Why Understanding AMD Stock Price Matters for Smart Investors

AMD stock price is currently trading at approximately $163-$173 per share, representing one of the most closely watched semiconductor stocks in today’s market. Here’s what you need to know right now:

Current AMD Stock Performance:

- Price Range: $163.38 – $172.76 (varies by source and timing)

- 52-Week Range: $76.48 – $227.30

- Market Cap: ~$280 billion

- Year-to-Date Performance: Up 34-44%

- P/E Ratio: 93-127 (varies by calculation method)

Advanced Micro Devices has become a major player in the artificial intelligence boom, competing directly with giants like Nvidia and Intel. The company’s stock has experienced significant volatility, with dramatic swings based on quarterly earnings, AI chip demand, and competitive pressures.

What makes AMD particularly interesting is its position across multiple high-growth markets: data centers, gaming, and emerging AI applications. The company powers nearly 70% of the global console market through partnerships with Sony PlayStation and Microsoft Xbox, while simultaneously challenging Nvidia’s dominance in AI accelerators.

However, understanding the true value behind AMD’s stock price requires looking beyond daily fluctuations. Recent analyst upgrades have set price targets as high as $200, while others express caution about high investor expectations in the AI space.

The simple way to get AMD stock price information is straightforward, but making sense of whether it’s a good investment requires digging deeper into the company’s financial health, growth drivers, and competitive positioning in the rapidly evolving semiconductor landscape.

Quick amd stock price terms:

What is the Current AMD Stock Price and How is it Performing?

If you’re wondering about the AMD stock price right now, you’re looking at a stock that’s been on quite a journey. Currently trading in the $162-$173 range, AMD shares have shown the kind of movement that keeps investors on their toes. Just recently, we’ve seen closes around $162.63 with daily swings of -3.53%, while after-hours trading might push it to $163.38 or beyond.

What really tells the story is AMD’s 52-week range of $76.48 to $227.30. That’s not a typo – we’re talking about a stock that nearly tripled at its peak! The March 2024 high of $227.30 shows just how much excitement the AI boom created around semiconductor stocks.

The year-to-date performance has been impressive too. AMD stock price has climbed between 34% and 44% this year alone, which is pretty remarkable in any market. When you zoom out to the five-year view, the numbers get even more eye-catching – we’re talking about returns ranging from 93% to over 450%, depending on your entry point.

Trading volume tells us another interesting story. With daily volumes typically hitting 56-64 million shares, AMD clearly has investors’ attention. This high volume means you can usually buy or sell without much trouble, which is always reassuring.

Here’s something worth noting: AMD’s Beta sits around 1.91-1.93, which means this stock moves almost twice as much as the broader market. When the market goes up 1%, AMD might jump 2%. When it goes down, well, you get the picture. It’s definitely not a stock for the faint of heart, but that volatility is part of what creates opportunity.

Market sentiment swings between cautious optimism and genuine excitement, often depending on what’s happening in the AI space or how competitors are performing. For broader market context, our Fintechzoom.com Markets Guide offers helpful insights into these larger trends.

Understanding the basics of the amd stock price

When you’re tracking the AMD stock price, you’re looking at shares that trade on the NASDAQ under the simple ticker symbol “AMD.” Reading a stock chart might seem intimidating at first, but it’s really just a visual story of how the price has moved over time.

The chart shows you daily price movements, trading volume (those bars at the bottom), and often includes helpful indicators like moving averages. Some investors look for patterns – maybe a “double bottom” that suggests a good buying opportunity, or periods where the stock trades in a tight range before making its next big move.

How to track the amd stock price in real-time

Keeping tabs on the AMD stock price throughout the day is easier than ever. Google Finance and Yahoo Finance are fantastic starting points – they’re free, reliable, and give you all the basic information you need. Most brokerage apps also provide real-time quotes, customizable watchlists, and news feeds that help you stay informed.

For direct access to comprehensive data, you can check Advanced Micro Devices Inc (AMD) Stock Price & News – Google Finance for up-to-the-minute information. These platforms make it simple to set up alerts, so you’ll know when AMD hits your target prices or makes significant moves.

Decoding AMD’s Financial Health and Valuation

When you’re trying to understand the AMD stock price, the numbers behind the company tell a fascinating story. Think of it like checking someone’s vital signs – we want to see how healthy AMD really is beneath all the market excitement.

AMD’s market capitalization sits at an impressive $263-282 billion, putting it firmly in the “mega-cap” category alongside tech giants. This massive valuation reflects investor confidence in AMD’s future, especially as the company has carved out a strong position in the semiconductor industry. When you compare this to competitors, AMD has established itself as a major player that commands serious respect from Wall Street.

The revenue picture looks particularly bright. AMD reported trailing twelve-month revenue of $27.75 billion, with recent quarterly results showing even stronger momentum. In Q2 2025, revenue jumped to $7.69 billion – a solid 31.7% increase year-over-year that beat analyst expectations. This kind of growth doesn’t happen by accident; it reflects real demand for AMD’s products across gaming, data centers, and AI applications.

Earnings per share (EPS) currently sits around $1.74-$1.75 for the trailing twelve months. While this might seem modest compared to the stock price, AMD is investing heavily in future growth. The company’s gross margin of 50.09% shows they’re maintaining healthy profitability even while scaling up operations.

Here’s where things get interesting with valuation analysis. AMD’s price-to-earnings ratio ranges from 93 to over 100, which is significantly higher than many traditional stocks. Is this a red flag? Not necessarily. These high P/E ratios reflect investor expectations that AMD’s earnings will grow substantially in the coming years. Analysts are forecasting revenue growth to $33 billion in 2025 and $40.1 billion in 2026, which would justify today’s premium pricing.

The company’s financial foundation appears solid with $5.8 billion in cash reserves against $3.2 billion in total debt. This gives AMD plenty of flexibility to invest in research, make strategic acquisitions, or weather any economic storms. Their debt-to-equity ratio of 7.19% suggests management is being prudent with leverage.

AMD’s commitment to shareholders shows through their recent $6 billion share repurchase authorization announced in May 2025. Share buybacks can boost the AMD stock price by reducing the number of shares in circulation, making each remaining share more valuable.

| Metric | AMD | Industry Average | What This Means |

|---|---|---|---|

| P/E Ratio | 93-127 | 30-50 | Premium valuation with high growth expectations |

| Gross Margin | 50.09% | 40-55% | Healthy profitability compared to peers |

| Market Cap | $263-282B | Varies | Established mega-cap leader |

The bottom line? AMD’s financials suggest a company that’s growing fast and investing in its future, though investors are clearly paying a premium for that growth potential. Whether that premium is justified depends largely on AMD’s ability to execute on its AI and data center opportunities in the coming years.

For more insights into how these market dynamics play out across different sectors, check out our Fintechzoom.com US Markets Guide.

The Engines of Growth: AI, Data Centers, and Gaming

What’s really driving the AMD stock price higher? It’s all about being in the right place at the right time – and AMD has positioned itself beautifully across some of the hottest tech markets today.

Data Center Segment

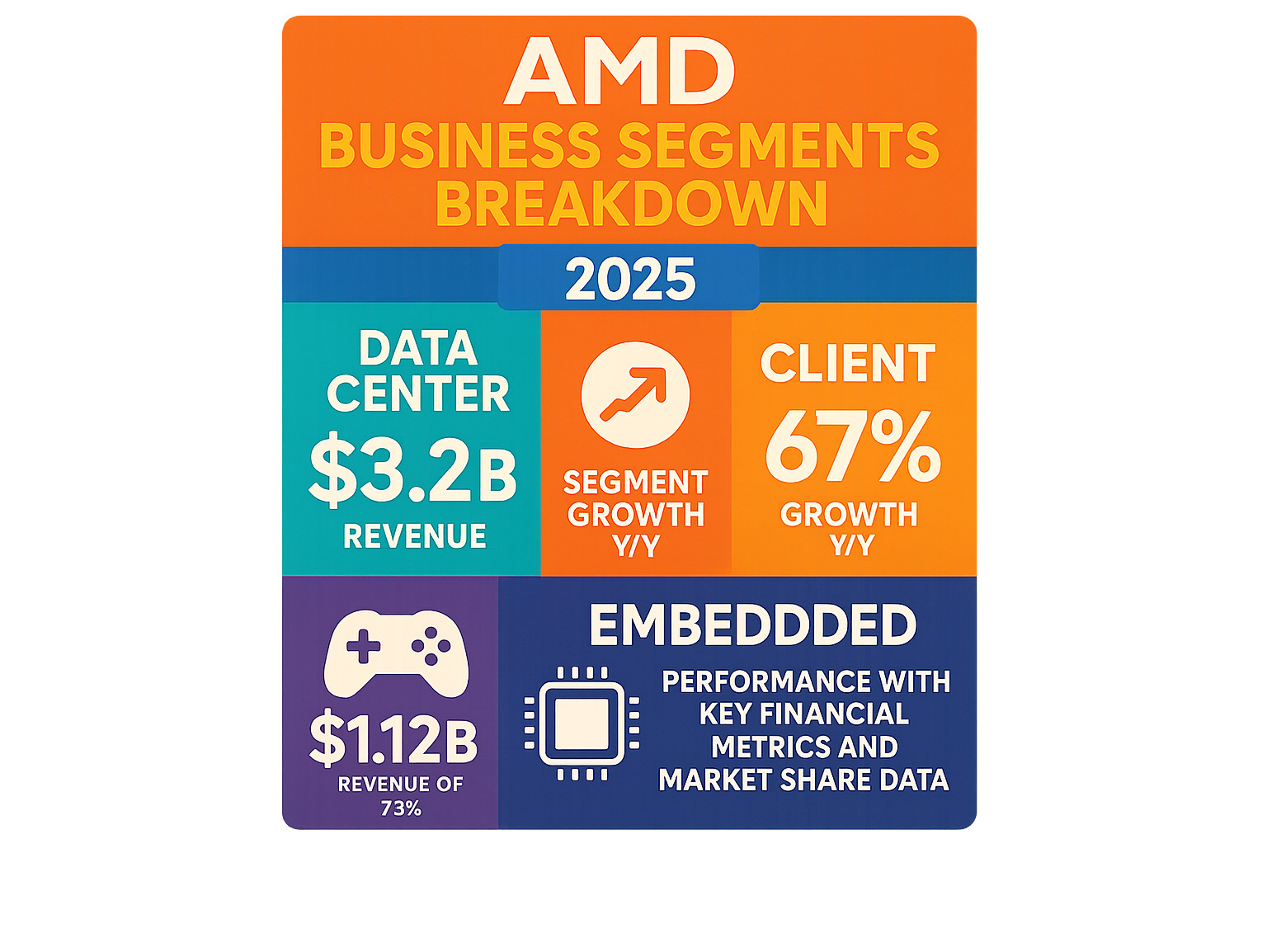

The data center business is absolutely crushing it for AMD right now. We’re talking about $3.2 billion in revenue just from Q2 2025 alone – that’s the kind of number that makes investors sit up and take notice.

The secret sauce here is AMD’s EPYC CPUs, which are winning over major players left and right. Nokia chose them for their cloud infrastructure, and Oracle is using 5th Gen AMD EPYC processors to power breakthrough cloud performance. But here’s where it gets really exciting: Oracle isn’t just buying a few chips – they’re committing to massive 27,000+ node AI clusters powered by AMD.

AMD’s Instinct MI300 and MI355 AI accelerators are the real game-changers here. These aren’t just keeping up with the competition – they’re actually offering better value. The MI355 delivers up to 40% more tokens per dollar compared to other options, which is exactly what cost-conscious enterprises want to hear.

Artificial Intelligence (AI) Strategy

Here’s where AMD is making some really smart moves. While everyone’s talking about the AI boom, AMD isn’t just following trends – they’re creating their own path with a focus on openness and cost-effectiveness.

Their ROCm open-source software strategy is brilliant. Instead of locking customers into proprietary systems, AMD is offering an open alternative that can save enterprises 30% on hardware costs. This approach is particularly appealing to smaller companies who don’t want to be tied down to expensive, closed systems.

The partnerships AMD is building are impressive too. There’s a $10 billion strategic partnership with HUMAIN to advance global AI, plus collaborations with major research institutions. These aren’t just handshake deals – they’re serious commitments that position AMD as a long-term player in the AI space.

For anyone interested in diving deeper into AI investment opportunities, our 5StarsStocks.com AI Guide 2025 offers some great insights into this rapidly evolving market.

Client and Gaming Segments

Don’t sleep on AMD’s traditional strengths – they’re experiencing a real renaissance. The client segment saw a remarkable 67% year-over-year revenue surge, driven largely by their Ryzen CPUs for PCs.

The timing couldn’t be better with the emergence of “AI PCs” – computers with built-in AI capabilities. Dell is already rolling out commercial PCs featuring AMD Ryzen AI PRO Processors, and this is just the beginning of what could be a massive upgrade cycle.

Gaming is where AMD really shows its resilience. After some tough times, the gaming segment bounced back with a 73% year-over-year increase in Q2 2025, reaching $1.12 billion in revenue. The Radeon GPUs continue to offer excellent performance-per-dollar value, and there’s genuine excitement building around upcoming releases.

But here’s AMD’s secret weapon: console partnerships. They power nearly 70% of the global console market through custom chips for Sony PlayStation and Microsoft Xbox. This isn’t just about current sales – it’s a projected $3.5-4 billion annually through 2029. That’s the kind of steady, predictable revenue stream that provides a solid foundation when other markets get volatile.

Emerging Technologies

AMD isn’t just playing today’s game – they’re positioning for tomorrow’s opportunities. The most exciting development might be their collaboration with IBM on quantum computing. This partnership is targeting a projected $130 billion quantum computing market by developing quantum-centric supercomputing architectures.

What makes this partnership particularly smart is how it aligns AMD’s open-source ROCm strategy with IBM’s open Qiskit framework. It’s a powerful combination that could open doors to enterprise customers who are just starting to explore quantum workflows.

This quantum computing initiative represents exactly the kind of forward-thinking strategy that can drive long-term AMD stock price appreciation. You can read more about this fascinating collaboration here: IBM and AMD Team Up to Drive Next-Gen Quantum Computing.

The bottom line? AMD has built a diversified growth engine that spans from gaming PCs in your home to the most advanced AI data centers in the world. That’s the kind of strategic positioning that creates lasting value for investors.

Navigating Headwinds: Risks, Competition, and Analyst Outlook

Every smart investor knows that understanding the AMD stock price means looking at both the sunshine and the storm clouds. While AMD’s growth story gets us excited, we’d be doing you a disservice if we didn’t talk about the real challenges this semiconductor giant faces.

Competitive Landscape

The chip world is like a high-stakes poker game, and AMD is playing at the big boys’ table. The most intense rivalry? That’s definitely with Nvidia in the red-hot AI and GPU markets. AMD’s Instinct MI355 chips offer impressive cost-efficiency, but Nvidia’s got that established market dominance and their CUDA software ecosystem that’s tough to crack. It’s like trying to convince people to switch from their favorite coffee shop – even if your coffee is cheaper and just as good, habits die hard.

AMD has actually been winning some impressive battles against Intel, especially in desktop CPUs where they’ve gained significant ground. Their EPYC Turin processors are making Intel’s Xeon line sweat in the server market. But here’s the thing – Intel isn’t going down without a fight, and the recent $5.7 billion government investment in domestic chip manufacturing adds another layer of complexity to this competitive landscape.

Potential Risks

Let’s be honest about what could shake up the AMD stock price. Geopolitical tensions are probably the biggest wildcard right now. Government restrictions on selling advanced AI chips to China have already caused some headaches – we’ve seen earnings drop by 30% due to these limitations. When a huge market like China becomes off-limits, that’s going to hurt.

The semiconductor industry’s cyclical nature is another reality check. These markets can swing from feast to famine pretty quickly, depending on everything from global economic conditions to whether people are buying new PCs or upgrading their gaming setups. It’s like the stock market’s mood swings, but with computer chips.

Then there’s the elephant in the room: sky-high investor expectations. AMD’s P/E ratio shows just how much faith people have in the company’s AI future. But when expectations are this high, even a small stumble can send the stock tumbling. As Morgan Stanley pointed out, investor expectations for the AI business might still be too optimistic.

Supply chain concentration is another concern that keeps executives up at night. AMD relies heavily on third-party manufacturers like TSMC to actually make their chips. Any hiccup in these relationships – whether from natural disasters, geopolitical tensions, or manufacturing issues – could seriously impact AMD’s ability to deliver products.

Recent News and Developments

The AMD stock price reacts to news faster than a cat hearing a can opener. Competitor earnings reports can send ripples through the entire chip sector. Sometimes even strong results from other companies can cause investors to shuffle their positions, creating unexpected volatility in AMD’s stock.

Recent government investment announcements in rival chipmakers have caused some stock price dips, showing how national industrial policies can directly impact market dynamics. It’s fascinating how policy decisions in Washington can immediately show up in stock prices.

AMD’s own Q2 2025 earnings were a perfect example of this sensitivity. Despite showing solid revenue growth, the stock initially dipped because some investors focused on what they saw as disappointing data center results. However, CEO Lisa Su’s optimistic comments about seeing “positive signals” helped calm some of those concerns.

The market also pays attention to insider trading activity. When CEO Lisa Su sold $23.5 million worth of AMD shares in June 2024, investors noticed. Though these sales are typically for personal financial planning rather than company outlook concerns, they still make headlines.

On a more positive note, Cathie Wood’s Ark Invest has been actively buying AMD shares, including 33,551 shares in June 2024. When a prominent investment firm keeps buying, that usually signals confidence in the company’s future.

Analyst Ratings

Wall Street analysts are generally bullish on AMD, with most maintaining “Buy” ratings. Price targets have been climbing, with some reaching as high as $200. Jefferies recently raised their target from $190 to $200, showing increased confidence in AMD’s trajectory.

The upgrade story gets interesting when you look at firms like Truist, which upgraded AMD from “Hold” to “Buy” specifically because of rising AI demand. This kind of upgrade shows that analysts are seeing real traction in AMD’s AI strategy. You can read more about these positive sentiment changes here: AMD Stock Upgraded To Buy. What Caused The Change In Sentiment?

However, not everyone’s completely convinced. Morgan Stanley downgraded AMD to “Equal Weight” while maintaining a $176 price target, citing those high investor expectations we mentioned earlier. This mixed sentiment is actually pretty typical for high-growth stocks – some analysts see the glass as half full, others worry it might be getting a bit too full.

The consensus seems to be that AMD has solid fundamentals and exciting growth prospects, but investors need to buckle up for what could be a bumpy ride as the company steers this competitive and rapidly changing landscape.

Frequently Asked Questions about AMD Stock

We know that watching the AMD stock price can feel overwhelming, especially when you’re trying to make smart investment decisions. That’s why we’ve gathered the most common questions investors ask us about AMD stock and provided straightforward answers to help you steer this exciting but complex investment opportunity.

Is AMD stock a good buy now?

The question of whether AMD stock price represents a good buying opportunity right now doesn’t have a simple yes or no answer. What we can tell you is that analysts generally maintain a “Buy” consensus on AMD, and there are compelling reasons for their optimism.

AMD’s growth potential in AI and data centers is genuinely impressive. The company’s recent financial results show robust revenue growth, particularly in the data center segment where they’re gaining serious ground against competitors. Their strategic push into AI accelerators and even quantum computing partnerships shows they’re thinking ahead, not just reacting to current trends.

But here’s where it gets interesting – and a bit nerve-wracking. AMD’s high P/E ratio means investors are already betting big on future success. This creates significant market risks because even small disappointments can lead to dramatic price swings.

The competitive landscape is intense, with major players fighting for dominance in AI and traditional computing markets. Add geopolitical factors affecting chip sales to certain regions, and you’ve got a stock that can be quite volatile.

Our advice? While AMD’s long-term prospects look promising, especially with their competitive products and open-source software strategy, personal research is absolutely crucial. What makes sense for a growth-focused investor might not work for someone seeking steady, predictable returns.

Who are AMD’s biggest competitors?

Understanding AMD’s competitive landscape helps explain many of the AMD stock price movements you’ll see in the market. Two companies dominate this competitive arena, and their actions directly impact AMD’s performance.

Nvidia represents AMD’s most formidable challenge in high-performance GPUs and AI accelerators. Nvidia’s CUDA platform has created what many call a “software moat” – developers become locked into their ecosystem, making it harder for alternatives to gain traction. AMD is fighting back with their Instinct MI300 and MI355 series, plus their open-source ROCm software stack that promises more flexibility and potentially lower costs.

Intel remains AMD’s traditional rival in the CPU market for both personal computers and servers. While AMD has made impressive gains with their Ryzen and EPYC processors – even overtaking Intel in desktop market share for the first time since 2006 – Intel is still a massive force with significant resources and government backing.

The battle for data center and AI dominance between these companies creates the dynamic tension that often drives AMD’s stock price movements. When one company announces breakthrough technology or major partnerships, investors quickly reassess the competitive balance.

What are the key terms for analyzing AMD stock?

When we discuss AMD stock price analysis, several financial terms come up repeatedly. Understanding these concepts will help you make sense of market reports and analyst recommendations.

The P/E Ratio (Price-to-Earnings Ratio) compares AMD’s current share price to its earnings per share. AMD’s P/E ratio often exceeds 90, which might seem high, but it reflects investors’ confidence in significant future growth. Think of it as paying premium prices today for tomorrow’s expected profits.

EPS (Earnings Per Share) shows how much profit AMD generates for each share of stock. When this number grows consistently, it usually signals a healthy, expanding business. AMD’s EPS has been climbing as their revenue increases across multiple segments.

Market Capitalization represents AMD’s total value in the stock market – currently over $260 billion. This massive figure places AMD among the world’s most valuable technology companies, reflecting both its current success and future potential.

Volatility (Beta) measures how much AMD’s stock price moves compared to the overall market. With a Beta around 1.9, AMD tends to swing nearly twice as much as the broader market. This means higher potential returns but also greater risk – perfect for investors who can handle the excitement, potentially challenging for those seeking stability.

These metrics work together to paint a complete picture of AMD’s financial health and market position, helping you see beyond the daily AMD stock price fluctuations to understand the underlying investment story.

Conclusion: Your Next Step in Analyzing AMD

We’ve taken quite a journey together exploring the AMD stock price and what makes this semiconductor giant tick. What started as a simple question about a stock quote has revealed a fascinating story of innovation, competition, and market dynamics that extend far beyond any single number on your screen.

Through our analysis, we’ve finded that AMD isn’t just another tech stock riding the AI wave. The company has positioned itself as a genuine force across multiple high-growth markets. From powering nearly 70% of gaming consoles worldwide to challenging Nvidia’s dominance in AI accelerators, AMD has built a diversified foundation that supports its impressive market capitalization of over $260 billion.

The financial health we examined tells a compelling story. Revenue growth of over 30% year-over-year, strong margins, and strategic investments in emerging technologies like quantum computing showcase a company that’s thinking beyond today’s trends. Yet we also learned that AMD’s high P/E ratio means investors are betting big on future performance, creating both opportunity and risk.

Perhaps most importantly, we’ve seen how the competitive landscape shapes everything about AMD’s future. The ongoing battle with Nvidia in AI and the persistent rivalry with Intel in traditional computing markets means that AMD stock price movements often reflect broader industry shifts, not just company-specific news.

The geopolitical factors we discussed, from China trade restrictions to government investments in competitors, remind us that semiconductor companies operate in a global arena where politics and technology intersect in complex ways.

So what’s the “simple way” to approach AMD stock analysis moving forward? It’s recognizing that there’s no single metric or news headline that tells the whole story. Instead, successful AMD stock analysis requires staying informed about technological trends, monitoring competitive developments, and understanding how macroeconomic factors influence this volatile but potentially rewarding investment.

Whether you’re just starting to explore semiconductor stocks or you’re a seasoned investor, the key is maintaining that continuous, informed analysis we’ve emphasized throughout this article. Keep an eye on quarterly earnings, watch for new product launches, and pay attention to how AMD’s open-source strategy with ROCm gains traction against proprietary alternatives.

At Beyond Beauty Lab, we believe in empowering you with the knowledge to make informed decisions, whether you’re exploring the latest in clean beauty or diving into financial markets. For more comprehensive stock analysis and investment insights, don’t miss our 5StarsStocks.com Stocks resource.

Investing in any stock, including AMD, carries risks. The volatility we’ve discussed means prices can swing dramatically based on earnings reports, competitive announcements, or broader market sentiment. Always do your own research and consider consulting with a financial advisor before making investment decisions.

The semiconductor industry will continue evolving at breakneck speed, and AMD’s role in shaping that future makes it a fascinating company to follow. Whether the AMD stock price rises or falls in the short term, understanding the fundamentals we’ve covered will help you make sense of those movements and their long-term implications.