Why Income Stocks Are Essential for Building Wealth in 2025

5starsstocks.com income stocks represent a smart approach to building steady wealth through dividend-paying companies that generate regular cash flow for investors. These stocks focus on established businesses that distribute a portion of their profits to shareholders, typically on a quarterly or monthly basis.

Quick Answer for 5starsstocks.com Income Stocks:

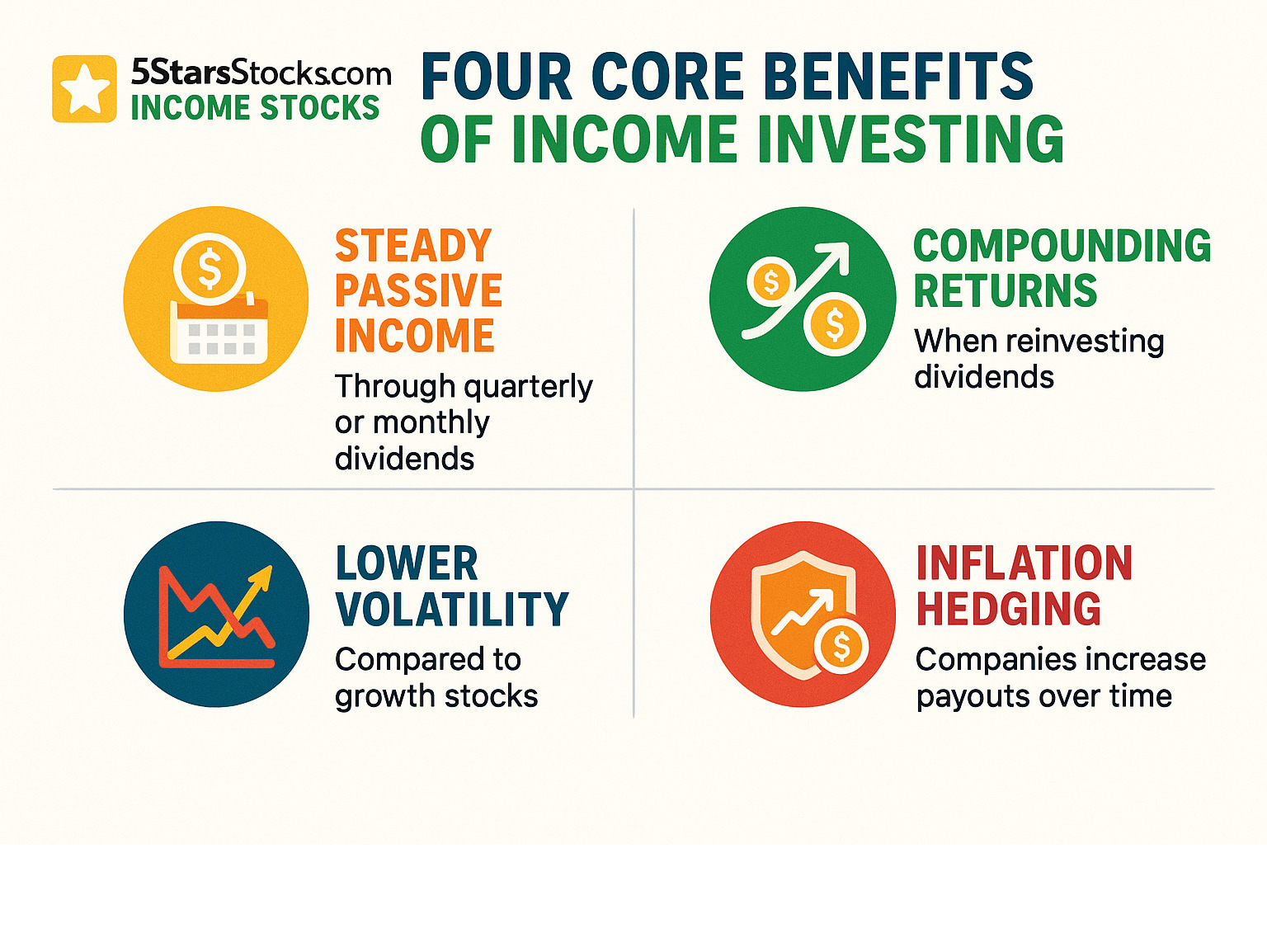

- What they are: Dividend-paying stocks selected through AI-powered analysis

- Key benefits: Passive income, lower volatility, inflation protection

- Top sectors: Healthcare, utilities, consumer staples, REITs

- Platform features: 7-layer screening, real-time alerts, dividend safety scores

- Best for: Investors seeking steady income and long-term wealth building

Income investing has become increasingly important as traditional savings accounts offer minimal returns. According to research, companies like Johnson & Johnson and Procter & Gamble have maintained consistent dividend payments for decades, with some raising dividends for over 25 consecutive years.

The 5StarsStocks.com platform uses artificial intelligence and comprehensive data analysis to identify quality income opportunities. However, it’s important to note that independent testing showed mixed results, with only 35% of stock picks being profitable in a 4-month period.

Building wealth through income stocks isn’t just about the immediate dividends – it’s about creating a foundation for long-term financial wellness that complements your overall life goals.

5starsstocks.com income stocks word guide:

What Are Income Stocks? The Foundation of Your Wealth-Building Strategy

Picture a beautiful apple tree in your backyard that produces fresh fruit every season. That’s exactly what 5starsstocks.com income stocks are like for your investment portfolio. Instead of waiting years for a tree to grow taller, you’re enjoying the sweet harvest it provides regularly.

Income stocks are shares in companies that make it a priority to share their profits with shareholders through dividend payments. These aren’t flashy startups trying to conquer the world overnight. They’re the steady, reliable companies that have been around the block and know how to generate consistent cash flow.

The beauty of these investments lies in their predictability. While growth stocks reinvest most of their earnings back into expansion, income stocks take a different approach. They’ve already established their place in the market and choose to reward their shareholders with regular payments.

Think about the companies you interact with daily. Your electric company, the brand of toothpaste you use, or the pharmaceutical company that makes your medications. These businesses operate in sectors where demand stays relatively stable, regardless of what’s happening in the broader economy.

Utilities companies are perfect examples. People need electricity and water whether the stock market is soaring or crashing. Consumer staples companies sell the everyday essentials we can’t live without – food, cleaning products, and personal care items. Real Estate Investment Trusts (REITs) own income-producing properties and are actually required by law to distribute most of their profits to shareholders. Healthcare companies benefit from consistent demand for their life-saving products and services.

The magic happens when you start receiving those dividend checks. This passive income can supplement your salary, fund your hobbies, or be reinvested to buy more shares – creating a snowball effect that builds wealth over time.

Key Characteristics of a Quality Income Stock

Not every company that pays dividends deserves a spot in your portfolio. Finding truly quality income stocks requires looking beyond the surface appeal of a high dividend yield.

The first thing to examine is a company’s consistent dividend history. The best income stocks don’t just pay dividends – they increase them year after year. Dividend Aristocrats are companies that have raised their dividends for at least 25 consecutive years. These are the gold standard of income investing, showing management’s commitment to shareholders through good times and bad.

Strong financial health is equally important. You want companies with low debt-to-equity ratios and robust cash flows. A company drowning in debt might struggle to maintain dividend payments during tough economic periods. Look for businesses with solid balance sheets and the financial flexibility to weather storms.

The sustainable payout ratio tells you whether a company can actually afford its dividend payments. If a company is paying out 90% of its earnings as dividends, there’s little room for error. A healthy payout ratio typically falls below 75%, leaving enough earnings for reinvestment and unexpected challenges.

Finally, seek companies with a competitive advantage – something that makes them difficult to replace. This might be a beloved brand name, exclusive technology, or a dominant market position. These advantages help ensure the company can continue generating the profits needed to support dividend payments.

For deeper insights into how these characteristics are evaluated and which stocks meet these criteria, you can explore More info about 5starsstocks.com Stocks.

Building wealth through income stocks is like tending a garden. With patience and the right choices, you’ll create a portfolio that provides both immediate income and long-term growth potential.

How 5StarsStocks.com Uncovers Top Income Opportunities

When you’re searching for reliable 5starsstocks.com income stocks, you want a system that does the heavy lifting for you. That’s where 5StarsStocks.com comes in, positioning itself as your research companion rather than your financial advisor. Think of it like having a really smart friend who loves crunching numbers and spotting patterns in the stock market.

The platform’s secret weapon is its AI-powered analysis that scans thousands of stocks looking for those hidden gems. While the company claims a 70% accuracy rate for its artificial intelligence system, independent testing has shown mixed results. That’s why we always recommend treating it as a powerful research tool, not a crystal ball that predicts the future.

What makes this platform interesting is its 7-layer screening process specifically designed for income-focused investors like us. This detailed approach helps identify companies where dividends consume less than 60% of earnings – a sweet spot that suggests the company can comfortably afford its payments without stretching too thin. It’s like finding a person who spends wisely within their means rather than maxing out their credit cards.

The five-star rating system gives you a quick visual snapshot of how each stock measures up based on the platform’s internal criteria. Combined with real-time data and user-friendly tools, this creates an environment where complex financial information becomes digestible. You won’t need a finance degree to understand what you’re looking at.

Here’s something crucial to remember: 5StarsStocks.com operates as a research platform, not as a registered financial advisory service. They provide data and suggestions, but they’re not giving you personalized financial advice. It’s important to use this platform for research and ideas, then make your own informed decisions.

Evaluating Stocks with 5StarsStocks.com’s Tools

The real magic happens when you dive into the platform’s specialized evaluation tools. These aren’t just fancy charts – they’re designed to help you avoid costly mistakes and spot genuine opportunities.

The Dividend Health Check tool is like getting a full medical exam for your potential investments. It shows you a 10-year dividend growth chart alongside a “Payout Safety” meter. Think of this safety meter as a credit score for dividends – it quickly tells you how secure those monthly or quarterly payments really are. When you can visualize a company’s dividend consistency over a decade, you start to see which businesses truly prioritize their shareholders.

One of my favorite features is the Yield Trap Detector. We’ve all been tempted by those stocks offering ridiculously high yields, only to find they’re too good to be true. This tool acts like an early warning system, showing you a “Dividend Cut Probability” percentage. It’s like having a friend who stops you from buying that “amazing deal” car that’s actually been in three accidents.

The platform also keeps a close eye on the debt-to-EBITDA ratio and other financial health indicators. Companies with debt-to-EBITDA ratios above 4x get flagged because excessive debt can threaten dividend payments. For example, a healthy company like Verizon might show a manageable 3.8x ratio, while a struggling business could be sitting at a dangerous 6x level.

The sector heatmaps give you a bird’s-eye view of entire industries, color-coding them by risk level. This visual approach helps you quickly spot which sectors might be experiencing headwinds or catching favorable tailwinds. It’s particularly useful when you’re trying to diversify your income portfolio across different industries.

A Beginner’s Guide to Using the Platform for 5starsstocks.com income stocks

Starting your income investing journey doesn’t have to feel overwhelming. The 5StarsStocks.com platform is designed with beginners in mind, offering clear explanations and organized categories that make sense even if you’re new to the investing world.

Navigating the interface feels intuitive once you spend a few minutes exploring. The main categories are clearly labeled, including dedicated sections for “Income Stocks” and “Dividend Stocks.” Take your time clicking around – there’s no rush, and familiarity with the layout will save you time later.

Your first stop should be the dividend yield filter. This tool lets you set a minimum threshold for the yields you’re interested in. Many investors start with stocks offering 3% or higher yields, which immediately narrows down your options to companies that prioritize returning cash to shareholders. It’s like walking into a massive library and asking for just the mystery novels – suddenly, your choices become much more manageable.

Setting up a watchlist becomes essential once you’ve identified some promising candidates. This feature lets you monitor your potential investments without having to search for them repeatedly. The platform’s Smart Alerts System can even notify you about price changes, unusual trading activity, or insider moves. It’s like having a personal assistant who keeps track of all your interests.

Don’t overlook the educational resources that 5StarsStocks.com provides. These materials help deepen your understanding of financial metrics, market trends, and investment strategies without drowning you in jargon. The interactive tools, including stock heat maps, transform complex market analysis into visual information that actually makes sense.

The goal is to use this platform as a source of ideas and research, not as your only decision-making tool. Always conduct your own research and consider your personal financial situation before making any investment decisions. For more comprehensive information about the platform’s features and approach, you can explore More info about 5starsstocks.com.

Building Your 2025 Portfolio with 5starsstocks.com income stocks

Creating a solid income portfolio for 2025 is like preparing a nourishing meal – you need the right ingredients in the right proportions to create something that will sustain you for years to come. Portfolio diversification becomes your secret recipe, spreading your investments across different sectors, company sizes, and investment styles to reduce risk while maximizing your income potential.

The beauty of building with 5starsstocks.com income stocks lies in understanding that not all dividend-paying companies serve the same purpose in your portfolio. Think of it as creating layers of financial security, each with its own role to play.

The 60/30/10 allocation model offers a time-tested framework that many successful income investors swear by. Your foundation layer should represent about 60% of your portfolio – these are your rock-solid dividend aristocrats like Johnson & Johnson and PepsiCo. These companies have weathered multiple economic storms while consistently rewarding shareholders. They’re the reliable friends you can count on, having paid dividends for 25+ years and often boosting payouts by at least 5% annually.

Your growth engine makes up the next 30% of your holdings – these dividend accelerators might not have decades of dividend history, but they’re rapidly increasing their payouts. These companies add excitement to your portfolio while still maintaining that income focus you’re seeking.

The final 10% is your “spice layer” – higher-risk, higher-reward plays like certain REITs or covered call ETFs. Just like seasoning in cooking, a little can improve the whole dish, but too much can overwhelm everything else.

Balancing safety and growth means understanding that a 4% yield growing at 10% annually often beats a stagnant 6% yield over time. This is where the magic really happens – through the power of reinvestment and compounding returns.

When you reinvest your dividends instead of spending them, you’re essentially buying more shares that will generate even more dividends. It’s like planting seeds that grow into trees that produce more seeds. One investor example showed how turning $500 monthly into a dividend reinvestment plan grew into $1.2 million over 25 years. That’s the compound effect working its magic! For a deeper understanding of how this wealth-building strategy works, explore more about reinvestment.

Top Income Stock Ideas on 5StarsStocks.com for 2025

While market conditions constantly evolve, certain types of companies consistently appear on quality income stock lists, and 5StarsStocks.com often highlights these reliable performers for good reason.

Johnson & Johnson (JNJ) represents healthcare stability at its finest. This pharmaceutical and consumer health giant has built its reputation on consistent dividend payments and a diverse business model that addresses permanent human health needs. Whether we’re in a recession or boom times, people still need medicine and healthcare products.

Procter & Gamble (PG) stands as a consumer staples giant that’s practically recession-proof. When times get tough, people might skip the fancy restaurant, but they still need toothpaste, soap, and household essentials. P&G’s impressive record of raising dividends for more than 25 consecutive years makes it a true Dividend Aristocrat.

Realty Income (O) offers something special – monthly dividends instead of quarterly payments. Known as “The Monthly Dividend Company,” this REIT focuses on essential retail properties that tend to stay occupied even during economic downturns. Imagine getting a dividend check every month instead of waiting three months between payments!

Verizon (VZ) provides high-yield opportunities in the telecom sector, benefiting from ongoing 5G expansion and the reality that people aren’t giving up their phones anytime soon. While telecom faces challenges, Verizon’s consistent cash flow supports reliable dividend payments.

NextEra Energy (NEE) combines utility stability with growth potential through renewable energy leadership. As a utility company, it provides essential services people can’t live without, while its focus on clean energy positions it well for future regulatory and consumer trends.

Managing Risks and Market Volatility

Even the most stable income stocks face challenges, and smart investors learn to steer these waters with confidence rather than fear. Understanding these risks helps you make better decisions and sleep better at night.

Interest rate risk affects income stocks when rates rise and bonds become more attractive alternatives. Think of it like competing restaurants – when the steakhouse next door lowers prices, some customers might switch. However, high-quality income stocks with strong fundamentals often prove resilient because they offer something bonds can’t: the potential for dividend growth over time.

The potential for dividend cuts represents perhaps the most serious risk income investors face. Companies experiencing financial difficulties might reduce or eliminate their dividends, as we saw with Kraft Heinz in 2019. This is exactly why tools like 5StarsStocks.com’s Yield Trap Detector and Dividend Safety Score become so valuable – they aim to spot trouble before it becomes a crisis.

Acknowledging mixed reviews and independent test results keeps us grounded in reality. While 5StarsStocks.com promotes its AI capabilities, independent testing showed only 35% of stock picks were profitable over four months, with the test portfolio losing 5.6% while the S&P 500 gained 8.2%. ScamAdviser gives the platform a trust score of 66 out of 100, noting concerns about team transparency. This doesn’t mean the platform lacks value, but it reinforces why we should never rely on any single source for investment decisions.

Market volatility affects all stocks, but income stocks typically experience less dramatic swings than growth companies. During market downturns, companies providing essential products and services often maintain steadier performance. The platform’s Crash Prep Dashboard can help you stress-test your portfolio against historical market crises.

Emphasizing due diligence means doing your homework beyond any platform’s recommendations. Read annual reports, understand the business model, and consider how economic changes might affect each company. Investment decisions should be based on your individual circumstances, and consulting with a qualified financial professional often provides valuable perspective custom to your specific situation.

The goal isn’t to eliminate all risk – that’s impossible. Instead, we aim to understand and manage risks while building a portfolio that can weather various market conditions and continue generating the income we need for our financial wellness journey.

Frequently Asked Questions about 5StarsStocks.com

When you’re exploring 5starsstocks.com income stocks, it’s natural to have questions about how the platform works and whether you can trust it with your investment research. Let’s explore the most common concerns investors have, so you can make informed decisions about using this tool in your wealth-building journey.

Is 5StarsStocks.com a legitimate financial advisor?

Here’s something really important to understand: 5StarsStocks.com is absolutely not a financial advisor. Think of it more like a really smart research assistant that helps you find interesting investment ideas, but it can’t tell you what’s right for your specific situation.

The platform works as a stock research tool that uses AI and data analysis to suggest potential investments. It’s like having a knowledgeable friend who’s great at crunching numbers and spotting patterns, but they don’t know your personal financial goals, how much risk you can handle, or what keeps you up at night worrying about money.

This distinction matters because while the platform can point you toward promising 5starsstocks.com income stocks, it won’t consider whether those stocks fit your retirement timeline, your need for immediate income, or your comfort level with market ups and downs.

Before making any investment decisions, especially significant ones, you should always chat with a qualified financial professional who can give you personalized advice. They’ll help you understand how any investment fits into your bigger financial picture. For official guidance on making smart investment choices, the U.S. Securities and Exchange Commission (SEC) offers excellent resources.

How often are the stock recommendations updated?

One of the nice things about 5StarsStocks.com is that it doesn’t just set up shop and forget about you. The platform regularly updates its recommendations because, let’s face it, the stock market never sleeps (even when we wish it would).

The AI system continuously monitors changing market conditions, company performance, and economic shifts that could affect your potential investments. This means when a company announces a dividend increase, reports surprising earnings, or faces unexpected challenges, the platform aims to reflect these changes in its analysis.

You’ll also receive real-time alerts for significant events that might impact the stocks you’re watching. Whether it’s a dividend announcement that makes your day or an earnings report that raises eyebrows, staying informed helps you make better decisions about your 5starsstocks.com income stocks.

Can I trust the platform’s stock ratings and safety scores?

This is probably the most important question you can ask, and we appreciate your healthy skepticism. 5StarsStocks.com claims impressive results – they say their AI caught 92% of dividend cuts since 2020 and boasts a 70% overall accuracy rate.

However, independent testing tells a more nuanced story. One test showed that only 35% of the platform’s stock picks were profitable over four months, and the test portfolio actually lost 5.6% while the S&P 500 gained 8.2%. This doesn’t mean the platform is useless, but it does mean you shouldn’t put all your eggs in one analytical basket.

Here’s our honest take: use 5StarsStocks.com as one tool in your research toolkit, not your only tool. When you see a high safety score on a dividend stock, dig deeper. Look at the company’s actual financial statements, check if their earnings are growing or shrinking, and see what other analysts are saying.

No system – whether it’s powered by artificial intelligence or decades of human experience – can predict the future with perfect accuracy. Markets are influenced by everything from global events to investor emotions, and sometimes even the smartest analysis gets blindsided by unexpected developments.

The platform can be incredibly helpful for generating investment ideas and providing initial analysis, but your own research and professional advice should always be part of the equation. Think of it as a starting point for your investment journey, not the final destination.

Conclusion

Building wealth through 5starsstocks.com income stocks isn’t just about picking the right dividend-paying companies – it’s about creating a foundation for the kind of life you want to live. Throughout our journey together, we’ve finded how these steady performers can generate passive income, provide a buffer against market turbulence, and even help protect your purchasing power when inflation tries to eat away at your savings.

The beauty of income investing lies in its simplicity and power. When you reinvest those quarterly dividend payments, you’re essentially putting compound interest to work for you. It’s like planting seeds that grow into trees, which then drop more seeds to plant even more trees. Over time, this creates a forest of wealth that can support you and your family for generations.

5StarsStocks.com serves as your research companion in this wealth-building trip. Its AI-powered tools, from the Dividend Health Check to the Yield Trap Detector, can help you spot both opportunities and potential pitfalls. The platform’s seven-layer screening process and five-star rating system aim to cut through the noise of thousands of stocks to highlight the gems worth your attention.

But here’s the thing – and this is really important – 5StarsStocks.com is a research tool, not your financial advisor. Think of it as a really smart friend who’s great with numbers and can spot patterns you might miss. However, just like you wouldn’t make major life decisions based solely on one friend’s advice, you shouldn’t base your entire investment strategy on any single platform.

The mixed results from independent testing remind us that even the most sophisticated AI can’t predict the future with perfect accuracy. That’s why we always recommend using multiple sources, doing your own homework, and perhaps most importantly, consulting with a qualified financial professional who can tailor advice to your unique situation.

At Beyond Beauty Lab, we understand that true wellness extends far beyond skincare routines and clean beauty products. Financial wellness is a crucial component of overall well-being. When you’re not constantly worried about money, you have more mental space to focus on the things that truly matter – your health, relationships, and personal growth.

Stress about finances can show up in so many ways: sleepless nights, tension headaches, even premature aging from worry. By building a solid foundation with income stocks, you’re not just securing your financial future – you’re investing in your peace of mind and overall quality of life.

Every financial journey is personal. What works for one person might not be the perfect fit for another. Your age, risk tolerance, financial goals, and life circumstances all play a role in determining the best approach for you.

As you continue exploring income investing and 5starsstocks.com income stocks, we encourage you to view it as part of a holistic approach to wellness. Just as you might research the best ingredients for your skincare routine or the most nourishing foods for your body, take time to understand and nurture your financial health.

Ready to take the next step in your wellness journey? Explore our resources to build your wellness journey and find how financial wellness, along with beauty and health insights, can help you create the balanced, fulfilling life you deserve.