Why Beauty Entrepreneurs Choose Modern Business Financing

Traceloans.com business loans provide fast, flexible funding for beauty and wellness businesses looking to grow. Whether you’re expanding your salon, launching a clean skincare line, or upgrading to eco-friendly equipment, accessing capital quickly can make the difference between seizing an opportunity and watching it slip away.

Quick Overview of Traceloans.com Business Loans:

- Loan amounts: $5,000 to $500,000

- Funding speed: 24-48 hours after approval

- Interest rates: Typically 5% – 29% based on creditworthiness

- Application: 100% online process

- Credit requirements: Flexible, often accepting scores from 500+

- Repayment terms: 6 months to 5 years

Traditional banks often reject over 60% of small business loan applications, leaving beauty entrepreneurs struggling to fund their vision. Sarah, a small bakery owner mentioned in recent industry reports, needed funds for new equipment ahead of the holiday rush. When traditional banks denied her application due to limited credit history, she turned to online lending and received approval within 24 hours – doubling her revenue as a result.

For eco-conscious beauty businesses like yours, having access to quick capital means you can stock up on organic ingredients, invest in sustainable packaging, or upgrade to energy-efficient equipment without the lengthy approval processes that traditional banks require.

Modern online lenders like Traceloans.com have streamlined the entire process, making business funding more accessible to entrepreneurs who prioritize both profit and purpose.

Related content about traceloans.com business loans:

Why Your Beauty Business Needs Smart Financing

Picture this: you’re walking through your salon at the end of a busy day, and suddenly inspiration strikes. Maybe it’s that new laser machine you’ve been eyeing that could transform your facial treatments, or perhaps you’re ready to finally launch that organic skincare line you’ve been perfecting for months. These moments of clarity are exciting – but they often come with a price tag that makes your wallet nervous.

The beauty industry moves fast, and timing is everything. When your competitor down the street is still using outdated equipment, upgrading your microdermabrasion tools or investing in cutting-edge aesthetic technology can set you apart. But here’s the thing – waiting for the “perfect financial moment” often means missing the perfect business opportunity.

Salon renovations aren’t just about looking pretty (though that certainly helps). A fresh, modern space attracts new clients and keeps existing ones coming back. Whether you’re creating Instagram-worthy treatment rooms or expanding your retail area, these improvements directly impact your bottom line.

Then there’s the behind-the-scenes reality of running a beauty business. Stocking inventory for seasonal rushes, covering payroll during slower months, or launching that marketing campaign to introduce your services to a wider audience – these operational needs don’t wait for convenient timing.

According to small business financial statistics, cash flow challenges are one of the biggest problems entrepreneurs face. Managing seasonal fluctuations in the beauty industry can be particularly tricky. Your busy season might be wedding season or the holidays, but rent and staff salaries don’t take breaks.

Traditional banks often feel like they’re speaking a different language when it comes to beauty businesses. They want extensive paperwork, perfect credit scores, and sometimes don’t understand why you need funds quickly for time-sensitive opportunities. That’s where modern financing solutions like traceloans.com business loans make sense – they’re designed for entrepreneurs who need capital when opportunity knocks, not months later.

Smart financing isn’t about taking on debt; it’s about investing in your business’s growth potential. Whether you’re a solo esthetician ready to expand or an established salon owner launching a product line, having access to flexible funding can be the difference between dreaming and doing.

For traditional funding options, the SBA funding programs overview provides comprehensive information about government-backed loans that might suit your long-term planning needs.

Understanding traceloans.com Business Loans

Picture this: you’re passionate about growing your beauty business, but the thought of walking into a traditional bank makes you want to hide under a face mask. Enter traceloans.com business loans – think of it as your tech-savvy friend who always knows how to get things done quickly and without drama.

Traceloans.com works as an online lending marketplace, connecting beauty entrepreneurs like you with a network of trusted lenders. It’s like having a personal matchmaker for your business financing needs. Instead of being stuck with one bank’s rigid requirements, you get access to multiple lending options, all through one simple platform.

This digital approach is perfect for busy beauty professionals who don’t have time to sit in bank lobbies or chase down loan officers. Everything happens online, at your own pace, whether you’re between clients or relaxing at home after a long day at the salon.

Key Features and Benefits

What makes traceloans.com business loans so appealing to beauty entrepreneurs? It’s all about removing the barriers that traditional banks love to put up.

Flexible loan amounts range from $5,000 to $500,000, which means you’re covered whether you need funds for a new microdermabrasion machine or a complete spa renovation. The lightning-fast funding typically gets money into your account within 24-48 hours after approval – faster than most skincare treatments show results!

The fully online application process means no more taking time away from clients to visit bank branches. You can apply while your client’s face mask is setting, and the transparent fee structure ensures you know exactly what you’re paying upfront. No hidden fees lurking like blackheads under the surface.

Perhaps most importantly, Traceloans.com offers high approval rates by working with lenders who understand that a perfect credit score doesn’t always tell the whole story of your business success. They look at your revenue, business history, and growth potential – not just a number.

Traceloans.com vs. Traditional Banks

The difference between traceloans.com business loans and traditional bank loans is like comparing a quick express facial to a full-day spa treatment. Both serve a purpose, but sometimes you need results fast.

Here’s how they stack up:

| Feature | Traceloans.com Business Loans | Traditional Bank Loans |

|---|---|---|

| Application Time | Minutes to complete online form; Approval often within hours/1-2 days | Days to weeks for initial review; Months for final approval |

| Required Paperwork | Minimal, often just bank statements and basic business info | Extensive, including detailed business plans, tax returns, etc. |

| Credit Score Flexibility | More flexible, considering revenue and business history; 500-600+ scores | Often requires high personal and business credit scores (700+) |

| Funding Speed | 24-48 hours after approval | Weeks to months after approval |

Traditional banks operate like they’re still in the 1950s, requiring mountains of paperwork and endless waiting periods. Traceloans.com business loans understand that in today’s beauty industry, opportunities move fast, and your financing should too.

When that perfect storefront becomes available or you find an amazing deal on organic ingredients, you need funding that moves at the speed of beauty trends – not at the pace of traditional banking bureaucracy.

Finding the Right Loan for Your Beauty & Wellness Venture

Just like choosing the perfect foundation shade or selecting the right cleanser for sensitive skin, finding the ideal financing solution requires understanding your unique business needs. Every beauty entrepreneur has different goals, whether you’re dreaming of that sleek new laser machine or need to stock up for the holiday rush.

The beauty of traceloans.com business loans is that they offer different types of financing, each designed to solve specific challenges. Think of it as having a complete skincare routine rather than just one product – each loan type serves its own purpose in keeping your business healthy and glowing.

Equipment Financing for Spa & Salon Upgrades

Nothing transforms a beauty business quite like upgrading your equipment. Whether you’ve been eyeing that advanced microdermabrasion system or dreaming of installing luxurious new spa beds, equipment financing makes these investments possible without draining your cash reserves.

Equipment financing works beautifully for purchasing new laser machines, high-tech styling stations, or even eco-friendly HVAC systems for your salon. The equipment itself becomes the collateral, which means lenders view these loans as less risky. This arrangement often translates to better terms for you as a borrower.

Interest rates typically range from 6% to 20%, depending on your business’s financial health and credit profile. The equipment serves as security, so lenders are often more willing to work with businesses that might not qualify for other types of loans. It’s like having a co-signer who happens to be a very expensive piece of machinery!

Working Capital Loans for Your traceloans.com business loans Needs

Sometimes your business just needs a financial energy boost to keep everything running smoothly. Working capital loans are perfect for those everyday operational expenses that keep your doors open and your clients happy.

These loans shine when you need to cover payroll during a slow season, pay rent when cash flow is tight, or launch that marketing campaign you know will bring in new clients. They’re also incredibly useful for buying seasonal product inventory – because nothing’s worse than running out of your bestselling holiday gift sets right before December hits.

Working capital loans typically offer repayment terms between 6 months to 2 years. This shorter timeframe makes sense because these loans are designed to solve immediate needs, and you’ll likely see returns on your investment relatively quickly as your business operations generate revenue.

A Business Line of Credit for Flexible Cash Flow

If working capital loans are like a refreshing facial, then a business line of credit is like having a complete at-home skincare arsenal – it’s there whenever you need it, ready to address whatever comes up.

A line of credit is perfect for managing those unexpected expenses that seem to pop up at the worst possible times. Maybe your main treatment room’s air conditioning decides to quit during a heat wave, or you find an amazing deal on organic ingredients that you simply can’t pass up. These situations require quick action, and a line of credit gives you that flexibility.

The beauty of revolving credit access means you only pay interest on what you actually use. Unlike a traditional loan where you receive a lump sum upfront, you can draw funds as needed, repay them, and draw again. It’s like having a financial safety net that doesn’t cost you anything until you actually need to use it.

This flexible option from traceloans.com business loans is especially valuable for beauty businesses that experience seasonal fluctuations or unpredictable cash flow. You have the peace of mind knowing the funds are available, but you’re not paying for money you’re not using.

How to Apply and Boost Your Approval Chances

Getting traceloans.com business loans shouldn’t feel like solving a complex skincare chemistry equation. The whole process is refreshingly straightforward, designed with busy beauty entrepreneurs in mind who need funding fast without the headache.

A Step-by-Step Application Guide

Think of applying for traceloans.com business loans like following your favorite skincare routine – simple steps that lead to beautiful results.

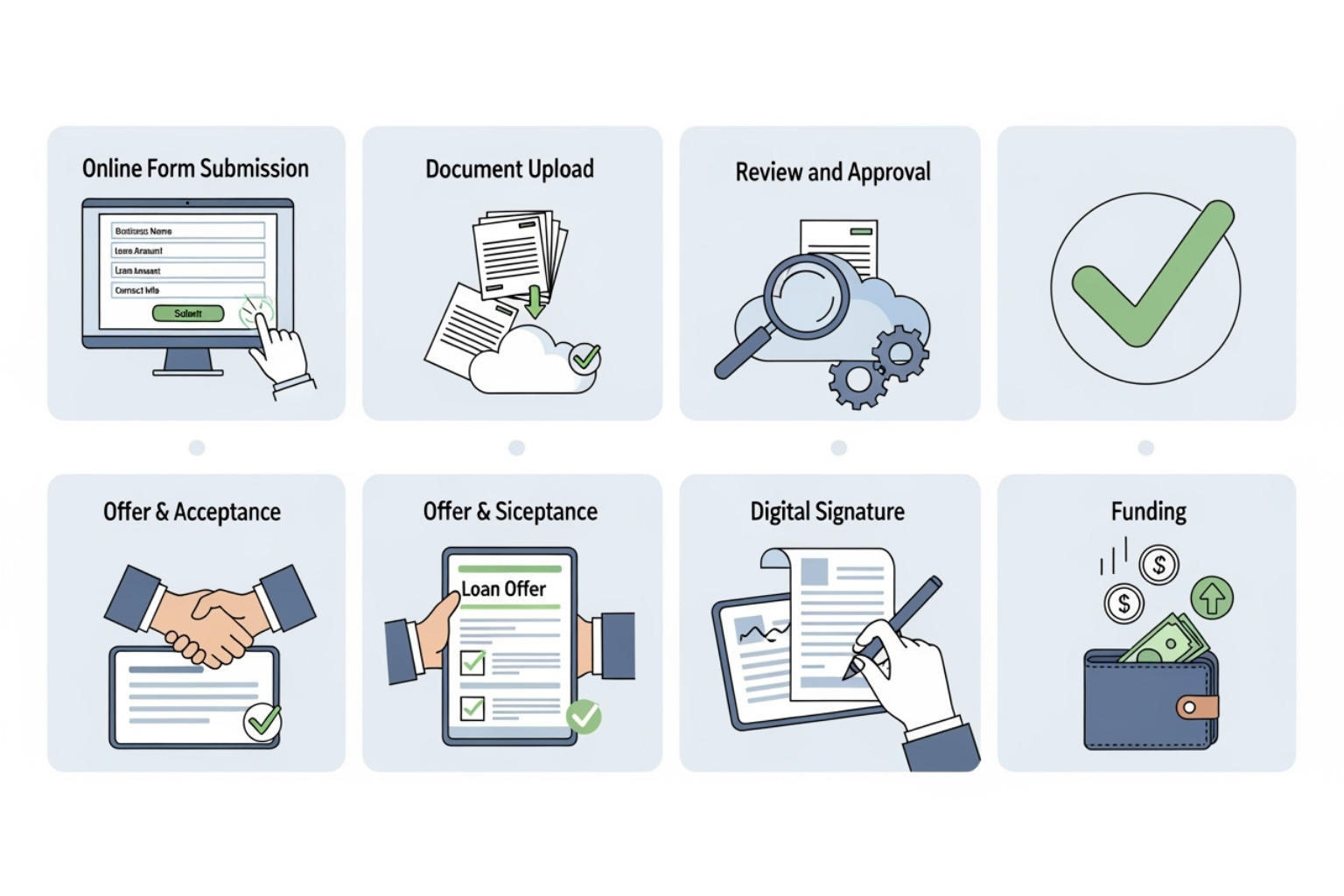

First, complete the simple online form. Head to the Traceloans.com website where you’ll find an intuitive application asking for basic business details. Your business name, annual revenue, how long you’ve been operating, and your funding needs are the main ingredients they’re looking for. This step typically takes just a few minutes – less time than it takes to apply a perfect face mask.

Next, upload your required documents. While the paperwork is minimal compared to traditional banks, you’ll need to show some financial proof. Usually this means your last 3-6 months of business bank statements and possibly recent tax returns. Having these ready beforehand is like prepping your skin before makeup – it makes everything go smoother.

Then, review your custom loan offers. Once you submit everything, the network of lenders gets to work reviewing your profile. Within hours (sometimes even faster), you’ll receive loan offers with all the details – amounts, interest rates, and repayment terms. It’s like getting multiple treatment options from different specialists, allowing you to choose what works best for your business.

Finally, accept the terms and receive funds. Found the perfect offer? Simply accept the terms electronically, and your funds get deposited directly into your business account within 24-48 hours. It’s almost like instant gratification, but for your business finances.

Tips for a Successful Application

While the process is streamlined, a little preparation can work wonders for your approval chances – think of it as priming your application for success.

Keep your financial records crystal clear. Just like maintaining a clean workspace in your salon, organized financial records show lenders you’re professional and reliable. Accurate income, expense, and cash flow records make document submission smooth and demonstrate your business stability.

Show off that steady revenue stream. Lenders love seeing consistent income because it signals your ability to repay the loan. Even if your business has seasonal ups and downs (hello, wedding season rush!), showing predictable patterns or general growth trends works in your favor.

Be realistic with your loan amount. While it’s tempting to dream big, applying for an amount that genuinely matches your business’s current revenue and repayment ability is crucial. Think of it like choosing the right strength of active ingredients – too much too fast can cause problems.

Have a clear plan for your funds. Whether you’re buying new equipment, stocking organic inventory, launching a marketing campaign, or covering working capital, having a well-defined purpose shows responsible financial management. Lenders appreciate entrepreneurs who know exactly how they’ll use every dollar.

Know your credit scores inside and out. While traceloans.com business loans are more flexible than traditional banks, understanding both your personal and business credit scores helps you prepare. Higher scores often mean better terms and lower interest rates. Even if your score isn’t perfect, knowing where you stand helps you explain your financial story confidently.

Frequently Asked Questions about Traceloans.com

We know you’ve got questions swirling around in your head – and honestly, that’s completely normal! When it comes to financing your beauty business, you want all the details before making such an important decision. Let’s explore the most common questions we hear about traceloans.com business loans.

What are the typical interest rates and repayment terms?

Ah, the money question – literally! We totally get why this is usually the first thing on everyone’s mind. With traceloans.com business loans, you’re looking at interest rates that typically fall between 5% and 29%. Now, before you panic about that range, where you land depends on several key factors.

Think of it like skincare – what works for one person might not work for another. Your interest rate depends on your business’s creditworthiness (both your personal and business credit scores), the type of loan you choose, your annual revenue, and your overall financial health. The stronger these factors, the closer you’ll be to that sweet 5% end of the spectrum.

Repayment terms are refreshingly flexible, ranging from 6 months to 5 years. This means you can choose a schedule that actually makes sense for your cash flow. Maybe you want to pay it off quickly to save on interest, or perhaps you prefer smaller monthly payments spread over a longer period. The choice is yours, and that flexibility is honestly a breath of fresh air compared to the rigid terms you often see elsewhere.

Do I need a perfect credit score to get approved?

Here’s some fantastic news that might just make your day: No, you absolutely do not need a perfect credit score to get approved for traceloans.com business loans! We know how stressful credit scores can be, especially when you’re pouring your heart and soul into building your beauty business.

While a higher credit score definitely helps with better terms and approval odds, the lenders in Traceloans.com’s network take a much more holistic approach. They’re interested in the full picture of your business – your steady revenue, how long you’ve been operating, and your overall cash flow patterns.

This broader perspective means opportunities exist for businesses with various credit profiles. Some lenders are willing to work with scores starting around 500-600, particularly if your business shows strong revenue and stable operations. It’s such a relief compared to traditional banks that often slam the door shut if your credit isn’t pristine.

How quickly can I receive the funds after approval?

Speed is honestly one of the most impressive features of traceloans.com business loans, and it’s a total game-changer when you’re facing a time-sensitive opportunity or unexpected expense. The approval process can happen in just a few hours after you submit your complete application – sometimes faster than it takes to give yourself a full facial!

Once you get that approval (cue the happy dance!), the funding moves at lightning speed too. Most businesses see funds deposited directly into their account within 24 to 48 hours. That means you could literally apply on Monday and be purchasing that new microdermabrasion machine or restocking your bestselling serums by Wednesday.

This rapid turnaround is designed for the reality of modern business, where opportunities don’t wait around for lengthy approval processes. Whether you need to cover payroll, jump on a bulk inventory deal, or handle an unexpected equipment repair, traceloans.com business loans move at the speed your beauty business needs.

Conclusion: Empowering Your Beauty Business to Grow

Your beauty business deserves every chance to flourish, and the right financing can be the secret ingredient that transforms your vision into reality. Throughout our journey together, we’ve finded how traceloans.com business loans serve as more than just a funding source – they’re a gateway to possibilities you might not have thought achievable.

Think about it: that state-of-the-art laser machine that could revolutionize your client treatments, the organic skincare line you’ve been dreaming of launching, or simply having the peace of mind that comes with steady cash flow during slower seasons. These aren’t just business expenses; they’re investments in your passion and your clients’ well-being.

What makes traceloans.com business loans particularly exciting for beauty entrepreneurs is their understanding that opportunities don’t wait for lengthy approval processes. When you can secure funding in 24-48 hours instead of waiting months, you’re able to move at the speed of innovation. You can say yes to that bulk order of sustainably-sourced ingredients, upgrade your salon’s ambiance before the holiday rush, or launch that marketing campaign while the timing is perfect.

The beauty industry thrives on trust, quality, and exceptional experiences – values that extend to how we handle our business finances. Smart financing isn’t about taking on debt; it’s about making strategic choices that position your business for sustainable growth. Whether you’re a seasoned salon owner or just starting your wellness journey, having access to flexible, transparent funding options means you can focus on what you do best: helping people feel beautiful and confident.

At Beyond Beauty Lab, we understand that building a thriving wellness brand requires more than just passion – it requires the right resources, knowledge, and support systems. Financial health is just as important as the products you choose or the services you offer. That’s why we’re committed to sharing insights that nurture every aspect of your business journey.

Your beauty empire is waiting to bloom. With the right combination of vision, dedication, and smart financial tools, there’s no limit to what you can achieve.

Explore more resources to build your thriving wellness brand