Why FintechZoom.com Bitcoin Mining Matters in Today’s Digital Economy

FintechZoom.com bitcoin mining has become a crucial resource for understanding one of the most profitable yet complex areas of cryptocurrency. With Bitcoin’s market cap exceeding $1.2 trillion and institutional adoption accelerating, having access to reliable mining insights can mean the difference between success and costly mistakes.

Quick Answer for FintechZoom.com Bitcoin Mining:

- What it offers: Real-time mining profitability calculators, expert market analysis, and comprehensive educational guides

- Key features: Mining hardware insights, pool comparisons, energy consumption analysis, and regulatory updates

- Best for: Both beginners learning mining basics and experienced miners optimizing operations

- Access: Free informational platform with premium analytical tools

- Focus areas: ASIC vs GPU comparisons, electricity cost optimization, and mining stock analysis

The platform stands out by focusing specifically on actionable intelligence rather than generic market updates. As one industry expert noted, “FintechZoom delivers real-time analysis that retail investors use to outperform institutional traders.”

Bitcoin mining involves powerful computers solving complex mathematical problems to validate transactions and earn cryptocurrency rewards. The process requires significant investment in specialized hardware like ASIC miners, ongoing electricity costs, and strategic planning to remain profitable.

The mining landscape has evolved dramatically. What started as a hobby for tech enthusiasts has become a global industry worth billions. Mining difficulty has increased by 500,000% since 2009, making professional-grade equipment and expert guidance essential for success.

FintechZoom.com addresses this complexity by providing mining profitability calculators, hash rate analysis, and energy consumption insights. The platform also covers mining stocks, Bitcoin ETFs, and the environmental impact of operations – giving you a complete picture of the mining ecosystem.

Important fintechzoom.com bitcoin mining terms:

Understanding Bitcoin Mining Through the FintechZoom Lens

Think of fintechzoom.com bitcoin mining as your friendly guide through what can feel like a maze of technical jargon and complex concepts. Just like learning any new skill, Bitcoin mining becomes much more approachable when you have the right teacher breaking it down step by step.

FintechZoom takes the intimidating world of cryptocurrency mining and transforms it into digestible insights that actually make sense. Whether you’re completely new to crypto or looking to refine your understanding, this platform serves as that knowledgeable friend who explains things without making you feel overwhelmed.

What is Crypto Mining? The FintechZoom Explanation

Imagine Bitcoin as a massive digital ledger that lives across thousands of computers worldwide. This blockchain backbone needs constant maintenance and verification – and that’s exactly where miners step in as the unsung heroes of the crypto world.

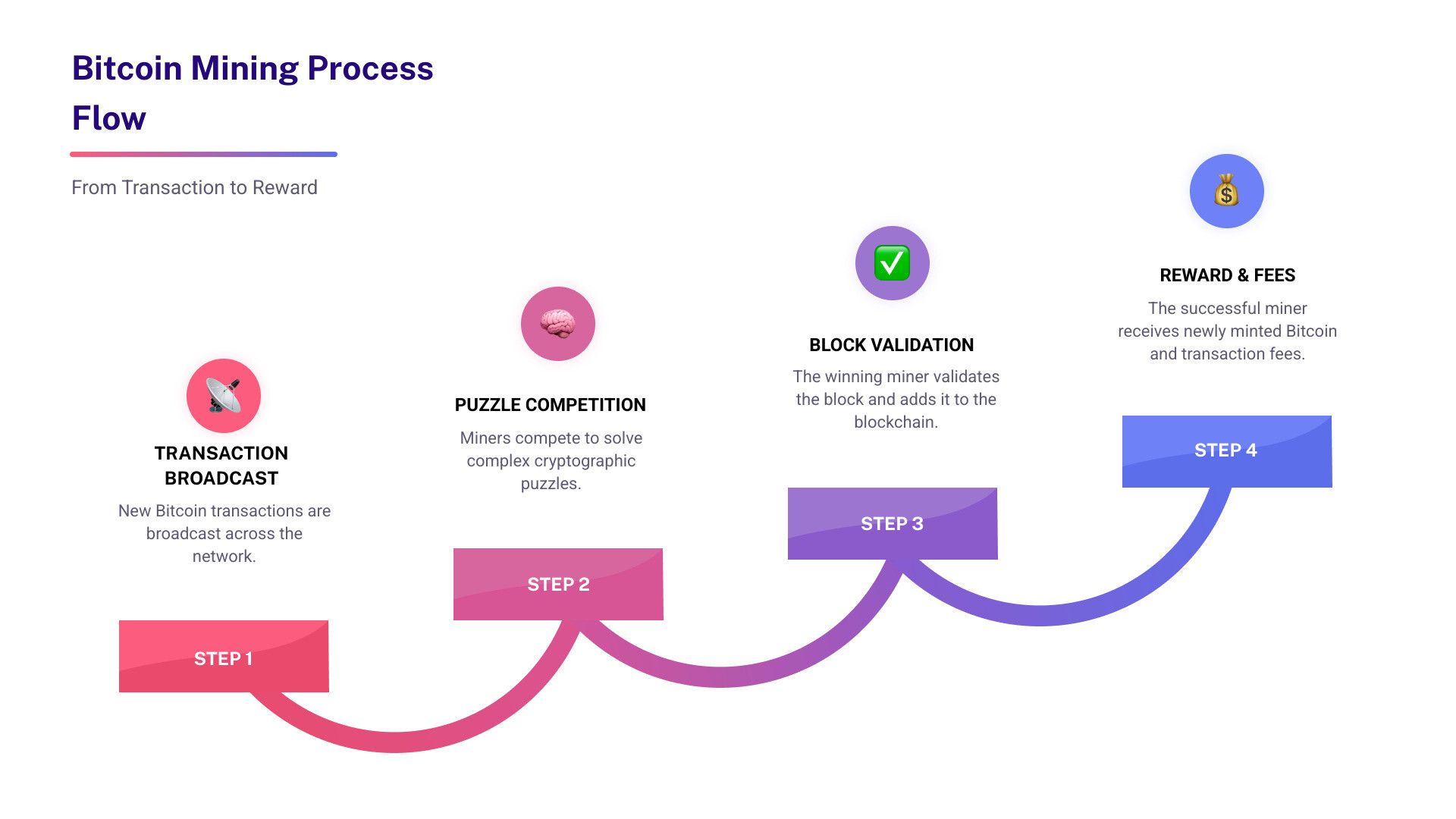

When you send Bitcoin to someone, that transaction doesn’t just magically appear in their wallet. Instead, it joins a queue with thousands of other transactions waiting to be verified. Miners use powerful computers to bundle these transactions together and secure the network by solving incredibly complex mathematical puzzles.

Here’s where it gets interesting: the first miner to crack the puzzle gets to add their bundle (called a “block”) to the official blockchain record. Think of it like being the first person to solve a really difficult crossword puzzle in a race – except the prize is earning Bitcoin rewards instead of just bragging rights.

This process of validating transactions isn’t just busy work. Every time miners solve these complex puzzles, they’re essentially voting on which transactions are legitimate and which should be rejected. This creates a democratic system where no single entity controls the network.

FintechZoom’s educational content breaks down these concepts using real-world analogies and clear explanations. They help you understand that mining isn’t just about creating new Bitcoin – it’s about maintaining the entire system’s integrity and trustworthiness.

The Core Components: Hardware, Software, and Energy

Getting into Bitcoin mining requires more than just downloading an app on your phone. FintechZoom emphasizes that while the concept might seem simple, the actual setup involves some serious hardware investment and ongoing costs.

ASIC miners represent the heavyweight champions of Bitcoin mining. These specialized machines are built for one purpose only: mining Bitcoin as efficiently as possible. They’re incredibly powerful but come with a hefty price tag and can become outdated faster than your smartphone. The trade-off is clear – maximum performance for Bitcoin, but zero flexibility for other tasks.

On the flip side, GPU rigs offer a more versatile approach. These graphics cards, originally designed for gaming and video editing, can tackle Bitcoin mining while maintaining the ability to switch to other cryptocurrencies or even AI projects. They’re like the Swiss Army knife of mining – not the most powerful for any single task, but incredibly adaptable.

Your mining software acts as the translator between your hardware and the Bitcoin network. FintechZoom guides users through selecting software that matches their setup and connects them to the broader mining ecosystem. This software manages everything from monitoring your hardware’s performance to communicating with mining pools.

But here’s the reality check that FintechZoom consistently emphasizes: electricity costs can make or break your mining operation. Bitcoin mining is incredibly energy-intensive, and those monthly power bills can quickly turn a profitable venture into an expensive hobby. Smart miners calculate their local electricity rates before investing in any hardware.

The platform helps you understand that successful mining isn’t just about buying the most expensive equipment – it’s about finding the right balance between performance, cost, and your local conditions.

Weighing the Pros and Cons of Mining

FintechZoom doesn’t sugarcoat the realities of Bitcoin mining. Like any investment opportunity, it comes with genuine potential for profit alongside real risks that could impact your financial wellbeing.

The upside can be compelling. When conditions align – reasonable electricity rates, efficient hardware, and favorable Bitcoin prices – mining can generate consistent income. Some operations manage to mine Bitcoin for significantly less than market price, creating substantial profit margins. Beyond the financial aspect, miners play a crucial role in supporting decentralization by contributing computing power that keeps the network secure and independent.

However, the challenges are equally real. Those high energy bills aren’t just a minor inconvenience – they’re often the difference between profit and loss. Many potential miners underestimate how much electricity their rigs will consume, leading to unpleasant surprises when the utility bills arrive.

Hardware obsolescence presents another significant hurdle. The mining equipment that’s cutting-edge today might struggle to remain profitable in just a year or two as newer, more efficient models hit the market. This creates ongoing pressure to reinvest in upgrades or risk falling behind the competition.

Market volatility adds another layer of complexity. Bitcoin’s price can swing dramatically, sometimes turning a profitable mining operation into a loss-making venture overnight. What looked like a smart investment at $60,000 per Bitcoin might feel very different at $30,000.

Perhaps most concerning is the regulatory uncertainty surrounding cryptocurrency mining. Governments worldwide are still figuring out how to approach crypto mining, and new regulations can suddenly impact operations. Some regions have banned mining entirely, while others have imposed restrictions that affect profitability.

FintechZoom’s balanced approach helps you understand that while Bitcoin mining can be rewarding, it requires careful planning, ongoing monitoring, and a realistic assessment of both the opportunities and risks involved.

Getting Started: Your Practical Guide to Fintechzoom.com Bitcoin Mining

Ready to dive into fintechzoom.com bitcoin mining? I know it might feel like you’re about to climb Mount Everest in flip-flops, but don’t worry! FintechZoom.com makes this journey much more manageable than you’d expect. Think of this section as your base camp – we’ll get you properly equipped and ready for the trip ahead.

Step 1: Choosing and Setting Up Your Mining Hardware

Here’s where things get exciting (and expensive, but let’s focus on the exciting part first!). Your hardware choice is like picking your superhero power – it’ll define everything about your mining trip.

ASIC miners are your Formula 1 race cars – sleek, powerful, and built for one thing: speed. If Bitcoin mining is your main goal and you’ve got some serious cash to invest, these specialized machines are your best bet. We’re talking about initial investments ranging from $3,000 to $10,000 for decent setups, with enterprise-grade operations reaching up to $100,000. Yes, that’s a lot of zeros, but these machines are purpose-built for performance.

GPU rigs, on the other hand, are like versatile SUVs – they can handle Bitcoin mining, but they’re also ready for other trips. While they’re less efficient for Bitcoin specifically, they give you flexibility to mine other cryptocurrencies or even repurpose them for AI projects later. It’s a gentler way to dip your toes into the mining waters.

Budgeting goes way beyond just buying the hardware. You’ll need reliable electricity (and lots of it), stable internet, and proper cooling systems because these machines run hot! FintechZoom.com walks you through all these hidden costs, from maintenance fees to software licensing. While some mining software is free, the hardware and electricity costs are very real investments.

For our friends in the USA, understanding local regulations and incentives can make a huge difference in your bottom line. Check out Learn Basics Of Bitcoin Mining With USA Fintechzoom.com for specific requirements and opportunities in your area.

Once you’ve chosen your hardware, setting up involves connecting all the components, ensuring proper ventilation (trust me, you don’t want an overheated rig!), and preparing for the next crucial step.

Step 2: Software Selection and Joining a Mining Pool

With your hardware humming along (or roaring like a jet engine, depending on what you chose!), it’s time to connect it to the Bitcoin network. This is where the magic really happens.

Mining software is your digital bridge connecting your powerful hardware to the blockchain. Popular options like CGMiner, BFGMiner, and BitMinter act as translators, helping your rig receive mining tasks and submit solutions to the Bitcoin network. FintechZoom.com regularly reviews these software solutions, focusing on which ones best track performance and manage your operations efficiently.

Now, here’s where reality hits: solo mining sounds romantic, but it’s basically like buying a lottery ticket with terrible odds. With today’s network difficulty, a single mining rig could theoretically take thousands of years to mine a complete Bitcoin block. Not exactly the get-rich-quick scheme we’re looking for!

Mining pools are where individual miners become part of something bigger. Think of it as joining a neighborhood book club, but instead of discussing novels, you’re combining computing power to solve Bitcoin blocks. When the pool successfully mines a block, everyone gets a slice of the reward based on how much they contributed. It’s like a potluck dinner where everyone brings something and everyone gets to eat.

The beauty of pool mining is consistency. Instead of waiting potentially forever for that one big payout, you get smaller, regular rewards that make your mining operation much more predictable. Major pools like Foundry USA, AntPool, and F2Pool control significant portions of the network’s hash rate, offering reliability and steady payouts.

Pool fees are the price of admission – typically 1-3% of your mining rewards. It’s like paying a small cover charge to join a club that dramatically increases your chances of success. FintechZoom.com provides detailed comparisons of these fee structures, helping you find a pool that maximizes your returns while minimizing costs.

Step 3: Using FintechZoom’s Tools for Strategic Analysis

This is where fintechzoom.com bitcoin mining truly becomes your secret weapon. Once your mining operation is running, the real strategic work begins – and this is where having the right tools makes all the difference.

Profitability calculators are like having a crystal ball (but with actual math instead of mystical powers). These essential tools factor in your hardware’s hash rate, power consumption, local electricity costs, and current network conditions like difficulty and Bitcoin price. By plugging in these variables, you can estimate potential revenue, figure out break-even timelines, and honestly assess whether your operation makes financial sense. It’s like having a financial advisor who specializes in digital gold mining.

Real-time hash rate data keeps you informed about the competition. When the global Bitcoin hash rate rises, it means more miners are joining the party, which can impact your individual slice of the pie. FintechZoom.com provides live data and analysis on these trends, helping you understand when the mining landscape is getting more crowded or when opportunities might be opening up.

Electricity cost analysis is absolutely crucial because power bills often represent your largest ongoing expense. FintechZoom.com emphasizes finding locations with cheap electricity – ideally below $0.05 per kilowatt-hour. They even suggest clever strategies like mining during off-peak hours when electricity rates drop, turning you into an energy-savvy miner who knows how to work the system.

Market trend monitoring keeps you ahead of the curve. Bitcoin’s notorious price volatility directly affects your mining revenue, so staying informed about market movements is essential. FintechZoom.com offers comprehensive analysis including price predictions, market sentiment indicators, and updates on Bitcoin ETFs. For more details about their broader market coverage, check out More info about Fintechzoom.com Markets.

This holistic approach transforms you from someone just running mining hardware into a strategic operator who understands the bigger picture. You’re not just throwing computational power at the blockchain – you’re making informed decisions that can significantly impact your success.

Advanced Strategies for Maximizing Mining Profitability

Ready to take your fintechzoom.com bitcoin mining journey to the next level? Once you’ve got the basics down pat, it’s time to explore the sophisticated strategies that separate casual miners from the pros. Think of it like skincare – you start with cleansing and moisturizing, but eventually you find serums, treatments, and advanced techniques that transform your routine completely.

Optimizing Operations with FintechZoom Insights

The beauty of advanced mining lies in working smarter, not just harder. FintechZoom.com reveals several game-changing strategies that can dramatically boost your profitability without necessarily requiring more powerful hardware.

Cloud mining has emerged as an neat solution for those who want to participate without the headaches of hardware ownership. Instead of investing tens of thousands in equipment, you’re essentially renting hash power from established mining facilities. It’s like getting a professional facial instead of doing everything at home – sometimes the expertise and infrastructure of specialists deliver better results than going solo.

Strategic timing can make or break your profitability. Mining during off-peak electricity hours might seem like a small adjustment, but it can slash your energy costs significantly. Many successful miners schedule their operations to run when electricity rates drop, typically during late-night hours. This simple shift in timing can improve your profit margins by 15-30%.

Renting hash power offers another fascinating approach. When network conditions are particularly favorable – perhaps Bitcoin’s price has surged or mining difficulty has temporarily dropped – you can rent additional computational power to maximize your earnings during these golden windows.

Staying informed about network upgrades is absolutely crucial. Bitcoin undergoes periodic updates that can affect mining difficulty, reward structures, or even the fundamental mining process. FintechZoom.com excels at breaking down these technical changes into digestible insights, helping you adapt your strategy before changes impact your bottom line.

The platform’s analysis goes beyond basic profitability calculations. They dive deep into equipment depreciation schedules, helping you understand when it’s time to upgrade your hardware. They also provide detailed comparisons between pool and solo mining economics, showing you exactly how different approaches affect your returns.

The Environmental Question: Energy Consumption and Sustainability

Let’s address the elephant in the room – Bitcoin mining’s environmental impact. Just as the beauty industry has acceptd clean, sustainable practices, the mining world is undergoing its own green change. FintechZoom.com provides honest, fact-based coverage of both the challenges and the innovative solutions emerging in this space.

The carbon footprint reality is significant – Bitcoin mining consumes over 120 terawatt-hours annually worldwide. A single ASIC miner can draw 3,250 watts continuously, which puts the environmental concerns into perspective. However, the industry isn’t ignoring this challenge.

Renewable energy solutions are rapidly becoming the norm rather than the exception. Solar panels, wind farms, and hydroelectric facilities are increasingly powering mining operations. The United States leads this charge, with approximately 60% of its mining operations now running on renewable energy. It’s inspiring to see how quickly the industry is pivoting toward sustainability.

Green mining initiatives are sprouting up everywhere, and FintechZoom.com tracks these developments closely. Mining companies are investing heavily in more energy-efficient hardware and strategically locating their facilities near abundant renewable energy sources. Some operations are even using excess heat from mining to warm buildings or greenhouses, creating circular energy systems.

Sustainable practices extend beyond just energy sources. Forward-thinking miners are implementing advanced cooling systems that reduce energy consumption, using waste heat recovery systems, and even participating in demand response programs that help stabilize electrical grids.

The regulatory landscape around environmental compliance is tightening, and FintechZoom.com keeps miners informed about these evolving requirements. Understanding and staying ahead of environmental regulations isn’t just good for the planet – it’s becoming essential for long-term business viability.

A Deep Dive into the Fintechzoom.com Bitcoin Mining Ecosystem

The fintechzoom.com bitcoin mining ecosystem extends far beyond just running mining rigs in your garage. It’s a complex, interconnected web of opportunities that FintechZoom.com maps out beautifully for both direct participants and investors.

Mining stocks offer an excellent entry point for those who want exposure without getting their hands dirty. FintechZoom.com provides comprehensive coverage of major players like Marathon Digital, Riot Platforms, Cipher Mining, and Core Scientific. Their analysis goes deep into operational metrics – hash rates, cost per Bitcoin mined, energy efficiency comparisons, and expansion plans. It’s like having a personal research team tracking every important development.

Bitcoin ETFs have opened entirely new investment avenues since their approval. FintechZoom.com offers essential analysis of these products, tracking performance, institutional adoption flows, and their broader market impact. This coverage helps you understand how traditional finance is embracing the crypto world, creating new opportunities for diversified exposure.

Market sentiment indicators play a crucial role in mining profitability. FintechZoom.com incorporates sentiment analysis from social media, news sources, and trading patterns to paint a complete picture of market psychology. Tools like the Fear and Greed Index provide valuable insights into investor attitudes that directly influence Bitcoin prices – and therefore your mining revenues.

Understanding how crypto correlates with traditional stocks has become increasingly important. FintechZoom.com analyzes these relationships, showing how Bitcoin’s price movements relate to the S&P 500, gold prices, and other traditional assets. This correlation analysis is invaluable for portfolio diversification and risk management. For deeper insights into their analytical approach, check out More info about Fintechzoom.com Gold Price, which showcases their expertise in tracking precious metals alongside crypto markets.

This comprehensive ecosystem view transforms mining from a simple computational exercise into a sophisticated investment strategy. FintechZoom.com’s holistic approach ensures you understand not just the mechanics of mining, but how it fits into the broader financial landscape – giving you the complete picture needed for long-term success.

The Future of Bitcoin Mining: Predictions and Trends from FintechZoom

Looking ahead at the fintechzoom.com bitcoin mining landscape feels a bit like gazing into a crystal ball – exciting, but with plenty of uncertainty mixed in! The world of Bitcoin mining never stands still, and that’s exactly what makes it so fascinating. FintechZoom.com offers valuable predictions and insights into these future trends, helping us prepare for what’s coming around the corner.

Technological and Regulatory Shifts on the Horizon

The future of Bitcoin mining is shaping up to be quite the trip, driven by some pretty incredible technological breakthroughs and an ever-changing regulatory landscape that keeps everyone on their toes.

AI-powered optimization is already starting to revolutionize how miners operate. Think of it as having a super-smart assistant that never sleeps! FintechZoom.com highlights how artificial intelligence and machine learning are being used to squeeze every bit of efficiency out of mining operations. These smart systems can predict when your hardware might fail, optimize energy consumption in real-time, and even suggest the best mining pool strategies. It’s like having a personal trainer for your mining rig!

The race for next-generation ASICs continues to heat up, and it’s honestly impressive to watch. FintechZoom.com tracks all the latest announcements of cutting-edge hardware that pushes the boundaries of what’s possible. These new machines are becoming more powerful while using less energy – a win-win that could significantly lower the cost per Bitcoin mined for those lucky enough to get their hands on the latest technology.

But here’s where things get a bit more serious: increasing regulatory scrutiny is becoming a reality we all need to face. Governments worldwide are paying much closer attention to cryptocurrencies, and this will definitely impact how mining operations function. FintechZoom.com provides thorough analysis on SEC enforcement actions, international regulatory developments, and tax law changes. It’s not the most exciting topic, but staying compliant is absolutely crucial for long-term success.

Perhaps the most predictable yet impactful events are Bitcoin halving events. These scheduled supply cuts happen approximately every four years, reducing the reward miners receive per block. The most recent halving in April 2024 reduced rewards to 3.125 BTC per block – that’s a significant change! FintechZoom.com provides extensive coverage and analysis of these events, helping miners understand their impact on profitability and plan accordingly. For a deeper dive into this crucial topic, check out More info about Fintechzoom.com Bitcoin Halving. These events are absolutely critical to Bitcoin’s economic model and directly influence how miners approach their strategies.

The intersection of technological innovation and regulatory frameworks will define the future of this industry. Thankfully, FintechZoom.com ensures we stay informed and prepared for every twist and turn along the way.

Is Bitcoin Mining Still Worth It in 2025 and Beyond?

This is the question that keeps many potential miners up at night, isn’t it? The honest answer from fintechzoom.com bitcoin mining insights is both encouraging and sobering: while the potential for profit definitely exists, success demands much more careful analysis and planning than ever before.

Profitability in 2025 is still achievable, but it’s not going to be a walk in the park. FintechZoom.com’s analysis shows that the increasing difficulty, post-halving reward reduction, and ongoing energy costs mean that success will largely depend on three key factors: hardware efficiency, electricity rates, and – perhaps most importantly – the price of Bitcoin itself. Some well-optimized operations can still mine Bitcoin for less than $20,000 per coin, but achieving this requires serious dedication to efficiency and optimization.

The challenge of balancing costs versus rewards is becoming more complex each year. FintechZoom predicts that the landscape is shifting towards a market dominated by “mega-miners” by 2030. This doesn’t mean individual miners are completely out of luck, but it does suggest that small-scale operations will need to find specific advantages – like extremely cheap electricity or access to the latest hardware – to remain competitive. Understanding your cost per Bitcoin mined will be absolutely critical.

For many people, long-term potential extends beyond just immediate profits. Bitcoin mining isn’t just about short-term gains; it’s about contributing to and investing in the future of decentralized finance. As institutional adoption continues and Bitcoin solidifies its reputation as “digital gold,” being part of its foundational security infrastructure could hold significant value that goes beyond daily mining rewards.

Strategic planning has never been more important, and FintechZoom.com continuously emphasizes this point. Whether crypto mining aligns with your goals depends heavily on your personal circumstances, risk tolerance, and market conditions. This definitely isn’t a “get-rich-quick” scheme – anyone promising that is probably not being honest with you! Instead, successful mining requires a strategic, adaptable approach, continuous monitoring of market trends, and a genuine willingness to invest in upgrades and efficiency improvements.

FintechZoom.com’s outlook suggests that while Bitcoin mining can still be profitable in 2025 and beyond, it will definitely be more challenging and require greater sophistication than in the early days. The future belongs to those who are well-informed, strategically minded, and ready to adapt to a rapidly evolving environment. At Beyond Beauty Lab, we believe this kind of informed, strategic thinking applies to all aspects of life – whether you’re choosing the right skincare routine or diving into cryptocurrency mining!

Frequently Asked Questions about Fintechzoom.com Bitcoin Mining

We know that stepping into fintechzoom.com bitcoin mining can feel overwhelming at first. You’re not alone in having questions! We’ve gathered some of the most common concerns that come up when people start exploring this exciting but complex field.

Think of this as your friendly chat over coffee, where we tackle those burning questions that might be keeping you up at night. After all, knowledge is the best foundation for any financial wellness journey.

How accurate is the data on FintechZoom for mining analysis?

This is such an important question, and we’re glad you’re thinking critically about data quality! FintechZoom.com bitcoin mining data comes from aggregating information across multiple cryptocurrency exchanges, which actually strengthens its reliability rather than weakening it.

The platform works hard to provide real-time updates, though like any financial data service, there can be tiny delays compared to primary sources. What sets FintechZoom apart is their multi-source validation approach – they’re not just pulling from one place and calling it good.

In practice, their data quality rivals what institutional investors use, but packaged in a way that makes sense for everyday people like us. That said, we always recommend the golden rule of financial decision-making: never rely on just one source for major investments. Cross-referencing with other trusted platforms is always wise, especially when significant money is on the line.

Can I start mining with no money?

We wish we had better news here, but the honest answer is no. While it’s true that some mining software can be downloaded for free, that’s just the tip of the iceberg when it comes to actual costs.

Bitcoin mining demands serious upfront investment. You’ll need specialized hardware – either ASIC miners or powerful GPU setups – which typically cost anywhere from $3,000 to $10,000 just to get started. Then there are the ongoing electricity costs, which can easily run $100 to $300 per month depending on your setup and local power rates.

Think of it like opening a bakery. You might find free recipes online, but you still need ovens, ingredients, and a space to work. Mining hardware is your “oven” in this digital world, and electricity is your ongoing “ingredient” cost. There’s simply no way around these fundamental expenses.

Does FintechZoom provide mining hardware or software?

This is a great clarification question! FintechZoom.com is purely an informational and analytical platform – think of them as your knowledgeable guide rather than your equipment supplier.

They excel at providing expert guides, market analysis, profitability calculators, and educational content that helps you understand the mining landscape. Their bitcoin mining insights are incredibly valuable for making informed decisions about which hardware to buy and where to buy it.

But when it comes to actually purchasing ASIC miners, GPUs, or downloading mining software, you’ll need to go to dedicated hardware vendors and software developers. The good news? FintechZoom’s educational content often points you toward reputable sources and trusted vendors, so you’re not left wandering in the digital wilderness trying to figure out what’s legitimate.

It’s like having a knowledgeable friend who can tell you everything about cars and recommend the best dealerships, but doesn’t actually sell cars themselves. Sometimes that’s exactly the kind of unbiased guidance you need!

Conclusion

Navigating Bitcoin mining is like learning a new dance – it’s complex at first, but incredibly rewarding once you find your rhythm. FintechZoom.com bitcoin mining serves as your trusted dance instructor, providing comprehensive guidance every step of the way, from understanding basic moves to mastering advanced choreography.

Throughout this journey, we’ve finded how FintechZoom transforms what could be an overwhelming technical maze into clear, actionable insights. They’ve helped us understand the blockchain backbone that keeps Bitcoin secure, explore the pros and cons honestly, and steer the practical steps of choosing hardware, selecting software, and joining mining pools.

We’ve also explored advanced strategies that separate successful miners from the rest – from cloud mining options and renewable energy solutions to understanding market correlations and regulatory shifts. The platform’s tools for analyzing profitability, monitoring hash rates, and tracking electricity costs provide the strategic intelligence needed to thrive in this competitive space.

Looking ahead, the technological and regulatory shifts on the horizon promise both challenges and opportunities. From AI-powered optimization to next-generation ASICs, the mining landscape continues evolving rapidly. Bitcoin halving events and increasing regulatory scrutiny will reshape profitability calculations, making expert guidance more valuable than ever.

At Beyond Beauty Lab, we believe that empowerment comes from knowledge – whether you’re mastering skincare routines or exploring cryptocurrency mining. Both require patience, continuous learning, and strategic thinking. Just as we guide you through wellness practices that improve your natural beauty, FintechZoom.com bitcoin mining resources guide you through the complexities of digital finance.

The environmental question around energy consumption reminds us that sustainable practices matter in every industry. As the mining sector accepts renewable energy and green initiatives, it mirrors our own commitment to clean beauty and responsible choices.

Is Bitcoin mining worth it in 2025 and beyond? The answer depends on your circumstances, risk tolerance, and commitment to staying informed. What’s certain is that having reliable resources like FintechZoom makes all the difference in navigating this dynamic frontier successfully.

By staying informed, adaptable, and strategic, you can confidently explore Bitcoin mining as part of your broader financial wellness journey. Explore more financial insights on our blog.