Why Platform Verification Matters in Today’s Digital Investment Landscape

Crypto30x.com asx has emerged as a controversial cryptocurrency trading platform that claims to offer up to 30x leverage on digital assets while integrating with the Australian Securities Exchange (ASX). With promises of AI-powered analytics and high-return opportunities, this platform has caught the attention of both investors and regulators.

Key Facts About Crypto30x.com ASX:

- Leverage Offering: Up to 30x leverage on cryptocurrency trades

- Security Claims: Stores 95% of user funds in cold storage

- Regulation Status: Holds Malta Digital Asset Service Provider license

- Major Concerns: Not regulated by SEC or FCA, transparency issues reported

- Risk Level: Extremely high – unsuitable for beginners

- User Complaints: Withdrawal difficulties and customer support issues documented

The platform combines traditional stock market elements with cryptocurrency trading, claiming to bridge the gap between conventional finance and digital assets. However, multiple red flags have emerged regarding its legitimacy and safety.

Recent research reveals that while Crypto30x.com promotes advanced features like AI-driven trading signals and Web3 integration, users have reported significant concerns about fund withdrawals and the platform’s lack of transparency about its team and operations.

The core question remains: Is this platform a legitimate investment opportunity or a sophisticated scheme designed to exploit inexperienced traders?

Understanding how to verify a platform’s legitimacy has never been more critical, especially when dealing with high-leverage trading that can amplify both gains and losses by 30 times your initial investment.

Crypto30x.com asx terms to remember:

Deconstructing Crypto30x.com: What Does the “ASX” Connection Imply?

When you first hear about crypto30x.com asx, it sounds intriguing, doesn’t it? The name itself suggests something exciting – a bridge between the fast-moving world of cryptocurrency and the more traditional, established Australian Securities Exchange. But what’s really happening behind this catchy branding?

Crypto30x.com asx presents itself as a high-leverage cryptocurrency trading platform that lets you control positions up to 30 times larger than your actual investment. Think of it like borrowing money to make bigger bets – which can mean bigger wins, but also much bigger losses.

The platform doesn’t stop at simple trading. It promises AI-powered analytics to help guide your decisions, plus features that dive into newer areas like GameFi and NFT marketplaces. They’re essentially trying to create a one-stop shop for everything crypto-related. You can explore more about how this connects to broader market trends through Crypto30x.com ASX.

Understanding the Platform’s Core Claims

Let’s break down what crypto30x.com asx actually promises to do. The headline feature is that 30x leverage – this means if you put in $100, you can trade as if you have $3,000. When the market moves in your favor, your profits get multiplied. But here’s the catch: your losses get multiplied too.

The platform also talks up its AI signals and something called the “Zeus” tool. This supposedly analyzes market data and gives you buy or sell recommendations. For people who like making data-driven decisions, this sounds pretty appealing.

Beyond basic trading, they’re venturing into the Web3 world. This includes GameFi (where gaming meets finance) and NFT marketplaces where you can buy, sell, or create digital collectibles. They’re trying to position themselves as more than just a trading platform – they want to be your gateway to the entire digital asset ecosystem.

The platform also emphasizes community support with forums, live chats, and educational webinars. This sounds great for newcomers who need guidance, though we’ll explore later whether beginners should actually use this platform. For more technical details about their underlying technology, check out Crypto30x.com Blockchain.

The Ambiguous ASX Integration

Here’s where things get interesting – and a bit concerning. The ASX connection that crypto30x.com asx promotes is not quite what it might seem at first glance.

The platform suggests it has some kind of integration with the Australian Securities Exchange, which would imply regulatory oversight and credibility. They talk about “aligning with Australian financial regulations” and offering features related to ASX-listed securities. This sounds reassuring, especially for Australian investors who trust the ASX’s established regulatory framework.

But here’s the important detail: the platform is not directly regulated by the ASX. This is a huge distinction that can easily get lost in the marketing language. While they might display ASX data or allow you to compare crypto prices with ASX stock indices, this doesn’t mean the ASX oversees their operations.

The ASX is Australia’s primary stock exchange with strict rules and oversight for companies that operate under its umbrella. You can learn more about how legitimate exchanges work at What Is ASX Exchange and How Does It Work?.

What crypto30x.com asx appears to offer is more like a marketing tactic – using the trusted ASX name to create an impression of legitimacy and familiarity. They might provide market data or analysis that includes ASX information, but this doesn’t make them an ASX-regulated platform.

This distinction matters enormously when you’re considering where to invest your money. True regulatory oversight means there are rules, protections, and accountability measures in place. Without that direct oversight, you’re essentially trading in a much riskier environment, despite the professional appearance and ASX branding.

The Core Features vs. The Hidden Risks

Let’s be honest – crypto30x.com asx presents itself like a shiny new sports car with all the bells and whistles. The features sound incredible, and the promises are enticing. But just like that sports car, what looks amazing on the showroom floor might come with some serious considerations once you’re behind the wheel.

The cryptocurrency world is already like riding a roller coaster blindfolded – prices can swing wildly in minutes, turning your morning coffee money into either a celebration dinner or a very expensive lesson. When you add 30x leverage into this mix, you’re essentially strapping rocket boosters to that roller coaster.

Think about it this way: if you’re using maximum leverage and the market hiccups just 3.3% against your position, your entire investment could vanish. Poof. Gone. That’s not a market crash we’re talking about – that’s barely a sneeze in crypto terms.

This volatility becomes particularly dangerous for anyone new to trading. The platform’s advanced features might make you feel like a Wall Street pro, but the market doesn’t care how sophisticated your tools are when it decides to take an unexpected turn. That’s exactly why leveraged trading is completely unsuitable for beginners – it’s like handing someone the keys to a Formula 1 car when they just got their learner’s permit.

If you want to stay informed about market movements and news that could affect your trades, our Crypto30x.com News Guide can help you understand what to watch for.

High-Leverage Trading: A Double-Edged Sword

Here’s where things get really interesting – and by interesting, we mean potentially terrifying. That 30x leverage that crypto30x.com asx promotes so heavily works exactly like it sounds. Put in $100, and you can control a $3,000 position. When things go your way, it feels like magic. A tiny 1% market movement in your favor suddenly becomes a 30% return on your money.

But here’s the part they don’t put in big, bold letters on the homepage: the sword cuts both ways, and it cuts deep.

That same 1% movement against you wipes out 30% of your capital instantly. And if the market moves just over 3% in the wrong direction? Game over. Your position gets liquidated faster than you can say “diamond hands.” This isn’t just losing your investment – you can actually lose more than you put in.

The platform will hit you with margin calls, demanding more money to keep your position alive. If you can’t pay up, they’ll automatically close your trade to prevent further losses. Suddenly, that $100 you thought you were risking has turned into a much bigger problem.

Amplified losses aren’t just a possibility with high leverage – they’re practically inevitable if you don’t know exactly what you’re doing. The market doesn’t care about your rent money or your good intentions. It just moves, and with 30x leverage, those movements hit like a freight train.

For those curious about the platform’s AI-powered trading tools, the Crypto30x.com Zeus Complete Guide breaks down how these systems work and their limitations.

AI Analytics and Other Advanced Tools

Now, let’s talk about the shinier side of crypto30x.com asx – the AI-powered analytics and advanced tools that make everything sound so professional and cutting-edge. The platform boasts about its algorithmic signals and ability to let you backtest strategies against historical market data. This sounds impressive, and honestly, it can be genuinely useful.

Having AI analyze market patterns and provide trading recommendations is like having a really smart friend who never sleeps and can crunch numbers faster than humanly possible. The backtesting feature lets you see how your brilliant strategy would have performed during past market conditions, which can save you from some expensive real-world lessons.

The community support forums and live chat features create a sense of belonging and shared learning. There’s something comforting about knowing other traders are going through the same emotional roller coaster of wins and losses. The expert webinars and educational resources show that the platform at least appears to care about user education, which is more than we can say for some fly-by-night operations.

The integration of GameFi and NFT marketplace functionality tries to position the platform as more than just a trading venue. You can supposedly mint NFTs, participate in decentralized gaming, and engage with the broader Web3 ecosystem all from one dashboard. This comprehensive approach sounds convenient and forward-thinking.

But here’s the reality check: even the most sophisticated AI can’t predict the future. Those algorithmic signals are based on past data and mathematical models, not crystal balls. The crypto market has a nasty habit of doing exactly what nobody expects, regardless of what the algorithms suggest.

User-friendliness is another claimed strength, with customizable dashboards, real-time price feeds, and intuitive watchlists. While these features can improve your trading experience, they can also create a false sense of security. A pretty interface doesn’t make dangerous trades any less dangerous.

For a deeper look at the platform’s broader ecosystem and tools, check out the Crypto30x.com Ocean Complete Guide, which explores these features in more detail.

The bottom line? Advanced tools are great, but they’re just tools. They can’t eliminate risk, and they certainly can’t guarantee profits. Think of them as a really good GPS system – helpful for navigation, but useless if you’re driving off a cliff.

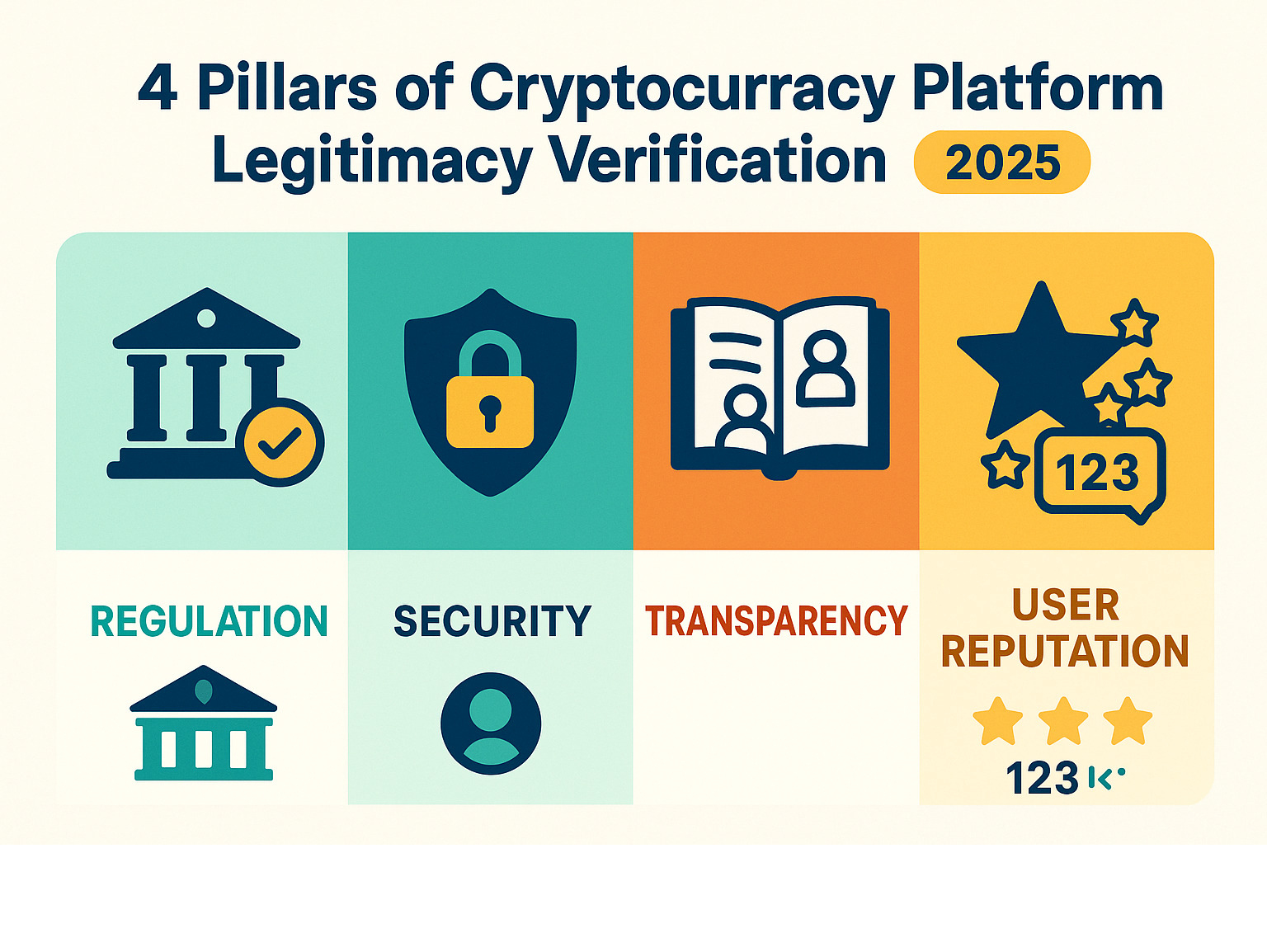

Your Legitimacy Checklist for crypto30x.com asx

Think of verifying a trading platform like checking the ingredients in your favorite skincare product – you wouldn’t put something questionable on your face, so why would you trust your money to an unvetted platform? When it comes to crypto30x.com asx, we need to approach this with the same careful scrutiny we’d use for any important decision affecting our wellbeing.

The cryptocurrency world can feel like the Wild West sometimes, with new platforms popping up daily and promises of incredible returns around every corner. But just like we’ve learned to read between the lines of beauty marketing claims, we need to develop that same critical eye for financial platforms. The stakes here are even higher – we’re talking about your hard-earned money.

Platform verification isn’t just about being cautious; it’s about being smart. The insights from Security show us just how many threats exist in this space. Think of this checklist as your personal protection routine, but for your finances instead of your skin.

Step 1: Verify Regulatory Compliance and Transparency

Here’s where things get interesting with crypto30x.com asx. The platform claims to hold a Malta Digital Asset Service Provider license, which sounds official and reassuring. Malta does have a framework for digital assets, so this isn’t meaningless. However, there’s a significant gap that should make us pause.

The platform is not regulated by major authorities like the SEC or FCA. Now, you might be thinking, “So what? They have Malta!” But here’s the thing – major regulators like the U.S. Securities and Exchange Commission or the UK’s Financial Conduct Authority provide layers of protection that smaller regulatory bodies simply can’t match. These big-name regulators have strict oversight, capital requirements, and established dispute resolution processes. When something goes wrong, you have somewhere to turn.

What’s even more concerning is the platform’s mysterious nature regarding its team and ownership. One source puts it bluntly: “It lacks transparency—there’s little information about who runs it, where they’re based, or whether they hold any legal licenses.” This anonymity should set off alarm bells. When you can’t find out who’s actually running the show, how can you hold them accountable if things go sideways?

The crypto world has seen its share of “catfish” tactics – platforms that look legitimate on the surface but disappear with user funds when the heat gets too high. This lack of transparency fits that concerning pattern perfectly.

Key red flags to watch for include: unclear regulatory status where platforms claim alignment without direct oversight, absence of licenses from well-known financial authorities, anonymous leadership teams with no public information, vague contact details with only generic emails, and unverifiable claims about returns or track records.

Step 2: Scrutinize Security Measures

Even with regulatory question marks, strong security can still provide some peace of mind. crypto30x.com asx does make some impressive security claims that deserve recognition. They state that 95% of user funds are stored in offline cold wallets, which is actually an industry best practice. Cold storage keeps digital assets away from internet-connected systems, making them much harder for hackers to reach.

The platform also mentions multi-signature technology and AES-256 encryption for data transmission, along with SSL/TLS protocols. These are solid, industry-standard security measures that show they’re at least thinking about protection seriously. Multi-Factor Authentication (MFA) is another feature they emphasize, and honestly, this should be non-negotiable for any financial platform you’re considering.

They also claim to conduct regular security audits by independent third-party auditors. If true, this demonstrates a commitment to finding and fixing vulnerabilities before they become problems.

But here’s where personal responsibility comes in. Even the most secure platform can’t protect you from threats that start on your end. Phishing attacks are incredibly common – scammers create fake websites or emails that look exactly like the real platform to steal your login information. Always double-check URLs and be suspicious of unexpected emails asking for your credentials.

SIM swapping is another nasty trick where criminals gain control of your phone number to intercept security codes. And don’t forget about malware and keyloggers that can capture everything you type, including passwords and private keys.

Your personal security habits matter just as much as the platform’s infrastructure. For more insights on protecting your digital assets, especially with wallet management, check out Crypto30x.com Trust Wallet.

Step 3: Assess User Reviews and Community Feedback

This is where the rubber meets the road. Marketing materials and fancy websites can paint beautiful pictures, but real user experiences tell the true story. Unfortunately, the feedback about crypto30x.com asx raises some serious red flags that we can’t ignore.

Research indicates significant “customer service concerns” and “complaints from users about fund withdrawals and customer support.” Let’s be clear about what this means – if you can’t get your money out when you want it, the platform is essentially holding your funds hostage. This is one of the most serious warning signs you can encounter with any financial platform.

Think about it this way: you might be able to live with a slightly clunky interface or limited trading features, but you absolutely cannot accept a platform that makes it difficult or impossible to access your own money. This isn’t just inconvenient – it’s potentially devastating.

When checking reviews, look for patterns rather than isolated complaints. Every platform will have some unhappy users, but when multiple people report similar problems with withdrawals or consistently unresponsive customer support, that’s a pattern worth paying attention to. These aren’t just minor inconveniences – they’re fundamental operational failures that suggest serious problems with how the platform operates.

Social media sentiment, independent review sites, and crypto forums can provide unfiltered insights into what it’s really like to use the platform day-to-day. Pay special attention to recent reviews, as platform quality can change rapidly in the crypto space.

Best Practices for Trading on crypto30x.com asx

If you’ve done your homework and still decide to venture into crypto30x.com asx, we want you to approach it like you would any important decision in your life – with preparation, wisdom, and a solid plan. Think of it as creating the perfect skincare routine: you wouldn’t jump into using the strongest retinol without building up your skin’s tolerance first, right? The same principle applies to high-leverage trading.

Trading with high leverage is like handling a powerful tool – it can be incredibly effective when used correctly, but it requires respect, knowledge, and careful handling. Just as we emphasize the importance of understanding ingredients before applying them to your skin, you need to understand every aspect of your trading strategy before risking your hard-earned money. For a comprehensive overview of what you’re getting into, take a look at Crypto30x.com.

Secure Account Setup and Management on crypto30x.com asx

Your account security is your first and most important line of defense. We like to think of it as your financial skincare routine – it needs to be thorough, consistent, and protective.

Account registration on crypto30x.com asx will likely require you to go through a KYC (Know Your Customer) verification process. While it might feel tedious uploading your ID and proof of address, this step actually works in your favor. It shows the platform is making an effort to comply with financial regulations, and it creates a paper trail that could protect you if issues arise later.

Strong password creation is absolutely non-negotiable. We’re talking about a unique, complex password that you’ve never used anywhere else. Mix uppercase letters, lowercase letters, numbers, and symbols into something that would make a hacker’s head spin. A password manager can be your best friend here – it’s like having a personal assistant who remembers all your complex passwords while you focus on the important stuff.

Multi-Factor Authentication (MFA) is your security superhero cape. The moment your account is set up, enable MFA using an authenticator app like Google Authenticator or Authy. Avoid SMS-based authentication if possible – it’s like leaving your front door key under a mat that everyone knows about.

Regular account monitoring should become as routine as checking your reflection in the morning. Log in frequently to review your transaction history and account balances. If something looks off, even slightly, report it immediately and change your password. Trust your instincts – they’re usually right.

Smart Trading and Risk Management on crypto30x.com asx

Now comes the art of trading wisely. Just because crypto30x.com asx offers 30x leverage doesn’t mean you should use it right away. It’s like having access to the strongest skincare acids – you start slowly and build up your tolerance.

Understanding fee structures is crucial before you place your first trade. The platform mentions commission rates of 0.1% for ASX stocks and 0.2% for crypto, spreads of 0.5%-1% for crypto, and withdrawal fees of AUD 10 for ASX trades plus network fees for crypto. These costs can nibble away at your profits faster than you’d expect, especially if you’re trading frequently.

Stop-loss orders are your trading safety net. Think of them as the sunscreen of trading – they protect you from getting burned when the market moves against you. Set these up before you even enter a trade, deciding in advance how much you’re willing to lose.

Take-profit orders work like your skin’s natural barrier – they lock in the good stuff when you’ve reached your goal. Decide ahead of time what profit level would make you happy, then stick to it. Greed can be as damaging to your portfolio as over-exfoliating is to your skin.

Portfolio diversification means not putting all your eggs in one basket. Even if you’re excited about crypto, spread your investments across different assets and platforms. It’s like using multiple products in your skincare routine – each serves a purpose, and together they create better results than relying on just one miracle product.

For experienced traders, API access for bots is available, allowing you to automate your trading strategies. However, approach this like you would a new skincare ingredient – test it thoroughly in small amounts before going all in. Always whitelist your IP addresses for security, and remember that automation doesn’t eliminate risk.

The key to successful trading on crypto30x.com asx is treating it with the same care and attention you’d give to any important aspect of your wellness routine. Start small, stay informed, and never risk more than you can afford to lose.

Frequently Asked Questions about Crypto30x.com ASX

We know you’re probably feeling a bit overwhelmed with all this information about crypto30x.com asx. It’s completely normal to have questions when exploring such a complex platform, especially one that promises high returns but comes with equally high risks. Let’s tackle the most pressing concerns we’ve heard from our community.

Is Crypto30x.com ASX suitable for beginners?

Absolutely not, and we can’t stress this enough. Crypto30x.com asx is like handing someone who’s just learned to ride a bike the keys to a Formula One car. The platform’s high-leverage trading features are extremely risky and complex, making it completely unsuitable for anyone new to cryptocurrency trading.

Think about it this way: with 30x leverage, even the tiniest market hiccup can wipe out your entire investment faster than you can say “blockchain.” Our research consistently shows that leveraged trading carries significant risk and is not recommended for beginners without proper risk management knowledge.

While the platform does offer educational content and community forums, it’s designed specifically for experienced traders who already understand how to manage substantial risk. If you’re just starting your crypto journey, we strongly recommend beginning with spot trading on well-regulated exchanges. Focus on understanding how markets work before even thinking about leverage.

Is Crypto30x.com a legitimate platform?

This is where things get really concerning. There are significant red flags regarding the platform’s legitimacy that make our warning bells ring loud and clear. The biggest issue? There’s a troubling lack of transparency about who actually runs the platform.

Multiple sources highlight that there’s little information about who runs it, where they’re based, or whether they hold any legal licenses. When you can’t find out who’s behind a financial platform, that’s a massive red flag waving in the wind.

Yes, crypto30x.com asx claims to have strong security features like cold storage and Multi-Factor Authentication, and they mention holding a Malta Digital Asset Service Provider license. However, they’re not regulated by major authorities like the SEC or FCA, which provide crucial investor protections.

Perhaps most troubling are the user complaints we’ve uncovered about fund withdrawals and customer support issues. When people can’t get their money out easily, that’s when we start getting really worried about a platform’s trustworthiness.

Our honest assessment? While the platform exists and offers services, its overall credibility is highly questionable. We’d advise proceeding with extreme caution, if at all.

What does the 30x leverage mean?

Let’s break this down with a simple example that’ll make your head spin. Thirty times leverage means you can control a trading position worth 30 times more than the money you actually put in. It’s like financial steroids for your trades.

Here’s how it works: Say you invest $1,000 with 30x leverage. Suddenly, you’re controlling a $30,000 position in the market. If the asset you’re trading goes up by just 1%, you make $300 profit on that $30,000 position. That’s a whopping 30% return on your original $1,000. Sounds amazing, right?

But here’s the terrifying flip side: if that same asset drops by just 1%, you lose $300, which is 30% of your initial investment. And if the price moves against you by a little over 3%, your entire $1,000 gets liquidated. Poof. Gone.

This mechanism makes trading incredibly volatile and suitable only for those with extensive experience and nerves of steel. While leverage can amplify profits, it equally amplifies losses, and those losses can exceed your initial investment faster than you’d believe possible. It’s a double-edged sword that cuts both ways, often leaving beginners wondering what just happened to their money.

Conclusion: Is This Platform a Sound Financial Decision?

After spending time carefully examining crypto30x.com asx – from its flashy promises to the concerning reality behind the marketing – we need to have an honest conversation about what we’ve finded.

Think of this like analyzing a skincare product that promises miraculous results overnight. At Beyond Beauty Lab, we’ve learned that when something sounds too good to be true, it usually is. The same principle applies here.

The platform’s high-risk profile is impossible to ignore. While crypto30x.com asx presents itself with advanced AI analytics, Web3 integration, and that tempting 30x leverage, the fundamental issues we’ve uncovered are deeply troubling. The murky “ASX integration” that doesn’t actually mean ASX regulation, the complete absence of oversight from trusted authorities like the SEC or FCA, and those concerning user reports about withdrawal difficulties all point to one conclusion: proceed with extreme caution, if at all.

What really concerns us is the lack of transparency about who’s actually running this platform. In our world of beauty and wellness, we always want to know who’s behind the products we’re considering. The same should be true for your financial decisions. When a platform won’t tell you who’s in charge or where they’re based, that’s not just a red flag – it’s a giant warning sign.

The mathematics of 30x leverage are unforgiving. Even experienced traders can find themselves in serious trouble when market movements work against them. For someone new to cryptocurrency trading, this platform could wipe out their investment faster than they can blink. It’s like using the strongest chemical peel without understanding your skin type – the damage can be swift and severe.

We believe in empowering people to make informed decisions about every aspect of their lives, whether it’s choosing the right moisturizer or making smart financial choices. The importance of due diligence cannot be overstated when it comes to platforms like this. Your financial wellness is just as important as your physical wellness, and both deserve careful, thoughtful attention.

Our guidance remains simple: prioritize safety, transparency, and verifiable legitimacy in all your choices. Just as we wouldn’t recommend a beauty product with questionable ingredients and no clear manufacturer information, we can’t recommend a financial platform with similar red flags.

Your hard-earned money deserves better than the uncertainty and risk that crypto30x.com asx presents. Focus on building your financial wellness through trusted, regulated platforms that put your security first and provide clear, accessible support when you need it.

For more resources on making balanced and informed lifestyle choices that support your overall well-being, we invite you to Explore more resources for a balanced and informed lifestyle.