Navigating the New Frontier of Financial Wellness

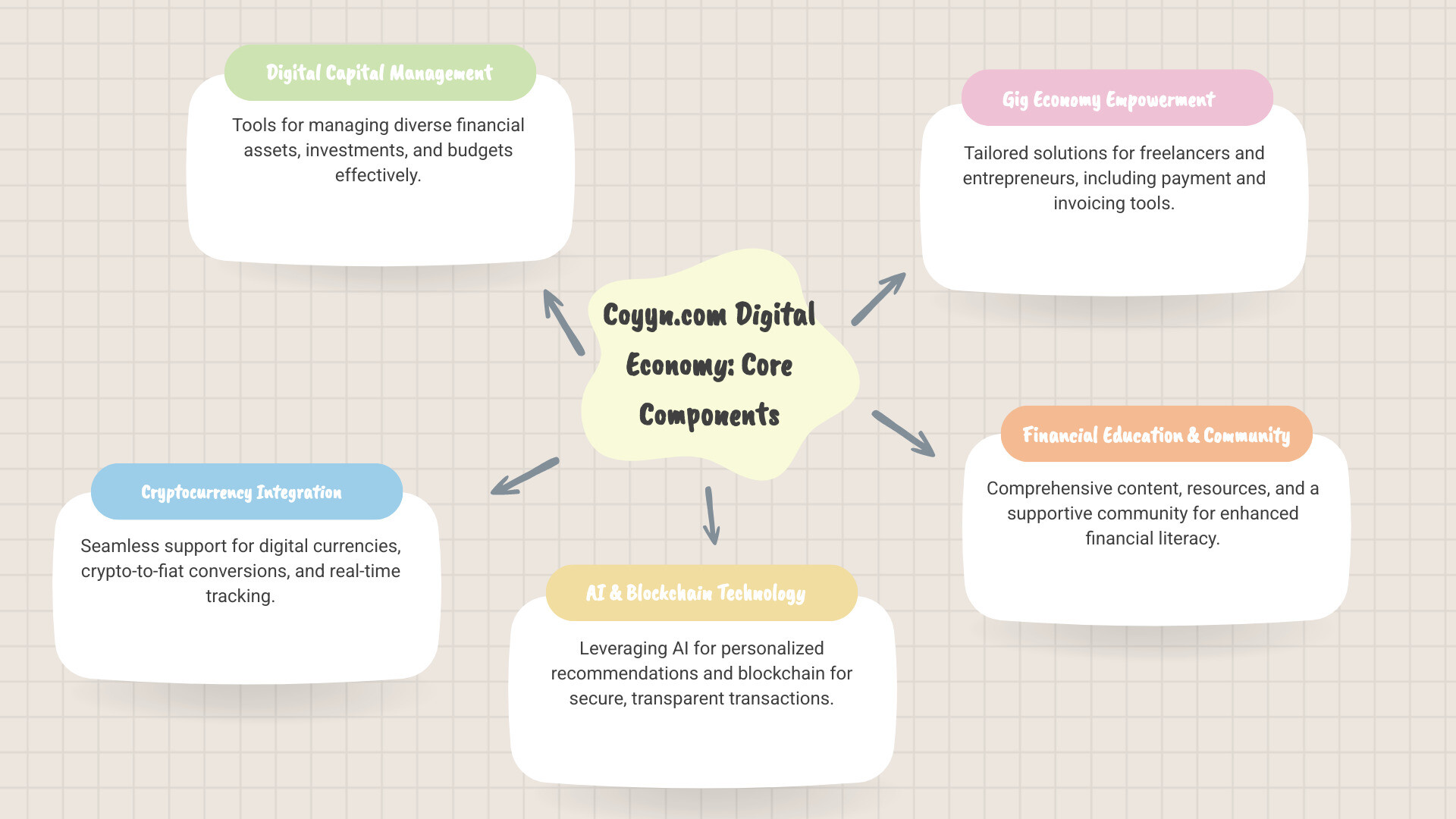

The coyyn.com digital economy represents a comprehensive platform that bridges traditional banking with modern digital tools like cryptocurrency, blockchain, and AI-powered services to help users manage their financial lives more effectively.

Quick Overview: Coyyn.com Digital Economy

- What it is: An online finance platform combining traditional banking with digital innovation

- Core services: Digital capital management, financial education, gig economy support

- Key features: Cryptocurrency support, AI-powered matching, blockchain security

- Target users: Individuals, businesses, and gig economy workers seeking financial empowerment

- Mission: Promote financial literacy and transparency in the digital age

In today’s fast-changing world, managing money has become more complex than ever. The rise of digital currencies, remote work, and online financial services has created new opportunities – but also new challenges.

Coyyn.com emerged from recognizing that people need better tools to understand and steer this digital financial landscape. The platform focuses on making complex financial concepts accessible while providing practical tools for everything from budgeting to cryptocurrency trading.

What makes this particularly relevant is the explosive growth of the gig economy. Research shows that 36% of US workers now participate in the gig economy, with projections reaching 50% by 2027. This shift means more people need flexible, digital-first financial solutions.

The platform stands out by combining transparency, education, and community engagement – values that align perfectly with those seeking holistic approaches to both financial and personal wellness.

Easy coyyn.com digital economy word list:

What is Coyyn.com and What is its Mission?

Think of Coyyn.com as your friendly guide through the sometimes overwhelming world of digital finance. Just like how we help you steer skincare routines and wellness practices, Coyyn.com makes the complex world of digital money management feel approachable and understandable.

At its core, Coyyn.com is a platform that bridges the gap between old-school banking and the exciting new world of digital assets. Their mission is beautifully simple: make digital capital management accessible to everyone, regardless of your tech background or financial expertise.

What sets Coyyn.com apart is their commitment to transparency and integrity – values that resonate deeply with anyone seeking authentic, trustworthy resources. Coyyn emerged from a realization that understanding economic history is crucial for building solid digital financial tools. This thoughtful approach means their solutions aren’t just trendy – they’re built on a foundation of real financial wisdom.

The coyyn.com digital economy platform focuses heavily on financial literacy. They believe that understanding your digital assets should be as straightforward as understanding your wellness routine. Their educational content breaks down complex concepts like cryptocurrency, blockchain technology, and digital investments into bite-sized, digestible pieces.

What really excites us about Coyyn.com is how they empower users through education rather than just offering another financial app. They provide transparency into their AI recommendations, letting you peek behind the curtain to understand why certain suggestions are made. This builds the kind of trust that’s essential when dealing with your financial future.

The platform serves individuals, businesses, and gig economy workers who want more control over their financial wellness. Whether you’re a freelancer managing irregular income or someone curious about cryptocurrency, Coyyn.com offers tools and knowledge to help you thrive in today’s digital economy.

For those interested in diving deeper into how platforms like this are reshaping business, check out this comprehensive Fintechzoom.com Business Complete Guide for additional insights.

How Coyyn.com Leverages Technology in the Digital Economy

Technology is the beating heart of the coyyn.com digital economy. Think of it like the perfect skincare routine – every component works together to create something truly transformative. Coyyn.com combines artificial intelligence, blockchain technology, and cloud computing to create a financial platform that’s not just smart, but genuinely helpful.

What makes this approach special is how these technologies work together. It’s not about throwing every new tech trend at the wall to see what sticks. Instead, Coyyn.com carefully integrates each piece to solve real problems that people face when managing their digital finances.

The platform stays ahead of the curve by constantly evolving. Just like how we’re always learning about new wellness practices, Coyyn.com keeps updating its technology to meet users’ changing needs. This commitment to innovation means better security, more personalized experiences, and tools that actually make financial management easier. For those curious about the broader impact of AI in financial services, this resource provides more info about AI’s role in finance.

The Role of AI, Blockchain, and Smart Contracts

Artificial intelligence on Coyyn.com works like having a really smart financial advisor who never sleeps. The platform uses something called DeepRecs™ technology, which combines image recognition and natural language processing to give you personalized recommendations. The best part? It doesn’t need years of your financial history to start helping you make better decisions.

Here’s where it gets really interesting for gig workers and freelancers. The AI-powered matching system is a game-changer. Research shows these AI-powered matching algorithms improve job completion rates by 42% and can cut job search time in half. That means less time scrolling through endless job listings and more time actually earning money.

Blockchain technology provides the security backbone for everything. Think of it as an unhackable digital ledger that keeps track of every transaction. It’s like having a security system that never takes a day off, protecting your digital assets and ensuring complete transparency.

Smart contracts are where things get really clever. These automated agreements handle transactions without needing a middleman. The results speak for themselves – payment disputes have dropped by 42% and transaction costs have been reduced by nearly a third. That means faster payments, fewer headaches, and more money staying in your pocket where it belongs.

For anyone wanting to dive deeper into the crypto world, the Fintechzoom.com Crypto Ultimate Guide offers comprehensive insights.

Digital Assets and Cryptocurrencies in the Coyyn.com Ecosystem

The digital currency world isn’t just growing – it’s exploding. The global market hit USD 5.81 billion in 2023 and experts predict it’ll reach USD 16.95 billion by 2032. This isn’t a passing trend; it’s a fundamental shift in how we think about money and value.

Within the coyyn.com digital economy, managing cryptocurrencies feels as natural as checking your bank balance. The platform supports multiple digital currencies with real-time price tracking and seamless crypto-to-fiat conversions. You can trade, invest, or even use crypto for everyday purchases without jumping through complicated hoops.

Tokenization is another powerful feature that transforms real-world assets into digital tokens. Imagine being able to invest in real estate or artwork through digital tokens – it opens up opportunities that were once only available to wealthy investors. This process increases liquidity, reduces costs, and brings unprecedented transparency to asset management.

The platform makes cryptocurrency accessible to everyone, not just tech enthusiasts. Whether you’re a complete beginner or an experienced trader, the tools are designed to meet you where you are. For those looking to understand Bitcoin specifically, the Fintechzoom.com Bitcoin Price Guide 2025 provides valuable market insights and practical guidance.

Empowering Users: Content, Community, and the Gig Economy

At Coyyn.com, we believe that true financial empowerment comes from three essential pillars: quality education, supportive community, and practical tools for the modern workforce. Just like how we approach wellness at Beyond Beauty Lab – where knowledge and community support lead to better choices – the coyyn.com digital economy thrives when users feel confident, connected, and equipped with the right resources.

Think of it this way: you wouldn’t start a skincare routine without understanding your skin type, right? The same goes for your financial journey. That’s why we’ve built our platform around the idea that informed users make better financial decisions, and supported users achieve better results.

Financial Literacy Through Comprehensive Content

We’ve created what we like to call a financial education playground – a space where complex topics become approachable and actionable. Our content library covers everything from basic budgeting to advanced investing strategies, with special attention to debt management and saving techniques that actually work in real life.

What makes our approach special is our user-friendly Content Management System, which includes something called Content Assist. This feature offers pre-written, personalized content that adapts to your specific financial situation. No more generic advice that doesn’t fit your life!

We break down financial jargon into conversations you might have with a trusted friend. Whether you’re trying to understand cryptocurrency basics or planning your first investment, our goal is to make you feel confident, not confused. This mirrors how we approach beauty education – making the complex simple and the intimidating approachable.

The beauty of comprehensive financial literacy tools is that they work best when they’re actually used. That’s why our content isn’t just informative – it’s engaging and practical. For those looking for broader money management guidance, our Fintechzoom.com Money Guide provides excellent additional resources.

A Deep Dive into the Coyyn.com Gig Economy

Here’s a statistic that might surprise you: 36% of US workers now participate in the gig economy, and experts predict this number will hit 50% by 2027. That’s not just a trend – that’s a complete change of how we work and earn money.

The gig economy isn’t just about driving for ride-share apps anymore. It includes freelancers, consultants, creative professionals, and entrepreneurs who are building businesses on their own terms. What’s really interesting is that 63% of gig workers now maintain traditional employment alongside their freelance work, creating these hybrid work models that offer both security and flexibility.

Coyyn.com recognized early on that these workers needed financial tools designed specifically for their unique challenges. Traditional banks weren’t built for people with multiple income streams, irregular payment schedules, or global client bases. That’s where our platform shines.

We provide automated invoicing that takes the headache out of getting paid, smart accounting that tracks multiple income sources, and global payment systems that work whether your client is in your hometown or halfway around the world. Our research shows that reliable financial infrastructure leads to a 75% increase in worker satisfaction and retention – because when you’re not stressed about getting paid, you can focus on doing great work.

The Coyyn.com Gig Economy guide offers detailed insights into navigating this landscape successfully. And for those interested in building wealth through various strategies, including passive income, 5StarsStocks.com Best Passive Stocks provides valuable investment perspectives.

What excites us most is seeing how community engagement and knowledge sharing help gig workers support each other. Just like how beauty enthusiasts share tips and experiences, the financial wellness community thrives when people share their successes, challenges, and solutions.

Benefits and Risks: A Balanced Look at the Coyyn.com Digital Economy

When exploring the coyyn.com digital economy, it’s important to understand both sides of the coin. Just like choosing the right skincare routine, making informed financial decisions requires knowing what works well and what potential challenges you might face. We believe in giving you the complete picture so you can make choices that truly serve your financial wellness.

Key Advantages for Individuals and Businesses

The coyyn.com digital economy offers some genuinely exciting benefits that can transform how you manage your money. Think of it as upgrading from basic financial tools to a comprehensive wellness routine for your finances.

Strong security stands as one of the platform’s biggest strengths. Using blockchain technology and advanced security protocols, Coyyn.com protects your transactions and personal data with the same care you’d want for your most precious beauty secrets. While no system is completely bulletproof, their commitment to security is impressive.

The platform shines with its ease of use. Complex financial concepts are broken down into digestible pieces, making digital finance accessible even if you’re just starting out. It’s like having a friendly financial advisor who speaks your language rather than confusing jargon.

For those interested in digital currencies, the crypto support is comprehensive. You get real-time price tracking and can easily convert between crypto and traditional money. This flexibility means you’re not locked into one type of currency – pretty handy in today’s diverse financial landscape.

Business solutions are where Coyyn.com really flexes its muscles. The platform offers automated invoicing, smart accounting tools, and global payment systems. These features streamline operations and help businesses grow by eliminating the usual headaches of international payments and complex reward systems.

The global access aspect means you can manage your finances from anywhere with internet connection. Whether you’re traveling for work or just prefer handling money matters from your couch, the platform adapts to your lifestyle.

Perhaps most importantly, users see lower transaction costs and faster payments. Smart contracts have reduced transaction expenses by nearly a third while cutting payment disputes significantly. This efficiency translates to real savings and quicker settlements compared to traditional banking – more money staying in your pocket where it belongs.

Here’s how Coyyn.com’s approach compares to traditional banking:

| Feature | Coyyn.com Digital Approach | Traditional Banking |

|---|---|---|

| Speed | Near-instant transactions, especially for digital assets | Can involve delays, especially for international transfers |

| Cost | Reduced transaction fees, no physical overhead | Often higher fees for transfers, maintenance, etc. |

| Access | Global, 24/7 access via digital platforms | Limited by branch hours and geographical presence |

| Transparency | Blockchain-backed, auditable transactions | Often opaque processes, less direct oversight |

Navigating the Potential Drawbacks

Now let’s talk about the challenges – because every good financial decision requires understanding the potential bumps in the road.

Fraud risks and hacking remain real concerns in any digital space. While Coyyn.com employs strong security measures, you’ll still need to stay alert and practice good online habits. Think of it like protecting your skin from sun damage – the platform provides the SPF, but you still need to apply it correctly.

Market volatility is particularly relevant when dealing with cryptocurrencies. These digital assets can swing in value quite dramatically, sometimes within hours. While this creates opportunities for gains, it also means potential losses can happen quickly. It’s not unlike trying a new skincare ingredient – exciting potential, but worth starting slowly.

Regulatory uncertainty adds another layer of complexity. The rules governing digital assets are still evolving, which means the landscape can shift unexpectedly. This uncertainty affects both platforms and users, as new regulations might change how things operate.

The digital divide is a real barrier for some people. Participating in the coyyn.com digital economy requires reliable internet and appropriate devices. This unfortunately means some individuals might be left out simply due to lack of access to necessary technology.

Data protection remains an ongoing challenge. While Coyyn.com prioritizes safeguarding your information, the sheer amount of data involved in digital finance means constant vigilance is required. Preserving the integrity of digital evidence becomes crucial in maintaining trust and security.

The key is approaching these risks with knowledge and preparation. Just as we educate ourselves about ingredients before trying new beauty products, understanding these potential challenges helps you make smarter financial choices. For additional guidance on managing financial health, resources like Gomyfinance.com Credit Score can provide valuable insights.

Every financial tool has trade-offs. The goal is finding solutions that align with your comfort level and financial goals while staying informed about both opportunities and risks.

The Future is Digital: What’s Next for Coyyn.com and the Economy?

The future of finance isn’t just approaching – it’s already here, and the coyyn.com digital economy is leading the charge into this exciting new territory. Think of it like the evolution of skincare: what once seemed futuristic (like personalized serums based on DNA analysis) is now becoming mainstream. The same change is happening in finance, and it’s absolutely fascinating to watch unfold.

Web 3.0 and decentralized platforms are creating the next wave of innovation, much like how clean beauty revolutionized the wellness industry. This isn’t just tech talk – it’s a fundamental shift toward transparency and user control. Experts predict that Web 3.0 and decentralized platforms lead the next wave of innovation, with these platforms potentially capturing 35% of the gig economy by 2025. That’s a massive change that will affect how millions of people work and earn money.

Tokenized assets represent another game-changing trend that’s gaining momentum. Imagine being able to own a fraction of a famous painting or invest in real estate halfway across the world – all through digital tokens. It’s like having access to a global marketplace where traditional barriers simply don’t exist anymore. Coyyn.com is building the infrastructure to make this possible, creating tools that let users manage both traditional investments and these exciting new tokenized opportunities.

The integration of AI-based investing tools is particularly promising. Just as AI helps us personalize skincare routines based on individual needs, it’s now helping people optimize their financial strategies. These aren’t just fancy calculators – they’re sophisticated systems that can balance automated optimization with personal goals and preferences. The result? Smarter financial decisions and potentially better outcomes for everyday investors.

The numbers tell an incredible story of growth and opportunity. The global digital currency market is projected to reach USD 16.95 billion by 2032, showing just how much potential exists in this space. Coyyn.com is committed to staying at the center of these developments, continuously developing innovations like online investment advisors and digital ID systems that make finance more secure, faster, and transparent.

What excites us most is how these changes democratize financial opportunities. Just as Beyond Beauty Lab makes wellness knowledge accessible to everyone, the coyyn.com digital economy is making sophisticated financial tools available to people who might never have had access before. For more insights into how these economic trends are shaping our world, the Fintechzoom.com Economy guide offers valuable perspective on what’s coming next.

Frequently Asked Questions about Coyyn.com

We understand that stepping into the digital financial world can feel a bit overwhelming at first. That’s perfectly normal! Just like when you’re trying a new skincare routine or wellness practice, it’s natural to have questions. We’ve gathered the most common questions people ask about the coyyn.com digital economy and answered them in simple, straightforward terms.

What is the Coyyn.com Digital Economy?

Think of the coyyn.com digital economy as a bridge between the traditional banking world you know and the exciting new possibilities of digital finance. It’s an online platform that brings together familiar banking services with cutting-edge tools like cryptocurrency, blockchain technology, and AI-powered recommendations.

The main goal is really quite simple: to help you manage your digital money more effectively while learning about modern finance along the way. Whether you’re curious about bitcoin, want to understand how blockchain works, or need better tools for managing freelance income, this platform aims to make it all accessible and understandable.

It’s designed for real people – not just tech experts or finance professionals. The platform recognizes that financial wellness is just as important as physical wellness, and both require the right knowledge and tools to thrive.

Is Coyyn.com safe to use?

Safety is understandably one of the biggest concerns people have about digital finance platforms. The good news is that Coyyn.com takes security very seriously, using advanced blockchain technology and robust security protocols to protect every transaction and keep your personal information safe.

Blockchain technology acts like a digital fortress – it creates transparent, traceable records that are extremely difficult to tamper with or hack. This helps significantly reduce fraud and gives you peace of mind when managing your digital assets.

However, just like you wouldn’t leave your front door open uped, you still need to do your part. We always recommend practicing good online safety habits: use strong, unique passwords, be cautious of suspicious emails or messages, and never share your login details with anyone. Think of it as your digital skincare routine – consistency and good habits make all the difference!

How does Coyyn.com help gig economy workers?

If you’re part of the growing gig economy – whether you’re a freelancer, consultant, or running your own small business – you know how challenging it can be to manage the financial side of things. Coyyn.com was built with people like you in mind.

The platform offers automated invoicing that takes the hassle out of billing clients, smart accounting features that help track your income and expenses, and seamless global payment solutions that make it easy to get paid no matter where your clients are located.

But here’s where it gets really interesting: the platform uses AI-powered algorithms that can improve job matching by an impressive 85% and reduce administrative work by 60%. This means less time spent on paperwork and searching for projects, and more time doing what you love.

For gig workers, this translates to finding better-fitting projects faster, getting paid more reliably, and having the financial tools you need to treat your freelance work like the serious business it is. It’s like having a personal financial assistant that never takes a day off!

Conclusion

The coyyn.com digital economy represents something truly exciting – it’s not just another financial platform, but a complete ecosystem that puts real power in your hands. Throughout our exploration, we’ve seen how this innovative approach combines the best of traditional finance with cutting-edge technology like AI and blockchain to create something genuinely transformative.

What strikes me most about Coyyn.com is how it mirrors our own philosophy here at Beyond Beauty Lab. Just as we believe that true beauty comes from being informed and making conscious choices, Coyyn.com champions the idea that financial wellness starts with understanding and education. The platform’s commitment to transparency, financial literacy, and community support creates a foundation where users can thrive rather than just survive.

The numbers speak for themselves – from 42% improvements in job completion rates through AI-powered matching to significant reductions in transaction costs through smart contracts. But beyond the statistics, what’s really compelling is how Coyyn.com is helping reshape the financial landscape for the 36% of workers already participating in the gig economy, with projections showing this will reach 50% by 2027.

As we’ve learned, the future is undeniably digital. Web 3.0, tokenized assets, and AI-based investing aren’t just buzzwords – they’re the building blocks of tomorrow’s financial world. With Coyyn.com as your guide, you’re not just keeping up with these changes; you’re positioned to benefit from them.

The journey toward financial wellness is deeply personal, much like your wellness and beauty routines. It requires the right tools, reliable information, and ongoing support. The coyyn.com digital economy provides all three, creating a space where financial empowerment becomes not just possible, but practical and accessible.

As we continue to champion holistic well-being in all its forms, we’re excited to see platforms like Coyyn.com making financial wellness more achievable for everyone. Your financial health is just as important as your physical and emotional well-being – they all work together to create a truly fulfilling life.

Ready to explore more ways to improve your overall wellness journey? Explore more resources on financial well-being and find how taking care of your finances can be just as rewarding as taking care of yourself.