Why Lithium Has Become the “White Gold” of Modern Investing

5starsstocks.com lithium analysis has gained attention from investors seeking exposure to the clean energy revolution. This platform focuses on lithium stocks as the world transitions toward electric vehicles and renewable energy storage.

Quick Overview: 5starsstocks.com Lithium Platform

- Platform Type: Trend aggregation site (2023)

- Rating System: 1-5 stars for fundamentals and growth

- Lithium Performance: Average 12% returns in this sector

- Trust Score: “Very low” (ScamAdviser) due to anonymity

- Best Use: Ideas and trend spotting

- Key Limitation: Lacks transparency and a verified track record

The global demand for lithium is surging, powering everything from phones to EVs. Government incentives are accelerating EV adoption, with penetration predicted to exceed 30% by 2030, driving lithium demand higher.

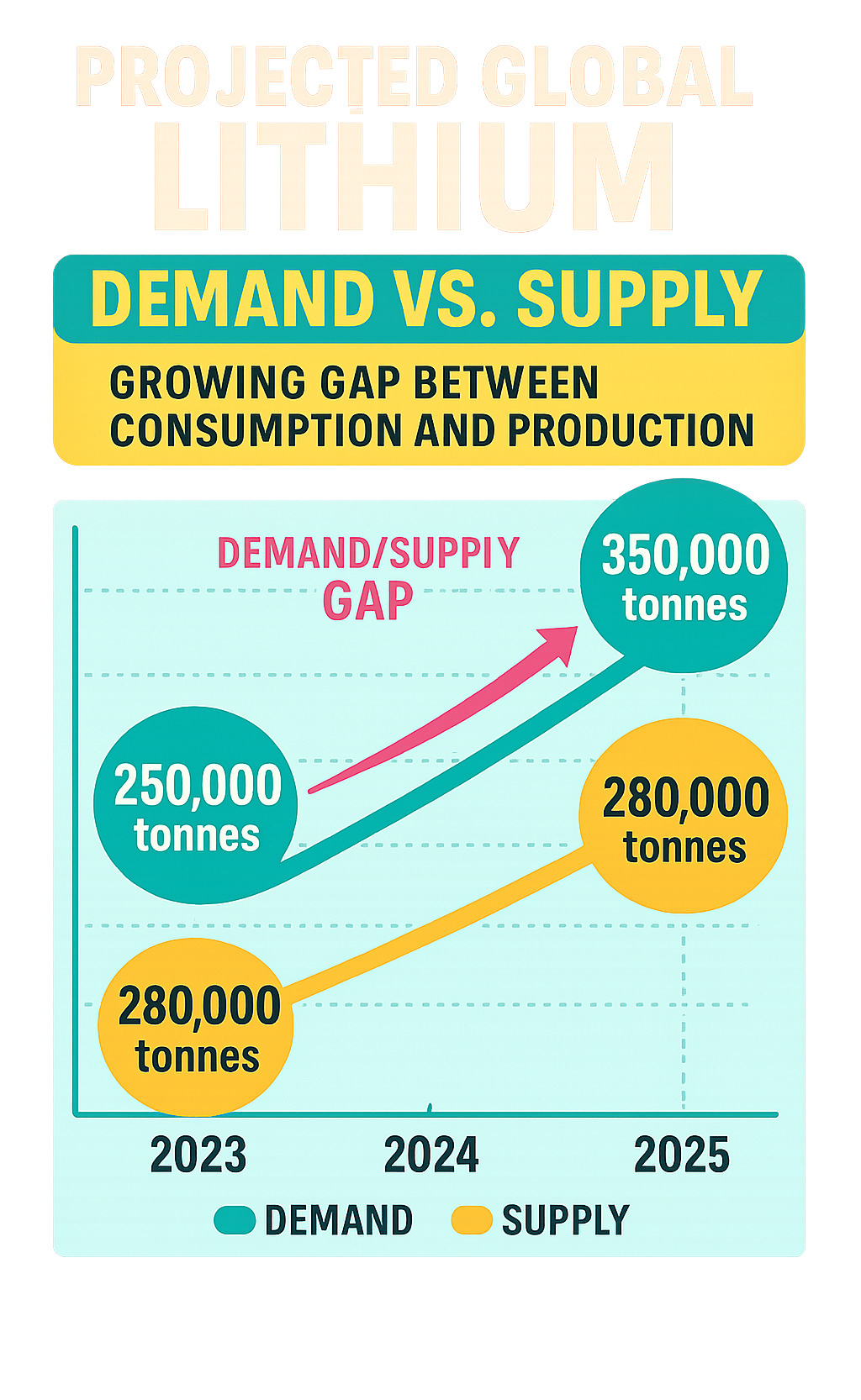

However, supply struggles to keep up, creating a demand-supply gap:

- 2023: 250,000 tonnes demand vs 220,000 tonnes supply

- 2024: 300,000 tonnes demand vs 280,000 tonnes supply

- 2025: 350,000 tonnes demand vs 320,000 tonnes supply

This imbalance creates opportunity, but platforms like 5starsstocks.com have red flags like anonymous leadership. Smart investors use multiple sources, focusing on companies with strong fundamentals and sustainable practices. The lithium sector has compelling potential, but success requires diligent research.

5starsstocks.com lithium vocabulary:

Why Lithium is a High-Stakes Investment for 2025

Every time you charge a device, you’re likely using lithium. This metal is the backbone of our digital world, and 5starsstocks.com lithium analysis highlights its importance to investors.

The EV market growth is exploding, with major automakers investing billions. Experts predict over 30% of vehicles will be electric by 2030, requiring massive amounts of lithium-ion batteries. Government incentives worldwide, like tax breaks and subsidies, are accelerating this shift.

The supply chain dynamics create a “perfect storm” as demand outpaces supply. New mines take years to develop, while battery factories are being built rapidly. This is compounded by the geopolitical importance of lithium, as most reserves are concentrated in a few countries (Australia, Chile, Argentina, China), leading to strategic competition.

Technological advancements are also expanding lithium’s use in large-scale energy storage and through cleaner production methods like direct lithium extraction.

This combination of factors creates enormous potential, but the market requires both vision and caution. For those looking to dig deeper, more info about our services can help guide your journey into this exciting sector.

Decoding Investment Signals: A Look at 5starsstocks.com Lithium Analysis

When exploring 5starsstocks.com lithium recommendations, you’re looking at a new platform launched in 2023 that acts as a trend aggregation platform. It uses AI-powered analysis to process data from news, social media, and financial reports to spot “what’s hot now” in sectors like lithium.

The 5-Star Rating System

The platform’s key feature is its 5-star rating system, which scores stocks on fundamentals, growth, valuation, sentiment, and risk. While simple, this approach can miss crucial nuances that experienced investors consider.

Performance Record: A Reality Check

While 5starsstocks.com makes bold claims, independent testing revealed a 35% success rate (8 winners out of 23 picks). A test portfolio following its advice lost 5.6% while the S&P 500 gained 8.2% in the same period. The platform has shown better results in specific trending sectors like defense stocks (18% average gains) and lithium-related investments (12% average returns).

Red Flags: Anonymity and Pressure

A major concern is the platform’s anonymous founders. In finance, this lack of transparency is a significant red flag. ScamAdviser gave 5starsstocks.com a “very low” trust score, citing its anonymity and aggressive marketing. Users have also reported “Buy Now” pressure tactics that encourage impulsive decisions.

How Does It Stack Up Against Traditional Research?

- Transparency:

- 5starsstocks.com: Low, with anonymous leadership and unclear premium pricing.

- Traditional research platforms: High, with known experts, clear methodologies, and transparent costs.

- Methodology:

- 5starsstocks.com: AI trend analysis with 5-star ratings.

- Traditional research platforms: Deep fundamental analysis by human experts.

- Best for:

- 5starsstocks.com: Quick trend spotting and simplified ratings for beginners.

- Traditional research platforms: Comprehensive research, long-term planning, and verified data.

- Cost:

- 5starsstocks.com: Free basic access with undisclosed premium pricing.

- Traditional research platforms: Clear subscription models with known pricing.

The Bottom Line on 5starsstocks.com

While 5starsstocks.com lithium picks might offer interesting ideas, they are too risky to be a primary guide. Use the platform as a starting point, but always verify its recommendations with trusted sources before investing. Success in the lithium sector requires more than star ratings; it demands deep research into company fundamentals and market dynamics.

7 Top Lithium Stocks to Watch for Potential Growth

The lithium market offers exciting opportunities but demands careful consideration, much like choosing a proven skincare routine over a passing trend. While 5starsstocks.com lithium analysis can spark ideas, smart investors know the real work begins with thorough research.

The key is balancing risk versus reward while building a diversified portfolio. Due diligence is essential-this means understanding each company’s reserves, production capabilities, management, and financial health.

Lithium investing’s appeal lies in its long-term potential, driven by the EV and renewable energy transition. However, this growth won’t be linear. Portfolio diversification is crucial to protect investments while capturing growth.

The seven companies below represent different approaches to the lithium opportunity, from proven leaders to promising newcomers. Each offers unique advantages and faces distinct challenges.

1. Albemarle Corporation (ALB): The Established Giant

Albemarle Corporation (ALB) is a reliable market leader in the lithium industry. While 5starsstocks.com lithium picks might highlight flashier opportunities, ALB represents stability.

What makes Albemarle impressive is their global production footprint, with diversified operations in Chile and Australia. This geographic spread provides insurance against regional disruptions.

The company’s strong financials are compelling. Albemarle consistently delivers robust revenue and reinvests in cutting-edge technology, giving it staying power during market downturns.

Perhaps most importantly, Albemarle has secured strategic partnerships and long-term contracts with major battery and EV manufacturers, providing predictable revenue streams.

For investors seeking exposure to lithium’s growth without the wild swings of smaller companies, Albemarle offers a more measured approach. If you’re drawn to this kind of stable, established investment approach, our Blue Chip Stocks Guide explores similar strategies for building a resilient portfolio.

2. Arcadium Lithium (ALTM): The Merger Powerhouse

Arcadium Lithium (ALTM), born from the merger of Livent and Allkem, is a new lithium powerhouse. This union created a vertically integrated lithium producer with impressive scale.

The post-merger synergies are expected to deliver significant cost savings, leading to better profit margins. For 5starsstocks.com lithium watchers, Arcadium is appealing due to its strong position in the EV supply chain, with an established network of customers ensuring steady demand.

Its global reach spans Argentina, Australia, Canada, and China, providing a safety net against regional instability.

Crucially, Arcadium specializes in lithium hydroxide-the high-purity stuff that’s essential for advanced EV batteries. As battery technology evolves, this expertise becomes increasingly valuable. The company presents a compelling middle ground between established giants and risky startups.

3. Lithium Americas Corp. (LAC): The North American Play

Lithium Americas Corp. (LAC) is a key player in the push for North American energy independence. The heart of its appeal is the Thacker Pass project in Nevada, one of the largest known lithium deposits in North America.

As 5starsstocks.com lithium analysis often highlights, securing domestic supply chains is a global priority. The geopolitical advantage of operating in the stable environment of the United States is huge.

From a production potential standpoint, Thacker Pass is massive. Once operational, it’s expected to produce enough battery-grade lithium carbonate to power millions of EVs annually.

The US supply chain security angle makes LAC even more compelling, as American automakers seek reliable domestic suppliers. This can translate into premium pricing and long-term contracts. While the project faces challenges, LAC represents a unique opportunity to bet on America’s clean energy future.

4. Piedmont Lithium (PLL): The Strategic Supplier

Piedmont Lithium (PLL) is a strategic supplier with key partnerships in the EV world, often highlighted in 5starsstocks.com lithium discussions.

Piedmont’s biggest claim to fame is its Tesla Partnership. The company has supply agreements with Tesla and other major EV manufacturers, providing a confidence-building foundation for investors.

The Carolina Lithium Project is Piedmont’s ambitious plan for a fully integrated operation on American soil. This US-based asset strategy offers a significant advantage as the push for supply chain security intensifies.

Piedmont’s integrated production goals-from mining raw spodumene to producing battery-grade lithium hydroxide-aim for cost efficiency and reliability. As a development-stage company, PLL carries higher risk but also offers potentially higher rewards for investors betting on its ability to execute.

5. Sigma Lithium (SGML): The Sustainable Miner

Sigma Lithium (SGML) is a 5starsstocks.com lithium pick known for its focus on sustainable and profitable mining. This Brazilian-focused company has carved out a niche by prioritizing environmental responsibility.

At its Grota do Cirilo project in Brazil, Sigma’s environmentally friendly practices are central to its operations. The company uses dry stacking tailings methods and powers its operations with renewable energy, reducing its carbon footprint.

Sigma also produces a high-purity lithium concentrate that meets the demanding specifications of battery manufacturers, giving it a competitive advantage.

The company has ambitious scalable production plans to meet growing global demand, benefiting from Brazil’s established mining infrastructure. For investors, Sigma represents an interesting play on South American lithium that balances growth ambitions with environmental stewardship, appealing to the rise in ESG investing.

6. A Promising Junior Miner

The junior mining space is where 5starsstocks.com lithium enthusiasts often hunt for the next big findy. These smaller companies are the startups of the mining world, offering high-growth potential. A successful find can transform a penny stock into a major player.

However, these are speculative investments. Success hinges on proving reserves, securing financing, and navigating complex regulations. Many projects fail to advance beyond the exploration phase.

Key factors to watch in a junior miner include exploration success, an experienced management team, and projects in mining-friendly jurisdictions. The small-cap volatility is extreme, with stock prices swinging dramatically on news.

Smart investors treat junior miners as a small, high-risk portion of their portfolio. For every success story, many others fail to find commercially viable deposits.

7. Global X Lithium & Battery Tech ETF (LIT): The Diversified Option

For investors wanting exposure to the 5starsstocks.com lithium sector without picking individual stocks, the Global X Lithium & Battery Tech ETF (LIT) offers a diversified solution. It’s a ticket to the entire lithium revolution, not just a single company.

Instant diversification is LIT’s biggest selling point. The ETF invests across the whole battery technology ecosystem, including miners, battery manufacturers, and refiners. This approach provides risk mitigation, as the poor performance of one company has less impact on your overall portfolio.

LIT offers broad market exposure to the entire battery supply chain. Its top holdings analysis reveals a who’s who of the battery technology world, giving you a comprehensive play on the sector without needing to research dozens of individual companies.

For a more hands-off approach, ETFs like LIT are an excellent foundation. If you’re interested in this strategy, our guide on More info about Best Passive Stocks can be helpful. An ETF lets you invest in the entire clean energy transition with less individual company risk.

Navigating Risks and Best Practices for Lithium Investing

While the lithium market offers exciting growth, it’s not without its challenges. Understanding the risks and adopting best practices is crucial for protecting your portfolio.

Key Risks Associated with Lithium Investments:

- Market Volatility: As a commodity, lithium prices can be highly volatile, impacting company revenues and profits.

- Technological Disruption: While lithium-ion is dominant, research into alternatives like sodium-ion batteries could shift long-term demand.

- Geopolitical Risks: Resource concentration in a few countries means political instability or trade disputes can disrupt supply chains.

- Supply Chain Challenges: Extracting and processing lithium is complex and capital-intensive. Delays in new projects can cause shortages and price spikes.

- Regulatory and Environmental Concerns: Stricter environmental regulations could increase operational costs or delay projects.

Best Practices for Mitigating Risks:

- Cross-Verify Information: Never rely on a single source. Treat platforms like 5starsstocks.com lithium, which has a “very low trust score,” as a starting point for ideas, not a definitive guide.

- Avoid FOMO (Fear Of Missing Out): Resist pressure tactics designed to trigger impulsive decisions. Do your own research and ensure an investment aligns with your goals.

- Diversify Your Portfolio: Spread your investments across different companies, geographies, and consider a lithium ETF (like LIT) to mitigate risk.

- Adopt a Long-Term Strategy: The lithium growth story is long-term. A patient approach can help you ride out short-term volatility.

- Understand Fundamentals: Look for companies with strong balance sheets, manageable debt, and clear growth plans.

- Stay Informed: The lithium market is dynamic. Keep up with industry news, technological advancements, and government policies.

By approaching lithium investments with a blend of enthusiasm and caution, supported by thorough research and smart strategies, we can steer this exciting but complex landscape more effectively.

Frequently Asked Questions about Lithium Stocks

Investing in lithium can be complex. Here are answers to the most common questions we hear from investors.

Is 5starsstocks.com a legitimate platform for lithium stock picks?

5starsstocks.com operates more like a trend-spotting website than a professional investment advisor. The biggest red flag is its anonymity-the founders are unknown. This, combined with a “very low trust score” from ScamAdviser and reports of aggressive “Buy Now” pressure tactics, is concerning. Its performance record is also inconsistent.

Our take? Use 5starsstocks.com lithium insights as a starting point for your own research, but never as a final answer. Always cross-verify information with established financial sources.

What are the biggest risks when investing in the 5starsstocks.com lithium sector?

Lithium investing carries significant risks:

- Price volatility: As a commodity, lithium prices can swing dramatically.

- Supply chain disruptions: Operational issues or geopolitical tensions in key producing countries can impact the entire sector.

- Geopolitical instability: Political changes or trade disputes in regions like South America or Australia can affect supply.

- Regulatory changes: Evolving environmental or trade policies can increase costs and limit market access.

- Competition from new battery technologies: While lithium-ion is dominant, alternatives like sodium-ion batteries are being developed.

Should I invest in individual lithium stocks or a lithium ETF?

This depends on your risk tolerance and experience.

- Individual stocks offer a high-risk, high-reward approach. You could see substantial returns if you pick a winner, but this requires extensive research and carries more risk if a single company fails.

- ETFs, like the Global X Lithium & Battery Tech ETF (LIT), offer instant diversification and lower risk. This is a great option for beginners, as it spreads your investment across the entire sector-from miners to battery makers.

Our recommendation? Most investors, especially those new to the lithium sector, benefit from starting with a diversified ETF. As you gain confidence, you can allocate a smaller portion of your portfolio to carefully selected individual stocks. Successful investing aligns with your overall financial wellness goals and risk tolerance – just like choosing the right wellness routine for your lifestyle.

Conclusion

The lithium market is a compelling investment opportunity at the heart of the clean energy transition. As this guide has shown, platforms like 5starsstocks.com lithium highlight the immense attention this sector is receiving.

The growing demand from EVs and renewable energy storage has earned lithium its “white gold” nickname. The growing demand-supply gap we discussed creates a powerful opportunity for investors.

However, opportunity and risk walk hand in hand. Volatility, geopolitical challenges, and technological risks are real factors. This is where informed decision-making becomes your superpower. Whether you choose an established giant like Albemarle or a diversified ETF like LIT, thorough research is key. Don’t let platforms with questionable transparency rush you.

At Beyond Beauty Lab, we believe that financial wellness is part of overall wellness. Just as you research skincare ingredients, you should understand your investments. The lithium story is still unfolding, and by staying informed and diversifying wisely, you can position yourself to benefit from this transformative journey.

The best investment strategy is one that lets you sleep peacefully at night, knowing you’ve made thoughtful, well-researched decisions. The future of energy is bright, and with the right approach, you can be part of this transformative journey.

Explore our AI investment guide for more future-focused insights and continue building your knowledge for smarter investing decisions.