Why Traceloans.com Auto Loans Are Changing How People Finance Cars

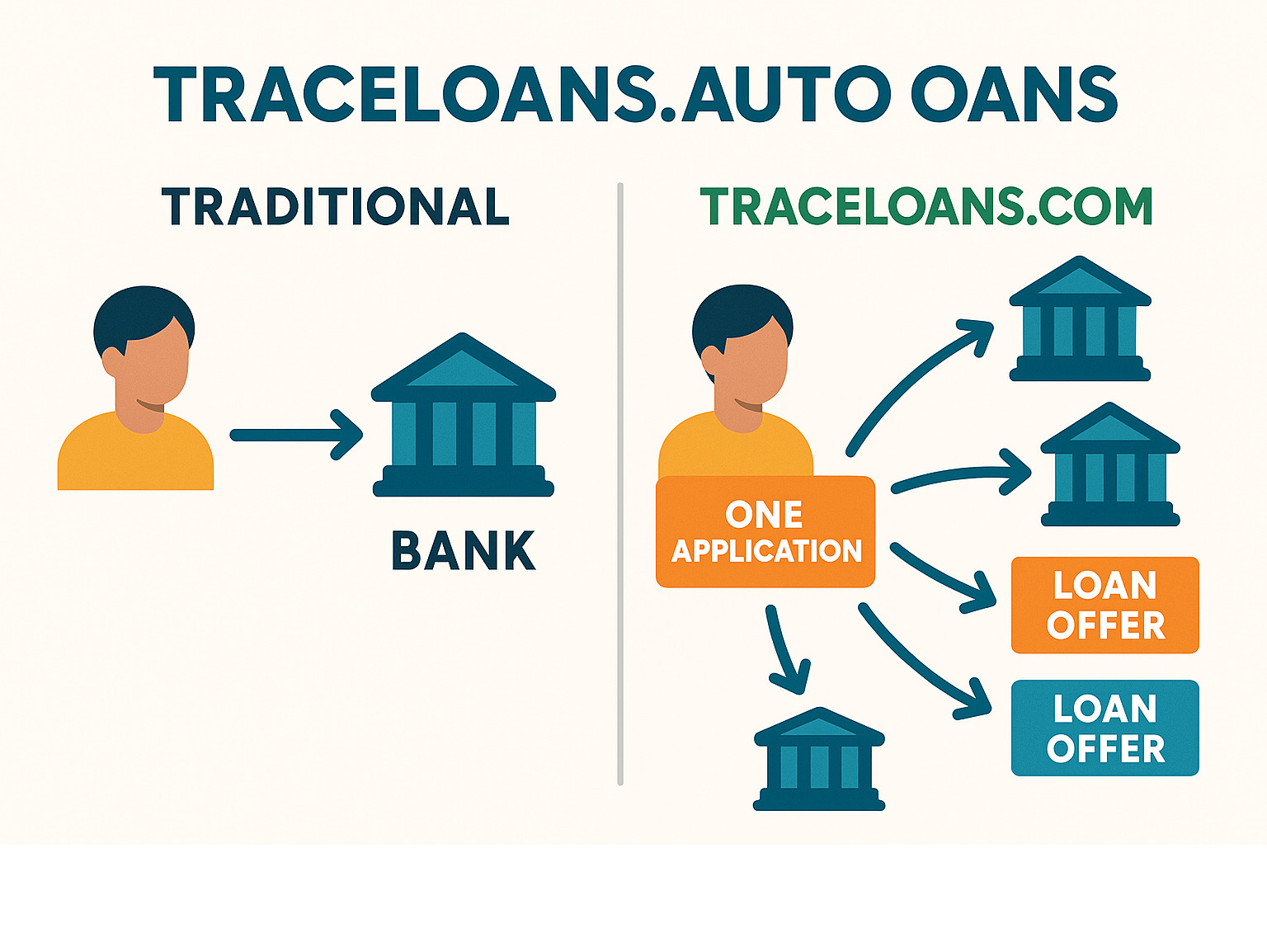

Traceloans.com auto loans connect you with multiple lenders through one simple application, making car financing faster and easier than traditional bank visits. Here’s what you need to know:

Quick Overview:

- Loan Type: Online marketplace connecting borrowers to multiple lenders

- Credit Requirements: Accepts all credit scores, including bad or no credit

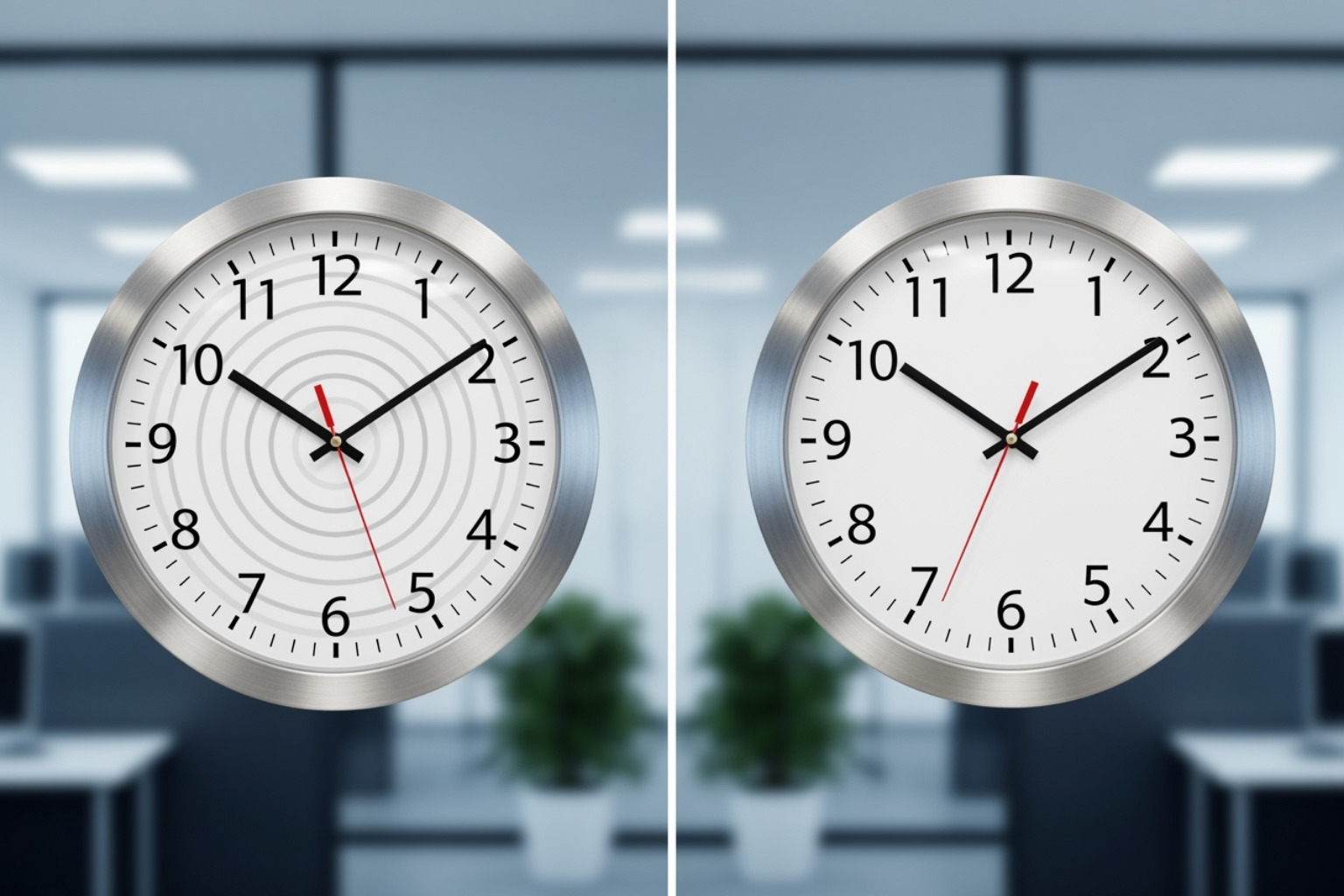

- Approval Time: Most loans approved within 24 hours

- Loan Types: New cars, used cars, and refinancing options

- Key Benefit: One application reaches multiple lenders for better approval odds

Finding the right auto loan used to mean visiting bank after bank, filling out endless paperwork, and hoping for approval. That’s changing fast.

Traceloans.com works differently than traditional lenders. Instead of being a bank themselves, they act as a loan marketplace – think of it like a dating app for borrowers and lenders. You fill out one application, and they share it with their network of lending partners.

This approach offers several advantages:

- Higher approval chances – Multiple lenders see your application

- Time savings – One form instead of many separate applications

- Better terms – Lenders compete for your business

- Credit flexibility – Options available even with poor credit history

Whether you’re buying your first car, upgrading to something more reliable, or refinancing an existing loan, understanding how loan marketplaces work can save you both time and money.

Traceloans.com auto loans terms simplified:

Understanding Traceloans.com Auto Loans

Picture this: you’ve found the perfect car, but now comes the part that makes your stomach flutter – figuring out how to pay for it. The old way meant driving from bank to bank, filling out form after form, and crossing your fingers that someone would say yes. Not exactly the fun part of car shopping, right?

Traceloans.com auto loans work completely differently. Instead of being just another bank, they operate as a loan marketplace – think of them as the friendly matchmaker between you and dozens of potential lenders. You fill out one simple application, and they do the heavy lifting by sharing your information with their entire network of lending partners.

This approach is like having a personal assistant who knows exactly which lenders might be interested in working with someone in your situation. Rather than hoping one bank will approve your loan, you’re essentially knocking on multiple doors at once. Each lender has different criteria, different specialties, and different comfort levels with various credit situations.

The beauty of this system is that it dramatically increases your approval odds. What might be a “no” from one lender could easily be a “yes” from another. Maybe Bank A doesn’t like your debt-to-income ratio, but Bank B specializes in exactly your situation. You’ll never know unless you ask them all – and that’s exactly what Traceloans.com does for you.

The convenience factor alone makes this approach worth considering. Instead of taking time off work to visit multiple banks, you can explore all your options from your couch while still in your pajamas. For More info about Traceloans.com, you can dive deeper into how their platform works.

Types of Auto Financing Available

Whether you’re dreaming of that new car smell or hunting for a reliable pre-owned gem, traceloans.com auto loans cover all the bases. The platform connects you with lenders who specialize in different types of vehicle financing, so you’re not stuck with a one-size-fits-all approach.

New car loans are perfect when you want to be the first person to adjust those mirrors and set those radio presets. These loans typically come with competitive interest rates because new vehicles hold their value better, making them less risky for lenders. Plus, you get all those manufacturer warranties and the peace of mind that comes with knowing exactly how your car has been treated.

But let’s be honest – not everyone needs or wants a brand-new vehicle. Used car loans open up a world of possibilities, from that practical sedan that’ll get you to work reliably to that slightly-used luxury car you’ve been eyeing. The financing terms might vary based on the car’s age and mileage, but you can often find excellent deals that give you more car for your money.

Already have a car loan but feeling like you could do better? Auto loan refinancing might be your ticket to lower monthly payments. If your credit score has improved since you first bought your car, or if interest rates have dropped, refinancing can help you renegotiate better terms. It’s like giving your existing loan a makeover.

The real advantage here is the flexible loan terms and focus on affordable monthly payments. The lenders in Traceloans.com’s network understand that everyone’s budget is different, and they work to find terms that won’t leave you choosing between your car payment and your grocery budget.

How Traceloans.com Supports All Credit Histories

Here’s where things get really interesting – and honestly, pretty refreshing. Traditional banks can be pretty picky about credit scores, sometimes turning away perfectly good people who’ve just hit a few bumps in their financial journey. Traceloans.com auto loans take a much more inclusive approach.

Got bad credit from a rough patch a few years back? The platform connects you with lenders who specialize in working with people in exactly your situation. They understand that life happens – maybe you lost a job, had medical bills, or just made some mistakes when you were younger. Your past doesn’t have to define your ability to get reliable transportation.

Starting from scratch with no credit history can feel like a catch-22 situation. How do you build credit without credit? Traceloans.com’s network includes lenders who get this dilemma and are willing to work with first-time borrowers. An auto loan can actually be a great way to start building that credit history you need.

If you’re in the process of rebuilding credit, making consistent, on-time car payments can be a powerful tool. Every month you make that payment on time, you’re showing future lenders that you’re responsible and reliable. It’s like proving to the financial world that you’ve got your act together.

This approach to supporting people with less-than-perfect credit isn’t just good business – it’s about recognizing that everyone deserves a chance to improve their situation. Sometimes getting reliable transportation is the first step toward getting back on solid financial ground. For those looking at the bigger financial picture, Traceloans.com Debt Consolidation offers additional resources for getting finances back on track.

The Application and Approval Process Explained

Getting a car loan doesn’t have to feel like climbing Mount Everest in flip-flops. We’ve all been there – sitting in a stuffy bank office, filling out forms that seem to ask for everything except your favorite childhood memory, and then waiting… and waiting… and waiting some more.

Traceloans.com auto loans flip this whole experience on its head. Instead of that traditional banking marathon, you get a streamlined digital process that actually respects your time. Picture this: you’re curled up on your couch in your favorite pajamas, maybe with a cup of coffee in hand, casually completing your loan application on your tablet. No uncomfortable chairs, no rushed meetings, and definitely no need to take time off work.

The beauty of this approach lies in its simplicity. The platform takes all the complicated banking jargon and bureaucratic nonsense and transforms it into something that feels more like online shopping than financial paperwork. It’s designed for real people living real lives – people who want to get approved quickly so they can focus on the fun part: picking out their new ride.

Step-by-Step Guide to Applying

Think of applying for traceloans.com auto loans like following a recipe for your favorite dish – each step builds on the last, and before you know it, you’ve got something amazing. The whole process is refreshingly straightforward, without any surprise ingredients or complicated techniques.

Step 1: Fill out the online form – Your journey starts at Traceloans.com, where you’ll find their user-friendly application waiting for you. It’s like the front door to your financing solution – welcoming and easy to steer.

Step 2: Provide your basic details – Here’s where you share the essential information about yourself. Think of it as introducing yourself to potential lenders. You’ll include your name, contact information, income details, and how much you’re hoping to borrow. Having this information ready beforehand is like prepping your ingredients before cooking – it makes everything go much smoother.

Step 3: Upload your documents – Don’t let this step intimidate you. It’s usually just a few key pieces of paperwork that help verify who you are and confirm your financial situation. Most people can gather these documents in just a few minutes.

Step 4: Compare your offers – This is where Traceloans.com really shines. Once your application is submitted, multiple lenders review your information and send back their best offers. It’s like having several car dealerships compete for your business, except you’re shopping for loan terms instead of cars. You get to compare interest rates, monthly payments, and loan terms to find what works best for your budget.

Step 5: Receive your funds – After you’ve chosen your favorite offer and completed the final paperwork with your selected lender, the money typically moves quickly. Many borrowers see funds in their account within 24 hours, which means you could be test-driving your new car by tomorrow.

This whole process puts you in the driver’s seat – literally and figuratively. You’re not at the mercy of one bank’s decision or stuck with whatever terms they offer you.

Eligibility and Documentation for traceloans.com auto loans

Nobody likes surprises when it comes to loan applications, especially the kind where you’re halfway through the process and suddenly need to hunt down some obscure document. That’s why we want to give you the complete picture of what you’ll need for traceloans.com auto loans right from the start.

The good news is that the requirements are pretty standard and straightforward. Most lenders in the Traceloans.com network are looking for the same basic things: proof that you’re who you say you are, evidence that you have income coming in regularly, and a glimpse into how you manage your money.

For ID proof, you’ll need something official that confirms your identity. Your driver’s license works perfectly, or you can use a passport if that’s more convenient. This isn’t about being nosy – it’s about preventing fraud and making sure everyone stays safe.

Income verification is where you show lenders that you have money coming in regularly to make your loan payments. If you’re employed, recent pay stubs usually do the trick. If you’re self-employed or have your own business, tax returns typically work better since they show your annual earnings. The key here is demonstrating stable income that can comfortably handle your monthly car payment along with your other expenses.

Bank statements from the last few months give lenders a window into your financial habits. They’re not judging your coffee purchases or that impulse buy from last month – they’re looking at the bigger picture of how money flows in and out of your account.

What makes Traceloans.com different from traditional banks is their flexibility. While they still need these documents, the lenders in their network are often more understanding about unique situations. They’re focused on finding solutions rather than finding reasons to say no.

Being honest and thorough with your documentation helps everyone involved. It speeds up the approval process and helps lenders offer you the most suitable terms for your situation. For more information about fair lending practices and your rights as a borrower, the Consumer Financial Protection Bureau offers excellent resources.

From Approval to Funding: How Quickly You Get Your Money

Here’s where traceloans.com auto loans really get exciting – the speed. We’re talking about the kind of fast that makes traditional bank timelines look like they’re moving through molasses.

Remember the old days of applying for a loan? You’d submit your paperwork, then sit around wondering if your application disappeared into some banking black hole. Days would turn into weeks, and you’d start questioning whether you actually applied or just dreamed about it. Those days are pretty much over with Traceloans.com’s fast approval process.

Most loans get approved within 24 hours. That’s not a typo – we’re talking about potentially hearing back tomorrow if you apply today. This speed comes from their streamlined digital systems and the fact that multiple lenders are reviewing your application simultaneously. It’s like having several people working on your approval instead of just one overworked bank employee.

But getting approved is only half the battle. The real magic happens with the quick funds transfer. Once you’ve picked your favorite loan offer and signed the dotted line, the money often shows up in your account incredibly fast. Many borrowers see their funds within that same 24-hour window.

Think about what this means for your car shopping experience. You could wake up tomorrow, apply for financing, get approved, receive your funds, and be driving away sooner than you ever thought possible. No more losing out on great car deals because your financing took too long to come through. No more awkward conversations with sellers about “pending” loan approvals.

This speed isn’t just convenient – it’s empowering. It puts you in control of your timeline and lets you move quickly when you find the perfect vehicle. In a competitive car market, being able to act fast can make all the difference between getting your dream car and watching someone else drive it away.

Key Benefits of Using Traceloans.com for Your Next Car

Finding the right auto loan shouldn’t feel like running a marathon through financial obstacle courses. Yet that’s exactly what many people experience when they visit bank after bank, filling out application after application, only to face rejection or disappointing terms. Traceloans.com auto loans change this entire dynamic by bringing efficiency, better terms, and genuine transparency to what can otherwise be a frustrating process.

Think about it this way: if you were shopping for a new outfit, would you rather visit one store and hope they have something that fits, or would you prefer having multiple boutiques compete to dress you in their best pieces? That’s essentially what Traceloans.com offers for auto financing – multiple lenders eager to offer you their most competitive terms.

The time savings alone make this approach incredibly appealing. Instead of spending entire weekends driving from bank to bank, you can complete one application from your couch while enjoying your morning coffee. This efficiency doesn’t just save you hours; it saves you the mental energy that comes with repeatedly explaining your financial situation to different loan officers.

The advantages of using traceloans.com auto loans

The beauty of traceloans.com auto loans lies in how they flip the traditional lending script. Instead of you chasing lenders, the lenders come to you – and they’re competing for your business. This fundamental shift creates several powerful advantages that can make a real difference in your financing experience.

When you gain access to multiple lenders through one application, you’re essentially creating a mini auction for your loan. Each lender in the network has different strengths, risk appetites, and specialties. What one lender might see as too risky, another might view as a perfect fit for their portfolio. This diversity dramatically increases your chances of not just getting approved, but getting approved with terms that actually work for your budget.

The competition between lenders naturally drives competitive rates. When lenders know they’re bidding against others for your business, they’re motivated to put their best foot forward. This often translates into lower interest rates, better terms, or more flexible repayment options than you might secure by walking into a single bank.

Perhaps one of the most refreshing aspects is the commitment to no hidden charges. We’ve all heard horror stories about surprise fees appearing at the last minute during loan closing. Traceloans.com emphasizes upfront transparency, so you know exactly what you’re signing up for from the beginning. This clarity helps you make informed decisions and budget accurately for your new vehicle.

The platform’s inclusive approach also means a high approval chance, even if your credit history isn’t perfect. By connecting you with lenders who specialize in different credit profiles, you’re much more likely to find someone willing to work with your unique situation. This inclusivity can be life-changing for people who’ve been turned away by traditional banks.

Understanding your rights throughout this process is crucial. You can Learn about your rights as a borrower from the FTC to ensure you’re making informed decisions every step of the way.

Flexible Terms for Every Budget

Life doesn’t come with a one-size-fits-all budget, so why should auto loans? Traceloans.com auto loans recognize that your financial situation is as unique as your fingerprint, and they’ve built their service around providing the flexibility you need to make car ownership work within your specific circumstances.

The variety of loan length options available through their network is impressive. Maybe you’re in a position where you can handle higher monthly payments and want to own your car outright as quickly as possible – shorter terms like 36 or 48 months might be perfect for you. On the other hand, if you’re juggling multiple financial priorities and need breathing room in your monthly budget, longer terms of 60, 72, or even 84 months can significantly reduce your monthly payment burden.

Understanding how different terms affect your wallet is crucial for making the right choice. The monthly payment examples in the table below show how loan amount, interest rate, and term length work together to determine your payment:

| Loan Amount | Interest Rate (APR) | Term (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $20,000 | 6.0% | 36 | $608 |

| $20,000 | 6.0% | 60 | $387 |

| $20,000 | 6.0% | 72 | $332 |

| $30,000 | 7.5% | 48 | $726 |

| $30,000 | 7.5% | 72 | $506 |

| $30,000 | 7.5% | 84 | $445 |

Note: These are illustrative examples. Actual payments and rates may vary.

Several interest rate factors influence what you’ll actually pay. Your credit score plays the starring role – the higher your score, the lower your rate is likely to be. But other elements matter too, including the loan amount, the term length you choose, and each lender’s individual policies and current market conditions.

This level of customization means you’re not stuck accepting whatever terms one bank offers. Instead, you can find a loan that genuinely fits your financial reality, ensuring that your new car improves your life rather than straining your budget. It’s about finding that sweet spot where you get the vehicle you need at a price that lets you sleep soundly at night.

Frequently Asked Questions about Traceloans Auto Loans

We know that even with all the helpful information we’ve shared, you might still have some lingering questions about traceloans.com auto loans. And honestly, that’s completely normal! Getting a car loan is a big financial decision, and we want you to feel confident every step of the way. Think of this section as your friendly chat with someone who’s been through the process before.

Can I apply for a loan if I have a low credit score?

Here’s the good news that might surprise you: yes, absolutely! This is honestly one of our favorite things about Traceloans.com. We’ve all been there – maybe you missed a few payments during a tough time, or perhaps you’re just starting to build your credit history. It can feel pretty discouraging when you need a car but worry your credit score will slam the door shut.

Traceloans.com takes a completely different approach. Instead of having one bank look at your application and potentially say no based on a single credit policy, they connect you with multiple lenders who specialize in working with all kinds of credit situations. Some lenders actually focus specifically on helping people with poor credit or no credit history at all.

This means your chances of getting approved go way up. What might be a “no” from one lender could easily be a “yes” from another who understands your situation better. It’s like having several different people vouch for you instead of just one.

What documents do I need to apply for an auto loan?

Getting your paperwork ready doesn’t have to be overwhelming. Most lenders want to see pretty standard stuff – nothing too crazy or complicated. The main goal is simply proving you are who you say you are and that you can handle the monthly payments.

You’ll typically need standard identification like your driver’s license – something that shows you’re a real person applying for this loan. Then comes proof of income, which might sound formal, but it’s really just showing that you have money coming in regularly. This could be recent pay stubs if you’re employed, or tax returns if you work for yourself.

Recent bank statements round out the typical requirements. These give lenders a peek into your financial habits and help confirm the income information you’ve provided. Usually, the last few months of statements do the trick.

The beauty is that having these documents ready before you start can make the whole process much smoother. No scrambling around looking for paperwork while you’re excited about that perfect car you found!

How is Traceloans.com different from applying directly at a bank?

This is such a great question because it really gets to the heart of why Traceloans.com can be a game-changer. Picture this: the traditional way means you walk into Bank A, fill out their application, wait for an answer, and if it’s not what you hoped for, you start all over again at Bank B. Then maybe Bank C. It’s exhausting, time-consuming, and frankly, pretty stressful.

Traceloans.com works as a loan marketplace – think of it like a helpful connector rather than a lender themselves. You fill out one single application, and they share it with their entire network of lending partners. It’s like having a personal assistant who knows exactly which lenders might be interested in working with someone in your situation.

This approach gives you some amazing advantages. You save tons of time by avoiding multiple applications, and you get to compare offers from different lenders side by side. Plus, because multiple lenders see your application, your approval odds shoot up significantly. The lenders end up competing for your business, which often means better terms and rates for you.

Instead of you doing all the legwork to find the best deal, Traceloans.com brings the best deals to you. It’s honestly a much smarter way to shop for an auto loan.

Conclusion: Drive Towards Your Goals with Confidence

The journey to car ownership shouldn’t feel like climbing a mountain with a backpack full of paperwork. Yet for so many of us, that’s exactly what traditional auto financing has felt like. We’ve all been there – the endless bank visits, the uncertainty, the stress of wondering if we’ll even get approved.

Traceloans.com auto loans change this entire experience. Instead of that uphill battle, you get a clear path forward. One application connects you to multiple lenders who actually want to work with you, regardless of where your credit score stands today. This isn’t just about convenience – it’s about reducing stress and putting you back in control of your financial decisions.

Think about what financial stability really means. It’s not just having money in the bank; it’s knowing you made smart choices that work for your life. When you can secure an auto loan with competitive terms, flexible payments, and transparent conditions, you’re not just buying a car – you’re investing in your peace of mind.

At Beyond Beauty Lab, we believe true wellness goes beyond skincare routines and morning rituals. It includes feeling confident about the big decisions in your life, like how you finance major purchases. Just as we help you make informed financial decisions about your beauty and wellness journey, we want you to feel empowered when it comes to your financial choices too.

The beauty of Traceloans.com lies in its simplicity. Within 24 hours, you can go from application to approval to having funds in your account. That means less time worrying about financing and more time enjoying the freedom that comes with reliable transportation.

Whether you’re a first-time car buyer building credit, someone with a few financial bumps in the past, or simply looking for better terms on your current loan, you deserve options that fit your life. You deserve to drive toward your goals with confidence, knowing you made a choice that supports your overall well-being.

Ready to experience car financing the way it should be? Empowering choices start with taking that first step.