Why FintechZoom Google Stock Analysis Matters for Your Financial Wellness

FintechZoom Google stock analysis has become essential for investors seeking comprehensive market insights. Just as we care for our physical well-being through clean beauty and sustainable practices, nurturing our financial health requires the right tools and knowledge.

Quick Answer for FintechZoom Google Stock:

- What it is: FintechZoom is a financial platform that provides real-time data, news, and analysis for Google (Alphabet Inc.) stock

- Stock symbols: GOOGL (voting rights) and GOOG (no voting rights)

- Current status: Google stock shows 59% recovery over the past 12 months

- Investment minimum: As little as $5 through fractional shares

- Key benefits: Real-time monitoring, personalized alerts, comprehensive analysis tools

Google remains one of the fastest-growing organizations in the tech sector, but successful investing requires the right approach and analytical platform. FintechZoom serves as that crucial bridge between complex market data and actionable investment insights.

Why this matters for holistic wellness: Financial security directly impacts our overall well-being. When we make informed investment decisions using reliable tools like FintechZoom, we create stability that allows us to focus on other aspects of self-care and sustainable living.

The platform offers everything from real-time stock monitoring to detailed financial analysis – making Google’s stock performance accessible to everyday investors. Whether you’re interested in Alphabet’s AI developments, cloud computing growth, or advertising revenue streams, FintechZoom consolidates this information into digestible insights.

Fintechzoom google stock terms you need:

Understanding the Key Players: FintechZoom and Google Stock

Think of fintechzoom google stock analysis like building a skincare routine – you need to understand your tools and ingredients before you can create something that truly works. Just as we carefully research clean beauty products at Beyond Beauty Lab, smart investing requires knowing exactly what you’re working with.

Let’s break down the two main players in this financial wellness journey. First, there’s Alphabet Inc. – Google’s parent company that’s become a $2 trillion powerhouse in our digital world. Then there’s FintechZoom, your analytical companion that makes sense of all those numbers and market movements.

Here’s what makes this exciting: fractional shares mean you can start investing in Google stock with as little as $5. No need to wait until you have hundreds of dollars – you can begin building your financial wellness today, just like starting with one quality skincare product rather than overhauling your entire routine at once.

What is FintechZoom?

FintechZoom is like having a knowledgeable friend who’s obsessed with the stock market – but in the best possible way. This financial data aggregation platform takes the overwhelming world of investing and makes it digestible for everyday people like us.

The platform shines through its real-time market news delivery. Imagine getting a gentle notification when something important happens with your investments, rather than finding major news days later. That’s the kind of timely information FintechZoom provides.

What sets it apart are the investment insights that go beyond raw numbers. The platform doesn’t just tell you Google’s stock price went up or down – it helps you understand why and what it might mean for your portfolio. Their stock analysis tools include everything from basic charts to advanced technical indicators, all presented in a user-friendly interface.

FintechZoom covers an impressive range of topics, from individual stocks like Google to major market indices, cryptocurrencies, and emerging fintech trends. It’s designed to grow with you as your investment knowledge expands.

More info about market analysis

Decoding Google’s Stock (GOOG vs. GOOGL)

Here’s where things get interesting – when people talk about buying “Google stock,” they’re actually choosing between two options. Alphabet Inc. offers Class A shares (GOOGL) and Class C shares (GOOG), and the difference matters more than you might think.

GOOGL shares come with voting rights, meaning you get a voice in company decisions like board member elections. Think of it as being part of the family – you get to weigh in on important choices. GOOG shares, on the other hand, are purely investment vehicles without voting power. You own a piece of the company’s success, but you don’t get to influence its direction.

The stock performance of both classes typically moves in sync, with prices hovering around $100 per share recently. Sometimes there are small price differences between GOOGL and GOOG, but they generally track each other closely.

Alphabet’s founders, Larry Page and Sergey Brin, maintain control through Class B shares that aren’t publicly traded. This structure lets them focus on long-term innovation rather than short-term market pressures.

How To Buy Google Stock (GOOGL)

| Feature | GOOGL (Class A) | GOOG (Class C) |

|---|---|---|

| Voting Rights | Yes | No |

| Symbol | GOOGL | GOOG |

| Primary Use | Provides shareholders with corporate influence | Primarily for investment without governance |

| Price | Generally similar to GOOG | Generally similar to GOOG |

| Liquidity | High | High |

Leveraging FintechZoom for In-Depth Google Stock Analysis

Now that we’ve covered the basics, let’s explore how to actually use FintechZoom for serious fintechzoom google stock analysis. Think of this as your investment skincare routine – just as we carefully analyze ingredients and results for our beauty regimen, we need the right tools to understand what makes Google’s stock tick.

FintechZoom transforms what could be overwhelming market data into something much more manageable. Instead of jumping between multiple websites and trying to piece together information, you get everything in one place. It’s like having a wellness coach for your financial health – guiding you through the complexity with clear, actionable insights.

The platform excels at real-time monitoring, which means you’re never working with stale information. Whether Google announces a breakthrough in AI or faces regulatory challenges, you’ll know about it as it happens. This immediate access to data and news helps you develop smarter investment strategies based on current market conditions.

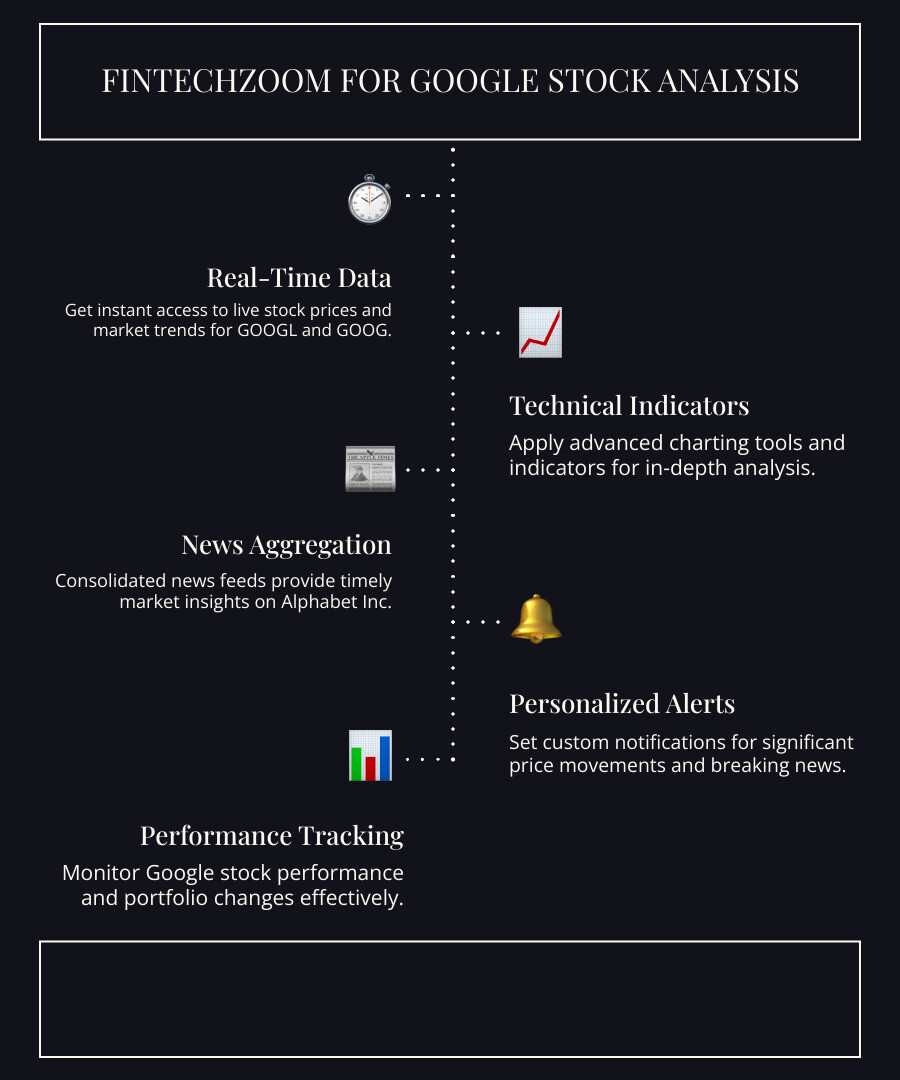

Key Analytical Features of FintechZoom

FintechZoom’s analytical toolkit is designed with both beginners and experienced investors in mind. The real-time charts are probably the first thing you’ll notice – they’re clean, easy to read, and update constantly throughout trading hours. You can track both GOOG and GOOGL prices side by side, watching how they move throughout the day.

The technical indicators available through the platform include all the classics you’d expect: Moving Averages, RSI, MACD, and On-Balance Volume. Don’t worry if these sound intimidating – the platform presents them in a way that makes sense, even if you’re just starting to learn about stock analysis.

What really sets FintechZoom apart is its financial statement access. You can dive deep into Alphabet’s quarterly earnings, revenue growth, and profit margins without hunting through SEC filings. For instance, when Alphabet reported Q1 2025 revenue of $90.2 billion (a 12% jump) with net profits of $34.5 billion (up 46%), FintechZoom made these numbers easy to find and understand.

The aggregated news feeds might be the most valuable feature for busy investors. Instead of checking multiple financial news sites, FintechZoom pulls together stories from various sources. This means you won’t miss important developments about Google’s AI initiatives, cloud computing growth, or any regulatory updates that might affect the stock price.

Why FintechZoom is a Go-To for Analyzing fintechzoom google stock

Google isn’t just a search engine anymore – it’s a massive technology ecosystem that touches everything from advertising to artificial intelligence to autonomous vehicles. This complexity is exactly why FintechZoom shines for fintechzoom google stock analysis.

The platform excels at consolidated Google news tracking. When you’re dealing with a company as diverse as Alphabet, staying on top of developments across all business units can feel overwhelming. FintechZoom solves this by bringing together news about Google Search, YouTube, Google Cloud, Waymo, and all the other subsidiaries in one feed.

Tracking AI developments has become crucial for understanding Google’s future prospects. The platform helps you monitor progress on projects like Bard, DeepMind research, and the Search Generative Experience. Since AI represents such a significant growth opportunity for Alphabet, having this information at your fingertips is invaluable.

Monitoring regulatory updates is another area where FintechZoom proves its worth. Google faces ongoing scrutiny from regulators worldwide, and these developments can significantly impact stock performance. The platform’s news aggregation ensures you’re aware of antitrust proceedings, privacy regulations, and other legal matters that might affect your investment.

The competitor analysis features let you see how Google stacks up against other tech giants in real-time. This comparative view helps you understand whether Google’s stock movements reflect company-specific issues or broader market trends.

Perhaps most importantly, FintechZoom makes it easy to track Google’s impressive stock recovery statistics. The platform clearly shows that Alphabet shares have climbed 59% over the past 12 months, and it provides the context you need to understand what’s driving this growth.

Is Google Stock A Buy After It Passes A $2 Trillion Valuation?

Navigating Risks and Opportunities with fintechzoom google stock

When it comes to fintechzoom google stock, understanding both the risks and opportunities is like knowing your skin type before choosing skincare products. Every investment has its unique challenges and potential rewards, and Google stock is no exception. While Alphabet Inc. stands as one of the world’s most valuable companies, even tech giants face headwinds that can affect their stock performance.

The beauty of using FintechZoom for your investment journey is that it helps you see the complete picture. Just as we believe in transparent ingredients for clean beauty, we need transparent data for smart investing. The platform gives you real-time insights into market sentiment, helping you make informed decisions rather than emotional ones.

Primary Risks of Investing in Google

Let’s be honest about what could go wrong when investing in Google stock. Understanding these risks upfront helps you prepare and make smarter choices about your portfolio.

Regulatory scrutiny remains Google’s biggest challenge. The company faces ongoing antitrust investigations and trials worldwide, particularly around its advertising dominance and search monopoly. These legal battles aren’t just expensive – they could result in hefty fines, operational restrictions, or even breaking up parts of the business. Information on Google’s antitrust accusations shows just how serious these challenges have become.

Market competition is another reality check for Google investors. While the company dominates search, it faces fierce rivals in cloud computing, artificial intelligence, and mobile services. Microsoft’s AI push, Amazon’s cloud leadership, and Apple’s ecosystem all pose real threats to Google’s market share. This competition can squeeze profit margins and slow growth.

Ad revenue dependency makes Google vulnerable to economic downturns. Despite diversification efforts, advertising still generates the majority of Alphabet’s revenue. When businesses cut marketing budgets during tough times, Google feels the pinch directly.

FintechZoom helps you monitor these risks through personalized alerts and comprehensive news feeds. You can set up notifications for regulatory developments, competitor announcements, or changes in advertising market trends. This real-time monitoring gives you the chance to adjust your investment strategy before problems become crises.

Market Sentiment and Future Outlook for Google

Despite the risks, the story around fintechzoom google stock remains largely positive. Most analysts maintain bullish ratings on Alphabet shares, with many setting price targets well above current levels.

AI leadership represents Google’s biggest opportunity. The company’s investments in artificial intelligence, from its Bard chatbot to DeepMind research, position it perfectly for the next wave of tech innovation. Google’s Search Generative Experience and AI-powered advertising tools are already showing promising results. The Google Gemini app even surpassed ChatGPT in App Store downloads during late April and early May, proving the company can compete in this crucial space.

Google Cloud growth continues to impress investors. While still behind Amazon Web Services, Google’s cloud division is gaining market share rapidly and becoming increasingly profitable. This diversification away from pure advertising revenue strengthens the company’s long-term prospects.

The company’s diversified revenue streams now include YouTube’s creator economy, Android’s global reach, Chrome’s browser dominance, and experimental “Other Bets” like Waymo autonomous vehicles. Waymo alone completed 25 million miles without a human driver by July 2024, showcasing real progress in technology.

FintechZoom’s sentiment analysis tools help you gauge how other investors feel about these developments. The platform aggregates analyst ratings, tracks institutional buying patterns, and monitors social media sentiment to give you a complete picture of market mood.

Economic factors generally favor Google’s position too. The company’s strong balance sheet and proven ability to manage costs during challenging periods make it more resilient than many tech stocks. With shares up 59% over the past 12 months, Google has demonstrated its ability to bounce back from market downturns.

Using FintechZoom for risk monitoring means you’re never caught off guard by major developments. The platform’s comprehensive approach to fintechzoom google stock analysis helps you separate temporary setbacks from fundamental problems, making you a more confident and successful investor.

Best Practices and Future Outlook

Just as your skincare routine becomes more effective with consistent practice and the right techniques, mastering fintechzoom google stock analysis requires developing smart habits and understanding where technology is headed. The beauty of financial wellness lies in creating sustainable practices that grow with you over time.

Think of it this way: you wouldn’t apply a face mask randomly and hope for the best. Similarly, successful investing with FintechZoom means following a thoughtful approach that leverages both current tools and emerging technologies.

A Practical Guide to Using FintechZoom for fintechzoom google stock

The secret to getting the most from FintechZoom isn’t just checking stock prices occasionally. It’s about creating a system that works for your lifestyle and investment goals.

Start with your watchlist – this becomes your financial dashboard. Add both GOOG and GOOGL to track how they move together, along with a few key tech stocks for comparison. This gives you context for Google’s performance within the broader market.

Smart alerts make all the difference. Rather than basic price notifications, set up alerts that actually matter. Get notified when Google’s stock moves more than 2% in a day, when trading volume spikes unusually high, or when earnings reports are about to drop. One investor shared how setting up earnings alerts helped them react quickly when Alphabet beat expectations, leading to significant gains.

The real magic happens when you cross-reference information. While FintechZoom provides excellent data, the wisest investors verify important insights with additional sources. This isn’t about doubting the platform – it’s about building confidence in your decisions.

Fractional shares make Google stock accessible to everyone. Even if the full share price feels steep at around $100, you can start investing with as little as $5 through most brokerages. FintechZoom’s analysis tools work just as well whether you own a fraction of a share or hundreds.

Consider your timeline too. Use FintechZoom’s historical data to understand long-term trends while leveraging real-time information for timely decisions. Google’s 59% recovery over the past year shows the value of patience combined with good information.

The Future of FintechZoom and AI-Powered Analysis

We’re entering an exciting era where artificial intelligence transforms how we understand investments. Just as AI is revolutionizing skincare diagnostics and personalized beauty recommendations, it’s reshaping financial analysis in ways that will make platforms like FintechZoom incredibly powerful.

Predictive analytics are becoming remarkably sophisticated. Future versions of FintechZoom will likely offer AI-driven insights that can spot patterns humans might miss. Imagine getting early warnings about potential Google stock movements based on subtle shifts in search trends, cloud adoption rates, or even social media sentiment around AI developments.

The platform is moving toward deeper personalization that adapts to your unique investment style. AI will learn your risk tolerance, preferred investment timeline, and portfolio goals to deliver customized insights about Google stock that matter most to your situation.

Sentiment analysis is getting a major upgrade too. Instead of just tracking news headlines, advanced AI can interpret the emotional tone of thousands of articles, social media posts, and analyst reports to gauge market mood with unprecedented accuracy. This could provide early signals about how investors really feel about Google’s latest AI breakthroughs or regulatory challenges.

Machine learning integration will make the platform smarter over time. The more data it processes about Google’s performance patterns, the better it becomes at identifying meaningful trends and filtering out market noise.

These technological advances will make analyzing fintechzoom google stock more intuitive and insightful. The combination of human wisdom and AI precision creates opportunities for better investment decisions, whether you’re tracking Google’s AI developments, cloud computing growth, or advertising revenue trends.

The future promises tools that don’t just show you what’s happening with Google stock, but help you understand what it means for your financial wellness journey.

Frequently Asked Questions about FintechZoom and Google Stock

When it comes to fintechzoom google stock analysis, investors naturally have questions. Just as we might wonder about the ingredients in our favorite skincare products, understanding the fundamentals of our investment tools helps us make better decisions for our financial wellness.

What is the main difference between GOOG and GOOGL stock?

The key distinction between these two Alphabet stock classes comes down to voting rights – it’s like the difference between having a voice at a community meeting versus simply attending as an observer.

GOOGL (Class A shares) come with voting rights, meaning you get a say in important company decisions like electing board members. Think of it as having a seat at the table when Alphabet makes major strategic choices.

GOOG (Class C shares), on the other hand, don’t include voting privileges. You still own the same piece of the company and benefit from its financial performance, but you can’t influence corporate decisions.

Both stock classes represent ownership in Alphabet Inc. and typically trade at similar prices – currently around $100 per share. The price movements usually mirror each other closely, so your investment returns will be nearly identical regardless of which class you choose. The decision often comes down to whether having a voice in company matters is important to you personally.

How does FintechZoom help investors analyze Google stock?

FintechZoom transforms the complex world of fintechzoom google stock analysis into something much more manageable. It’s like having a personal financial wellness coach who never sleeps.

The platform provides real-time data that keeps you updated on live stock quotes and price movements for both GOOG and GOOGL. You’ll never miss important market shifts because the information flows continuously.

What makes FintechZoom particularly valuable is its comprehensive news aggregation. Instead of hunting across multiple websites for Alphabet-related news, earnings reports, and regulatory updates, everything gets consolidated in one place. This saves time and ensures you don’t miss crucial developments.

The technical analysis tools deserve special mention. FintechZoom offers advanced charting capabilities with various indicators like RSI and Moving Averages. These help identify trends and patterns that might not be obvious from just looking at price numbers.

You also get direct access to financial reports, allowing you to dive into Google’s financial statements for fundamental analysis. The platform includes sentiment indicators that help gauge overall market mood toward Google stock, plus personalized alerts that notify you about price changes, news, or specific events.

Essentially, FintechZoom takes overwhelming market data and transforms it into actionable insights, making informed decision-making much more achievable for everyday investors.

Is Google stock considered a risky investment?

Like all investments, Google stock carries inherent risks, but it’s generally viewed as a solid choice for long-term portfolios. Think of it like choosing a skincare routine – there are always potential reactions to consider, but quality ingredients typically yield positive results over time.

Market risks affect all stocks, including Google. The company faces overall market volatility, economic downturns, and shifts in investor sentiment that can impact share prices regardless of business performance.

Regulatory challenges present ongoing concerns. Google faces antitrust scrutiny globally, which could result in fines or required operational changes. These legal battles create uncertainty that can affect stock performance.

The competitive landscape is intense. Google operates against tech giants like Microsoft and Amazon across multiple sectors, from cloud computing to artificial intelligence. Staying ahead requires continuous innovation and significant investment.

Advertising revenue dependence remains a vulnerability. While Google has diversified, a substantial portion of revenue still comes from online ads, making the stock somewhat susceptible to advertising market fluctuations.

However, several factors mitigate these risks. Google’s stock has shown impressive resilience, with a 59% recovery over the last 12 months. The company’s leadership in AI and cloud computing, plus its diversified revenue streams, provide multiple growth avenues.

Long-term investment in Google stock can be beneficial, but thorough due diligence remains essential. Market volatility and unpredictable global events mean predictions should never be your sole basis for investment decisions. As with any aspect of wellness, balance and careful consideration lead to the best outcomes.

Conclusion

Our journey through fintechzoom google stock analysis has shown us how the right financial tools can transform complex market data into actionable insights. Just as we believe in nurturing our skin with clean, sustainable ingredients, building financial wellness requires the same thoughtful, holistic approach.

FintechZoom’s true power lies in making the intimidating world of stock analysis accessible to everyday investors. Whether you’re tracking the subtle differences between GOOG and GOOGL shares, staying updated on Google’s latest AI breakthroughs, or monitoring those ever-present regulatory challenges, this platform brings everything together in one place.

Google’s position in today’s market remains remarkably strong. With its 59% recovery over the past year, continuous innovation in artificial intelligence, and expanding cloud services, Alphabet represents the kind of forward-thinking investment that aligns with long-term financial goals. Yes, there are risks – regulatory scrutiny isn’t going anywhere, and competition in tech is fierce – but the company’s diversified revenue streams and market leadership provide a solid foundation.

Here’s what really matters: Financial security directly impacts every aspect of our well-being. When we feel confident about our financial future, we can focus more energy on self-care, sustainable living practices, and the things that bring us joy. Using tools like FintechZoom for fintechzoom google stock analysis isn’t just about making money – it’s about creating the stability that supports our overall wellness journey.

Even with the best analysis tools, investing always carries risks. The key is making informed decisions based on solid research and understanding your own comfort level with market volatility.

As you continue building your financial wellness, Beyond Beauty Lab is here to support your complete well-being journey. Financial health is just one piece of the puzzle that includes clean beauty, sustainable practices, and mindful living.