What Are Monthly Dividend Stocks and Why Do They Matter for Your Financial Wellness?

Monthly dividend stocks are companies that pay dividends to shareholders every month instead of the typical quarterly payments. These investments can provide a steady income stream that aligns perfectly with your monthly expenses and financial wellness goals.

Quick Answer for Monthly Dividend Stocks:

- What they are: Stocks that pay dividends 12 times per year instead of 4

- Current count: 82 individual monthly dividend securities available as of 2025

- Typical yields: Range from 4% to over 20%, with many offering 7%+ annually

- Main types: REITs (Real Estate Investment Trusts), BDCs (Business Development Companies), and royalty companies

- Top example: Realty Income (O) – “The Monthly Dividend Company®” with 663 consecutive monthly payments

Think about it this way – your rent, groceries, and wellness subscriptions all happen monthly. So why shouldn’t your investment income match that rhythm?

The appeal goes beyond just convenience. Monthly dividend payments can help reduce financial stress by creating predictable cash flow. This steady income stream supports your overall wellness by providing financial stability that lets you focus on what matters most to you.

As dividend-paying expert research shows, “bills and other obligations normally happen every month, these firms can offer plenty of appeal for income seekers.” The math works in your favor too – monthly compounding can generate slightly higher total returns over long periods compared to quarterly payments.

But here’s the catch: many monthly dividend stocks carry higher risks than their quarterly counterparts. Some companies offering eye-catching yields above 15% may not be sustainable long-term. That’s why understanding how to evaluate these investments becomes crucial for your financial health.

Basic monthly dividend stocks glossary:

- fintechzoom.com russell 2000

- JD Vance’s Net Worth

- what must an entrepreneur assume when starting a business?

How to Analyze and Select the Best Monthly Dividend Stocks

Think of choosing monthly dividend stocks like selecting the perfect skincare routine – you wouldn’t just grab the first product with the flashiest claims, right? The same wisdom applies to investing. While that eye-catching 15% yield might look tempting, successful dividend investing requires careful analysis to separate quality companies from potential disappointments.

The key is due diligence – thoroughly researching each potential investment before committing your hard-earned money. Just as you’d check ingredients and reviews before trying a new serum, you need to examine the financial health and sustainability of any dividend-paying company. This approach helps you avoid “yield traps” – those deceptively high payouts that often disappear when you need them most.

We’re building long-term investing strategies here, not chasing quick wins. The goal is creating a reliable income stream that supports your financial wellness for years to come.

Key Metrics to Watch: Beyond Just the Yield

When evaluating monthly dividend stocks, that headline yield is just the beginning of your research journey. Think of it like judging a book by its cover – sure, it might catch your attention, but the real story lies inside.

Dividend Yield gives you the annual dividend percentage based on the current stock price. While a 12% yield sounds amazing, it might actually signal trouble if the stock price has crashed due to business problems. A sustainable yield typically falls between 4-8% for most quality companies.

The Payout Ratio reveals what percentage of a company’s earnings goes toward dividend payments. Companies paying out 90% or more of their earnings leave little room for error. When tough times hit, these high payout ratios often lead to dividend cuts. Look for companies maintaining payout ratios below 80% – they have breathing room.

For Real Estate Investment Trusts, Funds From Operations (FFO) provides a clearer picture than traditional earnings. REITs add back depreciation to show their true cash-generating ability. This metric helps you understand whether a REIT can actually afford its monthly payments.

Dividend Growth Rate shows whether a company consistently increases its payments over time. Companies that grow their dividends year after year demonstrate financial strength and management commitment to shareholders. Even modest 3-5% annual increases compound beautifully over time.

Many research platforms offer a Dividend Safety Score that combines multiple financial health indicators into one easy-to-understand rating. While these scores aren’t perfect, they provide a helpful starting point for your analysis.

Finally, Balance Sheet Strength matters enormously. Companies with manageable debt levels and strong cash reserves weather economic storms much better. They can maintain dividend payments even when business temporarily slows down.

Spotting Quality vs. Speculation: A Checklist for Investors

Distinguishing between solid monthly dividend stocks and risky speculation protects your financial wellness. Here’s how to spot the difference between companies worth your trust and those likely to disappoint.

Look for a strong Competitive Advantage (Moat) – something that protects the company’s profits from competitors. This might be premium locations for a REIT, exclusive contracts, or specialized expertise that’s hard to replicate. Companies with durable advantages tend to maintain stable dividends.

Examine the Management Track Record carefully. Has leadership steerd previous challenges successfully? Do they communicate honestly with shareholders? Great management teams make tough decisions early to protect long-term dividend sustainability.

Check how the company performed during the last Recession. Companies that maintained or quickly restored their dividends during 2008-2009 or the 2020 pandemic show real resilience. This historical performance often predicts future reliability.

Watch Debt Levels closely. Excessive borrowing makes companies vulnerable to rising interest rates and economic downturns. High-quality dividend payers typically maintain conservative debt levels that won’t force difficult choices during tough times.

Revenue Stability provides the foundation for reliable dividends. Companies with predictable, recurring income streams – like REITs with long-term leases – generally make more dependable dividend payers than those with volatile earnings.

Consider Industry Trends affecting the company’s future prospects. Is the business model thriving or facing disruption? Understanding whether a company operates in a growing or declining sector helps predict long-term dividend sustainability.

Finding Your Fit: Using Tools to Find Potential Investments

With over 80 monthly dividend stocks available, finding your perfect matches requires the right research tools. Fortunately, today’s technology makes this analysis much easier than it used to be.

Stock Screeners work like search engines for investments, letting you filter companies based on dividend yield, payout ratios, market size, and industry. You can quickly narrow thousands of options down to a manageable list that fits your criteria. The Morningstar Investor Screener tool offers particularly robust filtering options for dividend-focused investors.

Research Databases provide the detailed information you need for thorough analysis. These platforms compile financial statements, analyst reports, historical performance data, and risk assessments in one convenient location. Quality research databases save you hours of hunting for information across multiple sources.

Building a Watchlist lets you monitor interesting companies before investing. Add potential monthly dividend stocks to your watchlist and observe how they perform across different market conditions. This patience often reveals the difference between temporarily attractive yields and genuinely sustainable dividends.

Financial News sources help you stay informed about developments affecting your potential investments. Industry changes, management updates, and economic trends all influence dividend sustainability. Staying current helps you make better investment decisions.

The key is using these tools systematically rather than randomly. Start with broad screening criteria, then gradually narrow your focus as you learn more about each potential investment. This methodical approach leads to much better outcomes than chasing the highest yields without proper research.

Top Monthly Dividend Stocks to Watch in 2025

Finding the right monthly dividend stocks is like curating the perfect wellness routine – it takes research, patience, and understanding what works best for your unique situation. Just as we wouldn’t recommend the same skincare regimen for everyone, there’s no one-size-fits-all approach to monthly dividend investing.

The beauty of monthly dividend investing lies in its diversity. You’ll find everything from rock-solid REITs with decades of reliable payments to higher-risk BDCs offering eye-catching yields. The key is understanding what you’re getting into and how each type fits your overall financial wellness goals.

Think of diversification as the foundation of healthy investing – much like how a balanced diet supports your overall wellness. You wouldn’t want all your income coming from just one type of investment, especially in the sometimes volatile world of monthly dividend stocks.

The Stalwart: Realty Income (O)

When people talk about monthly dividend stocks, Realty Income often steals the spotlight – and honestly, they’ve earned it. This Real Estate Investment Trust has turned consistency into an art form, literally trademarking themselves as “The Monthly Dividend Company®”.

What makes Realty Income so special? They’ve managed to pay 663 consecutive monthly dividends while increasing their payout 132 times since going public. That’s the kind of track record that makes income investors sleep better at night.

Their business model is beautifully simple. They own freestanding commercial properties leased to tenants like CVS, Walgreens, and Dollar General – businesses that tend to stay busy even when times get tough. These triple-net leases mean tenants handle property taxes, insurance, and maintenance, giving Realty Income predictable cash flow.

Even during the 2008 financial crisis, their occupancy rate never dropped below 96%. That resilience earned them a spot in the prestigious S&P 500 Dividend Aristocrat club. Their current 5.62% forward yield might not be the flashiest on this list, but sometimes steady wins the race.

The Industrial Powerhouse: STAG Industrial (STAG)

STAG Industrial brings something different to the monthly dividend stocks table – pure exposure to America’s industrial backbone. This industrial REIT focuses on the warehouses and distribution centers that keep our economy humming.

The e-commerce boom has been a gift that keeps giving for STAG. Every online order needs somewhere to be stored, packed, and shipped. STAG owns the buildings that make that magic happen, from coast to coast.

What we love about STAG is their smart approach to risk management. No single tenant accounts for more than 4% of their rent roll. That means if one company hits hard times, STAG’s income stream stays relatively stable.

With a 4.3% dividend yield and 11.3% expected total return, STAG offers a nice balance of current income and growth potential. If you want to dig deeper into their strategy, you can View an Investor Presentation that breaks down their latest business updates.

The High-Yield Play: AGNC Investment Corp. (AGNC)

AGNC Investment Corp. is where things get interesting – and by interesting, we mean higher risk and higher reward. This mortgage REIT offers a tempting 15.4% dividend yield that can make your eyes light up, but there’s more to this story.

AGNC makes money by investing in agency-backed securities – essentially mortgages guaranteed by government entities like Fannie Mae and Freddie Mac. They borrow money cheaply and invest it in higher-yielding mortgage securities, pocketing the difference.

Here’s the catch: mortgage REITs are incredibly sensitive to interest rate changes. When rates rise unexpectedly, their profit margins get squeezed, and dividend cuts can follow. AGNC’s dividend has actually declined about 10% annually over the past decade, which shows the volatility inherent in this strategy.

Think of AGNC as the high-maintenance friend in your investment portfolio – potentially rewarding, but requiring constant attention and a strong stomach for ups and downs.

The Hospitality Option: Apple Hospitality REIT (APLE)

Apple Hospitality REIT gives you a slice of America’s travel industry through their portfolio of upscale hotels operating under trusted brands like Marriott and Hilton. Their 8.2% dividend yield reflects both opportunity and risk in the hospitality space.

The hotel business runs on economic cycles and travel trends. When times are good, hotels fill up and rates climb. When uncertainty hits, business travelers cancel trips and families postpone vacations. Apple Hospitality learned this lesson the hard way when they suspended dividends for nearly two years during the pandemic.

But here’s the thing about resilient businesses – they bounce back. Apple Hospitality has recovered strongly, and their 10.7% expected total return suggests the market sees brighter days ahead. Just remember that economic cycle sensitivity comes with the territory in hospitality investing.

The BDC Lender: Horizon Technology Finance (HRZN)

Horizon Technology Finance represents the high-risk, high-reward end of the monthly dividend stocks spectrum. This Business Development Company specializes in venture debt – essentially lending money to tech startups backed by venture capital firms.

The numbers are certainly attractive: a 16.7% dividend yield and 14.9% expected total return. BDCs like Horizon are required to distribute most of their income to shareholders, which explains those generous payouts.

But lending to technology sector startups means dealing with companies that might not have profitable track records yet. While Horizon focuses on secured loans for some protection, they’ve still had to reduce their dividend twice since 2010.

Think of Horizon as the adventurous choice in your portfolio – potentially rewarding for those who understand and can handle the volatility that comes with backing emerging companies.

The key takeaway? Each of these monthly dividend stocks serves a different purpose in building your income stream. Just like your wellness routine benefits from variety, your dividend portfolio thrives on thoughtful diversification across different risk levels and business models.

Strategic Approaches to Building a Monthly Income Stream

Creating a portfolio of monthly dividend stocks is like developing a personalized wellness routine – it requires thoughtful planning, strategic choices, and ongoing attention to what works best for your unique situation. Just as we carefully select products that complement each other in our skincare regimen, building a monthly income stream involves thoughtful portfolio construction, smart diversification strategy, and careful risk management to support your long-term goals and create truly passive income.

Individual Stocks vs. Monthly Dividend ETFs: Which is Right for You?

When you’re ready to dive into monthly dividend stocks, you’ll face an important decision: should you handpick individual companies or go with Exchange Traded Funds (ETFs) that do the heavy lifting for you? Think of it like choosing between creating your own custom skincare blend or buying a professionally formulated product – both can work beautifully, but they require different levels of involvement.

Individual stock selection gives you complete control over your investment destiny. You become the curator of your portfolio, choosing companies based on your own research and preferences. Maybe you love the stability of Realty Income or you’re drawn to the industrial growth story of STAG Industrial. This approach offers higher potential returns if your picks outperform the market, but it also comes with higher risk if one of your chosen companies hits a rough patch. You’ll need to dedicate time to researching financial statements, tracking company news, and monitoring your holdings regularly.

On the flip side, monthly dividend ETFs offer instant diversification without the homework. These funds hold baskets of dividend-paying stocks, spreading your risk across many companies and often multiple sectors. While you’ll pay management fees for this convenience, you gain professional oversight and the peace of mind that comes with not having all your eggs in one basket. It’s worth noting that some ETFs that pay monthly dividends achieve this by selling covered calls rather than holding exclusively monthly dividend stocks, so their income generation strategy might differ from what you’d expect.

The choice really comes down to your comfort level with research, your available time, and how hands-on you want to be with your investments.

Maximizing Returns with Dividend Reinvestment Plans (DRIPs)

Here’s where the magic of compound growth really shines with monthly dividend stocks. Dividend Reinvestment Plans (DRIPs) are like the secret ingredient that can transform good results into great ones over time.

Instead of receiving cash dividends that might sit in your account earning minimal interest, DRIPs automatically reinvest those payments back into buying more shares of the same company or fund. For monthly dividend stocks, this creates a powerful rhythm – every month, your dividend payments purchase additional shares, which then generate their own dividends the following month.

This process creates beautiful dollar-cost averaging without any effort on your part. You’re buying more shares at various price points throughout the year, which helps smooth out market volatility. When share prices are high, your dividends buy fewer shares. When prices dip, those same dividend dollars snag more shares at a discount.

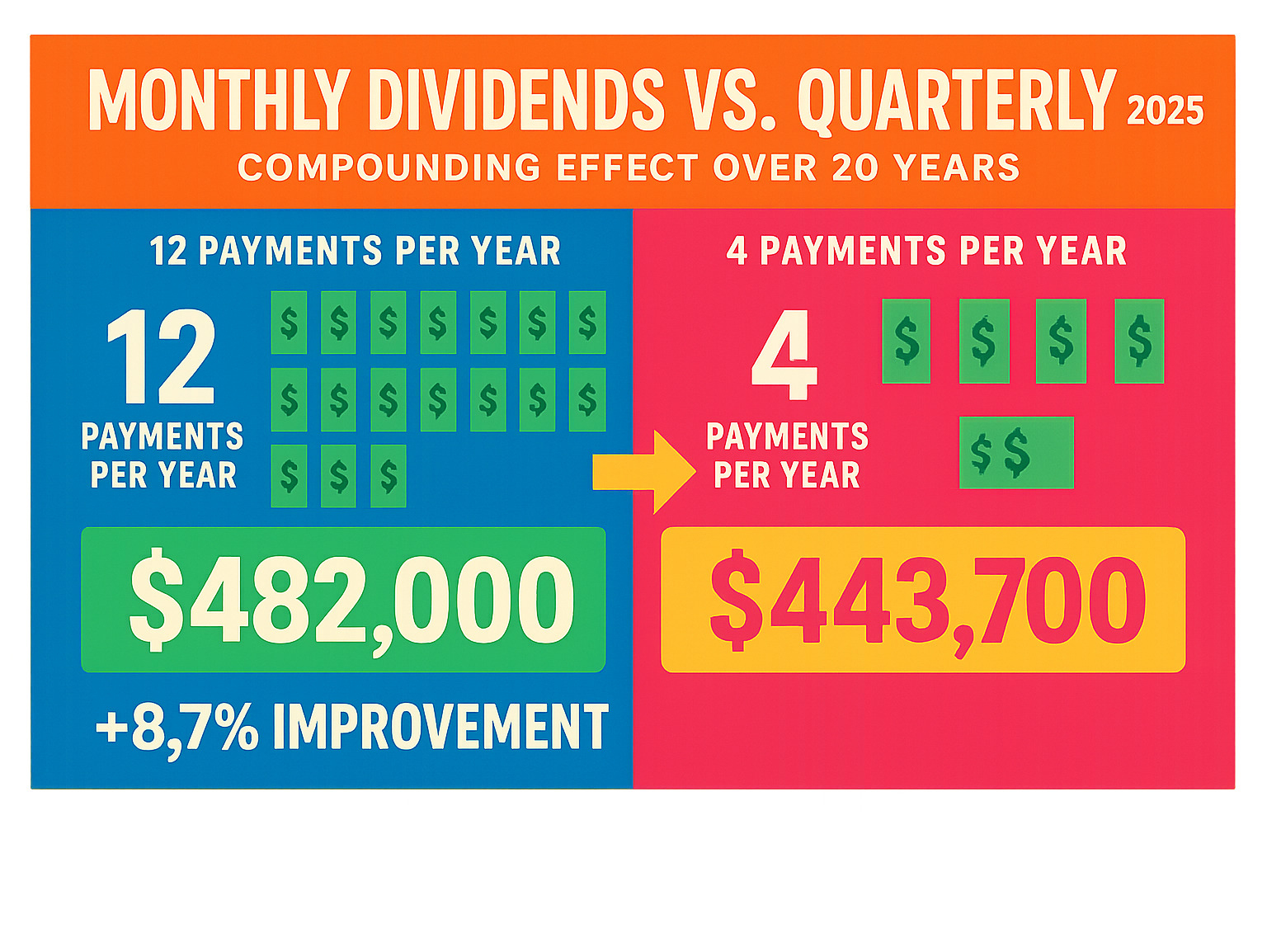

The research shows that manually reinvesting dividend payments on a monthly basis might not be practical, making DRIPs particularly valuable for monthly dividend stocks. The compounding acceleration that results can be remarkable. Monthly compounding of dividends can lead to slightly higher total returns over the long run compared to quarterly compounding. Over a 30-year horizon, the compounding advantage of monthly reinvestment can exceed $1,700 compared to quarterly reinvestment – a meaningful difference that demonstrates how small advantages compound into significant benefits over time.

A Closer Look at REITs and BDCs in a monthly dividend stocks portfolio

Most monthly dividend stocks fall into two main categories that are specifically designed to be income powerhouses: Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs). Understanding these structures helps you make smarter choices about which types of monthly payers fit your portfolio.

REITs are companies that own, operate, or finance income-producing real estate. They come in several flavors – Equity REITs own physical properties like the shopping centers and warehouses we see every day, while Mortgage REITs invest in mortgages and mortgage-backed securities, and Hybrid REITs blend both approaches. REITs enjoy special tax advantages that allow them to avoid corporate income tax, provided they distribute at least 90% of their taxable income to shareholders. This requirement explains why they’re such reliable dividend payers, though it’s important to know that dividends from REITs typically don’t qualify for favorable tax treatment as qualified dividends.

BDCs operate quite differently – they’re publicly traded investment firms that primarily lend to and invest in small and mid-sized private companies. Think of them as alternative banks that provide crucial financing to businesses that might struggle to get traditional bank loans. Like REITs, BDCs benefit from favorable tax treatment and must distribute at least 90% of their taxable income to shareholders, which explains their often very high dividend yields.

Both REITs and BDCs are structured specifically to pass income through to shareholders, making them natural fits for monthly dividend strategies. However, each carries unique risks – mortgage REITs are sensitive to interest rate changes, while BDCs face credit risks from their borrowers. For a deeper understanding of how BDCs work, you can Learn more about Business Development Companies (BDCs).

Understanding these structures helps you build a more thoughtful monthly income strategy, much like understanding different skincare ingredients helps you create a more effective beauty routine.

Frequently Asked Questions about Monthly Dividend Stocks

We know you have questions, and we’re here to provide clear, straightforward answers. Understanding the nuances of monthly dividend stocks can empower you to make informed decisions that support your financial wellness journey – think of it as your investment skincare routine, where consistency and quality matter more than flashy promises.

Are monthly dividend stocks better than quarterly ones?

This is like asking if daily moisturizing is better than weekly – technically yes, but it’s not the whole story! From a purely mathematical perspective, monthly dividend stocks do have an advantage because “monthly compounding generates slightly higher returns over quarterly compounding.” Your money gets reinvested and starts earning returns faster, which is always a beautiful thing.

The psychological benefits are equally compelling. “Monthly dividend payments can help investors match portfolio income with personal expenses, which typically recur monthly.” This alignment can “simplify budgeting for people who rely on income investing, such as retirees.” Imagine having your investment income arrive just like your wellness subscription box – predictably and when you need it most.

But here’s our expert take: company quality over frequency. While monthly payments feel great, the durability of the dividend and the strength of the underlying business matter far more than how often the payment arrives. Don’t sacrifice a high-quality, stable quarterly payer for a risky monthly one just for the convenience factor.

Portfolio diversification remains key. A well-balanced approach might include both monthly and quarterly payers, ensuring you have income flowing throughout each month while maintaining exposure to quality companies regardless of their payment schedule. Dividend durability is what truly builds long-term financial freedom.

What are the biggest risks with high-yield monthly dividend stocks?

High yields can be as tempting as those “too good to be true” beauty products – but just like with skincare, if it seems too amazing, there might be a catch. Let’s break down what to watch for.

Dividend cuts represent the biggest threat to your income stream. Many monthly dividend stocks have “high payout ratios, indicating potential risk.” When a company pays out most of its earnings as dividends, there’s little buffer if business conditions worsen. A high payout ratio also means less money for growth investments, potentially leading to increased borrowing – a dangerous combination for dividend sustainability.

Yield traps are particularly sneaky. Sometimes a stock shows a sky-high yield not because the company is thriving, but because its stock price has crashed due to underlying problems. This creates a trap where the attractive yield is unsustainable and likely to disappear. “Chasing high-yield assets can lead to capital loss” as both the dividend and stock price continue falling.

Price volatility tends to be higher with many monthly dividend stocks. Research shows that “many stocks with monthly dividends have a beta greater than one,” meaning they swing more dramatically than the overall market. Speculative businesses often populate the monthly dividend space, especially in the higher-yield categories, requiring extra careful evaluation.

Sector concentration risk poses another challenge since “monthly dividend payers are often concentrated in a few sectors” like REITs and BDCs. While these sectors excel at generating income, putting too many eggs in these baskets means your entire portfolio could suffer if those specific industries face headwinds.

How do monthly dividend stocks compare to bonds?

Comparing monthly dividend stocks to bonds is like comparing your favorite serum to your daily moisturizer – both serve important purposes, but they work differently and offer distinct benefits.

Risk vs. reward represents the fundamental difference. Bonds, especially government or highly-rated corporate bonds, offer lower risk with fixed income and principal return at maturity. Monthly dividend stocks carry market risk where your principal fluctuates, but they offer higher potential returns over time.

Growth potential sets them apart dramatically. Bonds typically provide no capital appreciation beyond their fixed interest payments. Monthly dividend stocks offer both income through dividends and the possibility of stock price appreciation as companies grow and prosper.

As an inflation hedge, dividend stocks often outperform bonds during inflationary periods. While fixed-income bonds lose purchasing power when prices rise, high-quality monthly dividend stocks with growing dividends can help maintain your buying power as companies increase payouts alongside rising revenues and costs.

Principal safety favors bonds if you hold them to maturity – you’re guaranteed your initial investment back (barring default). With stocks, your principal rides the market waves without guarantees, though consistent dividends can help cushion price declines.

The choice between fixed income vs. variable income depends on your priorities. Bonds deliver predictable, steady payments, while dividends, though often consistent, can be reduced or suspended during tough times – as many companies demonstrated during the 2020 pandemic.

For predictable, low-risk income, bonds might suit you perfectly. But if you’re willing to accept more risk for higher growth potential and better inflation protection, monthly dividend stocks can be a powerful addition to your diversified investment wellness routine.

Conclusion: Aligning Your Finances with Your Wellness Goals

Think of monthly dividend stocks as the skincare routine for your financial health – they require patience, consistency, and the right ingredients to truly shine. Just like we wouldn’t expect overnight results from a new serum, building a sustainable income stream takes time and careful selection.

Throughout our journey together, we’ve finded that these investments offer something beautiful: financial stability that matches the rhythm of your life. Your rent, groceries, and wellness subscriptions all happen monthly, so why shouldn’t your investment income follow the same pattern? This alignment creates a sense of financial harmony that can significantly reduce stress and support your overall well-being.

But here’s what we’ve learned is most important – the quality of the company matters far more than how often they pay. Just as we read ingredient lists on our beauty products, we need to dig deep into payout ratios, dividend growth rates, and balance sheet strength. A gorgeous yield means nothing if the company can’t sustain it long-term.

The research we’ve done together shows that successful investing in monthly dividend stocks requires the same thoughtful approach we bring to our wellness routines. We prioritize business quality over payment frequency, use tools like stock screeners to find the best options, and understand that diversification across REITs, BDCs, and other sectors creates a more resilient portfolio.

Building wealth through dividend investing isn’t just about the money in your account – it’s about creating financial security that empowers you to live your best life. When you’re not worried about monthly cash flow, you can focus your energy on the things that truly matter: your health, relationships, and personal growth.

This approach to investing is really an act of self-care for your future self. You’re creating a foundation that supports not just your financial goals, but your overall wellness journey. And that’s something worth investing in.