Why Clean Beauty Market Statistics Matter for Today’s Consumers

The clean beauty industry statistics reveal a movement that has leapt from niche shelves to the global spotlight. What once occupied a small corner of health-food stores is now a multibillion-dollar force reshaping cosmetics and personal-care standards.

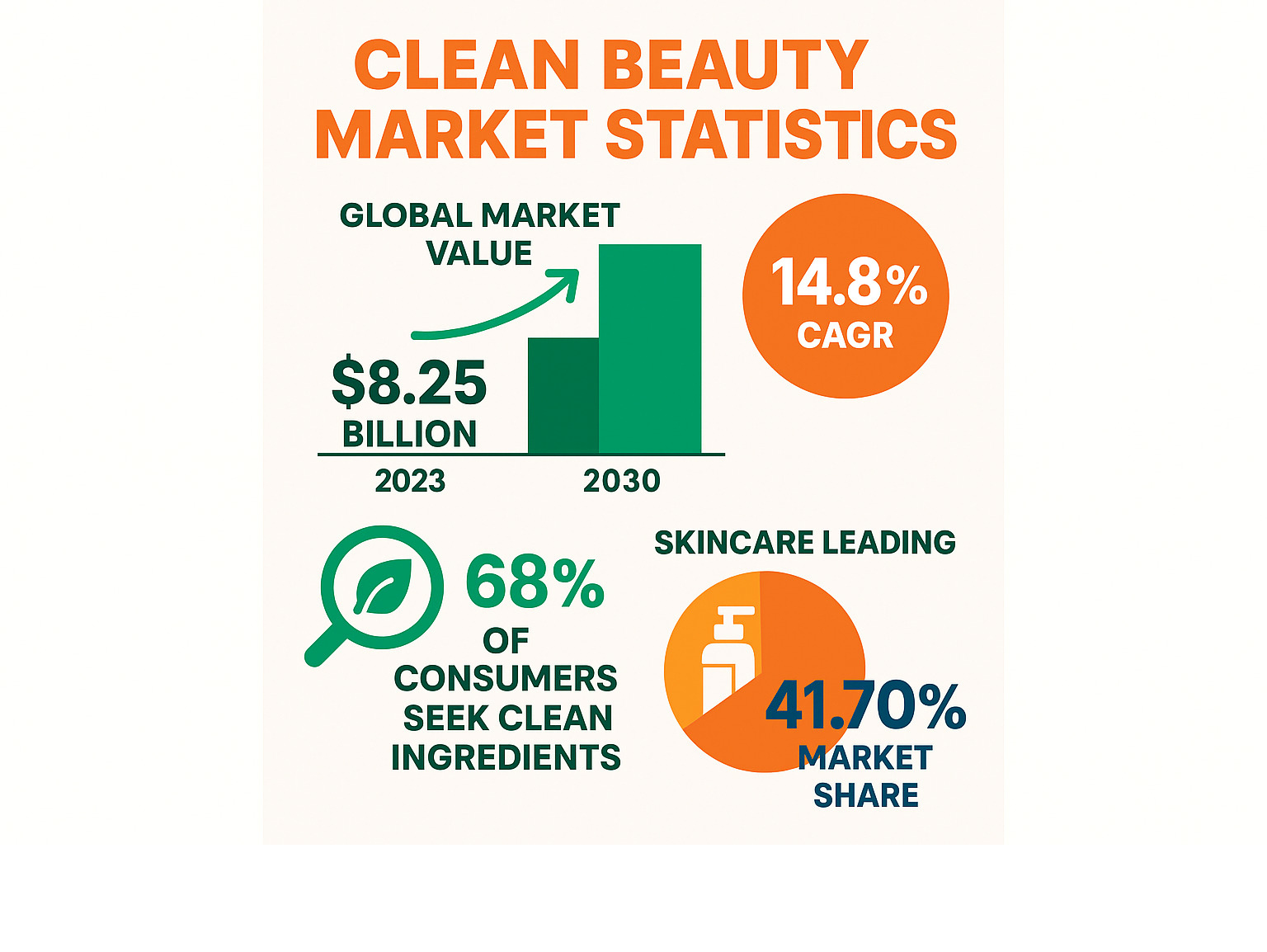

Key Numbers in One Glance

- Global Market Value: $8.25 billion in 2023, projected to hit $21.29 billion by 2030

- Growth Rate: 14.8 % CAGR—roughly four times the pace of conventional beauty

- Ingredient Demand: 68 % of shoppers intentionally seek clean skincare

- Top Category: Skincare captures 41.70 % of revenue

Social media is accelerating awareness: Instagram influences 41 % of beauty purchases and TikTok content tagged “clean beauty” has surpassed 1.3 billion views. Younger consumers may lead the charge, yet every age group is becoming more ingredient-savvy, proving clean beauty is no fleeting fad.

Rapid growth, however, brings questions about definitions, regulation, and potential greenwashing. The sections that follow unpack the numbers, people, and challenges shaping this fast-moving market.

The Explosive Growth of the Clean Beauty Market

When we dive into the clean beauty industry statistics, one thing becomes crystal clear: we’re witnessing something extraordinary. The numbers tell a story of consumer demand that’s reshaping the entire beauty landscape.

The global clean beauty market hit USD 8.25 billion in 2023, and here’s where it gets really exciting – experts project it will soar to USD 21.29 billion by 2030. That’s a compound annual growth rate of 14.8%, which is absolutely remarkable for any industry, let alone beauty.

But what makes this growth even more impressive is how it stacks up against traditional beauty. In 2021, clean beauty products saw 8.1% sales growth while the overall beauty and personal care industry managed just 2% growth. That’s a four-fold difference that shows clean beauty isn’t just keeping up – it’s leading the charge.

The pandemic, surprisingly, didn’t slow this momentum down. Instead, it actually accelerated consumer interest in clean products. Clean beauty sales climbed 33% in the first half of 2021, reaching a total of $1.6 billion. This growth during such a challenging time really demonstrates how much people value these products.

What’s particularly fascinating is that the global market is expected to reach $22 billion by 2024, showing that even the most conservative estimates point to massive expansion ahead.

This isn’t just a trend happening in one corner of the world – it’s a global shift. From North America to Asia-Pacific, consumers are increasingly willing to invest in products that align with their values around health, sustainability, and transparency.

The momentum behind these numbers reflects something deeper than just changing shopping habits. We’re seeing people fundamentally rethink what they want from their beauty products. For more insights into this change, check out our Clean Beauty Insights.

Decoding “Clean”: What It Means and Why It’s Complicated

Here’s where things get interesting – and a bit messy. The clean beauty industry statistics show explosive growth, but what exactly is driving this boom? The answer lies in understanding what “clean beauty” means, which turns out to be surprisingly complicated.

At its heart, clean beauty is about products that are safe for people and the planet. Think non-toxic ingredients, transparent labeling, and formulations you can feel good about using every day. But here’s the twist – clean doesn’t automatically mean organic or all-natural. A product can be perfectly clean while containing synthetic ingredients that are both safe and effective.

The plot thickens when we look at global regulations. The European Union has banned over 1,300 chemicals from cosmetics, while the United States restricts just 11. Yes, you read that right – eleven. This massive regulatory gap creates a wild west situation where what’s considered safe varies dramatically depending on where you live.

This regulatory disparity has given birth to the “dirty list” concept. Brands and retailers now create their own standards, with some maintaining lists of over 2,700 ingredients to avoid. Others focus on specific villains like parabens, sulfates, and phthalates. It’s like everyone’s playing by different rules in the same game.

The result? Consumer confusion on a massive scale. Research reveals that 65% of UK adults find it difficult to know if a brand is genuinely eco-friendly or just really good at marketing. This skepticism isn’t unfounded – greenwashing has become a real problem, with brands making misleading claims about their environmental or safety benefits.

Without standardized definitions, the industry has essentially become self-policing. Third-party certifications have stepped up to fill the gap, but even these vary in their standards and criteria. It’s no wonder consumers feel overwhelmed when trying to make informed choices.

The lack of regulation has created both opportunity and chaos. While it’s allowed innovative brands to flourish, it’s also made it harder for consumers to separate genuine clean products from clever marketing. For anyone feeling lost in this maze, our guide Beyond The Label How To Read Clean Beauty Ingredients Like A Pro offers practical tools for decoding what’s actually in your products.

The Conscious Consumer: Who’s Driving the Clean Beauty Boom?

Key Consumer Drivers and Values

Behind every impressive statistic in the clean beauty industry statistics lies a real person making conscious choices about what they put on their skin. These aren’t just numbers on a spreadsheet – they represent millions of consumers who’ve decided that what goes into their beauty products matters as much as how those products make them look.

The shift toward ingredient-focused purchasing has been nothing short of remarkable. Today, 68% of consumers actively seek out clean skincare brands, while 40.2% make natural ingredients their top priority when shopping. This represents a complete flip from the days when we chose products based on flashy advertising or celebrity endorsements. Now, consumers are reading ingredient lists like they’re studying for a test.

And honestly, they have good reason to be concerned. The average woman is exposed to 168 chemicals daily through personal care products alone. When you think about your morning routine – cleanser, moisturizer, sunscreen, makeup – those chemical exposures add up quickly. It’s no wonder that safety concerns have become such a driving force in purchasing decisions.

But it’s not just about personal health. The environmental impact weighs heavily on consumers’ minds too. An impressive 67% of shoppers have made changes to lessen their environmental impact, including seeking out recyclable or environmentally friendly packaging in beauty products. This “better for me, better for the planet” mindset is reshaping entire product lines.

The ethical considerations go even deeper. More consumers are seeking Cruelty-Free Beauty Products and Ethical Vegan Skincare options. These values have become non-negotiable for many shoppers, who see their beauty purchases as a reflection of their personal ethics.

Perhaps most telling is consumers’ willingness to put their money where their values are. More than one-third of customers knowingly pay higher prices for sustainable beauty products, with an additional 20% open to it depending on quality and price differences. This financial commitment proves that clean beauty isn’t just a passing trend – it’s a fundamental shift in consumer priorities.

Demographic Deep Dive: The Power of Gen Z and Millennials

If you want to understand where the clean beauty market is heading, look no further than the youngest consumers. The generational divide in the clean beauty industry statistics tells a fascinating story about how different age groups approach beauty and wellness.

The numbers reveal a clear pattern: 43% of Millennials and Gen Z consumers prefer natural skincare, compared to just 31% of the overall U.S. population. That 12-percentage-point difference might not sound huge, but it represents millions of consumers who are actively reshaping market demand with every purchase.

Gen Z consumers are particularly influential, being 1.3 times more likely to experiment with eco-friendly items in their daily routines. This generation didn’t have to “convert” to environmental consciousness – they grew up with it. Climate change, sustainability, and ingredient safety have always been part of their worldview, making clean beauty choices feel completely natural.

The role of social media in driving these trends cannot be overstated. A remarkable 41% of consumers say Instagram influenced their beauty purchases, while TikTok has generated over 1.3 billion views for clean beauty content. These platforms have completely transformed how beauty education happens, with consumers learning about ingredients and sharing experiences in real-time.

The engagement numbers are staggering. In 2023, clean beauty content had 5.7 million hashtag views on Instagram and 1.3 billion on TikTok. By 2024, Instagram views had grown to 6.3 million, showing how quickly this conversation is expanding. Young consumers aren’t just passively consuming this content – they’re creating it, sharing it, and building communities around it.

Women continue to drive the market, accounting for 83.63% of revenue in 2023. However, the men’s clean beauty segment is growing rapidly, with a projected growth rate of 15.4% from 2024 to 2030. This expansion shows that clean beauty values are spreading beyond traditional demographics.

The purchasing behavior of these demographics is particularly interesting. Women aged 35-54 are especially engaged, with 65% actively checking ingredient lists before making purchases. This “ingredient-first” approach represents a fundamental shift in how we shop for beauty products – from impulse buying to informed decision-making.

What’s remarkable is how these younger consumers have turned beauty shopping into an educational experience. They’re not just buying products; they’re researching formulations, understanding ingredient benefits, and making choices that align with their values. This approach is driving the entire clean beauty market forward and setting new standards for transparency and accountability in the industry.

A Closer Look at Clean Beauty Industry Statistics by Segment

Key Clean Beauty Industry Statistics for Products and Users

Skincare remains the undisputed leader, accounting for 41.70% of 2023 revenue. Consumers apply these products daily, so ingredient scrutiny is naturally highest here. Meanwhile, color cosmetics boast the quickest expansion, with a projected 15.4% CAGR through 2030, signaling that performance and clean formulas can coexist. Haircare and men’s grooming are also rising as shoppers demand safer shampoos, styling aids, and beard products.

Key Clean Beauty Industry Statistics for Regions and Retail

On a global level, mature markets currently generate the largest revenue, while emerging markets post the fastest year-over-year growth. Specialty beauty stores captured about one-third of sales in 2023, thanks to their curated assortments and ingredient education. E-commerce, however, is expanding even faster (15.7% projected CAGR) because detailed product information, reviews, and community feedback are only a click away.

Major retailers now stock dozens of brands that meet internally defined “clean” standards, making safer formulas accessible well beyond boutique shelves. For tips on navigating trusted online shops, visit our guide to Where To Shop Trusted Sites Stores For Clean Beauty.

Navigating the Challenges: Barriers to Trust and Growth

Despite impressive clean beauty industry statistics, several headwinds threaten long-term momentum.

Trust & Transparency

A majority of shoppers struggle to verify whether brands’ eco-claims are accurate, fuelling skepticism and slowing adoption. The absence of a universal, legally enforced definition of “clean” leaves consumers comparing ingredient “no-lists” that differ from retailer to retailer.

Pricing Perception

Cleaner raw materials, sustainable packaging, and ethical sourcing often raise production costs. Many non-buyers cite price as their primary deterrent, underscoring the need for affordable yet effective options.

Effectiveness & Ingredient Anxiety

Some shoppers still assume natural formulas won’t perform as well as conventional counterparts, while others avoid products altogether if they can’t understand the ingredient list. Clear science communication – backed by third-party data – remains critical.

Brands that accept radical transparency, publish full ingredient breakdowns, and obtain reputable certifications can bridge these gaps. For real-world examples, explore our list of Transparent Skincare Brands.

Frequently Asked Questions about the Clean Beauty Industry

What is the current market value of the clean beauty industry?

According to the latest clean beauty industry statistics, global sales reached USD 8.25 billion in 2023 and are expected to grow to USD 21.29 billion by 2030 – representing a powerful 14.8% CAGR.

What is the biggest challenge facing the clean beauty industry?

The largest obstacle is the absence of a universally accepted, regulated definition of “clean.” Without clear standards, greenwashing persists and consumers find it hard to differentiate genuine efforts from marketing hype.

Which consumer group is most influential in the clean beauty market?

Millennials and Gen Z remain the loudest champions: 43% prefer natural skincare, and their social-media influence amplifies clean-beauty education worldwide. While women still account for the majority of sales, interest is rapidly expanding across genders and age brackets.

Conclusion: The Future is Clean, Transparent, and Growing

The clean beauty industry statistics we’ve explored reveal something remarkable happening in the beauty world. This isn’t just another trend that will fade away – it’s a complete reimagining of what beauty means to consumers.

Think about it: we’ve gone from a $8.25 billion market in 2023 to projections of $21.29 billion by 2030. That’s not just growth – that’s a revolution happening in real time. When 68% of consumers actively seek clean ingredients and clean beauty products are growing four times faster than traditional beauty, we’re witnessing a fundamental shift in what people value.

The numbers tell us that this change is being driven by real people making conscious choices. 43% of younger consumers prefer natural skincare, but what’s really exciting is that we’re seeing adoption across all age groups. The 55-64 demographic showed the largest increase in clean beauty households, proving that the desire for cleaner, safer products transcends generational boundaries.

From North America’s 35.08% market share to Asia-Pacific’s explosive 15.9% growth rate, clean beauty has become a global phenomenon. It’s reshaping beauty standards in every corner of the world, creating new expectations for transparency, safety, and environmental responsibility.

But let’s be honest – the path forward isn’t without its bumps. The lack of standardized definitions creates confusion, and consumer skepticism about greenwashing is real and justified. 65% of consumers find it difficult to know if brands are overstating their eco-claims, and that’s a problem the industry needs to solve.

The good news? These challenges are driving innovation and pushing the industry toward greater transparency and authenticity. Brands that truly commit to clean beauty principles are finding ways to stand out, while those making empty promises are being called out by increasingly educated consumers.

What gives us hope is seeing how informed consumers make better choices. When people understand ingredients, recognize genuine sustainability efforts, and demand corporate transparency, the entire industry lifts. This creates a positive cycle where better products lead to more educated consumers, who then demand even better products.

The demographic trends are particularly encouraging. While Gen Z and Millennials lead the charge with their social media influence and environmental consciousness, the broadening appeal across age groups suggests that clean beauty values are becoming universal rather than niche.

At Beyond Beauty Lab, we’re committed to being part of this positive change. The statistics show that education and transparency are key to helping consumers steer this evolving landscape. When you understand what to look for, how to read labels, and which brands truly walk the talk, you can make choices that align with your values and beauty goals.

The future of beauty is undeniably clean, transparent, and growing. As consumers become more ingredient-savvy, environmentally conscious, and demanding of authentic brand promises, the clean beauty industry will continue to evolve in exciting ways.

Ready to be part of this beauty revolution? Learn more about our approach to Clean Beauty and find how you can make informed choices that benefit both you and the planet.

The revolution is here, and the numbers prove it’s here to stay.