Why Blue-Chip Stocks Are Essential for Your Financial Wellness

5starsstocks.com blue chip insights can help you build the stable financial foundation that supports both your long-term wealth goals and overall well-being. When financial stress from market volatility impacts everything from your sleep quality to your skin health, choosing reliable investments becomes an act of self-care.

What 5starsstocks.com Blue Chip Offers:

- Curated blue-chip stock recommendations with AI-driven analysis

- Star-rating system (1-5 stars) for easy evaluation

- Real-time market insights and expert commentary

- Educational resources for informed decision-making

- Portfolio diversification tools across stable sectors

Blue-chip stocks represent shares of large, well-established companies with market capitalizations often exceeding $10 billion. These companies typically offer consistent dividends, stable earnings, and strong brand recognition – qualities that make them attractive for investors seeking predictable returns with lower volatility.

The term “blue chip” comes from poker, where blue chips hold the highest value. Oliver Gingold first used this term in the stock market during the 1920s while working at Dow Jones, and it perfectly captures what these investments represent: premium quality and lasting value.

For eco-conscious professionals like yourself, financial stability isn’t just about money – it’s about creating the peace of mind that allows you to focus on what matters most. Whether that’s investing in sustainable beauty products, supporting clean companies, or simply reducing the stress that shows up on your skin, a solid financial foundation supports your holistic wellness journey.

Essential 5starsstocks.com blue chip terms:

What Are Blue-Chip Stocks? The Foundation of Financial Wellness

When we talk about financial wellness, we’re not just discussing numbers on a spreadsheet; we’re exploring how our financial health impacts our entire lives. Just as a balanced diet and regular exercise contribute to physical well-being, a stable investment portfolio contributes to our mental and emotional peace. At the heart of such a portfolio, we often find blue-chip stocks.

So, what exactly are blue-chip stocks, and why are they so important for us as investors? Simply put, blue-chip stocks are shares of large, well-established companies that have consistently demonstrated financial stability and strong market performance. Think of them as the titans of industry, the household names we’ve grown up with, companies that have weathered countless economic storms and emerged stronger. These are often companies with a large market capitalization, frequently exceeding $10 billion, and sometimes even topping $100 billion, according to Morningstar’s criteria.

The importance of blue-chip stocks for investors stems from their inherent reliability. They are known for generating stable earnings year after year, even during challenging economic conditions. This predictability is a soothing balm for anyone who’s ever felt the stomach-churning anxiety of market volatility. Many blue-chip stocks also boast consistent dividends, providing us with a steady income stream that can be reinvested or used to fund other aspects of our holistic wellness journey, like that new meditation app or organic skincare line.

Beyond their stability, blue-chip companies typically possess robust financials, characterized by strong balance sheets, low debt levels, and ample cash reserves. They often have strong brand recognition and are leaders in their respective industries. These qualities make them a cornerstone for wealth accumulation, offering long-term growth potential and contributing significantly to our financial security and peace of mind. Investing in blue-chip stocks is, in essence, investing in stability and a calmer financial future. It’s about choosing reliability over fleeting hype, and that, in itself, is a form of self-care.

5starsstocks.com – Income Stocks Guide 2025

Why They Are Called “Blue-Chip”

The term “blue chip” is a fascinating part of stock market history, and its origin perfectly encapsulates the value these stocks represent. As we briefly touched on earlier, the term ‘blue chip’ originates from the game of poker. In poker, blue chips traditionally hold the highest value among all the chip colors, symbolizing their premium status.

This analogy was first brought into the financial world in the 1920s by Oliver Gingold, an employee at Dow Jones. He observed that certain stocks consistently traded at $200 or $250 per share, which was a very high price for that era. He began to refer to these high-value, consistently performing stocks as “blue chips,” drawing a direct parallel to the most valuable chips in a poker game. The name stuck, and today, it remains synonymous with quality, reliability, and value in the stock market. It’s a reminder that even in the complex world of finance, some concepts are as simple and enduring as a game of cards.

The Link Between Stable Investments and Personal Well-being

For us at Beyond Beauty Lab, the connection between financial stability and personal well-being is not just theoretical; it’s a lived experience for many. When our finances are in disarray, it can manifest as stress, anxiety, and even physical symptoms that impact our skin, sleep, and overall health. Conversely, a sense of financial security can be incredibly liberating, allowing us to focus on our passions, our self-care routines, and our contributions to a healthier planet.

Investing in stable, blue-chip companies can significantly reduce financial stress. Knowing that a portion of our hard-earned money is safely invested in companies with strong fundamentals and a history of consistent performance provides a profound sense of long-term security. This peace of mind is invaluable. It frees up mental space that might otherwise be consumed by worry about market fluctuations or economic downturns.

Consider it financial self-care. Just as we nourish our bodies with wholesome food and our minds with mindfulness practices, we nourish our financial future with sensible investment strategies. Blue-chip stocks, with their predictable cash flows and often consistent dividends, act as a stable anchor in what can often be a choppy sea of market news. This stability allows us to breathe easier, sleep more soundly, and approach life with a greater sense of calm and control. Investment decisions should be based on your individual circumstances, and for us, those circumstances always include our holistic well-being.

A Practical Guide to Using 5starsstocks.com Blue Chip Insights

Finding reliable investment guidance can feel like searching for a needle in a haystack – overwhelming and time-consuming. That’s where 5starsstocks.com blue chip insights come in, acting as your trusted guide through the complex world of stock investing.

The platform’s role centers around AI-driven analysis that cuts through market noise to identify genuinely promising blue-chip opportunities. Rather than drowning you in endless data, 5starsstocks.com focuses on providing actionable insights that busy professionals can actually use. Their approach combines sophisticated technology with practical wisdom, making investment research feel less like rocket science and more like having a knowledgeable friend share their expertise.

What makes this platform particularly valuable is their star-rating system. Each stock receives a rating from 1 to 5 stars based on comprehensive analysis of financial health, growth potential, and market positioning. This visual approach means you can quickly spot the most promising blue-chip candidates without spending hours buried in spreadsheets.

The beauty of 5starsstocks.com blue chip lies in its independent insights. Unlike platforms tied to specific brokerages or financial institutions, this tool provides unbiased analysis focused purely on helping you make informed decisions. It’s like having a research team working behind the scenes, constantly monitoring market conditions and company fundamentals to keep you informed.

5starsstocks.com – AI Guide 2025

Key Metrics for Evaluating Any Blue Chip Stock

Understanding the fundamental metrics behind blue-chip stocks empowers you to make confident investment decisions, whether you’re using 5starsstocks.com blue chip or conducting your own research. Think of these metrics as the vital signs of a company’s financial health.

The Price-to-Earnings (P/E) Ratio tells you how much investors are willing to pay for each dollar of a company’s earnings. For blue-chip stocks, you’ll typically want to see reasonable P/E ratios that reflect stable, consistent earnings rather than speculative hype. A company trading at 15 times earnings might be more attractive than one at 50 times earnings, especially if both have similar growth prospects.

Dividend Yield becomes particularly important when evaluating blue-chip investments. This percentage shows how much a company pays in dividends relative to its stock price. Many investors love blue-chips specifically for their reliable dividend payments, which can provide steady income regardless of market volatility. The key is finding companies with predictable cash flow that can sustain those dividend payments through various economic cycles.

The Debt-to-Equity Ratio reveals how much debt a company carries compared to shareholder equity. Blue-chip companies typically maintain conservative debt levels, giving them flexibility during tough times and reducing financial risk. A lower ratio generally indicates stronger financial stability – exactly what you want from a blue-chip investment.

These metrics work together to paint a complete picture of a company’s financial wellness. A valuable resource for financial terms can help you dive deeper into any concepts that seem unclear.

Evaluating Stocks with the 5starsstocks.com Blue Chip Framework

Navigating the platform starts with understanding how 5starsstocks.com organizes its blue-chip recommendations. The site typically features curated blue-chip lists that have already been filtered through their AI analysis, saving you the initial legwork of screening thousands of potential investments.

When you’re finding curated blue-chip lists on the platform, look for sections specifically dedicated to stable, dividend-paying companies or large-cap stocks. These lists represent the cream of the crop – companies that have passed multiple quality filters and demonstrate the characteristics we associate with true blue-chip status.

Interpreting stock ratings becomes intuitive once you understand the system. A 5-star rating indicates the highest confidence in a stock’s potential, while 1-star ratings suggest caution. However, even a 3-star blue-chip stock might perfectly suit your investment timeline and risk tolerance. The star system provides guidance, not absolute rules.

The most important step involves cross-referencing data with other sources. While 5starsstocks.com blue chip provides excellent starting points, wise investors always verify information through additional research. Check recent earnings reports, read industry news, and compare the platform’s analysis with other reputable financial sources.

This layered approach ensures your investment decisions rest on solid ground rather than single-source information. Think of 5starsstocks.com as your initial research assistant – incredibly helpful for identifying opportunities and organizing data, but always complemented by your own due diligence and critical thinking.

Building a Resilient Portfolio for Long-Term Growth

Think of building a resilient investment portfolio like creating the perfect skincare routine – you need a thoughtful blend of reliable ingredients that work together harmoniously. 5starsstocks.com blue chip stocks serve as your portfolio’s essential foundation, much like a quality moisturizer forms the base of any good skincare regimen.

The beauty of blue-chip investing lies in how these stable companies create a buffer against market turbulence. When economic storms hit, these established giants tend to weather them with more grace than their smaller counterparts. Their consistent dividend payments provide a steady income stream that can be reinvested to compound your returns over time, building wealth gradually and sustainably.

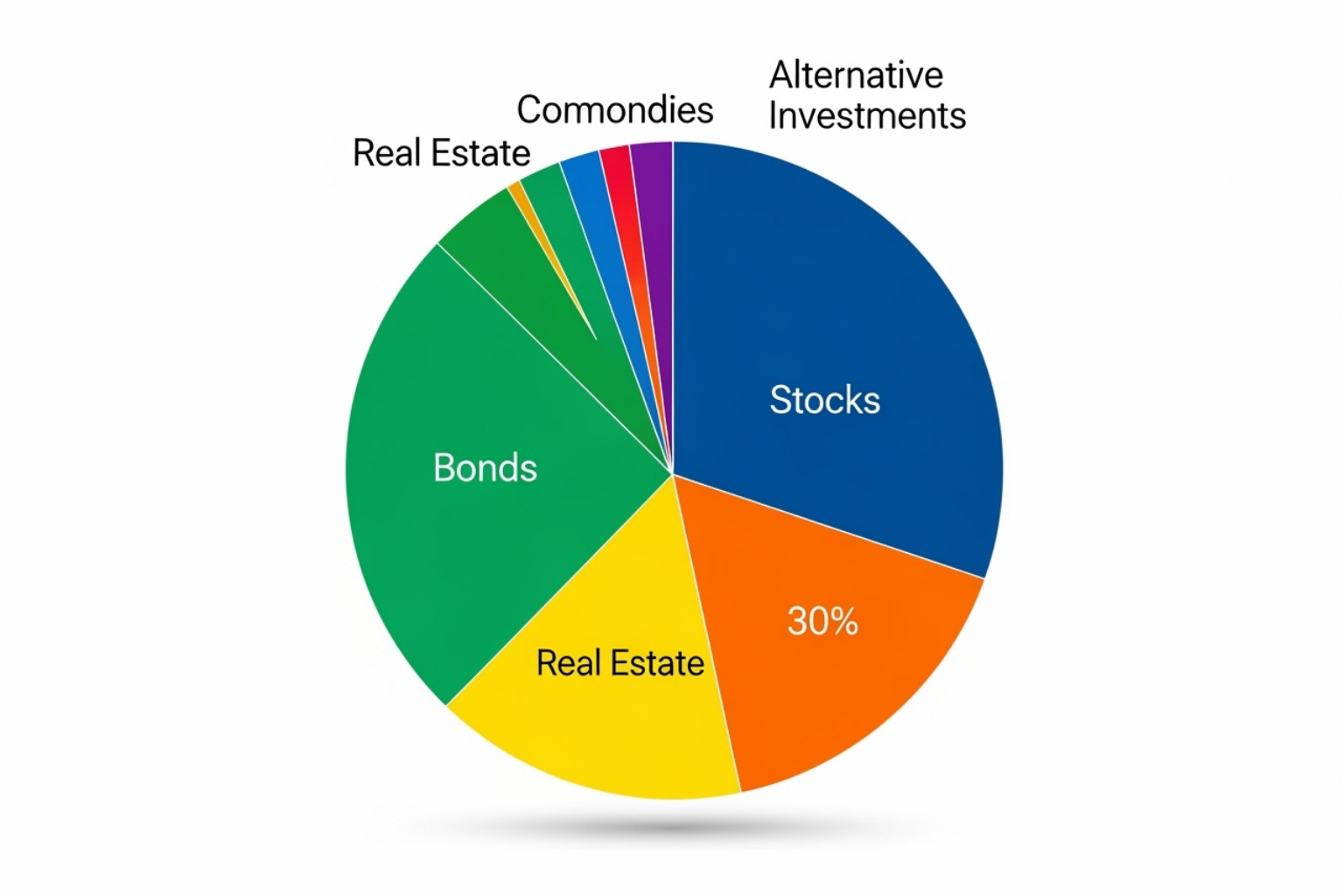

But even the most reliable blue-chip stocks need companions to truly shine. This is where diversification becomes your best friend. By spreading your investments across different sectors and asset types – perhaps combining your blue-chip holdings with bonds, ETFs, or even real estate – you’re creating multiple layers of financial protection.

Portfolio rebalancing is another crucial element that keeps your investment strategy healthy. Just as you might adjust your skincare routine seasonally, periodically reviewing and adjusting your asset allocation ensures your portfolio stays aligned with your goals. If your blue-chip stocks have performed exceptionally well and now represent a larger slice of your portfolio than intended, it might be time to trim some gains and redistribute them to maintain your desired balance.

The 5starsstocks.com blue chip approach encourages this thoughtful diversification, helping you identify opportunities across various stable sectors. This strategy supports your long-term financial goals while reducing the stress that comes from putting all your eggs in one basket – even if that basket contains premium blue-chip stocks.

5starsstocks.com – Best Passive Stocks

Addressing the Risks of Blue-Chip Investing

Even the most trusted skincare ingredient can cause reactions in certain conditions, and the same truth applies to blue-chip investing. While these stocks are celebrated for their stability, understanding their potential challenges helps us invest more wisely.

Market volatility affects even the steadiest blue-chip companies. Economic downturns, geopolitical tensions, or unexpected market events can cause price swings. Think of it like how even the healthiest skin can react to environmental stressors – it’s not a flaw in the system, just a reality to acknowledge. Stock prices fluctuate, and preparation helps us stay calm during these inevitable ups and downs.

The trade-off for stability often means slower growth potential. Blue-chip companies, due to their massive size, simply can’t grow as rapidly as nimble startups. It’s like expecting a mature oak tree to grow as quickly as a seedling – unrealistic and unnecessary. If you’re seeking steady, reliable growth rather than explosive gains, this characteristic actually works in your favor.

Industry disruption poses another consideration. Even market leaders can face unexpected competition from innovative newcomers or shifting consumer preferences. The key is choosing blue-chip companies with strong competitive advantages and adaptable management teams.

5starsstocks.com blue chip insights help address these risks through rigorous research and continuous analysis. Their platform focuses on identifying companies with solid competitive moats and smart leadership – qualities that help businesses steer challenges successfully. However, your own research and diversification across different sectors remain your strongest defenses.

The importance of personal research cannot be overstated. While platforms like 5starsstocks.com provide valuable guidance, combining their insights with your own due diligence creates the most robust investment approach.

Aligning Your Portfolio with a Long-Term 5starsstocks.com Blue Chip Strategy

Investing in blue-chip stocks through a long-term lens mirrors our holistic approach to wellness – it’s about patience, consistency, and sustainable growth rather than quick fixes or dramatic changes.

The magic of compounding growth truly shines over extended periods. When you reinvest dividends and allow your investments to grow undisturbed for years, your returns begin earning their own returns. It’s like how consistent skincare habits compound over time to create lasting beauty – the daily routine might seem small, but the long-term results are transformative.

5starsstocks.com blue chip strategy aligns perfectly with this long-term perspective by focusing on companies with predictable performance patterns and established market presence. These aren’t speculative bets on the next big thing; they’re investments in proven entities designed to provide steady returns over decades.

Building sustainable investment practices – such as making consistent contributions and periodic portfolio reviews – maximizes the benefits of this patient approach. Your long-term investment horizon allows you to ride out short-term market fluctuations while benefiting from the overall upward trend of quality companies.

This strategy ultimately supports your journey toward financial independence and the peace of mind that comes with it. When your financial foundation is solid, you gain the freedom to make choices aligned with your values – whether that’s pursuing passion projects, prioritizing self-care, or supporting causes you believe in.

The 5starsstocks.com blue chip approach recognizes that true wealth building happens gradually, through consistent effort and smart choices compounded over time. It’s about creating a financial future that supports not just your bank account, but your overall well-being and life satisfaction.

Frequently Asked Questions about Blue Chip Investing

When we talk with our community about building financial wellness, the same thoughtful questions come up again and again. It’s wonderful to see so many people taking charge of their financial health – just like they do with their skincare routines! Let’s explore the most common questions about blue-chip investing and how 5starsstocks.com blue chip insights can support your journey.

What makes 5starsstocks.com a useful tool for blue-chip investors?

Think of 5starsstocks.com blue chip as your personal finance concierge – it does the heavy lifting so you don’t have to. The platform offers curated watchlists that save you from drowning in an ocean of stock options. Instead of spending hours researching thousands of companies, you get a filtered selection based on sophisticated analysis.

What really sets it apart are the AI-driven insights that work behind the scenes. These aren’t just random computer picks – they’re based on complex algorithms that analyze market data, financial health, and growth potential. The platform then presents this information through their intuitive data simplification approach, including that helpful star-rating system we’ve discussed.

Perhaps most importantly, 5StarsStocks.com provides educational resources that empower you to understand why certain stocks make the cut. It’s like having a knowledgeable friend who explains things clearly without talking down to you. This time-saving research approach means you can focus on making informed decisions rather than getting lost in financial jargon.

Are blue-chip stocks a guaranteed safe investment?

Here’s where we need to have an honest conversation. Blue-chip stocks are lower risk, not no-risk investments. It’s a bit like asking if expensive skincare products guarantee perfect skin – they’re generally safer and more reliable, but nothing in life comes with absolute guarantees.

While blue-chip companies have proven track records and strong reputations, they still experience market fluctuations. Even the most established companies can face unexpected challenges, from economic downturns to industry disruptions. Past performance is not a guarantee of future results – this isn’t just legal fine print, it’s a fundamental truth about investing.

The key is understanding that blue-chip stocks offer stability and reliability relative to other investments. They’re like that trusted skincare brand you’ve used for years – generally dependable, but you still need to pay attention and adapt when needed. Due diligence is crucial no matter how blue-chip a stock appears to be.

How many blue-chip stocks should I have in my portfolio?

This question reminds me of “How many skincare products should I use?” – there’s no magic number that works for everyone. The answer depends on your individual financial goals, risk tolerance, and overall investment strategy.

Diversification is key – just like you wouldn’t put all your beauty budget into one product category. Instead of fixating on a specific number, focus on spreading your blue-chip investments across different industries. You might include companies from technology, healthcare, consumer goods, and industrial sectors to create a well-rounded foundation.

Some investors feel comfortable with a core of five to ten carefully chosen blue-chip stocks, while others prefer broader exposure through blue-chip focused funds. The important thing is that there’s no magic number – what matters is choosing quality companies that align with your long-term goals.

Remember to focus on quality over quantity. It’s better to thoroughly understand and believe in fewer companies than to own many stocks you don’t really know. Your blue-chip holdings should complement the other assets in your portfolio, creating a harmonious blend that supports your overall financial wellness journey.

Conclusion

As we reach the end of our journey together, it’s clear that 5starsstocks.com blue chip investing isn’t just about numbers on a screen – it’s about creating the financial foundation that supports your entire well-being. Think of blue-chip stocks as the reliable friend who’s always there when you need them, offering steady dividends and consistent performance even when the market gets a little wild.

Throughout this guide, we’ve finded how these established giants of industry can become your partners in building lasting wealth. Their large market capitalizations, stable earnings, and strong brand recognition aren’t just impressive statistics – they’re the building blocks of the peace of mind that lets you sleep better at night and wake up feeling more confident about your future.

5starsstocks.com blue chip insights have shown us that investing doesn’t have to be overwhelming or stressful. With their AI-driven analysis, star-rating system, and curated watchlists, you have the tools to make informed decisions without needing a finance degree. It’s like having a knowledgeable friend guide you through the investment landscape, pointing out the most promising opportunities along the way.

Financial wellness is just as important as the clean beauty products you choose or the mindful practices you accept. When your money is working steadily for you through blue-chip investments, you’re free to focus on what truly matters – whether that’s supporting sustainable companies, investing in your health, or simply having the flexibility to make choices that align with your values.

The beauty of a long-term blue-chip strategy lies in its simplicity and power. By choosing quality companies with proven track records and letting compounding growth work its magic over time, you’re not just building wealth – you’re building the freedom to live life on your own terms.

At Beyond Beauty Lab, we understand that true wellness touches every aspect of your life. Your financial health directly impacts your stress levels, your sleep quality, and even how your skin looks and feels. By taking control of your financial future with smart, stable investments, you’re practicing the ultimate form of self-care.

Ready to dive deeper into your wellness journey? Find our ultimate guides to investing and wellness and find how financial peace can improve every part of your beautiful, balanced life.