Understanding CoreWeave Stock: A Deep Dive into the AI Infrastructure IPO

CoreWeave stock has become a hot topic for investors since its March 2025 IPO, marking a major new entry in the AI infrastructure market. Here’s a breakdown of what you need to know:

Key CoreWeave Stock Facts:

- Ticker Symbol: CRWV (Nasdaq)

- IPO Date: March 28, 2025

- Current Market Cap: $47.90 billion

- 52-Week Range: $33.52 – $187.00

- 2024 Revenue: $1.92 billion (+736.64% growth)

- Analyst Rating: Hold with $106.79 price target

At Beyond Beauty Lab, we view financial wellness as an essential part of holistic wellbeing. Understanding fast-moving market topics like the CoreWeave IPO can help our readers evaluate risk, set goals, and make informed choices that support long-term wellness plans.

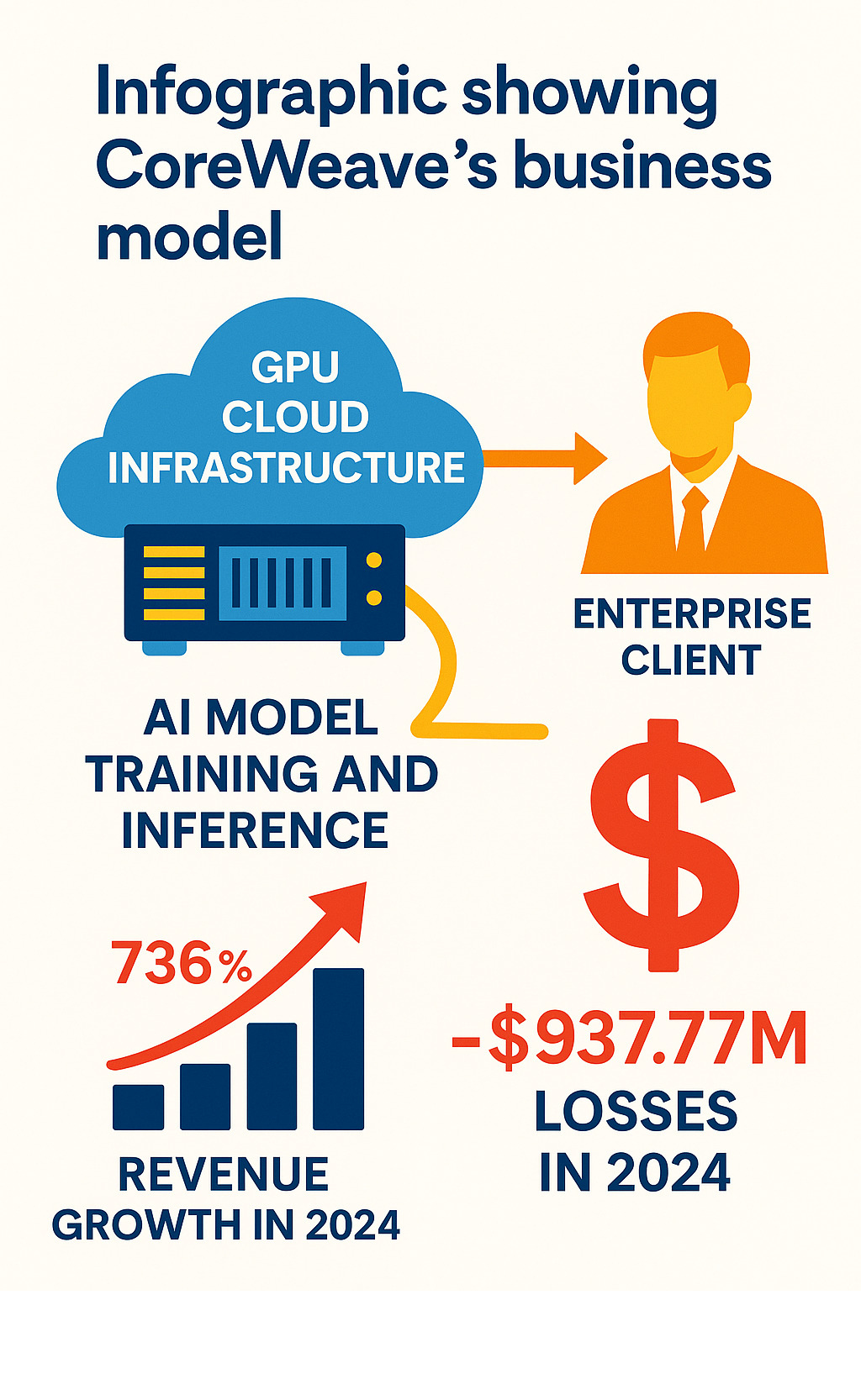

CoreWeave is an AI cloud-computing startup providing the specialized GPU infrastructure that AI developers and companies need. Their business is all about offering the raw power for AI model training and inference – the essential backbone of the current AI boom.

The company’s financials tell a complex story. While revenue exploded over 700% in 2024 to $1.92 billion, it also posted significant losses of $937.77 million. This reflects the high cost of building AI infrastructure at such a massive scale.

Since its IPO, CoreWeave stock has been volatile. Shares have swung from highs near $187 to lows around $33, reflecting excitement over AI and concerns about profitability. Analyst coverage is mixed; some see a pure-play on AI growth, while others are cautious about heavy spending and debt.

The stock is sensitive to earnings reports, often dropping after quarterly results despite strong revenue. This highlights the market’s focus on translating growth into sustainable profits.

Common coreweave stock vocab:

- 5starsstocks.com passive stocks (https://beyondbeautylab.com/5starsstocks-com-best-passive-stocks/)

- traceloans.com auto loans (https://beyondbeautylab.com/traceloans-auto-loans-complete-guide/)

- traceloans.com personal loans (https://beyondbeautylab.com/traceloans-personal-loans-complete-guide/)

Focus Keyphrase: coreweave stock

What is CoreWeave? The Engine Behind the AI Boom

Behind the magical AI tools we use daily lies an enormous amount of computational power. CoreWeave stock represents a company that has become essential to this AI revolution by providing that power.

Founded in 2017, CoreWeave, Inc. is a New Jersey-based AI cloud-computing startup. It has carved out a powerful niche as the go-to provider for companies needing serious computational muscle to train and run AI models.

Think of it this way: if regular cloud computing is a family car, CoreWeave offers a Formula 1 race car. They specialize in GPU infrastructure – super-powered processors that handle thousands of simultaneous calculations, which is exactly what AI needs to learn.

Beyond just hardware, CoreWeave’s proprietary chip management software optimizes how these powerful systems work together, like a master mechanic fine-tuning a race car. You can learn more about CoreWeave (https://en.wikipedia.org/wiki/CoreWeave) for more technical details.

Core Business Segments and Services

CoreWeave has built its business around giving AI developers exactly what they need: speed, power, and reliability. The heart of their business is GPU compute, providing access to massive arrays of the latest graphics processors, mainly from Nvidia. These are industrial-strength processors for training multi-million dollar AI models.

CoreWeave also offers CPU compute for traditional processing, plus high-performance networking to move data at lightning speed – critical when dealing with terabytes of information. Their storage solutions are designed for AI workloads, ensuring models get data as fast as they can consume it. For companies wanting power without the complexity, they offer managed services to handle the technical details.

Whether clients need flexible virtual servers or bare metal servers for maximum control, CoreWeave has options that scale from small experiments to enterprise-level AI projects.

Strategic Position in the AI Ecosystem

CoreWeave’s deep connection to key players in the AI world sets it apart. Its Nvidia partnership is a strategic alliance, giving it early access to the most advanced hardware.

This connection has paid off. CoreWeave built what Nvidia calls the world’s fastest AI supercomputer – a $1.6 billion facility in Plano, Texas, showcasing their commitment to pushing AI infrastructure boundaries.

The results are clear: CoreWeave has attracted major clients and is capturing AI dollars from Microsoft and Google, a significant achievement in a competitive market. Their data center expansion across the U.S. and Europe shows they are positioning themselves as the critical engine for AI projects worldwide.

This strategic positioning is why coreweave stock has attracted so much investor attention – they aren’t just riding the AI wave; they’re helping to create it.

The Journey of CoreWeave Stock: From IPO to Market Volatility

The journey of CoreWeave stock (CRWV) since its March 28, 2025 IPO has been a financial thriller, keeping investors on the edge of their seats.

CoreWeave’s Nasdaq debut was surprisingly quiet. Despite the AI hype, shares opened nearly 3% below the IPO price, a muted start for a highly anticipated company. But the stock didn’t stay down. By the third trading day, CoreWeave stock bounced back above its IPO price, signaling strong investor appetite for AI infrastructure and hinting at the volatility to come.

The numbers tell a dramatic story. With a 52-week range from $33.52 to $187.00, CRWV has given investors both thrilling highs and stomach-dropping lows. This volatility captures the market’s struggle to value this fast-growing, cash-burning company.

Recent months have been dramatic. After its Q2 earnings release, the stock dropped more than 10% in one session due to wider-than-expected losses, despite impressive revenue growth. This shows the market’s dual focus on growth and profitability.

One major event was the expiration of CoreWeave’s post-IPO lockup period, when insiders could first sell their shares. CoreWeave’s lockup expiration and its potential impact on the stock (https://www.marketwatch.com/story/coreweaves-lockup-is-about-to-expire-what-that-could-mean-for-the-stock-1228f44b) became a hot topic, as such events can create temporary selling pressure.

Key Events Impacting Stock Price

Several key moments have shaped CoreWeave stock’s volatile journey.

Earnings reports are consistently major market movers. While the company delivers impressive revenue growth, wider-than-expected losses have repeatedly spooked investors, creating tension between future excitement and present concerns.

The post-IPO lockup expiration added another layer of complexity by increasing the potential supply of shares for sale. While this can cause short-term pressure, it also increases the stock’s public float, which could reduce volatility over time.

Analyst rating changes have also influenced the stock’s swings. Wall Street is divided on CoreWeave – some are bullish on its position in the AI boom, while others worry about debt and profitability. These conflicting views fuel the stock’s unpredictability.

Broader market trends also play a role. Like any tech stock, CRWV is affected by general market sentiment. When AI stocks are in favor, CoreWeave tends to rise, and when investors get nervous, it often gets pulled down.

Historical Performance Since IPO

Since its debut as CRWV, CoreWeave has delivered a performance typical of a high-growth AI company: lots of excitement mixed with plenty of uncertainty. The stock’s journey from a muted debut to its current standing shows how quickly sentiment can shift in the AI space. Those dramatic swings between $33.52 and $187.00 represent real investor emotions, from fear to greed.

Volume spikes have often coincided with major news, showing that investors are paying close attention. The market reacts quickly and dramatically to news about partnerships, funding, or quarterly results.

Interestingly, CoreWeave stock has often moved independently of broader market indices, suggesting that company-specific factors are the primary drivers of its volatility. The stock’s performance perfectly captures the current state of AI investing: enormous potential paired with significant uncertainty.

Decoding the Financials: A Look at CoreWeave’s Numbers

To understand CoreWeave stock, you have to look at its wild financials, which tell a story of a company moving at breakneck speed. It’s like building a rocket ship while it’s launching – incredible momentum mixed with serious financial fireworks.

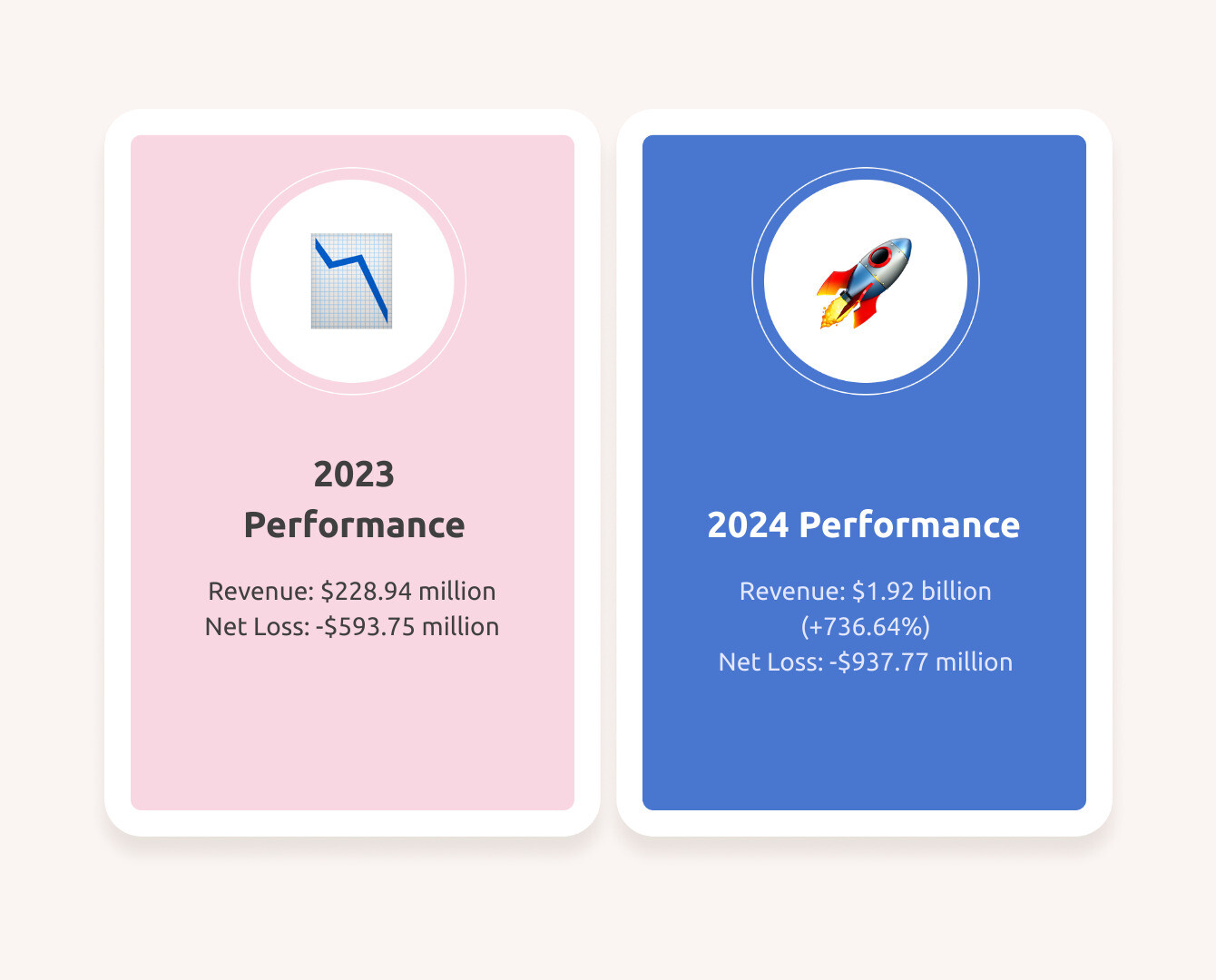

The numbers show explosive growth paired with explosive spending. CoreWeave’s 2024 revenue hit $1.92 billion, a staggering 736.64% jump from 2023. This seven-fold increase in a single year shows the power of riding the AI wave at the right moment.

But here’s the catch for some investors. Despite that revenue, CoreWeave lost $937.77 million in 2024, a 57.9% increase from its 2023 losses. The earnings per share reflect this, sitting at a negative -3.82.

Why is a company with such incredible revenue growth losing so much money? It comes down to an aggressive expansion strategy. CoreWeave is in a race to build the infrastructure for tomorrow’s AI, pouring cash into new data centers and expensive GPUs.

The company’s balance sheet reflects this spending. Total assets grew to $17.83 billion in 2024 (up 258.30%), but total liabilities also ballooned to $16.52 billion (up 223.44%). This means CoreWeave carries significant debt to fuel its growth, with a quarterly debt-to-equity ratio of 612.78%.

Despite the spending, there’s a silver lining. CoreWeave generated $2.75 billion in cash from operations in 2024, showing its core business is generating money. The issue is that it’s reinvesting all of it and more into expansion. Investing activities consumed $8.66 billion in 2024, explaining the need to raise $3.39 billion in financing in Q4 alone.

With a market cap around $47.90 billion, investors are betting this upfront investment will pay off. The question for anyone considering CoreWeave stock is whether the AI boom will be profitable enough to justify these massive expenditures. It’s a classic high-growth, high-risk scenario.

The Future of CoreWeave: Risks, Opportunities, and Analyst Outlook

The future of CoreWeave stock is a high-stakes race. As AI development accelerates, the demand for specialized computing power is soaring. This creates a landscape of incredible opportunities and significant challenges for CoreWeave.

We are in the early stages of the AI revolution. Every new AI breakthrough, solution, and startup needs serious computational muscle – exactly what CoreWeave provides.

Growth Prospects in the AI Sector

The growth story for CoreWeave is driven by surging AI demand across nearly every industry. CoreWeave’s expansion spending, while currently hurting profitability, is a strategic move. By investing heavily in new data center portfolio growth and acquiring cutting-edge GPUs, they are building the infrastructure for tomorrow’s AI traffic. This positions them to be the go-to provider, which could pay off handsomely.

What’s particularly exciting is how CoreWeave is capturing market share from cloud giants like Microsoft and Google. While these titans have their own cloud services, CoreWeave’s sharp focus on GPU-optimized infrastructure gives them a unique edge. They aren’t trying to be everything to everyone; they’re aiming to be the best at one very important thing.

Key Risks and Challenges for coreweave stock

Of course, CoreWeave stock faces real challenges. The high capital expenditure is staggering, with massive, ongoing investments in expensive hardware that quickly becomes outdated. This creates a constant need for capital.

Debt financing adds another layer of risk. CoreWeave has borrowed heavily to grow, increasing the pressure to deliver results and service its obligations.

Profitability concerns remain a key issue. The company is spending more than it makes, which is typical for high-growth tech but makes investors nervous. The question is when it will transition from growth to profit mode.

The competitive landscape is also heating up. Major cloud providers are pouring billions into their own AI infrastructure, which could squeeze CoreWeave’s market share.

Stock volatility has been extreme, with shares swinging from $33 to $187 in their first year. This can be difficult for investors who prefer steady returns and reflects fluctuating investor sentiment about high-growth, unprofitable tech stocks.

Analyst Consensus on coreweave stock

Wall Street analysts are debating CoreWeave stock, with smart people on both sides. The average ‘Hold’ rating and a 12-month price target of $106.79 mask these polarizing opinions.

Bull case supporters believe CoreWeave’s explosive 736% revenue growth proves it’s on the right track. They see today’s losses as the foundation for future market dominance and view its ability to win business from tech giants as proof of its superior strategy. Some analysts have even called stock price weakness a “screaming buy” opportunity.

Bear case advocates point to the nearly $1 billion loss in 2024 and question the sustainability of its debt-heavy balance sheet. They worry that expansion spending is out of control and that profitability is a distant dream. The lock-up expiration also raises concerns about selling pressure.

These polarizing Wall Street debates come down to a single question: will CoreWeave’s aggressive investment strategy lead to a dominant market position, or are the financial risks too great? It’s a classic growth vs. value investor dilemma.

Frequently Asked Questions about CoreWeave

We know that CoreWeave stock can be confusing, given the buzz around AI and the company’s unique market position. Here are answers to some of the most common questions.

Is CoreWeave a publicly traded company?

Yes, CoreWeave Inc. is a publicly traded company. It went public on March 28, 2025, and trades on the Nasdaq under the ticker symbol CRWV. The IPO was a major event for the AI sector, as it was one of the first pure-play AI infrastructure companies to go public. Since then, the stock has been volatile.

Why is CoreWeave losing money despite high revenue?

This is a key question for understanding CoreWeave stock. It seems strange for a company with nearly $2 billion in revenue to lose almost $938 million, but there’s a reason.

CoreWeave is in a massive building phase. The company is making huge capital expenditures, building new data centers and buying fleets of expensive, high-demand GPUs to meet the explosive demand for AI computing. These are some of the most advanced and costly computer chips in the world, requiring specialized facilities, cooling, and networks.

The strategy is simple: spend big now to capture market share while AI demand is exploding, then reap the rewards later from the profitable infrastructure. It’s a risky but common growth strategy for successful tech companies. The main question for investors is whether this aggressive expansion will pay off in the long run.

Who are CoreWeave’s main competitors?

CoreWeave faces competition from several directions. The biggest challenge comes from major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These tech giants have deep pockets and are also investing heavily in their own AI infrastructure.

However, CoreWeave isn’t trying to beat these companies at everything. It’s focusing specifically on being the best at GPU-powered AI computing. While the big cloud providers offer a wide range of services, CoreWeave is laser-focused on providing the most powerful and efficient GPU infrastructure for AI workloads.

There are also other specialized cloud computing companies offering GPU-based infrastructure, but the landscape is evolving rapidly. CoreWeave’s bet is that by specializing, it can offer better performance, flexibility, or pricing than its general-purpose competitors. Its explosive growth suggests this strategy is working so far.

Conclusion: Is CoreWeave a Stock for Your Portfolio?

Our deep dive into CoreWeave stock (CRWV) reveals a fascinating, high-risk, high-reward investment story. It’s a high-stakes game where the potential payoff is as enormous as the risks.

CoreWeave stock offers a pure-play investment in the AI revolution. Instead of focusing on AI applications, it provides the essential GPU infrastructure that powers them – like investing in the electric grid during the dawn of electricity.

The financials are complex. The explosive 736.64% revenue growth in 2024 to $1.92 billion is remarkable, showing CoreWeave is a key player in the AI boom. Companies are lining up for the computing power it provides.

But the risks are just as significant. Those losses of $937.77 million represent CoreWeave’s massive bet on the future, funded by heavy spending on data centers and GPUs.

The stock’s wild ride since its March 2025 IPO, swinging from $33.52 to $187.00, perfectly captures the market’s uncertainty. Investors are torn between euphoria over AI’s potential and concern about mounting losses.

Wall Street is split. Some analysts see CoreWeave stock as a “screaming buy,” believing current losses are just growing pains. Others worry about the $16.52 billion debt load and question if the company is expanding too quickly.

So, should CoreWeave be in your portfolio? It depends on your risk tolerance. If you are excited by transformative technologies and can handle significant volatility, CoreWeave might be worth considering. The potential upside is enormous if AI’s growth continues.

However, if you prefer steady returns or are risk-averse, this may not be the right investment for you. CoreWeave stock is not a “set it and forget it” investment; it requires attention and a strong stomach for volatility.

Even the most promising companies face risks. The AI boom could slow, or CoreWeave might struggle to turn revenue into profit. These are real risks to consider carefully.

From a financial wellness perspective, make sure your basics are covered first: maintain an emergency fund, tackle high-interest debt, and prioritize your core wellness budget. If you invest in speculative names like CoreWeave, consider them as small, high-risk satellite positions only after your foundation is secure.

We always recommend doing your own research and consulting with a financial advisor before making any investment decisions. Your financial goals are unique, and what works for one person might not work for another.

If you’re interested in exploring other investment strategies, you might find our articles on 5starsstocks.com passive stocks (https://beyondbeautylab.com/5starsstocks-com-best-passive-stocks/), traceloans.com auto loans (https://beyondbeautylab.com/traceloans-auto-loans-complete-guide/), and traceloans.com personal loans (https://beyondbeautylab.com/traceloans-personal-loans-complete-guide/) helpful for building a well-rounded financial picture.

Find more insights on our blog (https://beyondbeautylab.com/)