Why Quantum Computing Stocks Are the Next Big Investment Frontier

The best quantum computing stocks represent a major investment opportunity. While the beauty industry evolves with sustainable innovations, the quantum sector is ready for explosive growth that could reshape entire industries.

Top quantum computing stocks to watch:

- IonQ (IONQ) – Pure-play leader with trapped-ion technology

- Microsoft (MSFT) – Azure Quantum platform and topological qubits

- IBM (IBM) – Quantum System One computers and enterprise focus

- Nvidia (NVDA) – GPU technology powering quantum development

- Alphabet (GOOGL) – Google’s Quantum AI and Sycamore processor

- D-Wave Quantum (QBTS) – Pioneer in quantum annealing systems

- Honeywell (HON) – Quantinuum subsidiary with qubit breakthrough

The quantum computing market, valued at $1.3 billion in 2024, is projected to hit $5.3 billion by 2029, a compound annual growth rate of 32.7%. This technology promises to solve problems that are impossible for traditional computers.

Unlike regular computers using bits (0 or 1), quantum computers use qubits, which can exist in multiple states at once. This gives them immense power for tasks like drug findy, financial modeling, and materials science. Investors can choose from high-risk pure-play companies, established tech giants, or companies supplying essential components.

Step 1: Grasp the Basics of Quantum Technology

Before investing in the best quantum computing stocks, understand the technology. Think of it like learning about skincare ingredients before buying new products.

Traditional computers use bits (0 or 1). Quantum computers use qubits, which can be 0, 1, or both simultaneously due to a principle called superposition. This allows them to solve problems that would take classical computers millennia.

Quantum computers have powerful applications. In medicine, they can simulate molecules to accelerate drug findy. In finance, they can optimize trading strategies and improve fraud detection. In materials science, they can help design new materials.

Companies are pursuing several different technologies to build these machines:

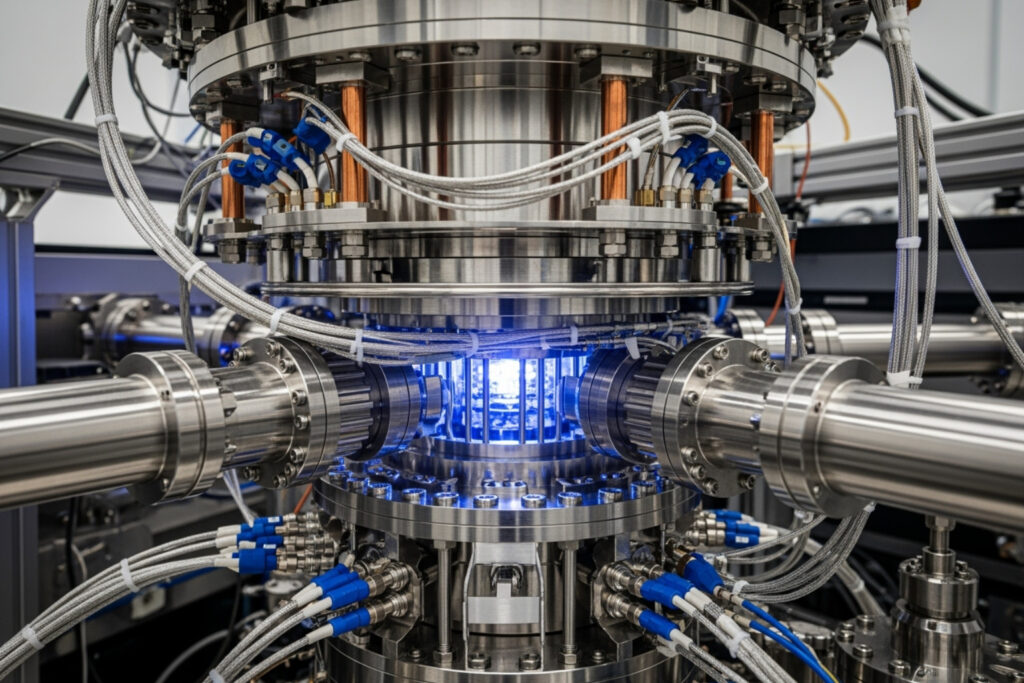

- Superconducting qubits: Used by IBM and Google, these require extremely cold temperatures, close to absolute zero, to function.

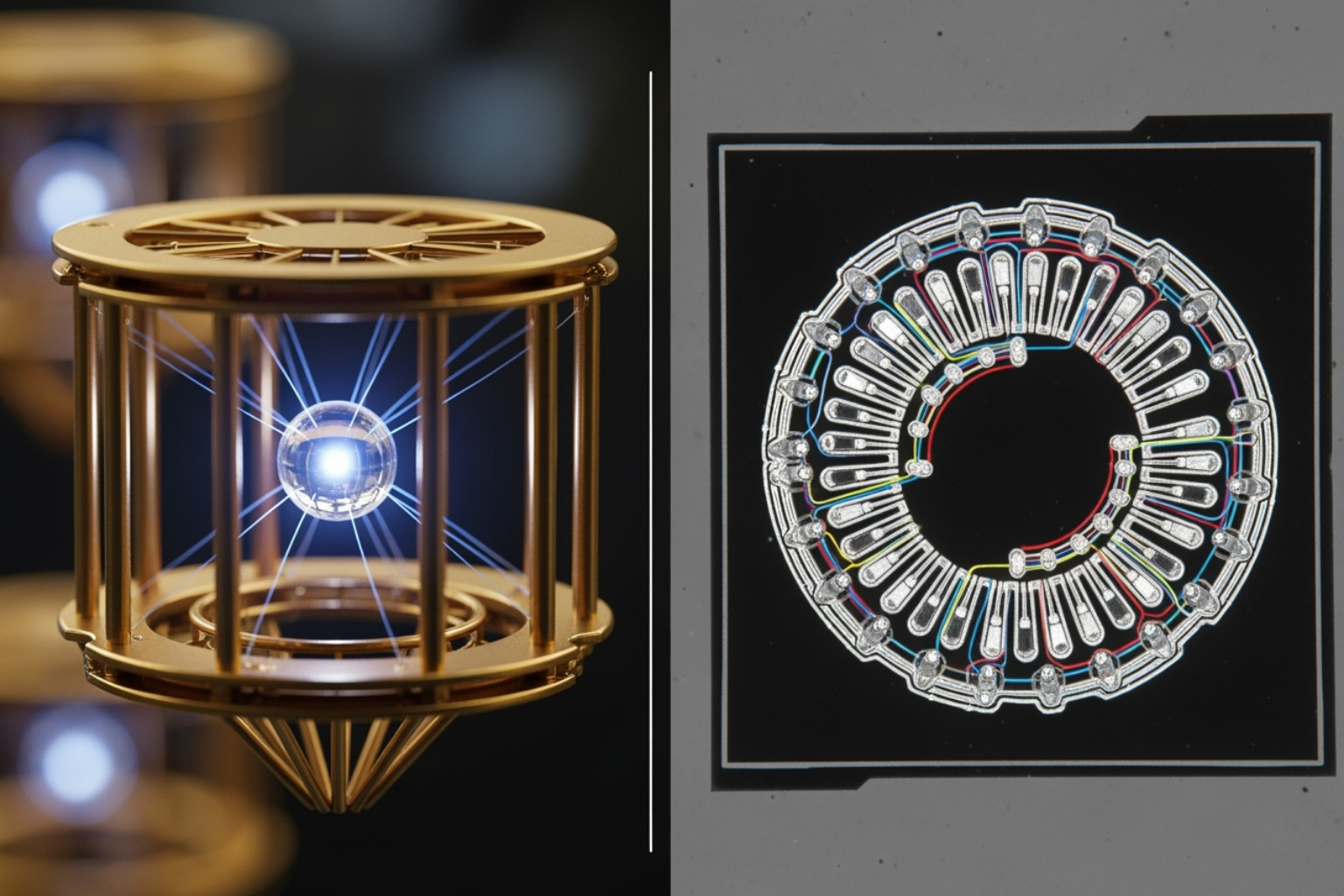

- Trapped-ion technology: Used by IonQ, this approach uses lasers to control individual atoms suspended in electromagnetic fields, resulting in high-quality qubits.

- Quantum annealing: Pioneered by D-Wave Quantum, this method excels at optimization problems, finding the best solution among countless possibilities.

- Gate-based computing: This is a versatile approach, similar to classical computers, that most major tech companies are pursuing to create general-purpose quantum machines.

Understanding these different approaches is key to navigating the diverse and exciting landscape of best quantum computing stocks.

Step 2: Understand the Different Ways to Invest

Now that you understand the basics, let’s explore how to invest. You can layer different approaches, much like a skincare routine, to match your risk tolerance.

-

Pure-play stocks: These companies, like IonQ and D-Wave Quantum, focus exclusively on quantum computing. They offer enormous growth potential but are high-risk, as most are not yet profitable and are burning through cash for research and development. This path is for investors with a high-risk tolerance and a long-term outlook.

-

Tech giants with quantum divisions: Companies like Microsoft, Google, and IBM are investing billions in quantum research while profiting from their established businesses (cloud services, software, etc.). This is a lower-risk approach, as your investment is supported by stable revenue streams. However, a quantum breakthrough may not dramatically impact their overall stock price.

-

The picks-and-shovels approach: Inspired by the gold rush, this strategy involves investing in companies that supply essential components. Nvidia (GPUs), Taiwan Semiconductor (chips), and Honeywell’s Quantinuum subsidiary are examples. These companies benefit from the industry’s overall growth, regardless of which specific quantum technology wins.

-

Quantum computing ETFs: These funds offer instant diversification by spreading your investment across multiple quantum companies. This reduces the risk of picking a losing stock but typically offers lower potential returns than a successful individual stock pick. You will also pay management fees.

Your strategy should align with your personal risk tolerance and investment timeline. Decide whether you prefer the high-risk path of pure-plays or the steadier approach of diversified tech giants and suppliers.

Step 3: Identify the Leading Companies

Let’s meet the companies shaping the quantum future. The ecosystem includes focused startups and established tech giants, each with a unique approach.

The Pure-Play Pioneers

These companies have dedicated their entire business to quantum computing.

- IonQ (IONQ): A leader in trapped-ion technology, known for high qubit fidelity. Its Aria computer is accessible via AWS, and it’s a promising pure-play option among the best quantum computing stocks.

- D-Wave Quantum (QBTS): A pioneer in quantum annealing, ideal for optimization problems. It offers cloud access to its systems through Quantum Computing as a Service (QCaaS).

- Rigetti Computing (RGTI): A key player pursuing the superconducting qubit path. Despite financial challenges, its expertise remains valuable in the quantum race.

The Tech Titans’ Quantum Leap

Major tech companies are leveraging their vast resources to enter the quantum space.

- IBM (IBM): A long-time quantum researcher with a clear development roadmap. Its Quantum System One computers are being deployed globally, serving over 210 organizations.

- Alphabet (GOOGL): Google’s Quantum AI division made headlines with its Sycamore processor and has achieved breakthroughs in error correction with its Willow chip.

- Microsoft (MSFT): Through its Azure Quantum platform, Microsoft is making quantum computing accessible and developing stable topological qubits. Its error-correction algorithm is a significant advancement.

The Essential Suppliers

These companies provide the crucial components and services for the quantum industry.

- Nvidia (NVDA): Famous for AI, its GPUs are also vital for quantum development and simulation. Its DGX Quantum system merges GPU and quantum computing.

- Honeywell (HON): Its quantum subsidiary, Quantinuum, achieved a key milestone in qubit quality (99.914% two-qubit gate fidelity) and focuses on cybersecurity and chemistry applications.

- Taiwan Semiconductor (TSM): As the manufacturer of roughly 90% of the world’s advanced chips, TSM is a foundational player for the entire quantum computing industry.

This diverse landscape shows that the best quantum computing stocks include pure-plays, tech titans, and essential suppliers, offering options for various risk appetites.

Step 4: Learn How to Evaluate Quantum Stocks

Evaluating the best quantum computing stocks requires looking beyond traditional metrics, as the technology is still experimental.

-

Financial Health: Most pure-play companies are not profitable and are in a heavy research and development phase, so losses are expected. Instead of profit, focus on revenue growth and cash position. For example, IonQ’s revenue is expected to grow 52% to $17.3 million, and it has a strong $1.6 billion cash position. This cash runway is critical for funding research without diluting shares.

-

Technological Milestones: This is where quantum companies truly differentiate themselves. Key metrics include qubit quality over quantity and progress in error correction. Honeywell’s Quantinuum achieving 99.914% two-qubit gate fidelity is a major milestone. Similarly, Microsoft’s advanced error-correction algorithm is a significant step toward building reliable quantum computers.

-

Partnerships: Collaborations with government agencies and major corporations are strong validation signals. Microsoft’s work with DARPA or IBM’s extensive network of enterprise and research partners indicate real-world confidence in their technology.

-

Analyst Ratings: Tools like TipRanks can provide helpful insights. IonQ holds a Moderate Buy consensus, while others like RTX and Booz Allen Hamilton have similar ratings. A TipRanks Smart Score of 8 or higher suggests a stock has the potential to outperform the market.

Evaluating these companies involves balancing financial prudence with technological promise. Look for a strong cash position, clear technical progress, and solid partnerships.

Step 5: Compare the Top Quantum Computing Stocks

Let’s compare some of the key players side-by-side to see how they stack up. This comparison highlights the different risk and reward profiles across the quantum landscape.

Here’s how some of the best quantum computing stocks measure up:

| Company | Technology Type | Market Cap (approx.) | Analyst Consensus (where available) | YTD Performance (as of May 14, 2024) |

|---|---|---|---|---|

| IonQ (IONQ) | Trapped-Ion | $12.76 Billion | Moderate Buy (Smart Score 8) | Flat |

| D-Wave Quantum (QBTS) | Quantum Annealing | $3.14 – $5.25 Billion | 100% Buy (Robinhood) | +118% (as of Wed. market open) |

| Microsoft (MSFT) | Topological Qubits | $3.0 Trillion | Strong Buy | +11% |

| IBM (IBM) | Superconducting Qubits | $242 Billion | Moderate Buy | +3.3% |

| Nvidia (NVDA) | GPU Acceleration | $3.4 Trillion | Strong Buy | +84.4% |

| Alphabet (GOOGL) | Superconducting Qubits | $2.2 Trillion | Strong Buy | +21.9% |

| Honeywell (HON) | Trapped-Ion (Quantinuum) | $132 Billion | Moderate Buy | -2.6% |

| Amazon (AMZN) | AWS Quantum, Error Correction | $1.9 Trillion | Strong Buy | +23.1% |

| Intel (INTC) | Silicon-based Qubits | $102 Billion | Moderate Buy | -37.8% |

| Taiwan Semiconductor (TSM) | Advanced Chip Manufacturing | $740 Billion | Strong Buy | +46.7% |

Market capitalization and performance data are approximate and change with market fluctuations. Analyst ratings reflect available research data at the time.

The data reveals the volatility of pure-play stocks like D-Wave, which saw an explosive gain, while the tech giants like Microsoft and Alphabet posted more stable returns. The “picks-and-shovels” plays, such as Taiwan Semiconductor, also showed strong performance, benefiting from broad industry growth. This comparison underscores that we are in the early stages of this technological revolution, and performance can vary widely.

Step 6: Acknowledge the Inherent Risks

Investing in the best quantum computing stocks, particularly pure-plays, involves significant risk. It’s crucial to understand these challenges before committing capital.

-

Speculative Nature: Most pure-play quantum companies are not yet profitable and are burning cash on R&D. This makes them high-risk, speculative investments.

-

Long Commercialization Timeline: Widespread commercial adoption of quantum computing may still be decades away. A McKinsey study highlights that the path is long and filled with challenges, with some experts pointing to the mid-2040s for transformative impact.

-

Technological Problems: Building a stable, error-corrected quantum computer is incredibly difficult. Companies face immense challenges in maintaining qubit coherence, achieving high fidelity, and scaling their systems.

-

Market Volatility: The sector is prone to extreme price swings. A single news announcement can cause stocks to soar or plummet, as seen with D-Wave’s 118% advance in 2024 while other companies struggled.

-

High Capital Requirements: Developing quantum hardware is extremely expensive, putting pressure on smaller companies to continuously raise capital, which can lead to share dilution for existing investors.

Quantum computing is not a get-rich-quick opportunity. It requires patience, a high tolerance for volatility, and a long-term perspective. These investments should only represent a small portion of a well-diversified portfolio.

Step 7: Build Your Investment Strategy

Now it’s time to build an investment strategy that fits your goals. A balanced approach is key, much like creating a good skincare routine.

Building a Quantum Portfolio

Creating a resilient portfolio means diversifying your investments to manage risk while capturing long-term potential.

- Diversify: Spread your investments across different types of quantum companies. Mix pure-plays (IonQ, D-Wave) with stable tech giants (Microsoft, IBM) and ancillary companies (Nvidia, TSM). This balances high-risk growth potential with stability.

- Think Long-Term: Widespread commercialization may be decades away. Treat these as long-term investments.

- Manage Risk: Allocate only a small portion of your overall portfolio to speculative investments like the best quantum computing stocks. Only invest what you can afford to lose.

- Consider ETFs: For beginners, quantum computing ETFs offer instant diversification and professional management, providing an excellent entry point.

Using Stock Screeners

Stock screeners can help you find companies that match your criteria.

- Filter by Industry: Start by looking for companies in the “Information Technology” sector.

- Use Relevant Financials: For pure-plays, prioritize a strong cash position and revenue growth over profitability. For established companies, traditional metrics apply.

- Check Analyst Ratings: Use platforms like TipRanks to check for analyst consensus and Smart Scores, which can indicate a stock’s potential to outperform the market.

Screening is just the first step. Always follow up with in-depth research into a company’s technology, partnerships, and roadmap. Tools like MarketSurge can help you build custom stock screens to begin your research.

Frequently Asked Questions about Quantum Computing Stocks

Here are answers to some of the most common questions about investing in the best quantum computing stocks.

Which company is the leader in quantum computing?

There is no single leader. Different companies excel in different areas. IBM is a pioneer with its global Quantum System One network. Google has made headlines with its Sycamore processor and error correction advances. Among pure-plays, IonQ is a leader in trapped-ion technology, while D-Wave leads in the specialized field of quantum annealing. The “leader” will likely depend on the specific application, and multiple winners may emerge.

What is the difference between a pure-play stock and a tech giant in this space?

This distinction is about risk and focus.

- Pure-play stocks (e.g., IonQ, D-Wave) focus 100% on quantum computing. They offer explosive growth potential but are high-risk, often unprofitable, and highly volatile.

- Tech giants (e.g., Microsoft, Google, IBM) are diversified, profitable companies with quantum research divisions. They offer lower risk and stability, but a quantum breakthrough will have a smaller impact on their overall stock price.

How soon will quantum computing be profitable?

This is a long-term investment. Most pure-play companies are not expected to be profitable for several years, as they are still in the R&D phase. Some are generating early revenue through cloud access, but widespread industry profitability driven by transformative quantum computers is likely decades away, with many experts pointing to the mid-2040s. Investing in this space requires patience and a timeline measured in decades, not quarters.

Conclusion

We’ve journeyed through the complex and exciting world of quantum computing, from understanding qubits to identifying the companies leading the charge. Just as our mission at Beyond Beauty Lab is to empower you with knowledge for your wellness journey, this guide aims to provide the information needed to confidently explore the best quantum computing stocks.

Investing in this sector requires patience, research, and a high tolerance for volatility. There is no single “right” way to invest; the best strategy depends on your personal risk tolerance and timeline. You can choose from high-potential pure-plays like IonQ, stable tech giants like Microsoft, or essential suppliers like TSMC.

The quantum revolution is on the horizon, but it will take time to mature. The companies that succeed will be those that balance groundbreaking innovation with solid business fundamentals. With a clear strategy and realistic expectations, you can be part of this transformative technological shift.