What is FintechZoom and Why Does It Matter?

The fintechzoom.com economy represents a new era of financial intelligence where technology meets investment wisdom. Unlike traditional financial media that often lags, FintechZoom delivers real-time insights across stocks, cryptocurrency, and digital banking innovations.

Quick Answer: What is the FintechZoom.com Economy?

- Real-time financial platform covering stocks, crypto, and fintech trends

- Market analysis methodology combining technical indicators with fundamental research

- Educational focus making complex financial concepts accessible to everyone

- Global coverage of economic indicators, regulatory developments, and emerging technologies

- Target audience includes retail investors, business professionals, and fintech enthusiasts

FintechZoom is a specialized platform that bridges the gap between traditional finance and emerging technologies. It covers everything from S&P 500 performance to Bitcoin price movements and neobank growth. With features like AI-driven analytics processing 2.8 million data points per second, FintechZoom shows how financial information is evolving in our digital-first world.

As of June 2025, Bitcoin trades at $106,678, the S&P 500 shows a 9.64% year-to-date performance, and the global neobanking market is projected to reach $210.16 billion. This highlights the importance of understanding how technology is reshaping every aspect of finance—from how we bank and invest to how we think about money.

Fintechzoom.com economy terminology:

What Defines the FintechZoom.com Economy?

The fintechzoom.com economy describes the platform’s unique approach to navigating the modern financial landscape by blending traditional economic analysis with advancements in financial technology. Its primary focus is the intersection of finance and technology, covering global economics, stock markets, and monetary policy through a distinct fintech lens.

The platform provides real-time data and insights that often precede mainstream news, giving users an edge. For instance, during the SVB collapse, FintechZoom reportedly surfaced critical information hours before traditional media. It contextualizes macroeconomic trends for their fintech implications, such as how interest rate changes affect digital assets or how new regulations impact decentralized finance. That’s the core of the fintechzoom.com economy.

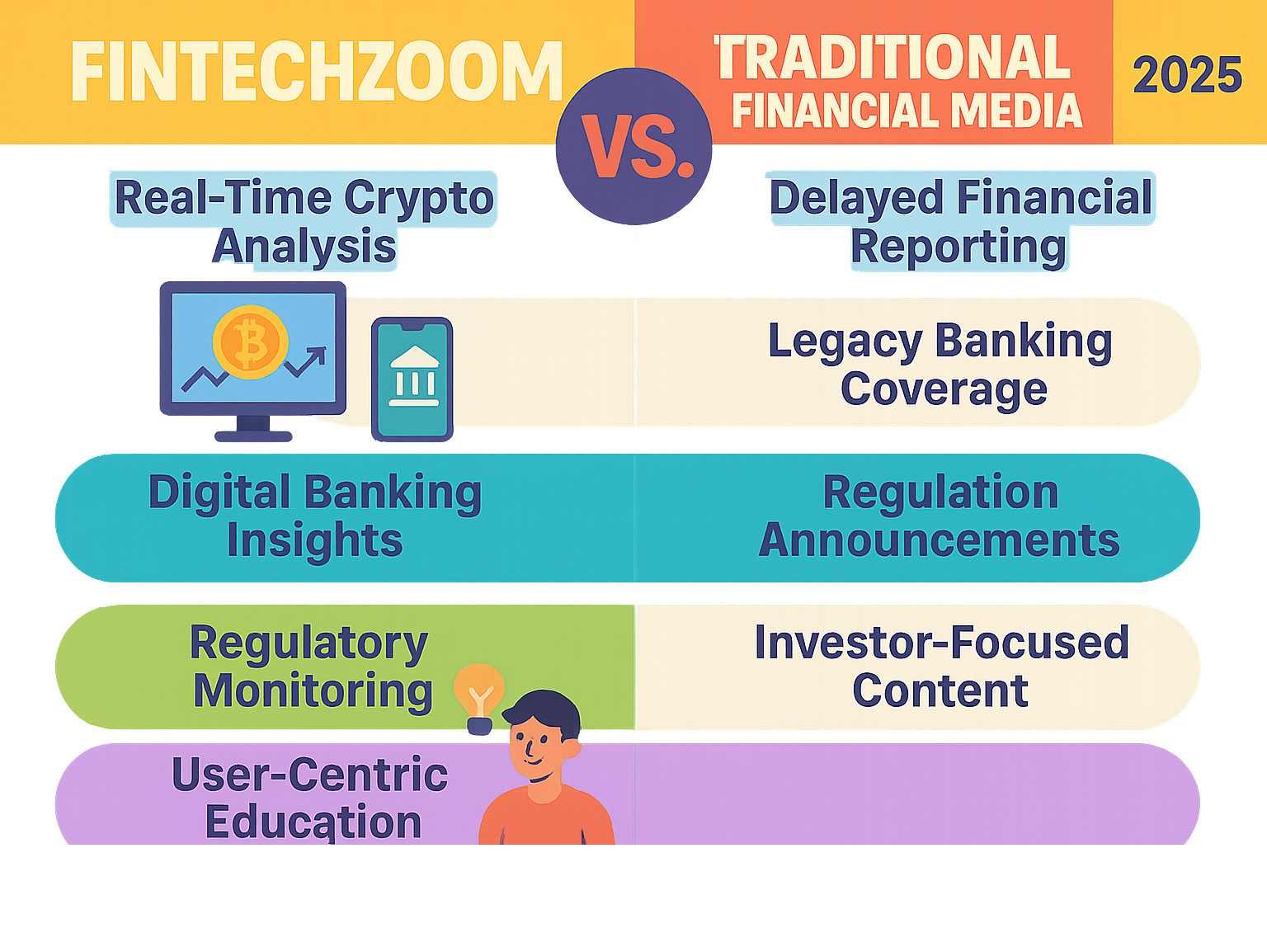

Differentiating from Traditional Financial News

FintechZoom stands out from other financial news outlets in several key ways:

- Niche Focus: It has a sharp, specialized focus on financial technology, from blockchain integration to strategic shifts in neobanking.

- Real-Time Crypto Analysis: It offers real-time price tracking for Bitcoin, Ethereum, and altcoins, alongside in-depth on-chain analytics and market cap rankings.

- Digital Banking Deep Dives: It dissects digital banking growth, adoption trends, and how traditional banks are integrating AI and blockchain.

- Regulatory Monitoring: It provides critical updates on developments like the EU MiCAR regulation, US cryptocurrency clarity, and open banking standardization.

- User-Centric Education: It democratizes financial knowledge by breaking down complex concepts into plain language through explainer articles and tutorials.

- Actionable Insights: It offers AI-driven analytics, “Conviction Scores,” and market analysis that combines technical indicators with fundamental research.

- Democratizing Finance: By simplifying complex topics and making expert-level analysis accessible, FintechZoom levels the playing field for all investors.

FintechZoom provides a comprehensive, technologically advanced, and education-focused portal into the future of finance.

Deconstructing the Core Components of FintechZoom’s Coverage

The fintechzoom.com economy excels at integrating different parts of the financial world. Rather than isolating stocks, crypto, and digital banking, FintechZoom presents a cohesive story of how money and technology are interconnected and reshaping our lives.

This approach connects the dots between market movements. When Bitcoin moves, how does that affect fintech stocks? When a new digital banking regulation passes, what does that mean for your portfolio? These connections are vital in today’s financial landscape.

Stock Market and Major Indices Analysis

FintechZoom’s stock market coverage goes beyond basic tickers. The platform delivers real-time data and context for major indices like the S&P 500, Nasdaq Composite, Dow Jones, and FTSE 100.

The platform makes technical indicators like moving averages, Bollinger Bands, and RSI accessible by explaining them in plain English. This is paired with fundamental research, providing access to revenue data, profit margins, and cash flow statements. This dual approach gives a clearer picture of market dynamics.

The AI-driven insights process millions of data points per second during trading hours, spotting patterns that human analysts might miss. For example, users following its insights on NVIDIA’s Q3 2023 earnings reportedly gained 8% before mainstream media caught on.

Market sentiment analysis adds another layer of intelligence. When major economic reports are released, FintechZoom immediately analyzes how these developments might ripple through different market sectors.

For those wanting to explore deeper market insights, you can find more info about market trends that builds on these foundational concepts.

Cryptocurrency and Digital Asset Intelligence

Cryptocurrency coverage is a core strength of the fintechzoom.com economy. The platform’s analysis engine operates 24/7, tracking the crypto market with precision.

Bitcoin and Ethereum receive special attention as institutional assets, with expert projections for Bitcoin ranging from $125K to $200K by the end of 2025. FintechZoom tracks every development that could influence these projections.

The on-chain analytics feature allows users to dig into blockchain data. Currently, low Bitcoin institutional reserves on exchanges suggest a trend toward self-custody and long-term holding strategies.

ETF inflows are a crucial metric, with Bitcoin ETFs averaging 12,700 Bitcoin per week in inflows. FintechZoom tracks these numbers as they reveal institutional sentiment.

The Fear & Greed Index, currently at 57 (neutral), is used alongside other tools to gauge whether the market is driven by rational analysis or emotional reactions.

Market sentiment analysis provides essential support and resistance levels, like Bitcoin’s current $102K-$104K support zone, for making trading decisions. Regulatory developments are also closely monitored to help users understand their implications.

For insights into how stock performance correlates with crypto movements, check out more info about stock performance.

The Pulse of Digital Banking and Fintech Innovation

Digital banking is completely reimagining how financial services work, and FintechZoom’s coverage is at the forefront of this shift.

Neobanking growth is explosive, with the global market projected to grow from $143.29 billion in 2024 to $210.16 billion in 2025—a 48.9% growth rate. This signals a permanent shift in how we manage money.

Embedded finance, the integration of financial services into non-financial apps, is another frontier. This market is projected to reach $7.2 trillion by 2030, and FintechZoom covers every major development.

Blockchain integration is revolutionizing payment systems and reducing cross-border payment costs by up to 80%, a fundamental shift affecting everyone from small businesses to multinational corporations.

AI in finance is actively reshaping fraud detection, risk assessment, and personalized banking. FintechZoom’s own platform demonstrates this power, offering predictive models that can reduce portfolio volatility.

Payment systems are also evolving. Real-time payment networks like Australia’s PayTo are achieving high conversion rates, and the RTP network processed 64 million transactions totaling $34 billion in Q3 2023. These numbers show how quickly money moves in our digital economy.

The platform covers three key innovations reshaping finance: AI-driven predictive modeling, Banking-as-a-Service compliance, and real-time payment networks.

Navigating the FintechZoom.com Economy: A June 2025 Snapshot

Understanding the fintechzoom.com economy requires familiarity with current market conditions. FintechZoom’s analysis provides a clear picture of the financial landscape, helping you understand what might happen tomorrow.

In June 2025, several key factors are shaping how we think about money, investing, and financial technology.

Current Economic and Market Conditions

Let’s start with the big picture. The Federal Funds Rate is at 4.50%-4.75%, with predictions of a drop to 3.25%-3.50% by year-end. Cheaper borrowing could boost funding for innovative fintech startups.

Tariff rates are averaging 15%, the highest since the 1930s. This creates ripple effects through global supply chains and impacts fintech companies with international partnerships.

In traditional markets, the S&P 500 is at 5,973, up 9.64% year-to-date. The Nasdaq is in recovery mode, which is relevant for the many fintech companies trading on the exchange. International markets are outperforming the US with gains of 12-15%.

For crypto enthusiasts, Bitcoin is trading at $106,678 with a 3.7% monthly gain, and expert predictions for year-end range from $125,000 to $200,000. Ethereum is at $2,555, showing a 50% monthly change and nearing the $3,000 resistance level.

The total crypto market cap is $3.27 trillion, despite a slight recent dip, telling a story of a maturing but still volatile market.

Investment Strategies within the FintechZoom.com Economy

FintechZoom helps you make sense of what these numbers mean for your investment decisions.

Portfolio allocation is crucial in this environment. The platform often recommends a conservative crypto allocation of 5-10% for most portfolios, allowing participation in growth potential without excessive risk.

The platform excels at identifying growth-oriented fintech stocks in areas like neobanking, payment processing, and embedded finance. These companies are building the financial infrastructure of the future.

Risk management is handled through sophisticated tools that monitor market concentration, regulatory uncertainty, and cybersecurity risks. Its AI processes millions of data points to create “Conviction Scores” that combine social sentiment, options flow, and institutional moves into weighted forecasts.

This approach combines technical and fundamental analysis, providing support and resistance levels, Fear & Greed Index readings, and moving averages alongside institutional adoption data and regulatory impact assessments.

This comprehensive view is important for your overall financial health. Understanding how economic shifts impact everything from investments to personal finance, including factors that influence more info about your credit score, helps build a resilient financial foundation.

The Future According to FintechZoom: Trends to Watch

The fintechzoom.com economy isn’t just about the present; it’s about future trends that will reshape how we handle money. The platform’s value lies in its ability to spot patterns before they become mainstream, helping you get ahead of the curve.

Emerging Technologies Shaping Finance

The financial world is undergoing a technological revolution, and these innovations will change how you bank, invest, and think about money.

AI in Financial Services is a major game-changer. It enables advanced fraud detection, personalized investment advice, and predictive market analysis.

Central Bank Digital Currencies (CBDCs) are on the horizon. Government-issued digital currencies could revolutionize international money transfers and monetary policy.

Decentralized Finance (DeFi) 2.0 is maturing beyond its initial phase, with more sophisticated lending protocols and financial products that rival traditional banking.

Quantum Computing in Fraud Detection promises to make financial security virtually unbreakable while processing complex calculations at incredible speeds.

Sustainable Finance (ESG) Technology Integration is changing responsible investing. FintechZoom covers platforms that help you build value-aligned portfolios and track the environmental impact of your investments.

The Evolving Regulatory Landscape

Technology moves at lightning speed, while regulations often lag. FintechZoom’s coverage helps you steer this complex landscape.

The EU MiCAR Regulation, implemented in December 2024, is setting a global standard for crypto regulation, bringing much-needed clarity to the market.

US Crypto Clarity is progressing, with efforts to create a coherent regulatory framework that protects consumers without stifling innovation.

BaaS Compliance Rules are evolving as more fintech companies offer banking services. FintechZoom helps you understand how these rules affect payment apps and investment platforms.

Open Banking Standardization is making it safer and easier for different financial services to work together, leading to better apps and more competitive rates.

Following these developments through the fintechzoom.com economy lens provides context, not just news, helping you understand why these changes matter for your financial decisions.

For those looking to capitalize on these trends, you can explore more info about 5-star stocks to see which companies FintechZoom highlights as potential winners.

Frequently Asked Questions about the FintechZoom.com Economy

Navigating the financial technology world can be overwhelming. Here are answers to common questions about the fintechzoom.com economy and how the platform can help you understand it.

Is FintechZoom.com a reliable source for beginners?

Yes, absolutely. FintechZoom is designed for newcomers. It uses plain language to break down complex concepts like blockchain or market volatility into understandable pieces.

The platform’s user-centric education approach includes explainer articles, tutorials, and guides on topics ranging from making a first stock purchase to understanding cryptocurrency. The accessible content allows you to start at any level and build financial literacy at your own pace.

What tools does FintechZoom offer for analysis?

FintechZoom is packed with practical tools to help you make better financial decisions. Its real-time charting lets you see market movements as they happen. Technical indicators are presented in a way that helps you spot trends without a finance degree.

These tools are improved by AI-driven analytics that process over 2.8 million data points per second. A key feature is the Conviction Scores, which combine social sentiment, institutional flows, and market movements to provide insight into where smart money may be heading.

You can also create custom watchlists to track your investments and set up personalized alerts to stay informed about important market movements.

How does FintechZoom help users understand the intersection of finance and technology?

FintechZoom excels at showing how traditional finance and modern technology are merging.

The platform contextualizes macro trends, explaining how events like Federal Reserve interest rate changes affect neobank growth and cryptocurrency prices. It continuously analyzes tech disruption, covering how AI is changing fraud detection and how blockchain is revolutionizing payments.

Regulatory changes are closely monitored, with updates on crucial developments like the EU’s MiCAR regulation or new BaaS compliance rules. These updates are vital as they directly impact investment opportunities.

Most importantly, FintechZoom provides educational guides on blockchain and DeFi that are clear and easy to understand. The fintechzoom.com economy represents this blend of financial wisdom and technological innovation, helping you understand trends and find opportunities.

Conclusion: Integrating Financial Wellness into Your Life

As we’ve explored the fintechzoom.com economy, it’s clear we live in an era of rapid, tech-driven financial change. We’ve found that platforms like FintechZoom are essential resources for anyone wanting to thrive in this digital-first financial world.

We’ve covered real-time stock analysis, cryptocurrency insights, the growth of neobanking, and emerging technologies like AI in finance. The fintechzoom.com economy represents this new reality where staying informed requires the right tools, data, and educational resources to make sound decisions.

At Beyond Beauty Lab, we believe true wellness is holistic. Just as you make informed choices about your skincare routine, we recognize that financial health is a crucial component of your overall well-being. Understanding your financial landscape—from interest rates to blockchain technology—is deeply empowering.

Financial literacy is a form of self-care. When you understand concepts like portfolio allocation or risk management, you’re taking control of your future with the same intention you apply to your physical and mental health.

Resources like FintechZoom are valuable because they are committed to making complex topics accessible. The platform breaks down everything from Bitcoin price movements to decentralized finance into language that makes sense. It’s education without intimidation.

Staying ahead of the technological curve is no longer just for tech experts. Developments like AI and Central Bank Digital Currencies will impact all of us. Having reliable sources helps us steer these changes with confidence.

Integrating financial intelligence into our daily lives is as important as any other wellness practice. It’s about being prepared, recognizing opportunities, and making choices that align with our long-term goals.

Your financial journey is personal. Having the right information and tools makes all the difference. Whether you’re diversifying your portfolio or exploring new opportunities, taking the first step toward greater financial understanding is an investment in yourself.

Ready to take the next step? Take control of your financial future by exploring real estate investment strategies that can help build long-term wealth and security. After all, your financial wellness deserves the same thoughtful attention you give to every other aspect of your well-being.