Understanding 5starsstocks.com: An AI-Powered Investment Platform

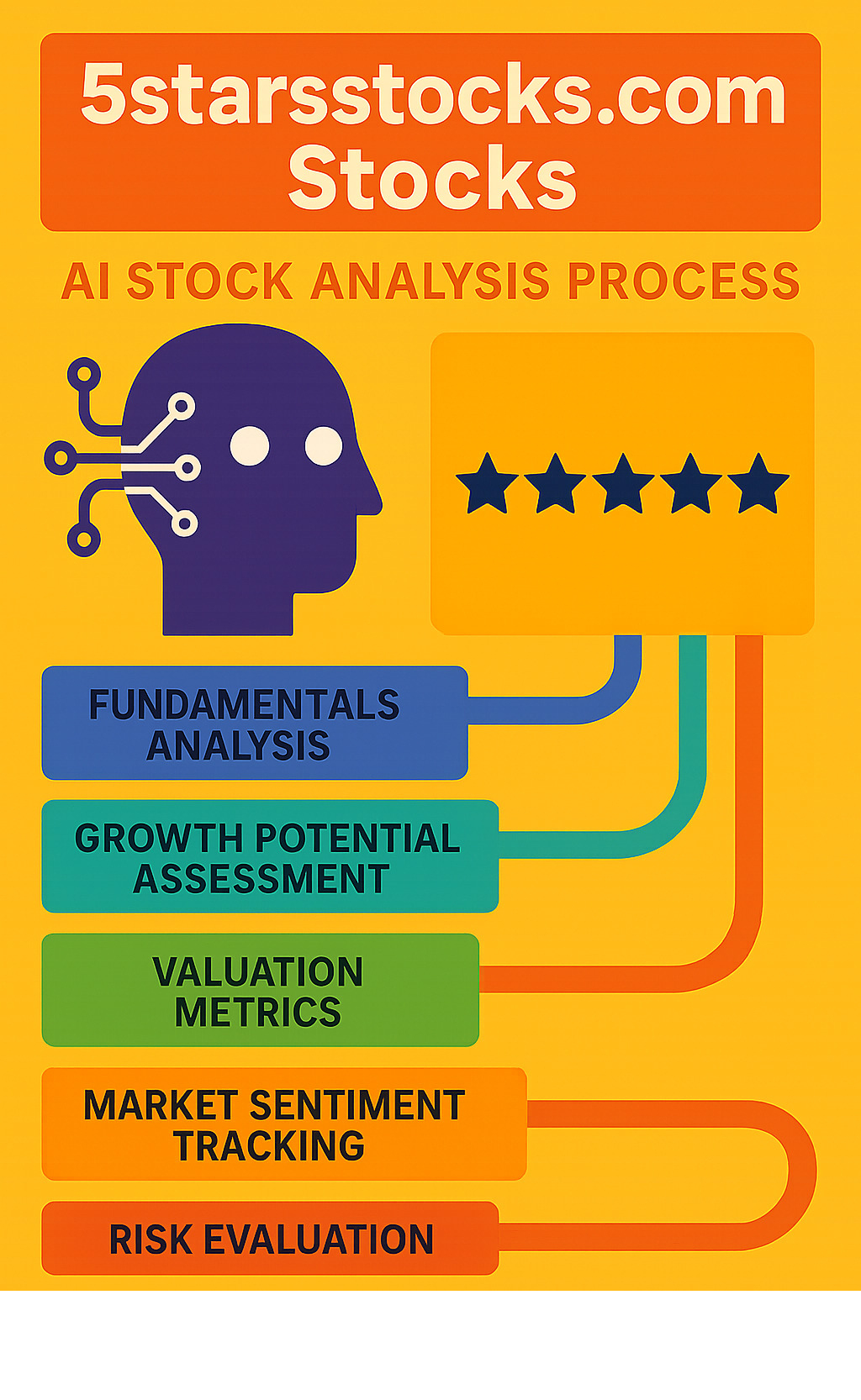

5starsstocks.com stocks are analyzed through an AI-powered platform that launched in 2023, offering stock recommendations using a five-star rating system. The platform aims to simplify investment decisions by evaluating stocks across five key areas: fundamentals, growth potential, valuation, market sentiment, and risk assessment.

Key Facts About 5starsstocks.com:

- What it is: AI-driven stock analysis platform with free access to curated lists and educational content

- Rating system: Five-star scoring based on multiple financial metrics and market data

- Accuracy claims: Platform advertises 70% accuracy rates (unverified)

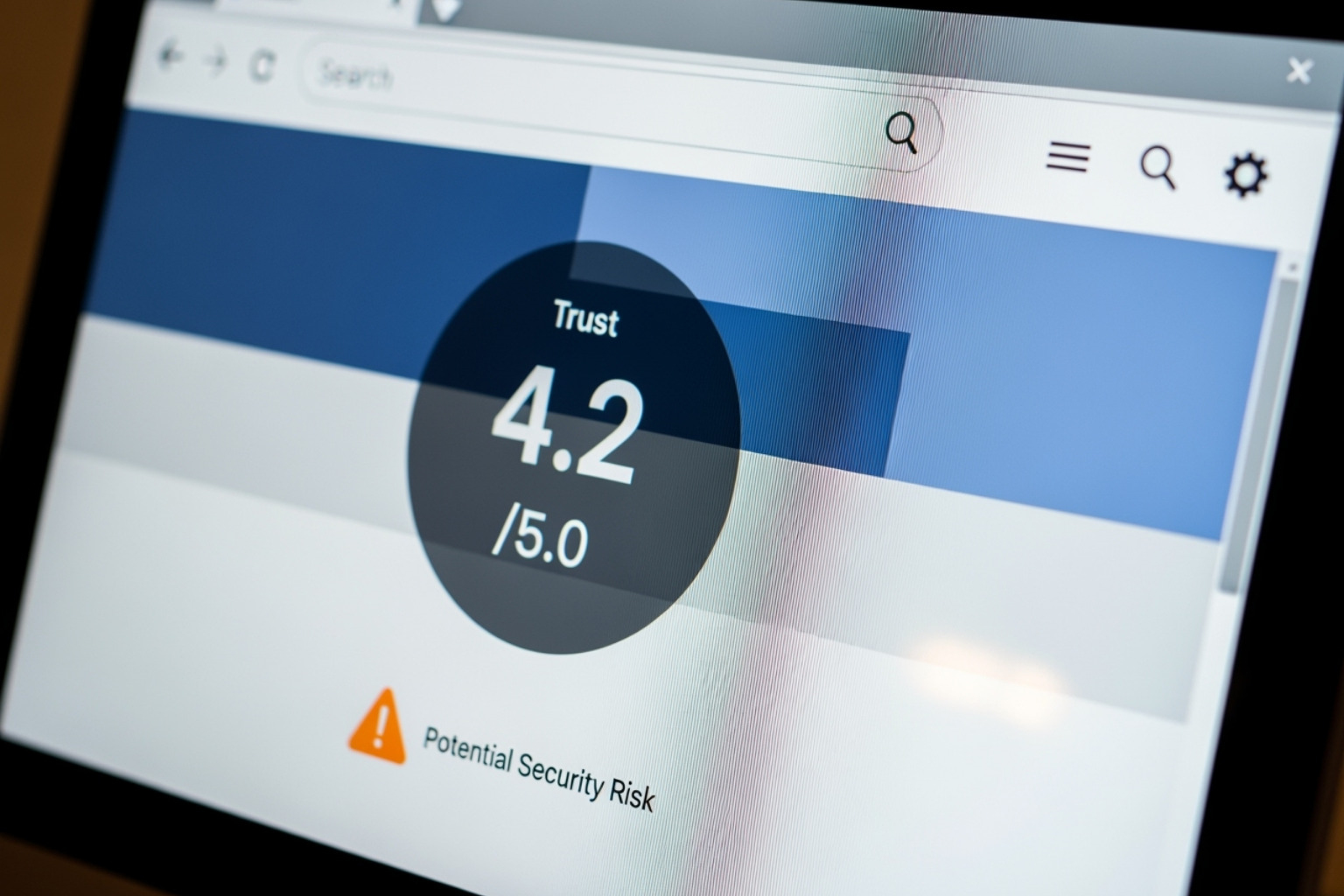

- Trust score: ScamAdviser rates it 66/100 due to anonymous ownership and recent launch

- Best for: Beginners seeking simplified analysis and experienced traders looking for new stock ideas

- Limitations: US-centric focus, unverified track record, should be used alongside other research sources

The platform targets both novice investors and experienced traders. However, it operates as a content website, not a regulated investment advisor, so users must approach its recommendations with caution. Real user experiences vary, with some reporting gains (a 34% return on lithium stocks) and others losses (a 67% drop on cannabis recommendations). This highlights the need to treat the platform as a starting point for research, not a definitive guide. The main challenge is balancing its accessibility against its transparency issues and unverified performance claims.

5starsstocks.com stocks terms explained:

What is 5starsstocks.com?

At its core, 5starsstocks.com is an AI-powered platform designed to simplify stock picking. Launched in 2023, it guides investors by identifying what it considers top stocks through its unique five-star rating system. While it provides valuable research tools, it operates as a content website, not a regulated investment advisor. It offers analysis and recommendations with a primary focus on US-centric stocks, so investors with international portfolios will need to supplement their research.

Who is This Platform For?

5starsstocks.com appeals to a broad range of investors. Novice investors will find the user-friendly interface and simplified analysis a great starting point for those new to the stock market. Self-directed traders can use the platform as an idea-generation tool to quickly highlight potential opportunities. Users seeking new stock ideas can benefit from the platform’s curated lists and AI-driven insights, which provide fresh perspectives for various investment strategies. Individuals interested in educational content can use the site’s articles, videos, and webinars to build their investment knowledge.

How the Five-Star AI Rating System Works

The core of 5starsstocks.com stocks is its AI-driven five-star rating system, which analyzes market data to identify promising investment opportunities. The platform uses artificial intelligence and machine learning to process vast amounts of financial data and generate predictive insights. The platform claims a 70% accuracy rate, though this lacks independent verification, and user experiences vary.

The system’s strength is its ability to balance multiple factors simultaneously, creating a more complete picture of each stock’s potential beyond just profitability or growth.

The Five Pillars of Analysis

The AI evaluates each stock across five key areas to generate its final star rating.

Fundamentals form the foundation. The AI examines company health by analyzing consistent earnings, revenue growth, profit margins, and debt levels to find businesses with solid financial footing.

Growth potential looks to the future, predicting how much a company’s earnings and revenue might expand. It identifies businesses entering new markets, increasing market share, or developing innovative products.

Valuation answers whether a stock is fairly priced. The AI assesses if the current stock price represents good value compared to the company’s intrinsic worth, hunting for bargains.

Market sentiment gauges the collective mood of investors. By analyzing news, social media, and trading volumes, the AI determines if the market feels optimistic or pessimistic about a stock.

Risk assessment quantifies potential downsides. It considers factors like stock price volatility, industry-specific challenges, and broader market conditions to help investors understand potential risks.

These five pillars create a comprehensive snapshot of each stock. For more on how such platforms operate, you can learn about A legitimate stock analysis platform.

How the AI Identifies Potential 5starsstocks.com Stocks

Sophisticated algorithms work to identify investment opportunities through several methods.

Pattern recognition allows the system to sift through historical data, searching for patterns that previously indicated successful stock movements.

Quantitative modeling uses complex mathematical models to analyze financial metrics, market trends, and economic indicators to predict future performance.

Scanning market trends keeps a constant eye on emerging sectors, identifying shifts in investor interest before they become mainstream.

Processing financial data from earnings reports and balance sheets happens at high speed, allowing the AI to spot opportunities or red flags almost instantly.

When these factors align, the system generates alerts and “Buy Now” suggestions. These notifications highlight opportunities the AI believes are ready for investment. However, these suggestions should be treated as starting points for your own research, not as definitive commands.

Unpacking 5starsstocks.com Stocks: Legitimacy, Risks, and Real User Reviews

When evaluating a new platform like 5starsstocks.com stocks, it’s important to consider its legitimacy, potential risks, and what actual users are experiencing.

Is 5starsstocks.com a Legitimate Platform?

The answer isn’t straightforward. ScamAdviser gave 5starsstocks.com a score of 66/100, which it classifies as a “very low trust score.” This doesn’t automatically mean it’s a scam, but there are red flags. The platform is new, having launched in 2023, so it lacks a long-term track record.

Ownership is also unclear, as the platform uses privacy services to hide its operators’ identities. We know the founder is David Cornsweet, a psychologist, but the broader team is not public. A major concern is the platform’s claim of a 70% accuracy rate, which is not independently verified. The aggressive marketing can also suggest higher returns or lower risks than is typical for stock investing.

Crucially, 5starsstocks.com is a content website, not a regulated financial advisor. This means it lacks the oversight of traditional investment firms, placing more responsibility on the user to perform due diligence.

For those interested in staying current with broader market movements, you might find More info about market trends helpful for additional context.

Reported Pros and Cons

Here is a summary of the platform’s strengths and weaknesses:

Pros: The platform offers free access to articles, curated lists, and core features. It has a user-friendly interface that’s easy to steer for beginners, is great for idea generation and finding new investment opportunities, and provides educational content including articles and learning resources. It also features AI-powered analysis that processes data faster than manual research.

Cons: It is a new platform with no long-term track record, and its performance claims are unverified and lack an independent audit. It has a low trust score (66/100) from ScamAdviser, a US-centric focus that limits international investment options, and the potential for overly optimistic recommendations without proper context.

The platform’s main benefits are its accessibility and educational focus. However, the limitations are significant. The lack of a verified track record and the low trust score mean users should proceed with caution and always cross-reference recommendations.

Real User Experiences and Success Stories

User reviews for the platform are mixed. Some investors report success, such as a 34% return on lithium stocks based on the platform’s recommendations. These users often treat the platform as a research starting point.

Conversely, other users report significant losses, including a 67% loss on cannabis stock recommendations. These stories are a reminder that no AI can predict market movements with certainty. Both wins and losses appear concentrated in volatile sectors like lithium and cannabis, suggesting the platform may favor momentum plays.

This mixed feedback highlights why you should never rely on a single source for investment decisions. While 5starsstocks.com stocks can provide ideas, your own due diligence is essential. For those interested in learning about successful investment approaches, you might find More info on high-profile investors educational.

Key Features and How 5starsstocks.com Compares to Alternatives

Core Features and Tools for Investors

5starsstocks.com stocks are presented through a toolkit that prioritizes simplicity and functionality for everyday investors.

The curated stock lists organize top-rated picks into categories like AI, Defense, Dividend, Lithium, and Cannabis stocks. This helps users sort through market noise efficiently.

Real-time market data, including stock quotes, market indices, and trading volumes, keeps users connected to current market movements.

The interactive stock heat map offers a visual snapshot of market performance, allowing users to spot trends at a glance.

Portfolio tracking and alerts let users monitor their holdings and receive personalized notifications about significant events, such as unusual trading volume or shifts in market sentiment.

Finally, the platform provides educational resources, including articles, video tutorials, and webinars, to help users become more informed investors.

5starsstocks.com vs. Established Platforms

Comparing 5starsstocks.com stocks to industry giants like Morningstar and Zacks reveals different strengths for different investor types.

Morningstar is the standard for deep, fundamental analysis conducted by verified CFA analysts. Its research is transparent and well-documented, making it ideal for investors who want comprehensive reports and detailed financial models. This depth comes with subscription fees and a steeper learning curve.

Zacks focuses on earnings momentum and growth, particularly for US mid-cap stocks. It excels at tracking earnings estimate revisions and identifying momentum plays, making it powerful for traders who prioritize growth and are willing to pay for premium tools.

5starsstocks.com serves as an approachable middle ground. Its AI-driven approach simplifies market data into actionable recommendations, and its free access makes it available to all. The trade-offs are its unverified performance claims, anonymous ownership, and less in-depth analysis compared to established platforms.

We see 5starsstocks.com as an excellent starting point for idea generation and learning. However, it works best when combined with research from more established sources. Its strength is democratizing investment research, even if it doesn’t yet match the institutional-grade analysis of its competitors.

How to Get Started and Use 5starsstocks.com Effectively

Getting started with 5starsstocks.com stocks is straightforward, but using it effectively requires a thoughtful and disciplined investment strategy. Investing always carries risks, and no AI system can guarantee returns.

A Step-by-Step Guide for New Users

Follow these steps to begin using the platform.

- Create an account: Go to the 5starsstocks.com website and sign up with your email and a secure password.

- Explore the dashboard: Familiarize yourself with the interface, which includes sections for top-rated stocks, market news, and analytical tools.

- Set up watchlists: As you browse stocks, add companies that interest you to a watchlist. This allows you to monitor their performance and receive alerts without committing capital.

- Use the stock screener: Filter the thousands of available stocks by sector, market size, or rating criteria to create a manageable shortlist custom to your interests.

- Access educational content: Use the articles, video tutorials, and webinars to build your knowledge, from basic concepts to advanced strategies. If you’re new to investing, starting with What are stocks? can provide a helpful foundation.

Best Practices for Using 5starsstocks.com Stocks Recommendations

To use the platform wisely and protect your financial wellness, follow these best practices. It is essential to cross-reference with other sources; treat 5starsstocks.com stocks recommendations as a starting point and always verify suggestions with financial news outlets, company reports, or your broker’s research. You should consider paper trading before risking real money by using a virtual portfolio to test the platform’s recommendations for at least 30 days to see how they perform in real market conditions. Diversify your portfolio by not putting all your capital into one stock or sector and keeping speculative investments to a small portion of your total portfolio (e.g., less than 5%). Set stop-loss orders to protect yourself from significant losses by setting orders that automatically sell a stock if it drops to a predetermined price (e.g., a 15% decline). Conduct your own fundamental analysis by reviewing company reports, understanding their business models, and assessing their financial health yourself. The platform’s insights should complement, not replace, your own research. Lastly, verify information; the platform’s 70% accuracy claim is unverified, so treat such claims with healthy skepticism and base your decisions on facts you can confirm.

Frequently Asked Questions about 5starsstocks.com

Here are answers to the most common questions about 5starsstocks.com stocks.

Is 5starsstocks.com free to use?

Yes, 5starsstocks.com is currently free to use. You can access its articles, curated stock lists, and basic analysis tools without a subscription. This makes it appealing for those just starting or testing the platform. However, platforms sometimes introduce premium features later, so it’s wise to check their website for the latest pricing information.

Can I trust the platform’s “Buy Now” suggestions?

The short answer is to treat these suggestions as starting points for research, not as final decisions. A “Buy Now” alert is an idea worth investigating, but it is not regulated financial advice. The platform is a content website, not a registered investment firm, so it lacks the same oversight and accountability.

We strongly recommend using these suggestions to begin your own research. Cross-check them with established sources, review the company’s financials, and consider how the investment fits your overall strategy. The mixed user experiences – some with gains, others with losses – illustrate why your own due diligence is crucial.

Does 5starsstocks.com cover international stocks?

The platform’s coverage of 5starsstocks.com stocks is heavily focused on US markets and companies listed on American exchanges. You will not find comprehensive coverage of European, Asian, or other emerging market stocks.

If international diversification is a key part of your strategy, you will need to supplement your research with other tools, such as those provided by major brokerages. For many investors, especially beginners, the US-centric focus can help simplify the investment process.

Conclusion: Is 5starsstocks.com Worth Your Time?

After a deep dive into 5starsstocks.com stocks, we see a platform with both promising innovation and reasons for caution. Its AI-driven approach makes complex financial data more accessible, and its user-friendly interface and educational content are genuinely helpful for building investment knowledge.

For new investors, 5starsstocks.com stocks can serve as an excellent starting point, offering simplified analysis and curated lists to build confidence. Seasoned investors may also find value in the AI’s ability to spot patterns and generate fresh ideas.

However, there are significant drawbacks. The platform is new and lacks a proven track record through various market cycles. The anonymous ownership and unverified 70% accuracy claim raise transparency issues that cannot be ignored. Real user experiences are mixed, reinforcing that no platform can eliminate the inherent risks of the stock market.

So, is it worth your time? Yes, if you approach it with the right mindset. Use it as a tool for idea generation, not as the final word on your investments. Combine its insights with your own research, cross-reference its suggestions with established sources, and never invest more than you can afford to lose.

The platform is best viewed as one tool in a larger investment toolkit, particularly for education and brainstorming. True financial wellness, much like the beauty and wellness journey we champion at Beyond Beauty Lab, comes from a holistic and informed approach. Just as you wouldn’t rely on a single product for all your skincare needs, you shouldn’t depend on one platform for all your investment decisions.

To continue expanding your financial knowledge, we invite you to Explore more financial insights and our mission of empowering you to make informed decisions in all areas of your life.