Why Finding Reliable Intraday Trading Advice Matters

Profitable intraday trading advice 66unblockedgames.com has become a surprisingly popular search term, combining day trading strategies with an unexpected gaming website reference. While this specific combination might seem unusual, it highlights a crucial need: accessible, beginner-friendly trading guidance.

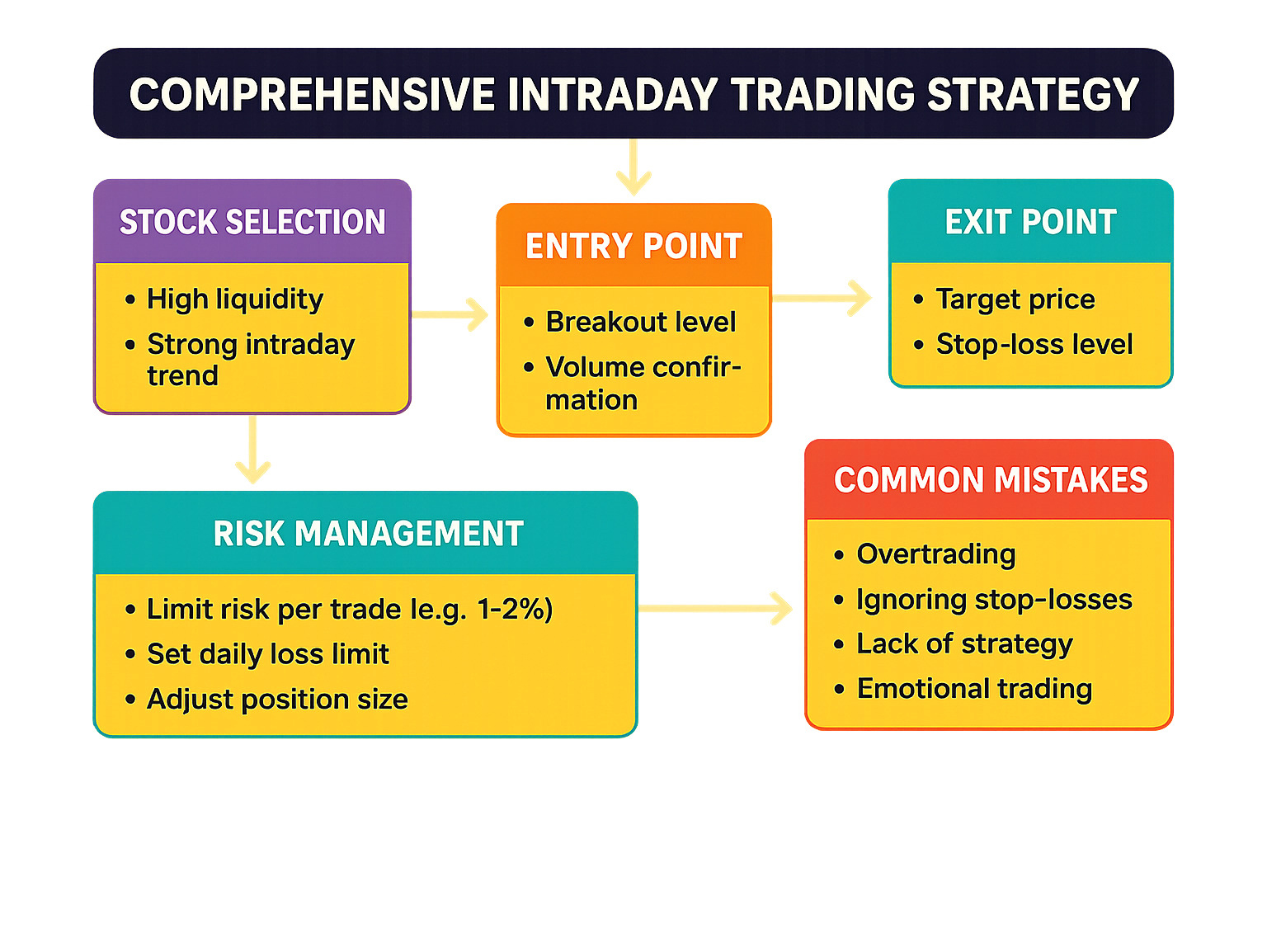

Here’s what you need to know about profitable intraday trading advice:

- What it is: Day trading involves buying and selling stocks within the same trading day to profit from small price movements

- Key requirements: Starting capital of INR 10,000-25,000, reliable trading platform, and basic technical analysis skills

- Best timeframe: Trade between 10:15 AM and 2:30 PM for optimal market conditions

- Risk management: Never risk more than 2% of your capital per trade

- Essential tools: RSI, ADX indicators, moving averages, and stop-loss orders

The appeal of quick profits can be addictive, as noted in trading research. However, successful intraday trading requires discipline, proper risk management, and a solid understanding of market fundamentals.

As trading expert Alexander Elder wisely stated: “The goal of a successful trader is to make the best trades. Money is secondary.”

Many beginners fall into common traps – overtrading, ignoring stop-losses, and letting emotions drive decisions. The key is starting with proper education and realistic expectations rather than chasing fast gains.

Profitable intraday trading advice 66unblockedgames.com further reading:

Understanding Intraday Trading: The Basics

What is Intraday Trading and How Does it Differ?

When people search for profitable intraday trading advice 66unblockedgames.com, they’re looking for quick, accessible guidance on day trading. Let me break down what intraday trading actually means and why it’s so different from other investment approaches.

Intraday trading is simply buying and selling stocks within the same trading day. Think of it as a daily sprint where you’re trying to profit from small price movements that happen over hours or even minutes. The golden rule? You close all your positions before the market shuts down, avoiding any overnight surprises.

This approach is worlds apart from other trading styles. Swing trading means holding stocks for days or weeks to catch bigger price swings. Position trading involves keeping stocks for months or years, focusing on a company’s growth potential. And traditional investing is like planting a tree – you’re building wealth over decades based on solid business fundamentals.

Intraday trading demands lightning-fast decisions and laser focus on immediate market movements. While the potential for quick profits can feel exciting, it’s also where many beginners stumble. The fast pace can be intoxicating, leading people to jump in without proper preparation.

Key Requirements and Tools for Intraday Trading

Starting your intraday trading journey requires more than just enthusiasm and hope. You need the right foundation and tools to steer these choppy waters successfully.

Capital requirements are your first consideration. In India, you’ll want between INR 10,000 to INR 25,000 to start, but here’s the crucial part – only use money you can afford to lose completely. Think of it as tuition for your trading education, not your rent money.

Your trading platform becomes your command center. You need one with low fees, real-time data, and an interface that won’t leave you fumbling during critical moments. A slow or confusing platform can cost you money faster than a bad trade decision.

Now, let’s talk about your essential toolkit. Charting software acts like your GPS, showing you where stocks have been and helping predict where they might go next. Real-time market data is absolutely non-negotiable – trading with delayed information is like driving blindfolded on a busy highway.

Technical indicators become your trusted advisors. The Relative Strength Index (RSI) helps you spot when stocks are overbought or oversold. The Average Directional Index (ADX) shows you trend strength, while moving averages smooth out price action to reveal clearer patterns. These aren’t magic formulas, but they’re proven tools that successful traders rely on daily.

Stop-loss orders are your financial safety net. They automatically sell your stock if prices drop to a preset level, protecting you from devastating losses. Never, ever skip setting these up – it’s like driving without a seatbelt.

Finally, news aggregators keep you connected to market-moving events. Breaking news can shift stock prices in seconds, so staying informed isn’t optional.

Successful intraday trading isn’t about having the fanciest tools – it’s about understanding how to use the right ones effectively. Start simple, master the basics, and gradually build your expertise.

Crafting Your Intraday Trading Strategy

Best Strategies for Profitable Intraday Trading

Now that we’ve got our tools ready, let’s dive into the heart of profitable intraday trading advice 66unblockedgames.com – developing strategies that actually work. Think of these as your trading recipes – each one designed for different market conditions and skill levels.

The Opening Range Breakout (ORB) is perfect if you’re just starting out. Picture this: the market opens, and for the first 15-30 minutes, traders are figuring out where prices want to go. This creates a range between the highest and lowest prices. When the stock finally breaks out of this range – either up or down – that’s our cue to jump in. It’s like waiting for a crowd to pick a direction before joining them. Our sweet spot for trading is between 10:15 AM and 2:30 PM, which gives us time to spot these early patterns.

Momentum trading is where things get exciting. Imagine a stock suddenly shooting up on heavy volume – maybe due to good news or strong earnings. We hop on this moving train, riding the wave until it starts to slow down. It’s thrilling, but requires you to stay glued to your screen and make quick decisions.

For the truly focused traders, scalping involves making dozens of tiny trades throughout the day. Think of it as collecting pennies that add up to dollars. Each trade might only make you a small profit, but they accumulate quickly. This approach demands lightning-fast execution and nerves of steel.

Range trading works beautifully when stocks are having a lazy day, bouncing predictably between support and resistance levels like a ball in a box. We buy near the bottom of the range and sell near the top. It’s less stressful than momentum trading but requires patience.

News-based trading is like being a financial detective. When major announcements hit – earnings reports, product launches, or economic data – stocks can move dramatically. The key is anticipating how the market will react and positioning ourselves accordingly.

No matter which strategy speaks to you, always do your homework first. Study your chosen stocks, watch for news that might move them, and identify those crucial support and resistance levels. Most importantly, stick to your planned entry and exit points like your trading life depends on it – because it does!

The Art of Stock Selection in Intraday Trading

Choosing the right stocks for intraday trading is like picking the right dance partner – you want someone who moves well but won’t step on your toes too hard. We’re not looking for stocks to marry; we just need them to behave predictably for a few hours.

Liquidity is absolutely everything in this game. Think of it as the difference between trying to sell ice cream on a busy beach versus in an empty parking lot. We need stocks that trade frequently with high volume, so we can get in and out quickly without our trades affecting the price. Large-cap stocks from well-known companies are typically our best friends here because they have the trading volume we need.

Volatility is a double-edged sword that we need to handle carefully. We want stocks that move enough to create profit opportunities, but not so wildly that they become unpredictable rollercoasters. It’s like preferring gentle ocean waves over a tsunami – both involve water movement, but only one is suitable for surfing.

News and events can be goldmines if we approach them smartly. Stocks making headlines or facing upcoming announcements often show increased activity. However, this requires quick thinking and careful analysis. Sometimes the market reacts exactly opposite to what seems logical, so we need to stay alert.

Sector performance gives us another edge. When an entire industry is hot – maybe tech stocks are rallying or pharma companies are in the spotlight – we can focus our attention on the strongest players in those sectors.

The secret sauce is creating a focused daily watchlist and doing your pre-market homework. This means analyzing charts, identifying key price levels, and staying updated on relevant news. By concentrating on a smaller group of stocks, we can understand their personalities and trade them more effectively. It’s better to know five stocks really well than to chase after fifty strangers.

Mastering Risk and Psychology in Intraday Trading

Managing Risk for Beginners

Think of risk management as your trading armor – it protects you from the inevitable battles you’ll face in the market. For beginners exploring profitable intraday trading advice 66unblockedgames.com, understanding that protecting your money matters more than making quick profits is crucial.

The foundation of smart risk management starts with always using a stop-loss order. This isn’t optional – it’s your emergency brake. A stop-loss automatically sells your stock when it hits a price you’ve set beforehand, preventing small losses from becoming account-killing disasters. Many beginners think they can mentally track their stop levels, but emotions cloud judgment when real money is at stake.

Here’s a golden rule: never risk more than 2% of your total capital on any single trade. If you’re starting with INR 20,000, that means risking no more than INR 400 per trade. This might seem conservative, but it ensures that even a string of bad trades won’t wipe out your account. You can always increase position sizes as your account grows and skills improve.

Smart traders also focus on maintaining a favorable risk-reward ratio of at least 3:1. This means if you’re willing to lose INR 100 on a trade, you should aim to make at least INR 300. This mathematical advantage means you can be wrong half the time and still come out ahead.

Overtrading is another trap that snares beginners. The excitement of quick profits can be addictive, leading to impulsive decisions throughout the day. Quality beats quantity every time. Sometimes the best trade is simply waiting for tomorrow’s better opportunity.

Finally, resist the temptation to convert losing intraday trades into investments. When a trade goes against you, exit according to your plan. Holding onto losers ties up your capital and often leads to much larger losses.

Avoiding Common Mistakes

Even armed with solid strategies, beginners can stumble into predictable pitfalls. Learning to recognize and avoid these mistakes can save you significant money and frustration.

Ignoring stop-loss orders tops the list of costly errors. It’s human nature to hope a losing position will turn around, but hope isn’t a trading strategy. Your stop-loss is there for a reason – use it religiously.

Emotional decision-making destroys more trading accounts than bad strategies. Fear makes you exit winning trades too early or hold losing ones too long. Greed pushes you to risk too much or ignore warning signs. The market doesn’t care about your feelings, so keep them in check.

Many traders start without a clear trading plan or abandon it when pressure mounts. Your plan should outline your strategy, entry and exit rules, risk management, and profit targets. Sticking to this plan, especially during stressful moments, separates successful traders from gamblers.

Insufficient research is another account killer. Jumping into trades without understanding the stock, its recent news, or key support and resistance levels is like driving blindfolded. Do your homework before risking real money.

Market conditions change constantly, and failing to adapt leaves traders using yesterday’s strategies in today’s different environment. Stay flexible and review what’s working and what isn’t.

The Psychological Edge

Trading success depends as much on your mindset as your strategy. The mental game often determines who survives and thrives in intraday trading.

Discipline forms the backbone of profitable trading. It means following your plan when everything inside you screams to do something different. Disciplined traders execute their strategies without hesitation, regardless of market noise or emotional impulses.

Emotional control extends beyond managing fear and greed. Impatience, frustration, and overconfidence can all derail your trading. When emotions run high, stepping away from the screen often prevents costly mistakes. Clear thinking beats reactive trading every time.

Patience might seem contradictory in intraday trading, but it’s essential. Patience to wait for high-probability setups, to let profitable trades reach their targets, and to accept that not every day offers good opportunities. Rushing leads to poor decisions.

Setting realistic expectations protects you from disappointment and dangerous risk-taking. You won’t become wealthy overnight, and that’s perfectly fine. Focus on learning, improving your skills, and protecting your capital. Consistent small gains compound over time.

Learning from every trade – both winners and losers – accelerates your development. Keep a simple trading journal noting what you did, why you did it, and how it worked out. This record reveals patterns in your behavior and helps refine your approach.

Successful intraday trading combines solid strategy with sound risk management and psychological discipline. Master these elements, and you’ll have built a foundation for long-term trading success.

Leveraging Technical Analysis for Opportunities

Identifying Profitable Opportunities with Technical Analysis

Think of technical analysis as your trading compass – it helps you steer the often confusing waters of profitable intraday trading advice 66unblockedgames.com by studying what stocks have done in the past to predict where they might go next. It’s like being a detective, looking for clues in price movements and trading volumes.

Candlestick patterns are your first clue. These little visual gems show you exactly what happened during short time periods, like 1-minute or 5-minute intervals. When you see patterns with fun names like ‘doji’, ‘hammers’, ‘engulfing patterns’, and ‘shooting stars’, they’re actually telling you stories about market sentiment. A hammer might signal that sellers got exhausted and buyers are stepping in, while a shooting star could warn you that buyers are losing steam.

Moving averages act like trend smoothers, cutting through all the market noise to show you the bigger picture. When a short-term moving average (like a 9-period Exponential Moving Average) crosses above a longer-term one (such as a 20-period EMA), it’s often like a green light flashing – the trend might be turning upward. Use the short-term ones to time your entries perfectly and the long-term ones to confirm you’re swimming with the current, not against it.

Support and resistance levels are where the real magic happens. These are price levels where buyers and sellers have historically shown up in force. Think of support as a floor where buyers tend to step in, and resistance as a ceiling where sellers often appear. Smart traders buy near support and sell near resistance – it’s like shopping at the best prices.

Volume analysis tells you how serious a price move really is. A stock jumping 5% on massive volume is much more meaningful than the same move on tiny volume. It’s the difference between a whisper and a shout in the market.

For beginners, RSI (Relative Strength Index) is like having a built-in warning system. When it climbs above 70, it’s telling you the stock might be getting overheated and due for a breather. Below 30? The stock might be oversold and ready to bounce back. Meanwhile, ADX (Average Directional Index) acts like your trend strength meter – readings above 25 suggest the trend has real power behind it, while below 20 means the market might just be wandering aimlessly.

The secret sauce is finding confluence – when multiple indicators and patterns all point in the same direction. It’s like having several friends all agree on the same restaurant recommendation. When your candlestick pattern, moving averages, and RSI all align, you’ve got a much higher probability setup than relying on just one signal.

Technical analysis isn’t about predicting the future with certainty – it’s about stacking the odds in your favor and making informed decisions based on what the market is actually showing you.

Advantages, Disadvantages, and Reliable Resources

Pros and Cons for Beginners

Let’s be honest about intraday trading – it’s not all sunshine and quick profits. Like any worthwhile endeavor, it comes with both exciting opportunities and real challenges that we need to understand upfront.

On the bright side, intraday trading offers some compelling advantages. No overnight risk is perhaps the biggest relief for many traders. When we close all positions before the market shuts down, we sleep peacefully knowing that unexpected news or global events won’t surprise us with losses the next morning.

The potential for quick profits is undeniably attractive. There’s something thrilling about making money from small price movements within hours or even minutes. This daily profit opportunity can be incredibly motivating, especially when trades go our way.

Many brokers also offer leverage opportunities specifically for intraday trades, allowing us to control larger positions with less capital. While this can amplify profits, it’s a double-edged sword that requires careful handling.

The steep learning curve might sound like a disadvantage, but it’s actually beneficial. The environment forces us to quickly master market dynamics, technical analysis, and risk management. We learn by doing, and the lessons stick because they come with real consequences.

Plus, intraday trading offers wonderful flexibility. Whether we want to trade part-time around our day job or make it our full-time focus, we can adapt it to fit our lifestyle and schedule.

However, let’s talk about the challenges because they’re equally important to understand. High risk and stress top the list. The potential for rapid losses is real, and the emotional roller coaster can be exhausting. Some days will test our nerves more than we’d like to admit.

Intraday trading requires significant time and focus – it’s definitely not a “set it and forget it” approach. We need to stay glued to our screens, monitoring charts and making quick decisions for several hours each day. This intensity isn’t for everyone.

While we mentioned earlier that starting capital can be as low as INR 10,000-25,000, consistent profitability often requires more. We need enough cushion to absorb inevitable losses while maintaining proper position sizing.

Don’t forget about brokerage fees either. Those INR 10-20 per trade charges can quickly add up when we’re trading frequently. It’s like death by a thousand cuts if we’re not careful about our trade selection.

The psychological toll might be the most underestimated challenge. The constant pressure, split-second decisions, and inevitable losses can be mentally draining. It demands emotional discipline that many of us didn’t know we needed to develop.

Most importantly, intraday trading isn’t for everyone. Too many beginners approach it like gambling, hoping for lucky breaks rather than developing disciplined strategies.

Where to Find Reliable Resources and Advice

Finding trustworthy guidance in the trading world can feel overwhelming, but there are plenty of solid resources available. At Beyond Beauty Lab, we understand that financial wellness is just as important as physical wellness – they’re both essential components of a balanced, beautiful life.

Educational websites and blogs form the foundation of good trading education. Look for platforms that emphasize risk management and realistic expectations rather than flashy promises of overnight wealth. The best resources teach patience and discipline alongside technical skills.

Books by renowned traders offer timeless wisdom that never goes out of style. Authors like Alexander Elder and Mark Douglas have helped countless traders understand market psychology and develop winning strategies. These books become trusted companions on our trading journey.

Online trading communities and forums provide invaluable peer support. Platforms like Reddit’s r/daytrading connect us with other traders sharing real experiences and lessons learned. Just remember to filter information critically – not every tip is golden.

Most reputable brokers offer excellent educational resources, including demo accounts and live webinars. This is perfect for learning their platform while absorbing general trading principles. Take advantage of these free resources before risking real money.

Demo accounts deserve special mention because they’re absolutely essential. Practice extensively in a risk-free environment before putting actual money on the line. Most brokers provide these virtual trading platforms that mirror real market conditions perfectly.

Here’s something interesting – even profitable intraday trading advice 66unblockedgames.com has emerged as an unexpected source of trading guidance. While 66unblockedgames.com is primarily known for gaming, it demonstrates how valuable trading advice can pop up in the most surprising places. These unconventional sources often focus on simple, beginner-friendly strategies that help newcomers avoid common pitfalls.

The key is starting with demo trading, learning the basics thoroughly, and then beginning with small amounts when we’re ready for real money. Becoming a profitable intraday trader is a continuous journey of learning, adapting, and growing. There’s no finish line – just constant improvement and refinement of our skills.