Why FintechZoom’s Nickel Coverage Matters in Today’s Market

Fintechzoom.com nickel coverage has become essential reading for investors and industry professionals tracking one of 2025’s most strategic metals. Here’s what you need to know:

Quick Overview:

- Current Price: $15,732 per metric ton (up 5.09% from March 2025)

- Primary Uses: 70% goes to stainless steel, growing demand from EV batteries

- Key Markets: Indonesia leads global production, supply chain tensions affect pricing

- Investment Access: Track via FintechZoom’s real-time data, news, and market analysis

Nickel has stepped into the spotlight as a critical component driving both traditional industries and the green energy revolution. As Elon Musk has emphasized, nickel plays a pivotal role in manufacturing electric vehicles, making it a cornerstone of the sustainable technology sector.

The metal’s dual identity – as both an industrial staple and a green technology enabler – creates unique market dynamics that require careful monitoring.

FintechZoom.com serves as a valuable resource for tracking these complex market movements. The platform aggregates real-time pricing data, market sentiment, and expert analysis to help users understand nickel’s role in everything from stainless steel production to battery manufacturing.

With the global nickel mining market projected to reach $83.8 billion by 2030 (growing at 6.6% annually), staying informed about price trends and supply chain developments has never been more important.

This guide will walk you through how to effectively use FintechZoom’s nickel coverage, understand market drivers, and make sense of the data for informed decision-making.

Terms related to fintechzoom.com nickel:

Understanding Nickel’s Pivotal Role in the 2025 Global Economy

Think of nickel as the unsung hero of modern life. This silvery metal quietly powers everything from the gleaming appliances in your kitchen to the electric vehicle charging in your driveway. While it’s been helping make steel stronger since the 1800s, nickel has found itself at the center of today’s green energy revolution.

What makes nickel so special? It’s incredibly versatile. When you add nickel to steel, you get stainless steel that won’t rust or corrode – perfect for everything from surgical instruments to skyscrapers. About 70% of all nickel still goes into making these industrial alloys that keep our world running smoothly.

But here’s where things get exciting for the future. Nickel has become a critical component in lithium-ion batteries, especially the high-performance ones that power electric vehicles. These nickel-rich batteries pack more energy and last longer, which is exactly what we need as more people switch to EVs.

The geopolitical significance of nickel can’t be ignored either. Indonesia dominates global production, having nearly doubled its output since 2020. When Indonesia considers cutting production or changing export policies, markets around the world pay attention. The same goes for supply chain disruptions – when major suppliers face sanctions or trade restrictions, nickel prices can swing dramatically.

The supply chain dynamics get even more complex when you consider that the European Union has labeled nickel a critical mineral. Countries are scrambling to secure reliable sources and reduce their dependence on just a few major producers. It’s a strategic chess game playing out on a global scale.

A high-authority resource about nickel’s critical role is the International Nickel Study Group

Key Drivers Influencing the Nickel Market

The forces shaping nickel markets in 2025 tell a fascinating story of change and growth. EV demand surge leads the charge, with the battery segment expected to grow at 7.2% annually through 2030. Every new electric car rolling off the production line needs nickel for its battery pack.

Green infrastructure spending adds another layer of demand. Wind turbines, solar installations, and massive energy storage systems all rely on nickel’s unique properties. As governments pour money into renewable energy projects, they’re essentially investing in nickel demand.

The global economic health still matters tremendously. When economies are strong, construction booms, manufacturing expands, and stainless steel demand follows. When times get tough, industrial demand can soften quickly.

Supply policies from major producers can make or break market stability. Indonesia’s decisions about production levels or export restrictions send ripples through global markets. It’s like having one player control a significant portion of the game board.

Technological advancements in battery chemistry keep evolving the landscape. Researchers are constantly working on better batteries, more efficient extraction methods, and new applications for nickel. These innovations can shift demand patterns in unexpected ways.

The numbers tell an impressive story: the global nickel mining market is projected to reach $83.8 billion by 2030, growing at 6.6% annually. That’s the kind of growth that gets investors’ attention.

Nickel’s Importance for ESG Investors

For investors who care about doing good while doing well, nickel presents both opportunities and challenges. Responsible mining practices are becoming non-negotiable as companies face pressure to clean up their act. Smart miners are adopting cleaner technologies and transparent supply chains.

The environmental impact of extraction remains a real concern. Traditional nickel mining can damage forests and pollute waterways, especially in sensitive ecosystems. Forward-thinking companies are investing in cleaner extraction methods and restoration efforts.

Social governance in producing nations matters more than ever. Mining operations need to benefit local communities, not exploit them. This means fair wages, proper safety measures, and genuine community engagement.

Here’s a bright spot: nickel’s recyclability makes it a sustainability champion. Unlike some materials that degrade when recycled, nickel can be reused indefinitely without losing its properties. That’s music to ESG investors’ ears.

When tracking these trends, fintechzoom.com nickel coverage increasingly highlights ESG considerations alongside traditional market analysis. This helps investors make decisions that align with their values while pursuing financial returns.

The beauty of nickel’s ESG story is that sustainability and profitability are increasingly aligned. Companies that adopt responsible practices often perform better financially, creating a win-win scenario for conscious investors.

How to Leverage Fintechzoom.com Nickel for Market Insights

When it comes to tracking nickel prices and market trends, FintechZoom.com has become a trusted companion for both seasoned investors and newcomers to the commodity space. Think of it as your financial Swiss Army knife – packed with tools that make complex market data surprisingly accessible.

FintechZoom.com operates as a comprehensive financial news aggregator and commodity data provider, bringing together information from multiple sources into one user-friendly platform. What sets it apart is how it transforms overwhelming market data into digestible insights that actually make sense.

The platform excels in several key areas that make fintechzoom.com nickel tracking particularly valuable. Real-time price tracking ensures you’re never working with outdated information – crucial when nickel prices can swing dramatically based on supply chain news or EV market developments. The historical data analysis feature lets you zoom out and see the bigger picture, helping you distinguish between temporary market hiccups and genuine trend shifts.

For those who enjoy diving deeper into market mechanics, the platform offers technical indicators like moving averages and RSI calculations. But don’t worry if these sound intimidating – the interface presents them in a way that’s approachable even for beginners. The curated news and expert analysis section acts like having a knowledgeable friend who keeps you updated on what’s really moving the nickel market.

One particularly clever feature is how FintechZoom tracks media attention and retail sentiment around nickel. This can give you early warning signs about potential price movements, since market psychology often drives short-term volatility. Just as we at Beyond Beauty Lab believe in empowering our readers with knowledge about wellness and beauty, FintechZoom empowers investors with financial literacy that makes complex markets more approachable.

More info about market tracking

Using the fintechzoom.com nickel dashboard for daily tracking

The daily dashboard is where fintechzoom.com nickel really shines for regular market monitoring. It’s designed with busy people in mind – you can get a complete picture of nickel’s daily performance in just a few minutes.

Live price updates form the heart of the dashboard, displaying current nickel prices alongside the daily percentage change that shows whether the metal is having a good day or struggling. These updates refresh continuously, so you’re always working with fresh data.

The price alerts feature deserves special mention because it’s genuinely useful. You can set custom notifications for specific price levels – maybe you want to know if nickel drops below $15,000 per ton or jumps above $17,000. The system will ping you when these thresholds are hit, even if you’re not actively watching the market.

The integrated recent news feed pulls in relevant headlines that could impact nickel prices. This might include anything from Indonesian mining policy changes to Tesla’s latest battery technology announcements. Having this context right alongside the price data helps you understand why nickel is moving, not just how much it’s moving.

Market sentiment indicators add another layer of insight by showing you the overall mood of the market. Are traders feeling optimistic about nickel’s prospects, or is there underlying concern? This sentiment data can be particularly helpful for timing your market moves.

Advanced analysis with fintechzoom.com nickel charts and tools

When you’re ready to move beyond basic price tracking, fintechzoom.com nickel offers sophisticated analytical tools that don’t require a finance degree to understand.

The charting tools let you apply various technical indicators to nickel price data. Moving averages smooth out price fluctuations to reveal underlying trends, while the Relative Strength Index (RSI) helps identify whether nickel might be overbought or oversold at current levels. These tools work together to paint a clearer picture of where nickel prices might be headed.

One particularly valuable feature is the ability to compare nickel to other assets. You can overlay nickel’s performance against broader market indices or other commodities to spot correlations or divergences. For instance, you might notice that nickel tends to move in sync with copper during certain market conditions, or that it sometimes moves independently of general commodity trends.

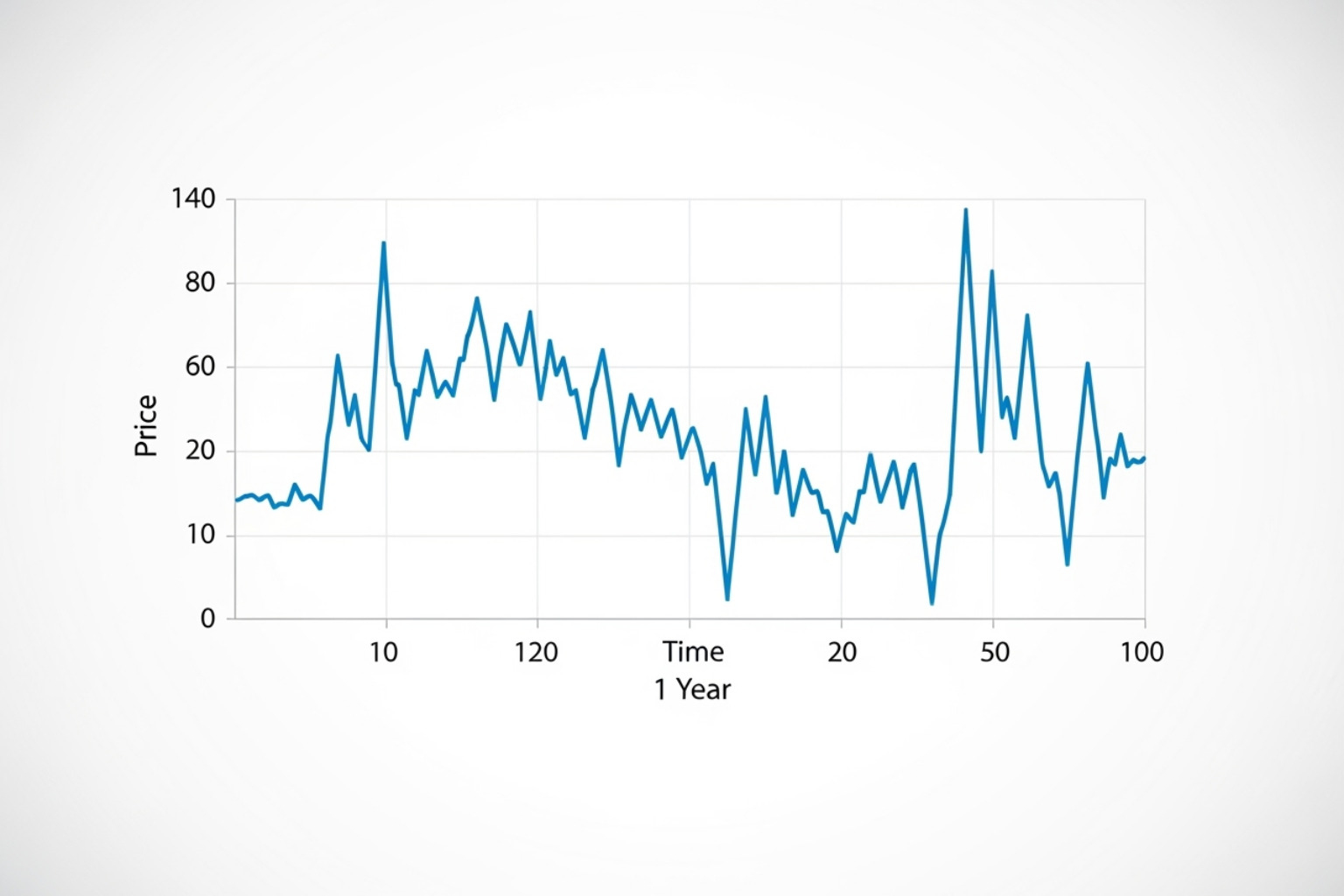

The platform also excels at helping you identify long-term trends versus short-term volatility. By adjusting the time frame on your charts, you can zoom out to see multi-year patterns or focus in on recent daily movements. This perspective is crucial because nickel can be quite volatile in the short term while following clearer directional trends over longer periods.

For those interested in broader commodity analysis, you might find value in exploring how similar analytical approaches apply to other metals. More info about gold price analysis offers insights into precious metals tracking that complement nickel market understanding.

The key to getting the most from these advanced tools is starting simple and gradually incorporating more sophisticated analysis as you become comfortable with the platform. Even the most complex indicators are just tools to help you make better-informed decisions about this fascinating and increasingly important metal market.

Analyzing Nickel Market Performance and Future Outlook

The nickel market tells a story of both promise and uncertainty in 2025. If you’ve been tracking fintechzoom.com nickel data, you’ve likely noticed some interesting patterns emerging.

Current market snapshot paints a mixed picture. Nickel is trading at $15,732 per metric ton as of recent data, showing a healthy monthly increase of 5.09% from March levels. That’s encouraging news for anyone watching the short-term trends. However, zoom out to the yearly view, and we see a 7.87% decrease compared to the same period last year when prices sat at $17,438 per ton.

This price movement reflects the complex nature of commodity markets. Think of it like a roller coaster – there are ups and downs, but the overall direction depends on multiple forces working together.

Indonesia’s influence cannot be overstated here. As the world’s largest nickel producer, any policy shift from Jakarta sends ripples across global markets. Recent discussions about potential production cuts to address oversupply have caught investors’ attention, though institutions like UBS warn of persistent market surplus conditions.

The regulatory landscape adds another layer of complexity. US tax bill discussions could impact critical mineral projects, while export restrictions from major producers create supply chain uncertainties. It’s like trying to predict the weather when storm clouds are gathering on multiple horizons.

Investment risks in the nickel market deserve careful consideration:

- Market Volatility – Price swings can be dramatic due to supply-demand shifts and speculative trading

- Geopolitical Instability – Conflicts in producing regions or sanctions on suppliers like Russia can disrupt markets

- Technological Disruption – Future battery innovations might reduce nickel dependence

- Environmental Regulations – Stricter mining standards could increase costs or limit supply

Despite these challenges, the long-term outlook remains compelling. The global energy transition continues to drive demand, with the batteries segment expected to grow at a 7.2% annual rate through 2030. This growth story is backed by solid fundamentals – electric vehicles aren’t going anywhere, and neither is our need for renewable energy storage.

Future market projections suggest the nickel mining industry will reach $83.8 billion by 2030, growing at a steady 6.6% annually. The math is simple: more electric cars plus more renewable energy infrastructure equals more nickel demand.

The potential for price recovery exists, especially if Indonesia follows through on production cuts. However, timing these market movements requires patience and careful analysis of multiple data sources, including platforms like FintechZoom that aggregate real-time market intelligence.

Expansion in Nickel Mining Market Thriving from Heightened Demand Around the Globe

Is FintechZoom’s Nickel Data Reliable for Trading?

When it comes to making trading decisions, the quality of your data can make or break your strategy. So let’s have an honest conversation about fintechzoom.com nickel data and whether it’s something you can truly rely on.

The platform operates on what’s called a data aggregation model – essentially, it pulls information from various financial market sources and presents it in one convenient location. Think of it like a financial news buffet where everything is gathered in one place for easy access.

| Feature | FintechZoom.com | Institutional Sources |

|---|---|---|

| Data Reliability | Medium | Very High |

| Update Frequency | Real-time | Real-time |

| Analysis Depth | Basic to Intermediate | Advanced |

| Cost | Free (basic features) | Premium pricing |

Now, here’s where things get interesting. FintechZoom.com has some genuine strengths that make it appealing. The accessibility and cost factor is hard to beat – you can access basic nickel price tracking and market news without spending a dime. For many of us just starting to understand commodity markets, this is incredibly valuable.

The platform also excels at tracking retail sentiment and market narratives. Sometimes, what everyday investors are talking about can actually give you insights into where prices might be heading. It’s like having your finger on the pulse of the broader investment community.

However, we need to be realistic about the limitations. The biggest concern is source transparency – or rather, the lack of it. Unlike institutional sources like the London Metal Exchange that provide direct exchange data, FintechZoom aggregates from what research indicates are “uncited sources.” This means you can’t always trace back to where specific data points originated.

The depth of analysis is another consideration. While you’ll find basic charting tools and news updates, you won’t get the sophisticated algorithms or granular historical data that professional trading platforms offer. It’s the difference between getting a weather forecast from a local news app versus a specialized meteorological service.

Here’s the practical approach we recommend: treat fintechzoom.com nickel as an excellent supplementary tool rather than your primary data source. Cross-verification is absolutely essential – always check the information against authoritative sources like the LME or other established commodity exchanges.

Think of FintechZoom as your “narrative scanner” – it’s fantastic for understanding what the broader market is discussing and for staying updated on general trends. But when it comes to making serious trading decisions, pair these insights with more robust, transparently sourced data.

The platform works best when you use it as part of a broader information strategy. Get your market sentiment and general updates from FintechZoom, but verify critical data points with institutional-grade sources before making any significant moves.

Even the most reliable data platform should never be your only source of information when real money is on the line.

Frequently Asked Questions about Fintechzoom.com Nickel

Let’s address the most common questions we hear about using fintechzoom.com nickel for market tracking and analysis. These answers should help clarify how the platform works and what you can expect from it.

Is FintechZoom.com free to use for nickel price tracking?

Yes, FintechZoom.com offers free access to its core features, including real-time fintechzoom.com nickel price tracking and general market news. This makes it wonderfully accessible for anyone wanting to stay informed about nickel markets without breaking the bank.

The free version gives you the essentials: live price updates, daily percentage changes, recent news feeds, and basic charting tools. It’s quite generous, actually – you can get a solid understanding of nickel market movements without spending a dime.

However, some of the more sophisticated analytical tools and advanced features may require a premium subscription. Think of it like having access to a well-stocked library versus having your own personal research assistant – both are valuable, but one offers more specialized support.

Can I trade nickel directly on FintechZoom.com?

No, FintechZoom.com is purely an informational platform – it doesn’t offer direct trading or brokerage services. Think of it as your market research hub rather than your trading desk.

What it does provide is incredibly valuable data and insights that can inform your trading decisions on other platforms. You’ll gather the intelligence on FintechZoom.com, then execute your trades through a separate brokerage or trading platform.

This separation actually works in your favor. It means FintechZoom.com can focus entirely on providing unbiased market information without any conflicts of interest that might arise from also handling trades.

How does FintechZoom get its nickel price data?

FintechZoom aggregates its data from multiple financial market sources, including major commodity exchanges, to give users a comprehensive view of price movements and market trends. It’s like having a skilled researcher who monitors various authoritative sources and compiles the most relevant information for you.

The platform pulls from established financial markets and exchanges to ensure you’re getting legitimate market data rather than speculation or outdated information. This aggregation approach means you’re seeing a broader picture of the nickel market rather than just one exchange’s perspective.

However, it’s worth noting that the specific origins of each data point aren’t always explicitly cited on the platform. While the data comes from reputable sources, this is something to keep in mind if you need complete transparency about data sourcing for your particular use case.

Conclusion

As we wrap up this comprehensive guide, it’s clear that fintechzoom.com nickel coverage provides an essential window into understanding one of today’s most fascinating and strategically important commodities. We’ve seen how nickel has evolved from a traditional industrial workhorse into a cornerstone of our green energy future – powering everything from the stainless steel in our kitchens to the batteries in our electric vehicles.

The journey we’ve taken together through this guide reveals nickel’s remarkable dual identity. On one hand, it remains the reliable backbone of stainless steel manufacturing, supporting 70% of global demand. On the other, it’s become the beating heart of the electric vehicle revolution, with battery applications growing at an impressive 7.2% annually.

FintechZoom.com emerges as a particularly valuable companion for anyone wanting to stay connected with this dynamic market. Its strength lies in making complex commodity data accessible and digestible – whether you’re tracking daily price movements, setting up alerts for significant changes, or simply staying informed about the latest supply chain developments from major producers like Indonesia.

What we especially appreciate about the platform is how it democratizes access to market information. You don’t need to be a professional trader or pay hefty subscription fees to understand what’s happening in the nickel market. The real-time tracking, historical charts, and news aggregation create a comprehensive picture that helps us make sense of this sometimes volatile commodity.

That said, we can’t stress enough the importance of taking a balanced approach to any financial data. Think of FintechZoom.com as your trusted starting point rather than your final destination. Cross-checking information with authoritative sources like the International Nickel Study Group and treating the platform as a powerful supplementary tool will serve you well in making informed decisions.

The future outlook for nickel remains compelling, with the global mining market projected to reach $83.8 billion by 2030. As the world continues its transition toward sustainable energy and electric mobility, understanding nickel’s role becomes increasingly valuable – not just for investors, but for anyone curious about the materials shaping our technological future.

At Beyond Beauty Lab, we believe that knowledge empowers better choices, whether we’re talking about skincare ingredients or strategic commodities. Just as we help our readers steer the complex world of beauty and wellness, we’re committed to providing educational resources that illuminate diverse topics that impact our daily lives.

The intersection of technology, sustainability, and smart investing continues to evolve, and staying informed helps us all make more thoughtful decisions about our future.