Why Understanding Mortgage Terms Can Transform Your Home Buying Journey

Traceloans.com mortgage loans offer a modern approach to home financing, combining competitive rates, transparent pricing, and faster closing times. This digital platform streamlines the traditional mortgage process, eliminating hidden fees and providing dedicated support.

Key Benefits of Traceloans.com Mortgage Loans:

- Fast closing times – Average of 21 days vs 30+ days with traditional banks

- Transparent pricing – No hidden fees with their “Clarity Guarantee”

- Flexible qualifications – Considers factors beyond traditional credit metrics

- Extended support – Customer service 7 AM-9 PM weekdays, 9 AM-5 PM Saturdays

- Digital efficiency – Streamlined online application and document upload

- Competitive rates – Often results in substantial savings compared to other lenders

The mortgage world is filled with confusing terms like APR, LTV ratios, and discount points that can overwhelm borrowers. As one industry expert noted, “Understanding the nuances of your loan options can change your narrative too.”

At Beyond Beauty Lab, we believe true wellness includes the confidence that comes from financial clarity. Just as we explain clean beauty ingredients, we want to explain mortgage terms to empower you in making one of life’s biggest investments.

Understanding these key concepts is crucial whether you’re a first-time homebuyer or refinancing, helping you steer the digital lending landscape with confidence.

* traceloans.com mortgage loans* word guide:

What is Traceloans.com and How Does It Simplify Home Financing?

Ready to buy your dream home but dreading the paperwork and confusing terms? Traceloans.com mortgage loans transform a stressful maze into a smooth journey.

Traceloans.com is a digital lender and online marketplace connecting you with multiple lenders via one simple application. Instead of applying to multiple banks, you submit your information once to receive competitive offers, letting lenders compete for your business.

What really sets them apart is their commitment to transparency. Traceloans.com takes the opposite approach with their “Clarity Guarantee” – a promise that your final closing costs won’t exceed your initial estimate by more than $250 (excluding third-party fees or changes you request). No hidden fees means exactly that – what you see is what you get.

The speed is also impressive. While traditional banks often take 30+ days to close a loan, Traceloans.com averages just 21 days. Their flexible qualifications mean they consider your full financial story, not just your credit score. Plus, their dedicated support team is available during extended hours – 7 AM to 9 PM on weekdays and 9 AM to 5 PM on Saturdays.

For more detailed information about their comprehensive services, check out More info about Traceloans.com.

Key Features and Benefits

Traceloans.com mortgage loans combine cutting-edge technology with genuine human care. Their competitive rates emerge naturally from an environment where lenders compete for your business, which often translates into thousands of dollars in savings over the life of your loan.

Their user-friendly platform feels refreshingly simple. The application process is designed to be completed quickly, without the usual headaches of traditional mortgage paperwork.

We also appreciate their lenient approval policies. They understand that everyone’s financial journey is different. Whether you’re self-employed or have had credit bumps, Traceloans.com considers factors that traditional banks might overlook, making homeownership accessible to more people.

The extended customer service hours deserve special mention. Getting help when you actually need it makes a huge difference when you’re making such an important decision. This focus on availability demonstrates their understanding that life doesn’t always happen from 9 to 5.

All these features combine to create significant time savings while putting you in control of your mortgage journey.

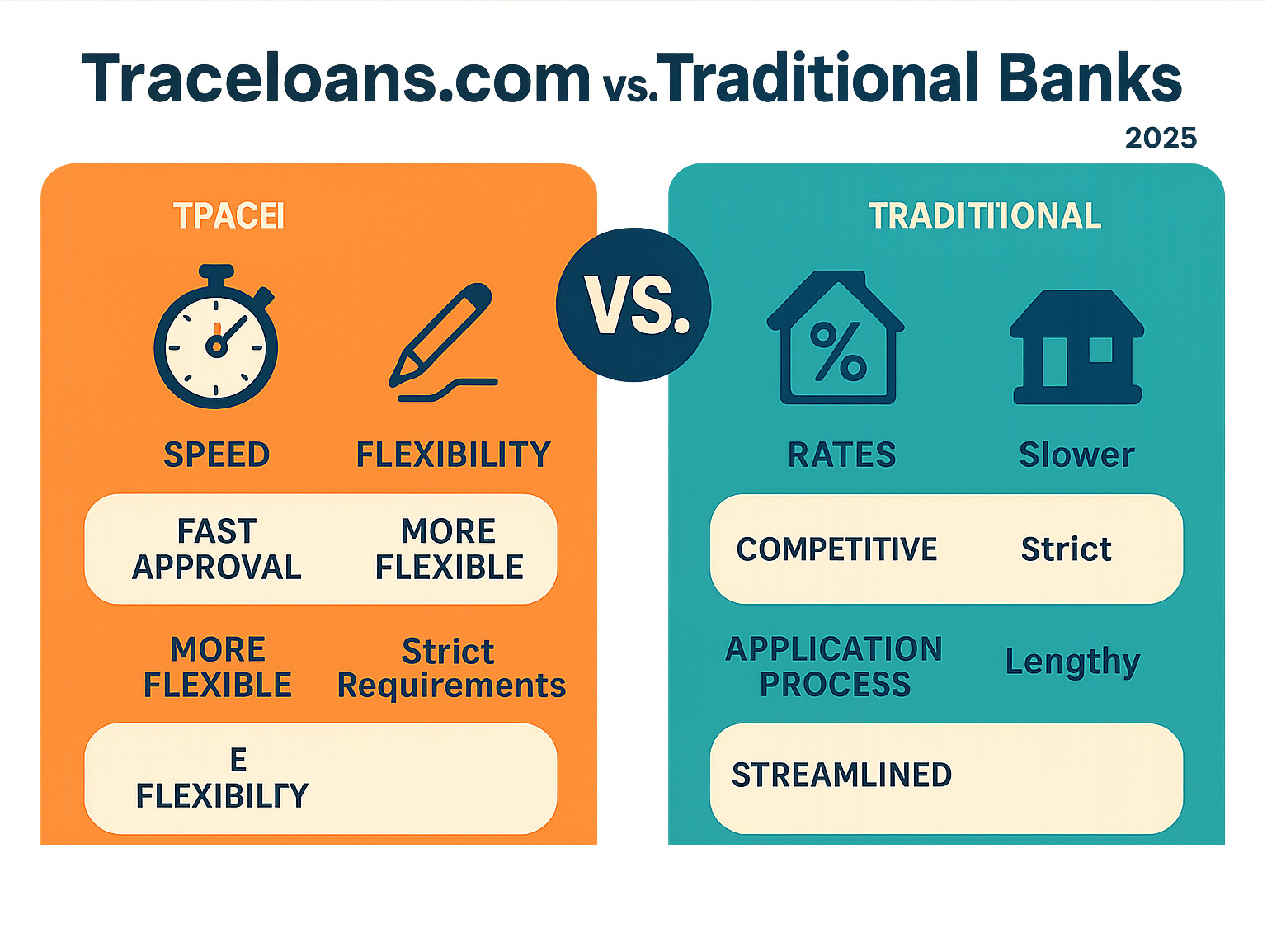

How Traceloans.com Compares to Traditional Lenders

The difference between Traceloans.com mortgage loans and traditional bank mortgages is stark. Traditional banks often require multiple office visits, stacks of paperwork, and weeks of waiting for decisions. Their processes can feel frustratingly slow.

Traceloans.com accepts a digital-first approach that respects your time. As both a direct lender and online marketplace, they use technology to eliminate unnecessary delays. Their reduced overhead costs from operating primarily online often translate directly into better rates and terms for you.

Crucially, they haven’t sacrificed the human touch for digital efficiency. Their personalized service combines smart technology with real mortgage experts who understand that buying a home is deeply personal. You get quick pre-approval decisions (often within hours) and that impressive 21-day average closing time, all while having access to knowledgeable professionals. This hybrid approach creates the best of both worlds: modern convenience and expert support.

A Guide to traceloans.com Mortgage Loans and Key Terms

Understanding mortgage terminology is key to making confident decisions. Just as we clarify skincare ingredients at Beyond Beauty Lab, we’re here to explain the terms you’ll encounter with traceloans.com mortgage loans. This guide will help you steer the mortgage world and make choices that serve your homeownership goals.

The mortgage world offers various loan products for different financial backgrounds. Whether you’re a first-time buyer, serving in the military, or refinancing, there’s likely a loan type that fits your circumstances.

Common Loan Types Explained

When exploring traceloans.com mortgage loans, you’ll find several options. Conventional loans are the most common, typically requiring good credit (around 620 minimum) and down payments as low as 3% for first-time buyers. Since they aren’t government-backed, lenders set their own guidelines, often resulting in competitive rates.

FHA loans, backed by the Federal Housing Administration, help many first-time homebuyers by welcoming credit scores as low as 580 and down payments of just 3.5%.

For military families, VA loans offer generous benefits, typically requiring no down payment and no private mortgage insurance. USDA loans offer similar no-down-payment benefits for properties in eligible rural areas.

Jumbo loans are for higher-value properties that exceed conforming loan limits ($766,550 in most areas for 2024). These loans have stricter criteria but enable financing for luxury properties.

Traceloans.com also offers specialized programs for self-employed entrepreneurs, investment property loans for rental portfolios, and construction and renovation loans to help turn fixer-uppers into dream homes.

Decoding Your Loan Estimate and Key Terminology

Your loan estimate from traceloans.com mortgage loans contains crucial information. The APR (Annual Percentage Rate) goes beyond your interest rate to show the true cost of borrowing, including fees and charges.

Loan-to-Value (LTV) is the ratio of your loan amount to your home’s value. A $200,000 loan on a $250,000 home has an 80% LTV. Lower LTV ratios often lead to better rates.

Discount points are an option to lower your interest rate by paying extra upfront (typically 1% of the loan amount per point). This is a trade-off: paying more now for long-term savings, so it’s best if you plan to keep the loan for several years.

Origination fees cover the lender’s processing costs (0.5% to 1% of the loan). Closing costs include all expenses to finalize the mortgage, like appraisal fees ($450-$650) and title insurance.

Rate locks protect you from rising rates while your loan processes, and a float down provision lets you capture a lower rate if market rates drop after you’ve locked.

For those interested in exploring other financial solutions beyond mortgages, you can find More info about Traceloans.com Business Loans.

Understanding traceloans.com Interest Rates and Fees

Transparency is central to the traceloans.com mortgage loans pricing structure. Their “Clarity Guarantee” ensures your final closing costs won’t exceed initial estimates by more than $250 (excluding third-party fees or your changes). This commitment eliminates unpleasant last-minute surprises.

Several key factors determine your interest rate. Credit scores are crucial; while a 620 may qualify, a score of 740+ typically secures the best rates. Your down payment also matters, as larger down payments create lower LTV ratios and better rates.

Property type and intended use influence your rate. Primary residences get the best rates, followed by second homes and investment properties. Loan terms also create a trade-off: 15-year mortgages have lower rates than 30-year loans but higher monthly payments.

Market conditions cause daily rate fluctuations. Traceloans.com provides daily rate updates so you have current information.

The fee structure is straightforward, including origination fees, appraisal costs, and title fees. Optional costs like discount points are clearly presented.

We always recommend verifying a lender’s credentials. You can check Traceloans.com’s licensing status by visiting Verify lender licensing on NMLS Consumer Access. This step adds confidence, ensuring you’re working with licensed professionals.

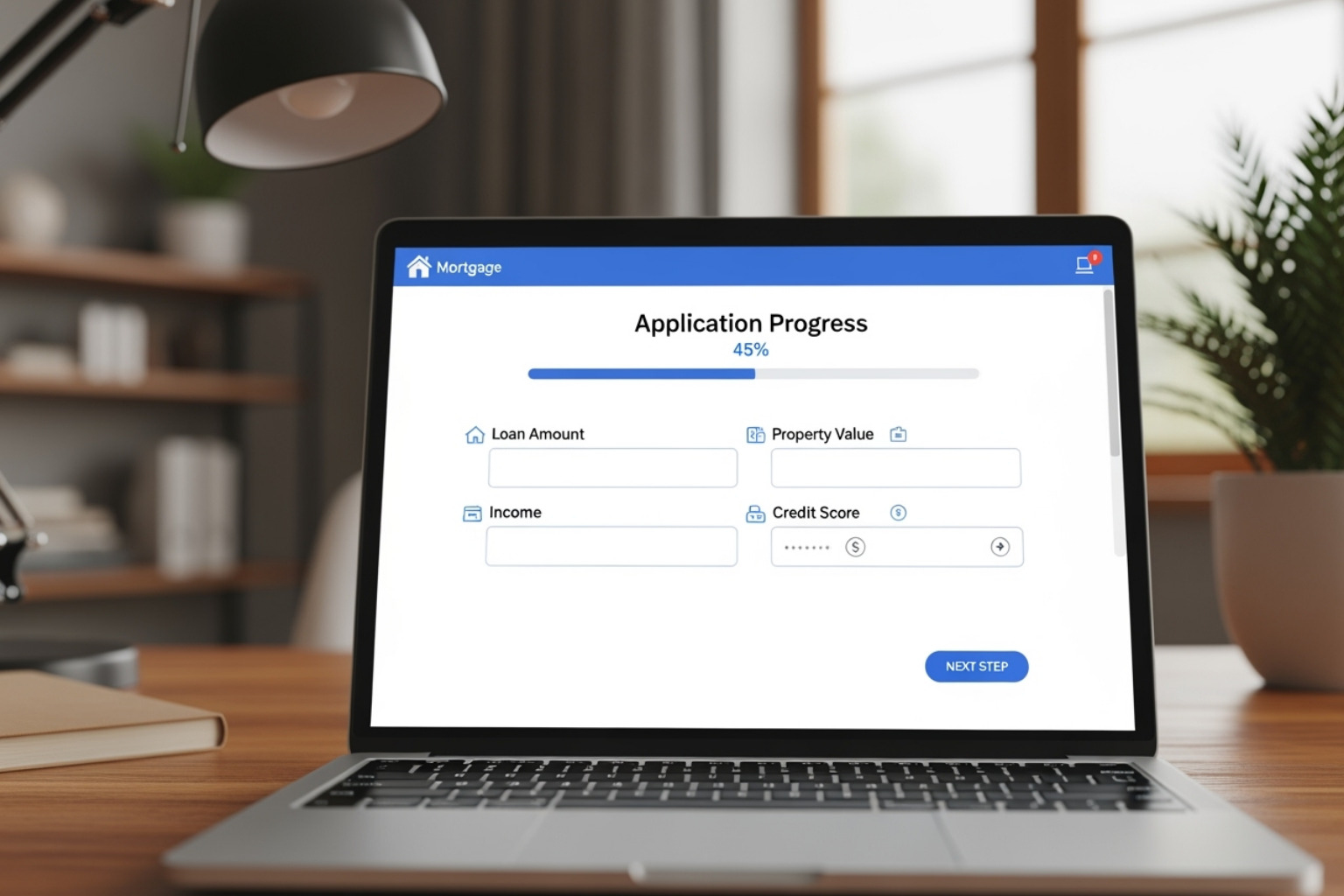

Navigating the Application: Your Step-by-Step Digital Journey

Traceloans.com mortgage loans feature a thoughtfully designed digital experience that simplifies the process, much like a clear skincare guide. Their streamlined approach eliminates the traditional hassles of paperwork and confusing calls.

You’ll steer an intuitive online portal that puts you in control. From uploading documents to tracking progress, everything is secure and user-friendly. You can check your application status or communicate with your loan officer on your own schedule. This modern approach transforms a stressful experience into something manageable and transparent.

The customer experience is at the heart of what they do. You’ll have clear visibility into each step, always knowing where you are and what comes next.

The Four Main Stages of Your Application

Your journey with Traceloans.com mortgage loans unfolds through four connected stages designed for clarity and efficiency.

Initial consultation and pre-qualification is the first step. You’ll share essential information about your finances and homeownership goals. The platform’s technology provides quick pre-qualification decisions, often within hours.

Next, the secure document upload phase begins. Through their protected online portal, you’ll upload documents like pay stubs and tax returns. The system flags missing items early, saving time and preventing delays.

During the property appraisal and underwriting stage, the technical review occurs. A professional appraiser evaluates the property’s market value (taking 3-7 business days), while underwriters review your financial profile with automated support. This dual approach ensures thoroughness and speed.

Final approval and closing is the last step. After underwriting confirms everything meets the criteria, you’ll receive final approval. Traceloans.com facilitates electronic closings when possible, meaning you could get your keys in as little as 21 days from application.

Security and Privacy Measures

Just as we prioritize safe ingredients, Traceloans.com prioritizes security and privacy for every Traceloans.com mortgage loans interaction. When sharing sensitive financial information, you deserve to feel protected.

Data security starts with 256-bit SSL encryption, the same military-grade protection used by major banks. All information travels through secure, encrypted channels.

Multi-factor authentication adds another protective layer to your account, creating real peace of mind. Even if someone obtained your password, they’d need additional verification to access your information.

The platform undergoes regular security audits and penetration testing, with cybersecurity experts continuously strengthening their defenses. Secure document storage keeps your files in encrypted environments with strict access controls.

Their comprehensive privacy policy clearly explains how your data is–and is not–used. Unlike some companies, Traceloans.com respects your privacy by never selling applicant data to third-party marketers.

These security measures mean you can focus on finding your perfect home, knowing your financial wellness and personal information are in trusted hands.

Is Traceloans.com the Right Fit for Your Homeownership Goals?

Choosing the right mortgage lender is a personal decision, much like finding the perfect skincare routine. Traceloans.com mortgage loans offer impressive benefits, but it’s crucial to see if their approach aligns with your financial situation and dreams.

Their strengths include competitive rates, transparent pricing, and a 21-day average closing time. Some borrowers might prefer the face-to-face interaction of traditional banks, while others thrive in the digital-first environment that Traceloans.com provides.

Who Benefits Most from Traceloans.com?

Several borrower profiles benefit most from the Traceloans.com experience. Tech-savvy buyers love the intuitive online platform and real-time application tracking.

Busy professionals find value in the extended customer service hours and streamlined digital process. The ability to upload documents at 8 PM or get answers on a Saturday can be a game-changer.

First-time homebuyers benefit from the educational resources and clear guidance. Their approach to explaining terms helps build confidence, and their flexible qualification criteria can open doors that might otherwise remain closed.

Self-employed entrepreneurs often struggle with traditional lenders. Traceloans.com’s willingness to consider alternative income verification and look beyond standard employment makes homeownership more accessible for them.

Refinancing homeowners who want to lower payments or tap into equity appreciate the efficient process and competitive rates. Speed and transparency are highly valuable when you’re looking to save money or access funds.

These borrowers all prefer flexibility, efficiency, and clear communication. If these values resonate with you, Traceloans.com mortgage loans likely align well with your goals.

Tips for Getting the Best traceloans.com Mortgage Loans

To get the most from your Traceloans.com experience, start before you apply. Check your credit score first to set realistic expectations. Even small increases can lead to better rates.

When you receive multiple offers, compare them carefully. Look beyond the interest rate to the APR, which shows the true cost of borrowing, and examine all fees.

Understanding all costs upfront prevents surprises. While the “Clarity Guarantee” offers protection, it’s wise to stay informed. Ask questions about anything that seems unclear.

Use their mortgage calculators to explore different scenarios. What happens if you increase your down payment? How much would a 15-year loan save you versus a 30-year loan?

Engage with their support team early and often. They are mortgage professionals who can provide personalized advice.

Finally, prepare your documentation in advance. Having pay stubs, tax returns, and bank statements ready speeds up the entire process.

By following these strategies, you’ll be positioned to secure the best possible Traceloans.com mortgage loans for your situation, setting the foundation for successful homeownership.

Frequently Asked Questions about Traceloans.com Mortgages

It’s natural to have questions about a major financial decision like a mortgage. At Beyond Beauty Lab, we believe in clarity, whether it’s about skincare ingredients or your mortgage options. Here are the most common questions we hear about Traceloans.com mortgage loans, answered with transparency.

How fast can I close on a mortgage with Traceloans.com?

Speed is where Traceloans.com mortgage loans truly shine. While traditional banks often take 30 days or more, Traceloans.com has an impressive average closing time of just 21 days. This speed is the result of a digital process that eliminates traditional bottlenecks.

Their efficient system includes quick pre-approvals, secure online document uploads, and streamlined underwriting. This means you can move into your new home or complete your refinance significantly faster, giving you more time to focus on what’s important.

Does Traceloans.com help people with less-than-perfect credit?

Yes. A refreshing aspect of Traceloans.com mortgage loans is their understanding that credit scores don’t tell the whole story. While they can’t work with severely damaged credit, they do offer flexible qualification criteria that look beyond a single three-digit score.

Their approach considers your overall financial picture and alternative income verification. This nuanced evaluation means those with moderate credit challenges may find a path to homeownership that traditional lenders might deny.

While better credit always secures better rates, their willingness to see the person behind the numbers makes homeownership accessible to a broader range of people.

What is the Traceloans.com ‘Clarity Guarantee’?

The ‘Clarity Guarantee’ is a reassuring feature of Traceloans.com mortgage loans, which aligns with our philosophy of transparency at Beyond Beauty Lab. This guarantee is their promise that your final closing costs will not exceed your initial loan estimate by more than $250.

This protection excludes third-party fees (like appraisals) and any changes you request. But for everything within their control, they are committed to minimizing surprises.

This means the costs you plan for at the beginning will be virtually the same at closing, preventing last-minute budget surprises. This level of predictability brings genuine peace of mind to what can be a stressful process.

Conclusion

The path to homeownership doesn’t have to be overwhelming. Our exploration of Traceloans.com mortgage loans reveals a modern approach centered on transparency and efficiency. Their competitive rates, 21-day average closing times, and Clarity Guarantee are commitments to making homeownership more achievable.

Traceloans.com’s focus on education and empowerment resonates with our philosophy at Beyond Beauty Lab. Just as we believe in understanding skincare ingredients, understanding mortgage terms creates the foundation for confident financial decisions. Understanding terms like APR and LTV transforms you from a passive borrower into an informed participant in a major life investment.

The flexible qualification criteria and digital-first approach make this platform appealing for busy professionals, first-time homebuyers, and anyone who values efficiency and support. Whether you’re refinancing or buying your first home, the streamlined process removes many traditional barriers.

At Beyond Beauty Lab, we’ve always believed that true wellness encompasses all areas of life. The confidence from securing a home with a transparent lender contributes to the holistic well-being we all seek. Financial clarity provides the peace of mind to focus on what matters most.

Ready to take that next step? Take control of your financial future today and explore how the right financial decisions can improve every aspect of your wellness journey.