Why SMCI Stock Price Matters for Today’s Tech Investors

The SMCI stock price has captured widespread attention as Super Micro Computer transforms from a niche server manufacturer into a critical player in the artificial intelligence revolution. Currently trading at around $44.36, SMCI represents one of the most volatile and closely-watched stocks in the tech sector.

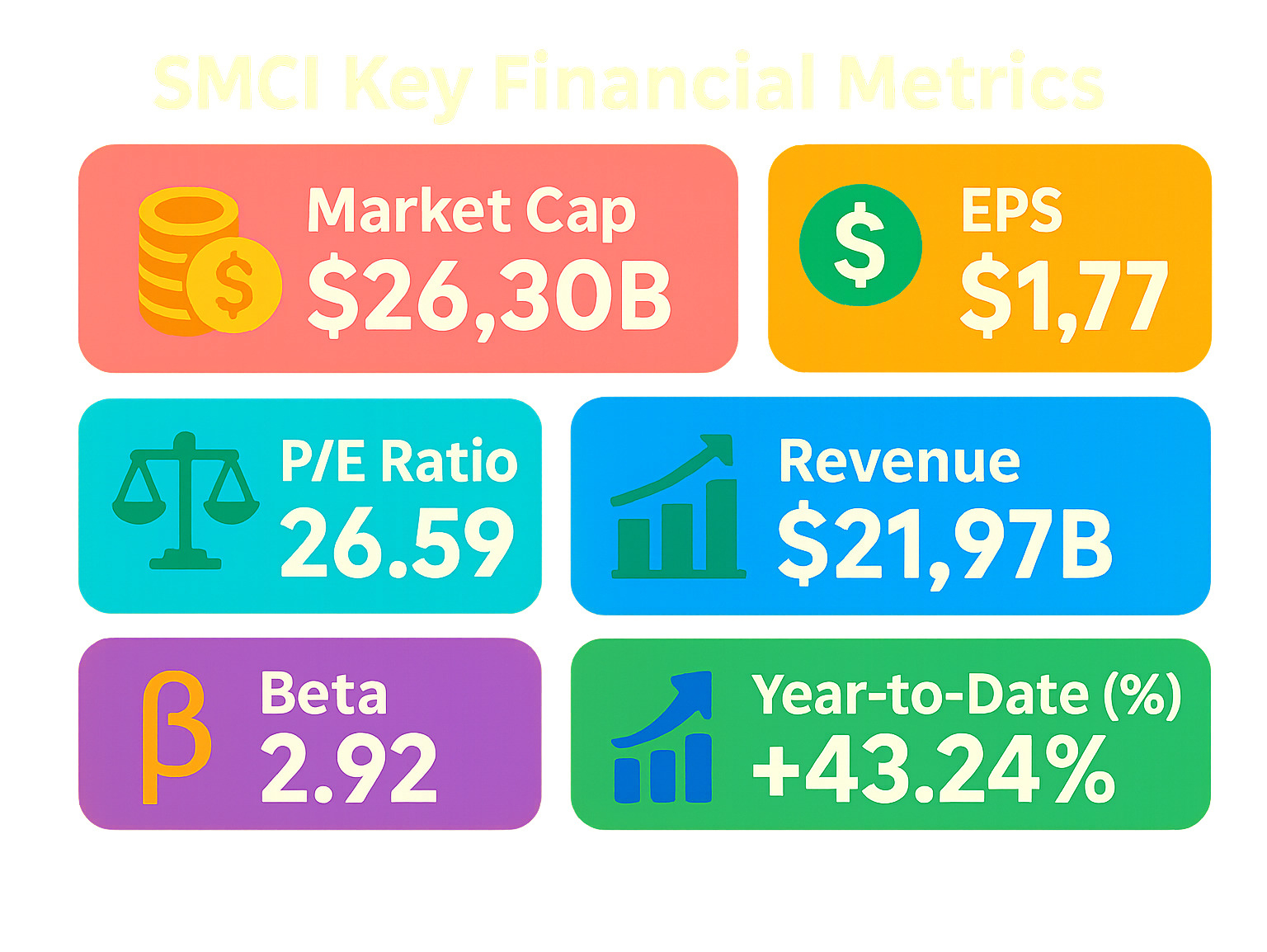

Quick SMCI Stock Price Facts:

- Current Price: $44.36 USD

- Daily Change: +0.66%

- 52-Week Range: $17.25 – $122.90

- Market Cap: $26.30 billion

- Year-to-Date Performance: +43.24%

- Beta (Volatility): 2.92 (highly volatile)

Super Micro Computer has experienced explosive growth over the past five years, with returns exceeding 4,300%. However, this meteoric rise comes with significant volatility – the stock has fallen 27.28% over the last year despite strong year-to-date gains.

The company’s AI server solutions have positioned it as a key beneficiary of the artificial intelligence boom. Major tech giants rely on Supermicro’s high-performance servers to power their AI training and inference workloads.

Yet SMCI faces headwinds too. The company recently cut its fiscal 2026 revenue forecast from $40 billion to $33 billion, and has missed earnings targets for four consecutive quarters. This creates both opportunity and risk for investors.

In this guide, we’ll break down everything you need to know about SMCI’s current stock price, the business fundamentals driving its valuation, and what analysts expect for the future.

Similar topics to smci stock price:

SMCI Stock Price and Key Financials

The SMCI stock price has been on quite a journey, and understanding where it stands today requires looking at both the current numbers and recent market movements. As we dive deeper into Super Micro Computer’s financial picture, you’ll see why this stock continues to capture so much attention from investors.

Currently, the SMCI stock price reflects the company’s position as a key player in the AI infrastructure space, though it’s important to note that stock prices can change rapidly throughout each trading day. The stock typically sees active trading volumes in the millions of shares, showing strong investor interest and engagement with the company’s story.

What really stands out about SMCI is its impressive 52-week range. The stock has traveled from lows around $17.25 to highs near $122.90 over the past year. This wide range tells us two important things: first, that investors see tremendous potential in the company’s AI-focused business model, and second, that the stock can be quite volatile – something every investor should keep in mind.

Market sentiment around the SMCI stock price tends to swing between excitement about AI growth opportunities and caution about the company’s recent challenges. The stock’s movements often reflect broader trends in the technology sector, particularly around artificial intelligence and data center infrastructure.

Recent and Historical Performance

Looking at how the SMCI stock price has moved recently gives us valuable insight into investor sentiment and market dynamics. The daily fluctuations might seem dramatic, but they’re part of a larger story about a company navigating rapid growth and market expectations.

Over the past week, SMCI has shown the kind of movement that’s become characteristic of high-growth tech stocks. Short-term traders and long-term investors alike watch these weekly trends to gauge momentum and market confidence in the company’s direction.

The monthly performance picture reveals even more about how the market views Super Micro Computer’s prospects. While the stock has faced some headwinds recently, it’s worth remembering that monthly movements in volatile stocks often reflect broader market conditions as much as company-specific news.

Year-to-date performance remains one of the most impressive aspects of the SMCI stock price story. Despite recent challenges, the stock has delivered substantial gains that few companies can match. This YTD performance of over 43% demonstrates the market’s continued belief in the company’s AI infrastructure opportunity.

When we zoom out to look at the one-year return, the picture becomes even more compelling. Even with recent volatility, investors who bought SMCI a year ago have seen significant returns, though past performance certainly doesn’t guarantee future results.

The five-year growth story is truly remarkable. Super Micro Computer has delivered returns that have transformed early investors’ portfolios, with gains exceeding 4,300%. This kind of explosive growth reflects the company’s successful transition from a niche server manufacturer to a critical AI infrastructure provider.

The company’s all-time high and low prices tell the complete story of its market journey. From humble beginnings to reaching peaks that seemed impossible just a few years ago, SMCI’s price history illustrates both the opportunities and risks in growth investing.

Essential Financial Metrics for the smci stock price

Understanding the SMCI stock price means looking beyond just the daily movements to examine the fundamental financial metrics that drive long-term value. These numbers help us understand whether the current price makes sense given the company’s business performance.

Super Micro Computer’s market capitalization of approximately $26.30 billion places it firmly in the large-cap category. This valuation reflects the market’s assessment of the company’s current business and future growth potential in the AI server market.

The Price-to-Earnings (P/E) ratio of 26.59 tells us how much investors are willing to pay for each dollar of the company’s earnings. While this might seem high compared to traditional manufacturing companies, it’s reasonable for a growth company positioned in the rapidly expanding AI infrastructure market.

Earnings Per Share (EPS) of $1.77 shows the company’s profitability on a per-share basis. This metric is particularly important because it helps investors understand how much profit they own for each share they hold.

The company’s revenue of $21.97 billion demonstrates Super Micro Computer’s substantial scale in the server and storage markets. This revenue figure reflects strong demand for the company’s AI-optimized server solutions from major technology companies.

With a beta coefficient of 2.92, SMCI stock moves much more dramatically than the broader market. This high beta means the stock can deliver outsized returns during good times but can also fall more sharply during market downturns. It’s a key factor for investors to consider when determining position sizes.

The debt-to-equity ratio provides insight into how the company finances its operations and growth. Super Micro Computer’s financial structure reflects a balance between leveraging opportunities for growth while maintaining financial flexibility.

For investors interested in broader market analysis and how economic trends affect technology stocks like SMCI, you can find more info about market analysis to deepen your understanding of market dynamics.

Decoding Super Micro Computer: The Business Behind the Ticker

When you look beyond the daily ups and downs of the SMCI stock price, you’ll find a company with a remarkable story that began over three decades ago. Super Micro Computer, Inc. – or simply Supermicro as most folks know it – started life in 1993 in the heart of Silicon Valley, San Jose, California.

The company’s mission is refreshingly straightforward: they build the powerful computer servers and storage systems that keep our digital world running smoothly. Think of them as the behind-the-scenes heroes who create the hardware that powers everything from your favorite streaming service to cutting-edge AI research.

What makes Supermicro special is their focus on modular and open architectures. Instead of forcing customers into rigid, one-size-fits-all solutions, they offer flexible systems that can be customized and upgraded as needs change. This approach has made them a critical technology provider, especially as companies scramble to build the computing power needed for artificial intelligence applications.

Core Products and Markets Served

Supermicro isn’t just selling metal boxes filled with circuits – they’re crafting sophisticated solutions for some of today’s most demanding computing challenges. Their high-performance servers form the backbone of modern data centers, designed to handle massive workloads while keeping energy costs reasonable.

The real excitement around the SMCI stock price comes from their AI training systems. These specialized servers are built specifically for artificial intelligence work, capable of handling the enormous computational demands of training large language models and running complex AI applications. It’s this AI focus that has investors so interested in the company’s future.

Their storage solutions range from traditional systems to advanced software-defined storage that can adapt to changing needs. Meanwhile, their modular blade servers offer the kind of flexibility that IT managers love – easy to upgrade, simple to maintain, and scalable as businesses grow.

The markets Supermicro serves read like a who’s who of cutting-edge technology. Artificial intelligence represents their biggest growth opportunity, with companies desperately needing the computing power to develop and deploy AI applications. Cloud computing providers rely on their servers to keep massive data centers humming along smoothly.

The expansion of 5G networks has created new demand for their infrastructure solutions, while edge computing – processing data closer to where it’s created rather than in distant data centers – has opened up entirely new market segments. Traditional enterprise data centers remain a steady source of business as companies continue to modernize their IT infrastructure.

For those wanting to dive deeper into the company’s background, An overview of Supermicro provides additional context about their evolution and market position.

Leadership and Global Operations

The driving force behind Supermicro’s success is Charles Liang, who founded the company in 1993 and continues to serve as its President and CEO. His vision of creating flexible, high-performance computing solutions has guided the company through multiple technology transitions, from the early days of server computing to today’s AI revolution.

Under Liang’s leadership, Supermicro has built a truly global manufacturing footprint with operations spanning the United States, Europe, and Asia. This distributed approach isn’t just about cost savings – it provides supply chain resilience and allows the company to serve customers more effectively across different regions.

Perhaps most importantly for the SMCI stock price, the company has forged strategic partnerships with leading chipmakers like Nvidia. These relationships ensure that Supermicro’s server designs are optimized for the latest and most powerful processors and graphics cards. When Nvidia releases a new AI chip, Supermicro is ready with servers designed to make the most of that new technology.

This integrated approach – from initial design through manufacturing and final deployment – helps explain why investors have been so interested in Supermicro’s stock. The company sits at the intersection of several major technology trends, with the leadership and global reach needed to capitalize on these opportunities.

Future Outlook: AI Boom, Analyst Ratings, and Potential Risks

The future of Super Micro Computer reads like a tech investor’s dream – and nightmare – all rolled into one. As we look ahead, the SMCI stock price will likely dance to the rhythm of the artificial intelligence boom, a sector that’s reshaping how we think about computing power and infrastructure.

The numbers tell a compelling story. The AI server market is projected to grow at an explosive pace, and Supermicro sits right at the heart of this change. Their high-performance servers, especially those packed with advanced GPUs, are the workhorses powering everything from ChatGPT to autonomous vehicles. It’s like being the pick-and-shovel supplier during a gold rush – except this digital gold rush shows no signs of slowing down.

What makes Supermicro particularly well-positioned is their agile, modular approach. While competitors might take months to integrate new chip technologies, Supermicro can often do it in weeks. Their close partnership with Nvidia means they’re frequently first to market with servers featuring the latest processors. It’s this speed and flexibility that has investors excited about the company’s prospects.

But let’s be honest – the road ahead isn’t all smooth sailing. Supermicro recently had to cut their fiscal 2026 revenue forecast from an ambitious $40 billion down to $33 billion. While $33 billion is still massive growth, this revision signals that even in the AI boom, challenges exist. Supply chain hiccups, intense competition, and the sheer complexity of scaling at this pace all play a role.

Analyst Ratings and the latest smci stock price forecast

Wall Street’s take on the SMCI stock price is fascinatingly divided, much like a family dinner discussion about politics. Out of 19 analyst ratings, roughly 42% are ‘Buy’, 42.1% are ‘Hold’, and 15.8% are ‘Sell’. This split reflects the classic growth stock dilemma – massive potential meets significant uncertainty.

The average 1-year price target sits at approximately $1,023.42, suggesting many analysts believe there’s still substantial upside from current levels. That’s the kind of target that gets investors’ hearts racing, but remember – analyst predictions can be as unpredictable as the weather.

The next major catalyst for the SMCI stock price comes on August 13, 2024, when Supermicro reports their quarterly earnings. These reports are like report cards for public companies, revealing whether all the AI hype is translating into cold, hard cash. Given that the company has missed earnings targets for four consecutive quarters, this upcoming report carries extra weight.

For investors looking to understand the broader AI investment landscape, exploring comprehensive resources like the 5StarsStocks.com AI Guide 2025 can provide valuable context for evaluating opportunities like SMCI.

Key Risks and Opportunities for Investors

Investing in Super Micro Computer is like riding a roller coaster designed by artificial intelligence – thrilling, but not for the faint of heart. The opportunities are genuinely exciting. The AI market expansion represents perhaps the biggest technological shift since the internet boom, and Supermicro is positioned as a critical infrastructure provider.

Their strategic partnerships with chip manufacturers ensure they stay ahead of the technology curve, while their modular business model allows for rapid customization that bigger, slower competitors struggle to match. Recent insider trading activity shows confidence from those who know the company best – insiders bought 27.5k shares versus selling only 16.19k in the last 100 trades. When Don W. Clegg bought 796 shares recently, it sent a positive signal about internal confidence.

However, the risks are equally real. With a beta of 2.92, the SMCI stock price moves like it’s had too much caffeine – nearly three times more volatile than the broader market. This means when markets get nervous, SMCI tends to get really nervous.

Intense competition from established players creates constant pressure on margins and market share. The company’s supply chain dependencies make it vulnerable to global disruptions – remember how chip shortages affected the entire tech industry? Add in the recent revenue forecast cuts and four consecutive quarters of missed earnings, and you have a stock that requires strong conviction and a tolerance for bumpy rides.

Perhaps most importantly, Supermicro faces concentration risk. Their success is tightly tied to the AI boom continuing at its current pace. If AI growth slows or shifts direction, the SMCI stock price could face significant headwinds.

For investors, the key is understanding that while the potential rewards are substantial, this isn’t a “set it and forget it” investment. It requires active monitoring and a clear understanding of your risk tolerance.

Frequently Asked Questions about SMCI

When it comes to the SMCI stock price and Super Micro Computer as an investment, we get lots of questions from readers who want to understand what they’re getting into. The company’s wild ride through the AI boom has left many people curious – and sometimes confused – about whether this stock makes sense for their portfolio.

Let’s tackle the most common questions we hear, so you can make informed decisions about this fascinating but volatile company.

Is SMCI a good stock to buy?

This is probably the question we hear most often, and honestly, it’s one of the trickiest to answer. The SMCI stock price has been on an absolute rollercoaster, and whether that’s exciting or terrifying depends entirely on your personality as an investor.

The bullish case is pretty compelling. We’re talking about 5-year growth of over 4,300% – that’s the kind of performance that creates millionaires. The company sits right at the heart of the AI revolution, building the specialized servers that power everything from ChatGPT to autonomous vehicles. With year-to-date gains of nearly 200%, it’s clear that investors see massive potential here.

But the bearish concerns are just as real. That sky-high valuation comes with equally high expectations, and Supermicro has stumbled recently. They’ve missed earnings targets four quarters in a row and had to cut their revenue forecast. Plus, with a beta of 2.92, this stock moves like it’s had too much coffee – nearly three times more volatile than the overall market.

Here’s our take: if you’re someone who can sleep soundly while your portfolio swings wildly, and you truly believe AI will keep growing explosively, SMCI might fit your strategy. But if you prefer steady, predictable returns, this probably isn’t your cup of tea. The key is doing your homework and never investing more than you can afford to lose in such a volatile stock.

Does Supermicro (SMCI) pay a dividend?

Nope, Super Micro Computer doesn’t pay dividends, and that’s actually pretty typical for a company in their position. Instead of sending cash back to shareholders, they’re reinvesting every penny they can into growing the business.

Think of it this way – when you’re in the middle of a gold rush (which is basically what the AI boom feels like), you don’t stop digging to count your coins. Supermicro is focused on expanding manufacturing, developing new server technologies, and grabbing as much market share as possible while the getting is good.

For income-focused investors, this means you won’t see quarterly dividend checks. But for growth investors, the idea is that all that reinvested money will eventually show up as a higher SMCI stock price down the road.

Who are Supermicro’s main competitors?

The server market is surprisingly competitive, with some heavyweight companies vying for the same customers that Supermicro targets. The landscape includes established tech giants like Dell Technologies and Hewlett Packard Enterprise, both of which have vast resources and long-standing relationships with enterprise customers.

What makes this competitive picture interesting is how Supermicro has carved out its niche. While the big players often move slowly and offer standardized solutions, Supermicro built its reputation on speed and customization. They can often get new GPU-powered servers to market faster than their larger competitors, which has been crucial in the fast-moving AI space.

The company’s modular approach also sets them apart. Instead of building everything from scratch, they use standardized building blocks that can be quickly reconfigured for different customer needs. It’s like having a really sophisticated set of Lego blocks for data centers.

This agility has helped Supermicro punch above its weight, especially as AI companies need specialized hardware solutions that the traditional server makers weren’t ready for. But staying ahead of well-funded competitors requires constant innovation and flawless execution – which partly explains the volatility we see in the SMCI stock price.

Conclusion

Super Micro Computer represents one of the most compelling investment stories of our time. What started as a modest server company in 1993 has blossomed into a cornerstone of the artificial intelligence revolution. The SMCI stock price journey tells this remarkable story – from humble beginnings to becoming a $26-49 billion market cap powerhouse that’s essential to powering our digital future.

The numbers speak for themselves. With five-year returns exceeding 4,300% and year-to-date gains of over 190%, SMCI has delivered the kind of performance that turns everyday investors into millionaires. But these aren’t just lucky breaks – they reflect Supermicro’s smart positioning at the intersection of AI, cloud computing, and high-performance computing. Their modular approach and lightning-fast adoption of cutting-edge technologies, especially through strategic partnerships with chip leaders, has created a sustainable competitive advantage.

Yet investing in growth stories like SMCI requires a clear-eyed view of the risks. The stock’s high volatility (with a beta nearly three times the market average), recent earnings misses, and revised revenue forecasts remind us that even the most promising companies face real challenges. The competitive landscape is fierce, and market sentiment can shift as quickly as the latest earnings report.

For investors considering SMCI, it’s truly a tale of high risk, high reward. If you believe in the long-term AI boom and can stomach the inevitable ups and downs, Supermicro offers a direct way to participate in one of technology’s most transformative trends. But this isn’t a stock for the faint of heart or those seeking steady, predictable returns.

As we’ve learned throughout this guide, successful investing requires balancing opportunity with prudent risk management. Just as we approach wellness and beauty with thoughtful consideration of what works best for our individual needs, investment decisions should align with your personal financial goals and comfort level.

At Beyond Beauty Lab, we believe that knowledge empowers better decisions – whether you’re choosing the right skincare routine or evaluating your next investment opportunity. Both require patience, research, and understanding your unique situation.