The Growing Need for Reliable Investment Guidance

5starsstocks .com has emerged as one of the more talked-about investment platforms in recent online discussions, but its legitimacy remains a significant concern for potential users. This platform claims to offer AI-powered stock analysis, trade alerts, and educational resources to help investors make informed decisions.

Quick Answer for 5starsstocks .com:

- What it is: An investment platform offering stock ratings, trade alerts, and educational content

- Red flags: Anonymous team, unverified performance claims, no regulatory oversight

- Trust score: 66/100 on ScamAdviser (moderate trust level)

- Cost: $99-$299 per month depending on subscription tier

- Bottom line: Lacks transparency and accountability expected from financial platforms

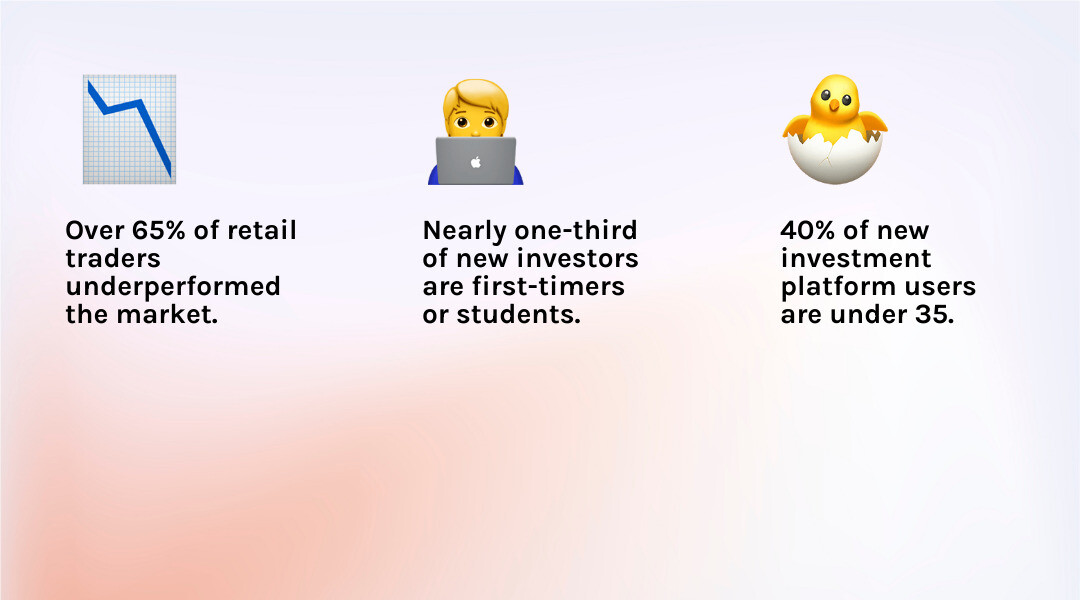

The rise of retail investing has created a massive demand for accessible investment guidance. Thousands of new investors are actively seeking trustworthy tools and resources to help steer the complexities of the market, according to recent industry analysis.

However, this surge has also led to the emergence of platforms that make bold claims without proper verification. The challenge lies in distinguishing between legitimate resources and those that may mislead investors with unsubstantiated promises.

5starsstocks .com represents a common dilemma in today’s financial landscape: a platform that appears polished and professional on the surface but raises serious questions about transparency, accountability, and regulatory compliance when examined more closely.

Understanding these concerns is crucial for anyone considering using such platforms, especially those new to investing who may be more vulnerable to misleading information.

Common 5starsstocks .com vocab:

What is 5starsstocks.com and What Does It Claim to Offer?

At first glance, 5starsstocks .com presents itself as a comprehensive investment resource to help everyday investors steer stock trading. It claims to bridge the gap between complex financial data and practical investment decisions, making professional-grade analysis accessible. The platform positions itself as a personal financial advisor, market analyst, and educational resource in one package. Whether you’re a seasoned trader or a beginner, 5starsstocks .com claims to offer value.

The Core Services Explained

The core of 5starsstocks .com is its suite of services for different investment styles. It’s like a financial Swiss Army knife with tools for various investment challenges.

Stock recommendations form the backbone of their offering. The platform claims to provide researched investment opportunities backed by data analysis, presented through a proprietary rating system.

For active traders, 5starsstocks .com offers swing trade alerts and options trading recommendations. They boast a 78% success rate for swing trades and a 55% average return for options trading. However, these performance claims are unverified by independent sources.

The platform also caters to long-term investors, claiming a 42% average ROI for their long-term picks, which would outpace most traditional investments if true.

Their AI-powered screener sounds modern, but its sophistication is unclear. This tool supposedly helps users filter stocks to find opportunities based on specific criteria.

For newcomers, 5starsstocks .com provides educational resources and beginner-friendly guides to help users understand trading strategies, risk management, and their ratings.

The platform’s philosophy is “consistent winners don’t chase headlines – they follow systems.” It positions itself as that system, offering a structured approach to stock selection over market hype.

Understanding the Five-Star Rating System

The centerpiece of 5starsstocks .com is its five-star rating system. Each company is rated from one to five stars based on performance across multiple criteria, simplifying complex financial data for easy understanding. A five-star rating suggests strong performance, while a one-star rating indicates significant concerns.

The ratings are built on five core evaluation pillars:

- Financial health examines a company’s balance sheet, debt, cash flow, and stability.

- Growth potential evaluates prospects for expansion, including revenue growth and market opportunities.

- Valuation metrics help determine if a stock is fairly priced, using measures like P/E ratios.

- Market sentiment gauges the investment community’s view through analyst ratings and news.

- Risk score assesses a stock’s inherent dangers, including volatility and industry risks.

5starsstocks .com claims ratings are refreshed weekly with the latest data. Premium subscribers allegedly get real-time alerts on significant rating changes. The platform positions this system as a “diagnostic tool” to help users ask better questions, acting as an “augmented lens” to improve judgment, not replace it.

While this approach sounds logical, the methodology lacks transparency, and the track record is unverified—concerns we’ll explore next.

An In-Depth Look at 5starsstocks .com: Transparency and Red Flags

Looking at 5starsstocks .com with a critical eye reveals concerning issues that should give any potential user pause. Like reading the fine print on a contract, what you find can change everything.

Who is Behind the Platform?

Unlike reputable financial platforms with detailed founder and team information, 5starsstocks .com offers very little. The platform operates with complete anonymity. There is no founder information, no professional backgrounds of analysts, and no clear accountability structure. This is highly concerning in the financial world, where transparency is crucial for evaluating expertise.

Reputable platforms display team credentials and registrations with bodies like FINRA or the U.S. Securities and Exchange Commission (SEC). This transparency is about accountability. This lack of basic transparency from 5starsstocks .com raises serious questions about its credibility.

Unverified Performance Claims and Marketing Hype

The platform’s impressive claims—a 78% swing trade success rate, 55% options return, and 42% long-term ROI—cannot be verified. Legitimate platforms provide documented, audited results with timestamps and detailed histories. 5starsstocks .com does not, so its impressive statistics remain unverified claims.

The heavy emphasis on being “AI-powered” also deserves scrutiny. This likely refers to basic automated filtering rather than sophisticated machine learning, which can be misleading about its actual capabilities. This gap between marketing hype and reality can lead to unrealistic investor expectations.

Regulatory Status and Trustworthiness

Perhaps the most significant red flag is the lack of regulatory supervision. Unlike regulated financial advisors, 5starsstocks .com has no governing body ensuring professional standards or protecting investor interests.

The platform’s ScamAdviser score of 66/100 places it in the “moderate trust” category, reflecting concerns about its newness, anonymous ownership, and lack of contact info.

More concerning are the data privacy issues. The platform reportedly lacks a published privacy policy, data encryption, or compliance with regulations like GDPR or CCPA. Protecting your personal and financial information is essential.

The combination of anonymous leadership, unverified performance claims, and lack of regulatory oversight creates a perfect storm of transparency issues. This means users are taking on significant additional risk by trusting their investment decisions to an unaccountable entity. Anyone considering 5starsstocks .com should weigh these red flags carefully.

Evaluating the User Experience and Subscription Costs

Let’s discuss the practical side: the cost and user experience of 5starsstocks .com. A platform isn’t valuable if it’s overpriced or hard to use.

Subscription Tiers and Pricing

5starsstocks .com uses a subscription model with three tiers. Its pricing competes with established financial research platforms but lacks their transparency and regulatory backing.

The Basic plan is $99 per month for core stock ratings and basic educational content. The Pro plan at $199 monthly adds advanced alerts, detailed analysis, and the “AI-powered” screener. The Elite plan is $299 per month for the full suite of tools, priority support, and exclusive content.

| Subscription Tier | Monthly Cost | Key Features |

|---|---|---|

| Basic | $99 | Core stock ratings, basic educational content |

| Pro | $199 | Advanced alerts, detailed analysis, AI-powered screener |

| Elite | $299 | Full tool suite, priority support, exclusive content |

These costs, from $1,200 to $3,600 annually, are significant. Many established, regulated platforms offer similar services for less, raising questions about the value of 5starsstocks .com given its transparency issues.

The User Journey: From Signup to Seeking a Refund

The initial experience seems straightforward: create an account, explore the interface, and use the data and ratings.

However, user reports suggest getting a refund under the advertised 30-day policy is an ordeal. The process is described as “time-consuming,” often requiring “multiple emails or dispute filing via payment processors.” This frustrating customer service experience is concerning, especially with substantial monthly fees.

The day-to-day experience also has challenges. Users report late trade alerts and inconsistent star ratings, questioning the system’s reliability. These anecdotal issues suggest the platform may struggle with consistent delivery and customer service. For its premium price, 5starsstocks .com may not be delivering on its promise.

High costs and difficult refunds create a potentially costly situation for unsatisfied users, adding another red flag to the list.

Who Should Use 5starsstocks.com (and Who Should Avoid It)?

Given what we’ve uncovered, let’s discuss who might benefit from 5starsstocks .com and who should avoid it. Consider this a friendly intervention to prevent a costly mistake.

The Ideal User Profile for 5starsstocks .com

A very specific, small group of investors might find some value in 5starsstocks .com.

Self-directed investors with years of experience might use this platform as one of many tools. They are comfortable making their own decisions and don’t rely on a single source.

Experienced traders might use it as a supplementary tool. They would use its recommendations as a starting point for their own research, treating it as a second opinion.

Crucially, anyone using this platform needs a high risk tolerance. They must be aware of and comfortable with the unverified claims, anonymous team, and lack of regulatory oversight. They must be able to afford potential losses from unproven advice. For these investors, 5starsstocks .com is just one data point—a starting point for ideas to investigate, not a final decision-maker.

Why Beginners and Cautious Investors Should Be Wary

If you’re new to investing or cautious with money, 5starsstocks .com is likely not for you.

First-time investors and students are a large part of the user base, which is concerning. They often lack the knowledge to see past marketing fluff and may take unverified claims at face value, leading to regrettable decisions.

If you value transparency and accountability, this platform will be frustrating. Its anonymous team, unverified claims, and lack of oversight are contrary to what a trustworthy service should offer.

Cautious investors needing documented results will find 5starsstocks .com lacking. Without verifiable data, you’re asked to trust blindly, which is contrary to smart investing.

Most importantly, if you cannot afford to lose money based on unverified advice, stay away. Manage investment risk with reliable, accountable information. Your financial well-being is too important to gamble. If you’re starting out, seek established, reputable sources that prioritize education and transparency. Build your knowledge first with trusted resources before considering other tools.

Frequently Asked Questions about 5starsstocks.com

We’ve covered a lot about 5starsstocks .com, but you may still have questions. Let’s tackle the most common ones.

Is 5starsstocks.com a scam or legitimate?

This isn’t a simple yes or no. 5starsstocks .com isn’t an outright scam (they won’t steal your money), but it operates with significant red flags. The anonymous team is a major concern. Combined with unverified performance claims, the platform operates in a gray area, lacking transparency and accountability. ScamAdviser gives it a moderate trust score of 66/100, meaning “proceed with caution.” We advise extreme care if you consider using their services.

Does a five-star rating guarantee a stock will perform well?

Absolutely not. The platform itself states its five-star rating system shows a stock’s performance against internal criteria at a specific time. It is not a guarantee of future success. The market is dynamic, and past performance never guarantees future results—a fundamental rule of investing that applies here.

How does 5starsstocks.com compare to established investment research sites?

Here, 5starsstocks .com shows its limitations compared to established financial authorities. Established platforms have transparent methodologies, accredited analysts, documented track records, and regulatory oversight from bodies like the U.S. Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA). 5starsstocks .com lacks this protection and accountability. The main appeal of 5starsstocks .com is its simple, visual rating system. This simplicity, however, comes at the cost of verifiable credibility. While it may offer “fresh perspectives,” it can’t compete on reliability with industry veterans.

Conclusion: The Final Verdict on 5starsstocks.com

Our deep dive into 5starsstocks .com reveals a platform that promises much but raises significant concerns. At Beyond Beauty Lab, our mission is to empower you to make informed decisions for your holistic well-being, including your financial health.

Just as you’d avoid skincare with mystery ingredients, you shouldn’t trust your finances to a shadowy platform. The anonymous team behind 5starsstocks .com is a major red flag. Without knowing the team, we can’t assess their qualifications or accountability. This lack of transparency erodes trust.

The performance claims remain unverified, which is troubling. The impressive success rates are just claims without an auditable track record. In finance, if it sounds too good to be true, it usually is.

5starsstocks .com is not for beginners. New investors need clear, regulated, and transparent advice. Relying on an unverified platform can lead to costly mistakes. It’s concerning that many users are beginners, who deserve better than anonymous, unverified advice.

The lack of regulatory oversight means there’s no safety net. No governing body ensures best practices or offers recourse. It’s a significant risk.

While the interface is user-friendly, the lack of transparency, unverified claims, and no regulatory oversight make 5starsstocks .com a risky proposition. True financial well-being comes from making confident decisions based on reliable information.

Just as you check skincare ingredients, scrutinize your financial advice. Don’t let marketing hype overshadow the need for transparency and credibility.

Financial stress impacts overall well-being, and sound investing is part of holistic health. We encourage you to prioritize transparent, accountable platforms with verifiable track records.

Start your journey to holistic wellness by making informed choices in every aspect of your life, including your investments.