Why Understanding Stock Recommendation Platforms Matters for New Investors

5starsstocks.com best stocks represents a growing trend of AI-powered investment platforms promising to simplify stock selection for everyday investors. The platform claims to use artificial intelligence and expert analysis to identify top-performing stocks across various sectors, from dividend-paying companies to emerging tech plays.

Quick Answer: What You Need to Know About 5starsstocks.com Best Stocks

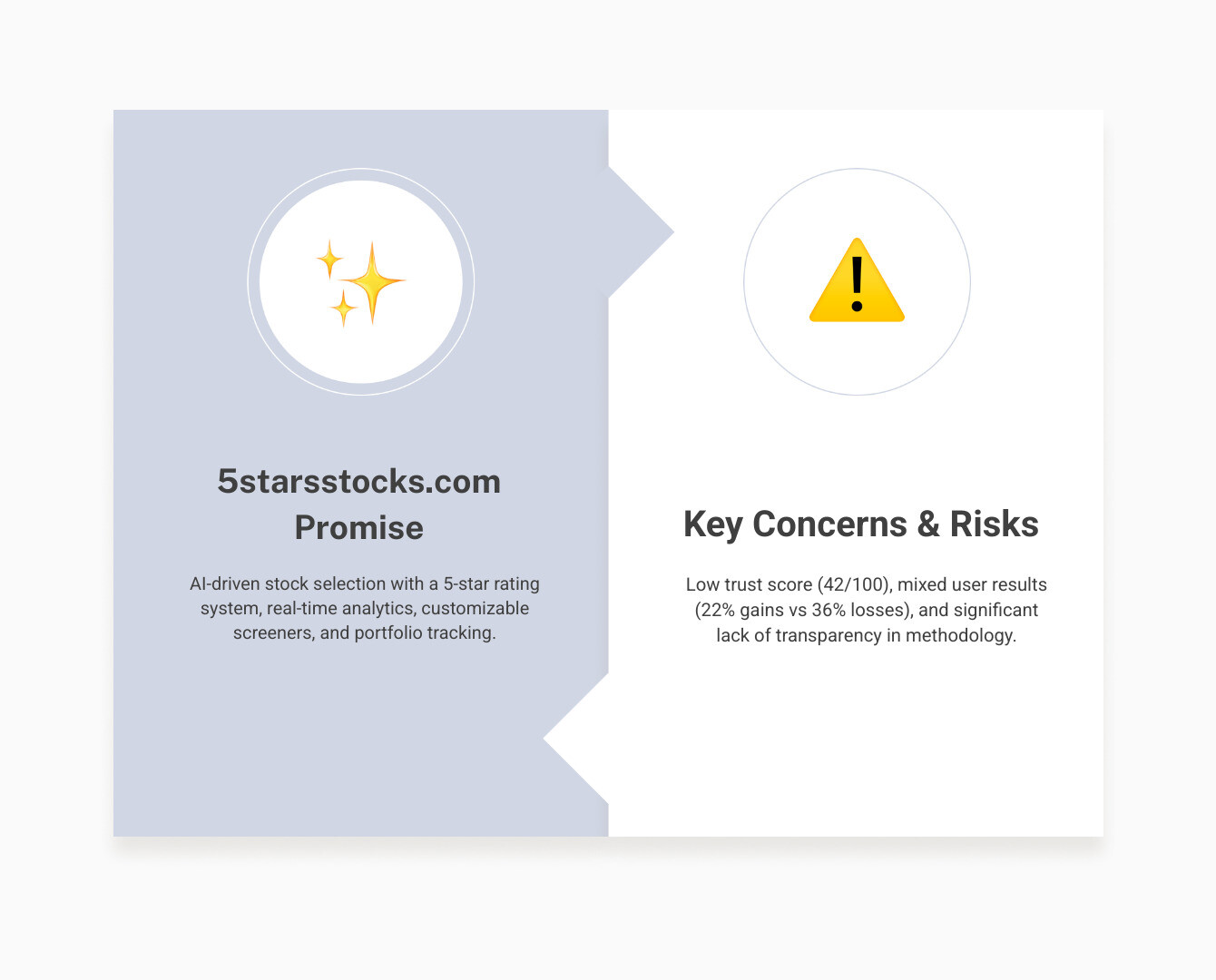

- Platform Type: AI-driven stock recommendation service with 5-star rating system

- Cost: Subscription plans range from $29/month (basic) to $99/month (premium)

- Key Features: Real-time analytics, customizable screeners, portfolio tracking

- Trust Score: ScamAdviser rates it 42/100 (low trust score)

- Mixed Results: Users report both 22% gains and 36% losses

- Main Concern: Lack of transparency in methodology and expert credentials

The appeal is obvious. Who wouldn’t want an intelligent system to scan thousands of stocks and serve up the best opportunities? The platform updates every 15 minutes and covers everything from established blue-chip companies to emerging AI stocks.

But here’s where things get complicated. While some users report impressive gains – like one trader who saw 22% returns in 2024 – others faced significant losses. One investor lost 36% on a luxury goods stock that failed to meet earnings expectations.

The bigger issue? Transparency. The platform’s methodology remains largely opaque, making it difficult to understand how these “expert” recommendations are actually generated. This matters especially for beginners who may not have the experience to spot potential red flags.

For someone like Emma, who values transparency and education in all her wellness choices, this lack of clarity in financial decisions would likely feel unsettling.

Quick look at 5starsstocks.com best stocks:

Understanding Stock Recommendation Platforms: A Look at 5starsstocks.com Best Stocks

Picture this: you’re standing in front of a massive library filled with thousands of investment books, each one promising to reveal the secret to picking winning stocks. That overwhelming feeling? It’s exactly what many new investors experience when they first dive into the stock market. This is where platforms like 5starsstocks.com best stocks come into play, promising to be your personal librarian in investing.

At its heart, 5starsstocks.com best stocks positions itself as your investment compass. The platform’s core value proposition is simple: take the guesswork out of stock picking by using artificial intelligence and expert analysis to identify promising opportunities. Think of it as having a really smart friend who’s obsessed with numbers and market trends, constantly scanning the financial landscape to find gems you might have missed.

The platform organizes its recommendations using a 5-star rating system – much like how you’d rate your favorite restaurant or movie. Five stars means “this stock looks amazing,” while one star suggests “maybe look elsewhere.” This approach makes complex financial analysis feel more approachable, especially for beginners who might feel intimidated by traditional investment research.

What’s particularly interesting is how 5starsstocks.com best stocks covers such a wide range of stock categories. Whether you’re drawn to dividend stocks that pay you regularly (like getting a monthly allowance from your investments), growth stocks from emerging companies, or established players in the tech sector, the platform aims to have something for every investment personality.

What 5starsstocks.com Offers Investors

Behind the scenes, 5starsstocks.com best stocks runs on some pretty sophisticated technology. The platform uses AI algorithms and machine learning models that analyze decades of historical data from major exchanges like the NYSE and NASDAQ. These digital brains are designed to spot patterns that human eyes might miss – kind of like having a super-powered detective investigating every stock’s past performance.

But here’s where it gets really interesting: the platform doesn’t just crunch numbers. It also performs sentiment analysis, scanning financial news and social media to gauge how people feel about certain stocks. After all, sometimes investor emotions drive prices more than cold, hard facts.

For hands-on investors, the platform offers customizable stock screeners – think of these as your personal search filters. Want to find only dividend-paying tech companies with a market cap under $10 billion? You can set those parameters and let the system do the heavy lifting. The portfolio tracking tools help you monitor your investments in one place, while real-time analytics keep you updated on market movements throughout the day.

The platform promises to deliver comprehensive insights through machine learning models that adapt to changing market conditions. This adaptability is crucial because, let’s face it, the stock market can be as unpredictable as weather patterns.

The User Experience and Interface

When it comes to actually using 5starsstocks.com best stocks, the platform seems to understand that not everyone speaks “Wall Street.” The interface features a beginner-friendly design with clear explanations and organized categories. It’s like having investment information translated from financial jargon into everyday language.

The navigation appears straightforward, making it easy to find what you’re looking for without getting lost in a maze of charts and numbers. Mobile access means you can check on your potential investments while waiting for your morning coffee, and real-time alerts can notify you when something important happens with your watched stocks.

The data visualization tools help transform complex financial information into charts and graphs that actually make sense. Instead of staring at endless rows of numbers, you get visual representations that tell the story of how a stock is performing.

However, it’s worth noting that while the platform aims to be user-friendly, some reviews suggest it might not offer the extensive educational resources that complete beginners need. For a more detailed look at what users actually experience, you might want to check out this 5StarsStocks.com Review: Is It Legit? to get the full picture.

The platform essentially promises to be your investment research assistant, handling the complex analysis while presenting you with clear, actionable recommendations. Whether it delivers on that promise is something we’ll explore further as we dig into the pros and cons of relying on AI-driven stock picks.

The Allure vs. The Reality: Weighing the Pros and Cons

Every investment tool comes with its own mix of bright promises and hidden pitfalls. When we look at 5starsstocks.com best stocks, it’s easy to get caught up in the excitement of AI-powered investing and potentially impressive returns. But just like choosing the right skincare routine, making smart investment decisions requires us to look beyond the marketing claims and examine what’s really underneath.

Potential Benefits for the Modern Investor

Let’s start with what makes 5starsstocks.com best stocks appealing to busy investors like us. The biggest draw? Time savings. In our packed schedules, who has hours to spend analyzing company reports and market trends? This platform promises to do the heavy lifting, scanning thousands of stocks and serving up curated recommendations.

This leads to simplified decision-making, which feels especially valuable when you’re just starting out. Instead of drowning in financial jargon and endless data points, you get clear ratings and focused picks. It’s like having a friend who’s done all the research for you.

The platform also offers exposure to emerging industries that might not be on your radar yet. Think AI companies, 3D printing innovators, or clean energy pioneers. For investors looking to catch the next big wave, this kind of forward-looking analysis can feel exciting and potentially profitable.

Then there are the success stories that really grab attention. One active trader reported earning 22% returns in 2024 by following the platform’s AI-driven stock picks in the tech sector. That’s not just good – it actually outperformed major market indexes during the same period. Stories like this make the platform’s promises feel tangible and achievable.

Critical Drawbacks and Red Flags to Consider

Now for the reality check. While those success stories sound amazing, we need to talk about some serious concerns with 5starsstocks.com best stocks.

The biggest red flag? Lack of transparency. The platform keeps its methodology largely secret. We don’t know how their “expert” analysts are chosen or what makes their algorithms tick. It’s like buying a beauty product with no ingredient list – you simply can’t make an informed decision.

This opacity shows up in the numbers too. ScamAdviser gave the site a trust score of just 42 out of 100. That’s pretty concerning for a platform handling investment advice. Plus, the domain was only created less than two years ago, which doesn’t exactly scream “established financial expertise.”

The success stories have a flip side too. Trader who made 22%? Well, another user lost 36% on a recommended luxury goods stock that failed to meet earnings expectations. This highlights something crucial: even AI-driven recommendations can lead to substantial losses.

What’s particularly troubling is that the platform seems to focus on short-term trades rather than sustainable, long-term investment strategies. This can encourage the kind of emotional decision-making that often leads to poor outcomes – jumping into stocks based on a “5-star” rating without understanding the underlying risks.

We also can’t ignore the unverified performance claims. Without clear disclosure of potential conflicts of interest or transparent track records, it’s impossible to know if the platform is truly working in investors’ best interests.

For more details on the stocks they cover and their approach, check out our analysis on 5StarsStocks.com Stocks.

How does the 5starsstocks.com best stocks approach compare to traditional advice?

When it comes to managing our money, traditional financial advice has stood the test of time for good reasons. Let’s see how 5starsstocks.com best stocks measures up against these established principles:

| Metric | 5starsstocks.com Best Stocks Approach | Traditional Financial Advice |

|---|---|---|

| Transparency | Low; opaque methodology, unclear expert credentials, undisclosed potential conflicts of interest. | High; clear disclosure of fees, methodologies, and conflicts of interest (e.g., fiduciary duty). |

| Risk Assessment | Mixed; claims risk analysis but anecdotal losses suggest gaps. Focus on individual stock picks rather than holistic portfolio risk. | Holistic; comprehensive assessment based on individual goals, time horizon, and capacity for loss. Strong emphasis on risk management. |

| Diversification | Offers diverse stock categories, but the focus is on “best picks” which might encourage concentrated bets. | Paramount; strong emphasis on spreading investments across various asset classes, sectors, and geographies to mitigate risk. |

| Source of Advice | AI algorithms and unnamed “expert financial insights.” | Regulated financial professionals (CFP, CFA), academic research, established financial institutions. |

| Performance Reliability | Unverified historical performance, anecdotal successes alongside significant losses. ScamAdviser low trust score. | Based on long-term historical data, audited performance, and regulated reporting. Emphasis on consistent returns over flashy short-term gains. |

The contrast is pretty stark. While platforms like 5starsstocks.com best stocks offer convenience and the excitement of cutting-edge technology, traditional financial advice emphasizes something crucial: transparency and accountability.

Traditional advisors have fiduciary duty – they’re legally required to put your interests first. They also take a long-term perspective, focusing on steady wealth building rather than chasing the latest hot stock. This approach might not be as thrilling as AI-powered picks, but it’s built on decades of proven results.

Leading regulatory bodies, like the U.S. Securities and Exchange Commission, put it well: Investment decisions should be based on your individual circumstances. That’s exactly what traditional financial planning emphasizes – understanding your unique situation, goals, and risk tolerance before making any investment moves.

The bottom line? While new technology can be helpful, it shouldn’t replace the fundamental principles of sound investing: diversification, transparency, and making decisions based on your personal financial situation.

Building a Resilient Portfolio: Core Strategies for Beginners

After exploring the flashy world of AI-powered stock pickers, let’s get back to what really matters for your financial future. Building a resilient portfolio isn’t about chasing the latest “5-star” recommendations – it’s about creating a solid foundation that can weather market storms and grow steadily over time.

Think of investing like tending a garden. You wouldn’t plant only one type of flower and expect it to thrive in all seasons, right? The same principle applies to your investment portfolio.

The Power of Diversification Across Sectors

Here’s the golden rule of investing: never put all your eggs in one basket. Diversification is your best friend when it comes to managing risk and building long-term wealth.

When we spread our investments across different sectors, we’re essentially creating a safety net. If tech stocks take a tumble, your healthcare or utility investments might stay steady – or even go up. It’s like having multiple income streams that don’t all depend on the same economic factors.

Effective diversification means mixing different types of investments. You might combine growth stocks (companies expected to grow faster than average) with dividend-paying stocks (companies that share profits with shareholders regularly). Add some exposure to various sectors like healthcare, consumer goods, and utilities, and you’re building something much more stable than any single “best stock” recommendation.

The beauty of diversification lies in how different sectors respond to market cycles. While one industry might struggle during economic uncertainty, another could thrive. This balance helps smooth out the inevitable ups and downs of investing.

Want to dive deeper into this crucial concept? Check out Why Portfolio Diversification Could Save Your Investments From Crashing. For broader market insights, our Russell 2000 Fintechzoom Ultimate Guide offers valuable perspective on small-cap investing.

Identifying Quality Companies Beyond the Hype

While platforms like 5starsstocks.com best stocks might promise to find winners for you, true investing success comes from understanding what makes a company actually worth your money. This is where fundamental analysis becomes your superpower.

Think of it like choosing a life partner – you wouldn’t base that decision solely on someone else’s recommendation, would you? You’d want to get to know them yourself, understand their values, and see if they align with your goals.

When evaluating companies, look for strong financials first. This means steady revenue growth, consistent profits, manageable debt, and healthy cash flow. You want companies that know how to make money and manage it wisely.

Next, consider their competitive advantage. What makes this company special? Maybe they have a unique product that customers love, a powerful brand that people trust, or patents that protect their innovations. This “moat” helps protect them from competitors.

Strong leadership matters enormously. The management team makes crucial decisions that can either build wealth or destroy it. Look for leaders with proven track records and clear vision for the future.

Finally, focus on sustainable growth. You want businesses that can keep expanding and innovating over many years, not just companies riding a temporary wave of excitement.

Blue-chip stocks – those large, established companies with long histories of reliable performance – make excellent foundation stones for beginner portfolios. They might not be as exciting as the latest AI startup, but they offer stability and steady growth that can anchor your investment strategy.

Even if an AI platform gives you a recommendation, treat it as a starting point for your own research. Read company reports, understand their business model, and make informed decisions based on your own analysis.

For additional market perspective, explore our Fintechzoom.com FTSE 100 Ultimate Guide to understand how established markets work.

Building a resilient portfolio takes patience and discipline, but it’s the surest path to long-term financial wellness. Just like maintaining good health requires consistent habits rather than quick fixes, successful investing rewards those who focus on fundamentals over flashy promises.

Frequently Asked Questions about AI Stock Pickers

As AI-driven platforms become more common in investing, it’s natural to have questions – especially when we’re just starting out. Think of it like trying a new skincare routine: we want to understand what we’re putting on our face before we commit! Let’s explore the most pressing questions about platforms like 5starsstocks.com best stocks.

Can beginners rely solely on platforms like 5starsstocks.com?

Here’s the honest truth: No, not solely. While 5starsstocks.com best stocks does offer a beginner-friendly design with clear explanations and organized categories, relying on it as your only investment guide would be like using just one ingredient for your entire wellness routine – it might help, but you’re missing the bigger picture.

Think of these platforms as a helpful starting point rather than the final word. They can certainly clarify investment goals and point you toward potential opportunities, but they shouldn’t replace your own research and understanding. The platform lacks the comprehensive educational resources you’d find elsewhere, which means you might miss learning the why behind their recommendations.

The smartest approach? Use 5starsstocks.com best stocks as a supplementary research tool while cross-referencing information with more established, transparent sources. Most importantly, always consider your individual financial situation and understand your own risk tolerance before making any investment decisions. No AI algorithm can do that personal assessment for you.

How much do these stock recommendation services typically cost?

When it comes to pricing, 5starsstocks.com best stocks follows a fairly standard subscription model. You’re looking at plans ranging from $29/month for basic access to $99/month for premium tools and real-time alerts. This pricing structure is pretty typical across similar platforms, with higher tiers usually offering more advanced features like sophisticated screeners and exclusive market insights.

But here’s the key question: does the value justify the cost? For someone making frequent trades with substantial capital, the monthly fee might pay for itself. However, if you’re a beginner making small, occasional investments, those monthly fees could eat into your potential profits faster than you’d expect.

Before committing to any subscription, honestly assess your investment capital, trading frequency, and financial goals. Sometimes the best investment advice costs nothing more than time spent reading reputable financial education resources.

Are AI-driven stock recommendations regulated?

This is where things get a bit murky, and it’s an important distinction to understand. Traditional financial advisors and established investment firms are heavily regulated by national organizations like the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations exist to protect investors and ensure transparency in financial advice.

However, AI-driven recommendation platforms operate in a less regulated space. While the underlying stock markets they reference are certainly regulated, the specific algorithms and methodologies these platforms use don’t face the same strict oversight as a human financial advisor who has a fiduciary duty to act in your best interest.

This regulatory gap is why transparency becomes so crucial when evaluating these platforms. The investigative research we’ve seen consistently highlights the need for increased regulatory scrutiny of online financial advice providers. As investors, this means we need to be extra diligent about seeking credible sources and understanding that cutting-edge technology doesn’t automatically mean adequate investor protection.

The evolving nature of these regulations means staying informed about changes in the industry and always prioritizing platforms with clear operational histories and transparent methodologies.

Conclusion: Investing in Your Financial Wellness

As we wrap up our deep dive into 5starsstocks.com best stocks and the fascinating world of AI-powered investment platforms, I hope you’re feeling more informed about what these tools can and can’t do for you. The journey through artificial intelligence stock picking has shown us both exciting possibilities and important limitations that every investor should understand.

The reality is that investing isn’t about finding a magic formula or perfect algorithm. It’s about building knowledge, staying curious, and making thoughtful decisions that align with your personal goals and comfort level. While platforms like 5starsstocks.com best stocks offer convenience and sophisticated technology, they’re just one piece of a much larger puzzle.

What strikes me most about this exploration is how it mirrors our approach to wellness in general. Just like we wouldn’t rely on a single product to transform our entire skincare routine, we shouldn’t expect any one platform to handle all our investment needs. The best results come from understanding the fundamentals, doing our research, and taking a balanced approach.

Building lasting wealth requires the same patience and consistency we apply to our wellness routines. It’s about showing up regularly, making informed choices, and staying committed to long-term goals rather than chasing quick fixes. The investor empowerment we gain from education and understanding is far more valuable than any single stock recommendation.

Financial education truly is the foundation of smart investing. When we understand concepts like diversification, fundamental analysis, and risk management, we’re equipped to evaluate any tool or recommendation that comes our way. This knowledge builds confidence and helps us avoid costly mistakes that can derail our financial journey.

The long-term perspective is especially important for beginners. While it’s tempting to get excited about platforms promising quick returns, the most successful investors focus on steady, sustainable growth. They understand that building wealth is a marathon, not a sprint, and they make decisions accordingly.

At Beyond Beauty Lab, we believe financial wellness is a key part of overall well-being. Just as we encourage you to nourish your skin with quality ingredients and your mind with positive practices, we want to see you nourish your financial future with wisdom and care. Smart investing starts with understanding yourself – your goals, your timeline, and your comfort with risk.

Whether you choose to explore AI-driven tools, work with traditional advisors, or take a DIY approach to investing, the most powerful tool in your arsenal is your own knowledge and judgment. No platform, no matter how sophisticated, can replace the value of understanding what you’re investing in and why.

Building wealth is ultimately about creating the financial foundation that supports the life you want to live. It’s about having the resources to pursue your passions, take care of your loved ones, and feel secure about your future. That’s a goal worth investing in thoughtfully and deliberately.

Start your journey to financial wellness with our resources and remember – we’re here to support you in creating a life that’s beautiful, healthy, and financially secure.