selecting skincare ingredients or exploring financial options.

Now, here’s where things can get a bit confusing. While researching Coyyn.com banking, you might also come across Coyni.com – notice the slightly different spelling. These are completely separate entities with different purposes.

Coyni.com is an actual payment system that uses a USD-backed stablecoin for business and personal transactions. It’s part of the RYVYL family and operates as a real financial service, where each Coyni token is backed by the U.S. dollar on a 1:1 ratio. If you’re curious about how this specific payment system works, you can learn more at What is coyni?

The Role of AI and Blockchain

One of Coyyn.com’s strongest focuses is explaining how AI-driven analytics and blockchain technology are revolutionizing finance. They don’t just throw around buzzwords – they break down these concepts into digestible pieces.

Blockchain technology forms the backbone of secure, decentralized transactions. Beyond just powering cryptocurrencies, Coyyn.com explains how blockchain enables smart contracts, improves supply chain transparency, and creates more secure digital identities. The platform emphasizes how this technology can make money move in minutes rather than days, while significantly reducing costs compared to traditional banking methods.

Artificial intelligence acts as the smart engine behind modern financial services. Coyyn.com showcases real-world applications like intelligent automation for fraud detection, personalized investment advice through robo-advisors, and AI-powered credit scoring systems. These aren’t futuristic concepts – they’re happening right now and changing how we interact with money.

The magic happens when AI and blockchain work together. Coyyn.com explains how AI improves blockchain security through advanced threat detection, while blockchain ensures the integrity of AI-driven data. This powerful combination is creating a more robust financial ecosystem that can automate compliance processes and optimize decentralized finance protocols.

This synergy between AI and blockchain isn’t just technical jargon – it’s reshaping the financial landscape to be faster, more secure, and more accessible to everyone. For a deeper exploration of how these technologies work together, check out this insightful piece: Coyyn.com: Finance’s Future with AI & Blockchain.

Understanding these technologies might seem daunting at first, but platforms like Coyyn.com are making it easier for everyday people to grasp how the future of finance is unfolding.

Evaluating the “Coyyn.com Banking” Service Claims

When exploring Coyyn.com banking, it’s important to understand that we’re looking at how Coyyn.com discusses and analyzes modern digital banking solutions rather than direct banking services. The platform serves as an educational resource, exploring how digital wallets are changing our daily financial lives, how peer-to-peer payments are making money transfers simpler, and how cross-border transactions are becoming more accessible for everyone.

Think about your last banking experience. Did you wait in line at a branch? Pay hefty fees for an international transfer? Struggle with confusing mobile apps? Modern digital banking, as described by Coyyn.com, aims to solve these everyday frustrations.

| Feature | Modern Digital Banking (as described by Coyyn.com) | Traditional Banking |

|---|---|---|

| Accessibility | 24/7 via mobile app/online platform | Limited to branch hours, some online access |

| Transaction Speed | Instant transfers, real-time processing | Often takes days for transfers (e.g., wire transfers) |

| Fees | Lower fees, transparent structures, often no monthly fees | Can have higher transaction fees, monthly maintenance fees |

| International Payments | Faster, lower cost, multi-currency support | Slower, higher wire transfer fees, less flexible FX |

| Financial Tools | Integrated budgeting, savings features, personalized insights | Basic online statements, limited budgeting tools |

| Customer Support | Live chat, email, phone (24/7), community forums | Phone, in-person at branches, limited online chat |

| Innovation | Smart contracts, AI-driven advice, DeFi integration | Slower adoption of new technologies |

| Physical Presence | Primarily online, no physical branches | Physical branches are central |

Key Features Promoted on the Platform

Coyyn.com paints an exciting picture of what modern digital banking can offer. Imagine having a seamless digital wallet that holds your regular dollars alongside Bitcoin or other digital currencies – all in one simple interface. No more juggling multiple apps or accounts just to manage different types of money.

The platform highlights how smart contracts are revolutionizing agreements. These are like digital contracts that automatically execute when conditions are met. Picture a freelancer who gets paid instantly when they deliver a project, or a subscription that renews automatically without any manual processing. It’s financial automation that actually works for you.

Invoicing and expense tracking become much simpler in this digital world. Instead of drowning in paperwork or complicated spreadsheets, everything happens automatically. Your business expenses get categorized, your invoices get sent and tracked, and you can see your financial picture clearly without the headache.

Security isn’t forgotten either. Coyyn.com discusses bank-level protection through end-to-end encryption, two-factor authentication, and even biometric login options. Your financial data stays protected while remaining easily accessible to you.

For anyone wanting to take control of their finances, there are excellent financial tools available, and modern platforms are making on-time delivery of payments simpler than ever.

Benefits for Personal and Business Finance

Coyyn.com banking discussions reveal how digital solutions can transform your daily money management. For individuals, this means 24/7 accessibility – checking your balance at midnight or sending money to a friend during weekend emergencies becomes effortless. Real-time transaction tracking means no more wondering if your payment went through or waiting days to see updates.

Personal finance gets simplified through automated bill payments and intelligent budgeting tools. Instead of manually tracking every expense, AI-powered systems can categorize your spending and offer personalized insights to improve your financial health.

Business owners and freelancers face different challenges, and Coyyn.com explores solutions specifically for them. Multi-currency payment acceptance with low fees means a small business can serve international customers without losing profits to transaction costs. Automated payroll systems can handle payments in both traditional currencies and digital assets, giving businesses flexibility their employees appreciate.

The promise of lower transaction costs is particularly appealing. Traditional wire transfers can cost $25-50 per transaction, while digital alternatives often charge a fraction of that amount. For businesses processing many transactions, this difference adds up quickly. The concept of lower transaction costs isn’t just theory – it’s a practical advantage that affects your bottom line.

Faster international payments transform how global businesses operate. Instead of waiting 3-5 business days for international transfers, digital systems can complete transactions in minutes. This speed improvement helps cash flow and builds better relationships with international partners and suppliers.

At Beyond Beauty Lab, we understand that financial wellness connects to your overall well-being. Just as we research the best ingredients for skincare, taking time to understand modern financial tools helps you make choices that support your beautiful, balanced life.

Security and Compliance: Is Coyyn.com Safe?

When you’re exploring any digital financial platform, security naturally becomes your top concern. Whether you’re reading about Coyyn.com banking or considering any fintech service, you want to know your information and money will be protected. Think of it like choosing skincare products – you wouldn’t put something on your face without checking the ingredients first!

Coyyn.com, as an educational platform, discusses the security measures that legitimate digital financial services should have in place. Just like we research wellness practices before adopting them into our routines, understanding these security features helps you make informed financial decisions.

A Look at Stated Security Protocols

The world of digital finance has developed some pretty impressive security measures. End-to-end encryption is like having a secret language that only you and your bank understand. Even if someone intercepts your information, it looks like gibberish to them.

Two-factor authentication adds an extra layer of protection beyond your password. It’s like having two locks on your front door instead of one. You might get a text message with a code, or use your fingerprint to confirm it’s really you trying to access your account.

Many platforms now use biometric login options, which means your unique physical features – like your fingerprint or face – become your password. It’s convenient and secure because nobody else has your exact biometrics.

Fraud monitoring systems work behind the scenes, using AI to watch for unusual activity. If someone tries to make a purchase that doesn’t match your normal spending patterns, the system flags it for review. It’s like having a digital security guard who never sleeps.

The best platforms follow strict compliance standards including KYC standards (Know Your Customer), AML regulations (Anti-Money Laundering), and GDPR for data privacy. These aren’t just fancy acronyms – they’re real protections that require financial services to verify who you are and keep your personal information safe. Multi-factor authentication and encryption have become standard practice in the financial industry for good reason.

Understanding the “Coyyn.com Banking” Regulatory Standing

Here’s where things get important, and we need to be crystal clear. Based on our research, Coyyn.com operates as a financial information hub rather than an actual licensed bank. Think of it like the difference between a wellness blog that teaches you about skincare ingredients and a dermatology clinic that actually treats your skin.

Coyyn.com provides valuable educational content about digital banking, cryptocurrency, and fintech trends. When we talk about Coyyn.com banking, we’re discussing the banking topics covered on their platform, not banking services they directly provide.

This distinction matters enormously for your financial safety. Just as you’d want to verify that a wellness practitioner has proper credentials, you should always confirm that any financial service provider has the right licenses and regulatory approvals in your area.

Due diligence becomes your responsibility as a user. Before trusting any platform with your money, check for regulatory licenses, look for clear information about deposit insurance (like FDIC protection in the US), and read independent reviews from other users.

User education is key here. Coyyn.com’s role is to help you understand these complex financial topics so you can make smart decisions. Just like learning about clean beauty ingredients helps you choose better products, understanding digital finance helps you steer this evolving landscape safely.

At Beyond Beauty Lab, we believe that financial wellness is part of your overall well-being journey. Taking time to research and understand financial platforms is just as important as researching the products you put on your skin or the wellness practices you adopt.

Getting Started and Future Outlook

Taking your first steps into digital finance might feel overwhelming, but understanding how these modern platforms work can transform your financial wellness journey. Just as we carefully research skincare ingredients before trying new products, learning about fintech platforms helps you make confident choices about your money management.

How to Engage with a Modern Fintech Platform

When exploring Coyyn.com banking content, you’ll find that most legitimate digital financial platforms follow a similar onboarding journey. This process balances user-friendly design with essential security measures that protect your financial information.

The typical journey begins with account setup on the platform’s website (such as Coyyn.com itself, or the digital banks they discuss). You’ll start by creating an account with your email address – much like signing up for any trusted online service.

Next comes KYC verification, which stands for Know Your Customer. This step requires submitting identification documents like your driver’s license or passport. While it might seem tedious, this process is actually a good sign – it means the platform follows regulatory requirements to prevent fraud and money laundering.

Wallet configuration allows you to customize your experience based on your needs. Some people prefer managing only traditional currencies, while others want to explore both fiat money and cryptocurrencies in one place. Think of it like choosing the right skincare routine – it should match your specific goals and comfort level.

Funding options typically include bank transfers, cryptocurrency deposits, or credit card payments. Most platforms offer multiple ways to add money, giving you flexibility in how you manage your finances.

Finally, quality platforms provide extensive learning resources. These include step-by-step guides, video tutorials, FAQs, and responsive customer support. Just as we believe in educating yourself about beauty ingredients, financial education empowers you to make better decisions about your money.

The Vision for the Future of Finance

The future of finance, as described by platforms like Coyyn.com, paints an exciting picture of integrated financial wellness. This vision goes far beyond simple payment processing to create a comprehensive ecosystem where traditional and digital currencies work seamlessly together.

DeFi integration represents one of the most significant developments on the horizon. This allows people to participate in decentralized lending and borrowing directly from their digital wallets, potentially earning higher returns than traditional savings accounts while maintaining control over their assets.

NFT support opens new doors for digital asset ownership. While NFTs have gained attention in art and collectibles, their applications extend to everything from digital certificates to unique financial instruments that could revolutionize how we think about ownership and value.

AI-based investment advisory promises to democratize financial planning. Instead of needing expensive financial advisors, AI-powered tools could provide personalized investment recommendations custom to your specific goals, risk tolerance, and financial situation. It’s like having a personal financial coach available 24/7.

Retail partnerships are making digital payments more practical for everyday life. As more stores accept digital currencies and integrate with modern payment platforms, using these services becomes as natural as paying with a credit card.

This comprehensive approach strongly emphasizes financial inclusion. Digital banking’s lower fees and mobile accessibility can serve populations traditionally excluded from conventional banking. By reducing barriers and providing affordable services, these platforms have the potential to bring financial wellness to people worldwide.

The evolving fintech landscape promises a future where managing money becomes more intuitive, accessible, and aligned with your personal values – much like how the beauty industry has evolved toward cleaner, more personalized products that truly serve individual needs.

Frequently Asked Questions about Coyyn.com

We know navigating digital finance can feel overwhelming, especially when you’re trying to understand what different platforms actually offer. Let’s clear up some common questions about Coyyn.com banking and help you make informed decisions about your financial wellness journey.

Is Coyyn.com a real, licensed bank?

The short answer is no. Coyyn.com appears to be a financial technology information hub that writes extensively about digital banking services, rather than a government-chartered and licensed banking institution itself. Think of it like a financial education website that helps you understand the digital banking landscape.

This distinction is really important for your financial safety. While Coyyn.com provides valuable educational content and insights into the digital finance world, it doesn’t offer direct banking services like holding your deposits, issuing loans, or managing traditional bank accounts.

Before using any financial service, we always recommend performing your own due diligence. This means verifying the regulatory status of any platform claiming to offer actual banking services. Your money deserves that extra layer of protection!

What is the difference between Coyyn.com and Coyni.com?

This is where things can get a bit confusing, and we’re glad you asked! Based on our research, these are two completely different platforms with similar names.

Coyyn.com is a content platform focused on digital finance, AI, and blockchain education. It serves as an informative resource, publishing articles, guides, and news about the evolving financial landscape. Think of it as your go-to source for learning about fintech trends and digital banking concepts.

Coyni.com, on the other hand, is a specific payment system that uses a USD-backed stablecoin for business and personal transactions. Coyni.com is a functional digital currency platform that you can actually use to send and receive payments, while Coyyn.com is an educational and informational website about digital finance topics.

It’s like the difference between a cooking blog that teaches you about nutrition and a meal delivery service that brings food to your door – both valuable, but serving completely different purposes!

How can I verify the legitimacy of any online banking platform?

This is such an important question, and we’re so glad you’re thinking about verification before diving in. Your financial security should always come first, just like how you’d research ingredients before trying a new skincare product.

Regulatory licensing is your first checkpoint. Confirm if the platform is licensed and regulated by the appropriate financial authorities in your jurisdiction. In the US, look for FDIC registration; in the UK, check for FCA approval. This information should be clearly displayed on their website – if you have to hunt for it, that’s a red flag.

Deposit insurance is crucial if it’s claiming to be a bank. Ensure your deposits would be insured up to the applicable limits. Security measures should include robust protection like encryption, multi-factor authentication, and fraud detection systems. These aren’t optional extras – they’re essentials.

Independent reviews from reputable financial publications or consumer protection sites can give you real insights beyond marketing claims. Look for transparent contact information including physical addresses, phone numbers, and responsive customer support channels. A legitimate platform won’t hide behind a generic email address.

Finally, examine their fee structures for transparency with no hidden charges, and research the company’s background, founding team, and partnerships. Trust your instincts – if something feels off, it’s worth investigating further.

Taking time to verify legitimacy isn’t being overly cautious – it’s being smart about your financial wellness. Just like we believe in researching beauty products at Beyond Beauty Lab, your money deserves the same careful consideration.

Conclusion: Financial Wellness in the Digital Age

Exploring digital finance through platforms like Coyyn.com banking has shown us just how rapidly our financial landscape is changing. It’s both exciting and, let’s be honest, sometimes a little overwhelming! As we’ve finded throughout this journey, Coyyn.com serves as a valuable educational resource, helping us understand the intricate world of digital currencies, blockchain technology, and artificial intelligence in finance.

What strikes us most is how these technological advances aren’t just fancy buzzwords – they’re reshaping how we think about money, payments, and financial security. The key takeaway? While the tools are evolving, the fundamentals of financial literacy and making informed decisions remain as important as ever.

At Beyond Beauty Lab, we’ve always believed that true wellness extends far beyond skincare routines and beauty products. Just as we encourage you to read ingredient labels and understand what you’re putting on your skin, we believe in empowering you with the knowledge to steer your financial choices confidently. Your financial wellness is deeply connected to your overall sense of well-being and peace of mind.

The digital change in finance offers incredible opportunities. We’re talking about faster transactions, lower fees, and financial services that are accessible 24/7 from your smartphone. But with these opportunities comes the responsibility to stay informed and practice due diligence. Whether it’s choosing a skincare product or a financial platform, knowledge is your best protection.

The beauty of platforms like Coyyn.com is that they make complex financial concepts more approachable. They bridge the gap between traditional banking and the digital future, helping everyday people like us understand what’s happening in the fintech world. This kind of education is invaluable as we work toward financial inclusion and helping underserved communities access better financial tools.

As you continue your journey toward holistic wellness, managing your finances thoughtfully is just as important as any other aspect of self-care. The digital age has given us powerful tools, but the most powerful tool remains your commitment to learning and making informed choices.

At Beyond Beauty Lab, we believe that managing your financial wellness with knowledge from trusted resources is a key part of living a balanced and beautiful life. Whether you’re exploring new payment methods, learning about digital currencies, or simply working to budget better, every step toward financial literacy is a step toward a more confident, empowered you.

For more insights into holistic wellness and informed living, visit us at https://beyondbeautylab.com/.