Protecting Your Investment After the Factory Warranty Ends

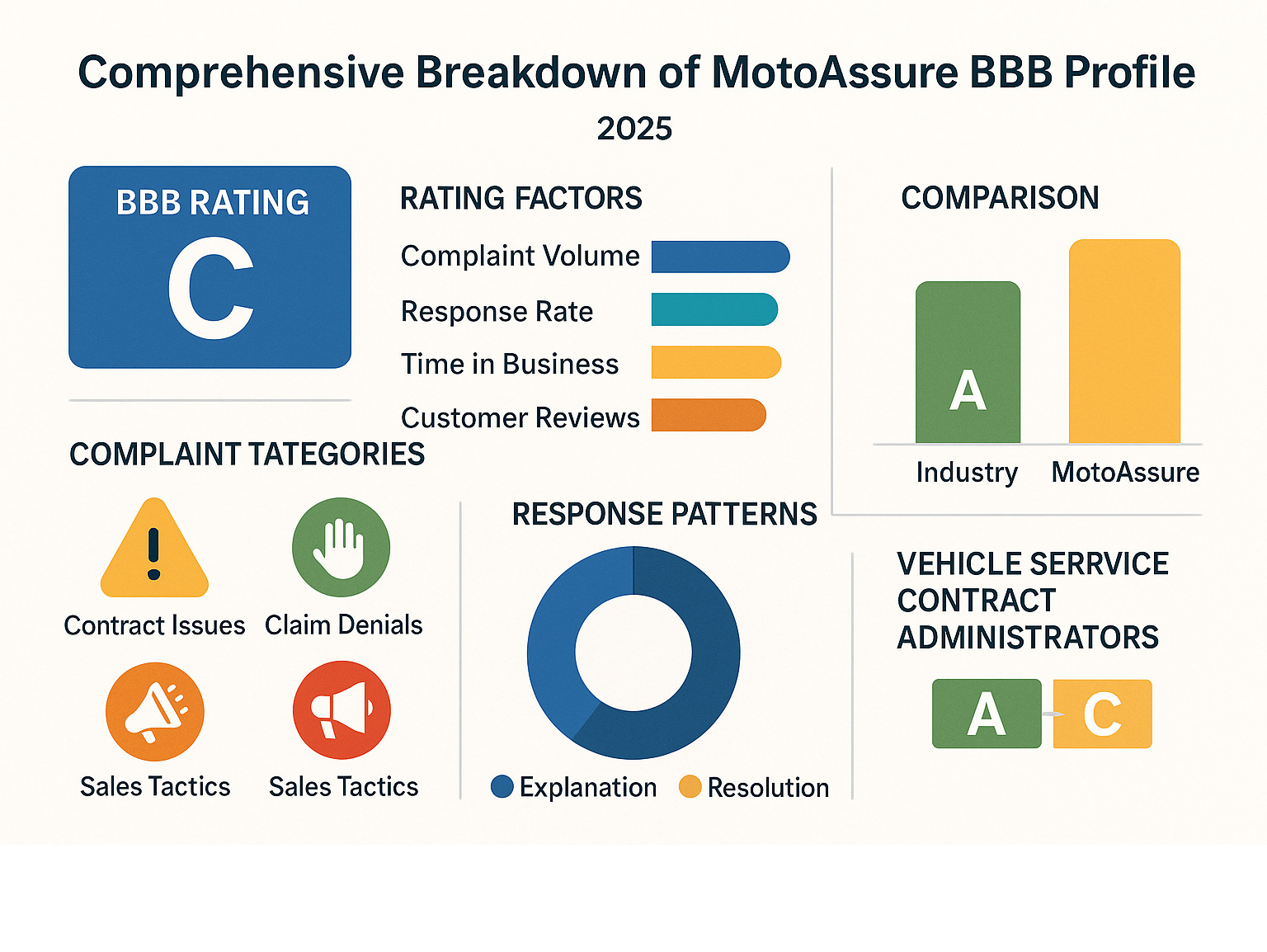

Motoassure bbb searches typically reveal a company that handles vehicle service contracts, but the reality is more complex than many consumers realize. If you’re researching MotoAssure’s Better Business Bureau standing, here’s what you need to know right away:

Quick Facts About MotoAssure BBB Status:

- Role: Third-party administrator for vehicle service contracts (not the warranty seller)

- BBB Profile: Mixed customer reviews with both positive and negative experiences

- Common Complaints: Contract clarity issues, claim denials, high-pressure sales tactics

- Response Rate: MotoAssure typically responds to BBB complaints with explanations or partial solutions

- Key Insight: The company’s BBB rating reflects typical challenges in the extended warranty industry

When your car’s factory warranty expires, you’re left facing potential repair bills that can reach thousands of dollars. A transmission replacement might cost $4,000. An engine repair could hit $6,000 or more. This is where vehicle service contracts – often called extended warranties – come into play.

But here’s the thing: not all warranty companies are created equal. Some provide excellent service and honor their contracts. Others leave customers frustrated with denied claims and confusing terms.

MotoAssure operates as what’s called a “contract administrator.” Think of them as the middleman who processes your claims and handles customer service, rather than the company that actually sold you the warranty. This distinction matters when you’re trying to understand their BBB profile and customer reviews.

The Better Business Bureau receives numerous complaints about MotoAssure, ranging from delayed reimbursements to denied claims for “pre-existing conditions.” However, the company does respond to most complaints, often by explaining contract terms or offering partial refunds.

Understanding these dynamics helps you make a smarter decision about whether a MotoAssure-administered warranty fits your needs and budget.

* motoassure bbb* helpful reading:

What is MotoAssure and Its Role as a Contract Administrator?

Think of buying an extended warranty like ordering a pizza. The person who takes your order isn’t the same person who makes your pizza or delivers it to your door. In the extended warranty world, MotoAssure fills a similar role – they’re not usually the company that sold you the warranty, but they’re the ones handling everything behind the scenes.

MotoAssure operates as a third-party administrator for vehicle service contracts. This means when your car breaks down and you need to file a claim, MotoAssure is likely the company you’ll be dealing with, even if you bought your warranty from a dealership or another sales company.

Here’s what MotoAssure actually does on a day-to-day basis:

Claims processing is their bread and butter. When you submit a repair claim, they review it to make sure it falls within your contract terms. They verify the problem is covered, check that you’ve maintained your vehicle properly, and authorize the repair shop to do the work.

Customer service is another major part of their role. They’re the voice on the other end of the phone when you have questions about your coverage or need help understanding your contract terms.

Repair authorization keeps the whole system moving. They work directly with repair shops to approve covered repairs and handle the financial side of things between you, the shop, and the insurance company that backs your contract.

This administrative role might sound simple, but it’s actually quite complex. MotoAssure manages a web of relationships between contract holders, repair facilities, and insurance underwriters. They’re essentially the traffic controller making sure everyone gets paid and repairs get done according to contract terms.

Understanding this role helps explain many motoassure bbb reviews you’ll find online. When customers praise quick claim processing or helpful customer service, that’s MotoAssure doing their administrative job well. When complaints arise about denied claims or confusing explanations, that often points to friction in this same process.

The distinction between MotoAssure and the original warranty seller matters more than you might think. It’s similar to how we approach holistic wellness at Beyond Beauty Lab – understanding all the moving parts helps you make better decisions about your overall financial health.

Vehicle service contracts differ significantly from manufacturer warranties. Your car’s factory warranty comes directly from the automaker and covers specific timeframes or mileage limits. A vehicle service contract, which MotoAssure administers, is a separate agreement you purchase to extend protection beyond those original limits.

This complex landscape of vehicle sales makes it even more important to understand who you’re really dealing with when you buy extended coverage. Just as we believe in making informed choices about your wellness journey, understanding these industry relationships helps protect your automotive investment.

For those looking to make smarter financial decisions across all areas of life, our financial planning guide offers valuable insights that complement this automotive knowledge.

An In-Depth Look at the MotoAssure BBB Reputation

When you’re researching motoassure bbb information, you’re taking a smart step toward understanding what real customers have experienced. The Better Business Bureau serves as a trusted watchdog for consumers, creating a space where people can share their experiences and businesses can respond to concerns.

Think of the BBB as your neighbor who’s tried every restaurant in town and is happy to tell you which ones are worth your time and money. They don’t endorse any specific business, but they do provide a rating system from A+ (excellent) down to F (needs serious improvement). These ratings consider factors like complaint history, how transparent a company is, and most importantly, how they respond when customers have problems.

Here’s something crucial to remember: when you see complaints about a large company like MotoAssure, you need to consider the bigger picture. A company that processes thousands of contracts will naturally have more complaints than a smaller operation, simply because they serve more customers. What really matters is the pattern of complaints and how the company handles them.

You can check out their current standing by visiting the MotoAssure Administration | BBB Business Profile directly.

Analyzing the motoassure bbb Customer Reviews

Reading through MotoAssure’s customer reviews is like listening to a mixed playlist – you’ll hear some upbeat songs and some that are definitely more blues than jazz. The variety of experiences tells an important story about what you might expect.

The positive experiences often highlight situations where everything worked as promised. Customers praise timely claim processing when their car needed repairs, and many mention helpful customer service agents who walked them through the process without making them feel like they were speaking a foreign language. These success stories typically involve customers who saved thousands of dollars on major repairs like transmission work or engine problems.

However, the challenging experiences are equally important to understand. The most common frustrations that appear in BBB reviews include misleading marketing practices where customers felt the contract terms weren’t clearly explained upfront. Some people report receiving high-pressure sales calls that made them feel rushed into making a decision.

Delayed reimbursements create another source of frustration. Imagine paying for a $2,000 repair out of pocket and then waiting weeks or months to get your money back – that’s a real financial strain for most families.

Perhaps the most contentious issue involves denied claims for pre-existing conditions. This happens when MotoAssure determines that a car problem existed before the contract started, even if the customer had no idea there was an issue. These situations often lead to disputes about diagnostic procedures and contract interpretation.

Some customers also report difficulties with canceling contracts, including unexpected fees or complicated procedures that make it challenging to get out of an agreement they no longer want.

If you want to read these experiences firsthand, you can see direct customer feedback on their BBB page.

How MotoAssure Responds to motoassure bbb Complaints

One positive aspect of MotoAssure’s BBB profile is that they actually respond to most customer complaints. This might seem like the bare minimum, but you’d be surprised how many companies ignore customer concerns entirely.

When MotoAssure does respond, they typically focus on explaining contract terms in detail. While this can help clarify misunderstandings, it also highlights why reading the fine print is so important from the start. Sometimes they’ll offer partial or full refunds to resolve disputes, especially when there’s been a genuine misunderstanding about coverage.

For denied claims, they usually provide detailed documentation explaining their decision, such as diagnostic reports that support their determination of a pre-existing condition or repairs that fall outside the contract’s scope.

The quality of these responses varies, though. Simply restating contract terms without offering a path forward can leave customers feeling frustrated and unheard. However, when MotoAssure engages constructively and works toward a resolution, it demonstrates their commitment to customer satisfaction.

This approach to problem-solving reflects the same principles we believe in at Beyond Beauty Lab – that education and transparency lead to better outcomes for everyone involved. Just as we help people make informed decisions about their wellness journey, understanding how companies handle complaints helps you make smarter choices about protecting your investments.

Key Factors to Consider Before Signing a Vehicle Service Contract

When you’re considering a vehicle service contract – whether it’s administered by MotoAssure or another company – think of it like choosing a skincare routine. You wouldn’t buy expensive serums without checking the ingredients first, right? The same careful attention applies here, especially after seeing those motoassure bbb reviews we discussed earlier.

The truth is, most people sign these contracts without truly understanding what they’re getting into. We get it – the paperwork can feel overwhelming, and sales representatives often create a sense of urgency. But taking time to evaluate your contract properly can save you thousands of dollars and countless headaches down the road.

Reading the fine print isn’t just a suggestion – it’s your financial lifeline. This is where you’ll find the real story about your coverage. Start by examining the coverage details carefully. Does the contract cover just the powertrain (engine and transmission), or does it include electrical systems, air conditioning, and other components? A comprehensive contract will spell out exactly which parts and systems are protected.

But here’s what many people miss: the exclusions list is often more important than what’s covered. This section reveals what won’t be covered, and it’s usually extensive. You’ll typically find exclusions for wear-and-tear items like brake pads and tires, maintenance services, cosmetic damage, and issues caused by poor maintenance or vehicle modifications. Pay special attention to clauses about “pre-existing conditions” – this is where many motoassure bbb complaints originate.

Next, understand your deductible amount. Some contracts charge you a set fee per repair visit, while others charge per individual repair. A $100 deductible might not sound like much, but if you need multiple repairs during one service visit, those costs can add up quickly.

Consider whether the contract is transferable to a new owner if you sell your car. This feature can actually increase your vehicle’s resale value, making it an attractive selling point. Similarly, review the cancellation policy thoroughly. Life changes, and you might need to cancel your contract early. Understanding the fees and refund structure upfront prevents unpleasant surprises later.

Choosing a repair facility is another crucial factor. Some contracts require you to use specific repair shops or dealerships, while others offer flexibility to visit any certified mechanic. If you have a trusted mechanic you’ve worked with for years, make sure your contract allows you to continue that relationship.

Don’t overlook reimbursement limits either. Some contracts cap how much they’ll pay for a single repair or over the contract’s lifetime. If your transmission needs a $4,000 repair but your contract only covers $2,500 maximum per incident, you’ll be responsible for the difference.

This careful approach to understanding agreements mirrors how we approach personal finance decisions at Beyond Beauty Lab. Just as we research ingredients in our skincare products, researching contract terms protects your financial wellness. For more insights into managing your financial health, check out our guide to managing debt.

Red Flags to Watch Out For

Trust your instincts – they’re usually trying to tell you something important. After reviewing hundreds of consumer complaints and motoassure bbb feedback, certain warning signs consistently appear when people encounter problems with vehicle service contracts.

High-pressure sales tactics top the list of red flags. If someone is pushing you to “sign today to get this special price,” that’s your cue to slow down. Legitimate companies understand that buying a service contract is a significant financial decision that deserves careful consideration. They’ll give you time to review terms and ask questions.

Unsolicited contact about your “expiring warranty” is another warning sign. While some of these contacts are legitimate, many come from companies using high-pressure tactics to sell overpriced contracts with limited coverage. Be especially wary if the caller claims to represent your car manufacturer but can’t provide specific details about your actual warranty status.

Watch out for vague answers to specific questions. When you ask about coverage details, exclusions, or cancellation policies, a reputable representative should provide clear, direct answers. If someone gives you runaround responses or says they’ll “explain everything after you sign,” consider that a major red flag.

Never work with anyone who refuses to provide a written contract for review. You should always have the opportunity to read through the entire contract away from any sales pressure. If they won’t send you a copy to review at home, or if they insist you must sign immediately to see the terms, walk away.

Pay attention to BBB profiles and ratings as well. While not every good business is BBB accredited, consistently low ratings or patterns of unresolved complaints should give you serious pause. This research is part of your due diligence process.

Finally, be suspicious of demands for immediate payment or promises that seem too good to be true. If a contract promises comprehensive coverage for an unusually low price, it likely has extensive exclusions that aren’t being clearly explained upfront.

Protecting yourself from these red flags is just as important as understanding what good coverage looks like. Your financial security depends on making informed decisions, whether you’re choosing a vehicle service contract or planning your overall financial strategy.

Frequently Asked Questions about MotoAssure and Extended Warranties

We know that sorting through vehicle service contract details can feel overwhelming. You’re making a significant financial decision, and naturally, you want to feel confident about it. Let’s tackle some of the most common questions we hear about MotoAssure and extended warranties to help you move forward with clarity.

Is MotoAssure a legitimate company?

The short answer is yes – MotoAssure operates as a legitimate third-party administrator for vehicle service contracts. They have a real business presence, handle actual claims, and process payments for repairs. You’re not dealing with a fly-by-night operation.

But here’s where it gets nuanced. Being legitimate doesn’t automatically mean every customer will have a stellar experience. Think of it like a restaurant – it can be a real, established business while still serving food that some people love and others find disappointing.

From the motoassure bbb profile, we see this exact pattern. Some customers praise their efficient claim processing and helpful customer service representatives who saved them thousands on major repairs. Others share frustrating stories about denied claims, communication breakdowns, or contract terms that weren’t as clear as they expected.

The key takeaway? MotoAssure is a real company with real operations, but your experience will largely depend on your specific contract terms, the nature of your claim, and how well you understand what you’re purchasing. This is why we always emphasize doing your homework before signing anything.

Why might a claim be denied by MotoAssure?

Claim denials are probably the biggest source of motoassure bbb complaints, and honestly, they can be heartbreaking. You think you’re covered, your car breaks down, and suddenly you’re told “sorry, that’s not included.” Let’s break down the most common reasons this happens.

Pre-existing conditions top the list of denial reasons. If MotoAssure determines that your car’s problem existed before you bought the contract – even if you had no idea – they’ll likely deny the claim. This often requires a mechanic’s diagnostic report, and the interpretation can sometimes feel subjective.

Excluded parts and systems are another major culprit. Long list of exclusions in your contract? If your repair involves anything on that list, you’re on your own. This is why we can’t stress enough how important it is to read through those exclusions carefully.

Missing maintenance records can also sink your claim. Most contracts require proof that you’ve kept up with regular maintenance like oil changes and scheduled services. No records often means no coverage, since poor maintenance can contribute to mechanical failures.

The claim process itself matters too. Many contracts require you to get approval before starting repairs or use specific repair shops. Skip these steps, and you might find yourself paying out of pocket even for covered repairs.

Wear-and-tear items like brake pads, tires, and belts typically aren’t covered unless specifically stated. These parts naturally wear out over time, and most contracts draw the line there.

Understanding these potential pitfalls ahead of time can help you steer the process more successfully and avoid unpleasant surprises.

Can I cancel a MotoAssure contract?

Most vehicle service contracts, including those administered by MotoAssure, do offer cancellation options – but the devil is in the details. Your specific contract terms will spell out exactly how this works, which is another reason to keep that paperwork handy.

Many contracts include a “free look” period – typically 30 to 60 days – where you can cancel for a full refund if you haven’t filed any claims. Think of it as a trial period to make sure you’re happy with your decision.

After that initial window, you’re usually looking at pro-rata refunds. This means you’ll get back a portion of what you paid based on how much of the contract term or mileage remains unused. If you’ve used half your contract’s coverage period, expect to get roughly half your money back, minus any claims that were paid out.

Cancellation fees are pretty standard, so factor those into your calculations. The exact amount should be clearly stated in your contract terms.

Before canceling, consider whether transferring the contract to a new owner might be a better option if you’re selling your vehicle. This can actually add value to your car sale and might be more beneficial than canceling outright.

If you decide to move forward with cancellation, contact MotoAssure’s customer service directly. Have your contract number, vehicle information, and reason for cancellation ready. Keep detailed records of all your communications – this protects you and helps ensure the process goes smoothly.

Understanding your options upfront gives you more control over your financial decisions, whether you’re dealing with extended warranties or any other significant purchase.

Conclusion: Drive with Confidence by Making an Educated Choice

After taking this deep dive into the motoassure bbb profile, we hope you feel more equipped to steer the sometimes confusing world of vehicle service contracts. Think of this knowledge as your roadmap – one that helps you avoid the potholes and dead ends that can leave you frustrated and out of pocket.

Our investigation revealed that MotoAssure operates as a legitimate third-party administrator, but like any company in this industry, customer experiences run the full spectrum. Some drivers praise their timely claim processing and helpful customer service, while others express frustration with denied claims and unclear contract terms. This mixed bag of feedback isn’t unusual in the extended warranty world, but it does highlight why your homework matters so much.

The power of due diligence cannot be overstated here. Before you sign any contract, make sure you thoroughly understand every detail – from what’s covered to what’s excluded, from deductible amounts to cancellation policies. Don’t let anyone rush you into a decision. Remember those red flags we discussed: high-pressure sales tactics, vague answers to your questions, and reluctance to provide written terms for your review.

Understanding that MotoAssure serves as a contract administrator rather than the original warranty seller helps set realistic expectations. When issues arise, you’ll know who to contact and what role they play in resolving your concerns. The BBB profile shows they do respond to complaints, which is encouraging, even if the resolution doesn’t always satisfy every customer.

At Beyond Beauty Lab, we believe knowledge is your best accessory – whether you’re choosing the right skincare routine or making important financial decisions. Just as we encourage you to read ingredient labels and understand what you’re putting on your skin, we champion the same careful approach with financial agreements that protect your assets.

A vehicle service contract can provide genuine peace of mind when unexpected repairs threaten your budget. But that peace of mind only comes when you truly understand what you’re buying. By researching thoroughly, asking specific questions, and reading every line of the fine print, you’re not just purchasing a contract – you’re investing in your financial security and confidence on the road.

Making informed financial decisions is a cornerstone of overall wellness, much like the holistic approach we take to beauty and health. When you understand your options and make educated choices, you’re taking control of your future in the most empowering way possible.

We hope this comprehensive guide serves you well as you consider your vehicle protection options. For more insights on making smart decisions across all areas of your life, we invite you to Explore more resources on our site.