Why fintechzoom.com bitcoin etf Analysis Matters for Modern Investors

Navigating cryptocurrency can feel as complex as creating a perfect skincare routine, but fintechzoom.com bitcoin etf resources are here to help. Since the SEC’s landmark approval of spot Bitcoin ETFs in January 2024, these investment vehicles have gone mainstream, attracting billions and making crypto more accessible than ever.

Quick Overview: FintechZoom.com Bitcoin ETF Coverage

- Real-time tracking of Bitcoin ETF prices

- Analysis of major ETFs like IBIT, FBTC, and BITO

- Insights on spot vs. futures-based Bitcoin ETFs

- Educational resources on ETF mechanics and risks

- Coverage of mining stocks like MARA and RIOT

- Market sentiment analysis to help time investments

The market’s explosive growth is clear. The iShares Bitcoin Trust (IBIT) saw massive inflows in 2024, while the Grayscale Bitcoin Trust ETF (GBTC) delivered a stunning 145% return, becoming the year’s top-performing non-leveraged ETF.

For investors wanting Bitcoin exposure without handling digital wallets and private keys, Bitcoin ETFs offer a regulated path through traditional brokerage accounts. However, with numerous options available—from spot ETFs holding actual Bitcoin to leveraged products that amplify returns and losses—reliable analysis is crucial.

Understanding these investment vehicles requires more than just price tracking. Factors like expense ratios, tracking errors, and an ETF’s underlying structure significantly impact returns. This is where specialized platforms like FintechZoom.com provide immense value with their focused coverage.

Fintechzoom.com bitcoin etf terms simplified:

Decoding Bitcoin ETFs: From Futures to Spot

If you’ve been curious about Bitcoin but felt overwhelmed by its technical side, you’re not alone. The good news is that Bitcoin ETFs have made it much easier to get involved without needing to be a crypto expert.

A Bitcoin ETF is a bridge between traditional investing and the digital currency world. Much like choosing a trusted beauty brand instead of mixing your own serums, you’re buying shares in a fund that handles the complex parts for you. Instead of managing crypto wallets and private keys, you purchase shares through your regular brokerage account.

The accessibility is a huge benefit. Direct Bitcoin ownership makes you your own bank, which comes with significant responsibility. You must secure wallets and safeguard private keys—if you lose them, your Bitcoin is gone forever. With a Bitcoin ETF, professional fund managers handle custody, wallets, and private keys, while you simply own shares reflecting Bitcoin’s value. The management fees are often a small price to pay for this convenience and peace of mind.

Spot Bitcoin ETFs: The Real Deal

January 2024 was a turning point when the SEC approved spot Bitcoin ETFs. These are game-changers because they hold actual Bitcoin, not derivatives. The beauty of spot ETFs lies in their direct ownership of BTC. As Bitcoin’s price moves, the ETF’s value should move right along with it. It’s like having a professional Bitcoin storage service you can invest in through your brokerage account.

Major financial players like BlackRock with its iShares Bitcoin Trust (IBIT) and Fidelity with the Fidelity Wise Origin Bitcoin Fund (FBTC) quickly launched popular options. The Grayscale Bitcoin Trust ETF (GBTC) also converted from a trust into a proper ETF. The SEC approval in January 2024 legitimized Bitcoin for mainstream finance, making it an asset your financial advisor might now recommend.

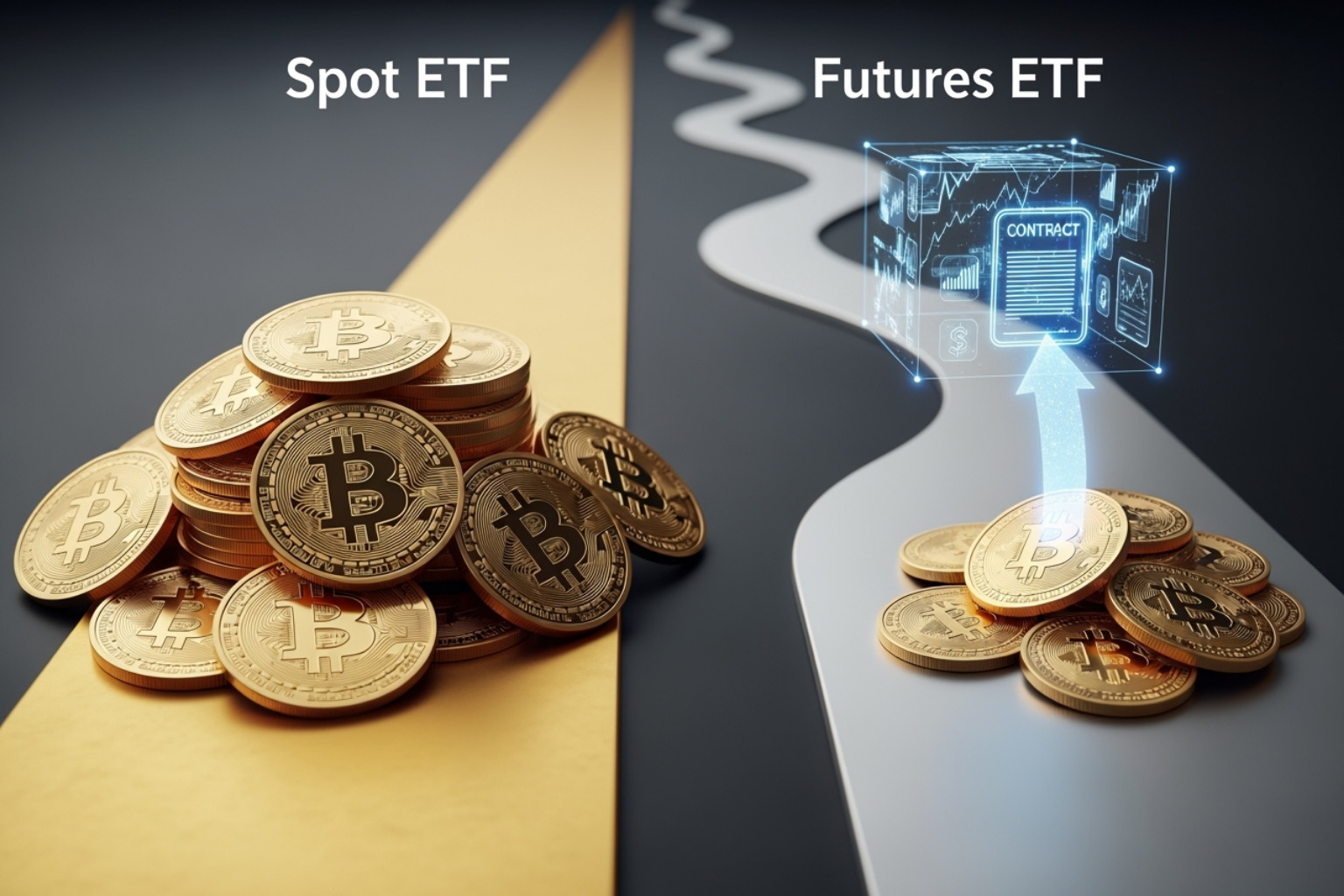

Futures-Based Bitcoin ETFs: A Different Approach

Before spot ETFs, futures-based Bitcoin ETFs were the primary option. These work differently and it’s important to understand the distinction. Instead of holding Bitcoin, these ETFs invest in CME futures contracts—agreements to buy or sell Bitcoin at a set price on a future date. The ProShares Bitcoin Strategy ETF (BITO) was a pioneer in this category.

These ETFs must constantly engage in rolling contracts, selling expiring ones to buy new ones. This process can create tracking error, meaning the ETF’s performance might not perfectly match Bitcoin’s price movements. Despite this, some actively managed funds have performed well, as noted in reports like Active Management Leads Best Crypto ETFs of 2024. While fintechzoom.com bitcoin etf analysis often favors spot ETFs for their simplicity, futures-based options remain relevant but require a deeper understanding.

How FintechZoom.com Provides Essential Bitcoin ETF Insights

Investing in Bitcoin ETFs without the right resources is like navigating a busy city without a map. FintechZoom.com serves as your guide, specializing in making complex market data digestible. The platform transforms overwhelming data into actionable intelligence, delivering real-time information and market analysis to help you make informed decisions. It’s like having a knowledgeable friend who speaks plain English about finance.

FintechZoom.com’s strength is its ability to aggregate information from reputable sources, ensuring you receive accurate, up-to-date data. When Bitcoin’s price is volatile, having a reliable data source is crucial for smart investing.

Using FintechZoom.com for Bitcoin ETF Research

When you’re researching fintechzoom.com bitcoin etf options, the platform offers a toolkit that simplifies complex data. Interactive price charts help you spot trends, while technical analysis tools provide deeper market insights. Think of it as getting a professional analysis of your wellness routine—it highlights what’s working and where you can improve.

One of its standout features is market sentiment analysis, which gauges the market’s mood by analyzing social media, news, and trading patterns. It’s like taking the market’s temperature to see if investors are optimistic or nervous.

The platform also clarifies key details like expense ratios (annual fees) and trading volumes (how actively an ETF is traded). Higher volumes typically mean it’s easier to buy and sell shares. For beginners, the educational guides are invaluable, covering everything from blockchain basics to advanced strategies. You can find more insights through resources like Fintechzoom.com Bitcoin Market Insights & Trends.

The Advantage of a Specialized Focus on fintechzoom.com bitcoin etf

FintechZoom.com’s focused approach on Bitcoin offers deep coverage rather than surface-level information. The platform provides comprehensive mining stock analysis for companies like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT), which are closely tied to Bitcoin’s performance.

It also keeps you informed about key events like Bitcoin halvings and institutional adoption trends. When major companies buy Bitcoin, it signals growing acceptance and can influence prices. This big-picture view is enriched by expert analysis from figures like Mallika Mitra, who help interpret complex market movements and explain why they matter for your investments.

Weighing the Pros and Cons of Bitcoin ETF Investing

When considering fintechzoom.com bitcoin etf investments, it’s important to understand both sides of the coin. Like deciding whether to try a new wellness routine, Bitcoin ETFs offer exciting benefits but also potential challenges.

The biggest advantage is accessibility through brokerage accounts. You can buy Bitcoin ETF shares just like stocks, avoiding the complexity of crypto exchanges and digital wallets. Other pros include diversification for your portfolio, high liquidity on major exchanges, and the safety of regulatory oversight.

However, market volatility is the primary risk. Bitcoin’s price swings are legendary, and ETFs directly reflect these ups and downs. Additionally, management fees are charged annually, which can reduce your overall returns over time.

Understanding Leveraged and Blended ETFs

The Bitcoin ETF world includes specialized products for different risk appetites. Leveraged ETFs like the Volatility Shares 2X Bitcoin Strategy ETF (BITX) aim to double Bitcoin’s daily returns—both gains and losses. This fund has seen impressive gains and attracted significant assets, as highlighted in reports like First Leveraged Bitcoin ETF Nears $1B in Assets.

But be cautious: leveraged products are designed for high risk, high reward scenarios and are not suitable for long-term holding due to daily rebalancing.

Blended ETFs offer a more conservative approach. The CYBER HORNET ETF (ZZZ) combines 75% S&P 500 exposure with 25% Bitcoin futures, creating a “Bitcoin kicker” for traditional portfolios while potentially reducing volatility.

Comparing Your Options

When evaluating Bitcoin ETFs, match the type to your goals:

- Spot ETFs hold actual Bitcoin, offering direct price exposure. They are ideal for long-term investors and typically have moderate fees (0.20% to 0.40%).

- Futures ETFs use Bitcoin contracts, which can lead to tracking errors. They are better suited for short-term speculation and usually have higher fees (0.70% to 1.25%).

- Leveraged ETFs amplify daily returns and are extremely high-risk. With expense ratios often above 0.95%, they are designed for aggressive, short-term traders.

Choosing the right ETF is like choosing the right wellness plan—it depends on your personal goals and comfort level with risk.

The Evolving Market of the fintechzoom.com bitcoin etf and Beyond

The fintechzoom.com bitcoin etf landscape has been transformed since the SEC’s approval of spot Bitcoin ETFs in January 2024. Bitcoin’s story as an investment continues to unfold, with strong performance and its narrative as “digital gold” reinforced by the 2024 halving event, which reduced mining rewards and highlighted its scarcity.

Spot ETF examples

The approval of U.S. spot Bitcoin ETFs opened the floodgates for institutional-grade products. The iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) rapidly accumulated tens of billions in assets, proving that mainstream investors will accept cryptocurrency when technical barriers are removed. The Grayscale Bitcoin Trust ETF (GBTC) also successfully converted to an ETF, solidifying its role as a major player.

Futures ETF examples

Before spot ETFs, futures-based products paved the way. The ProShares Bitcoin Strategy ETF (BITO), launched in 2021, was the pioneer that proved investor appetite. Despite the complexities of futures contracts, BITO remains the largest futures-based Bitcoin ETF, managing billions in assets. These products demonstrated that Bitcoin could be packaged for traditional finance, meeting regulatory standards.

How Bitcoin ETFs Compare to Other Crypto Investments

When weighing your options, the trade-offs are clear. Direct ownership of Bitcoin offers full control but requires technical know-how and carries custody risks. Crypto stocks like MicroStrategy (MSTR) and Coinbase (COIN) provide indirect exposure but come with company-specific risks. Other crypto ETFs are also emerging, with Ethereum ETFs already launched and multi-token funds on the horizon, showing that the ETF wrapper is becoming the preferred vehicle for digital assets.

Future of the fintechzoom.com bitcoin etf Space

The future looks bright for the fintechzoom.com bitcoin etf ecosystem. The success of Bitcoin ETFs has created a blueprint for other digital assets, with companies already filing for Solana ETFs. We’re also seeing innovative products like the Nexo 7RCC Spot Bitcoin and Carbon Credit Futures ETF, which blends Bitcoin with environmental credits.

Multi-token funds and options-based strategies represent the next frontier, offering diversification and downside protection. The SEC’s regulatory clarity has been the catalyst for this innovation, integrating digital assets into the broader financial ecosystem.

The change has been remarkable. What once required technical expertise can now be accessed with the same ease as buying traditional stocks. This democratization of Bitcoin investing is likely just the beginning of a major shift in how digital assets are included in modern portfolios.

Frequently Asked Questions about Bitcoin ETFs

We know diving into fintechzoom.com bitcoin etf investing can feel overwhelming. Think of it like learning a new skincare routine—there’s a lot to understand, but the basics make everything clearer. Here are the most common questions from investors starting their Bitcoin ETF journey.

How do I buy a Bitcoin ETF?

The beauty of Bitcoin ETFs is their simplicity. You can purchase shares through any standard brokerage account like Fidelity, Charles Schwab, or E*TRADE, just as you would buy a stock. Simply search for the ETF’s ticker symbol—such as IBIT, FBTC, or BITO—and place your order.

No crypto wallets, private keys, or specialized exchanges are required. This seamless integration into traditional finance is what makes Bitcoin ETFs so appealing to everyday investors who want exposure without the technical problems.

Are Bitcoin ETFs safe?

This question has two parts. From a regulatory and structural perspective, yes. Bitcoin ETFs are regulated financial products that trade on major stock exchanges, offering investor protections and professional custody. This eliminates risks like losing your investment because of a forgotten password or a hack.

However, the value of your Bitcoin ETF is tied to Bitcoin’s price, which is a highly volatile asset. While the investment vehicle itself is secure, it is not safe from market risk. So, the ETF structure is sound, but the underlying asset’s value can swing dramatically.

What is the difference between a spot and futures Bitcoin ETF?

Understanding this is key to choosing the right investment. Think of it as owning an asset versus a contract for that asset.

Spot Bitcoin ETFs hold actual Bitcoin. When you buy shares, you’re investing in a fund that owns the cryptocurrency directly. The ETF’s price, therefore, moves in close alignment with Bitcoin’s current market price. It’s the most straightforward way to get exposure to the real asset.

Futures Bitcoin ETFs invest in contracts to buy or sell Bitcoin at a future date. Their performance is designed to track Bitcoin’s value but can deviate due to factors like contract rolling costs and market sentiment about future prices. This can create a tracking error between the ETF and Bitcoin’s immediate price.

For most investors seeking direct exposure, spot ETFs offer a clearer path, while futures ETFs introduce complexities better suited for sophisticated trading strategies.

Conclusion

Our journey through fintechzoom.com bitcoin etf investing shows how these financial products have dramatically transformed cryptocurrency access. What was once complex and required technical skill has become as simple as buying shares through a regular brokerage account. The tens of billions flowing into these funds signal a major shift in finance, democratizing access to an asset class previously out of reach for many.

Platforms like FintechZoom.com have become essential companions in this new landscape. Their real-time data, expert analysis, and educational resources help investors steer a market that can feel overwhelming. Understanding the differences between spot, futures, and leveraged ETFs is crucial for making informed decisions.

The key to success is understanding what you’re investing in. Each ETF type serves different goals and risk tolerances. Knowing these differences helps you make choices that align with your personal financial picture.

As we look ahead, the fintechzoom.com bitcoin etf ecosystem will likely continue to expand with new products and strategies. The regulatory approval of Bitcoin ETFs has opened doors that seemed permanently closed just a few years ago.

At Beyond Beauty Lab, we believe true wellness includes financial health. Just as we research skincare ingredients, understanding investment options like Bitcoin ETFs reflects a thoughtful approach to self-care. Being informed about our financial choices builds the confidence and peace of mind that radiates from within.

The intersection of traditional and digital finance will continue to evolve. Staying curious, informed, and true to your personal risk tolerance will serve you well. The tools and knowledge are more accessible than ever—the question is how you’ll choose to use them.

Beyond Beauty Lab; Explore more insights on achieving holistic well-being.