Why Alaska’s Permanent Fund Dividend Matters for Your Financial Wellness

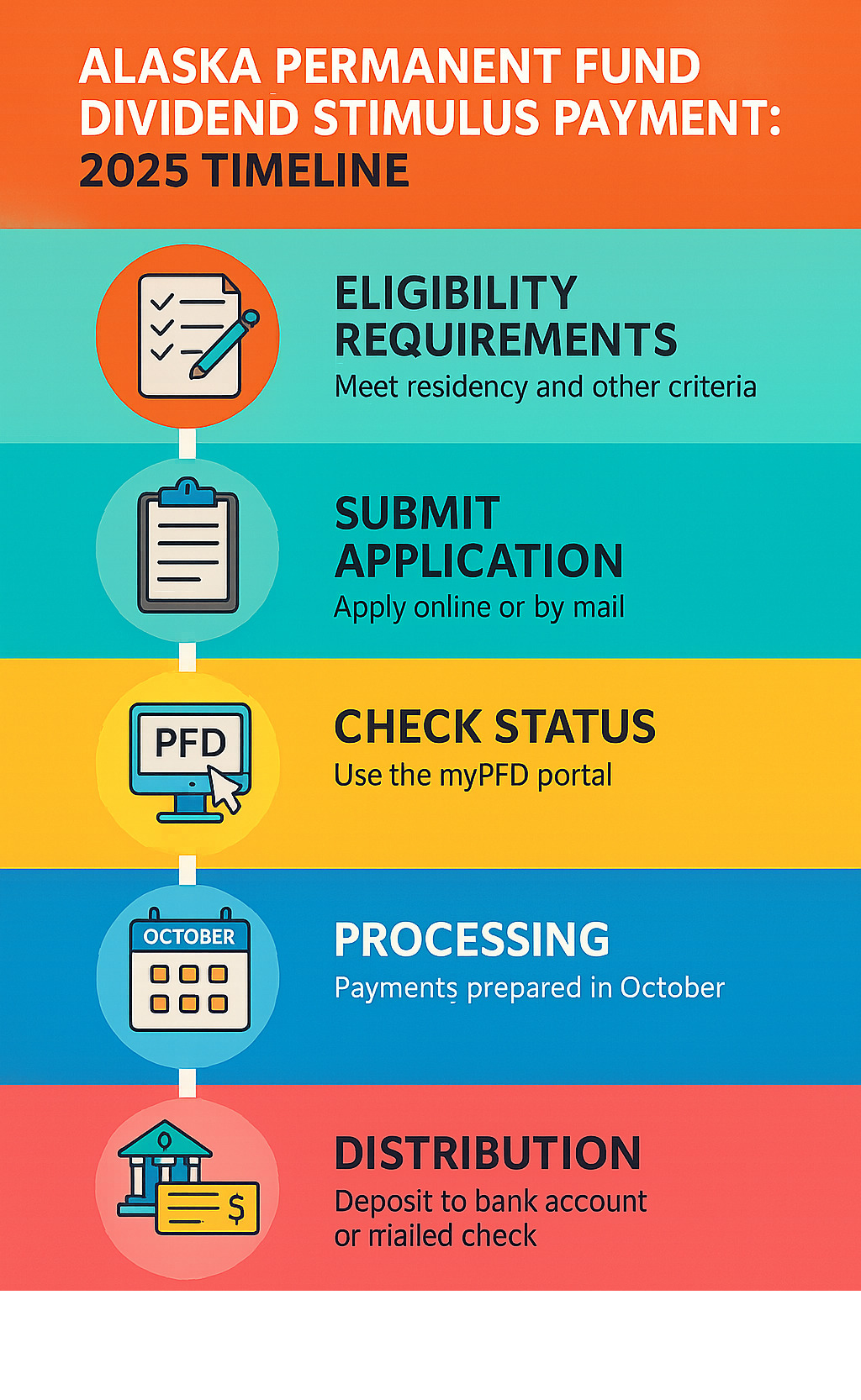

The alaska permanent fund dividend stimulus payment is an annual payment that provides a significant financial boost to eligible residents. For instance, the 2024 payment was $1,702 per person, which included a base dividend and a special energy relief payment. Each year, this distribution helps over 600,000 Alaskans manage living expenses and maintain financial stability.

Key Facts About the Alaska PFD:

- Payment Amount: Varies annually based on fund earnings and legislative decisions. The 2024 payment was $1,702.

- Eligibility: Based on Alaska residency for the entire previous calendar year (e.g., to be eligible in 2025, you must have been a resident throughout 2024).

- Payment Schedule: Typically distributed in October.

- Economic Impact: Injects hundreds of millions of dollars into Alaska’s economy each year.

- Status Check: Available through the official myPFD portal online.

The Alaska Permanent Fund Dividend isn’t a federal stimulus check. It’s a unique state program that’s been running since 1982. The fund shares Alaska’s oil revenue with residents, creating a form of financial wellness support that helps families cover essential expenses like heating, food, and other necessities during Alaska’s harsh winters.

This dividend payment can significantly reduce financial stress, especially when you know exactly when to expect it and how to track its status. Understanding your payment timeline helps you plan better and creates peace of mind around your financial wellness journey.

For busy professionals juggling work and wellness goals, having this extra financial cushion can mean the difference between stress and stability. It allows you to focus on what matters most: your health, your family, and your personal growth, without worrying about unexpected expenses.

Simple alaska permanent fund dividend stimulus payment word guide:

What is the Alaska Permanent Fund Dividend?

The Alaska Permanent Fund Dividend is truly one of America’s most remarkable financial programs. Imagine getting paid just for being a resident of your state! This unique system has been putting money directly into Alaskans’ pockets since 1982, and it’s all thanks to the state’s incredible foresight in managing its oil wealth.

Back in 1982, Alaska established the Permanent Fund through a constitutional amendment with a brilliant idea: instead of spending all the oil money right away, let’s save some for the future. The state takes a portion of its oil and mineral revenues and invests them wisely, creating what’s essentially a massive savings account that now holds over $81 billion.

Here’s where it gets really interesting for your financial wellness. Every year, Alaska shares these oil revenues with its residents through dividend payments. Since the program began, the average Alaskan has received about $1,299 annually. That’s nearly $5,200 for a family of four! This isn’t just pocket change; it’s real money that helps with everything from heating bills to holiday shopping.

The alaska permanent fund dividend stimulus payment creates incredible economic stability throughout the state. Each year, this program injects hundreds of millions of dollars into local economies. For example, in 2024, over $914 million flowed directly into Alaskans’ bank accounts and communities. This consistent financial boost helps families breathe easier, especially during those long, expensive winters.

What makes this program so special is how it reduces financial stress for hundreds of thousands of people. When you know that annual payment is coming, it’s easier to plan ahead and focus on what really matters: your health, your family, and your personal well-being. Financial security creates space for self-care and mental wellness, which is why we believe programs like this are so valuable for overall life satisfaction.

You can learn more about how financial wellness impacts your mental health and find practical ways to build that stability into your daily routine.

How is the PFD Amount Determined?

The Alaska Permanent Fund Corporation manages this massive fund like the world’s most important investment portfolio; that’s exactly what it is! They work hard to grow those billions through smart investments while protecting the money for future generations.

Every year, the fund earns money from its investment earnings, and that’s where your dividend comes from. But here’s the thing: the final amount you receive isn’t just about how well the investments performed. The Alaska Legislature gets the final say on how much actually gets distributed to residents.

This legislative decision process can get pretty intense! Lawmakers have to balance giving residents a good dividend with funding other important things like schools, roads, and public safety. It’s like managing a household budget, but with billions of dollars and hundreds of thousands of people depending on the outcome.

The number of eligible applicants also affects your payment. More eligible residents means the pot gets divided more ways, though Alaska’s population has remained fairly stable over the years.

As an example of how this works, the 2024 payment of $1,702 was composed of a base PFD amount of $1,403.83 from fund earnings, plus a one-time energy relief payment of $298.17 that the legislature added to help families with rising costs and inflation.

This shows how flexible the PFD can be. It’s not just a rigid annual payment, but a tool the state can use to provide targeted help when Alaskans need it most. That’s what makes it function so effectively as an alaska permanent fund dividend stimulus payment that responds to real economic challenges.

PFD Payment and Eligibility Details

Each year, the alaska permanent fund dividend stimulus payment provides a welcome financial boost to residents across the state. While the amount varies, it often represents a substantial payment that makes a real difference in people’s lives. For example, the 2024 payment was $1,702 per person.

What makes this particularly meaningful is the sheer scope of impact. Over 600,000 Alaskans are typically eligible for this payment, which means hundreds of millions of dollars flow directly into communities throughout the state. That’s real money going to real families, helping with everything from winter heating bills to back-to-school expenses.

Who is Eligible for the Alaska Permanent Fund Dividend Stimulus Payment?

Understanding eligibility for the alaska permanent fund dividend stimulus payment doesn’t have to be complicated, but it is important to get it right. The state has clear guidelines to ensure this benefit goes to genuine Alaska residents who’ve made the state their true home.

Alaska residency is the cornerstone requirement. You need to have lived in Alaska for the entire calendar year before the dividend year. For example, to receive the 2025 payment, you must have been an Alaska resident throughout all of 2024. This isn’t just about having a mailing address; it’s about making Alaska your primary home with the intent to remain there indefinitely.

The state also looks at whether you’ve claimed residency anywhere else. If you filed resident tax returns in another state, claimed in-state tuition benefits elsewhere, or took other actions showing you consider somewhere else home, that could affect your eligibility.

Allowable absences are limited but reasonable. You can’t be away from Alaska for more than 180 days during the qualifying year. There are exceptions for things like military service, medical treatment, or education, but extended vacations or work assignments elsewhere can impact your eligibility.

Felony convictions during the qualifying year make you ineligible, as does being incarcerated for multiple misdemeanors. The state takes these requirements seriously as part of maintaining the program’s integrity.

For the complete picture of all requirements and exceptions, we recommend checking the official guidance at Learn about the official requirements.

How Much is the PFD and When Will It Be Paid?

The annual payment amount is determined each year and can include different components. The 2024 payment of $1,702, for instance, combined a base PFD amount of $1,403.83 from fund earnings with an energy relief payment of $298.17, which the legislature approved to help Alaskans with inflation and high energy costs.

This shows how the PFD program can adapt to help residents during challenging times, functioning as both a regular dividend and an economic stimulus when needed most.

Payment distribution typically happens in October. The first wave of payments usually goes to those who applied electronically and chose direct deposit. Subsequent distributions cover remaining electronic applications and paper applications, for both direct deposit and paper checks.

The timing matters for your financial planning. Knowing when to expect your payment helps reduce stress and lets you make better decisions about managing your household budget. Whether you’re planning for winter expenses or thinking about wellness investments for your family, having this predictable income can provide real peace of mind.

At Beyond Beauty Lab, we understand that financial wellness directly impacts your overall well-being. When you’re not worried about money, you have more energy to focus on the things that truly matter: your health, your relationships, and your personal growth. Taking care of your finances is just as important as taking care of your skin or your mental health. Learn more about creating a balanced approach to self-care at More on planning for your well-being.

How to Check Your Alaska Permanent Fund Dividend Stimulus Payment Status

Once you’ve submitted your application for the alaska permanent fund dividend stimulus payment, waiting can feel a bit nerve-wracking. Will it go through? When will you know? The good news is that Alaska makes it easy to track your application’s progress through their myPFD online portal. Think of it as your personal window into the PFD process. No more wondering or worrying about whether your application is moving along smoothly.

Checking your status regularly isn’t just about satisfying curiosity. It’s about taking control of your financial wellness and catching any potential hiccups early. If there’s an issue with your application, you’ll want to know sooner rather than later so you can address it before the payment deadlines roll around.

Step-by-Step Guide to Using myPFD

The myPFD portal is surprisingly user-friendly, even if you’re not particularly tech-savvy. Alaska designed it with real people in mind: busy folks who just want to check their status quickly and move on with their day.

Getting started is simple. Head to the official myPFD website by searching for “Alaska myPFD” or using the direct link we’ve provided below. You’ll see two main options for accessing your information, and which one you choose depends on how much detail you want and whether you plan to make any updates.

The quick and easy route is the limited search function. You don’t need to create any accounts. Just enter your dividend year, first and last name (remember those hyphens if your last name has them), Social Security Number, and date of birth. If you’re checking on a child’s application, you’ll also need the sponsor’s information. This gives you basic status information without any fuss.

For the full experience, logging in with a myAlaska account is the way to go. Yes, it requires creating an account if you don’t have one, but it’s worth it. You’ll get complete access to your application details, the ability to electronically sign documents, and options to update your personal information. Plus, myAlaska uses multi-factor authentication, which means better security for your sensitive information.

Understanding what you see is just as important as accessing the portal. When you pull up your application, you’ll see a status that tells the whole story. “Applied” means they’ve received your paperwork. “Processing” tells you they’re reviewing everything. The status you really want to see as payment time approaches is “Eligible-Not Paid”. That’s your green light indicating approval and upcoming payment.

If you see “Paid,” congratulations. Your money is on its way! “Denied” means there was an issue, but don’t panic. You’ll receive a determination letter explaining what went wrong and your options for appeal. “Action Required” simply means they need more information from you to move forward.

A word of caution about security: Alaska takes fraud seriously, and you should too. The state will never send you text messages or emails asking you to change your password. If you get one of these messages, it’s a scam. Delete it immediately.

Ready to check your status? Log in to check your status and see where your alaska permanent fund dividend stimulus payment stands.

Updating Your Personal Information

Keeping your information current with the PFD Division is one of those small but crucial steps that can save you major headaches later. Think about it: if they can’t find you or can’t deposit your money, all that waiting becomes pointless.

Address changes are the big one. Whether you’ve moved across town or just changed your mailing address, the PFD Division needs to know. If you applied through myAlaska and electronically signed your application, updating your address is as simple as logging into the myPFD portal and making the change online. For everyone else, you’ll need to fill out an official Address Change Form and submit it the traditional way.

Banking information updates work similarly. Direct deposit is faster and more secure than waiting for a paper check, but only if your account information is correct. Again, if you’re in the myAlaska system, you can update your direct deposit details online. Otherwise, you’ll need to complete and submit a Payment Method form.

Here’s something that catches people off guard: the PFD Division won’t take these changes over the phone. They require official documentation or online portal updates for security reasons. It might seem like extra work, but it protects both you and the integrity of the program.

Timing matters more than you might think. For your changes to be processed in time for the main October payments, you typically need to submit updates by late August or early September. Miss that deadline, and you might have to wait for later payment batches or deal with returned checks and delayed deposits.

This attention to detail (making sure your information is accurate and up-to-date) reflects the same mindful approach we encourage in all aspects of wellness. Small, proactive steps lead to better outcomes, whether you’re managing your finances or developing a consistent self-care routine. These practical habits create a foundation for reduced stress and increased peace of mind. For more ideas on building these kinds of beneficial routines into your daily life, explore our Tips for a mindful routine.

Frequently Asked Questions about the PFD

We know that a program as unique as the Alaska Permanent Fund Dividend can spark plenty of questions, especially when people hear it described as a “stimulus payment.” Let’s clear up some of the most common confusion points so you can feel confident about your PFD knowledge.

Is the Alaska PFD the same as a federal stimulus check?

This question comes up all the time, and we totally understand why! The short answer is no. The alaska permanent fund dividend stimulus payment is completely different from federal stimulus checks, even though both put money directly into your pocket.

Think of it this way: federal stimulus checks are like emergency financial aid during tough times. They’re funded by federal tax dollars or government borrowing and distributed nationwide during economic crises, like we saw during the COVID-19 pandemic. These payments are based on your income level and tax filing status, and they’re meant to help the entire country get through a rough patch.

The Alaska PFD, on the other hand, is more like getting your share of the family business profits. It’s funded entirely by Alaska’s oil revenues: money that comes from the state’s natural resources, not from taxes or federal borrowing. This has been happening every single year since 1982, not just during emergencies.

The PFD also serves a unique purpose beyond just economic support. It’s Alaska’s way of saying “thanks for choosing to live here” and helps encourage people to make Alaska their permanent home. While it definitely acts as a powerful economic boost for the state, injecting nearly a billion dollars into local communities each year, it comes from a completely different source and philosophy than federal stimulus programs.

So yes, it stimulates Alaska’s economy in a big way, but it’s not a federal stimulus check by any stretch of the imagination.

Is the PFD payment taxable?

Here’s where things get a bit tricky, and honestly, it’s one of those topics that makes even tax professionals scratch their heads sometimes. The basic rule is yes: your PFD is generally considered taxable income for federal tax purposes.

Since Alaska doesn’t have a state income tax, you won’t owe the state anything. But Uncle Sam? He’ll want his share when you file your federal return.

But wait. There’s a twist. Sometimes portions of the PFD get special treatment. For example, in some years the dividend has included an energy relief payment. In 2022, the IRS ruled that the energy relief portion of that year’s dividend was not taxable, classifying it as a “general welfare” payment. This meant Alaskans only paid federal taxes on the base dividend amount.

For any given year, the tax treatment of special components like an energy relief payment can vary. The safest approach is to consult the latest guidance from the Alaska Department of Revenue and keep an eye on IRS announcements for the specific dividend year.

If tax stuff makes your head spin (and honestly, whose doesn’t it?), chatting with a qualified tax professional is always your best bet. They can help you steer any changes and make sure you’re handling everything correctly, especially if new guidance comes out after you’ve already filed.

What should I do if my application is denied?

Getting a denial letter in the mail is never fun, but don’t panic. It’s not necessarily game over for your PFD hopes. The state has a fair process for handling these situations, and many denials actually get overturned once people provide the right information.

The most important thing is that determination letter the PFD Division sends you. This isn’t just a “sorry, better luck next year” note. It’s your roadmap to understanding exactly what went wrong and how you might be able to fix it.

The letter will spell out the specific reason for your denial. Maybe they couldn’t verify your residency for the full year, or perhaps you exceeded the 180-day absence limit, or there was an issue with a felony conviction. Sometimes it’s as simple as missing paperwork that got lost in the shuffle.

Here’s the crucial part: you have a limited time to appeal, and that deadline is clearly stated in your determination letter. Missing this deadline could mean missing your chance to fight the decision, so mark your calendar as soon as you get that letter.

If you decide to appeal, start gathering your evidence right away. Got proof you were actually living in Alaska when they say you weren’t? Medical records showing you were out of state for treatment? Court documents that clarify your legal situation? Round up everything that supports your case.

The appeal process involves a review by an impartial hearing officer who takes a fresh look at your situation. It might feel intimidating, but remember: the system is designed to be fair, and plenty of people successfully overturn their initial denials when they can provide the right documentation.

Conclusion

The alaska permanent fund dividend stimulus payment represents something truly special. It’s not just an annual check arriving in your mailbox, but a genuine lifeline that touches the lives of over 600,000 Alaskans every year. This unique program has been quietly revolutionizing what financial stability can look like, turning Alaska’s natural resource wealth into real, tangible support for families across the state.

What strikes us most at Beyond Beauty Lab is how deeply financial wellness connects to every other aspect of our well-being. When you know that a significant payment is coming your way each fall, it changes how you sleep at night. That kind of financial predictability creates space for you to breathe, to plan, and to focus on the things that truly matter, like taking care of yourself, nurturing your relationships, and pursuing personal growth.

Think about it: when you’re not constantly worried about making ends meet, you have more energy to invest in quality self-care routines. Maybe it’s finally trying that organic skincare product you’ve been eyeing, or having the peace of mind to take a day off for mental health. The PFD doesn’t just put money in your pocket. It gives you permission to prioritize your wellness without guilt.

The beauty of understanding how to steer the myPFD portal and stay on top of your application status is that it puts you in the driver’s seat. You’re not just waiting and hoping; you’re actively managing this important piece of your financial puzzle. This kind of proactive approach to your money mirrors the mindful attention we encourage you to give to all areas of your life.

Whether you’re using your dividend to stock up on winter essentials, build an emergency fund, or treat yourself to something that brings joy, this payment is designed to improve your quality of life. It’s Alaska’s way of saying, “You belong here, and we want you to thrive here.”

For more insights on creating a life that balances financial wellness with personal growth and self-care, we invite you to Explore our complete guide to wellness and well-being. Because true beauty and wellness start from a foundation of stability and peace of mind, and the PFD is helping thousands of Alaskans build exactly that.