Why Understanding FintechZoom Russell 2000 Data Matters for Modern Investors

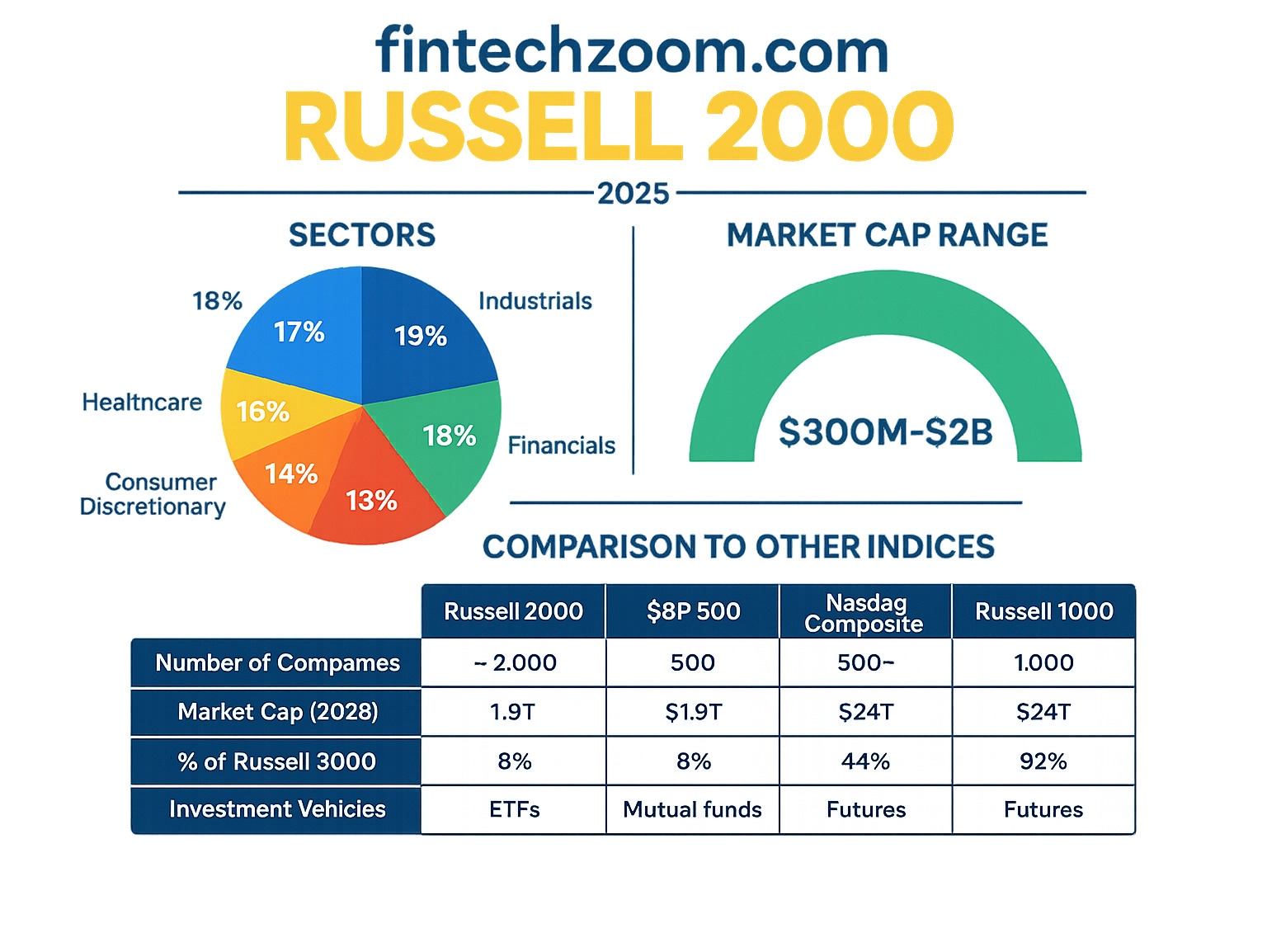

FintechZoom.com Russell 2000 data represents one of the most comprehensive resources for tracking small-cap stock performance in today’s financial landscape. The Russell 2000 Index, which measures approximately 2,000 small-cap companies in the United States, serves as a critical barometer for economic health and emerging business opportunities.

Quick Overview: FintechZoom Russell 2000 Essentials

- What it is: A financial platform providing real-time data, analysis, and insights on the Russell 2000 Index

- Index composition: Tracks approximately 2,000 small-cap U.S. companies with market caps between $300M-$2B

- Key features: Real-time updates, expert commentary, historical performance data, custom alerts

- Investment access: Available through ETFs, mutual funds, and futures contracts

- Risk profile: Higher volatility than large-cap indices but greater growth potential

The Russell 2000 represents approximately 8% of the total market capitalization of the broader Russell 3000 Index, yet it captures the pulse of America’s emerging businesses. These smaller companies often drive innovation and economic growth, making them essential for investors seeking diversification beyond blue-chip stocks.

Small-cap companies are more sensitive to domestic economic conditions than their large-cap counterparts, which means the Russell 2000 can provide early signals about economic trends. When economic conditions shift, this index often reflects changes before they appear in larger indices like the S&P 500.

FintechZoom’s coverage transforms complex market data into accessible insights, helping both institutional and individual investors make informed decisions about small-cap investments. The platform’s real-time analytics and comprehensive market sentiment analysis have become invaluable tools for navigating this volatile but potentially rewarding market segment.

Basic fintechzoom.com russell 2000 terms:

What is the Russell 2000 and Why Does It Matter?

Think of the Russell 2000 as America’s economic pulse checker for smaller businesses. While everyone talks about the big players on Wall Street, this index keeps its eye on something equally important: the 2,000 small-cap companies that often drive innovation and economic growth from the ground up.

The Russell 2000 isn’t just a random collection of stocks. It’s a carefully maintained benchmark that tracks companies with market capitalizations typically ranging from $300 million to $2 billion. These are the businesses that might not make front-page news every day, but they’re often the ones creating the products and services that shape our daily lives.

What makes this index so fascinating is its role as an economic crystal ball. Small-cap companies are incredibly sensitive to domestic economic conditions – much more so than their giant corporate cousins. When these smaller, nimble businesses start thriving, it usually signals that the broader U.S. economy is healthy. When they struggle, it often hints at economic headwinds before they show up in other major indices.

FintechZoom.com Russell 2000 data becomes particularly valuable here because it helps investors track these early economic signals in real-time. The platform transforms complex small-cap market movements into understandable insights that both seasoned investors and newcomers can use to make informed decisions.

For more comprehensive information about this index, you can explore More info about the Russell 2000 to deepen your understanding.

Key Characteristics of the Index

The Russell 2000 follows a precise methodology created by FTSE Russell, ensuring it accurately represents America’s small-cap landscape. Understanding how this index works helps explain why it’s such a trusted market barometer.

The composition is straightforward yet sophisticated. The index includes approximately 2,000 companies that represent the smallest two-thirds of the Russell 3000 Index. Think of it as taking the bottom 2,000 companies from a larger pool of 3,000 – but “bottom” here simply means smaller in size, not lesser in potential.

Market capitalization determines which companies make the cut. While the general range sits between $300 million and $2 billion, there’s some flexibility. As of March 2024, the average market cap was around $4.82 billion, with a median of $960 million. The largest company reached $58.43 billion, showing that successful small-cap companies can grow significantly while still remaining in the index.

The annual rebalancing process happens every June, like a yearly spring cleaning for the financial world. Companies move in and out based on their market cap changes, ensuring the index stays true to its small-cap focus. It’s fascinating to watch companies graduate to larger indices as they grow – it’s like watching your favorite local restaurant expand into a national chain.

Weighting methodology uses market capitalization, meaning larger companies within the index have more influence on overall performance. This approach ensures that the most successful small-cap companies have proportionally more impact on the index’s movements.

The index maintains a domestic focus on U.S. companies, making it an excellent gauge of American economic health. Finally, sector diversity ensures representation across industries – from technology startups to healthcare innovators, consumer goods manufacturers to financial services companies. This diversity provides a well-rounded view of the small-cap ecosystem.

Russell 2000 vs. Other Major Indices

Comparing the Russell 2000 to its more famous relatives helps illustrate why it deserves attention in any well-rounded investment strategy. While the S&P 500 and Dow Jones Industrial Average focus on established giants, the Russell 2000 captures the energy and potential of smaller, often more dynamic companies.

| Feature | Russell 2000 | S&P 500 | Dow Jones Industrial Average |

|---|---|---|---|

| Focus | Small-cap U.S. companies | Large-cap U.S. companies | 30 “blue-chip” U.S. companies |

| Number of Constituents | Approximately 2,000 | 500 | 30 |

| Market Cap Range | Typically $300M – $2B (though can vary) | Generally greater than $10B (larger, established firms) | Large-cap, industry leaders |

| Weighting | Market capitalization-weighted | Market capitalization-weighted | Price-weighted (unique) |

| Economic Indicator | Barometer for U.S. economy, emerging trends | Broad market health, corporate performance | Health of specific industrial sectors |

| Volatility | Higher (due to smaller company size) | Moderate | Lower (due to established companies) |

| Growth Potential | Higher (early stages of growth) | Moderate | Moderate (stable, mature companies) |

The Russell 2000 offers higher volatility but also greater growth potential compared to large-cap indices. It’s like choosing between a stable, established neighborhood and an up-and-coming area with lots of development potential – both have their merits, but they serve different investment goals.

This higher risk-reward profile makes fintechzoom.com Russell 2000 analysis particularly valuable for investors trying to balance potential returns with acceptable risk levels. The platform’s real-time data helps steer the increased volatility that comes with small-cap investing.

Analyzing the Russell 2000 with FintechZoom

In today’s financial world, having the right tools to analyze market data is paramount. This is where platforms like FintechZoom truly shine. FintechZoom.com provides an invaluable service by aggregating news, analysis, and reports on the financial technology sector, and it serves as a robust resource for real-time updates on market trends, stock performance, and even regulatory changes. For us, it’s like having a super-powered magnifying glass for the financial markets, allowing us to dig deep into the intricacies of indices like the Russell 2000.

FintechZoom is positioned as an excellent tool for both new and seasoned investors to gain exposure to smaller companies and potentially improve portfolio performance. It’s not just about raw data; it’s about providing context and insights that help us make sense of the numbers. You can explore more about FintechZoom’s market coverage here: Fintechzoom.com Markets.

How to Use fintechzoom.com russell 2000 Data for Investment Decisions

FintechZoom’s coverage of the Russell 2000 is designed to empower investors with the information they need to make informed decisions. Here’s how we can leverage its features:

- Real-time Data Tracking: FintechZoom provides real-time updates on the Russell 2000’s performance. This means we can see how the index is moving throughout the day, offering immediate insights into market shifts. This is crucial because, as we’ve learned, small-cap companies can be quite volatile, and timely information is key.

- Advanced Charting Tools: The platform often offers advanced charting tools that allow us to visualize historical performance, identify trends, and spot potential patterns. This helps us to assess the long-term growth potential and risk associated with the index.

- Historical Performance Review: While real-time data is great, understanding the past helps predict the future (or at least prepare for it!). FintechZoom enables us to review the historical performance of the Russell 2000, comparing it to other indices and understanding how it has reacted to various economic cycles.

- Custom Alerts: Imagine setting up a notification that tells you when the Russell 2000 hits a certain threshold or when a specific company within the index makes a significant move. FintechZoom’s custom alerts can act as our personal market assistant, ensuring we never miss a beat.

- Data Merging for Comprehensive Analysis: FintechZoom often pulls data from various sources, merging it to provide a more comprehensive view of the index’s performance. This integrated approach saves us time and ensures we have a holistic understanding of the market dynamics affecting the Russell 2000.

By providing these tools, FintechZoom helps investors track stock metrics, gain better insights, and ultimately make more informed investment decisions about the fintechzoom.com russell 2000 index. It’s about explaining complex market data and making it accessible.

Understanding Market Sentiment with fintechzoom.com russell 2000

Beyond just numbers, understanding market sentiment is crucial. How do investors feel about the market? Are they optimistic or cautious? FintechZoom helps us gauge this emotional barometer of the market through several features:

- News Analysis: The platform aggregates financial news, providing context for the Russell 2000’s movements. This helps us understand the “why” behind the market’s ups and downs, whether it’s due to economic reports, geopolitical events, or specific company news.

- Expert Commentary: FintechZoom features expert opinions and analysis, offering valuable perspectives from seasoned professionals. These insights can help us interpret market trends and anticipate future movements. We love a good expert opinion, especially when it helps us steer tricky waters!

- Social Media Trends: In today’s interconnected world, social media can influence market sentiment. While not explicitly detailed, platforms like FintechZoom often incorporate or point to broader market sentiment indicators, which can sometimes be influenced by discussions on financial social media channels.

- Volatility Patterns: By analyzing historical and real-time volatility patterns, FintechZoom helps us understand the risk appetite of the market. Higher volatility might indicate investor uncertainty or, conversely, rapid growth potential.

The article “Understanding the Impact of Fintechzoom.com and Russell 2000 in the Financial Landscape” emphasizes that Fintechzoom.com serves as a critical tool for staying ahead of market changes, especially for small-cap investing. It’s like having a highly tuned radar for the financial landscape. You can learn more about economic insights on FintechZoom here: Fintechzoom.com Economy.

Performance, Risks, and Rewards of the Russell 2000

When we look at the Russell 2000’s track record, it’s like watching a spirited young athlete – full of energy, sometimes unpredictable, but with incredible potential to surprise us. The fintechzoom.com russell 2000 data reveals a fascinating story of how small-cap companies have steerd through various economic seasons over the years.

The index has shown us some truly remarkable moments throughout its history. During the economic recovery following the 2008 financial crisis, we witnessed the Russell 2000 experience substantial gains as small-cap companies rode the wave of improving economic conditions. These smaller businesses, often more nimble than their large-cap counterparts, were able to adapt quickly and capitalize on new opportunities.

Then came 2020, and the pandemic threw everyone for a loop. The Russell 2000 experienced sharp declines as uncertainty gripped the markets. But here’s what’s fascinating – it also showed incredible resilience, rebounding as markets stabilized and investors recognized the potential in these emerging businesses. It’s been quite the roller coaster ride, with exhilarating highs and some nerve-wracking dips along the way!

Factors Influencing the Index

Understanding what makes the Russell 2000 tick is like learning to read the weather patterns – once you know the signs, everything starts to make more sense. Several key forces shape how this index performs, and they’re all interconnected in interesting ways.

Economic indicators play a huge role in the Russell 2000’s performance. Small-cap companies are often more sensitive to domestic economic conditions than those multinational giants we see in other indices. When GDP growth looks strong, employment rates are healthy, and consumers are spending confidently, these smaller businesses tend to thrive. Manufacturing output is another important piece of the puzzle – when factories are humming along, it usually signals good things for the broader economy.

Interest rates can be a game-changer for small businesses. Think about it this way – when borrowing costs are low, it’s easier for these companies to fund their expansion dreams and day-to-day operations. But when rates climb, those same businesses might find themselves tightening their belts as borrowing becomes more expensive.

Inflation presents an interesting challenge. While some small businesses can pass increased costs along to their customers, many don’t have the same pricing power as larger corporations. Higher inflation can squeeze their margins and make it harder for consumers to afford their products or services.

Government policies often have an outsized impact on smaller companies. Changes in regulations, tax policies, or government spending initiatives can either give these businesses a helpful boost or create new problems to steer. It’s why many investors keep a close eye on political developments when tracking the Russell 2000.

Financial experts consistently highlight the Russell 2000’s role as a critical indicator of economic health, especially for the U.S. economy. Many view it as an invaluable tool for understanding where we’re headed economically.

Benefits and Risks of Investing

Investing in the Russell 2000 is a bit like choosing between a reliable sedan and a sports car – both have their place, but they offer very different experiences. Let’s explore what makes this index both exciting and challenging for investors.

The high growth potential is probably the most compelling reason people are drawn to small-cap investing. These companies are often in their early growth stages, which means they have plenty of room to expand and potentially deliver returns that would make larger, more mature companies envious. They’re like the promising startups of the investment world – full of potential and hungry to prove themselves.

Portfolio diversification is another major benefit that shouldn’t be overlooked. Including the Russell 2000 in a diversified portfolio can help reduce overall risk because small-cap stocks often march to their own beat, behaving differently from large-cap stocks. When bigger companies are struggling, smaller ones might be thriving, and vice versa.

The index also offers broad market representation across 2,000 companies spanning various sectors. This comprehensive coverage means we’re not putting all our eggs in one basket – we’re getting exposure to a wide slice of American business innovation and entrepreneurship.

But let’s be honest about the challenges too. Higher volatility is probably the biggest hurdle for many investors. Small-cap stocks can experience more dramatic price swings, which means our investment might feel like a bumpy ride at times. It’s not uncommon to see significant movements that might make our hearts skip a beat.

Economic sensitivity is another reality we need to face. During recessions or periods of uncertainty, small-cap companies can be more vulnerable simply because they often have fewer resources and less financial cushioning compared to large corporations. They feel economic headwinds more acutely.

Liquidity risk is worth considering too. While the Russell 2000 generally maintains good liquidity, some individual small-cap stocks within the index might be harder to buy or sell quickly without affecting their price.

The Russell 2000 offers higher risk and potential rewards due to its smaller company focus and greater volatility compared to large-cap alternatives. For long-term investors who can stomach short-term fluctuations, the growth potential of small-cap companies often makes the journey worthwhile. It’s all about matching your investment approach with your risk tolerance and timeline.

Frequently Asked Questions about fintechzoom.com russell 2000

We totally get it – when you’re diving into fintechzoom.com russell 2000 data, questions naturally bubble up! Let’s clear up some of the most common curiosities we hear from investors just like you.

What is the relationship between FintechZoom and the Russell 2000?

Here’s where things get interesting, and honestly, it’s a question that trips up quite a few people! FintechZoom is an analytical platform that provides comprehensive data, news, and insights about the Russell 2000 index – it’s not actually a company within the index itself.

Think of it this way: if the Russell 2000 were a fascinating book about small-cap companies, FintechZoom would be like having an expert book reviewer who breaks down all the important chapters for you. The platform aggregates real-time market data, expert commentary, and historical performance information to help investors understand what’s happening with these 2,000 small-cap companies.

FintechZoom serves as a resource for analysis, not a constituent company of the index. While there’s always speculation in the financial world about which companies might join or leave major indices, FintechZoom’s primary role is to illuminate the Russell 2000’s movements and help investors make sense of the sometimes wild ride that small-cap investing can be.

This relationship is incredibly valuable because it transforms complex market data into digestible insights. Instead of trying to track 2,000 individual companies yourself (which would be absolutely exhausting!), you can rely on FintechZoom’s comprehensive coverage to stay informed about trends, risks, and opportunities within the small-cap space.

How can I invest in the Russell 2000 index?

You can’t directly buy “shares” of the Russell 2000 itself – it’s more like a recipe than an actual dish you can order. But don’t worry, there are several delicious ways to get exposure to this small-cap feast.

Exchange-Traded Funds (ETFs) are probably your most straightforward option. These financial products are designed to track the index’s performance, giving you instant diversification across all those small-cap companies. When you buy shares of a Russell 2000 ETF, you’re essentially getting a tiny slice of each company in the index – pretty neat, right?

Mutual funds work similarly, pooling money from many investors to buy the underlying stocks that mirror the Russell 2000’s composition. The main difference is that mutual funds typically trade once per day after markets close, while ETFs trade throughout market hours like individual stocks.

For the more adventurous (and experienced) investors out there, futures contracts offer another avenue. These are more complex instruments that involve leverage, so they’re definitely not for beginners. Think of futures like agreeing to buy something at a future date for a price you set today – exciting but risky!

Each of these options offers different benefits in terms of fees, trading flexibility, and minimum investments, so it’s worth exploring which fits your investment style best.

Is investing in the Russell 2000 suitable for everyone?

Honestly? No, it’s not suitable for everyone – and that’s perfectly okay! Investing in the Russell 2000 is a bit like deciding whether to go bungee jumping. Some people thrive on the excitement, while others prefer keeping their feet firmly planted on solid ground.

Your investment goals play a huge role here. If you’re looking for steady, predictable returns and can’t handle much volatility, the Russell 2000’s roller-coaster nature might keep you up at night. But if you’re excited about the growth potential of smaller, innovative companies and can stomach some bumpy rides, it could be a great fit.

Time horizon matters tremendously. Small-cap stocks often need time to mature and realize their potential. If you’re planning to retire next year, the Russell 2000’s short-term volatility might not align with your needs. However, if you’re investing for goals that are 5-10 years away, you have time to ride out the inevitable ups and downs.

Most importantly, your risk tolerance is the deciding factor. The Russell 2000 can swing dramatically based on economic conditions, interest rate changes, and market sentiment. Some investors find this exciting – like the thrill of finding a promising new skincare ingredient before it goes mainstream. Others prefer the stability of well-established, proven investments.

We always recommend considering the Russell 2000 as part of a diversified portfolio rather than putting all your investment eggs in one small-cap basket. It’s about finding the right balance for your unique financial situation and comfort level.

Conclusion

As we wrap up our journey through fintechzoom.com russell 2000 analysis, it’s clear that we’ve uncovered something pretty special. The Russell 2000 Index isn’t just a collection of numbers on a screen – it’s a window into the heart of American entrepreneurship and innovation. These 2,000 small-cap companies represent the dreams and ambitions of businesses across our country, from tech startups to regional manufacturers.

What makes this particularly exciting is how platforms like FintechZoom have democratized access to sophisticated market analysis. Gone are the days when only Wall Street insiders could make sense of complex market movements. Now, whether you’re a seasoned investor or someone just starting to explore the financial world, you have powerful tools at your fingertips to understand what’s happening in the small-cap universe.

The Russell 2000 serves as both opportunity and teacher. Its higher volatility compared to large-cap indices might seem intimidating at first, but it’s actually teaching us valuable lessons about risk, reward, and the importance of patience in investing. These smaller companies often move faster and react more quickly to economic changes, making them excellent barometers for broader economic health.

FintechZoom’s role as an analytical powerhouse cannot be overstated. By changing complex financial data into digestible insights, complete with real-time updates and expert commentary, it bridges the gap between raw market information and actionable investment knowledge. It’s like having a knowledgeable friend who speaks fluent “finance” translating everything for you.

Here at Beyond Beauty Lab, we believe that informed decision-making is beautiful – whether you’re choosing the right skincare routine or building an investment portfolio. Just as we encourage you to understand the ingredients in your beauty products, we advocate for understanding the components of your financial decisions. The Russell 2000 offers compelling growth potential for those willing to accept its dynamic nature, but like any powerful tool, it requires knowledge and respect.

Due diligence remains your best friend in this journey. Every investment carries its own personality, complete with unique risks and potential rewards. The key is aligning your choices with your personal goals, timeline, and comfort level with market fluctuations. There’s no one-size-fits-all approach to investing, just like there’s no universal beauty routine that works for everyone.

We’re excited to continue supporting your learning journey across all aspects of wellness – financial health included. For more insights that can improve your overall well-being and knowledge, we invite you to explore more financial insights on our platform. After all, true beauty comes from feeling confident and informed in all areas of your life.